Working abroad

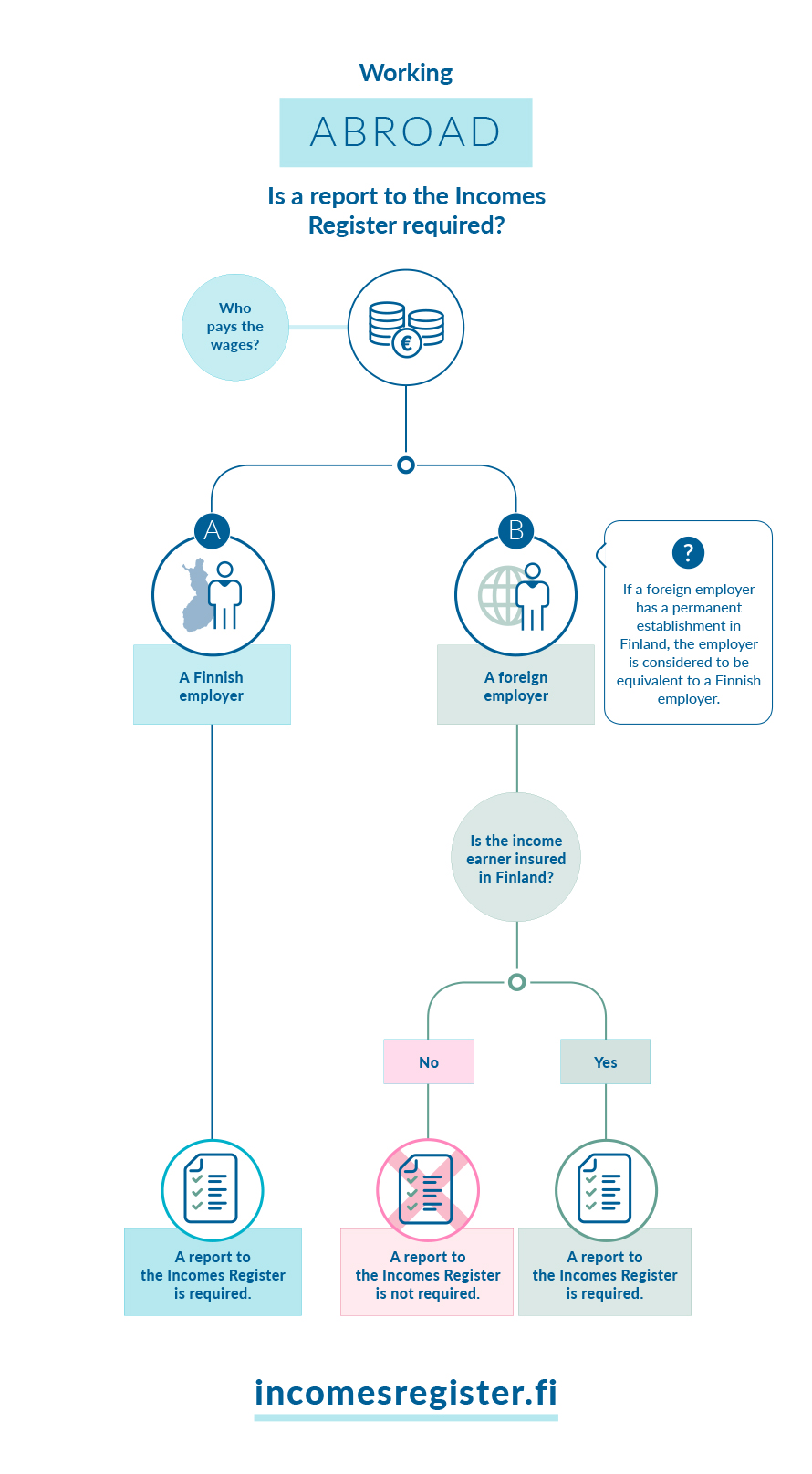

The income paid to an income earner for work performed abroad and other information must be reported to the Incomes Register on an earnings payment report when the information is required for taxation purposes or when the income earner is insured in Finland. Correspondingly, the income paid for working in Finland to an employee who came to Finland from abroad is reported using an earnings payment report.

See more detailed instructions and examples of data to be submitted to the Incomes Register in different international situations:

- Working abroad: basic information

- Reporting data on working abroad

- Guide Reporting data to the Incomes Register: international situations.

Working abroad — other pages

Page last updated 8/2/2018