Studies on the shadow economy

Trading with receipts and invoices costs millions for the state

Published 18.3.2024

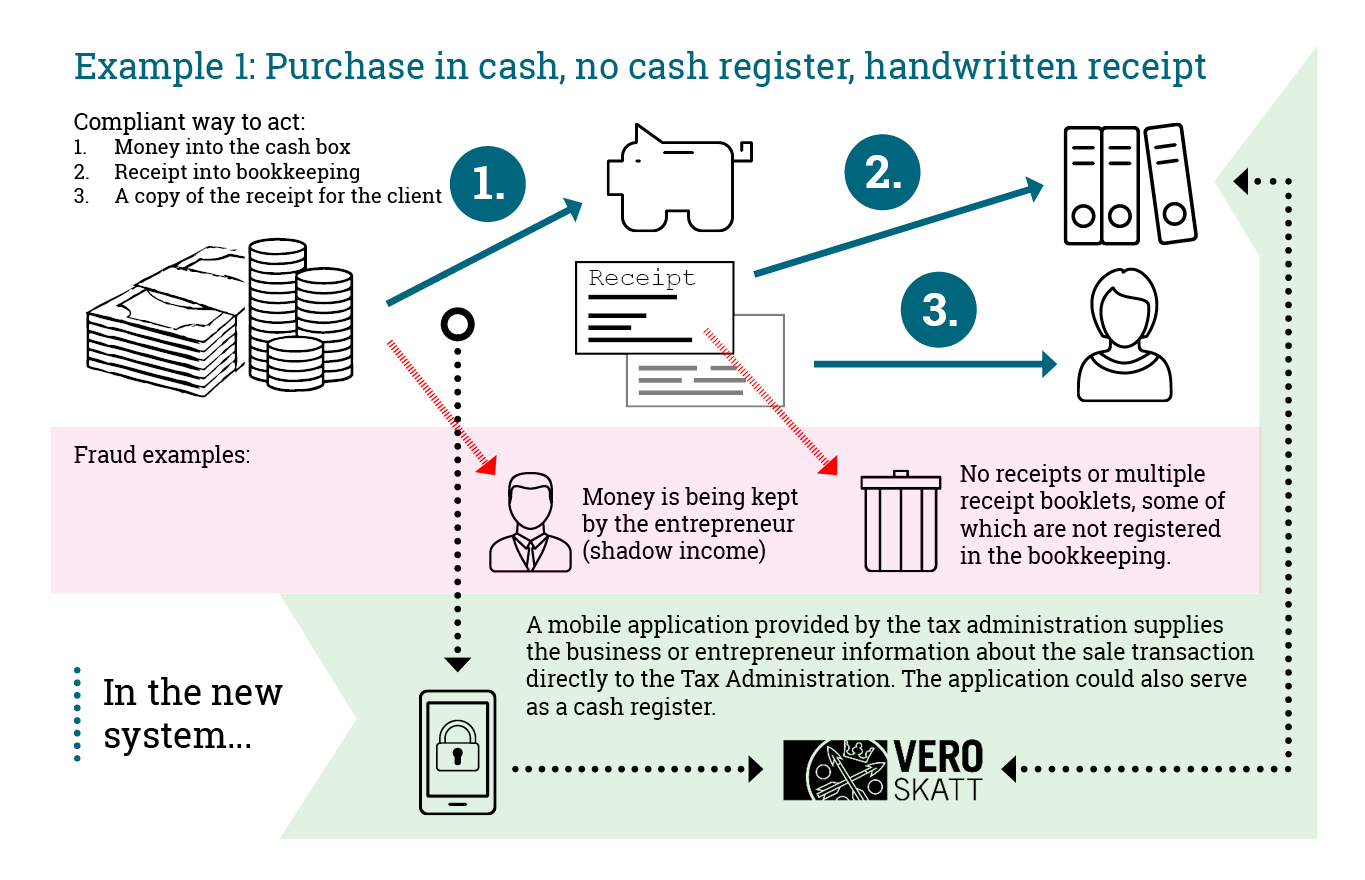

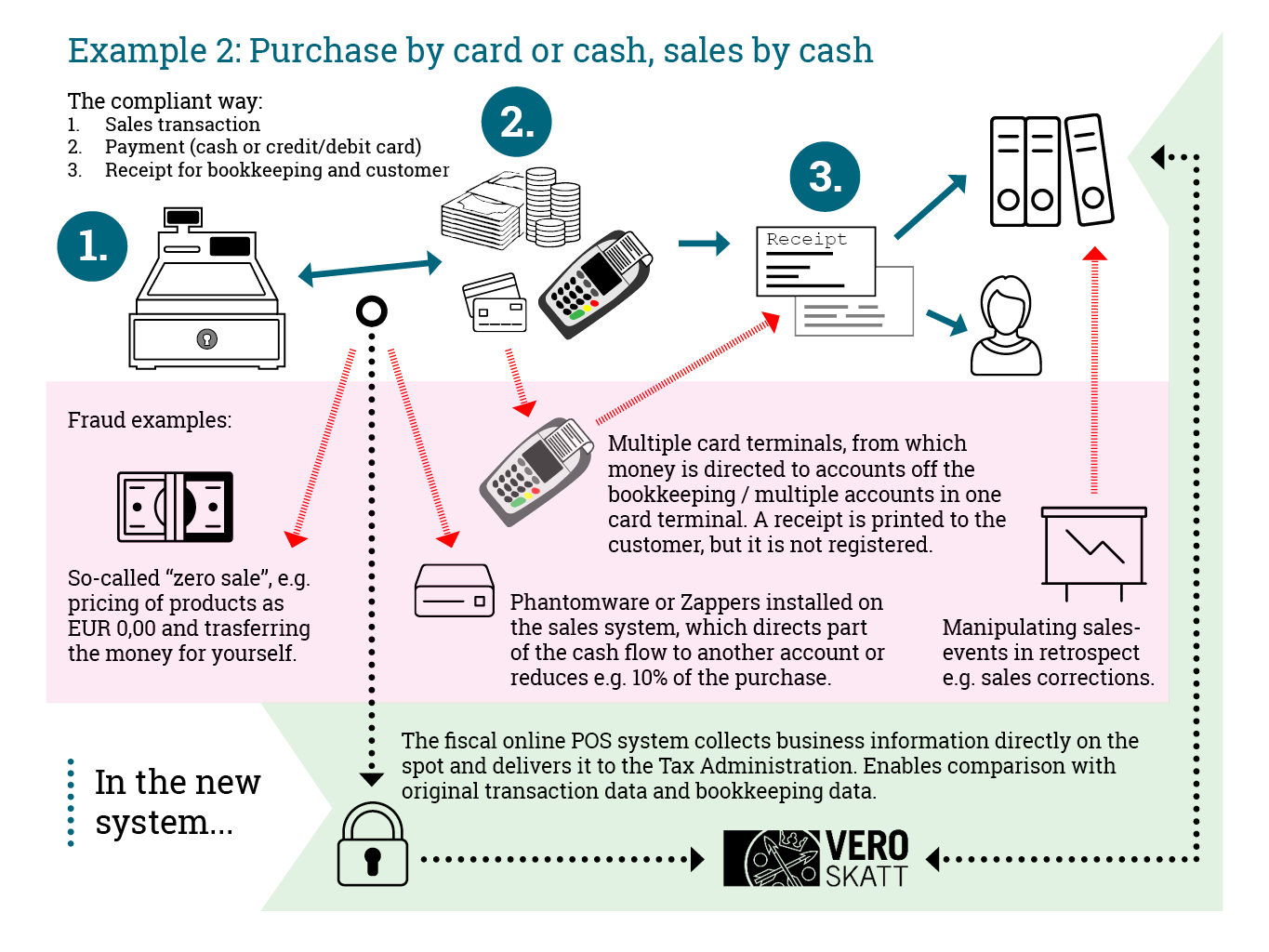

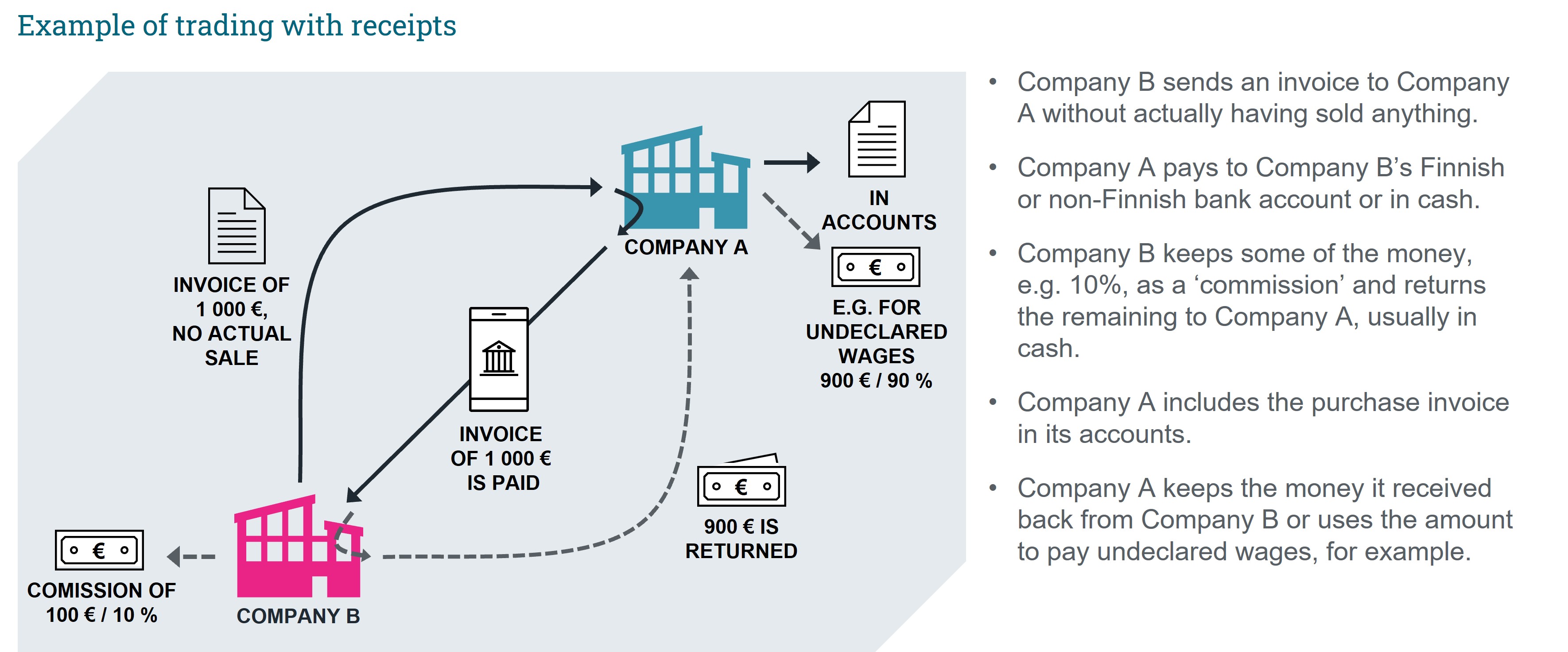

Buying and selling receipts and fictitious or false invoices is used to evade taxes for the worth of millions of euros. Today, tax evasion with buying and selling receipts and falsified documents is becoming increasingly global. In more than half of the cases involving buying and selling receipts, a company has hidden money for undeclared wages or assets have been transferred to a shareholder without paying taxes. This type of fraud is usually discovered in tax audits.

Falsified receipts and invoices are a significant phenomenon of the shadow economy and economic crime

The Grey Economy Information Unit has examined the falsified receipts and invoices discovered during tax audits. A falsified document is a document included in a company’s accounts whose content or amounts do not correspond to real life events. Sometimes the entire document is falsified.

According to the Finnish Tax Administration’s information, a total of 30,000 falsified documents were found during tax audits in 2017–2022. These findings amounted to a total of more than €182 million and involved some 500 companies. Around 85% of the cases were forwarded for the consideration of a crime report.

Falsified documents are still bought and sold

The report identified three themes to which the falsified documents often related based on the analysed tax audit reports. These were buying and selling receipts and invoices, unjustified VAT refunds, and misconduct between related parties and associated companies.

Of the falsified documents, some 60% were related to buying and selling receipts. ‘Buying and selling receipts’ refers to a situation where two companies engage in trade with falsified documents for a commission. By including falsified documents in their accounts, businesses can avoid paying taxes and other statutory contributions such as pension insurance contributions.

What kind of company typically engages in buying and selling receipts?

Typically, a company that engages in buying and selling receipts is a one-man limited liability company in the construction industry. Most of these companies were founded less than three years ago and their turnover was less than €1 million.

Increasing internationality brings challenges

The report included findings of the increasing internationality of companies and responsible persons. In addition, the use of non-Finnish bank accounts and payment methods has increased. Findings related to internationality were made both in cases involving falsified documents and especially buying and selling receipts and invoices.

Cases involving buying and selling receipts and invoices have become more international in the recent years. The number of cases with an international aspect has doubled in the past five years. The number of cases of buying and selling receipts and invoices with international connections has also increased each year when examined through the amount of euros involved.

Read the full report in Finnish (PDF, 440 kB)

Up to 7,400 Finnish companies operate outside the Finnish Tax Administration’s registers

Publication date 15 January 2024

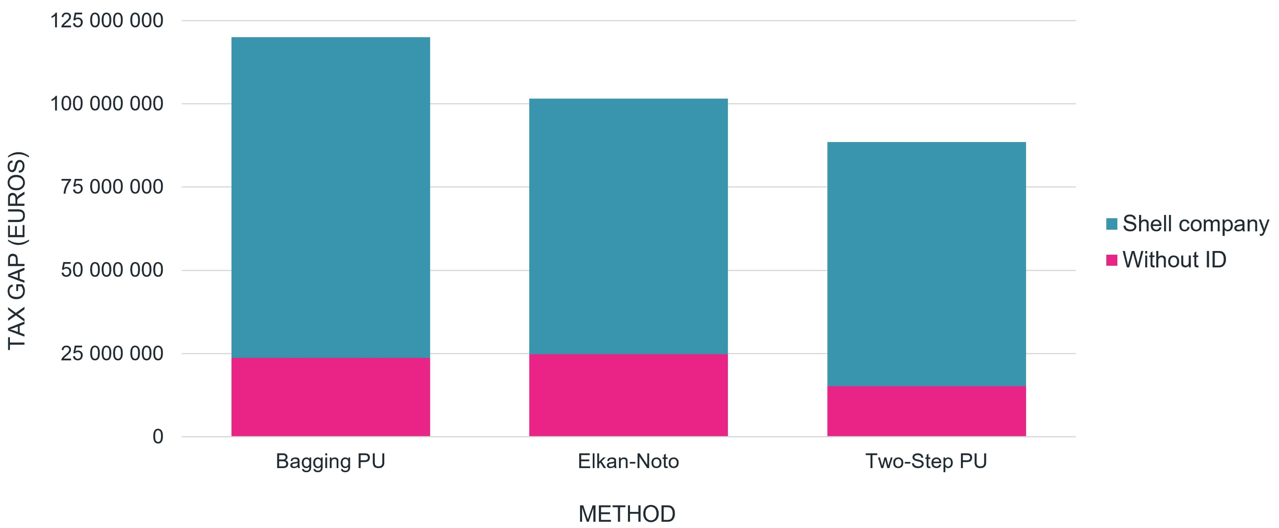

The number of Finnish companies engaged in business activities outside the Finnish Tax Administration’s registers and the resulting losses of income for the state were now estimated for the first time in Finland. It is estimated that there are 5,300–7,400 Finnish companies carrying out business activities outside registers. The tax gap resulting from the business activities carried out by these Finnish companies outside registers is estimated to have been roughly €90–120 million in 2021. The report of the Grey Economy Information Unit describes the types of business activities that have been discovered outside registers in Finland based on tax audits and assesses the reasons that have led to activities outside registers.

A tax gap of a hundred million from non-registration

Based on tax audit findings, Finnish companies often carry out business activities outside registers through shell companies that, based on registered data, had discontinued their activities or had not even started to operate. Some 15% of all companies carried out business activities wholly non-registered without any business ID. According even to the highest estimate, Finnish companies carrying out business activities outside registers account for some 1–2% of all companies in Finland. According to the estimates made in the report, not many companies operate in the unofficial sector in Finland relative to all companies, but the fiscal impact of this phenomenon on the public economy is still quite significant. As the estimates were made in the report using machine learning methods, they offer indicative information about the size of the phenomenon due to its nature.

Estimate of the tax gap in 2021 calculated using various methods.

The debt background of individuals reduces registrations with the Finnish Tax Administration

Prior neglects of payment obligations by responsible persons of companies have an impact on registrations with the Finnish Tax Administration. As much as 58% of responsible persons of Finnish companies operating outside the Finnish Tax Administration’s registers were in enforcement proceedings and 16% were subject to a business ban. Responsible persons of Finnish companies carried out business activities outside registers full-time and in addition to other work or another source of income. Some self-employed individuals regarded business activities rather as a non-professional activity, even though their activities were extensive, systematic and continuous and generated taxable business income.

Increasing public information would help discover companies operating outside registers

The efficient use of information obtained from third parties reduces business activities outside registers in Finland. The report showed that roughly a third of all companies carrying out business activities outside registers had concealed cash sales income. The issuance of a prohibition on cash payments would make it easier to discover business activities outside the Finnish Tax Administration’s registers, at least in certain sectors, as payment transactions regarding business activities would have to pass through bank accounts. Expanding the data content of VAT returns to the transaction level would improve the accuracy of registered data when up-to-date data about companies operating outside registers would be obtained based on their business partners’ reports submitted to the Finnish Tax Administration. Moreover, the addition of information about business bans and information about insolvency verified during enforcement proceedings, publicly available and free of charge, to the Finnish Business Information System would improve the transparency of company information. Transparency steers companies to fulfil their obligations and therefore helps combat the shadow economy.

Read the full report in Finnish (PDF, 1.33 MB)

Read more: Business activities outside registers

Register data alone cannot reveal shadow economy companies unwilling to pay taxes

Published 13.11.2023

The Grey Economy Information Unit studied whether companies unwilling to pay their taxes could be found solely based on tax debt and business tax return data. A total of 700 companies were selected for the study whose assets were greater than their debt (positive net assets) and who had accumulated tax debt within a longer time span. This group was examined to determine whether the reason for the accumulation of debt was a temporary payment default or some other, more serious issue with the company’s finances. If neither could be found, the reason could be unwillingness to pay.

Why are companies unwilling to pay taxes interesting?

A company can be deemed unwilling to pay if it wilfully does not pay its taxes. In this case, the company engages in shadow economy activities. A company that is unwilling to pay taxes is a company that could pay the taxes on time, but chooses not to.

However, being unable to pay does not contribute to the shadow economy. Companies that plan to engage in their business activities in the future as well strive to pay off their tax debt.

Authorities successful in reaching companies with tax debt

The results of the study indicate that the actions of the Finnish Tax Administration and the National Enforcement Authority Finland support companies with tax debt in their work to pay off the debt. Nearly all the companies included were subject to measures related to insolvency taken by the authorities.

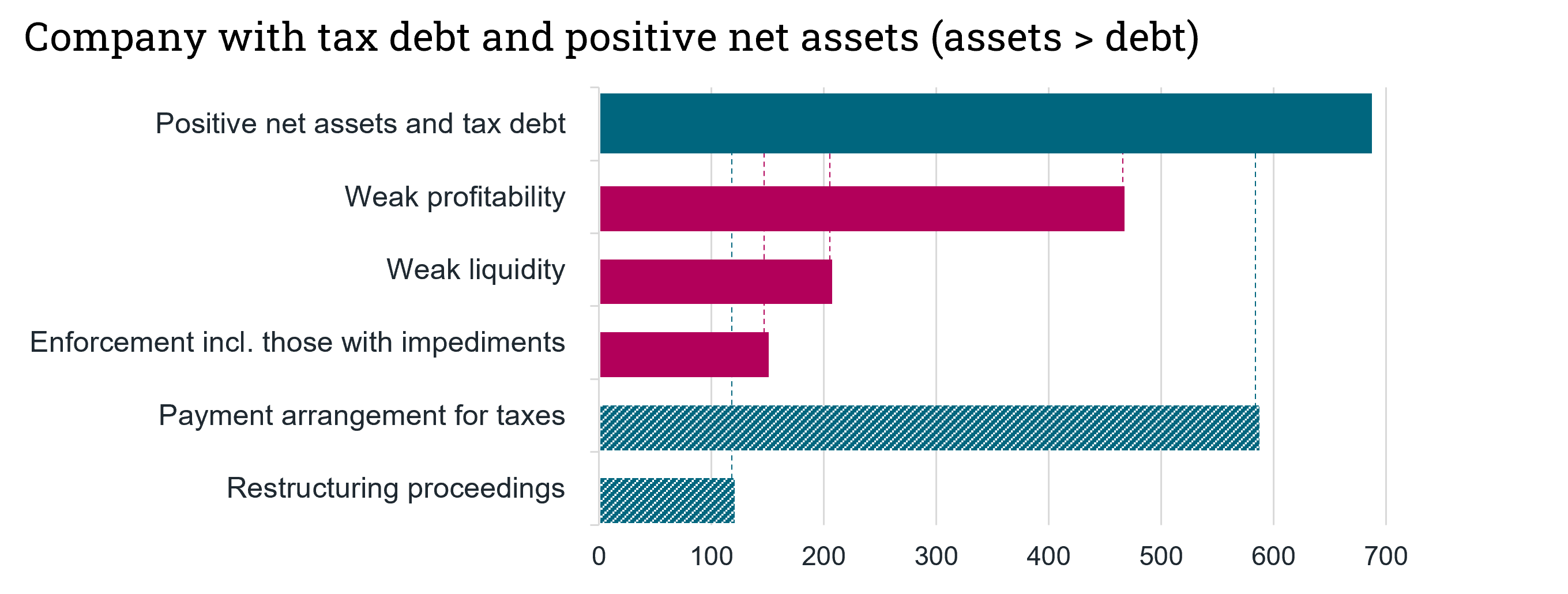

The measures of the Finnish Tax Administration support temporarily insolvent companies in their work to pay off their tax debt by dividing the tax debt into several instalments. Temporary insolvency is caused by both weak profitability and liquidity. Of the companies studied, 80% had established a payment arrangement with the Finnish Tax Administration. Of these companies, most had succeeded in reducing their tax debt during the payment arrangement. In addition, 17% had initiated restructuring proceedings. Of the companies studied, only 2% were not subject to any measures by the authorities, but these companies could not be deemed to be unwilling to pay either.

Figure. Temporary insolvency and payment arrangements

Deeming a company unwilling to pay requires closer examination of business transactions

Deeming a company unwilling to pay requires more intense supervision from the authorities, and these companies are often only discovered during a tax audit or a special audit. Even if a company seems insolvent based on register data, it can still engage in shadow economy activities. These can be cases of dishonesty by a debtor, in which the debtor infringes or endangers the rights of its creditors with its actions and causes its own insolvency or worsens it. Debtors usually transfer their assets somewhere where they are “safe” from the creditors when they realise that the preconditions for running their business are in danger.

The Coronavirus pandemic and recent changes in alcohol legislation had an impact on licence holders

Published 21.8.2023

The Pandemic pushed heavily indebted companies out of business. The changes in alcohol legislation have made licence supervision more difficult and companies’ tax debts are on the increase again following the pandemic.

The Coronavirus pandemic helped to clean up the market

Companies were able to strengthen their financial position following the pandemic: their balance sheets and solvency positions improved, and turnover increased. At the same time, there was a decrease in the number of loss-making companies and companies with negative equity.

More than €20 million in tax debts are still unpaid

Companies that went bankrupt and stopped serving alcohol during the coronavirus pandemic left more than €20 million in tax debts behind. The tax debts of the companies that have continued to serve alcohol decreased by about €10 million each year during the period in review (2020–2021).

Following a brief improvement, tax debts are on the increase again. In December 2021, tax debts totalled €12.8 million, and in June 2023, they had reached €20.4 million.

Supervising compliance with licensing laws has become more difficult

With the introduction of the new Alcohol Act in 2018, the authorities are no longer able to combat the shadow economy in the alcohol-serving sector as effectively as before. The changes in the supervision of serving licences contained in the new act have led to a situation where few licences granted by the Regional State Administrative Agencies are revoked. Licensing authorities now prefer milder sanctions.

Changes in the periodic reporting to alcohol administration may also have complicated tax control of the sector as less comparison data is now available.

Obligations regarding the audit are neglected

Published 12.6.2023

Compliance with the audit obligation is not monitored systematically in Finland. Neglecting obligations regarding the audit is fairly common.

Most deficiencies are seen in Trade Register information. Deficiencies can also be seen in auditor registrations and tax return information. Negligence is more common in companies that also carry other tax risks.

The monitoring of audits is distributed between several authorities – an overview is lacking

Companies with an audit obligation have certain reporting and registration obligations related to auditing. This means that companies have an obligation to provide auditing information through tax returns, register their auditor in the Trade Register, and submit the auditor’s report to the Trade Register attached to their financial statements.

No overview of the level of fulfilling obligations regarding the audit has been available in Finland. In part, this can be explained by reporting and registration obligations being distributed between several authorities.

Auditing plays a central role in verifying the accuracy of accounting and financial reporting

Auditors verify that companies’ managers act lawfully. As financial statements form the basis of companies’ tax returns, auditors verifying the accuracy of information is also important from the perspective of taxation. Errors in taxation and the grey economy risk may increase if auditing is not conducted.

According to the results, it is necessary to verify more extensively that all companies within the scope of the audit obligation fulfil their obligation

From the perspective of users of financial statements information, the data content of the Trade Register should be developed so that information about companies’ audit obligation and its fulfilment is made public. As a result, users of financial statements information would be better able to assess the reliability of financial information and the lawfulness of the activities of managers.

Read the full report in Finnish (PDF 1,09 MB)

Tax Administration Bulletin, 6/14/2023, New study: Nearly four out of ten limited liability companies neglect their audit obligations [.fi]›

Tax credit for household expenses combats the shadow economy – however, with limited impact

Published 23.5.2023

Companies that carry out large amounts of work subject to the tax credit for household expenses are at a smaller shadow economy risk than their reference group. However, the tax credit for household expenses does not reduce the shadow economy in sectors as a whole. The tax credit system is also susceptible to various abuses. The Grey Economy Information Unit’s publication discusses the impact of the tax credit for household expenses and offers alternatives to develop the system.

Tax credit for household expenses encourages companies to fulfil their obligations and improves the efficiency of tax control

The tax credit for household expenses promotes the combating of the shadow economy by targeting consumers’ demand at companies listed in the prepayment register. The system also provides companies with an additional incentive to fulfil their tax obligations appropriately to remain registered. Nevertheless, the study shows that companies with a similar risk level and in a similar financial position have fulfilled their reporting and tax payment obligations in the same way, regardless of whether they carry out work subject to the tax credit for household expenses.

The information obtained from tax credit returns is useful in tax control in various ways. For example, it helps target tax control and identify any unreported sales, and it can also be used as the basis of assessments by estimation.

Impact on the shadow economy risk is only limited to companies carrying out high amounts of work subject to the tax credit

Based on a statistical analysis, the existence of the system of tax credit for household expenses does not reduce the shadow economy in the industry as a whole. This can be identified by comparing a sector with similar businesses operating in sectors in which services subject to the tax credit for household expenses cannot be provided.

However, the system of tax credit for household expenses reduces the shadow economy risk of individual companies in situations where a significant part of a company’s revenue comes from work subject to the tax credit. The provision of occasional and small-scale activities subject to the tax credit was not found to similarly reduce the shadow economy risks of companies.

Abusing The tax credit system causes significant annual tax losses

The system is also abused using unfounded tax credit applications and artificial arrangements. Incorrect returns submitted unintentionally or intentionally are estimated to generate annual tax losses of roughly €20–30 million for the Government. This accounts for some five to seven per cent of total tax credits, as the tax credit for household expenses has reduced the tax revenue obtained from individual income tax by more than €400 million annually.

No simple solutions exist to improve the efficiency of the system

Based on an international comparison, other countries’ systems offer elements that can be used to develop the criteria applied to the tax credit for household expenses. However, many reforms would require investments and increase administrative work. Based on the study’s results, eliminating the deductible or expanding the tax credit system are not well-justified measures from the perspective of more effective combating of the shadow economy.

Private individuals have access to the tax credit for household expenses in their taxation if they purchase services carried out at their regular or holiday home. Services entitling private individuals to this tax credit include regular housekeeping and care services, as well as building maintenance and repairs. The purpose of the tax credit system is to improve employment and combat the shadow economy.

Read the full report in Finnish (PDF 1,33 MB)

Tax Administration Bulletin, 5/24/2023, New study: Limited impact of the tax credit for household expenses on the shadow economy among businesses [.fi]›

Organised crime exploits legitimate business activities

Published 23.01.2023

For organised crime, business activities offer a way to support crime and acquire influence and assets. When organised, criminal groups are more effective and can cause more damage to society and the justice system. Business activities carried out by organised criminal groups can cover the shadow economy or financial or other crime.

Organised criminal groups exploit legitimate business structures to maximise financial profit and other benefits. In addition to profit, legitimate business activities are used to hide the origin of assets obtained from crime, carry out various types of fraud and financial crime, and maintain and conceal illegal activities. Benefits other than directly financial gain include the establishment of a social position or control in a certain sector or area.

Networks, straw men and front companies set challenges for supervisory authorities

Organised criminal groups both establish new companies and acquire long-standing companies that have a good reputation or are near bankruptcy, depending on the purpose of their activities. Establishing or buying a company is not subject to any strict legal requirements, which makes it easy to engage in business activities. Organised criminal groups prefer company forms that enable them to conceal their criminal identity. This sets challenges for supervisory authorities. Organised criminal groups have large networks and are engaged in cooperation with other companies and interest groups, also through bribery, coercion, threats or extortion. Their activities often involve the inner circle and relatives of organised criminal groups’ members, as well as professional assistants who help organised criminal groups acquire and carry out legitimate business activities.

Research and studies increase knowledge of organised criminal groups’ activities

In combating organised crime, it is important to reduce demand for criminal activities, i.e. cooperation with criminals. Operating conditions can be reduced by increasing knowledge of criminal activities and their consequences.

The exploitation of legitimate business activities and the use of networks can be explored using the financial records of companies controlled by criminal groups. The shadow economy risk of companies can be measured using various data analysis methods and statistical models. It is important to study and research organised crime to identify the power, financial capacity and regional activities of criminal groups.

What is organised crime?

How is tax debt linked to the shadow economy?

Published 26.09.2022

The tax debt of shadow economy companies often results from intentional misreporting. At least part of the tax debt associated with taxes imposed based on tax audits and assessments by estimation is linked to the shadow economy. Other tax debt linked to the shadow economy is related to intentional non-payment. Tax debt offers important information for various authorities, and its existence may prevent companies from obtaining permits, for example.

Based on investigation results, tax debt does not apparently result in any significantly increased shadow economy risks. Any non-payment of taxes leads to deregistration, which makes it more difficult to continue operations. As a result, companies that also intend to be engaged in business activities in the future seek to pay their tax debt in one or more instalments.

Of limited liability companies’ tax debt, €200 million comes from the shadow economy

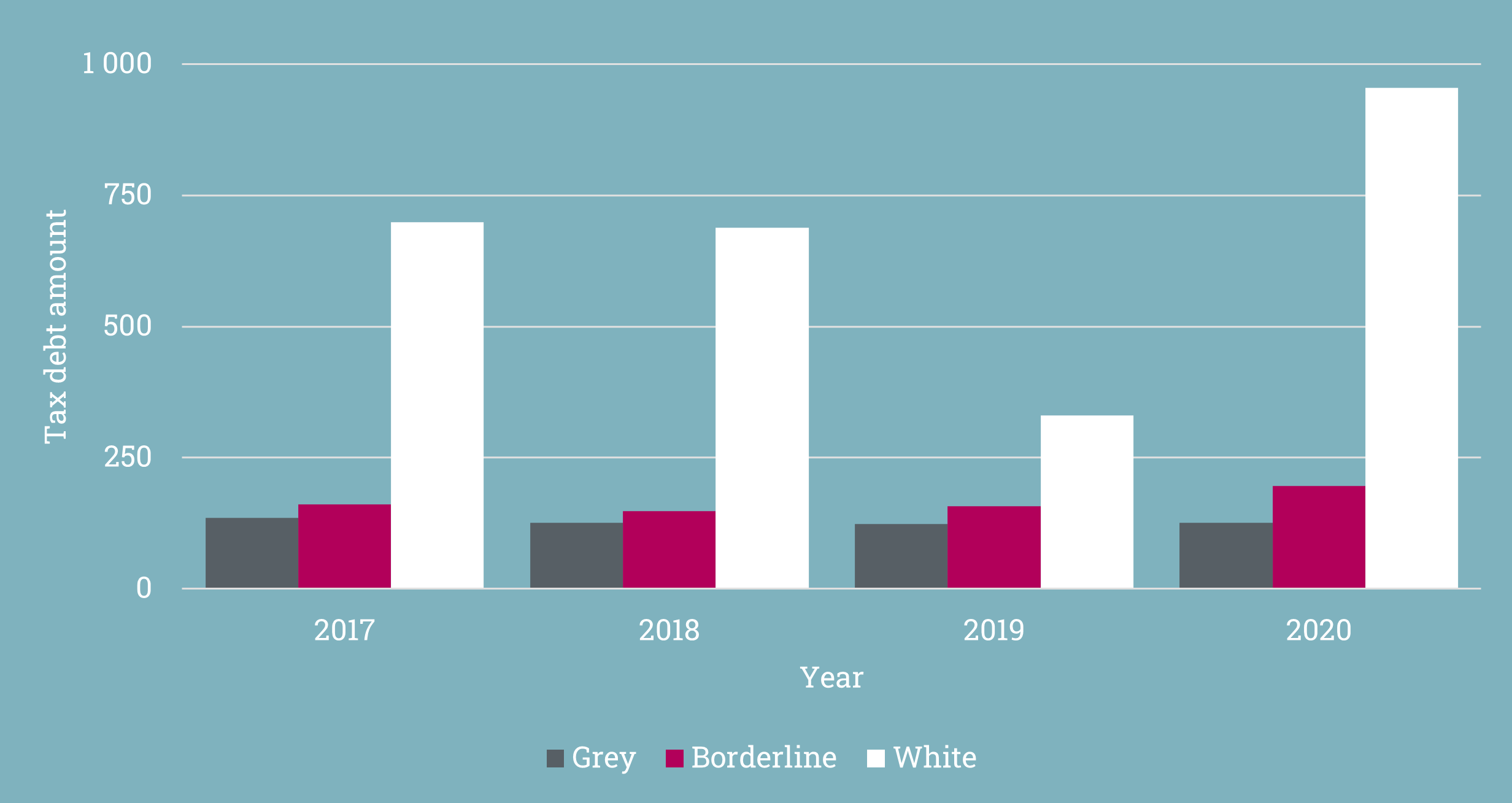

In the investigation, limited liability companies with tax debt were divided into three categories based on the probability of the shadow economy: 1) white; 2) grey; and 3) borderline cases. The division into these three categories allows part of the limited liability companies that operated during each investigated year to be fairly certainly classified as white or grey.

The investigation used machine learning to evaluate companies’ shadow economy activities.

The white category includes companies whose modelled probability of inappropriate activities is less than 50%.

The category of borderline cases includes companies whose modelled probability of inappropriate activities is 51–80%.

The grey category includes companies whose modelled probability of inappropriate activities is more than 80%.

Euro-denominated breakdown of tax debt in 2017–2020

The coronavirus pandemic broke out in 2020, which can be seen as a temporary increase in tax debt among white companies.

40–50 per cent of limited liability companies engaged in the shadow economy have tax debt

An average of 40 per cent of shadow economy companies had tax debt in 2017–2019. The corresponding figure was almost 50 per cent during the exceptional year of 2020 alone. Among white companies, the proportion of companies with tax debt was roughly 15 per cent. In the category of borderline cases, a quarter of all companies had annual tax debt.

Financial problems are the most significant cause of tax debt – not shadow economy activities

Tax debt was also investigated based on their root causes. Clearly the largest part – 40 per cent – of companies with tax debt have faced financial difficulties, with these financial difficulties being the reason why these companies cannot pay their tax debt. The second largest category consists of delayed payments (roughly 15 per cent). The category of companies subject to assessments by estimation is almost as large.

Having people with a prior criminal conviction in positions of responsibility increases shadow economy risk

Published 13.6.2022

Companies with persons in a position of responsibility who have been convicted of economic crime have double the risk of making reporting errors compared with companies whose responsible persons have no criminal convictions. The Grey Economy Information Unit has investigated whether a prior criminal conviction of a responsible person increases the risk of neglected tax liabilities in companies that have applied for coronavirus subsidies. The investigation identified a strong link especially between responsible persons convicted of economic crime and neglected tax liabilities.

Millions of euros allocated in coronavirus subsidies to companies with persons convicted of crime

In the companies that applied for coronavirus subsidies, three per cent of responsible persons had criminal convictions. This is equivalent to the criminal convictions of all responsible persons in Finnish companies. Companies with responsible persons convicted of crime received a total of €15 million in coronavirus subsidies in 2020, representing one per cent of the total amount of subsidies.

Five most significant offences

Certain offences among responsible persons seem to have a more significant negative impact on the fulfilment of companies’ obligations. According to the investigation, the five most significant offences were:

- Aggravated dishonesty by a debtor

- Aggravated fraud

- Fraud

- Aggravated money laundering

- Unlicensed provision of taxi services

For example, the negative impact of aggravated dishonesty by a debtor on the fulfilment of obligations was more than ten times higher compared to assault.

The task of the Grey Economy Information Unit is to produce and disseminate information on the shadow economy and how to combat it. The purpose of investigations is to produce information to support decision making.

Shadow economy risks in foreign unit-linked life insurance – a new monitoring project about to start

Published 21.3.2022

Billions of euros of Finnish assets are tied up in foreign unit-linked life insurance. The insurance products have been used not only in investment activities, but also as instruments of the shadow economy. The Finnish Tax Administration started to obtain information about foreign insurance products a few years ago, but the use of the information continues to involve various challenges. The Grey Economy Information Unit has investigated options to improve access to information and intensify tax control.

Insurance products used in both tax planning and tax evasion

Finnish assets in foreign investment-linked insurance products have increased significantly during the 2000s. In 2020, foreign insurance companies reported some 42,000 investment-linked endowment insurance products and capitalisation contracts held in the name of Finnish customers. The total assets in these unit-linked life insurance products were reported to be more than six billion euros.

Until 2020, unit-linked life insurance benefited from a tax benefit, in which taxation on income and value increases was postponed until assets were withdrawn from the product in excess of the amount of invested capital. However, the popularity of foreign insurance products can largely be explained by the fact that they can often be customised to meet the needs of individual investors. This means that they may have been used to exploit certain tax planning measures permitted by law and any gaps in legislation. Insurance products have also been used to hide income and cash out undeclared income.

Legislators have intervened in artificial arrangements

At the beginning of 2020, Finland introduced regulations to intensify the tax treatment of unit-linked life insurance. In addition, legislators aimed to especially intervene in artificial arrangements carried out using foreign insurance products. Before the new legislation entered into force, it was discovered that insurance surrenders by taxpayers had increased.

The monitoring of insurance products involves highly significant tax interests, and the new legislation helps to intervene more effectively in tax evasion than before. However, deadlines set for tax adjustments present a problem, as they make it more difficult to use information obtained through the automatic exchange of information (AEOI).

The Finnish Tax Administration responds to challenges with its new monitoring project

Information obtained automatically from other countries cannot as such be used as the basis for taxation, and monitoring nearly always requires requests for clarification and foreign administrative assistance requests. This means that monitoring is laborious, while risk-based monitoring can only be targeted at part of potential fraudsters. The Finnish Tax Administration will, however, launch a monitoring project for unit-linked life insurance in the spring of 2022 with the goal of ensuring the correct taxation on unit-linked life insurance and gathering first-hand information on the impact of legal amendments on these insurance products. The report was part of the programme for combating the shadow economy, and the new project will also be funded from appropriations allocated to the programme.

Finland at an average level internationally in preventing profit shifting to tax havens

Published 20.12.2021

Regulations on tax evasion have increased considerably since the early 2010s based on OECD and EU projects, for example. At the same time, legal provisions have been harmonised internationally. As part of this trend, regulations on controlled foreign companies (CFC) have been introduced more broadly to prevent profit shifting to tax havens. An examination based on the comparison of dozens of countries shows that, despite its few special characteristics, the Finnish CFC regime does not differ significantly from the regime of key countries included in the comparison.

Key elements of legislation are fairly similar everywhere

CFC regulations that tackle the avoidance of taxes by using tax havens are surprisingly similar practically everywhere. Before EU and OECD measures, CFC regulations were already built on the same principles, first and foremost due to the impact of the US law and the simultaneous introduction of the regulations in countries with similar tax systems. This was also the case in the Nordic countries in the 1990s. In the EU Member States, the Anti-Tax Avoidance Directive and the Court of Justice’s decisions have later set fairly strict frameworks for legislation. In practice, this has led to the harmonisation of CFC regimes and to a situation where regulations that prevent tax evasion can only rarely apply to companies operating in the EEA.

The purposes of the CFC legislation vary from one country to the next according to other tax law and the business structure. Certainly, regimes have different positions in countries where income received from abroad is primarily tax-exempt compared with such countries as Finland where global income is taxed more broadly. Then again, the significance of special regulations is emphasised in Finland because the tax residency was only determined, before 2021, based on the country in which each company was registered, meaning that not even a foreign company run from Finland can have become a resident taxpayer in Finland.

The effectiveness of legislation can be assessed based on various criteria

Finnish regulations largely correspond to similar key countries in the EU that protect their tax bases fairly comprehensively and are not engaged in any active tax competition. Of the EU Member States, certain smaller economies and states engaged in an active tax competition, however, apply very light regulations to prevent tax evasion. As a result, the Finnish CFC regime can even be considered to be stricter than on average in the EU. Due to extensive exemptions, however, the scope of application of the Finnish CFC regime does not extend to many arrangements that have been prevented more actively in Austria, Denmark and Portugal, to name a few.

The purpose of the CFC regime is that, when the conditions for its application are met, the income of a low-tax foreign company can be levied from shareholders in Finland, even if the company has not distributed any profit through dividends, for example. The application of the regulation is not subject to the purpose of tax evasion – the fulfilment of its criteria is sufficient. Key differences between the CFC regulations of different countries consist, first and foremost, of their potential application to organisations acting as shareholders only, or also to private individuals, like in Finland. In addition, certain states only collect taxes on passive income, whereas in Finland all income of low-tax foreign companies is subject to tax. Then again, foreign companies engaged actively in business have largely been exempted from the scope of application of the Finnish CFC regime. Other significant differences consist of the definition of the low-tax level.

A study presented perspectives to develop the regime

In its study published at the beginning of 2021, the Grey Economy Information Unit studied whether the Finnish CFC regime effectively prevents the shifting of profit to foreign low-tax companies. One of the key findings presented in the report was the opportunity to develop Finland’s CFC regulations in the direction of the Danish legislation. In Denmark, regulations prevent situations where taxes are avoided in the EEA exploiting structures related to holding companies and funding more effectively than in Finland. Two texts have previously been published on this website regarding the study 15.3.2021 and 17.5.2021. They firstly discussed the minor impact of the most recent legal amendment and secondly the challenges caused by the exemptions included in the regime.

Risks associated with the use of foreign workforce investigated

Published 25.10.2021

The survey investigated foreign employees who are regarded as resident and non-resident taxpayers in Finland, and the fulfilment of obligations and the taxation behaviour of the more than 13,000 companies that employed them. The majority of wage payers were Finnish companies.

Inconsistencies in work permits and earnings payment data

A tenth of all companies that employed foreign employees holding a work permit did not report their earnings payment data or turnover in 2019. In some companies, the payment of wages could not be connected to hourly wages or data about hourly wages was unavailable.

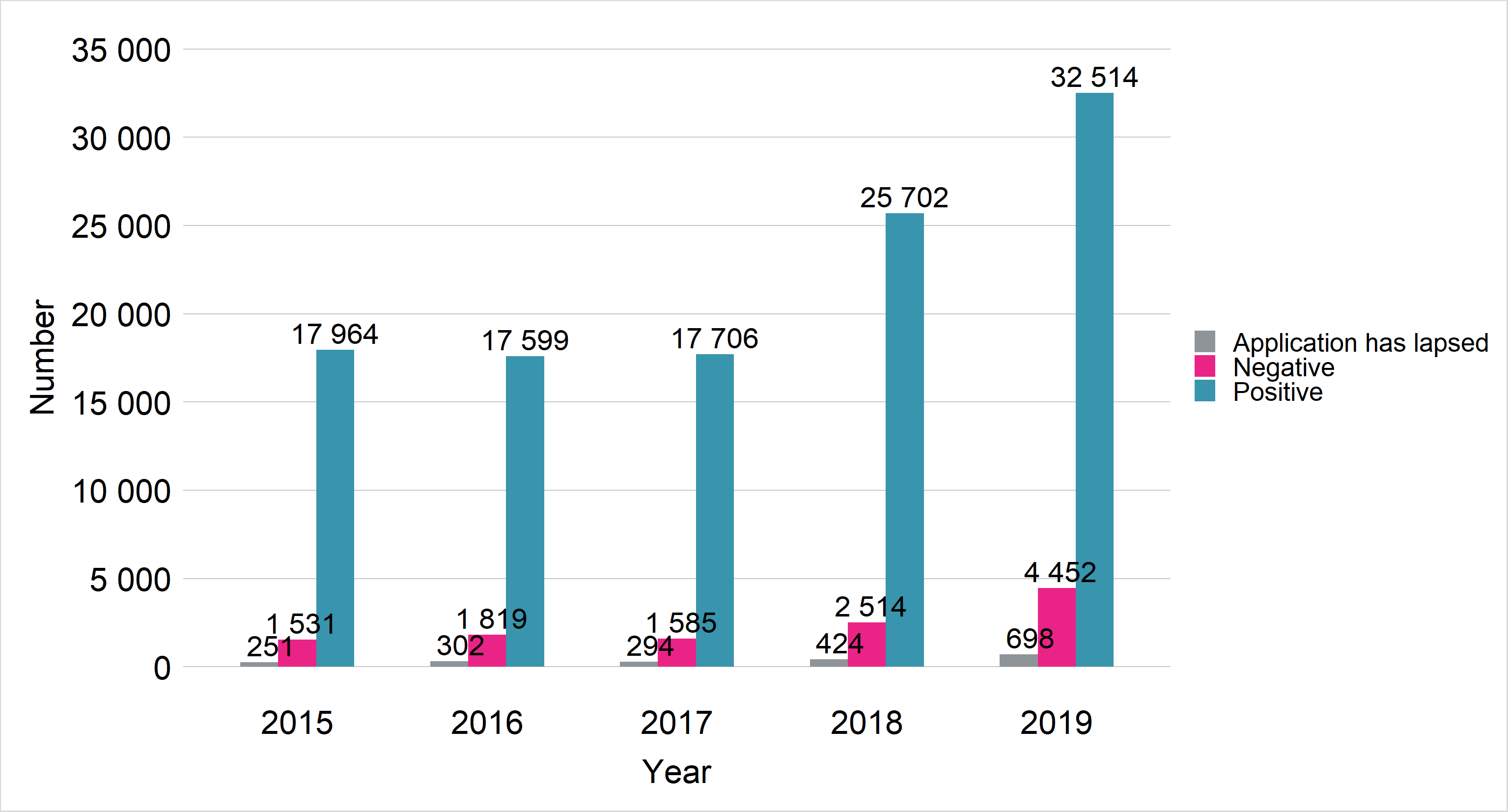

Figure 1. The Finnish Immigration Service’s decision types for permit applications in 2015–2019. Source: Finnish Immigration Service 3/2020

Official information should be coordinated

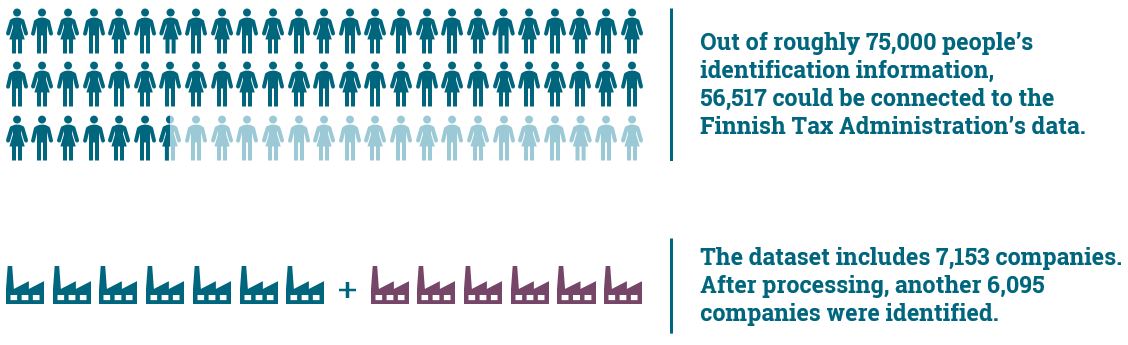

The survey was based on information obtained from the Finnish Immigration Service and the Finnish Tax Administration regarding 2015–2019. Some individuals and companies remained unidentified due to incomplete names, misspelling, and inaccurate characters and identifiers.

A higher interoperability of databases would enable better monitoring, and ensure any cases of underpayment, exploitation and work discrimination to be discovered. The merger of data could ensure the start of an employment relationship and the payment of wages, and identify the fulfilment of statutory obligations by wage paying companies.

Improvements expected in information exchange between the authorities

The prevention of the shadow economy and economic crime has for long focused on problems in information exchange between the authorities. Project 3.1 of the current action plan aims to develop regulations on information exchange between the authorities to identify shadow economy actors and improve the efficiency of prevention.

The law has already been amended

The high availability of information about business activities and electronic services in information exchange between the authorities, in particular, make the identification and monitoring of shadow economy actors easier and more effective. Relating to the action plan’s project, the act on the processing of personal data by migration authorities (Laki henkilötietojen käsittelystä maahanmuuttohallinnossa) entered into force on 1 September 2020. The amendment provides the migration authorities with the right to use extensive official information in their activities. From 1 March 2021, they were also provided with the right to use the VHS service of the Grey Economy Information Unit for identifying the fulfilment of obligations.

How have crowdfunded companies fulfilled their obligations?

Published 20.9.2021

The Grey Economy Information Unit investigated how companies that have received crowdfunding have fulfilled their obligations and whether there are any signs of the grey economy. Business financed through venture capital involves a higher risk of loss-producing operations and bankruptcy than start-up businesses. Financial difficulties have also been seen to present the risk of the grey economy. Financial difficulties or inabilities to pay are not part of the grey economy as such, while they increase the risk of companies intentionally neglecting their obligations related to taxes and other statutory fees.

The Finnish Financial Supervisory Authority is also aware of these risks, and it has advised companies seeking crowdfunding and crowdfunding intermediaries to focus on how to provide investors with information about the financial standing of the companies being invested in.

The investigation covered companies whose operations were funded by investments made through three Finnish crowdfunding platforms between 2012 and 2018. In total, 121 limited liability companies were investigated.

Many companies afflicted with weak finances

In 2020, nearly 70 per cent of the investigated companies produced a loss. More than 40 per cent were in a weak situation in terms of solvency. Furthermore, one quarter of the companies had negative capital.

Overdue tax liabilities presented the largest problem in the fulfilment of obligations. One third of the companies had tax liabilities, with their total amount being nearly EUR 4 million. Of the total tax liabilities, EUR 2.5 million had no valid payment arrangement. An assessment by estimation was carried out for two companies in 2019.

Only a small part of the companies were subject to enforcement proceedings, despite the companies’ generally weak financial standing and their tax liabilities. Of the companies, 14 had been declared bankrupt and three were in restructuring proceedings. As stated above, a company’s insolvency does not directly hint at the grey economy or economic crime.

No findings of the grey economy

If any signs of the grey economy are discovered, uncovering it often requires a tax or special audit targeted at the company in question. In the worst case, the company’s managers may attempt to cover the company’s weak financial standing by committing accounting crime and taking legal action to violate creditors’ rights. This often takes place before the company seeks bankruptcy proceedings.

Eleven of the companies receiving crowdfunding had been tax audited in 2017–2020. No signs of the grey economy were found in any of the tax audits. Furthermore, no business prohibitions were in effect.

No significant differences in the fulfilment of obligations compared with other small and growing companies

The operations of companies that had received crowdfunding were compared with those of leading companies without any crowdfunding. No clear or significant differences were found in the fulfilment of obligations between the company groups. It is safe to say that, in general, the early operations of small and growing companies carry a high risk. However, most companies aim to stabilise their operations and continue their business activities.

Harmful tax competition and loopholes in legislation enable tax avoidance

Published 17.5.2021

Foreign companies can be used to attempt to avoid taxes in Finland. These arrangements have partly been enabled by harmful tax competition, in which countries attract income accumulated in another country by using various tax incentives. Finland has taken steps to prevent the shifting of profit to tax havens through several regulatory solutions. Key instruments include the Finnish controlled foreign company (CFC) regime, whose exemptions, however, still leave room for the use of tax incentives for wealth management.

The CFC regime effectively prevents simple arrangements

By virtue of the CFC regime, the undistributed profit of a low-tax foreign company can be levied from shareholders in Finland. The regime does a fairly good job of preventing many simple tax avoidance structures that make use of companies registered outside the EEA. Based on the report of the Grey Economy Information Unit, the CFC regime broadly covers different taxpayers and legal forms, and its scope of application does not include any gaps in this respect. Actual problems are associated with exemptions to the scope of application of the regime that can be potentially exploited in many ways in arrangements aimed to avoid taxes in Finland (see Section 6 of the report).

Exemptions to the scope of application of the regime as key challenges

The CFC regime does not apply if any separately defined exemption applies to a company. The most important of these is the substance carve-out applied to entities resident in the EEA. Based on the substance carve-out, units are exempted from the scope of application of the CFC regime if they are placed in their country of residence and are actually engaged in financial activities in any line of business there. Furthermore, companies outside the EEA may be exempted from the scope of application if they receive the majority of their income from industrial production or services, for example. Exemptions can be attempted to be exploited in various ways in tax avoidance.

Drawing the line in situations where the substance carve-out applies to companies registered in the EEA may involve holding companies whose business operations are small. In practice, fairly small business operations may prevent the regime from being applicable. In the case of purely dormant companies, the application of the carve-out is often subject to interpretation. The carve-out largely requires a similar assessment as the application of the general tax evasion standard, whose limited scope of application and poor predictability were the reasons why the CFC regime was originally prescribed. Being subject to interpretation may also lead to a situation where a private person’s neglected obligation to report profit in a controlled foreign company cannot be considered to be intentional. This is problematic from the perspectives of shadow economy prevention and the preventive nature of the regime.

Exemptions can be exploited in various ways

If the CFC regime is applicable, tax on a unit’s entire income will be levied in Finland. This structure based on the taxation or exemption of all income is also open to exploitation. First of all, assets that accumulate passive income can be shifted to a company engaged in exempted activities. Correspondingly, a sufficient amount of financial activities can also be attempted to be shifted to a low-tax company to have an exemption applied to it. In the example cases presented in the report, the use of tax incentives regarding intangible rights or financing has typically been combined with evasion based on tax treaties and the exploitation of the CFC regime’s exemptions. However, whether an arrangement concerns aggressive tax planning or tax evasion and the shadow economy depends largely on the case.

The Grey Economy Information Unit studied whether the Finnish CFC regime effectively prevents the shifting of profit to foreign low-tax companies. As stated in the first article on this theme, the regime does not achieve all of its goals, and the most recent amendment to the regime has not been found to have any significant impact.

The third article to be published at the end of the year will discuss in more detail what types of solutions certain other countries have decided on to prevent the problems presented in this text.

Problems remain in the Finnish CFC regime – law amendments appear to have only a minor impact

Published 15.3.2021

Foreign entities, such as companies and trusts, are still being exploited in many ways to avoid taxes in Finland. Some 50 countries use regulations on controlled foreign companies (CFCs) to prevent the shifting of profit to foreign low-tax entities. A new comparative legal study shows that arrangements that are attempted to be prevented in other countries by means of different regulatory solutions still remain outside the scope of application of the Finnish CFC regime.

The Grey Economy Information Unit investigated whether the Finnish CFC regime effectively prevents the shifting of profit to low-tax entities. The broad topic has been divided into three online texts. This first discusses the Finnish CFC regime in general and briefly examines the impact of the most recent legal amendment. The second to be published in May will focus more on any problems in the CFC regime. The third will discuss how the Finnish CFC regime differs from CFC rules worldwide and assess whether CFC structures have been prevented more effectively in other countries than in Finland.

The purpose of the Finnish CFC regime is to prevent the avoidance of taxes via CFCs

When the CFC regime is applied, corporate income tax can be levied from shareholders in CFCs, even if the company has not distributed any corporate income to its shareholders. A company whose income tax effective corporate income tax rate is significantly lower than in Finland and which is controlled by a taxpayer in Finland can be regarded as a CFC. However, the CFC regime does not apply if any separately defined exemption applies to the company.

The aim of the CFC regime is to prevent private individuals from avoiding taxes and groups of companies from shifting profit to low-tax countries. Preventing these two highly different phenomena also sets challenges to the structure of the law. When the CFC regime was enacted in the 1990s, it reduced the supply and use of services related to CFCs. However, defects in the international exchange of tax information prevented undeclared shareholdings in CFCs from being detected in tax control until the 2010s.

Nearly all declared CFCs outside the EEA

The number of CFCs declared voluntarily in taxation seems to have remained at a few dozen for several years now. In these situations, a shareholder in a CFC does not receive any tax benefits; instead, a company is established in a low-tax country, for example, due to raw materials or customers. There are practically no declared CFCs owned by private individuals, even though undeclared CFCs detected during tax audits have, in fact, been primarily owned by private individuals. Individual tax audits have revealed undeclared CFC profits ranging from hundreds of thousands to millions of euros. Nearly all audited and declared CFCs are located outside the EEA, largely due to the restricted scope of application of the CFC regime in the EEA.

Legal amendments in the right direction, but with a minor impact

Several amendments were made to the CFC regime in 2019 as a result of the EU Anti-Tax Avoidance Directive. However, the majority of the amendments have had a minor impact, at least in the light of statistics. Currently, the CFC regime could, for example, be more easily applicable to entities located in tax treaty countries, while the amendments have not increased the number of voluntarily declared CFCs. Nevertheless, amendments concerning exemptions would appear to have an impact on companies operating in developing countries instead of companies registered in tax havens (see Section 4 of the report for more information).

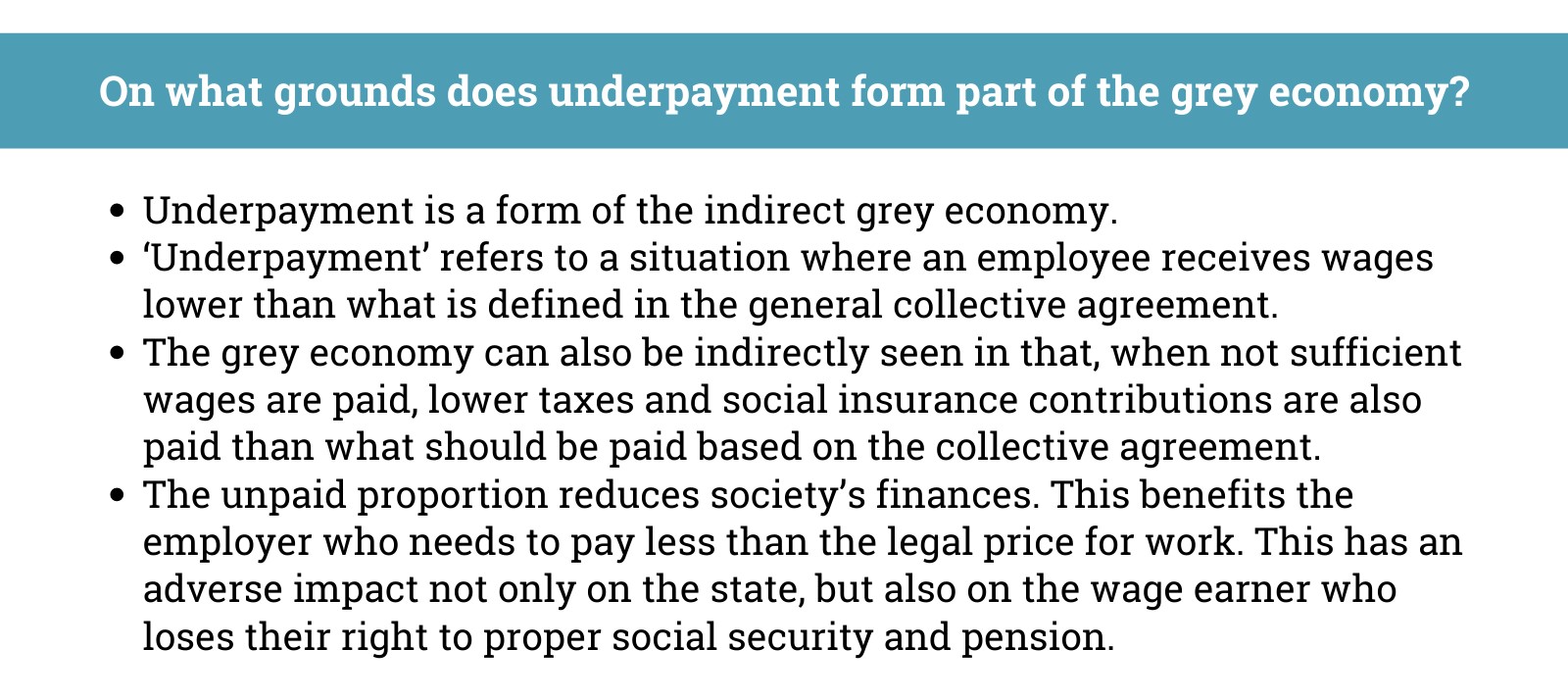

Only a fraction of all cases involving underpaid foreign employees went to court

Published 19.10.2020

Recently, exploitation faced by foreign employees has become a hot topic. There has been news of the oppression of Ukrainian construction workers, the systematic exploitation of restaurant workers and large-scale problems in the cleaning sector.

A growing number of cases of work-related exploitation has been identified in Finland. The underpayment of foreign employees is one form of exploitation. Employers guilty of misconduct aim to maximise their profits and hide any exploitation from the authorities. The Finnish Tax Administration’s Grey Economy Information Unit has studied court cases involving underpayment.

Three central findings were discovered. First of all, the underpayment of foreign employees is a partly punishable act in Finland, although it is not laid down in any separate provisions in the Criminal Code of Finland. Secondly, those cases of underpayment that resulted in legal proceedings are only the tip of the iceberg: the number of court cases is very low, punishments are mild and the compensation practice shows great variation. Thirdly, the authorities do not have sufficient means to tackle the underpayment problem.

Cases of underpayment only rarely enter in court proceedings

Only few cases of underpayment are entered in the legal process. When this happens, decisions are primarily issued on the basis of provisions on extortionate work discrimination as laid down in the Criminal Code. Some decisions are also issued on the basis of work discrimination. One reason for the low total number of work offences concerning underpayment is their short statute of limitations. Work offences expire repeatedly in different phases of the criminal process.

Based on the analysis of court cases, they are rarely processed in conjunction with other economic offences, such as tax or accounting offences. However, it is fairly probable that underpayment often actually involves other work and/or economic offences that are not discovered for one reason or another.

If a court of law deems that too low wages meet the characteristics of work discrimination, the penalty is, nearly without exception, a fine of a few hundred euros.

New means to prevent underpayment are needed

The Government Programme defines that the Government is investigating new means to combat underpayment based on intent or gross negligence. This is necessary, because labour protection authorities do not, at present, have well-functioning means to impose sanctions on cases of underpayment.

An increase in cooperation between different authorities could be one potential way to detect cases of underpayment more effectively. In concrete terms, this could mean that, by conducting a tax and occupational safety audit at the same time, it would be more probable to identify and intervene in underpayment problems from many different perspectives.

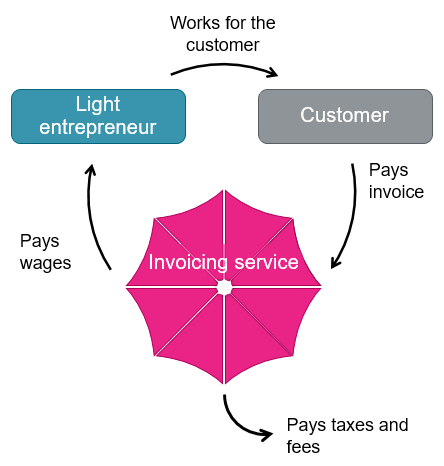

A light entrepreneur works under the umbrella of an invoicing service company

Published 21.9.2020

No single law defines what constitutes a light entrepreneur. The authorities and different laws approach the concept of work through the traditional binary of entrepreneurs and workers. However, there are significant differences in the definitions of entrepreneur and worker used by different authorities.

A light entrepreneur is treated as a wage earner for tax purposes. However, according to the prevailing labour law interpretation, a light entrepreneur in a commission relationship serves as an entrepreneur that sells services through an invoicing service company without having a company of their own (business ID).

In other parts of the world, it is common to use invoicing service companies. In English, an invoicing service company is referred to as an “umbrella company” – light entrepreneurs operate under the umbrella of the invoicing service company .

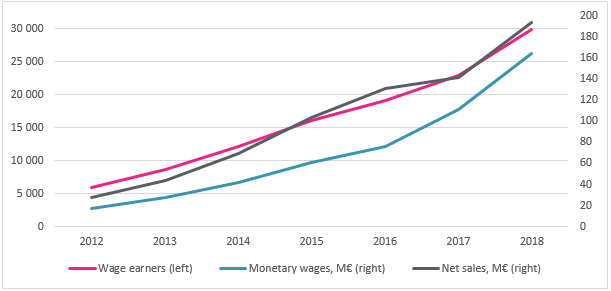

Light entrepreneurship is growing at a tremendous clip

In 2018, there were a total of 32 invoicing service companies. The net sales of these invoicing service companies totalled almost EUR 200 million. The 30,000 light entrepreneurs operating under their umbrella were paid wages of EUR 165 million. The number of light entrepreneurs grew six-fold in 2012–2018. At the same time, the number of invoicing service providers almost doubled.

How do light entrepreneurs attend to their obligations compared to self-employed individuals?

It has been suspected that debtors in enforcement proceedings use invoicing services in an attempt to avoid the garnishment of their income. Individuals may also use these services to circumvent a ban on business operations, as a light entrepreneur is primarily considered a wage earner rather than an entrepreneur for tax purposes.

A study showed that one in ten light entrepreneurs were debtors subject to enforcement proceedings and that a ban on business operations had been imposed on 75 light entrepreneurs. A light entrepreneur was twice as likely as the average self-employed individual to have debt subject to enforcement proceedings. In relative terms, the number of light entrepreneurs subject to a ban on business operations was 12 times higher than the equivalent number of self-employed individuals.

Are Estonian companies used as tools of the shadow economy in Finland?

Published 15.6.2020

Finns have many links to the Estonian business world. However, merely establishing a company in Estonia does not confer tax benefits if its operations are led from Finland.

Finns have many links to the Estonian Business Register

The Tax Administration’s Grey Economy Information Unit has investigated how Estonian companies are involved in the shadow economy. The study delved into issues such as the Finnish connections of the responsible officers of companies included in the Estonian Business Register. During the period 1999–2018, the number of Finnish citizens in the Estonian Business Register almost tripled. In 2018, more than 8,000 Finnish responsible officers were included in the Estonian Business Register.

The shadow economy takes the form of many activities

Shadow economy activity related to Estonian companies includes the concealment of income, VAT fraud, failure to keep accounting records, and moving to Estonia on paper even though the individual, in fact, lives in Finland.

One indication of shadow economy risks is a situation in which all the responsible persons of a company are Finnish and they all live in Finland. More than 3,000 companies meeting these criteria were found.

Comparing information from the Finnish Tax Administration with the Estonian Business Register revealed almost 300 Finns who live in Finland and have no income according to the Finnish tax records, but who serve as responsible officers of an Estonian company. The lack of taxable income might indicate deliberate concealment of income, a typical shadow economy activity.

Estonia does not provide tax benefits when business operations are carried out in Finland

Merely establishing a company in Estonia does not confer tax benefits if it engages in operations in Finland and has a so-called permanent establishment here – that is, if it has its headquarters or an office in Finland. In that case, the permanent establishment of the foreign company is taxed in accordance with Finnish legislation. In addition, a permanent establishment is subject to Finnish work legislation, including the terms and conditions of remuneration.

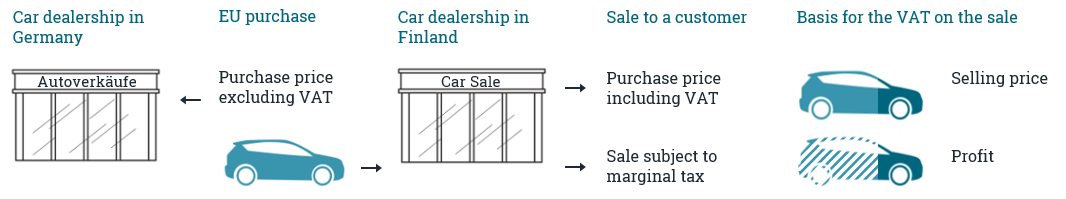

There are various ways to evade taxes in the car business

Published 24.2.2020

Car sales and imports have been found to be vulnerable to the shadow economy.

Does the car business suffer from under-the-counter sales?

Selling under the counter is one of the most common ways to evade taxes in the car business. Companies can neglect to report a part of their sales, but there are also companies that do not report their activities to the Finnish Tax Administration at all. Extensive car trade by a private individual may also, in reality, constitute business activity in reality. Reviewing car tax returns provides hints of undeclared business carried out by private individuals.

Purchases from other EU countries are becoming more common, but many car dealers only report part of them to the Tax Administration

More and more companies in the car business buy cars from other EU countries as purchases of goods including VAT. The number of purchases reported by companies has increased by nearly 36% during the past five years. Out of the companies that have made purchases of goods within the EU, nearly one third report making a clearly lower number of purchases compared to the sales to the same parties reported by the European seller. The differences may be partly due to errors in reporting, but they may also be due in part to intentional failures to report and the shadow economy.

Marginal taxation is a tax risk in car imports

The marginal taxation method can be used in the sale of used cars. The possibility of misusing the procedure increases the risk of shadow economy. The sale of a car subject to VAT may be processed incorrectly in the company’s bookkeeping as sale subject to marginal taxation. This reduces the tax on the sale, because in the marginal taxation method, the VAT on the sale is only calculated for the share of gross profit.

Simple marginal tax fraud

Taxi legislation poses challenges in combating the shadow economy

Published 23.1.2020

Legislation governing the taxi business was thoroughly revised in summer 2018. The revised legislation has ushered in new challenges in tackling the shadow economy.

The three key aspects that hinder efforts to tackle the shadow economy are:

Logical explanation for the decline in VAT revenue

It has been speculated in public discussion that VAT revenues have declined due to the shadow economy. The Tax Administration’s Grey Economy Information Unit carried out a study to investigate this issue. There are many natural explanations for the decline in VAT revenue – the major reasons are the growth in outsourcing and equipment procurements by new entrepreneurs.

The study also examined tax revenues in this field of business compared with an affiliated business, goods transport by road. The study revealed that the tax revenues generated by the taxi business are relatively moderate.

The taxi business in transition

Taxi entrepreneurs who neglect their public obligations pose a challenge of their own. The number of companies with tax debts has surged after the legislative reform. Steps are being taken to address this issue. The Finnish Transport Safety Agency may revoke the transport permits of taxi entrepreneurs who neglect their obligations.

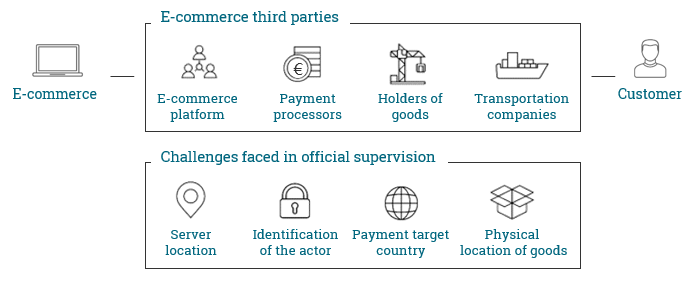

Payment information is required for effective control of e-commerce

Published 18.11.2019

Information from payment processors would enable the tax authorities to form an overall picture of e-commerce business and control compliance with tax obligations. The largest share of payments for European consumers’ purchases from online stores outside the EU are handled through payment processors. Without information on these transactions, it would be difficult for the authorities to identify online stores in third countries and their sales volume.

International agreements, legislation and confidential co-operation with the actors involved play an important role in accessing payment information. Accordingly, the proposed amendments to the VAT Directive state that payment processors should provide payment information to the tax authorities of various countries in order to prevent VAT fraud in cross-border e-commerce.

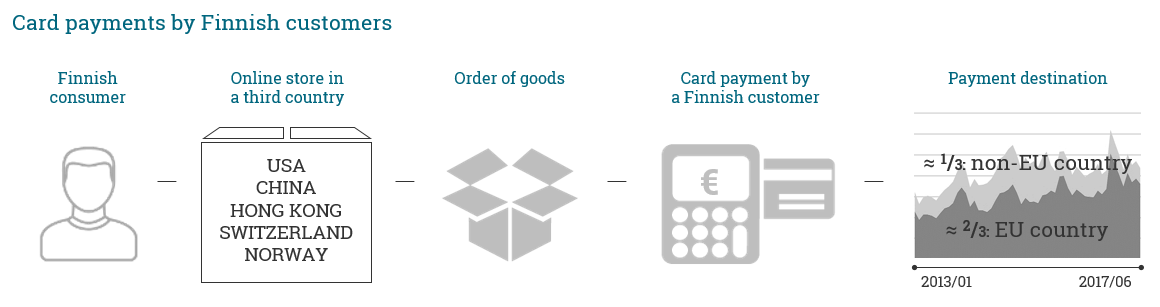

Payments to online stores most often end up in the EU

Card payments received by the largest online stores in third countries are often transferred from consumers to actors in the EU. This makes it more difficult to see the full picture of how much online trading takes place in third countries. Two-thirds of payments to online stores in third countries are first transferred to Europe. Only a third of payments are transferred directly to third countries.

There are also great differences in how payments to online stores in various countries are transferred. Almost all payment transactions to Chinese online stores and 70 per cent of payments to US online stores are first transferred within Europe. On the other hand, payments to EFTA countries outside the EU are transferred directly to the country in which the online store is located.

Foreign investment-related tax evasion is changing

Published 17.9.2019

Concealment of income and assets from the tax authorities has become more difficult during the past few years. Consequently, individuals who were earlier utilising bank secrecy for tax evasion purposes have been trying to find new ways to evade taxes.

The amount of assets transferred to life assurance contracts, essentially to foreign ones, has substantially increased. Life assurance contracts can be utilised for tax planning, tax avoidance and tax evasion purposes in several ways. In addition, artificial arrangements with intention to obtain status as a person with limited tax liability in Finland have been detected in tax control more often.

One type of investment-related tax evasion phenomena has been an arrangement in which nominee-registered shares are acquired by Finnish residents via foreign service providers, and after the shares are sold the capital gains have not been reported to the tax authorities. Moreover, the tax at source on dividends is possible to avoid by means of several arrangements.

Change initiated by the revolution in exchange of information

Arrangements based on the utilisation of bank secrecy and offshore companies primarily remained outside the scope of tax control until the 2010s. In addition to tax evasion, bank secrecy had enabled illegal insider trading and the concealment of assets from enforcement authorities. However, after the financial crisis tax havens were pressured to conclude tax information exchange agreements with other countries and, further, the bank secrecy laws started to crumble. A few years later, due to the legal amendments on comparison data audits, the Finnish Tax Administration – for the first time – acquired adequate tools to control cross-border money transactions as well as the use of foreign credit cards in Finland. Furthermore, multilateral automatic exchange of information based on the OECD’s Common Reporting Standard (CRS) began in 2017, and it has provided an unforeseen amount of data based on foreign investment-related income for tax control purposes.

The Tax Administration has allocated more resources towards tax control over cross-border transactions. Consequently, a considerable number of tax evasion arrangements have emerged during the past few years.

The need for development of treaty network and national legislation continues

Some significant financial centres are still staying outside the CRS, as well as the agreement of mutual assistance for the recovery of tax claims. Furthermore, there is the need to close a few essential loopholes in Finnish national legislation. For example, the avoidance of tax at source on dividends by making transactions round the ex-dividend date would be possible to block by means of legal amendments as well as by re-negotiating tax treaties. Furthermore, in order to intervene in tax evasion arrangements via holding companies registered abroad, Finland should determine the tax residence of companies as based on the place of effective management instead of the place of incorporation. In addition, the introduction of a new tax targeted at increasing the value of assets liquidated after moving away from Finland would prevent artificial tax avoidance arrangements that are intentionally made to obtain status as a person with limited tax liability in Finland

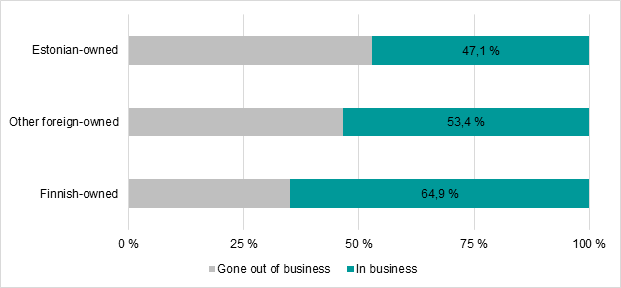

Companies with Estonian responsible persons have more irregularities than Finnish-owned companies

Published 20.8.2019

Estonian-owned companies registered in the Finnish Trade Register have tax-related reporting and payment irregularities more frequently than Finnish-owned or other foreign-owned companies. A far greater share – almost half – of Estonian-owned companies operate in the construction sector, where the risks of shadow economy are high.

Almost half of Estonian-owned companies have tax arrears. The average amount of the tax arrears is more than threefold that of all Finnish companies.

Estonian-owned companies are often short-lived and do not accumulate capital

Of the companies founded in 2013, less than half were still in business in 2018. Two thirds of the Finnish-owned companies established at the same time were still operational in 2018.

Business operations of companies founded in 2013 in the year 2018.

Debtors are often faced with nothing but the sham façade of the company. The companies have no restricted equity. In half of the cases, the equity ratio of the company is not known or it is less than ten percent of the balance-sheet total. Only one third of Finnish-owned companies are in the same situation.

The tax audits of Estonian-owned companies often lead to consideration of a crime report

More than seven percent of Estonian-owned companies have been tax audited. Of the tax audits made on Estonian-owned companies, approximately one third have led to consideration of a crime report

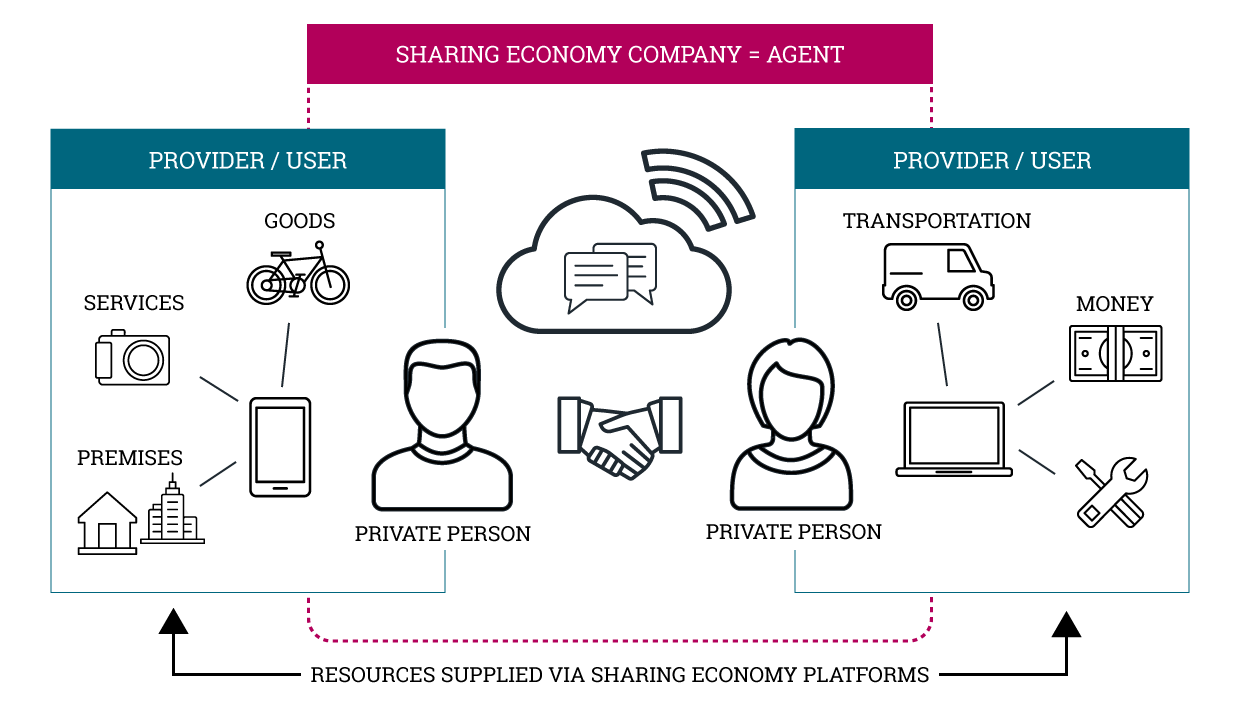

Finnish sharing economy companies are small but perform their public obligations well

Published 26.3.2019

Close to thirty domestic sharing economy companies operate in Finland at the moment. Their economic significance is relatively small so far. A poor economic situation poses a risk to sharing economy companies.

Income from the sharing economy is taxable

Natural persons using the sharing economy platform are obliged to pay income tax on their income. The treatment of the sharing economy in taxation does not differ from the tax treatment of traditional operating practices. The income received by a natural person is either earned income or capital income. Expenses incurred from the generation of income can be deducted in taxation.

Tax authority access to information from sharing economy platforms must be ensured

The owner of a sharing economy platform is obliged to declare the income earned from platform activities. Platform owners are not, however, currently required to declare income from the taxable activities of users of the platform if cash payments are not transferred via the platform.

Legislation needs to be improved to ensure that the Finnish Tax Administration has access to information on business activities conducted by means of platforms. Legislation should be improved in such a way that operators would be obliged to provide more extensive information on platform users and their activities.

Companies with foreign responsible persons have more irregularities than Finnish-owned companies

Published 18.12.2018

Foreign-owned companies registered in the Finnish Trade Register have tax-related reporting and payment irregularities far more frequently than those managed by Finnish persons.

Companies managed by foreign nationals more commonly fail to pay their taxes

One third of foreign-owned companies have tax debts, and the average amount of the tax debt is twice as much as that of Finnish companies. The share of companies managed by foreigners that are taxed based on an estimation is 2.5 times that of Finnish companies, and the share of companies with tax debt is 1.5 that of Finnish companies.

Irregularities are particularly common in companies managed by Estonian nationals

Companies managed by Estonian nationals represent a fifth of foreign-owned companies. However, up to one third of companies with tax debt have Estonian ownership. Over 90 percent of the tax debt of these companies belong to companies that have already gone out of business.

Foreign-owned companies are short-lived

Companies with foreign ownership stand in clear contrast to those managed by Finnish persons in terms of their short lifecycle. The risk of termination of their business operations is also much higher than among Finnish companies. The country of origin of the responsible persons has an effect on the companies’ lifecycle; for example, companies with Swedish ownership have a longer average lifespan than those owned by Estonians.

These are some of the facts that emerge from the reports conducted by the Grey Economy Information Unit.

Foreign entities and branches in Finnish (PDF 449 kB)

Foreign companies in the Finnish Trade Register in Finnish (PDF 1,30 MB)

Online sales of electronic cigarette products declined even before the ban on distance sales

Published 20.11.2018

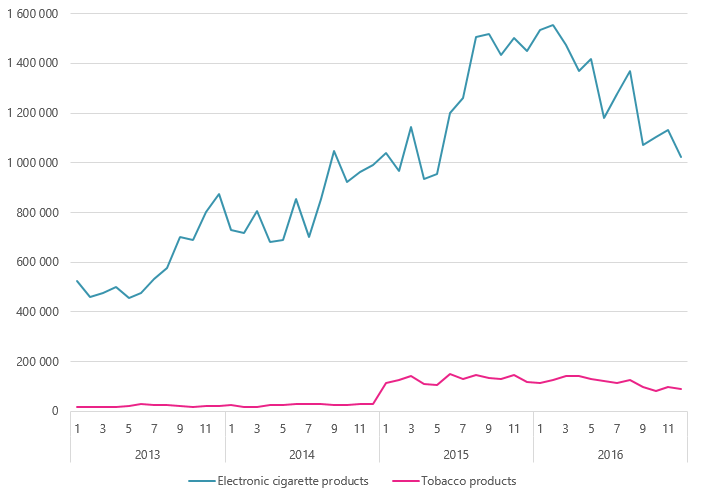

Online sales of electronic cigarette and tobacco products increased clearly in 2013–2015. In 2016, online sales of electronic cigarette products began to decline.

The ban on distance sales of electronic cigarettes and nicotine-containing liquids came into effect in 2017, after which private individuals have not been allowed to receive electronic cigarettes or nicotine-containing liquids purchased from online stores by post, as goods transportation or via other similar means from outside Finland. However, monthly sales had already fallen by some EUR 500,000 during 2016.

The Finnish Tax Administration’s Grey Economy Information Unit studied the development of online sales of electronic cigarette and tobacco products in 2013–2016. The share of electronic cigarettes of all online sales of tobacco products was 90 percent. This means that Finnish consumers spent more than one million euros per month on electronic cigarette products.

Online sales of electronic cigarette and tobacco products to Finland. Monthly sales in euros in 2013–2016. Source: Finnish Tax Administration 2/2018

Ordering traditional tobacco products from online stores has already prohibited before the review period, but their purchases from online stores amounted to EUR 1.5 million. The total annual value of online sales was calculated as EUR 18 million.

Distance sales concentrated in Estonia and Spain

Nicotine-containing liquids for electronic cigarettes could previously be ordered from online stores in the EU by post to Finland. The legality of ordering nicotine-containing liquids to Finland from the European Economic Area was determined by the nicotine content of the liquid and whether the customer had a prescription for the product.

Total sales of electronic cigarette and tobacco products from Estonia, Spain and the UK amounted to 60 percent of total online sales to Finland in 2016. The share of these sales amounted to approximately EUR 6.5 million. Other major online store locations were Latvia, Luxembourg and Germany. The ten biggest online stores represented 70 percent of the total sales from all countries in 2013–2016.

The average sales transaction was relatively small

The development of sales transactions and the number of customers followed the development of online sales in euros up to 2015. In that year, this translated to a total of 150,000 sales transactions and 30,000 customers. The average value of a Finnish customer’s purchase transaction for all electronic cigarette and tobacco products was EUR 50. The average value of traditional tobacco product purchases was EUR 150.

How can consumers do the right thing?

Consumers can do the right thing by buying electronic cigarette products from retail stores or specialty stores in Finland, as, for the first time, the Tobacco Act now allows sales of nicotine-containing liquids in Finland. Both nicotine-containing and nicotine-free electronic cigarette liquids were included in the scope of tobacco taxation from the beginning of 2017. The Act specifies a tax of EUR 0.30 per millilitre for electronic cigarette liquids. With the new Act, sales of electronic cigarette products will be the same as other tobacco products, i.e. electronic cigarette products must be kept hidden in the store like other tobacco products (display ban). Ordering electronic cigarette products from online stores, on the other hand, is currently illegal, similarly to snus or tobacco.

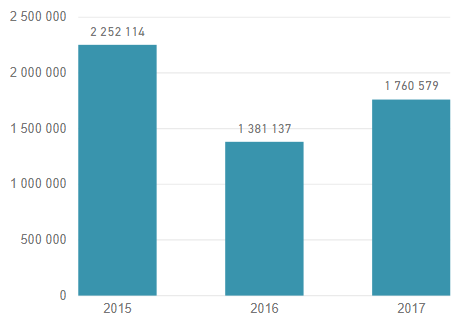

Companies’ tax debt information available in a tax debt register free of charge

Published 23.10.2018

The tax debt register helps both ordinary consumers and entrepreneurs to avoid purchases from companies with tax debt. The tax debt register refers to information, open for all, on any tax debts of companies and deficiencies in reporting of self-assessed taxes. Tax debt information is available online at ytj.fi → yrityshaku.

Tax debt register browsed more than a million times each year

Based on the number of users, the tax debt register is necessary. The usage rate has totalled 1.4 to 2.2 million searches per year. The tax debt register was introduced in December 2014.

The number of searches performed in the tax debt register in 2015–2017

High user satisfaction but more information is required

Based on a user survey, the users of the tax debt register have a positive attitude towards the register and find it quick and easy to use. The register is considered reliable and useful. However, just a fraction of users of the tax debt register satisfy themselves with only the information provided by the register. Most users simultaneously utilise the commercial tilaajavastuu.fi service, which provides details on compliance with contractors’ obligations.

Tax debt register users would like all information pursuant to the Act on the Contractor’s Obligations and Liability when Work is Contracted Out to be available in the same place, free of charge. Many find this a key development area.

Finnish Tax Administration aims to expand the information content of the tax debt register

The Finnish Tax Administration proposes that the information contents of the public tax debt register be expanded to become considerably more comprehensive than now. The change would make compliance with the Act on the Contractor’s Obligations and Liability when Work is Contracted Out easier and enhance the efficiency of the Finnish Tax Administration's operations. However, expanding the information content would require legislative amendments.

The impact survey of the tax debt register was conducted by the Finnish Tax Administration’s Grey Economy Information Unit.

Food frauds on the increase – difficult to control

Published 18.9.2018

The food sector is vulnerable to fraudulent activities: the risk of being caught is small, the profits are often high and the sanctions for any crimes tend to be low. The common motivator in food-related crimes is financial gain. In most cases, such crimes are financial offences, and often also hidden crimes.

Prevention and investigation of food frauds is challenging. In Finland, the focus of food supervision authorities is on food safety, and potential suspected crimes have not always been brought under pre-trial investigation.

Kirsi Hannula from Evira points out that, in recent years, cooperation between authorities has been stepped up, which has resulted in more efficient initiation of criminal proceedings in police departments all over Finland.

Through their unions, representatives of the food industry have expressed their willingness to participate in the prevention of food fraud. In spite of the increased cooperation and support by the sector, investing in the prevention of crime in the food chain will be a challenge for the whole chain of authorities in the years to come.

Shortcomings in fulfilling obligations among food industry operators

A survey on how food companies fulfil their obligations reveals, for example, that almost every third operator has tax liabilities, and about every fifth food company has negative equity.

The survey showed that companies with shortcomings or serious shortcomings in complying with food laws had, relatively speaking, more irregularities in fulfilling their reporting and payment obligations related to taxation than other companies.

Increased powers for food control

Evira and the Grey Economy Information Unit have together examined the needs for amending the Food Act. Their report proposes introducing in the law provisions on the reliability of food industry operators, expanding the data access rights of authorities and the right of authorities to disclose information to other authorities on their own initiative.

The reliability of the operator, which, in this context, would refer to, for example, carrying out the statutory obligations, should serve as the precondition for operating in the food sector. The reliability requirement would promote honest competition within the food industry and improve the operating conditions of companies that follow the rules. The authorities’ access to information should also be enhanced to ensure that authorities could verify the reliability of companies without increasing the administrative burden of entrepreneurs.

A comprehensive reform of the Food Act is currently pending in the Ministry of Agriculture and Forestry, and it would be appropriate to implement the reforms proposed in the survey in connection with the comprehensive reform.

Criminal record increases risk of grey economy activities

Published 21.8.2018

A person’s criminal record is important to assessing the risk of involvement in the grey economy. There is a connection between the criminal record of a responsible person and their management of business obligations. However, strict limitations are in place on the usability of criminal intelligence in official supervision.

More debt and irregularities in the case of persons with a criminal record

In general, companies owned by persons with a criminal record have more tax liabilities than other companies. According to the survey, high tax liabilities in excess of EUR 30,000 were clearly more common than normal and the share of non-managed tax liabilities was more than three times that of other companies. The share of companies taxed based on an estimation was five times that of other companies. Research proves that a company's tax liability predicts the risk of participation in the grey economy.

Companies owned by persons with a criminal record underwent tax audits more frequently than other companies, and more than half of the audits were grey economy audits. The companies and responsible persons were more frequently subject to enforcement measures and such companies had undergone the various stages of bankruptcy three times more frequently than other companies.