Working in Finland

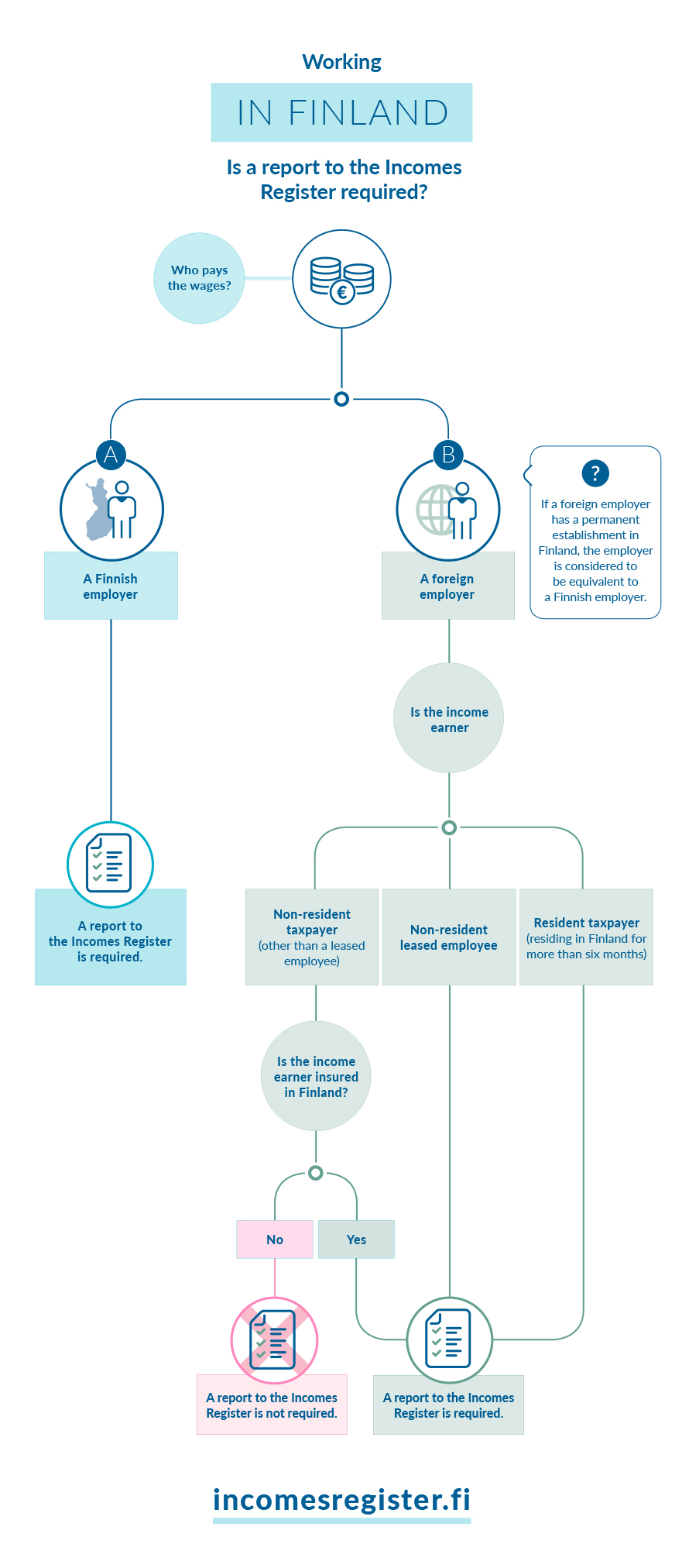

A Finnish employer must report to the Incomes Register the wages paid and other payments made to an employee coming to Finland from abroad. The data must also be reported when the income is not taxed in Finland, or the employee is not insured in Finland.

A foreign employer must report to the Incomes Register the wages paid and other payments made when the employee coming to Finland from abroad is a resident taxpayer, or is insured in Finland. A foreign employer must also report payments made to a leased employee who is a non-resident taxpayer if Finland has the taxing right to the wages according to a tax treaty between the employee's country of residence and Finland.

See more detailed instructions and examples of data to be submitted to the Incomes Register in different international situations:

- Working in Finland: basic information

- Work in Finland and data to be submitted to the Incomes Register when the payer is Finnish

- Work in Finland and data to be submitted to the Incomes Register when the payer is foreign

- Guide Reporting data to the Incomes Register: international situations.

Leased employee

Leased employee

If a foreign employer leases an employee in its service to a company in Finland, the foreign employer must report the payments it makes to the leased employee coming to Finland on an earnings payment report submitted to the Incomes Register. The data must be submitted when the tax treaty between the employee's country of residence and Finland does not prevent Finland from taxing the employee's wage income, or when there is no tax treaty.

Additionally, the employer must submit the foreign employee leasing notice data to the Incomes Register, for example the estimated duration of the work assignment, the details of the Finnish service recipient and the foreign employer's representative, and an estimate of the amount of wages.

See more information in the guide Reporting data to the Incomes Register: international situations.