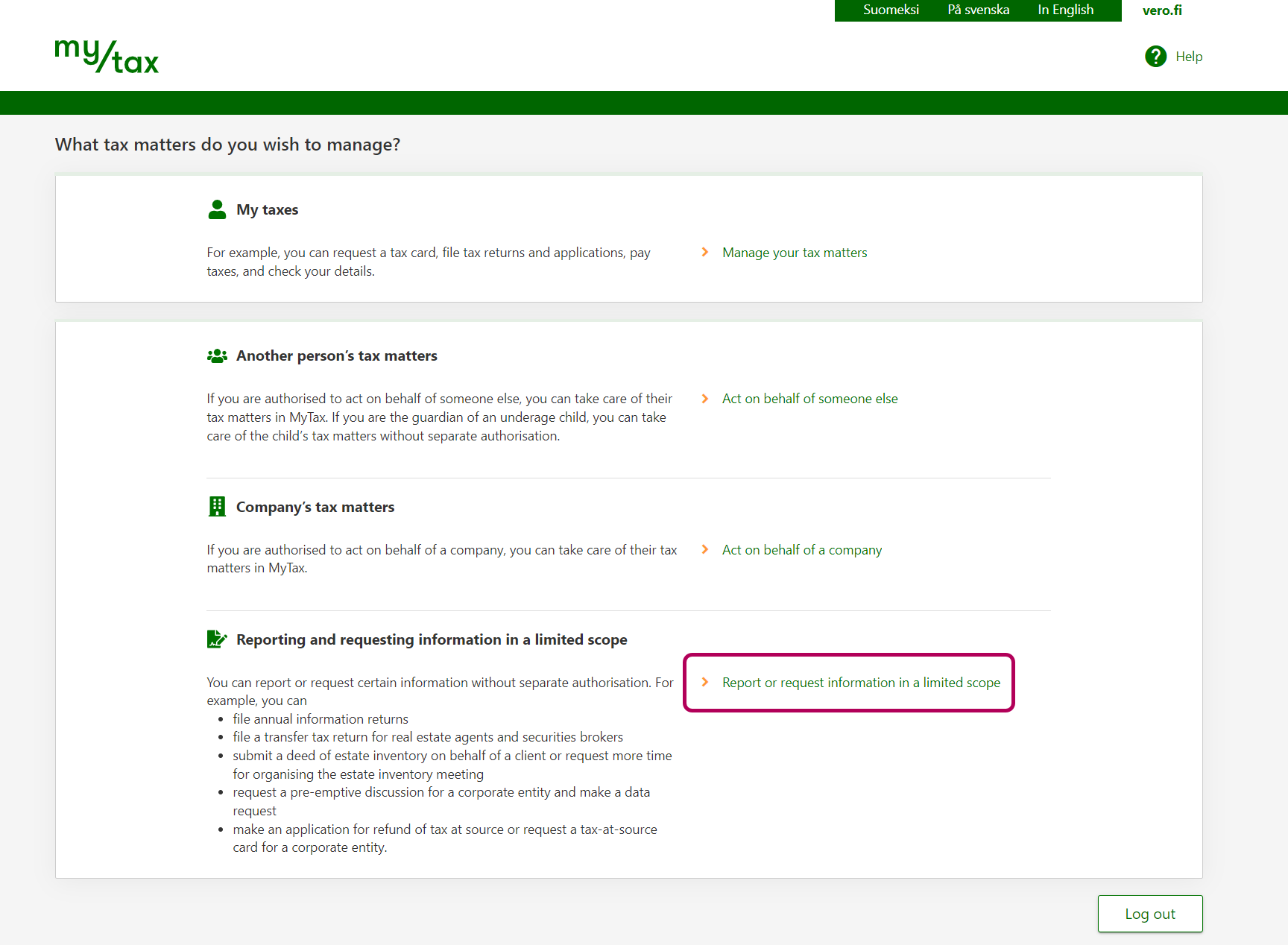

If you are an operator of trade or business (T:mi), an agricultural/forestry operator, select Manage your tax matters in MyTax. When you start with Manage your tax matters, you can access all your tax affairs. Read more: New in MyTax

Corporate income tax returns for tax year 2026 can be filed in MyTax starting on Friday, 13 March 2026.