Taxation

Key figures in the prevention and investigation of tax fraud 2024

Source: Finnish Tax Administration

The Tax Administration is combating the shadow economy and other forms of economic crime using various tools ranging from the registration of persons and companies to report monitoring and from control visits to tax audits. The key is to put an end to fraudulent activities effectively and as early as possible. As a rule, targets for the shadow economy include any cases that concern an object of tax control under consideration for police reporting. The Tax Administration has staff specialised in processing more serious shadow economy phenomena and cases.

Various kinds of cooperation between authorities constitute an essential part of the prevention efforts. The cooperation aims to ensure a comprehensive approach to combating, identifying and preventing different types of economic crime. As a rule, a tax audit is performed on operators involving a significant tax risk. While there is a clear need for real-time audits, which involve carrying out a tax audit simultaneously with a pre-trial investigation, their number has been declining for years due to a backlog in economic crime investigations by the Police. The Tax Administration also participates in supervision involving multiple authorities targeting various business sectors, in which the activities of companies in a certain sector are examined more extensively. Producing information to competent public authorities in the enforcement of sanctions has also been an important task in 2024. In addition, the Tax Administration carries out extensive preventive work with different stakeholders.

The exchange of information affecting taxation between the tax authorities of different countries and international cooperation plays an important role in the Finnish Tax Administration’s work to combat the shadow economy and economic crimes. The Tax Administration’s work in combating the shadow economy plays an active role in international anti-fraud forums.

Dishonesty occurs throughout business life

Tax control activities reveal shadow economy activities across business life. In labour-intensive industries, the shadow economy has changed its shape as a result of the introduction of invoicing services and light entrepreneurship. In quantitative terms, there is an emphasis on the consumer service sector, including restaurants, taxis and the beauty industry. Phenomena of the shadow economy are most commonly found in car sales and electronic trade, and other cross-border business. Identity fraud, exploitation of companies for criminal activities, foreign money transfers, virtual banks and various payment platforms are also keeping the Tax Administration busy in its efforts to combat the shadow economy.

Turnover of audited grey economy businesses

More than €10 million 2,6 %€2–10 million 7,2 %

Less than €2 million 50 %

Not known 40 %

The Finnish Tax Administration does not have information on the turnover of all grey economy actors, including foreign companies and companies that have been reported dormant or dissolved. This category also includes natural persons.

Control results in 2024

The results of the shadow economy audits have been increasing in euro terms, and the number of audits has remained at the same level as in the previous year. Tax fraud has become increasingly international and more complicated to investigate, the operations of companies have changed with the introduction of new forms of work, and smaller companies are increasingly exploited in shadow economy activities. The use of companies and identities as instruments of crime has increased. The Tax Administration is constantly developing other faster control methods alongside audits. Of the cases audited by the procedure area specialised in combating the shadow economy, 88% led to the imposition of taxes and around 80% to criminal reporting consideration to the police.

The Tax Administration’s bankruptcy petitions in 2024

In 2024, the Finnish Tax Administration filed a total of 1,506 bankruptcy petitions, the amount is approximately 10% more than in the previous year. The Tax Administration accounted for 43% of all petitions in 2024. The total number of bankruptcy petitions is based on data from Statistics Finland (Chart 1).

Criminal matters

The Finnish Tax Administration filed 878 reports of an offence in 2024. In addition, there were 271 other criminal matters in which the Tax Administration was a party but the pre-trial investigation was based on a report by another party.

A criminal case may contain several criminal offences, which is why the number of criminal offences is higher than the number of criminal cases. For example, an accounting offence is commonly associated with tax fraud. The focus of criminal cases involving the Tax Administration is on aggravated tax frauds (Chart 2a).

Judgment according to court

The number stands for criminal matters involving the Finnish Tax Administration in which a judgment was rendered in 2024. It is not the same as the total number of judgments rendered, as more than one criminal matter may be considered under each criminal proceeding and sentencing phase (Chart 2b).

Tax debts

The statistics show all tax debts, regardless of whether they are accumulated in the shadow economy or by other taxable entities. The challenging economic situation is reflected in the amount of total tax debt. In the first months of 2025, the amount of total tax debt has been some EUR 200 million larger than one year before. From the main categories of tax debt, the most debt is seen in value added tax and income tax of individuals, which also includes amounts withheld by employers that have been not been filed and paid.

In Figure 1 (tax debt by main category), the amount of tax debt on 1 March 2025 is presented in main categories following the largest tax types. Figure 2 shows the breakdown of tax debt under the main categories in more detail, e.g. the division of excise duty debt between different types of excise duties. Figure 3 presents the total amount of tax debt on the review date of 1 March 2025. The figures can be filtered by tax year to identify the amount of unpaid taxes for each tax year.

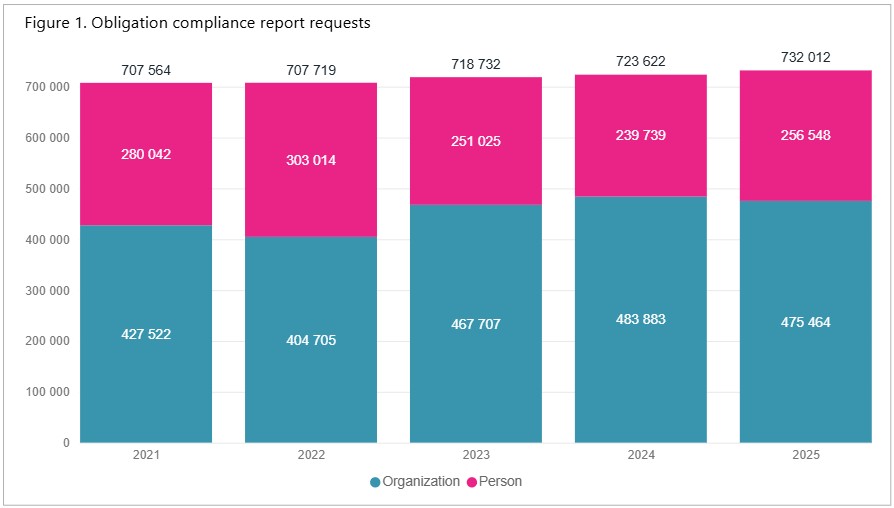

The Compliance Report supports decision-making

The information exchange between the authorities is at the core of the fight against the grey economy. It is difficult to make the right decisions without sufficient information on the financial standing of a subject or an applicant. The Compliance Report is an updated summary of the essential records held by the authorities. The Compliance Reports are issued by the Grey Economy Information Unit. The reports help authorities target and execute their control measures. The exchange of information between the authorities must always be based on the law.

The information on the Compliance Report is illustrative of the level of compliance of an organisation or a person with statutory obligations. The report includes information on activities, financial standing and compliance with obligations related to taxes, statutory pension, accident insurance and unemployment insurance contributions and fees levied by Customs.

The information on the Compliance Report is mostly based on information submitted by the subjects themselves. The report includes payroll information obtained from the Tax Administration, pension contribution information obtained from the Finnish Centre for Pensions and Customs information. The report also includes a possible extract from the enforcement register and information on bankruptcy and restructuring proceedings. The reports can be requested and received through an automated interface.

Act on Grey Economy Information Unit [.fi]› (in Finnish)