The earliest possible time to divide the estate between the inheritors is when inventory is completed, and if needed, a distribution of matrimonial assets has taken place. There is no need to wait for the Tax Administration’s decision concerning inheritance taxes before you divide the estate, and there is no need for any kind of consent or permission of the Tax Administration.

Experience has shown that the faster the heirs can write up the deeds of partition and estate distribution, the easier it will be to divide the estate. The idea is to resolve certain issues at the beginning – to avoid situations where a task or issue has been addressed, but then the same task would be addressed again later.

To have an estate of a deceased person stay undistributed for a longer time is not recommended. As time passes, many tasks or issues will become more complex. This means that if the inheritors leave their estate undistributed, it should always be a conscious decision to do so.

It is recommended that a professional should be called in to help – who has experience with marital-property division, the deeds that must be drawn up, with estate inventorying, and with issues relating to family law and taxes.

An estate does not need to be distributed if there is just one shareholder. In the case of just one shareholder, the property is deemed as having been inherited by that person, at the time when the decedent died.

Distributing the property

If the deceased person was married at the date of death, i.e. there is a surviving spouse with whom they shared mutual marital-property rights, it will be necessary to distribute the assets before the inheritors can receive their inheritance. The written deed of partition will define the part of the property to be deemed as belonging to the deceased person. By consequence, it will also define the surviving spouse’s property. As a result, the inheritors will now be able to divide the inheritance between themselves.

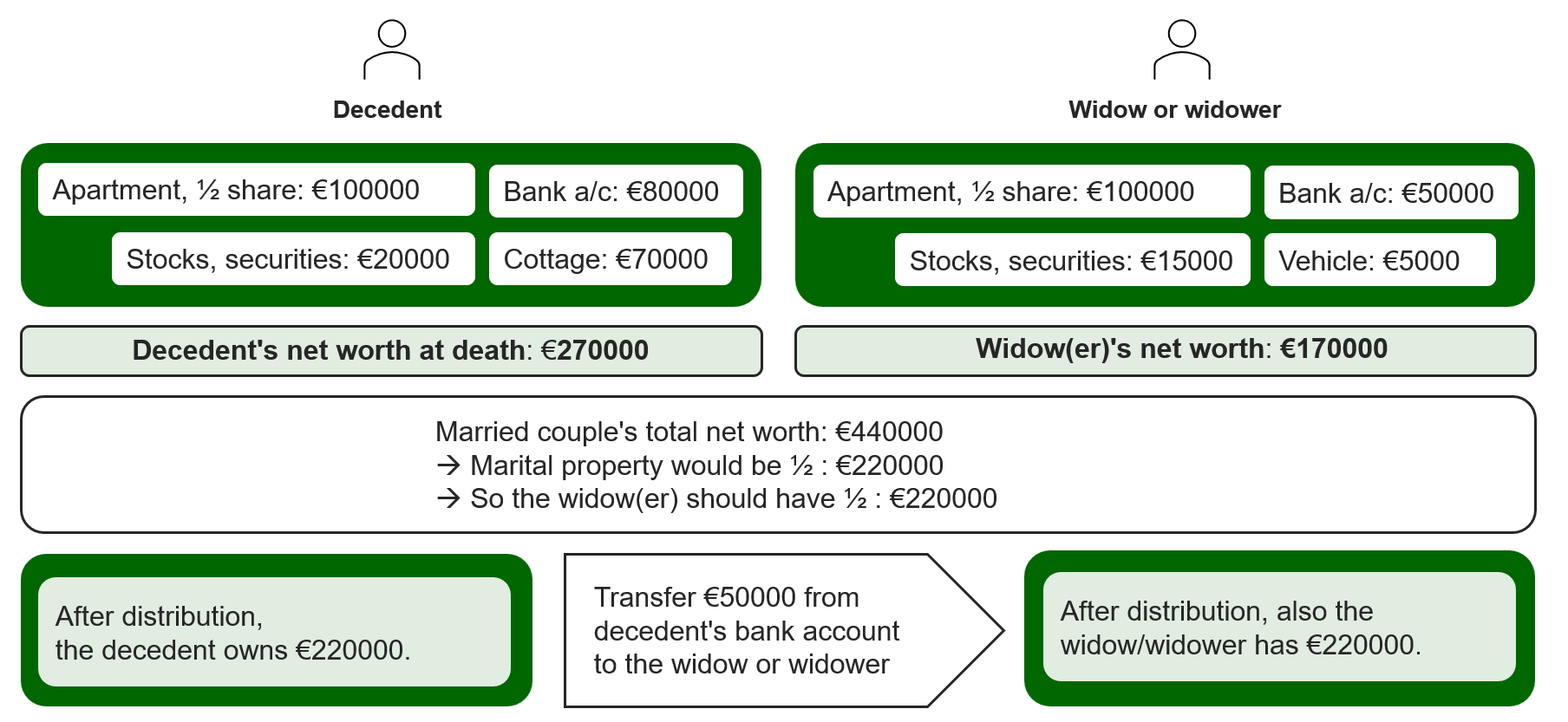

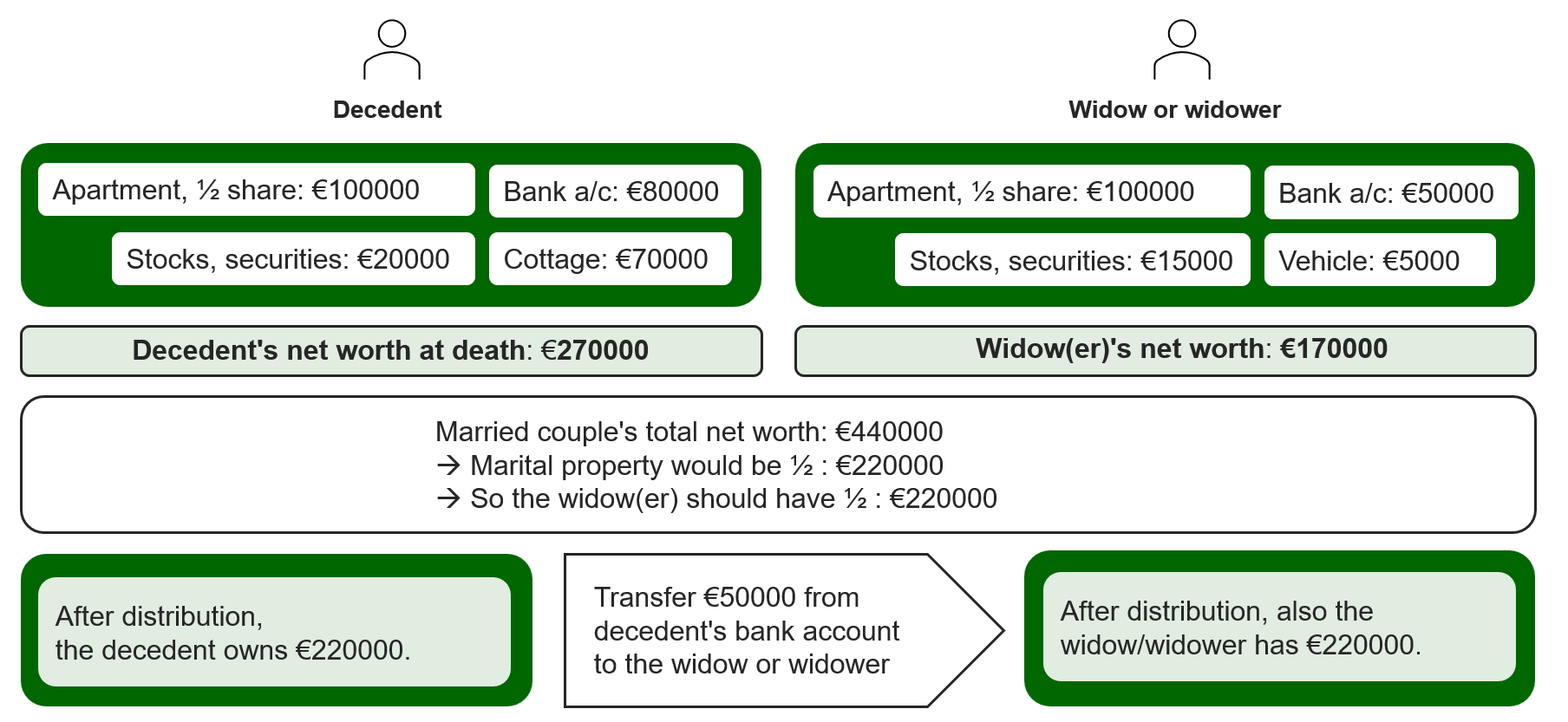

Diagram 1. Example: distribution in situations where both spouses had full rights to marital property

The first step is to add all funds, assets, other property together. In this example, the decedent was wealthier, and this will create a necessity to transfer property to the surviving widow or widower. After transfer of an adjusting payment, the net-worth values of both spouses will be equal.

However, in real life, the widow/widower may be the wealthier one: If the widow/widower were wealthier than the deceased spouse, an adjusting payment would move part of the widow’s/widower’s property into the decedent’s property that the inheritors will inherit. However, widows and widowers have a legal right to refuse making the payment.

When to distribute marital property?

After the other spouse has passed away, property has to be divided if all of the following conditions are fulfilled:

- At the time of death, the decedent and the spouse were married or they were a couple in a registered partner relationship. This means that the spouse has become a widow or widower.

- Both spouses had full mutual marital property rights.

- There is a natural heir or a beneficiary of the last will, which the decedent left behind.

- The decedent had a spouse who died earlier and their marital property remains undistributed so far.

After performing the divisions or distributions, you need to write up a deed of partition. It is permissible to create that document simultaneously with the deed of estate distribution.

In the case of spouses who had a prenuptial agreement during their marriage, there are no marital rights to each other’s property. As a result, the property left behind will have to be separated.

Read more about marital property divisions in this guidance, subheading “In the case of distribution of matrimonial assets, transfer tax may have to be paid"

Distribution of the estate

The inheritors will divide the inheritance between themselves. The only situations in which the widow/widower can be an inheritor are the case where the decedent had made a will in favour of the spouse, and the case where there are no natural heirs of the decedent.

The property recorded in the deed of inventory is the property that can be distributed.

The usual way to distribute an inheritance is as follows: first, the parts of it that will go to each inheritor are determined. For example, if the decedent has three inheritors in the same family line (such as brothers and sisters), the parts are ⅓ for each. These shares of distribution determine the exact portions of the total inheritance value that will go to each inheritor. They can each receive their personal part the form of a sum of money, in the form of immovable property, or in other ways as the case may be.

The inheritors are the ones who have responsibility for dividing the inheritance and for finalizing the estate distribution. As for details regarding how the inheritance should be divided, the Tax Administration will refrain from giving any opinions or advice.

When ready, the distribution must be documented in a deed of estate distribution — you will need to send a photocopy of the deed to the Tax Administration.

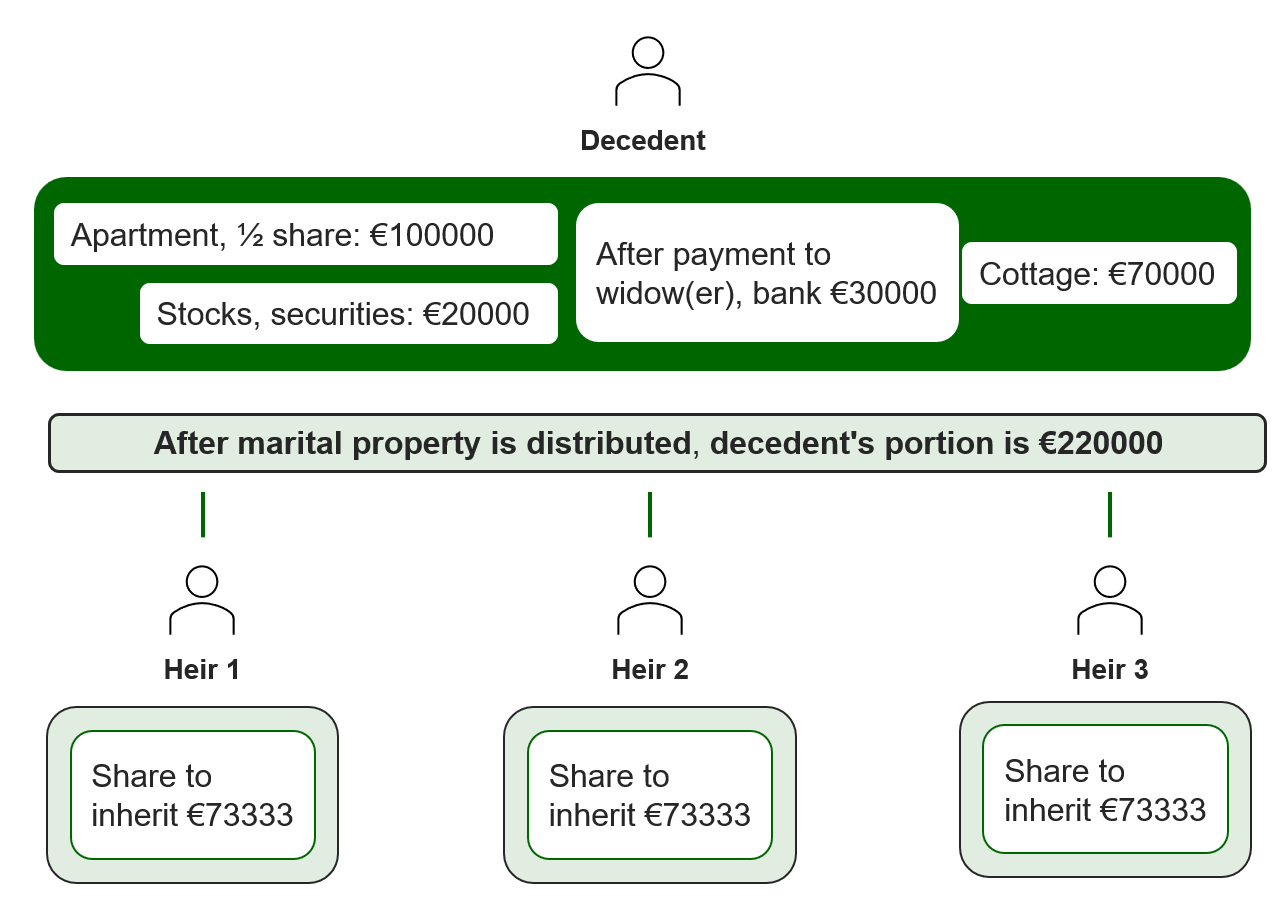

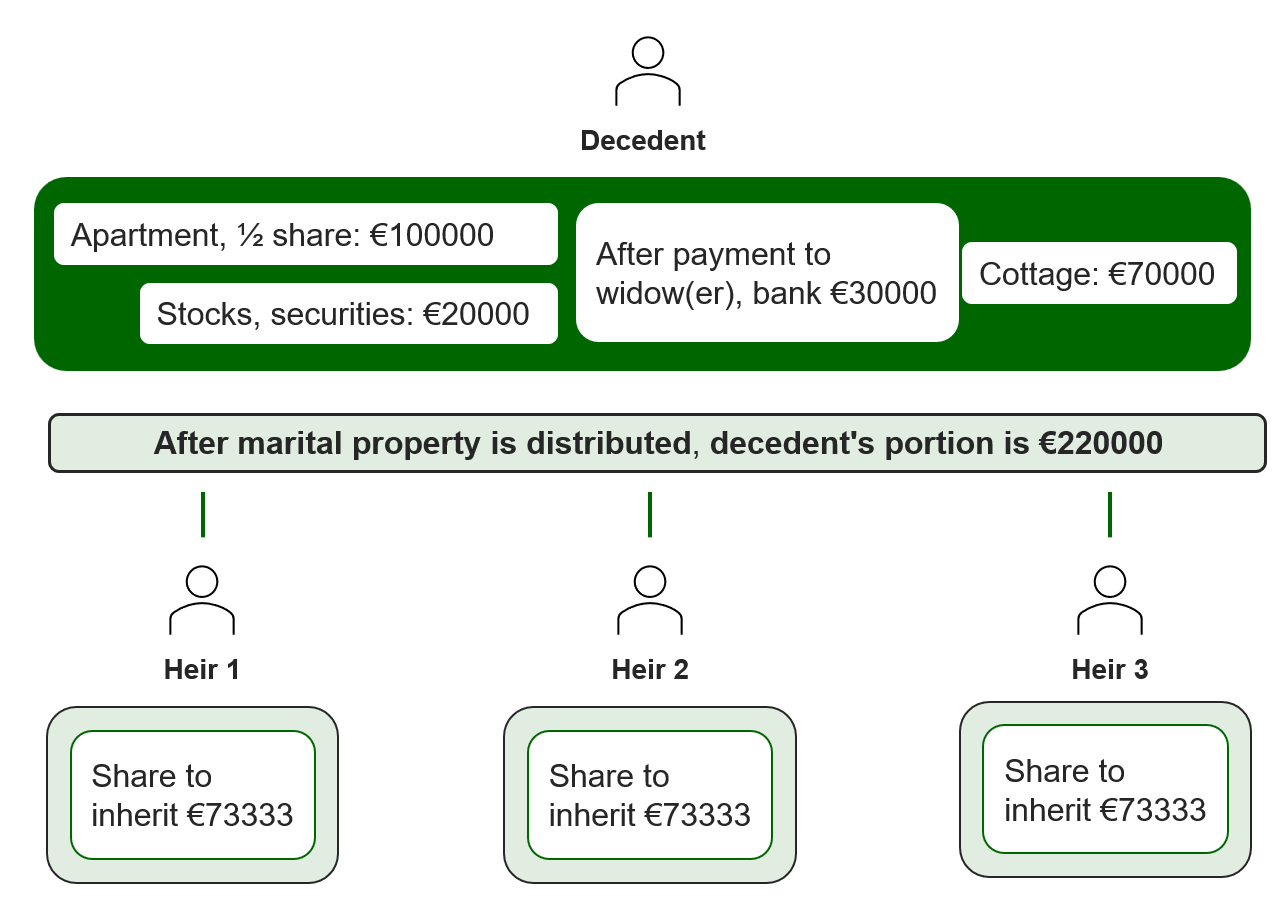

Diagram 2. Example: three inheritors divide the inheritance

The objective is to create 3 equal-size parts when dividing the property that belonged to the decedent. It is the responsibility of the inheritors to reach agreement on how to have everyone receive property items so that their values will match one another.

If anyone among them received an advance on inheritance during the decedent’s lifetime, see the Tax Administration’s instructions Advancement – how gifts affect the assessment of inheritance tax?

Prepare a deed of partition and a deed of estate distribution

To document the division of the married couple’s property, you will need to draw up a deed of partition. Correspondingly for the estate distribution – write a deed of distribution. However, both can be included in one single deed. One photocopied example of each of the two documents must be sent to the Tax Administration.

It is useful to draw up both the deed of partition and the deed of estate distribution, because this kind of documentation is likely to be referred to later, for many different reasons.

The deed of partition should contain facts and information regarding the decedent’s property, itemising the different assets (and liabilities, if any) – and likewise for the property belonging to the surviving spouse.

The decedent’s property will get transferred to the inheritors according to what is recorded in the deed of estate distribution.

For purposes of tax assessment, it is recommended that the deed of estate distribution provide the following information:

- What property has been distributed

- What is the property’s value at the date when distributed

- What property did each one of the inheritors receive

- What property was not distributed, if any

- Whether or not the estate was distributed fully

- Whether or not any outside funds were utilised in order to distribute the estate. This means any amounts of money or other assets that are not part the distributable inherited property – such as an inheritor’s own personal funds.

Each one of the shareholders must put their signature on the deed of estate distribution.

The Tax Administration refrains from giving an opinion on whether electronically provided signatures would be sufficient. Handwritten signatures on paper are still the generally accepted and safe method of signing.

However, the Tax Administration has no template or model format for the deed. For preparing the deed, you can use the templates available online and in bookshops.

When the deed of estate distribution is ready, you are required to send a photocopy to the Tax Administration. For the needs of the Tax Administration, one single photocopied example will be sufficient.

If a shareholder is a minor or a person under legal guardianship

If any of the estate shareholders is under 18 years old or have a guardian appointed for them for other reasons, certification by the Finnish Digital Agency (DVV) is required concerning the distribution. The certification would also be required in situations where only a part of the estate has been distributed.

However, circumstances other than those stated above require no certification by the DVV.

Further information about the certification

How to submit the deed in MyTax

- Go to MyTax and log in if you are not logged in yet (a new window appears)

- After login, select Manage your tax matters. You need no Suomi.fi authorisation.

- Select the Tax matters tab.

- Select Deed of partition and distribution of an estate or another additional account under Inheritance tax.

- The process has 2 stages. You can see them in the breadcrumb trail below your name.

Basic details:

- Enter the deceased person’s details.

- Click Add file to add attachments. Attachments can have the following file formats: pdf, rtf, doc, docx, jpeg, jpg, tiff and png.

- Enter the contact information of a person who can provide further information.

- Preview and send: Re-check all the information you entered. Finally, click Submit.

- Go to MyTax and log in if you are not logged in yet (a new window appears)

- After logging in, go to Reporting and requesting information in a limited scope, and click Report or request information in a limited scope. You do not need a Suomi.fi authorisation. Note: when you submit something through the Report information in a limited scope functionality, it will not be connected in any way to your personal tax affairs, and it will not show in your MyTax sessions later.

- Select Deed of partition and distribution of an estate or another additional account under Inheritance tax.

- The process has 2 stages. You can see them in the breadcrumb trail below your name.

Basic details:

- Enter the deceased person’s details.

- Click Add file to add attachments. Attachments can have the following file formats: pdf, rtf, doc, docx, jpeg, jpg, tiff and png.

- Enter the contact information of a person who can provide further information.

- Preview and send: Re-check all the information you entered. Finally, click Submit.

If you need a list of what you just sent, you must print out the list or save it immediately when sending the documents.

If you have no access to electronic services

If you cannot submit the deed in MyTax, send it to the address below:

Tax Administration – Verohallinto

Inheritance and gift tax

P.O. Box 760

FI-00052 VERO

Make sure to receive title to the property you inherit

After the Tax Administration has received the photocopied deed of estate distribution, we will proceed with updating our registers as appropriate. The information will be shown on your pre-completed tax return the following spring. Please make a thorough check.

However, do not forget to request updates for the registers maintained by other public authorities besides the Tax Administration, to ensure that you will be on record as the new owner of the inherited property.

Examples:

Tax issues frequently connected to distributions of marital property and inherited property

It may be that you become liable to pay transfer tax, income tax, or gift tax because of a distribution of property or because of other reasons related to your inherited property.

Submit a tax return for transfer tax and pay the tax

The following circumstances are examples of when transfer tax must be accounted for by submitting a tax return and by paying the transfer tax:

- A distribution of property is taking place, and to obtain the right of ownership to a house, apartment, etc. you need to utilize outside funds – such as a bank loan – to cover the value of the house, apartment, etc. and to reach an even distribution of property between the persons involved.

- You receive property (such as real estate), the value of which is greater than the item of property that another heir will receive (such as the balance of savings in a bank account). You make a payment, from your personal funds, to another heir i.e. you use money outside of the death estate.

For more information, see Transfer taxes related to a contract of exchange, to partition of matrimonial property, to distribution of an estate.

After selling movable or immovable property, submit a capital-gains tax return and pay the tax

After the sale of various items of value at a profit, the inheritors may receive capital gains. Conversely, it may be that the estate receives the gains. This gives rise to a conveyance or a sales transaction that must be declared to the Tax Administration.

Examples of situations where taxes on capital gains must be dealt with:

- The decedent’s estate sells some property to a buyer. If the selling price is greater than the property’s value confirmed for purposes of inheritance taxes, the estate has made a profit – in other words, a capital gain. The estate’s pre-completed tax return must give sufficient information on the sold property and the gains received. In the reverse case, if your selling of property creates a loss, the tax rules require that you declare the loss, as well.

- You inherited some property recently but you decide to not keep it, so you sell it to a buyer. If the selling price is greater than the property’s value confirmed for purposes of inheritance taxes, you are treated as having made a profit. You must submit your pre-completed tax return for declaring the taxable gains you received, and to give details on the sold property. In the reverse case, if your selling of property creates a loss, the tax rules require that you declare the loss, as well.

In the same way, for any exchanges of property, you need to declare the transactions on the tax return.

However, if the selling price is lower than the property’s value confirmed for purposes of inheritance taxes, you are treated as having made a loss. The Tax Administration will subtract such a loss from the year’s profits, i.e. offset capital losses against capital gains, or if no gains or profits were received that year, subtract the loss from the taxpayer’s other capital income.

Read more:

Selling the estate’s property or inherited property – how to deal with taxes

Capital-gains taxes on sales and other conveyances of property left behind (in Finnish and Swedish a detailed guidance)

Capital gains, capital losses, and how to submit related tax returns (in Finnish and Swedish)

Complete and submit a gift tax return, if needed

Please note that both the division of marital property and the distribution of the estate can produce a result which is deemed a taxable gift. An example of how this would happen is that you receive assets of greater value than what your actual portion of inheritance would entitle you to receive, and you have not compensated for this by giving an amount of money to the other heirs.

Read more about the taxes on gifts

What needs to be done to make an estate cease to exist?

The Tax Administration will regard an estate as a ceased estate, when:

- All of the estate’s property was distributed.

- One photocopied example of the deed of inventory was delivered to the Tax Administration.

- At tax year end, it has become clear that no income was received and no property was owned during the year ending.

After the events listed above, the Tax Administration will independently alter the estate’s records in the Tax Administration’s registers to make the estate a ceased one. Please note that we will send no notices or informational messages to you or to other heirs at that stage.

Example: In January, February, March and April 2025, a tenant paid rent to an estate, i.e. the estate still received rental income. The heirs had distributed the estate at the end of June 2023, and photocopy of the deed of distribution was delivered to the Tax Administration in July 2023. In spring 2026, the estate will receive a final pre-completed tax return. On 31 December 2026, the estate will be recorded as ceased, because it no longer receives income and no longer owns any assets or property.

Final tax affairs relating to the estate

After the deed of distribution is delivered, there will still be a few issues relating to taxation for the estate shareholders or the estate’s authorised agent to deal with.

How to inform the Tax Administration of any changes in your contact information

How to submit the bank account number of an estate of a deceased person

Check the pre-completed tax return addressed to an estate

Apply for removal from the Tax Administration’s registers