What do income data say?

You can view data on wages, pensions and benefits paid to you in the Incomes Register.

Earnings payment data is available in the Incomes Register from 2019 and pensions and benefits payment data from 2021. You cannot retrieve data prior to this from the register.

How can I view my own data in the Incomes Register?

You can search for and view your income data by signing in to the Incomes Register’s e-service. At the service you can also see your previously submitted reports.

If you want to use the service of behalf of another, check when you also need a Suomi.fi authorisation.

Sign in to the Incomes Register’s e-service and select “Act as a private individual” as the role.

- Select “Personal income data” and search for data over a specific time range.

- By default, the time range is the current year.

- You can search for earnings payment data since 2019, and benefits and pensions payment data since 2021.

How do I interpret search results?

The search results include a summary of data reported by payers. They include reports whose payment date is within the given time range.

You can view a single report by first selecting a summary row:

- Select “Earnings payment reports” if you are looking for a single earnings payment report over a specific month.

- Select “Benefits payment reports” if you are looking for a single benefits payment report over a specific month.

- Select the income type if you want a list of reports in which a payer has used the specific income type.

In the view that opens, reports are arranged by payment date, and you can select a report you want to view.

If you only want to view the total amounts of payments during a single calendar year, request an Incomes Register extract.

What data can I see in reports?

You can only see valid data about yourself. For example, you cannot see technical data, including when the report was originally submitted or whether the payer has corrected the report. Furthermore, cancelled, or deleted, reports are not shown to you.

If the payer corrects any data, the data will be forwarded again from the Incomes Register to data users to always keep them updated. For example, when we transmit corrected data to the Finnish Tax Administration, they may have an impact on when you receive your tax refund.

What can I see in the earnings payment report?

The earnings payment report includes

- the pay period and payment date;

- data about the payer;

- data about you as an income earner;

- payments made as reported by the payer, e.g. wages, fringe benefits and daily allowances; and

- the occupational class and insurance-related data.

Some payers also report voluntary data, such as data about absences and employment relationships. If they have been reported, they will also be shown to you as part of the report.

What can I see in the benefits payment report?

The benefits payment report includes

- the payment date;

- data about the payer;

- data about you as an income earner;

- benefits and pensions paid as reported by the payer; and

- any deductions made from the benefit.

Various additional data are also reported about different benefits. If the payer has made deductions from a benefit, such as paid part of it to the Social Insurance Institution of Finland (Kela) or your employer, you can also see deductions made from your income data.

Frequently asked questions

What are income types?

Payers report the payments they have made using income types. Currently, some 120 wage income types are used in earnings payment reports.

For each income type, it has been defined

- what kind of income is reported under it; and

- what social insurance contributions are paid from it.

- The default values of social insurance contributions can be changed in certain situations by entering exceptional insurance data for a single income type or by entering a type of exception to insurance for the entire report.

Read more about earnings payment data

What is the insurance information provided under a specific income type?

It has been defined for each wage income type what different social insurance contributions are paid from it. Payers can change this default value by entering insurance information for a single income type. Information about one or more social insurance contributions can be changed.

For example, the default value set for lecture fees determines that no social insurance contributions are typically paid from them. If lecture fees are irregularly based on work carried out in an employment relationship, social insurance contributions must be paid from them. Any derogation from the default value must be indicated by selecting “Subject to social insurance contributions: Yes” for the income type.

If a payment is made in accordance with the income type’s default value, the payer does not need to separately specify social insurance contributions.

What is the type of exception to insurance?

The following situations involve an exception to insurance:

- The income earner is not covered by the Finnish social security system.

- The payer is not obligated to take out insurance for the income earner.

An exception to insurance always applies to the entire report and all its income types. For example, an exception must be reported if the income earner is of a certain age or the amount of the income paid remains below the insurance obligation limit.

If the income earner is not within the scope of earnings-related pension insurance due to their age, for example, no earnings-related pension insurance contribution will be deducted from any payments made to them. The payer must indicate this by selecting the type of exception to insurance “No obligation to provide insurance (earnings-related pension insurance)” in their report.

More pay types and more diverse pay types may be used in payroll accounting than in the Incomes Register. This is why your payslip and the report submitted by the payer to the Incomes Register may differ.

If you receive monthly wages, for example, overtime is reported to the Incomes Register as a total amount using the overtime compensation income type. In payroll accounting, overtime can instead be divided into the basic component and increment, both of which are processed as separate pay types.

In the Incomes Register, income types are presented at the accuracy at which the Finnish Tax Administration, the earnings-related pension sector and other data users require income data.

Payers are responsible for the accuracy of the data they submit to the Incomes Register.

If earnings payment data are submitted correctly, the amount paid to your account should match the report available in the Incomes Register. If your data are incorrect, ask the payer to correct the data in the Incomes Register.

You can compare the amount paid to your account with the Incomes Register’s report. Calculate as follows:

- Sum up the reported 200 series income types.

- Sum up the amount withheld and employee contributions (income types 402 Withholding tax, 413 Employee’s pension insurance contribution, and 414 Employee’s unemployment insurance contribution).

- Deduct taxes and fees from the wage amount.

If the payer has used the minimum level of detail for reporting (the report includes income type 101 Total wages), deduct the amount withheld and employee contributions from the amount indicated under income type 101.

- In the comparison, also consider the following:

- Reimbursements of expenses reported under 300 series income types, including daily and kilometre allowances;

- Other deductions reported under 400 series income types;

- Voluntarily reported deductions that can be reported under income type 408 Other item deductible from net wage or salary, or left completely unreported (for example, trade union and unemployment fund membership fees or parking fees); and

- Income not reported to the Incomes Register, including travel and accommodation expenses paid based on receipts.

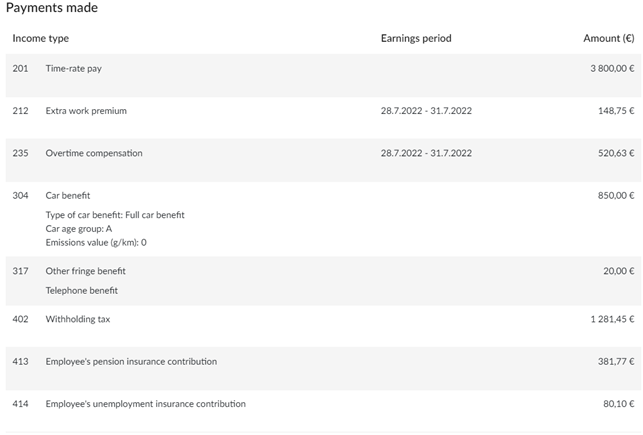

The earnings payment report in the example has been submitted in August 2022.

The earnings payment report’s pay period was 1–31 August 2022 and the payment date was 31 August 2022. The income earner is an employee earning a monthly salary who was ill on 4–5 August 2022.

1. Sign in to the Incomes Register and search the report

The income earner can see the following data in the Incomes Register:

Payments made and fringe benefits

- 201 Time-rate pay: The time-rate pay includes the normally paid monthly salary. The amount also includes sick pay.

- As the Incomes Register does not have any separate income type for sick pay, it must be reported as part of the time-rate pay.

- In the payslip, sick pay may be indicated as a separate amount, and a calculated deduction may also have been made from the monthly salary. Such interim payroll accounting stages are not reported to the Incomes Register.

- 212 Extra work premium: The employee carried out extra work in July, and the payment is made in conjunction with August wages.

- The payer summed up the basic component and increment for extra work and reported them under income type 212. The payer also reported the earnings period for the reimbursement as voluntary data.

- 235 Overtime compensation: The employee carried out overtime in July, and the payment is made in conjunction with August wages.

- The payer summed up the basic component and increment for overtime and reported them under income type 235. The payer also reported the earnings period for the reimbursement as voluntary data.

- 304 Car benefit: The employee has access to a full car benefit.

- The car is a new electric car of age group A, and its carbon dioxide emissions are 0 g/km.

- 317 Other fringe benefit: In addition to the car benefit, the employee has a telephone benefit.

- The payer has reported it under income type 317 Other fringe benefit. Alternatively, the benefit can be reported under income type 330 Telephone benefit. Certain fringe benefits can be reported in two ways.

Items deducted from income and other payments

- 402 Withholding tax: The withheld amount deducted from wages, i.e. tax calculated in accordance with the withholding rate.

- 413 Employee’s pension insurance contribution: The statutory earnings-related pension insurance contribution deducted from wages.

- 414 Employee’s unemployment insurance contribution: The statutory unemployment insurance contribution deducted from wages.

Even though taxes and fees are deducted from wages, they are not reported to the Incomes Register as negative. Negative figures are only reported to the Incomes Register in irregular situations; for example, if the payer credits an amount previously withheld as an excessive amount to an employee.

2. Check your wages in your payslip

The income earner’s total wages in August 2022 are EUR 5,339.38.

Gross wages consist of the following income types:

- 201 Time-rate pay (EUR 3,800)

- 212 Extra work premium (EUR 148.75)

- 235 Overtime compensation (EUR 520.63)

- 304 Car benefit (EUR 850)

- 317 Other fringe benefit (EUR 20)

The amounts of tax and insurance contributions are calculated from gross wages:

- 402 Withholding tax (24% = EUR 1,281.45)

- 413 Employee’s pension insurance contribution (7.15% = EUR 381.77)

- 414 Employee’s unemployment insurance contribution (1.5% = EUR 80.10)

3. Compare the Incomes Register report to the amount paid in your account

Wages of EUR 2,726.06 have been paid to the income earner’s account on 31 August 2022. The income earner wants to compare the Incomes Register’s data with the amount received.

- The income earner sums up the income types paid:

- 201 Time-rate pay (EUR 3,800) + 212 Extra work premium (EUR 148.75) + 235 Overtime compensation (EUR 520.63) = total EUR 4,469.38

- Fringe benefits are not included (304 Car benefit, and 317 Other fringe benefit)

- The income earner sums up the amount withheld and insurance contributions:

- 402 Withholding tax (EUR 1,281.45) + Employee’s pension insurance contribution (EUR 381.77) + 414 Employee’s unemployment insurance contribution (EUR 80.10) = total EUR 1,743.32

- The income earner deducts the amount withheld and insurance contributions from the total amount of all income types, and the result is the amount paid to the income earner’s account:

- Total amount of all income types (EUR 4,469.38) - amount withheld and insurance contributions (EUR 1,743.32) = total EUR 2,726.06

Payers report the payments they have made using income types. Some 400 pension and benefit income types are used in benefits payment reports.

For each income type, it has been defined

- what kind of income is reported under it; and

- whether the payment is subject to tax.

The Incomes Register may show benefits that you have not received if a part of the benefit or the entire benefit was paid to a substitute recipient, meaning to a recipient other than you.

Kela, the Employment Fund, earnings-related pension providers, non-life insurance providers and employers are examples of possible substitute recipients.

A benefit or part of a benefit granted to you may be paid to a substitute recipient in the following cases, for example:

- You have been granted two overlapping benefits. For example, you receive a labour market subsidy from January to March. However, in March, you receive a decision stating that you will receive disability pension from January onwards. In this case, the pension is paid to the payer of the labour subsidy for the overlapping period (January to March) and to you from April onwards.

- Your employer paid your wages for a period for which Kela has granted parental allowance to you. Kela pays the parental allowance to your employer for the corresponding period.

- A housing allowance granted by Kela is paid directly to the lessor.

- A benefit or pension is paid to the wellbeing services county.

In these situations, you will be shown the amount paid to the substitute recipient as a deduction on the benefits payment report. The deduction lets the authorities using the data know who the benefit was paid to.

If you suspect that the benefit data reported for you has errors, please contact the benefit payer. The benefit payer reports the data to the Incomes Register and is also responsible for correcting the data.

If you want to check the data you have submitted, search for and view reports on the Submitted reports page in the e-service.

Sign in to the Incomes Register. Select “Act as a private individual” as the role and then select “Submitted reports”.

Are you looking for these?

The Finnish Tax Administration: How to find your valid tax card in MyTax