Individuals

You can view your own data in the Incomes Register

As an individual, you can view your earnings payment data in the Incomes Register’s e-service. You can also view data on pensions and benefits paid to you.

If you want a summary of your income, you can request an Incomes Register extract through the Incomes Register e-service. The extract shows all wages, pensions and benefits reported to the Incomes Register.

If you need a more detailed specification of your income or want to examine an individual report, you can search and view the data on the “Personal income data” page in the e-service.

Earnings payment data is available in the Incomes Register from 2019 and pensions and benefits payment data from 2021.

You can access the Incomes Register on behalf of another individual or company if you have received an authorisation.

Protect your income data and carefully consider to whom you give authorisation to use it

You can always see the wages and benefits paid to you directly in the Incomes Register. You never need any external service for viewing your data.

The Incomes Register recommends that you do not give viewing or access rights to your income data to any external services. Such services typically use special screen scraping software or an online application to collect information from the online service’s view.

How to view your data in the Incomes Register

1) Sign in to the Incomes Register’s e-service

Identify yourself using online banking codes, a mobile certificate or a certificate card.

Read more about identification.

2) Select a role

- Select “Act as a private individual” if you want to view your own income data.

- Select “Act on behalf of another individual” if you want to view the data of your under 15-year-old child or a private individual who has authorised you.

3) Select “Personal income data”

You can search for income data over a specific time range.

Take a closer look at your income data

Watch the instructional video on how to view your own income data in the Incomes Register’s e-service:

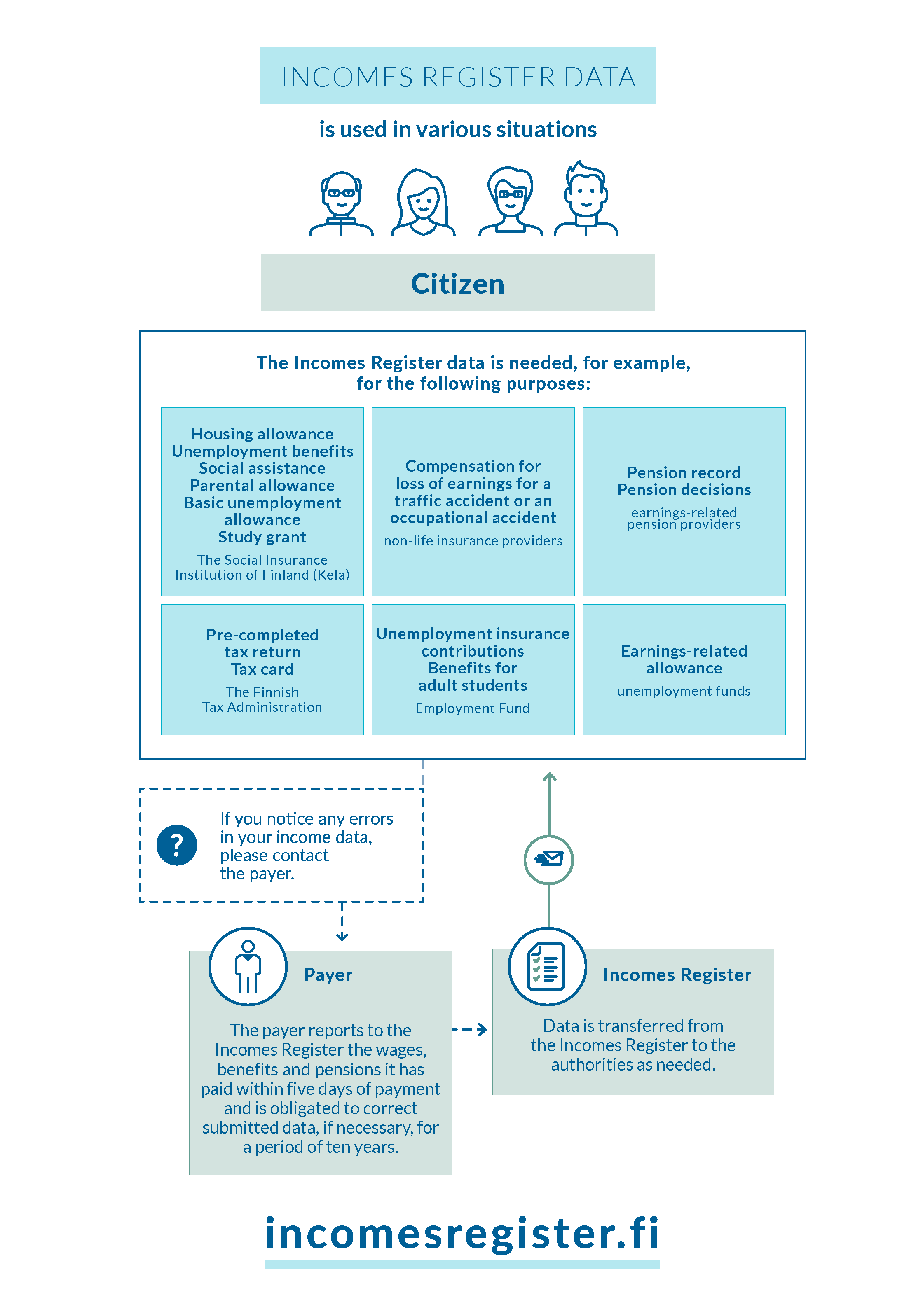

The payer reports data to the Incomes Register

The employer or other payer reports data on payments to the Incomes Register. The data is usually available in the Incomes Register within five calendar days after the payment date.

If the data is not available in the Incomes Register, contact your employer or other payer to ensure whether the data has been reported to the Incomes Register.

Households may also act as employers and pay wages.

Read more about when households report data to the Incomes Register.

Data in the Incomes Register is used as grounds for decisions

The authorities use data reported to the Incomes Register as the basis for many types of decisions. The data is used by unemployment funds for calculating allowances and by the Social Insurance Institution of Finland (Kela) when granting allowances paid to employers, for example. The Tax Administration uses data reported to the Incomes Register for pre-completed tax returns and revised tax cards.

Access the Incomes Register’s e-service to check what income data your employer has reported to the Incomes Register.

If your data are incorrect, ask the payer to correct the data in the Incomes Register.