Reporting benefits payment data to the Incomes Register

Benefit payers must report the pensions and benefits they have paid to the Incomes Register by filling in the benefits payment report. Data about a single payment made to a single income earner is reported using a single benefits payment report.

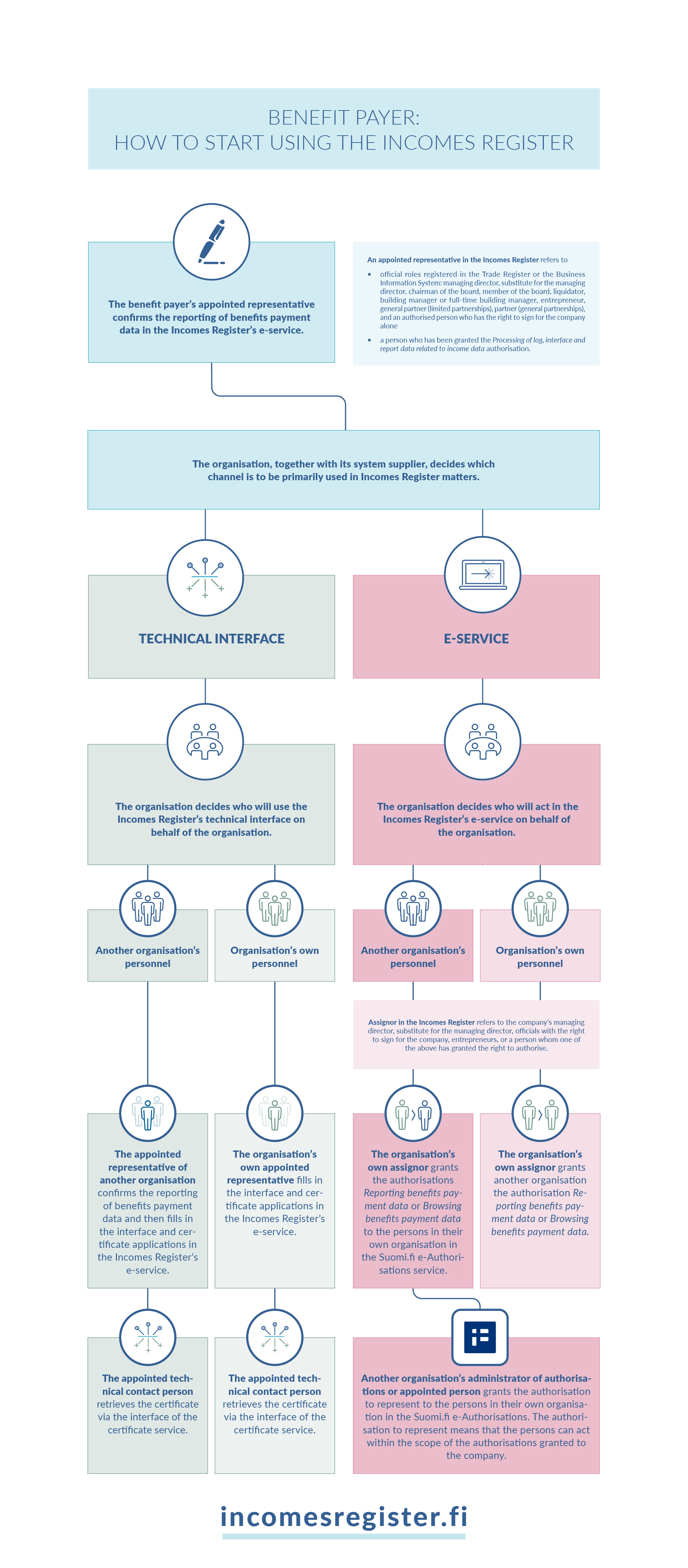

The benefits payment report can only be submitted by a benefit payer who has confirmed the reporting of benefits payment data in the e-service of the Incomes Register. However, benefits payers may authorise a third party to use the Incomes Register on their behalf.

Pensions paid by employers are reported to the Incomes Register by filling in the earnings payment report. The report is submitted by the employer.

Data reported on the benefits payment report

The following data is reported on the benefits payment report:

- identifying information about the income earner and the payer

- payment date

- earnings period

- technical information about the record, if the data is provided via an interface or upload service

- paid pensions and benefits by income type.

Most of the information to be entered on the benefits payment report is mandatory data. Complementary data is associated with certain data and payment types in certain situations. For example, ‘Benefit unit’ is mandatory for unemployment benefits and for the ‘Other pension’ income type. However, it is recommended that you also specify the 'Benefit unit' as information supplementing other income types. After you have specified the benefit unit, the Incomes Register user can determine the daily benefits and use this information in its decision-making.

You must always specify the earnings period for the income type on the benefits payment report. The period during which the benefits income was earned must be given as the earnings period, irrespective of when the benefits were paid. For example, the benefits earned during December but paid in January must be given as benefits earned in December. Read more about reporting the earnings period in Section 3.4 of the instructions Benefits: Reporting data to the Incomes Register.

Four-digit codes are used to represent different income types when reporting benefits payment data. Several different income types of a single income earner can be reported using a single benefits payment report if the benefits share the same payment date. Any items deducted from income are also reported using income types. Read more about the income types of benefits.

Submit your benefits payment report via the technical interface or in the e-service

Pensions and benefits payment data are reported to the Incomes Register in electronic format. The data can be submitted via the technical interface or in the e-service. Benefit payers cannot report data using a paper form.

- A certificate is used in the technical interface to identify organisations. A different certificate is needed for reporting benefits payment data than for reporting earnings payment data.

- You can log in to the Incomes Register’s e-service using your personal online banking codes, a mobile certificate or a certificate card.

- In the Suomi.fi e-Authorisations service, organisations must authorise the necessary persons and organisations to use the e-service.

Read more about the reporting channels.

Also read technical documents

The data content of the benefits payment report is described in the instructions Application instructions on the data contents of a benefits payment report on the Documentation pages.

Income types of benefits and their taxation are described in the instructions Benefits – Descriptions of income types and items deducted from income on the Documentation pages.