If you are an operator of trade or business (T:mi), an agricultural/forestry operator, select Manage your tax matters in MyTax. When you start with Manage your tax matters, you can access all your tax affairs. Read more: New in MyTax

This is an unofficial translation. The official instruction is drafted in Finnish (Sijoitusrahastojen verotuksesta ja TVL 20 a §:n sääntely, record number VH/2777/00.01.00/2023) and Swedish (Om beskattningen av placeringsfonder och bestämmelserna i 20 a § i ISkL, record number VH/2777/00.01.00/2023) languages.

This detailed guidance concerns the income taxation of domestic and foreign investment funds and special investment funds, the conditions for tax exemption and the taxpayer’s obligation to provide information. This detailed guidance also briefly discusses the taxation of foreign investment funds that do not qualify for tax exemption of investment funds and special investment funds.

The guidance was updated on 11 August 2023 by taking into account judgment A SCPI, C-342/20 of the Court of Justice of the European Union (CJEU) and decision no. H3151/2022 of the Helsinki Administrative Court based on the CJEU judgment, as well as decisions KHO 2022:130, KHO 2022:138, KHO 2022:139 and KHO 2022:142 of the Supreme Administrative Court (KHO). Section 3.2 explaining the circumstances in which the provisions on tax exemption for investment funds and special investment funds apply to non-resident funds established in the form of a company and trust as a result of EU law on the free movement of capital was also added during the update.

This guidance applies to taxation in tax years beginning on or after 1 January 2020.

1 General

Provisions regarding the taxation of investment funds were revised by a legislative reform which entered into force on 1 January 2020, further clarifying the terms ‘investment fund’ and ‘special investment fund’, as well as the conditions for the tax exemption of investment funds and special investment funds in the Income Tax Act (Tuloverolaki 1535/1992) and in the Act on the Taxation of Nonresident Taxpayers’ Income (Laki rajoitetusti verovelvollisen tulon verottamisesta 627/1978). Provisions on the tax treatment of sub-funds were also included in the reform. The purpose of the legislative reform was not to change the tax treatment of investment funds (government proposal HE 304/2018, p. 53) except for introducing the concept of ‘sub-fund’ and its tax treatment in tax law.

In connection with the legislative reform, special investment funds were added alongside investment funds to the list of corporate entities in section 3, subsection 5 of the Income Tax Act. Investment funds were removed from the list of tax-exempt corporate entities in section 20 of the Income Tax Act, and provisions on the tax exemption of investment funds and special investment funds were transferred, with further specifications, to the new section 20a in the Income Tax Act, which concerns both domestic and foreign investment funds. A separate provision on the tax treatment of sub-funds was added to the Income Tax Act (section 20a, subsection 7). Furthermore, provisions on exemption from tax at source for an investment fund satisfying the conditions given in section 20a of the Income Tax Act and on the taxpayer’s obligation to provide information were added to section 3, subsection 10 of the Act on the Taxation of Nonresident Taxpayers’ Income.

The legislative amendment regarding the provisions on tax treatment of investment funds was partly related to an amendment made to the Act on Common Funds (213/2019). Provisions in private law concerning investment funds are contained in the Act on Common Funds, which regulates areas such as fund investments pursuant to contractual law. The Act on Common Funds implements the Directive on the coordination of laws, regulations and administrative provisions relating to undertakings for collective investment in transferable securities (hereinafter “the UCITS Directive”), including later amendments thereto. Regulation of special investment funds was transferred in the process of legislative amendment from the Act on Common Funds to the Act on Alternative Investment Funds Managers (162/2014, “the AIFM Act”), which implements the Directive on Alternative Investment Fund Managers (2011/61/EU, “the AIFM Directive”). The amendment of the legislation on investment funds also involved allowing the sub-fund structure provided for in the UCITS Directive in investment funds and special investment funds.

The provisions on the tax exemption of investment funds and special investment funds also apply to domestic investment funds and special investment funds and equivalent foreign contractual funds. Due to the effects of Articles 63 and 65 of the Treaty on European Union (TFEU) on the free movement of capital, non-resident funds constituted in the form of a company or a trust may also be exempt from tax under certain circumstances. The effects of EU law on the condition of contractual form for foreign investment funds and special investment funds in the case of non-resident funds constituted in the form of a company or a trust are discussed in more detail in Section 3.2 below.

2 Taxation of domestic investment funds and special investment funds

2.1 Domestic fund investments and general considerations on the taxation of funds

Domestic investment funds include contractual investment funds as per the Act on Common Funds and contractual special investment funds as per the AIFM Act. Domestic investment funds are contractual arrangements, not independent legal persons. They may be described as separate sets of assets (pools of assets) jointly owned by the unitholders that have invested in the fund. An investment fund is administered by a fund management company, a limited liability company with which the unitholders in the investment fund enjoy a contractual relationship. It is not permitted under Finnish law to establish other kinds of UCITSs referred to in the UCITS Directive, such as an undertaking for collective investment in transferable securities with variable capital or a unit trust. However, a domestic investment fund may consist of one or more sub-funds.

Fund investments may also be made in Finland for instance in the form of a limited partnership or public limited liability company (REIT company) investing in real estate as per section 1 of the Real Estate Funds Act (Kiinteistörahastolaki 1173/1997). Fund investments are also undertaken in the form of private equity funds set up as limited partnerships. In a private equity fund set up as a limited partnership, the asset management company (a limited liability company) is the general partner and the investors are silent partners.

Investment funds as per the Act on Common Funds and special investment funds as per the AIFM Act are corporate entities as referred to in section 3, subsection 5 of the Income Tax Act, for which the conditions for tax exemption are provided in section 20a of the Income Tax Act.

Limited partnerships are business partnerships as referred to in section 4 of the Income Tax Act. Funds set up as limited partnerships and their unitholders shall be taxed like other partnerships, as per section 16 of the Income Tax Act. Furthermore, silent partners in limited partnerships engaging exclusively in venture capital investment business who are non-resident taxpayers are subject to the exception in section 9, subsection 5 of the Income Tax Act, whereby under certain conditions a portion of the income corresponding to the share in the limited partnership of the silent partner who is a non-resident taxpayer shall be deemed taxable income only to the extent that the income would have been taxable had it been received directly by the non-resident taxpayer silent partner. Provided that the conditions in section 9, subsection 6 of the Income Tax Act are met, the tax treatment under section 9, subsection 5 of the Income Tax Act also applies to non-resident taxpayers whose share of the profit of a domestic limited partnership engaged exclusively in venture capital investment business is based on the profit share of one or more domestic or foreign partnerships.

Taxation of REIT companies is provided for in the Act on Tax Relief to Certain Limited Liability Companies in the Rental Housing Business (Laki eräiden asuntojen vuokraustoimintaa harjoittavien osakeyhtiöiden veronhuojennuksesta 299/2009). Further information: taxation of business partnerships and Act on Tax Relief to Certain Limited Liability Companies in the Rental Housing Business (Finlex).

2.2 Conditions for tax exemption for investment funds under the Act on Common Funds

Tax exemption of domestic investment funds is provided for in section 20a, subsection 1 of the Income Tax Act. Under section 20a, subsection 1 of the Income Tax Act, an investment fund as referred to in Chapter 1, section 2, subsection 1, paragraph 2 of the Act on Common Funds shall be tax-exempt in income taxation when it has 30 or more unitholders.

Under Chapter 1, section 2, subsection 1 of the Act on Common Funds, an investment fund is defined as a set of assets obtained in the course of investment fund operations and invested as per rules confirmed in Finland and pursuant to Chapter 13 of the Act on Common Funds, including any obligations thereby incurred. For a fund to qualify for tax exemption as above, it must have been established and must operate in accordance with the Act on Common Funds. Furthermore, to qualify for tax exemption, an investment fund must have 30 unitholders; an exception may be made if the fund is newly established or if the number of unitholders decreases temporarily (section 20a, subsection 6 of the Income Tax Act; see Section 4 below for more details). The conditions for the number of unitholders and exceptions thereto are consistent with the provisions in the Act on Common Funds. Therefore, a domestic investment fund as per the Act on Common Funds is, by default, a corporate entity exempt from income tax.

Under Chapter 1, section 2 of the Act on Common Funds, an investment fund may consist of one or more sub-funds, to which the provisions on investment funds apply (section 20a, subsection 7 of the Income Tax Act; see section 5 below for more details).

2.3 Conditions for tax exemption of special investment funds pursuant to the AIFM Act

The conditions for the tax exemption of domestic special investment funds are provided for in section 20a, subsections 2–4 of the Income Tax Act. Section 20a, subsections 2–3 of the Income Tax Act contain the general conditions for the tax exemption of special investment funds. There is also an additional condition on the profit distribution of special investment funds primarily investing in real estate and real estate securities in section 20a, subsection 4 of the Income Tax Act. However, like other special investment funds, in addition to the profit distribution condition, real estate funds must meet the conditions laid down in section 20 a, subsections 2–3 of the Income Tax Act to be tax-exempt (see decision KHO 2022:138 of the Supreme Administrative Court).

2.3.1 Conditions in section 20a, subsection 2 of the Income Tax Act

Under section 20a, subsection 2 of the Income Tax Act, a special investment fund as referred to in Chapter 2, section 1, subsection 2 of the AIFM Act is tax-exempt in income taxation when it is of the open-ended type and has at least 30 unitholders.

In accordance with Chapter 2 section 1, subsection 2 of the AIFM Act, a special investment fund is an AIF as referred to in Chapter 16a, section 1 of the AIFM Act which must be managed in accordance with the obligations set in that Chapter. The primary condition for a special investment fund to be tax-exempt is that the special investment fund is an AIF established and operating pursuant to the AIFM Act.

The second condition for the tax exemption of a special investment fund is that the special investment fund must be open-ended, meaning that the fund must be open to the public, and must have an obligation to issue and redeem shares in the fund. The requirement on open-ended form in section 20a, subsection 2 of the Income Tax Act corresponds to the open-ended requirement for domestic special investment funds laid down in Chapter 16a, section 4 of the AIFM Act. In accordance with Chapter 16a, section 4, subsection 1 of the AIFM Act, domestic special investment funds must be open to the public. In accordance with Chapter 16a, section 4, subsection 1 of the AIFM Act, by exception from Chapter 8, section 8 of the Act on Common Funds, the rules of a special investment fund may specify restrictions to its openness.

A special investment fund may deviate from the requirements for being open-ended; for example, under its own rules, a fund may be open for subscriptions and redemptions once every three months. In such cases, the frequency of the opening times is usually coordinated with the realisation times of investments in the special investment fund. According to government proposal HE 304/2018 (p. 56), a restriction on opening times does not in itself render a special investment fund closed-ended. Even if a special investment fund is not offered to the public, it may still meet the conditions for an AIF of the open-ended type. In this respect, the government proposal refers to Commission Delegated Regulation (EU) No 694/2014 supplementing Directive 2011/61/EU of the European Parliament and of the Council with regard to regulatory technical standards determining types of alternative investment fund managers, in which an AIF is defined as follows:

“…an AIF (....) the shares or units of which are, at the request of any of its shareholders or unitholders, repurchased or redeemed prior to the commencement of its liquidation phase or wind-down, directly or indirectly, out of the assets of the AIF and in accordance with the procedures and frequency set out in its rules or instruments of incorporation, prospectus or offering documents.

A decrease in the capital of the AIF in connection with distributions according to the rules or instruments of incorporation of the AIF, its prospectus or offering documents, including one that has been authorised by a resolution of the shareholders or unitholders passed in accordance with those rules or instruments of incorporation, prospectus or offering documents, shall not be taken into account for the purpose of determining whether or not the AIF is of the open-ended type.

Whether an AIF’s shares or units can be negotiated on the secondary market and are not repurchased or redeemed by the AIF shall not be taken into account for the purpose of determining whether or not the AIF is of the open-ended type.”

When applying section 20a, subsection 2 of the Income Tax Act, a special investment fund shall be considered to meet the requirement of being open-ended when it satisfies the condition of being open-ended referred to in the aforementioned Delegated Regulation.

The third condition for tax exemption is that the special investment fund must have at least 30 unitholders; an exception may be made if the fund is newly established or if the number of unitholders decreases temporarily (section 20a, subsection 6 of the Income Tax Act; see section 4 below for more details).

2.3.2 Conditions in section 20a, subsection 3 of the Income Tax Act

Under the AIFM Act, it is permissible for a special investment fund not to be open-ended or to have fewer than 30 unitholders. A special investment fund that fails to satisfy either or both of these conditions may nevertheless be considered tax-exempt if it satisfies all the conditions laid down in section 20, subsection 3 of the Income Tax Act:

- the special investment fund distributes to its unitholders at least three fourths of its profits for the financial year each year, excluding unrealised appreciations;

- the special investment fund has a capital of at least €2 million; and

- the unitholders of the special investment fund are professional investors or high net worth individuals treated as such within the meaning of Chapter 16a, section 4 of the AIFM Act.

The requirement for profit distribution during each financial year refers to the actual distribution of profits. A special investment fund must therefore annually distribute at least three quarters of its profits for the financial year, excluding unrealised appreciations. This requirement is consistent with the requirement for profit distribution during each financial year in Chapter 16a, section 5 of the AIFM Act.

The ‘professional investors or comparable high net worth individuals’ referred to in Chapter 16a, section 4 of the AIFM Act refers to the concept of ‘professional client’ defined in the AIFM Act, which is equivalent to the group defined in Chapter 1, section 23 of the Act on Investment Services (747/2012) to which the concept of ‘professional investor’ in Chapter 1, section 2, subsection 31 of the Act on Common Funds is also equivalent. A high net worth individual comparable to a professional investor is defined in Regulation (EU) No 345/2013 of the European Parliament and of the Council on European venture capital funds and in Regulation (EU) No 346/2013 of the European Parliament and of the Council on European social entrepreneurship funds (high net worth individuals).

2.3.3 Condition on profit distribution of real estate funds (section 20a, subsection 4 of the Income Tax Act)

In accordance with section 20a, subsection 4 of the Income Tax Act, a special investment fund as referred to in Chapter 2, section 1, subsection 2 of the AIFM Act which invests its assets primarily in real estate and real estate securities as referred to in Chapter 16a, section 4 of said Act, shall be tax-exempt if the fund distributes at least three fourths of its profits to its unitholders annually, excluding unrealised appreciations. The content of the condition on profit distribution in section 20a, subsection 4 of the Income Tax Act corresponds to the profit distribution condition in section 20a, subsection 3, paragraph 1 of the Income Tax Act (see Section 2.3.2). Section 20a, subsection 4 of the Income Tax Act does not contain any other conditions for tax exemption (see decision KHO 2022:139 of the Supreme Administrative Court).

The profit distribution condition in section 20a, subsection 4 of the Income Tax Act is a specific condition for real estate funds. In addition to the conditions on the distribution of profit, real estate funds must, like other special investment funds, meet the conditions in section 20a, subsections 2–3 of the Income Tax Act to be tax-exempt (see decision KHO 2022:138 of the Supreme Administrative Court).

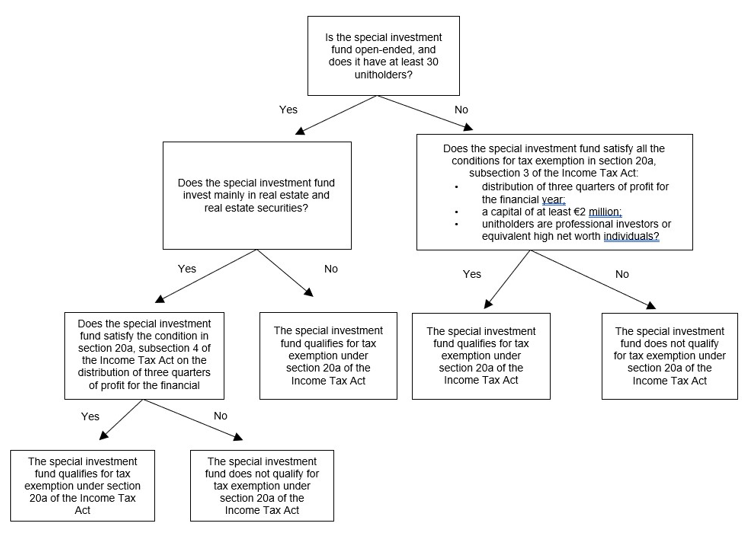

2.3.4 Summary of the conditions for tax exemption for special investment funds

The tax-exempt status of special investment funds pursuant to the AIFM Act in cases where section 20a, subsections 2–4 of the Income Tax Act is applied is determined as shown below:

3 Taxation of foreign investment funds and special investment funds

3.1 General information on the taxation of foreign funds

The legal structures available for pursuing investment fund operations vary between countries. In Member States of the European Union and within the European Economic Area (EEA), investment fund operations are governed by the UCITS Directive, which allows three legal structures for an UCITS: a contractual investment fund, an investment company with variable capital and a unit trust. The umbrella term for all of these is an ‘undertaking for collective investment in transferable securities’ (UCITS). Investment funds established in Finland can only be contractual investment funds, but the other legal structures defined in the UCITS Directive are in use in other Member States.

There are also funds in various Member States that are not investment funds as defined by the UCITS Directive but, for instance, alternative investment funds (AIF) as defined in the AIFM Directive. The AIFM Directive allows for a variety of legal structures. Furthermore, there may be AIFs not covered by the AIFM Directive in EU Member States and third countries. The legal structure of such funds depends on the national legislation of each country.

In Finland, foreign funds considered as corporate entities in taxation are non-resident taxpayers (section 9, subsection 1 of the Income Tax Act). A non-resident taxpayer is only liable to pay tax in Finland on income earned in Finland under the Income Tax Act. In accordance with sections 9 and 10 of the Income Tax Act, income from Finland includes, but is not limited to, income from real estate or from the sale of real estate (section 10, subsection 1, section 10 and section 10a of the Income Tax Act) and dividends paid in Finland (section 10, subsection 6 of the Income Tax Act). Certain taxpayers and certain types of income may have been defined as tax-exempt in national tax legislation. Such provisions exist in section 20a of the Income Tax Act, which specify the conditions for the tax exemption of investment and special investment funds.

When a foreign fund invests in a Finnish investment, it may also be necessary to resolve whether the foreign fund is entitled to any tax treaty benefits. In cases where Finland does not have a tax treaty with the country in which a foreign corporate entity is resident, the right of the Finnish government to levy taxes is determined solely on the basis of Finland’s national tax legislation. In most cases, however, tax treaties restrict the right to tax based on Finland’s national legislation.

EU law also has an impact on the taxation of foreign funds. The precedence of EU law over national law means that national legislation and tax treaties must be applied and interpreted within the requirements of EU law. TFEU has an impact on direct taxation via fundamental freedoms, for example. The most important fundamental freedoms in terms of the tax treatment of foreign funds are provided for in Articles 49, 63 and 65 of the TFEU (right of establishment and free movement of capital, respectively). The provisions of Articles 63 and 65 of the TFEU are also applicable to residents of countries other than the EU or EEA Member States, i.e. third countries. The application of the fundamental freedoms may overlap, and with respect to tax at source on dividends, for instance, the right of establishment as defined in Article 49 of the TFEU may also be applicable, but only between Member States. As the articles of the TFEU that guarantee basic freedoms have a direct effect, they take precedence over national provisions in cases of conflict. The case-law of the Court of Justice of the European Union (CJEU) on the application of the fundamental freedoms plays an important role in the interpretation of EU law.

For more information on the taxation of non-resident taxpayers, see the guidelines of the Finnish Tax Administration Income taxation of foreign corporate entities and Payments of dividends, interest and royalties to nonresidents.

3.2 Effects of EU law on the condition of contractual form for foreign investment funds

The conditions for the tax exemption of foreign investment funds and special investment funds are provided for in section 20a of the Income Tax Act. According to its wording, section 20a only applies to contractual funds. Regardless, the provision also applies in certain circumstances to foreign funds constituted in the form of a company or a trust because of the effects of EU law.

At the request of the Helsinki Administrative Court, the CJEU has issued a preliminary ruling in case C-342/20, A SCPI, concerning the condition of contractual form in section 20a of the Income Tax Act in the light of Articles 63 and 65 of the Treaty on the TFEU. In its judgment, the CJEU held that the condition relating to contractual form constituted a restriction on the free movement of capital, which could not be justified by overriding reasons relating to the public interest when it excluded from entitlement to that exemption a foreign alternative investment fund constituted in the form of a company, even though that fund, which benefits from a system of tax transparency in the Member State in which it is established, was not subject to income tax in that latter Member State. Based on the judgment of the CJEU, the Helsinki Administrative Court issued an equivalent decision No. H3151/2022.

The Supreme Administrative Court has also issued a yearbook decision, KHO 2022:130, concerning the condition of contractual form. The Supreme Administrative Court held that an open-ended sub-fund of a registered investment management company of the Delaware Statutory Trust type registered in the US had to be equated with Finnish investment funds within the meaning of section 20a, subsection 1 of the Income Tax Act even though the sub-fund was not contractual.

By virtue of the abovementioned case-law, a foreign fund constituted in the form of a company or a trust is tax-exempt despite the condition of contractual form in section 20a of the Income Tax Act and section 3, subsection 10 of the Act on the Taxation of Nonresident Taxpayers’ Income when such a foreign investment fund is in an objectively comparable situation as a domestic contractual investment fund or special investment fund and the fund meets the other conditions for tax exemption in section 20a of the Income Tax Act. As the free movement of capital also extends to third countries, the principle also applies to foreign funds constituted in the form of a company or a trust residing outside the EEA.

The objective comparability of the situations is examined based on the aim pursued by the tax exemption for investment funds and special investment funds under section 20a of the Income Tax Act, the purpose of which is to ensure that taxation happens only at the level of the investor. In light of this aim, a foreign fund constituted in the form of a company or a trust which benefits from an exemption in respect of its income or belongs to a system of tax transparency in its State of residence can be considered to be in a comparable situation to a resident investment fund or special investment fund constituted in accordance with contract law. The situations can be considered objectively comparable also when the foreign fund is in practice exempt from income tax in its State of residence on the basis of, for example, the right to make a deduction on the taxable income of the fund under the law of the State of residence of the fund (see decision KHO 2022:130 of the Supreme Administrative Court).

In order to obtain a tax exemption, a foreign fund constituted in the form of a company or a trust must demonstrate to the Finnish Tax Administration that it is in an objectively comparable situation to a resident investment fund or special investment fund constituted in accordance with contract law and that it meets the other conditions for tax exemption under section 20a of the Income Tax Act.

3.3 Conditions for tax exemption for foreign investment funds

The tax exemption of foreign investment funds equivalent to domestic funds is provided for in section 20a, subsection 1 of the Income Tax Act. Under section 20a, subsection 1 of the Income Tax Act, a contractual, open-ended foreign investment fund equivalent to an investment fund as referred to in Chapter 1, section 2, subsection 1, paragraph 2 of the Act on Common Funds shall be exempt from income tax if it has 30 or more unitholders.

Condition on equivalence

Under Chapter 1, section 2, subsection 1 of the Act on Common Funds, an investment fund is defined as a set of assets obtained in the course of investment fund operations and invested as per rules confirmed in Finland and pursuant to Chapter 13 of the Act on Common Funds, including any obligations thereby incurred. The equivalence specified as a condition for tax exemption in section 20a, subsection 1 of the Income Tax Act means that the foreign investment fund in question must have been established in a manner that is essentially equivalent to that defined in the Act on Common Funds and operate in a manner essentially equivalent to an investment fund as defined by the Act on Common Funds. For example, a UCITS established in an EEA State under the UCITS Directive is, in principle, considered an investment fund established in a manner substantially equivalent to the Act on Common Funds and operating in a manner essentially equivalent to an investment fund operating under the Act on Common Funds.

Foreign funds equivalent to domestic partnerships within the meaning of section 4 of the Income Tax Act do not meet the equivalence requirement in section 20a, subsection 1 of the Income Tax Act. Foreign funds equivalent to domestic partnerships are not taxed as corporate entities like investment funds. Instead, the income received from Finland by such funds in accordance with section 10 of the Income Tax Act is taxable income of the fund’s unitholders.

Condition on contractual form

The contractual form specified as a condition for tax exemption in section 20a, subsection 1 of the Income Tax Act means that the investment fund must have been established as a contractual arrangement and must comprise an aggregate of separate assets that does not have a legal personality. To be contractual, the fund must exist as a contractual arrangement between the fund management company and the unitholders.

Regardless of the wording of the Act on contractual form, foreign funds constituted in the form of a company or a trust may also be tax-exempt on the basis of the principle of free movement of capital under section 20a of the Income Tax Act if they are in a comparable situation to a domestic investment fund constituted in accordance with contract law and meet the other conditions for tax exemption under section 20a of the Income Tax Act. For more information, see Section 3.2.

Condition on open-ended form

The open-ended form of an investment fund as a condition for tax exemption means that the fund must be open to the public and must have an obligation to issue and redeem shares in the fund. The definition of ‘open-ended’ in section 20a, subsection 1 of the Income Tax Act is consistent with the definition of same in Chapter 8, section 8 of the Act on Common Funds. According to the provision, an investment fund satisfies the open-ended condition if it is open to all investors without restrictions. The condition on an investment fund to be open-ended, provided in Chapter 8, section 8 of the Act on Common Funds, stems from Article 1(2) of the UCITS Directive, according to which:

“UCITS means an undertaking a) with the sole object of collective investment in transferable securities or in other liquid financial assets referred to in Article 50(1) of capital raised from the public and which operate on the principle of risk-spreading; and (b) with units which are, at the request of holders, repurchased or redeemed, directly or indirectly, out of those undertakings’ assets. Action taken by a UCITS to ensure that the stock exchange value of its units does not significantly vary from their net asset value shall be regarded as equivalent to such repurchase or redemption.”

Therefore, an investment fund that complies with the UCITS Directive or an equivalent requirement for being open-ended is considered to be open-ended as referred to in section 20a, subsection 1 of the Income Tax Act. For example, exchange traded funds (ETF funds) are considered open-ended when they are obligated to perform the alternative action according to the second sentence of Article 1(2)b of the UCITS Directive.

Condition on minimum number of unitholders

To qualify for tax exemption, a fund must have at least 30 unitholders; an exception may be made thereto when the fund is newly established or if the number of unitholders decreases temporarily (section 20a, subsection 6 of the Income Tax Act; for more information, see Chapter 4 below). In the Act on Common Funds, the minimum number of unitholders is given as 30 to ensure that the fund really is a joint investment undertaking.

The term ‘unitholder’ refers to an investor who has invested in the foreign investment fund and received units of the fund in exchange for their investment. If the units of an investment fund are nominee-registered, the actual owner of the nominee-registered units instead of the intermediary in charge of nominee registration is considered the unitholder.

Investment funds registered outside the EEA

For an investment fund registered outside the EEA to be tax-exempt, not only the conditions in accordance with section 20a, subsection 1 of the Income Tax Act but also the specific conditions in section 20a, subsection 5 of the same Act must be satisfied (for more information, see Section 3.5 below).

3.4 Conditions for tax exemption for foreign special investment funds

The conditions for the tax exemption of foreign special investment funds equivalent to domestic special investment funds is provided for in section 20a, subsections 2–4 of the Income Tax Act. Section 20a, subsections 2–3 of the Income Tax Act contain the general conditions for the tax exemption of special investment funds. There is also a condition on the profit distribution of special investment funds primarily investing in real estate and real estate securities in section 20a, subsection 4 of the Income Tax Act. However, like other special investment funds, in addition to the profit distribution condition, real estate funds must meet the conditions laid down in section 20 a, subsections 2–3 of the Income Tax Act to be tax-exempt (see decision KHO 2022:138 of the Supreme Administrative Court).

3.4.1 Conditions in section 20a, subsection 2 of the Income Tax Act

Under section 20a, subsection 1 of the Income Tax Act, a foreign contractual special investment fund equivalent to a special investment fund as referred to in Chapter 2, section 1, subsection 2 of the AIFM Act is tax-exempt in income taxation when it is open-ended and has 30 or more unitholders.

Condition on equivalence

In accordance with Chapter 2, section 1, subsection 2 of the AIFM Act, a special investment fund is an AIF as referred to in Chapter 16a, section 1 of the AIFM Act which must be managed in accordance with the obligations set in that Chapter. For this reason, the equivalence specified as a condition for tax exemption in section 20a, subsection 2 of the Income Tax Act means that the foreign special investment fund must have been established essentially in the manner specified in the AIFM Act and operate in a manner essentially equivalent to that defined the AIFM Act.

To assess whether a fund is an alternative investment fund established and operating in an essentially equivalent manner as defined in the AIFM Act, it is necessary to take into account factors such as the provisions of the AIFM Act on the investment of assets of domestic special investment funds (Chapter 16a, section 6 of the AIFM Act). For example, in accordance with section 16a, section 6, paragraph 3 of the AIFM Act, a special investment fund investing its assets mainly in real estate must comply with the provisions of chapters 3 and 4 of the Real Estate Funds Act (Kiinteistörahastolaki 1173/1997) on matters such as the investment of real estate funds. Hence, when assessing whether a foreign real estate fund is equivalent to a domestic special investment fund, the provisions on real estate fund operations in the Real Estate Funds Act must be taken into account (see decision KHO 2022:138 of the Supreme Administrative Court). Special characteristics of the equivalence assessment of foreign real estate funds are discussed in more detail in Section 3.4.3.

Furthermore, a foreign special investment fund equivalent to a domestic one must be established under the AIFM regulations of its country of registration or, in the case of a non-EEA country, under the legislation corresponding to the AIFM regulations (government proposal HE 304/2018 vp, p. 58).

Foreign funds equivalent to domestic partnerships within the meaning of section 4 of the Income Tax Act do not meet the equivalence requirement in section 20a, subsection 2 of the Income Tax Act. Foreign funds equivalent to domestic partnerships are not taxed as corporate entities like special investment funds. Instead, the income received from Finland by such funds in accordance with section 10 of the Income Tax Act is taxable income of the fund’s unitholders.

Condition on contractual form

The contractual form specified as a condition for tax exemption in section 20a, subsection 2 of the Income Tax Act means that the special investment fund must have been established as a contractual arrangement between the fund management company and the unitholders, i.e. it must comprise an aggregate of separate assets that does not have a legal personality.

Regardless of the wording of the Act on contractual form, foreign special investment funds constituted in the form of a company or a trust may also be tax-exempt on the basis of the principle of free movement of capital under section 20a of the Income Tax Act if they are in a comparable situation to a domestic special investment fund constituted in accordance with contract law and meet the other conditions for tax exemption under section 20a of the Income Tax Act. For more information, see Section 3.2.

Condition on open-ended form

The condition on open-ended form in section 20a, subsection 2 of the Income Tax Act means that a special investment fund must be open-ended in order to be tax-exempt, meaning that the fund must be open to the public, and must have an obligation to issue and redeem shares in the fund. The requirement on open-ended form in section 20a, subsection 2 of the Income Tax Act corresponds to the open-ended requirement for domestic special investment funds laid down in Chapter 16a, section 4 of the AIFM Act. In accordance with Chapter 16a, section 4, subsection 1 of the AIFM Act, special investment funds must be open to the public. In accordance with Chapter 16a, section 4, subsection 1 of the AIFM Act, by exception from Chapter 8, section 8 of the Act on Common Funds, the rules of a special investment fund may specify restrictions to its openness.

A special investment fund may deviate from the requirements for being open-ended; for example, under its own rules, a fund may be open for subscriptions and redemptions once every three months. In such cases, the frequency of the opening times is usually coordinated with the realisation times of investments in the special investment fund. A restriction on opening times does not in itself render a special investment fund to be closed-ended (government proposal HE 304/2018, p. 56). A special investment fund not being open to the public can nevertheless satisfy the requirements for being open-ended set for an AIF, with respect to which the government proposal refers to Commission Delegated Regulation (EU) No 694/2014, where an open-ended AIF is defined as follows:

“…an AIF (....) the shares or units of which are, at the request of any of its shareholders or unitholders, repurchased or redeemed prior to the commencement of its liquidation phase or wind-down, directly or indirectly, out of the assets of the AIF and in accordance with the procedures and frequency set out in its rules or instruments of incorporation, prospectus or offering documents.

A decrease in the capital of the AIF in connection with distributions according to the rules or instruments of incorporation of the AIF, its prospectus or offering documents, including one that has been authorised by a resolution of the shareholders or unitholders passed in accordance with those rules or instruments of incorporation, prospectus or offering documents, shall not be taken into account for the purpose of determining whether or not the AIF is of the open-ended type.

Whether an AIF’s shares or units can be negotiated on the secondary market and are not repurchased or redeemed by the AIF shall not be taken into account for the purpose of determining whether or not the AIF is of the open-ended type.”

When applying section 20a, subsection 2 of the Income Tax Act, a special investment fund shall be considered to meet the requirement of being open-ended when it satisfies the condition of being open-ended referred to in the aforementioned Delegated Regulation.

In case law, a special investment fund has been considered closed-ended when, for example, the number of units does not vary according to subscriptions and redemptions and the units could not be called for redemption during the fund’s fixed term (see decision KHO 2022:142 of the Supreme Administrative Court).

Condition on minimum number of unitholders

To qualify for tax exemption, a fund must have at least 30 unitholders; an exception may be made thereto when the fund is newly established or if the number of unitholders decreases temporarily (section 20a, subsection 6 of the Income Tax Act; for more information, see Chapter 4 below).

The term ‘unitholder’ refers to an investor who has invested in the foreign special investment fund and received units of the fund in exchange for their investment. If the units of a special investment fund are nominee-registered, the actual owner of the nominee-registered units instead of the intermediary in charge of nominee registration is considered the unitholder.

Special investment funds registered outside the EEA

For a special investment fund registered outside the EEA to be tax-exempt, not only the conditions in accordance with section 20a, subsection 2 of the Income Tax Act but also the specific conditions in section 20a, subsection 5 of the same Act must be satisfied (for more information, see Section 3.5 below).

3.4.2 Conditions in section 20a, subsection 3 of the Income Tax Act

If a foreign special investment fund referred to in section 20, subsection 2 of the Income Tax Act does not satisfy the condition of having 30 or more unitholders or the condition of being open-ended, or both, it may nevertheless be tax-exempt if it satisfies all of the conditions in section 20a, subsection 3, paragraphs 1–3 of the Income Tax Act:

- the special investment fund distributes to its unitholders at least three fourths of its profits for the financial year each year, excluding unrealised appreciations;

- the special investment fund has a capital of at least €2 million; and

- the unitholders of the special investment fund are professional investors or comparable high net worth individuals as referred to in Chapter 16a section 4 of the AIFM Act.

Condition on profit distribution

The condition on profit distribution in each financial year is an actual requirement to qualify for tax exemption. A special investment fund must therefore annually distribute at least three quarters of its profits for the financial year, excluding unrealised appreciations. However, there may be exceptions to the condition on profit distribution in certain circumstances. Given that the profit-sharing provision is intended to prevent a tax deferral, a flow-through fund is deemed to meet the condition on actual profit distribution if three-quarters of the fund’s profits are considered distributed, or those profits are taken into account in the taxation of the unitholders as actually distributed income (see C-156/17, Köln-Aktienfonds Deka).

Example 1. A foreign special investment fund equivalent to a domestic special investment fund within the meaning of section 20a of the Income Tax Act is a contractual arrangement without legal personality. The special investment fund is closed-ended and has 33 unitholders. As the special investment fund is closed-ended, it must satisfy the conditions for tax exemption in section 20a, subsection 3 of the Income Tax Act. The special investment fund is a flow-through fund in its State of residence, and the annual profits for the financial year are taxed as income for the unitholders each tax year. The special investment fund submits a report to the Finnish Tax Administration that includes a clarification of the national tax legislation of the State of residence, according to which at least three quarters of the profit distribution for the financial year is considered distributed, and the profit is taken into account in the taxation of unitholders as actually distributed income. With the report, the fund has demonstrated that it is in a comparable situation to a domestic special investment fund as a result of the national legislation. The special investment fund is a tax-exempt special investment fund pursuant to section 20a, subsection 3 of the Income Tax Act.

Condition on minimum capital

The €2 million minimum capital of a foreign special investment fund, which is a condition for tax exemption, refers to the assets contributed by the unitholders of the fund and entered in the fund’s capital.

Conditions on professional investors or comparable high net worth individuals

An additional condition for tax exemption is that the unitholders of the special investment fund are professional investors or comparable high net worth individuals as referred to in Chapter 16a, section 4 of the AIFM Act.

The ‘professional investors or comparable high net worth individuals’ referred to in Chapter 16a, section 4 of the AIFM Act refer to the concept of ‘professional client’ defined in the AIFM Act, which is equivalent to the group defined in Chapter 1, section 23 of the Act on Investment Services (747/2012), to which the concept of ‘professional investor’ in Chapter 1, section 2, subsection 31 is also equivalent. A high net worth individual comparable to a professional investor is defined in Regulation (EU) No 345/2013 of the European Parliament and of the Council on European venture capital funds and in Regulation (EU) No 346/2013 of the European Parliament and of the Council on European social entrepreneurship funds (high net worth individuals).

The condition on professional investors or comparable high net worth individuals has been discussed in a yearbook decision KHO 2022:142 of the Supreme Administrative Court. In the said case, 33 external investors who met the definition of a professional investor under French law had invested in a French special investment fund. The fund’s management company and 12 of its employees had also invested in the fund. No detailed explanation had been provided as to whether the employees of the management company could be regarded as professional investors or comparable high net worth individuals within the meaning of section 20a, subsection 3, paragraph 3 of the Income Tax Act. However, according to the Supreme Administrative Court, taking into account the fact that the persons in question were employed by the management company, the situation of the fund in this respect had to be considered to be essentially comparable to that of a domestic special investment fund qualifying for the tax exemption. Therefore, the fund met the tax exemption condition on professional investors or comparable high net worth individuals under section 20a, subsection 3, paragraph 3 of the Income Tax Act.

3.4.3 Conditions for tax exemption for foreign real estate funds

Like other special investment funds, special investment funds investing primarily in real estate or real estate securities must meet the conditions in section 20a, subsection 2 or 3 of the Income Tax Act to be tax-exempt (see decision KHO 2022:138 of the Supreme Administrative Court).

In addition to the conditions in accordance with section 20a, subsections 2–3 of the Income Tax Act, section 20a, subsection 4 of the Income Tax Act lays down an additional condition concerning the distribution of profits for foreign real estate funds. In accordance with the provision, a foreign contractual special investment fund equivalent to a special investment fund as referred to in Chapter 2, section 1, subsection 2 of the AIFM Act which invests its assets primarily in real estate and real estate securities as referred to in Chapter 16a, section 4 of said Act, shall be exempt from income tax if it distributes at least three fourths of its profits to its unitholders annually, excluding unrealised appreciations. Compliance with the condition of profit distribution under section 20a, subsection 4 of the Income Tax Act is assessed in the same way as compliance with the condition of profit distribution under section 20a, subsection 3 of the Income Tax Act (see Section 3.4.2). Section 20a, subsection 4 of the Income Tax Act does not contain any other conditions for tax exemption (see decision KHO 2022:139 of the Supreme Administrative Court).

In practice, the additional condition on the profit distribution of real estate funds means that even if a foreign real estate fund equivalent to a domestic special investment fund meets the conditions on its open-ended form and 30 unitholders in section 20a, subsection 2 of the Income Tax Act, to be tax-exempt, it must also distribute its profits to its unitholders in the manner required in section 20a, subsection 4 of the Income Tax Act.

Furthermore, as in the case of other special investment funds, the tax exemption for foreign real estate funds is conditional on the real estate fund being equivalent to a domestic special investment fund within the meaning of Chapter 2, section 1, subsection 2 of the AIFM Act. The equivalence under section 20a, subsection 4 of the Income Tax Act means that the real estate fund must be established and operating in a manner essentially equivalent to that defined in the AIFM Act.

In order to assess whether a foreign real estate fund is an alternative investment fund established and operating in a manner essentially equivalent to that defined in the AIFM Act, it is necessary to take into account factors such as the provisions of the AIFM Act on the investment of assets of domestic special investment funds (Chapter 16a, section 6 of the AIFM Act). In accordance with section 16a, subsection 6, paragraph 3 of the AIFM Act, a special investment fund which invests its assets primarily in real estate shall comply with the provisions in Chapters 3 and 4 of the Real Estate Funds Act on the investment of assets in a real estate fund, among other matters. Thus, to be equivalent to a domestic special investment fund, a foreign real estate fund must invest its assets in a manner equivalent to that defined in the Real Estate Funds Act (see decision KHO 2022:138 of the Supreme Administrative Court). In section 1 of the Real Estate Funds Act, a real estate fund is defined as an operation where operators as defined by the Real Estate Funds Act invest assets received from members of the public primarily in real estate and real estate securities for purposes other than construction or property development. Section 15 of the Real Estate Funds Act lays down more detailed provisions on the investment of the assets of a real estate fund.

In its yearbook decision KHO 2022:138, the Supreme Administrative Court has assessed the equivalence of a sub-fund of a foreign real estate investment fund to a domestic special investment fund within the meaning of Chapter 2, section 1, subsection 2 of the AIFM Act. In the case at hand, the sub-fund had invested approximately 29% of its assets in construction activities. However, a domestic special investment fund investing mainly in real estate may only invest up to one fifth of its assets in construction and real estate development by virtue of section 15, subsection 5 of the Real Estate Funds Act. The Supreme Administrative Court held that since more than one fifth of the assets of the foreign sub-fund had been invested in construction activities, the sub-fund was engaged in such significant construction activities that it could not be considered equivalent to a tax-exempt domestic special investment fund within the meaning of section 20a of the Income Tax Act, considering section 15, subsection 5 of the Real Estate Funds Act. As Articles 63 and 65 of TFEU on the free movement of capital did not prevent such an interpretation either, the sub-fund was not a tax-exempt special investment fund under section 20 of the Income Tax Act.

The equivalence of a foreign real estate fund to a domestic special investment fund within the meaning of Chapter 2, section 1, subsection 2 of the AIFM Act in accordance with Section 20a of the Income Tax Act thus requires, among other factors, that the real estate fund invests no more than one fifth of its assets in construction and real estate development activities in accordance with section 15, subsection 5 of the Real Estate Funds Act.

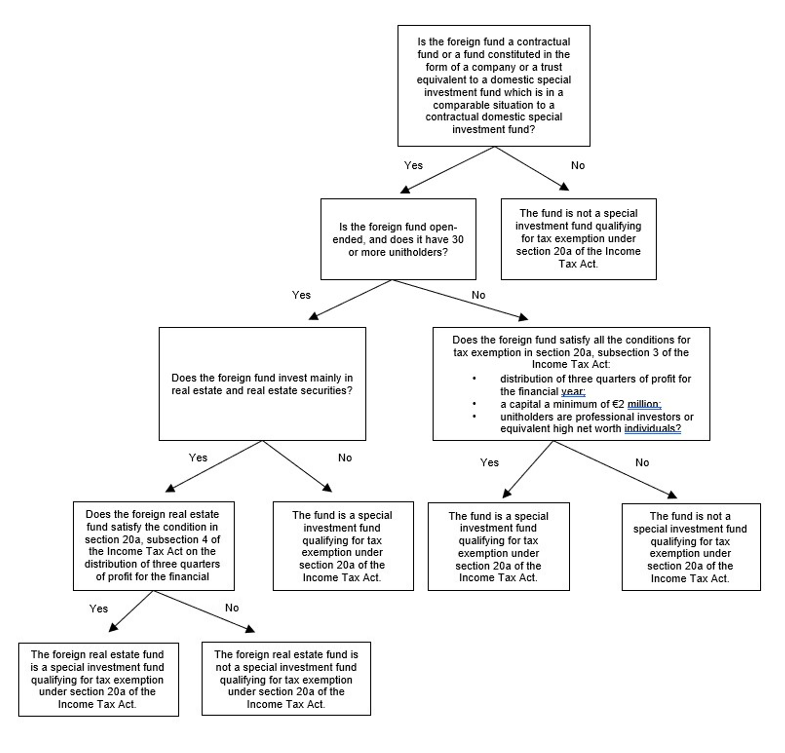

3.4.4 Summary of the conditions for tax exemption for foreign special investment funds

As indicated above, the tax-exempt status of foreign special investment funds is determined as shown below in cases where section 20a, subsections 2–4 of the Income Tax Act apply:

3.5 Special conditions for funds not registered in the EEA

In accordance with section 20a, subsection 5 of the Income Tax Act, for a foreign investment fund or foreign special investment fund registered outside the European Economic Area to qualify for tax exemption, it must satisfy the following requirements in addition to what is provided in section 20a of the Income Tax Act:

- Finland must have an agreement on the exchange of information on tax matters with the country of registration, and the country of registration must be able to provide sufficient information for tax assessment and for verifying the correctness of taxation; and

- the foreign investment fund must have been established pursuant to the UCITS legislation in the country of registration, or the fund must have been established pursuant to legislation equivalent to the AIFM Act in the country of registration.

The ability to obtain information as referred to in section 20a, subsection 5 of the Income Tax Act refers to, despite the difference in wording, the same as ‘sufficient information exchange’ in section 3, subsection 2, paragraph 2 of the Act on the Taxation of Shareholders in Controlled Foreign Companies (1217/1994; see government proposal HE 304/2018, pp. 54–55).

Sufficient information exchange for the purposes of the aforementioned information exchange may be satisfied by the Finnish Tax Administration being able to request the information required from the country of registration of the foreign fund.

Exchange of bulk data by automatic information exchange is not sufficient to satisfy the information exchange condition. The information exchange condition is only satisfied if an agreement has been made with the country of registration of the foreign fund concerning, at a minimum, the exchange of information on request, on the basis of which it is actually possible to receive information on individual cases, and if such an agreement is enforced. It is also required that there are no restrictions imposed on information exchange by the national legislation of the country of registration. The agreement on information exchange may be made by a tax treaty equivalent in scope to the OECD Model Tax Convention on Income and on Capital. An agreement on sufficient information exchange may also be made by implementing the OECD Convention on Mutual Administrative Assistance in Tax Matters. Additionally, Finland has more limited agreements in place with certain countries concerning matters such as the exchange of tax information, and these may include clauses on sufficient information exchange. To satisfy the condition on sufficient information exchange, it is not enough to have an agreement in place; information exchange must also actually happen. In other words, sufficient information exchange must be possible and the Tax Administration must be actually able to request the information required from the country of registration of a fund.

Information exchange will not be considered to have taken place before the enforcement of an agreement on information exchange has begun. If the information exchange condition is satisfied at the beginning of a taxpayer’s tax year or at any time later in the tax year, the requirement will be considered to have been satisfied for the entire tax year. If any circumstances emerge in the course of a tax year leading to the condition on sufficient information exchange no longer being satisfied, this will have no impact on the taxpayer’s taxation in the current tax year, but only in the following tax year.

For the purpose of the information exchange mandated in the Act on the Taxation of Shareholders in Controlled Foreign Companies, the Finnish Tax Administration maintains a list of the jurisdictions for which the information exchange condition is satisfied. For the jurisdictions on the list, either there is an agreement in place that satisfies the information exchange requirement in section 20a, subsection 5 of the Income Tax Act, or information exchange is considered to be otherwise sufficiently provided for. The jurisdictions on the list also satisfy the condition of actual information exchange. For further information, see the Tax Administration guideline Act on the Taxation of Shareholders in Controlled Foreign Companies, whitelist (Laki ulkomaisten väliyhteisöjen osakkaiden verotuksesta, valkoinen lista).

In addition to the information exchange requirement, for a foreign investment fund registered outside the EEA to qualify for tax exemption, it must have been established pursuant to the UCITS legislation of its country of registration.

Similarly, for a foreign special investment fund registered outside the EEA to qualify for tax exemption, it must have been established pursuant to the legislation in its country of registration equivalent to the AIFM Act. ‘Equivalent’ here means that the legislation on special investment funds in the country of registration must be essentially equivalent to the provisions of the Finnish AIFM Act and/or the AIFM Directive.

3.6 Foreign funds that do not qualify for tax exemption

If a foreign fund does not meet the conditions for tax exemption set out in section 20a of the Income Tax Act and section 3, subsection 10 of the Act on the Taxation of Nonresident Taxpayers’ Income, the fund will be taxed based on what domestic entity it is equated to in Finnish taxation. A foreign fund may be equated to, for example, a domestic corporate entity within the meaning of section 3 of the Income Tax Act or a partnership within the meaning of section 4 of the Income Tax Act. In these cases, any income received from Finland, such as dividend, will be taxed according to the tax provisions on the income and legal form in question, taking into account EU law and the provisions of any applicable tax treaties (see, for instance, decision KHO 2015:9 of the Supreme Administrative Court and preliminary ruling KVL 57/2017 of the Central Tax Board).

For example, if a foreign fund is equated to a Finnish corporate entity, the corporate tax at source rate (20%) will by default be applied to dividend income earned by the fund in Finland. However, this rate may be decreased by a provision in a tax treaty, or the withholding of tax may be prevented by the provisions in section 3, subsections 5–6 of the Act on the Taxation of Nonresident Taxpayers’ Income if the conditions are met. A foreign fund that does not qualify for tax exemption as per section 20a of the Income Tax Act but is considered to be equivalent to a corporate entity as referred to in section 3, subsection 5 of the Income Tax Act may thus be tax-exempt for dividend income similarly to a Finnish corporate entity pursuant to section 6a of the Act on the Taxation of Business Income (360/1968), provided that the conditions in section 3, subsection 5 of the Act on the Taxation of Nonresident Taxpayers’ Income are satisfied. In such a case, the factors determining whether the dividend income is tax- exempt include whether the corporate entity paying out the dividend is a publicly traded corporation and whether the units or shares in the investment fund receiving the dividend are operating in a regulated market. For more information on tax at source on dividends from non-resident corporate entities, see guidance of the Finnish Tax Administration Payments of dividends, interest and royalties to nonresidents.

A foreign investment fund that fails to qualify for tax exemption as per section 20a of the Income Tax Act but is considered to be equivalent to a corporate entity as referred to in section 3, subsection 5 of the Income Tax Act may also be earning income from real estate or real estate securities as referred to in section 10, subsection 1, section 10 or section 10a of the Income Tax Act, for example. The tax treatment of such income is determined according to the general provisions of the Act on the Taxation of Business Income, taking into account any relevant tax treaty provisions. The income referred to in section 10, subsection 1, section 10 and section 10a of the Income Tax Act is taxed as per the Act on Tax Assessment Procedure (Laki verotusmenettelystä 1558/1995). If tax assessment is carried out as per the Act on Tax Assessment Procedure, the taxpayer must file a tax return in Finland on the basis of which the tax assessment will be carried out. For more information on the tax assessment of income for corporate entities that are non-resident taxpayers in accordance with the Act on Tax Assessment Procedure, see guideline of the Finnish Tax Administration Income taxation of nonresident foreign corporate entities.

If a foreign fund is equated to a partnership in accordance with section 4 of the Income Tax Act, income received by the fund from Finland in accordance with section 10 of the Income Tax Act is taxable income of the fund’s unitholders, who are non-resident taxpayers. The taxation of the unitholders is affected by which domestic operator the shareholder can be equated to or whether the unitholder is a natural person, for example. Income paid to a foreign fund equated to a partnership may be subject to the provisions of a tax treaty between Finland and the country of residence of the partnership or its unitholders, depending on whether the partnership is a separate taxpayer in its country of residence. For more information on the application of a tax treaty to dividend and royalty income, see Payments of dividends, interest and royalties to nonresidents (Section 6.1).

Example 2. A foreign investment fund is constituted in the form of a trust and is an independent legal person. The fund is registered outside the EEA and established pursuant to the UCITS legislation of its country of registration. The fund is closed-ended and has more than 30 unitholders. The fund does not satisfy the open-ended condition in section 20a, subsection 1 of the Income Tax Act and is thus not a tax-exempt investment fund under section 20a of the Income Tax Act. The fund is equated to a limited liability company as referred to in section 3, subsection 5 of the Income Tax Act. The fund is a non-resident taxpayer in terms of dividend income earned from Finland. The tax treatment of the dividend income is determined in accordance with section 3, subsections 5–6 of the Act on the Taxation of Nonresident Taxpayers’ Income. A tax treaty between Finland and the country of residence of the fund may also decrease the amount of tax at source to be deducted.

Example 3. A foreign real estate fund is an alternative investment fund with variable capital constituted in the form of a company and also a legal person. The fund is open-ended and has more than 30 unitholders. The fund is exempt from income tax in its country of residence. The aim of the tax exemption for investment funds and special investment funds in section 20a of the Income Tax Act is to ensure that taxation happens only at the level of the investor. A foreign real estate fund in the form of a company that is exempt from income tax in its country of residence is in an objectively comparable situation to a domestic contractual special investment fund in terms of the aim of tax exemption under section 20a of the Income Tax Act. Hence, due to the effect of the free movement of capital, the fund is tax-exempt if the other conditions in section 20a of the Income Tax Act are met, even if the fund is not contractual.

According to a report submitted by the fund, it is equivalent to a domestic special investment fund within the meaning of section 20a of the Income Tax Act. The investment fund also satisfies the conditions on openness and 30 unitholders in section 20a, subsection 2 of the Income Tax Act. However, during the tax year, the fund has distributed less than three quarters of the realised profit for the financial year to its unitholders. Therefore, for the tax year in question, the real estate fund does not meet the condition for tax exemption regarding the distribution of a real estate fund’s profit for the financial year laid down in section 20a, subsection 4 of the Income Tax Act. The investment fund is thus not tax exempt pursuant to section 20a of the Income Tax Act for the tax year in question. Based on the report provided by the fund, in the tax year in question, it is most closely equated to a limited liability company (osakeyhtiö) under section 3 of the Income Tax Act and is therefore a non-resident taxpayer under section 9, subsection 1 of the Income Tax Act on, for example, real estate income from Finland (rent; section 10, subsection 1 of the Income Tax Act), dividends (section 10, subsection 6 of the Income Tax Act) and direct and indirect alienation of property (section 10, subsection 10 and section 10a of the Income Tax Act). However, the fund may receive dividends from Finland tax-exempt during the tax year if the conditions in section 3, subsection 5 of the Act on the Taxation of Nonresident Taxpayers’ Income are met. A tax treaty between Finland and the country of residence of the real estate fund may also decrease the amount of tax at source to withheld from dividend.

4 Deviation to the condition on the number of unitholders

The number of unitholders in an investment fund or special investment fund may be fewer than 30, which is given as the minimum for qualifying for tax exemption in section 20a, subsections 1–2 of the Income Tax Act, when the fund is newly established or at other times on a temporary basis. Deviations to the conditions on the number of unitholders have been enacted to address such situations (section 20a, subsection 6 of the Income Tax Act). Under this provision, tax exemption as provided for in section 20a, subsections 1–2 of the Income Tax Act shall also apply to:

- a newly established investment fund or special investment fund where the requirement of 30 or more unitholders has not yet been satisfied during the first year of operation and which was not created through a merger or demerger;

- an investment fund or special investment fund where the number of unitholders has temporarily fallen below 30, provided that the fund management company has undertaken the measures referred to in Chapter 19, section 7 of the Act on Common Funds to rectify the situation or the fund is dissolved.

These deviations only apply to the condition on a minimum number of unitholders. In other words, an investment fund or special investment fund that has fewer than 30 unitholders when newly established or on a temporary basis must satisfy all the other conditions in section 20a, subsections 1–2 of the Income Tax Act to quality for tax exemption.

The first paragraph, concerning newly established investment funds and special investment funds, only applies in cases where the fund genuinely is a newly established fund and not a fund created through a merger or demerger. The deviation only applies to the first year of operation of the fund.

The second paragraph applies to a situation where the number of unitholders in an investment fund or special investment fund has temporarily fallen below 30. The provision refers to Chapter 19, section 7 of the Act on Common Funds, which also applies to special investment funds pursuant to the reference provision in Chapter 16a, section 1 of the AIFM Act. In accordance with Chapter 19, section 7 of the Act on Common Funds, a fund shall have 90 days in which to rectify the situation if the number of unitholders falls below 30. In accordance with Chapter 10, section 6, subsection 2 of the Act on Common Funds, this period shall be calculated from the time when the minimum condition ceased to be satisfied.

If the fund is able to rectify the situation within the prescribed time, the fund shall be considered to have satisfied the condition on the minimum number of unitholders also during the period when there were actually fewer than 30 unitholders. However, if the fund fails to rectify the situation within the prescribed time, the Act on Common Funds prescribes that action shall be taken to merge or dissolve the fund. In such a situation, the fund shall be considered to satisfy the condition on the minimum number of unitholders up until the time of its merger if the merger leads to a situation where the combined number of unitholders in the receiving and merging funds is 30 or more. If the fund is dissolved in such a situation, the fund shall be considered to satisfy the condition on the minimum number of unitholders up until the time of its dissolution.

The same principles also apply to a foreign investment fund if the fund management company has taken measures equivalent to those referred to in Chapter 19, section 7 of the Act on Common Funds when the number of unitholders fell below 30.

5 Sub-fund structures

A sub-fund is a subdivision of an investment fund whose investments may differ from those of other sub-funds in the same investment fund and from the general investment policy of the investment fund, as described in the rules of the investment fund. A structure known as an ‘umbrella fund’, where an investment fund consists of dozens or even hundreds of sub-funds, is permissible in several EU Member States within either an investment company with variable capital or a contractual investment fund. Umbrella funds of the unit trust form can be established in the USA, for instance. In an umbrella fund, an investor subscribes directly to units in the sub-fund(s) of their choice, and in many cases to a specific series of units within a sub-fund.

The taxation of sub-fund structures is provided for in section 20a, subsection 7 of the Income Tax Act, which applies to both domestic and foreign investment and special investment funds. In accordance with this provision, sub-funds are subject to the provisions on investment funds and special investment funds in section 20a, subsections 1–6 of the Income Tax Act. Therefore, all of the above in this guidance concerning investment funds and special investment funds also applies to sub-funds. To be tax-exempt, each sub-fund must separately satisfy the conditions for tax exemption in section 20a of the Income Tax Act.

The structure formed by the principal umbrella fund and its sub-funds shall, by default, be considered a single legal entity. This means that by default, the legal form of the principal fund determines the legal form of its sub-funds. For example, a sub-fund of a principal fund constituted in the form of a company is also considered to be constituted in the form of a company.

6 Foreign funds’ obligation to file tax returns, obligation to provide information and documentation

6.1 Obligation to file tax returns

A foreign investment or special investment fund exempt from tax under section 20a of the Income Tax Act is not required to file a tax return on the income received from Finland that is will be carried in accordance with the Act on Tax Assessment Procedure. However, if the foreign fund is not tax-exempt under section 20a of the Income Tax Act, it must file a tax return on the basis of which the tax assessment will be performed. For example, income from real estate or real estate securities (section 10, subsection 1, section 10 and section 10a of the Income Tax Act) is taxed in accordance with the Act on Tax Assessment Procedure on the basis of the tax return.

If the fund receives dividend income which is taxable under the Act on the Taxation of Nonresident Taxpayers’ Income, the fund is not required to file a tax return, but the fund is nevertheless required to provide evidence by virtue of section 3, subsection 10 of the Taxation of Non-Resident Taxpayers’ Income on it satisfying the conditions for tax exemption under section 20a of the Income Tax Act, even if it is tax-exempt under section 20a of the Income Tax Act.

6.2 Obligation to provide information under section 3, subsection 10 of the Act on the Taxation of Nonresident Taxpayers’ Income

Section 3, subsection 10 of the Act on the Taxation of Nonresident Taxpayers’ Income includes a provision on the obligation of the taxpayer to provide information. Under this provision, tax at source shall not be levied on dividends paid to a foreign contractual investment fund that is equivalent to a Finnish investment fund or special investment fund and qualifies for tax exemption under section 20a of the Income Tax Act. Under this provision, the exemption from income tax on dividends earned is contingent on the dividend recipient submitting information to the Finnish Tax Administration explaining how the conditions for tax exemption are satisfied. The burden of proof thus rests with the taxpayer. The obligation to provide information applies to applications for tax at source refunds and tax-at-source cards.

The information may be provided in Finnish, Swedish or English. In addition to the above, funds must comply with other obligations to provide information regarding applications for tax at source refunds or tax-at-source cards. The other information and appendices required are described in more detail in the instructions for completing the application forms.

A taxpayer may also satisfy the obligation to provide information pursuant to section 3, subsection 10 of the Act on the Taxation of Nonresident Taxpayers’ Income by means of a preliminary ruling issued by the Finnish Tax Administration pursuant to section 85 of the Act on Tax Assessment Procedure or section 12a of the Act on the Taxation of Nonresident Taxpayers’ Income.

Forms related to this guideline

- Application for Refund of Finnish Withholding Tax - Foreign Corporations and Organisations (6163e, 6167e and 6165e)

- Foreign corporation’s tax-at-source card application for dividend, interest and royalty income (6211e)

- Cover page for advance ruling, special permit or guidance application (7300e, 7301e)

6.3 What the obligation to provide information means

Section 3, subsection 10 of the Act on the Taxation of Nonresident Taxpayers’ Income provides for the taxpayer’s obligation to provide information, meaning that the taxpayer must submit a report on the legal and operational characteristics of a fund that are relevant for qualifying for tax exemption under section 20a of the Income Tax Act. The actual content of the obligation to provide information is determined according to the conditions laid down in section 20a, subsections 1–7 of the Income Tax Act. The conditions in these subsections are minimum requirements; the Finnish Tax Administration may request further clarification for the purpose of resolving the matter. In addition to information according to the conditions in the aforementioned provisions, an investment fund, special investment fund and each of their sub-funds must submit to the Finnish Tax Administration financial statements for the tax year in which dividends or other income from Finland was received, or the financial statements for the year before that if the financial statements for the tax year in question are not yet complete. If the fund does not have financial statements for the tax year concerned, the fund must nevertheless be able to reliably verify any and all information that is relevant for resolving the matter.

A foreign investment fund must demonstrate that it qualifies for tax exemption as per section 20a, subsection 1 of the Income Tax Act by submitting to the Finnish Tax Administration the following information:

- the legal form of the fund, including a description of the national legislation pertaining to investment funds in the country of registration of the fund, its instrument of incorporation and a description of the relationship between the fund management company and the unitholders; and

- the open-ended nature of the fund and its number of unitholders, including the rules of the fund and a fund prospectus concerning the year in which the dividends were paid or the year before that.

A foreign special investment fund must demonstrate that it qualifies for tax exemption as per section 20a, subsections 2–3 of the Income Tax Act by submitting to the Finnish Tax Administration the following information:

- the legal form of the fund, including a description of the national legislation pertaining to special investment funds in the country of registration of the fund, its instrument of incorporation and a description of the relationship between the fund management company and the unitholders;

- the open-ended nature of the fund and its number of unitholders, including the rules of the fund and a fund prospectus concerning the year in which the dividends were paid or the year before that; and

- in cases where subsections 3 and 4 apply, annual profit distribution for the financial year, minimum capital and whether the unitholders are professional investors, including the rules of the fund and a fund prospectus, and annual financial statements from the tax year in question and/or the previous tax year.

In order to obtain tax exemption, a non-resident investment fund constituted in the form of a company or a trust must demonstrate to the Finnish Tax Administration that it is in an objectively comparable situation to a resident investment fund or special investment fund constituted in accordance with contract law and that it meets the other conditions for tax exemption under section 20a of the Income Tax Act. For more information on the equivalence of situations, see Section 3.2.

A foreign special investment fund must demonstrate that it satisfies the annual profit distribution condition in section 20a, subsection 3, paragraph 1 (and, in the case of real estate funds, section 20a, subsection 4) of the Income Tax Act by submitting to the Finnish Tax Administration information on:

- profit distribution by financial year, including the rules of the fund and a fund prospectus, and annual financial statements from the tax year in question and/or the previous tax year, showing actual profit distribution by financial year; and