If you are an operator of trade or business (T:mi), an agricultural/forestry operator, select Manage your tax matters in MyTax. When you start with Manage your tax matters, you can access all your tax affairs. Read more: New in MyTax

VAT refund application, bilateral Defence Cooperation Agreement (DCA) (Form 6169e, instructions for filling out the form)

You can use this form to request a VAT refund from Finland if you are entitled to receive a refund under the bilateral Defence Cooperation Agreement (DCA). Fill in the form in Finnish, Swedish or English. You can either type or write by hand, but make sure the text is easy to read.

Fill in all the fields in the application. If you submit the application yourself instead of using a representative, you do not need to fill in the information on your representative.

You can download the form on our Forms page. After completing the application form, please send it by post to the address stated on it.

Detailed instructions

Applicant

Enter the applicant’s official name (organisations) or the applicant’s family name and their first and middle names (individuals) in the appropriate fields. Also enter the applicant’s ID code. Select the ID type by ticking one of the options given. Enter the ID code in the Applicant’s ID code field at the top of each page of the application.

If the applicant is an individual, they should primarily enter their Finnish personal identity code if they have one. If the applicant does not have a Finnish personal identity code, they should enter their ID code or tax identification number (TIN) in their home country. Other applicants (organisations) should primarily enter their VAT number or tax registration number, such as trade register number. The ID code must be the same as in the certification attached to the application to prove the applicant’s right to apply for a refund.

Further, individuals must always enter their date of birth and citizenship. Other applicants must enter their home country. Also submit the applicant’s contact information, such as address, postal code, post office, country, email address and phone number.

Fill in all the address and contact information fields carefully to make sure any decisions and information requests sent by post arrive at the right address. In some situations, we may also contact the applicant by phone or email about the application.

Always attach an appropriate certification to prove that the applicant is entitled to a refund based on the DCA, the applicant’s position and the purpose of use of the goods or services.

Representative

Fill in this section only if you act as the applicant’s representative.

In addition to your official name and contact information, submit the VAT number, tax registration number or other ID code issued by a registration authority of your home country. If you do not have a VAT number or tax registration number, for example because of the practices of your home country’s authorities, enter the trade register number.

Select the ID type by ticking one of the options given.

Fill in all the address and contact information fields carefully to make sure any decisions and information requests sent by post arrive at the right address. In some situations, we may contact the representative by phone or email about the application.

Attach the authorisation you have received from the applicant and tick the box indicating that a letter of authorisation is attached.

Application period

The period for which you apply for a refund must be a quarter year, i.e. three consecutive full months. The months must be within the same calendar year.

The application period must always consist of full calendar months. Enter the period in the format ddmmyyyy–ddmmyyyy, for example 01012025–31032025.

Applicant’s ID code

Fill in the applicant’s ID code (e.g. personal identity code or VAT number) that you gave on the first page in the Applicant’s ID code field at the top of each page of the application.

Payment information for refunding

The VAT refund is paid to the bank account specified in the application. Enter here the bank account to which the applicant wants the refund to be paid.

In the case of payments made within the Single European Payment Area (SEPA), fill in the account holder’s name, the bank account number in IBAN format and the bank’s BIC code. Note that the country code for the IBAN bank account number and for the BIC code must be the same. For example, if the IBAN begins with the country code FI, the country code used in the BIC must also be FI.

In payments made outside the SEPA zone, enter a country-specific clearing code and the name and address of the receiving bank, as well as the account holder and the bank account number. Also enter the bank account currency.

Enter the name of the account holder if it is different from that of the refund recipient.

Please note that the bank may collect a fee for the tax refund according to their price list if the bank account is outside the EU.

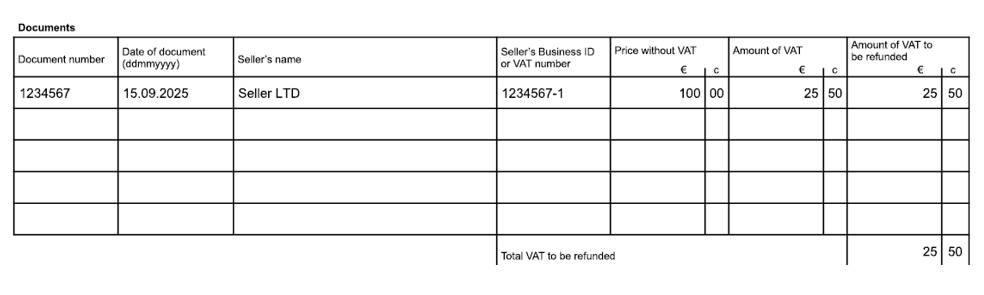

Documents

Make a specification table of the invoices and receipts for which you are requesting a VAT refund. If one page (page 3 of the application) is not enough for all the receipts, you can add more pages to the specification. Remember to fill in the applicant’s ID code (e.g. personal identity code or VAT number) that you gave on the first page in the Applicant’s ID code field at the top of each page.

Use only the original form and its specification page. Excel worksheets, for example, are not accepted. Do not modify the form.

How to fill in the specification:

Document number

Enter the number indicated on the invoice or receipt.

Date of document

Enter the date of the invoice or receipt in the format ddmmyyyy, for example 15082025.

Seller’s name

Enter the official name of the seller as indicated on the invoice or other document.

Seller’s ID code

Enter the ID code of the seller as indicated on the invoice or other document. The code is usually an FI-prefixed VAT number.

Price without VAT

Enter the purchase price without VAT.

Amount of VAT

Enter the amount of VAT indicated on the invoice or document.

Amount of VAT to be refunded

Enter the amount of VAT included in the invoice and requested to be refunded.

Total VAT to be refunded

Calculate the total amount of VAT that you request to be refunded and enter it here. If you need more than one page for the specification, enter the total amount on the last page.

A precondition for refunding is that the total purchase price for the goods or services (incl. VAT) is at least €170 or the amount stated in the DCA.

Date and signature of the applicant or authorised representative

The application can be signed only by a person who is entitled or authorised to represent the applicant.

Sending the application

The application must be submitted within one year of the invoice payment date. The return address is marked on the first page of the form.

Additional information

Read more about the preconditions for VAT refunds: Tax exemptions based on the DCA – instructions for U.S. forces and U.S. contractors.

You can also contact us about VAT by calling our general service number for businesses, 029 497 051. Alternatively, you can contact us by email if needed: vatrefunds@vero.fi.