Instructions for MyTax

How to activate Suomi.fi Messages in MyTax

You can add companies and tax types to your favourites in MyTax

How to print a document and enable popups in MyTax

How to find saved and submitted returns, requests and applications in MyTax

How to order email notifications about a company’s tax matters in MyTax

Companies or corporations: How to make changes to e-mail settings

How to give your telephone number

How to find functions relevant to Authorised Intermediaries in MyTax

How to book a tax office appointment in MyTax

Entrepreneurs and individual taxpayers

How to request prepayment – instructions for entrepreneurs and individual taxpayers

How to request additional prepayments – individual taxpayer

Limited liability companies and other corporate taxpayers

How to request an additional prepayment – limited liability companies (and other organisations)

How to find your valid tax card in MyTax

How to request a tax card for wage or benefit income or for a study grant in MyTax

How to file deductions in MyTax – travel expenses, a credit for household expenses, expenses for the production of income, a deduction for second home for work and a credit due to maintenance obligation

Annual information returns are used by corporate taxpayers and other payors to report information to the Tax Administration. Individual taxpayers do not use annual information returns for reporting their income or deductions.

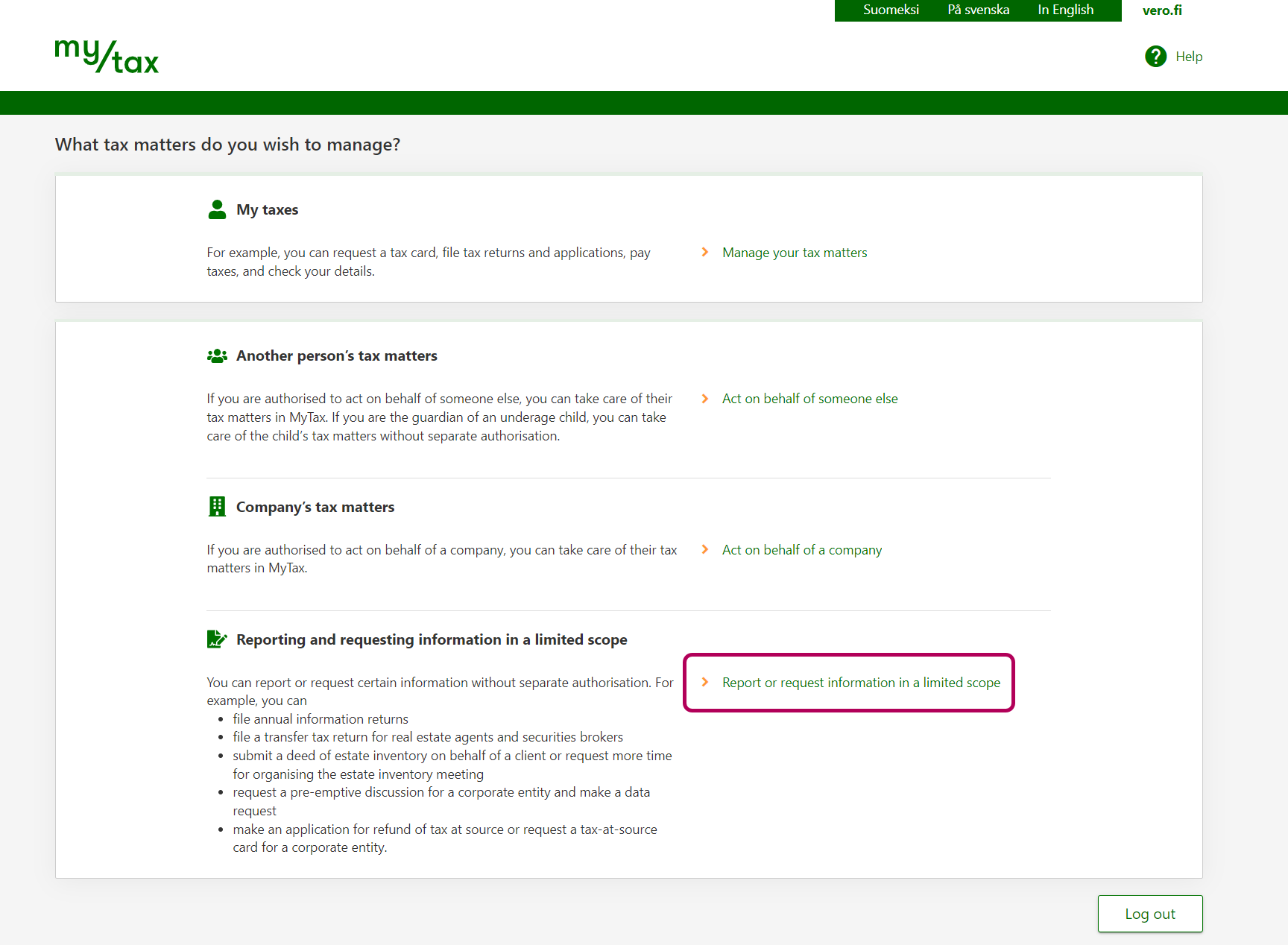

Log in to MyTax (opens in a new window)

- In order to file annual information returns in MyTax, go to “Reporting and requesting information in a limited scope” at the bottom of the page. Select “Report or request information in a limited scope”.

- Select which annual information return you want to file.

Please note that you cannot file annual information returns in other roles, such as “Act on behalf of a company”. If you have accessed MyTax in another role, click “Change role” in the top-right corner of the page and then select “Report or request information in a limited scope”.

Instructions for filing and correcting annual information returns

The pre-completed tax return – making corrections in MyTax or on paper

The pre-completed tax return in MyTax — how can I make corrections to it?

How to report gains and losses from virtual currencies in MyTax

How to find letters, tax decisions and tax certificates in MyTax

How to respond to information requests in MyTax

How to submit a bank account number in MyTax

How to check the amount and payment of your tax refund in MyTax

How to see in MyTax if your tax refund has been used for payment of taxes

How to request a Business ID and sign up for the Tax Administration’s registers

How to request entry in the Tax Administration’s registers

How to unregister from the Finnish Tax Administration's register on MyTax

Instructions for completing the VAT return

How to change selections relating to refunds of self-assessed taxes

How to apply for VAT special scheme registration

How to file a transfer tax return in MyTax

How to make corrections to a transfer tax return

How to request a refund of transfer tax

How a company requests a refund of transfer tax or exemption from transfer tax

How to find the certificate of transfer tax in the MyTax mailbox

How to file a car tax return in MyTax

How to submit a Declaration of vehicle use

How to request a refund of car tax based on disability

How to apply for registration as a filer of car tax information in MyTax

How to file a household’s report on construction work

How to file a contractor report

How to file an employee report

How to make corrections to a construction report or delete it

How to file an excise duty return in MyTax

How to file an advance notice and deposit a one-off guarantee

How to make corrections to an excise duty return in MyTax

How to file an excise duty registration notice in MyTax

How to apply for an authorised warehouse keeper's authorisation in MyTax

How to file an excise duty return on alcohol in MyTax

How to file an advance notice and deposit a one-off guarantee – private individual

How to submit a bank account number

How to change selections relating to refunds of self-assessed taxes

How to check the amount and payment of your tax refund

How to view the balance specification

How to view used payments and refunds

How to request a payment arrangement

How to request a tax debt certificate

How to check the amount of back taxes and the details for making the payment

How to see in MyTax if your tax refund has been used for payment of taxes

How to view the balance specification in MyTax

How to view payments made and refunds paid in MyTax

How to view transactions in MyTax

How to see your unused credit in MyTax

How to see in MyTax if your tax refund has been used for paying taxes

Accounting firms, bookkeepers, accountants: MyTax can show you the clients’ tax balances and more

Corporate income taxes (limited liability companies, cooperatives, associations, foundations)

Income taxes of general and limited partnerships (available in Finnish and Swedish, link to Finnish)

Decision on self-assessed taxes (Self-assessed taxes include value added tax, excise duties and employer's contributions, for example.)

Registration matters (VAT, tax prepayment, excise taxation and register of car tax filers)