If you are an operator of trade or business (T:mi), an agricultural/forestry operator, select Manage your tax matters in MyTax. When you start with Manage your tax matters, you can access all your tax affairs. Read more: New in MyTax

Undeclared work in Finland may equal €1.4 billion per year

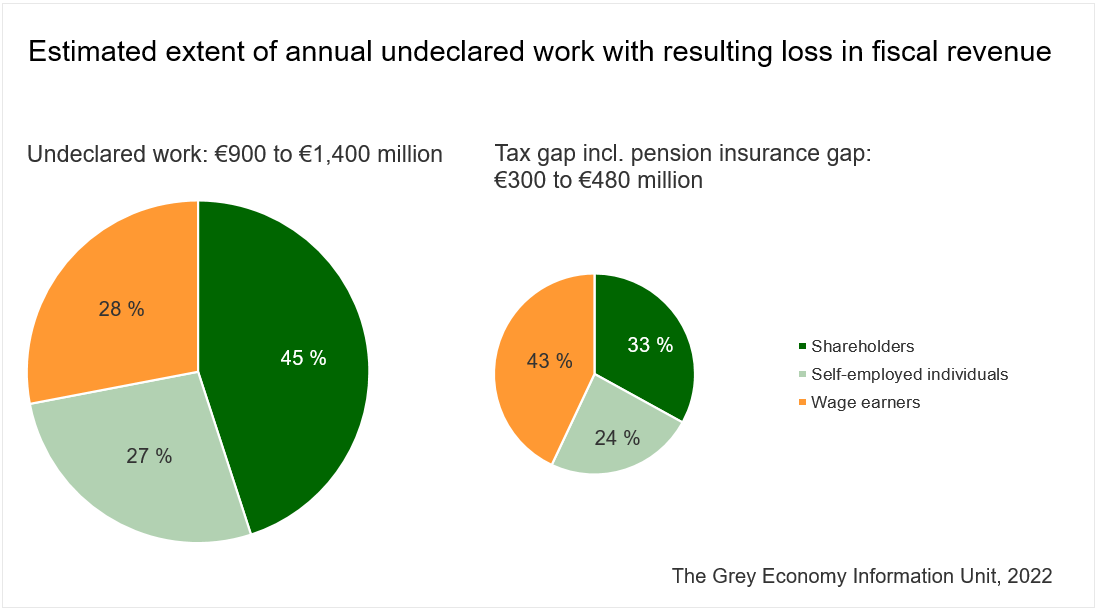

Tax Administration Bulletin, 11/22/2022Latest reports make the conclusion that an important tax gap is formed every year due to illegal, undeclared work. The gap’s size ranges from 300 to 480 million euros, representing tax and social-insurance revenues that the State of Finland does not receive. The results of the reports make it evident that Finland’s existing strategy for combating the shadow economy and the related action plan governing the cooperation between public authorities must be maintained. Undeclared work and the losses in fiscal revenue resulting from it were examined for the first time in Finland.

The total magnitude of illegal undeclared work in Finland is at least 900 million, but may reach as high as 1.4 billion euros every year. These are some of the conclusions in the reports conducted by the Grey Economy Information Unit.

“Undeclared work brings about great losses, both in the form of a fiscal tax gap and in the form of social insurance contributions that cannot be received. However, if the problem is examined at an international level, Finland is doing rather well. But undeclared work is a significant issue also in our country, and we need to keep combating it. I am very pleased with having more precise information available to us, so the authorities will be able to step up the enforcement work in the right areas”, says Janne Marttinen, Director of the Grey Economy Information Unit.

The reports contain estimates of undeclared work within the statistics concerning wage earners, small businesses and the self-employed. Of the total extent of undeclared work, the self-employed seem to be responsible for almost three quarters. The remaining one quarter is related to wage earners.

Previously, undeclared work was studied almost entirely based on various interviews or surveys. This time, the Grey Economy Information Unit of the Tax Administration made use of tax-assessment data, tax audit reports and other materials, and additionally, national statistics from Statistics Finland. In other words, the research method was a combination of several different approaches.

Undeclared work is a problem of low-income sectors that require lots of labour

Business enterprises pay out illegal, undeclared wages amounting to an estimated total from €240 million to €400 million a year. Work and wages not being reported to public authorities causes annual losses ranging from €130 million to €210 million to the State of Finland. This loss is partially a tax gap, partially a gap consisting of lost social insurance contributions.

Out of all wage payments by business enterprises to employees, less than one percent falls into the category of illegal, undeclared wages.

Typically, a workplace that pays undeclared wages to workers is an enterprise in the construction sector, in the restaurant sector or the transport services sector, or it may be a warehousing company or a retail trader.

These sectors of business activity require a large amount of labour to produce their goods or services; the level of pay is relatively low, and payments made in cash are usual practice.

“The Tax Administration monitors labour-intensive sectors such as construction on an ongoing basis. We have recently had an enforcement campaign with the taxi service sector. Our next campaign will concern restaurants. However, the tax control that we exercise can detect cases of non-compliance in almost any sector of business”, says Tarja Valsi, Deputy Director at the Tax Administration’s unit in charge of combating the shadow economy.

Undeclared business income means a tax gap of several hundred million euros

One of the conclusions of the recent reports was that shareholders of limited-liability companies pay themselves some 430 to 590 million euros illegally every year. From this follows an annual tax gap of some 110 to 150 million euros.

About 10 percent of the amounts that the shareholders receive represents various forms of undeclared, illegal work.

Undeclared payments to shareholders tend to occur in the sectors where it is common that also the workers are paid undeclared wages.

“If a company pays undeclared wages to its workers, it is likely that the company has a shareholder who receives some undeclared money, too” notes Janne Marttinen.

Because self-employed operators of a trade or business do not pay wages to themselves, undeclared work among them typically takes the form of submitting an income tax return where taxable profits are too low.

According to the report, illegal or undeclared work among the self-employed reaches 220 or even 400 million euros a year – meaning a roughly estimated tax gap of €70 million to €120 million. The estimate points to a 10-percent share of the true economic result of self-employed businesses being hidden under the veil of undeclared work.

Strategy and action plan for combating the shadow economy must continue

Finland has established an efficient network of cooperation across administrative sectors that exercises control over undeclared work and the shadow economy. From 1996, there has been a national strategy combined with an appropriate action plan, aimed for enhancing and steering the cooperation.

“Based on the recently released reports, it is evident that Finland must continue to pursue the ongoing long-term control activity. It is necessary for our country to maintain a similar strategy and action plan going forward. This ensures that we will be able to work together, focusing our joint efforts across administrative sectors, to combat undeclared work and other non-compliance,” says Tarja Valsi.

Further information on this subject:

A deficit of hundreds of millions in state funds from undeclared work