Information on the Incomes Register

The Incomes Register is an electronic database, in which data about paid wages, pensions and benefits is reported.

In 2025, a total of 56.6 million earnings payment reports, 2.2 million employer’s separate reports and 58.4 million benefits payment reports were submitted to the Incomes Register.

Earnings payment data was reported by 270,000 payers. Benefits were reported by nearly 700 payers. By the end of year, the Incomes Register contained earnings payment data regarding of 3.1 million individuals and benefits payment data regarding of 3.5 million individuals.

At present some 370 organisations utilise the Incomes Register in their decision-making. In 2025, income data was distributed about 1.7 billion times to data users with data access rights.

Earnings payment data is available in the Incomes Register from 2019, and pensions and benefits payment data from 2021.

The Incomes Register in a nutshell

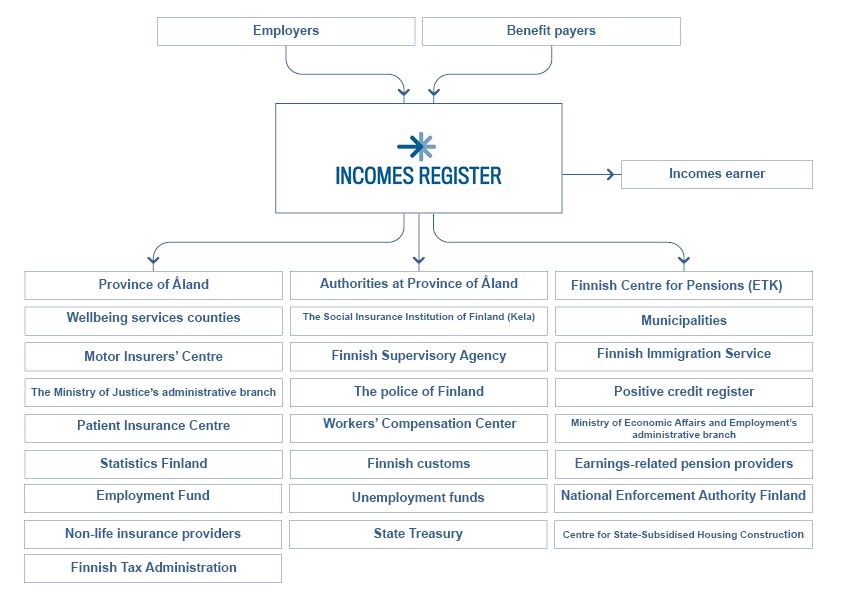

Income payers, such as employers and benefit payers, report data to the Incomes Register in real time, separately for each individual and payment transaction. As a private individual, you can use the e-service to view your own data or data which you have been authorised to access.

Data is reported to the Incomes Register in electronic format. It may be transferred directly from payment systems through an interface or it may be reported in the e-service. Paper forms can only be used for specific reasons for reporting earnings payment data. Data about pensions and benefits cannot be reported at all using paper forms.

The Incomes Register’s data can only be used by those authorities and other parties who have the statutory right to do so. Reporting and using the data is free of charge. Reporting and using the data is regulated by the act on the incomes information system (available in Finnish and Swedish, link to Finnish: Laki tulotietojärjestelmästä 53/2018).

The Incomes Register’s administrator and responsible authority is the Finnish Tax Administration's Incomes Register Unit. The Incomes Register Unit is also responsible for the Positive credit register.

In addition to earnings payment data, data concerning employees’ employment relationships and absences is reported to the Incomes Register. Furthermore, data about tax-exempt pensions and other benefits that the Social Insurance Institution Finland (Kela) needs in the processing of basic social assistance is reported to the Incomes Register.

No sensitive data is reported, such as data about social assistance paid. In addition, the obligation to report information does not include for example the majority of capital income, travel and accommodation compensation paid based on receipts, and a self-employed person’s income from work if the self-employed person is insured in accordance with the self-employed persons’ pensions act or the farmers’ pensions act.

Centralised real-time income data registers similar to the Finnish Incomes Register are also used in other countries, while the Finnish Incomes Register is unique in terms of its scope and real time data. The authorities and other parties entitled to use the register can use the data saved in the Incomes Register simultaneously, without income earners or employers needing to report it separately to each party.

The Incomes Register simplifies and clarifies payers’ obligations

Employers or other payers only report data about paid wages, pensions and benefits once to the Incomes Register. After this, it is available to the authorities and other data users in real time. When a payer reports data comprehensively at once, no separate attachments need to be provided when applying for a benefit, for example.

Reporting can be automated in full. In this case, an electronic connection, or an interface, has been built between the payment system and the Incomes Register, through which data about paid wages, pensions and benefits is transferred to the Incomes Register. As a result, reporting does not require any separate time or effort.

Data reported to the Incomes Register is used in real time for taxation, granting f benefits and pensions, processing insurance indemnities, labour protection, statistics, and the determination of various customer payments.

Because the Incomes Register’s data is available to different authorities in real time immediately after reports have been submitted, employers, income earners and data users benefit from accurately reported data.

Employer and benefit payers must correct any errors in the data they have reported immediately after becoming aware of the error. Payers are responsible for data submitted to the Incomes Register and for correcting it. The Incomes Register Unit staff or income earners cannot correct data in the Incomes Register.

Incomes Register for companies and organisations

Earnings, pensions and benefits payment data easily available to income earners

Private individuals can use the e-service to view their own income data or data which they have been authorised to access. Income earners have a real-time overview of their earnings, pensions and benefits payment data in the register.

Furthermore, income earners can check in the Incomes Register whether the payer of wages or benefits has fulfilled their obligation to report information. If the data is incorrect, ask the payer to correct the data reported to the Incomes Register. The Incomes Register authority or income earners cannot correct data in the Incomes Register.

The authorities and other data users search for income data directly in the Incomes Register. Users have access to data following the schedule and extent according to which they need the data. This makes things easier for private individuals, as their income data is up to date in the Incomes Register, and they do not need to report the data to the authorities when applying for a tax card or as an attachment to another application, for example.

Incomes Register for private individuals

The Incomes Register automates the use of data in society

The Incomes Register is an up-to-date database containing earnings data. The authorities and other data users are only able to access the data to which they are entitled and which they need in their activities. The Incomes Register also enables real-time monitoring and simplifies correspondence with other data users.

One goal of the Incomes Register is to support the fight against the grey economy. Each data user monitors data obtained from the Incomes Register from their respective sector’s perspective. Any defects in reporting can be identified fairly quickly after payments. Moreover, data can no longer be only reported to specific authorities, since the data on each report is accessible to all users who are entitled to access the data.

See also: