If you are an operator of trade or business (T:mi), an agricultural/forestry operator, select Manage your tax matters in MyTax. When you start with Manage your tax matters, you can access all your tax affairs. Read more: New in MyTax

After payment of dividends

Payors or service providers acting on payors’ behalf must submit a self-assessed tax return with information on the amount withheld, including withholding taxes and taxes withheld at source. The payor also needs to submit an annual information return concerning the payments made to dividend recipients. The annual information return can also be submitted by a service provider – often an account operator – acting on the payor’s behalf.

Dividend reports

Payors must submit a self-assessed tax return in order to provide information on the taxes withheld, including withholding taxes and taxes withheld at source. Payors must also submit an annual information return on dividends paid to dividend recipients. See more detailed instructions below.

Payors need to complete a self-assessed tax return to inform the Tax Administration of the amounts withheld, including withholding taxes and taxes withheld at source. The return can be filed electronically in MyTax or through the Ilmoitin.fi website. The tax period of the payor company determines the time when the tax return must be submitted. Payors that have a calendar-monthly tax period must submit their tax returns and pay the tax by the 12th day of the month following the calendar month when dividends were paid.

However, the tax return can be submitted on the payor’s behalf for example by an accounting firm representing the payor or by a central securities depository. For example, submittals by Euroclear Finland are made on behalf of the companies in the book-entry system after having received the necessary facts and information from the account operators. Accordingly, the central securities depository sends the self-assessed tax return to the Tax Administration.

Further information about reporting:

- Self-assessed taxes — Instructions for filing and payment

- Data file specification for the tax return on self-assessed taxes (VSRMUUKV)

- "Guidance on withholding on paid-out dividends and on the required information to be given to the Tax Administration” — Ennakonpidätys osingosta ja Verohallinnolle annettavat ilmoitukset (section 3.1) (in Finnish and Swedish)

- Withholding tax at source on dividends, interest and royalties, and the payor’s obligations (section 6 – Collecting and reporting tax at source)

- How to withhold tax on dividends paid to a resident shareholder when the underlying shares are nominee-registered (section 4 – Completing the tax return, making payments)

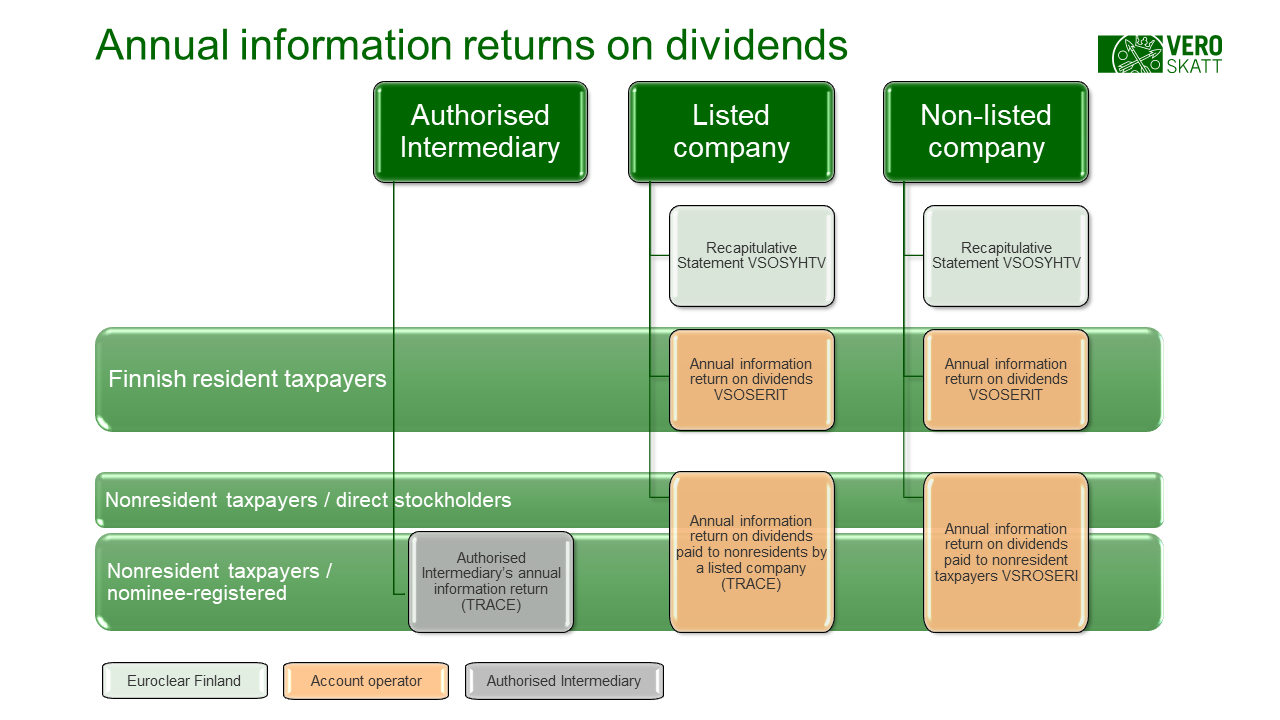

Payors are required to submit an annual information return to the Tax Administration in order to give details on the dividends paid to the dividend recipient. Also other operators of the financial sector may have an information-reporting requirement. For example, Authorised Intermediaries are required to submit an annual information return on the dividends of listed companies they have transferred by way of intermediation, and other intermediaries are required to submit an annual information return concerning dividends transmitted from abroad.

Payors can enter into various contracts with service providers; for example, if the company is in the book-entry system, it can be agreed that an account operator, or the central securities depository, will handle annual information return submittals on the payor’s behalf.

The correct return to be submitted depends on:

- Whether the dividends are paid from Finland or from abroad.

- Whether the dividend recipient’s status is resident or nonresident.

- Whether the payor is a listed or a nonlisted company.

Submit the annual information return after the end of the year of payment, by the end of January. Extensions of time may be requested on certain grounds. The consequence for non-filing may be a penalty charge for negligence.

Annual information returns from payors in the book-entry system of Euroclear Finland

The illustration below describes the possible arrangements of different parties to submit reports on behalf of the payor when a listed or non-listed company within the book-entry system of Euroclear Finland is the payor of dividends. Additionally, the illustration separates the required reporting concerning nonresident and resident taxpayers. Authorised Intermediaries’ reporting is also included in the illustration.

More information on annual information returns

- Specifications of data records

- The official decision of the Tax Administration on requirement to report information – Verohallinnon päätös yleisestä tiedonantovelvollisuudesta (available in Finnish and Swedish)

- “Guidance on withholding on paid-out dividends and on the required information to be given to the Tax Administration” — Ennakonpidätys osingosta ja Verohallinnolle annettavat ilmoitukset (section 3.3)

- Withholding tax at source on dividends, interest and royalties, and the payor’s obligations (section 6.4 – Annual information returns)

- How to withhold tax on dividends paid to a resident shareholder when the underlying shares are nominee-registered (section 5 – Annual information returns)

Tax Administration's decision on the general requirement to report information

Tax Administration has issued a decision on the general requirement to report information (Verohallinnon päätös yleisestä tiedonantovelvollisuudesta, (VH/6280/00.01.00/2025). The official decision has been issued in Finnish and Swedish. Specific sections concerning foreign operators in the financial sector has been translated also in English.

- Verohallinnon päätös yleisestä tiedonantovelvollisuudesta, official decision (in Finnish and Swedish)

- Tax Administration’s decision on the general requirement to report information (pdf), unofficial translation of specific sections

Making corrections to the amount of tax withheld

Where an amount of tax withheld needs to be adjusted when the year of payment is still ongoing, the payor company can adjust it. In contradistinction with this, when the year of payment is over, the Tax Administration can adjust it. See more detailed instructions below.

Where an amount of tax withheld needs to be adjusted when the year of payment is still ongoing, the payor company can adjust it.

If the amount of tax withheld is too high, the payor can submit a replacement self-assessed tax return to the Tax Administration in order to remedy the error. See the data record specifications concerning the self-assessed tax return (Details on other self-assessed taxes VSRMUUKV). Having received the replacement tax return, the Tax Administration will pay the excess amount of tax back to the payor. After that, the payor can transmit it on to the dividend recipient. This is known as the ‘quick refund’.

If it is not possible for the payor to remedy an error caused by an amount of tax withheld being too low, the payor must inform the Tax Administration of the fact that the payor failed – fully or in part – to withhold a tax. After that, the Tax Administration will impose the tax and possible late-payment charges to the payor, according to a payor-provided explanation of the situation. If the amount of tax withheld at source is insufficient on dividends paid to a nonresident dividend recipient but there was no neglect on the payor’s part, the Tax Administration will impose the tax on the dividend recipient instead.

For more information, see detailed guidance on Withholding tax at source on dividends, interest and royalties, and the payor’s obligations (section 6.3 Making corrections to the amount withheld) and “Information on withholding” – Ennakonpidätyksen toimittaminen (section 8 (available in Finnish and Swedish)).

When Authorised Intermediaries submit the annual information return, they need to specify any corrections or adjustments made during the year of payment to the dividends paid by publicly listed-companies when the dividend recipient is a nonresident taxpayer with nominee-registered shareholdings. See the specification of data records for the Authorised intermediary’s annual information return (WRP101).

Making corrections related to dividends paid by companies in Euroclear Finland’s book-entry system

For companies in the Euroclear Finland’s book-entry system, Euroclear Finland enters the necessary corrections to the self-assessed tax return based on information that the account operator has supplied. Then, Euroclear Finland sends the corrected self-assessed tax return to the Tax Administration.

After having received the replacement self-assessed tax return, the Tax Administration will pay the excess amount of tax back to the payor. After that, the payor will pay it on to the account operator. Then, the account operator refunds the excess withholding tax to the dividend recipient either directly or via the next intermediary in the custody chain.

When the dividend-paying company is a publicly listed company, an Authorised Intermediary can make the necessary adjustments during the year of payment and grant tax treaty benefits based on the explanation provided by the dividend recipient, on the condition that the relevant requirements of the tax-treaty are met. In the same way as above, the account operator and Euroclear Finland normally take the steps needed to carry out these adjustments.

In contrast with adjustments made during the year of payment, the Tax Administration carries out the adjustments after the year of payment.

If the amount of tax withheld is too high, no payor-initiated corrections can be made after the year of payment. In general, when the dividend recipient is a Finnish resident taxpayer, the excessive amount of tax withheld, will result as a credit to the taxpayer when their taxes are assessed for the year, in accordance with the annual information return received from the payor. However, in a situation where the payor of dividends withheld an amount of tax although there were no grounds – for example, an amount of tax was withheld although an item of tax-exempt income was paid – and this excess withholding was not credited to the taxpayer so as to cover the taxpayer’s other tax liabilities, the Tax Administration will refund the amount to the dividend recipient directly (§ 22 of the Prepayment Act). This type of refunding usually requires that the dividend recipient submits a refund application.

If the dividend recipient is nonresident and too much tax was withheld at source on a payment of dividends, the dividend recipient (or a representative authorised to do so) can submit a refund application to the Tax Administration when the calendar year of payment is over. If preconditions for refunding are satisfied, the Tax Administration will refund the excess of withholding tax directly to the taxpayer-beneficiary of dividends – which is not done when the year of payment is still ongoing. Accordingly, when the year of payment is still ongoing, the Tax Administration refunds the excess amount to the payor instead. When the year of dividend payment is still ongoing, the Tax Administration refrains from processing any refund applications. Read more about how to submit a request for refund of tax withheld at source.

If after the year of payment has ended, a problem is detected concerning the amount of tax withheld – no withholding at all or an amount too low – the payor can no longer make adjustments to the amount of tax withheld although the amount is wrong. The Tax Administration does not collect the unwithheld amount of tax from the payor if the dividend recipient’s taxes are already assessed for the year that has ended and he or she has already paid them.

If it is not possible for the payor to remedy the error caused by an amount of tax withheld that was too low, the payor must inform the Tax Administration of the fact that the payor failed – fully or in part – to withhold a tax. After that, the Tax Administration imposes tax and late-payment charges on the payor, according to a payor-provided explanation of the situation. Although the payor was not at fault, the payor must still notify the Finnish Tax Administration of the error; if the payor is not at fault, the tax will be imposed on the income recipient.

Making corrections to a report or information return already submitted

It may become necessary to remedy an error not only related to amounts of tax but also to reporting; this means that the payor withheld the right amount of tax but the tax return contains wrong data, not matching the actual circumstances. An example of this type of error is a return that refers to wrong types of taxes although the amount of tax is correct. The remedy is to submit a replacement self-assessed tax return to the Tax Administration. Under the circumstances, it will also be necessary to make appropriate corrections to the annual information return.

Read more:

- Making corrections to electronically filed self-assessed tax returns and VAT recapitulative statements (open the pdf file on top of the page)

- Making corrections to annual information returns

- Correcting annual information returns in MyTax

Giving a voucher to the dividend recipient

The payor or intermediary is required to provide the dividend recipient with a voucher of the payment made and the tax withheld – either as a withholding tax, or tax withheld at source. See more detailed instructions below.

Provisions of law (§ 35 of the Prepayment Act) require the payor or intermediary to give the Finnish resident income recipient a voucher of the payment made and the tax withheld on it as a withholding tax. The Tax Administration does not have an outline for the exact format to be used. However, the minimum requirements for the information content on the vouchers are as follows:

- Dividend recipient’s name, personal identity code or Business ID

- The accounting period for which the dividends were distributed

- The quantity of shares and their type or class

- Name of the company that distributes dividends

- Amount of the dividends

- The total amount of withholding tax or tax withheld at source

The deadline for giving the voucher is by 15 January the year following the year of payment unless the Finnish Tax Administration lays down other rules concerning the deadline.

The payor or intermediary must also provide nonresident income recipients with a certificate of the payment made and the tax withheld at source (§ 5 of the government decree on the taxation of nonresidents' income (Valtioneuvoston asetus rajoitetusti verovelvollisen tulon verottamisesta 1228/2005)). The deadline for giving the voucher is by 15 January the year following the year of payment.

Certificate on final tax in Finland (dividends, interest and royalties).

Tax control, tax liability and tax assessment

Whereas the previous chapter addresses various corrections and remedies to errors that the payor and the dividend recipient can initiate when incorrect withholding is detected, this chapter focuses on the Tax Administration’s procedure of remedying errors.

It is standard procedure for the Tax Administration to carry out a number of control measures in order to ensure that taxes are withheld and related reports are submitted correctly. For example, an inquiry letter requesting further information or explanation may be sent to parties that have a reporting requirement, concerning any issues detected during monitoring that require additional information for the verification of their correctness. Another example of the Tax Administration’s control measures are tax audits which can be conducted in order to examine various questions concerning payors of dividends, Authorised Intermediaries or dividend recipients.

Tax assessment and imposing a punitive tax increase

If the amount of tax reported is too low due to the payor’s neglect or the amount of tax paid is otherwise too low, the Tax Administration will impose the tax and adjust the decision to the taxpayer’s (the payor’s) detriment. The Tax Administration additionally imposes a punitive tax increase if the tax was not withheld by its deadline. In addition to this, the Tax Administration imposes a late-payment interest on the tax.

For more information on the tax liability that lies on the payor of dividends, see Withholding tax at source on dividends, interest and royalties, and the payor’s obligations, section 5 – Tax liability. For more information on the procedure of adjusting taxation to the taxpayer’s detriment or in taxpayer’s favour on the Tax Administration’s initiative, see “Changes to tax assessment on initiative of public authorities” — Verotuksen muuttaminen viranomaisaloitteisesti, section 4 (in Finnish and Swedish). For more information on penalty fees (in Finnish and Swedish), see “Penalty fees in self-assessed taxation” — Seuraamusmaksut oma-aloitteisessa verotuksessa.

For more information about imposing tax at source on the income earner, see Tax at source procedure applied to a non-resident taxpayer’s income and a key employee’s wage income, section 4.

Situations where no tax is imposed

The Tax Administration’s detailed guidance referred to above also discusses circumstances where tax is not imposed. An example of these circumstances is a situation where the payor provides satisfactory evidence proving the payor’s diligent behaviour and actions, which means that the payor is not at fault. Further examples of situations where no tax is imposed:

- After a submitted appeal, the matter has already been resolved, or the Finnish Tax Administration has looked into the matter and made a specific decision on it.

- The income amount concerned is low or the tax amount is low, and there is no need to impose the tax on account of fairness or other reasons, including the type of taxpayer’s neglect or possible recurrence of neglect. Read more “On decisions of the Tax Administration to not impose taxes or to refrain from adjusting taxes connected with self-assessment” — Verohallinnon päätöksestä veron määräämättä tai päätöksen oikaisun tekemättä jättämisestä oma-aloitteisessa verotuksessa (in Finnish and Swedish).

- In light of the entire perspective of circumstances, it seems likely that tax revenue does not need to be secured through a procedure of imposing tax on the taxpayer. However, in the above cases, the Tax Administration may impose a punitive tax increase and late-payment interest to be paid by the payor.

The tax liability of an Authorised Intermediary and tax imposition

For more information on the tax liability of Authorised Intermediaries and the procedure of tax imposition, see the detailed guidance Authorised Intermediaries’ responsibilities and liabilities, section 6 – Tax liability, and The contents, period of validity and verifying the reliability of the Investor Self-Declaration, section 6 – Authorised Intermediary's tax liability.