Employer’s separate report

Report on the employer’s separate report the total amount of the employer’s health insurance contribution and deductions made from it.

If you have not paid any wages during the month and are registered with the Tax Administration’s Employer Register, report ‘No wages payable'.

Only submit one employer’s separate report for each month. The employer’s health insurance contribution is determined based on total wages paid during the month.

Read more about the health insurance contribution and other social insurance contributions

Submit the report no later than on the fifth day of the calendar month following the reporting month. The duration of the company’s tax period has no impact on the reporting due date.

In addition to submitting the employer’s separate report, report wages paid by submitting a separate earnings payment report for each employee.

Example: A company pays wages on the first, fifteenth and thirtieth day of each month. The employer’s separate report must be submitted by the fifth day of the month following each wage payment. Data are compiled for the report over all paydays during the previous month.

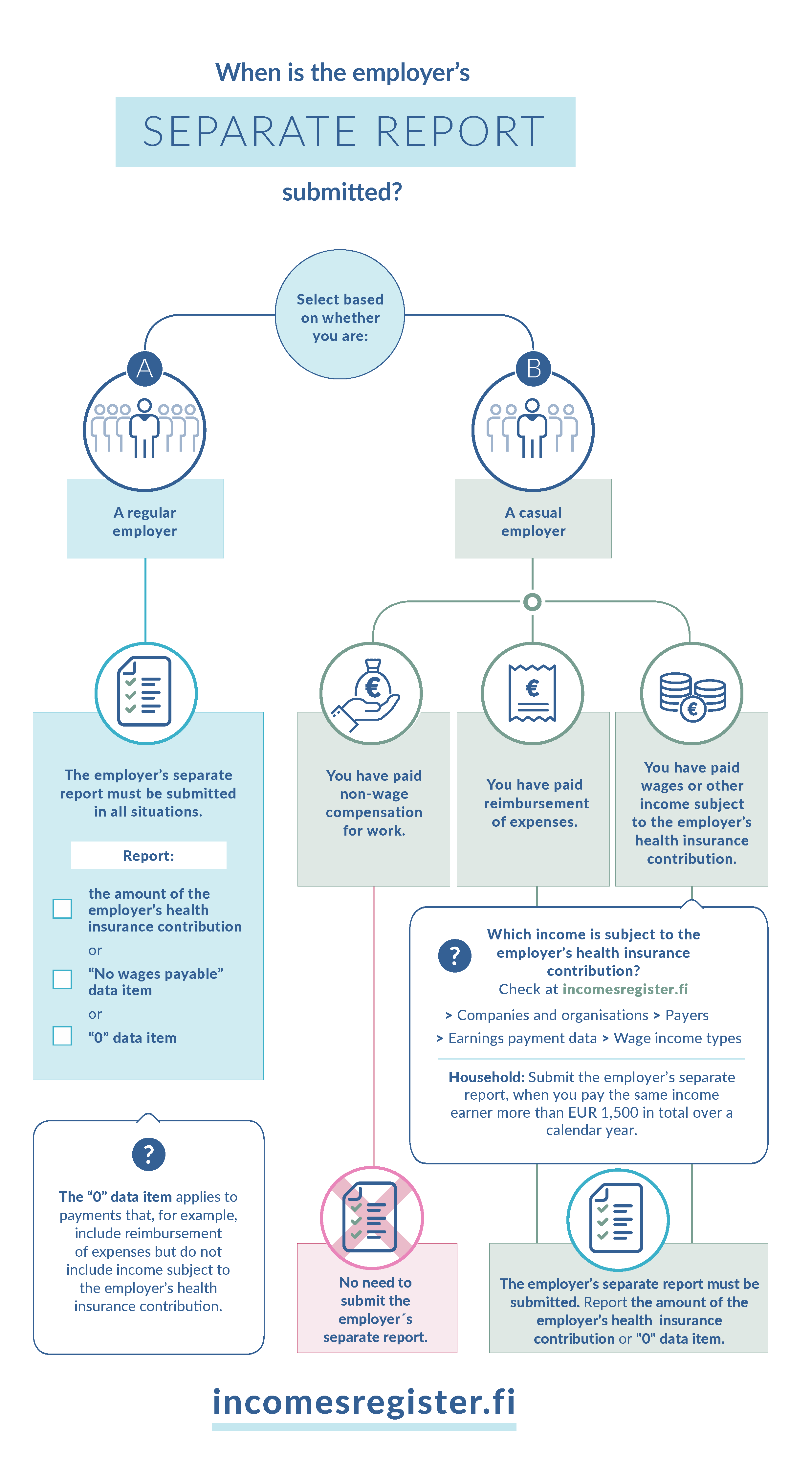

Regular employers must submit a report each month

You are a regular employer if you pay wages regularly and are registered with the Employer Register maintained by the Finnish Tax Administration.

Report the total amount of the employer’s health insurance contribution. Calculate the amount based on total wages paid during the reporting month.

- If you have made deductions from the health insurance contribution, report them separately. However, do not deduct any amounts from the total health insurance contribution, as you need to report its original amount.

- If you have only made payments based on which no employer’s health insurance contribution needs to be paid, report EUR 0 as the amount of the health insurance contribution.

If you have not paid any wages during the month, select ‘No wages payable’. In addition, report

- information about earnings-related pension insurance (pension policy number and earnings-related pension provider code) if you have an insurance policy with an earnings-related pension provider, and

- information about occupational accident insurance (policy number and identifier of the occupational accident insurance company, i.e. business ID) if you have covered your employees with more than one occupational accident insurance policy.

You can submit the employer’s separate report to the Incomes Register one month beforehand. The ‘No wages payable’ selection can be reported for six months ahead.

If the situation changes later and you pay wages during this period, you can correct the pay period’s report by submitting a replacement report with correct information.

If you cancel your registration with the Finnish Tax Administration’s Employer Register, you still need to submit the employer’s separate report for the wage payment month during which the registration ended. A report must be submitted even if no wages were paid during the month.

Read more about the Employer Register

Casual employers only need to submit a report when they pay wages

You are a casual employer if are not included in the Finnish Tax Administration’s Employer Register.

Report the total amount of the employer’s health insurance contribution. Calculate the amount based on total wages paid during the reporting month.

- If you have made deductions from the health insurance contribution, report them separately. However, do not deduct any amounts from the total health insurance contribution, as you need to report its original amount.

- If you have only made payments based on which no employer’s health insurance contribution needs to be paid, report EUR 0 as the amount of the health insurance contribution.

You can submit the employer’s separate report to the Incomes Register one month beforehand.

Submit reports in electronic format

If you use the Palkka.fi service (available in Finnish and Swedish, link to Finnish), the data will be transferred directly to the Incomes Register. So you do not need to submit anything separately to the Incomes Register.

If you calculate and pay wages yourself, report the data to the Incomes Register.

If you pay wages as a private individual, read more about reporting as a household

Correcting reports

If there are errors in the data you have reported, correct the data.

Submit a replacement report if you have have overstated or understated an employer’s health insurance contribution, for example. Cancel a submitted report if you have reported an incorrect Business ID or reporting period, for example.

Detailed instructions and examples

See examples on reporting and read more:

Reporting data to the Incomes Register: employer’s separate report

Making corrections to the employer’s separate report: Correcting data in the Incomes Register