Products, services and equal competition

Finnish Food Authority | Alcohol administration | Finnish Patent and Registration Office | Centre for Economic Development, Transport and the Environment

Food business operators under target-specific control

Source: Finnish Food Authority

Every grocery store, restaurant, café and establishment that produces foods (food business operator) is a separate target of food control. If a food business operator engages in more than one food business activity, it is registered in the category of its principal activity. The category of “food service” includes cafés, restaurants and mass caterers. Figure 1 presents the number of sectors included in the scope of food control.

Food control is risk-based and planned

Risk-based food control means that high-risk food business operators are subject to greater control than low-risk operators. For instance, a food establishment that produces meat products is classified as a higher-risk food control target than, say, a kiosk that sells packaged foodstuffs. In food control, the control targets are categorised into various risk categories, and the control frequency of each group is determined on the basis of the risk categorisation. For this reason, some control targets are inspected several times a year, whereas other control targets may go several years between inspections.

A total of 38 per cent of all objects of control were inspected last year. Figure 2 shows the percentage of inspected objects of control by sector: Approximately 80% of objects of control involving a high risk for food safety have been inspected, while in primary production, only 3% of objects of control have been subjected to a food control inspection.

Results of food control are easily available online and by the doors of food business operators

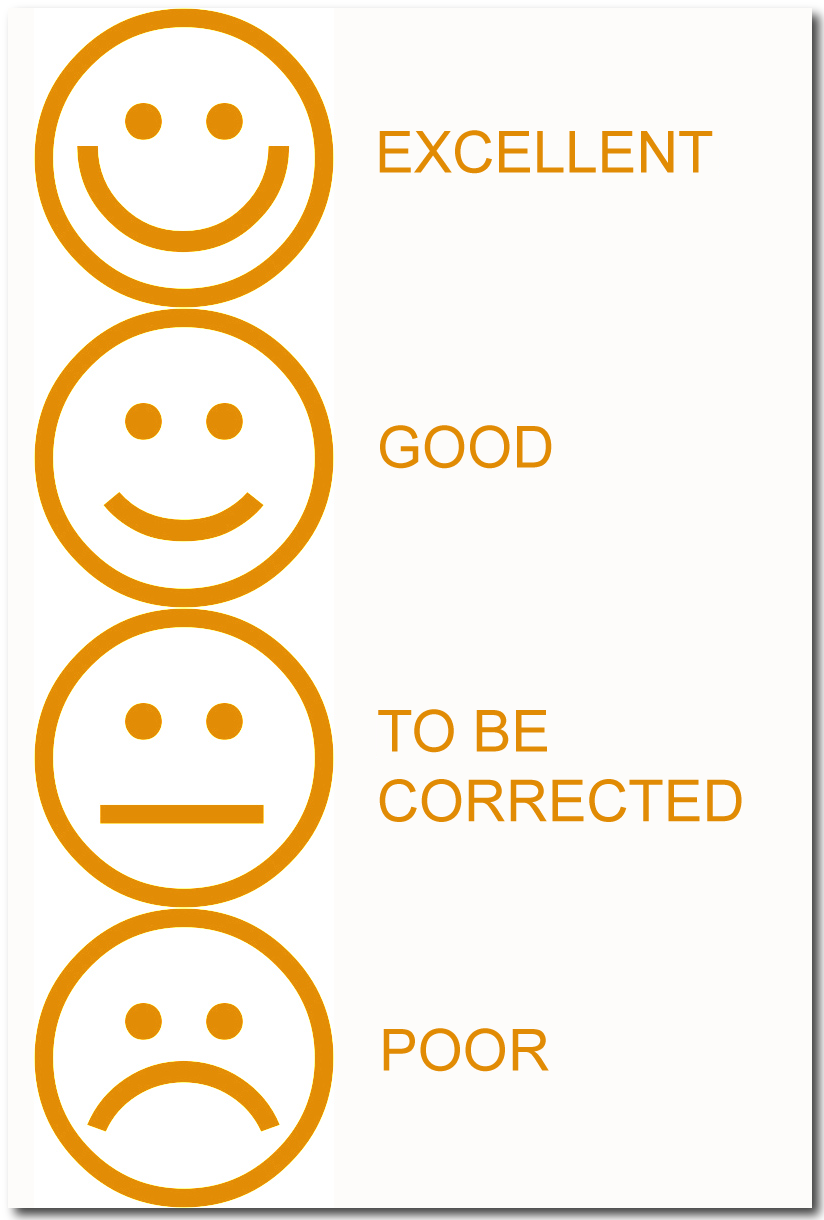

Food control is carried out systematically across the country under the OIVA (Finnish Smiley) system. The food control authority inspects selected aspects of the control target during each inspection. The results are published as an OIVA report. There are four possible results: excellent, good, to be corrected and poor.

OIVA scale. Picture: oivahymy.fi/en [.fi]›

The results of OIVA inspections are published at the entrances of inspected food business operators and on their websites. The OIVA results of food business operators can also be found at oivahymy.fi/en [.fi]›.

Results of OIVA inspections based on a scale from A to D

Figure 4 presents a breakdown of the OIVA grades of grocery stores and service locations, as well as the total grades of all inspected food business operators. So far, annual differences between the grades of different operator groups have been minor. More than 82% of the objects of control received the grade excellent or good last year, while fewer than 18% of objects received the grade to be corrected or poor.

If a food business operator receives the grade to be corrected or poor, the authority will often issue an order or use another administrative coercive measure to ensure that the non-compliance is corrected. All companies receiving the grade to be corrected or poor will be subject to a follow-up inspection.

Administrative coercive measures are taken to address activities that do not comply with the law

Food control authorities are obligated to ensure that any situation that does not comply with the law is rectified. The Food Act lays down administrative coercive measures that are to be employed when necessary. Last year, 234 decisions on administrative coercive measures were made (figure 5). The use of administrative coercive measures in food control increased significantly compared to the previous year. The most commonly employed administrative coercive measure is an order.

Reliability and compliance with obligations of food business operators

A business operating in the food industry must comply with food legislation to ensure that the safety of consumers is not compromised and that consumers are not misled. The reliability of financial activities is also assessed by monitoring the payment of taxes and other statutory fees, for example.

Issues with meeting statutory obligations may reflect a shadow economy risk, and operators who fail to comply with their statutory obligations may also fail to comply with the requirements laid down to ensure food safety.

By combining the data from a compliance report with the data from an OIVA (Finnish Smiley) assessment, the reliability of an operator can be assessed from both an economic and a food safety perspective, thus achieving a comprehensive idea of the company’s operations. These insights can be used to target control measures, and they are also helpful when investigating suspected offences in the food supply chain.

Suspected offences and requests for investigation regarding business operations related to the food supply chain

The compilation of suspected offences in the entire food supply chain and requests for investigation to the criminal investigation authorities started in 2021. In addition to food business operators, the food supply chain includes animal and plant production farms and feed, fertiliser, seed and by-product industry operators, among others.

A single recorded suspected offence or request for investigation may involve suspected offences from several legislative sectors and also several different offences. The most common offences in the case of the food supply chain are health offence, marketing offence, registration offence, animal welfare offence and aggravated animal welfare offence, causing a risk of spreading an animal disease, degradation of the environment, fraud and aggravated fraud, as well as forgery and aggravated forgery. Figure 6 shows the number of suspected criminal offences and the number of submitted requests for investigation brought to the attention of the Finnish Food Authority.

Last year, the most typical suspected offences involved a series of suspected offences related to animal production in primary production and cases where it was suspected that food had been produced outside the scope of food control under inappropriate conditions. There was also an increase in suspected offences concerning professional food sales on social media platforms. The food items sold were in many ways non-compliant with the valid regulations and their origin or country of origin could often not be traced.

The authorities involved in the supervision of the food chain continue to regularly receive information about operators engaged in business activities outside the scope of supervision. Such operators are making unlawful financial gains, both through the avoidance of food control fees and the possibility of engaging in activities regardless of the legal requirements set for the food chain.

You can use the Oivahymy website at www.oivahymy.fi [.fi]› to check whether or not food business operators are covered by food control.

The food control statistics should be examined by comparing them with the observations and statistics of other authorities presented in this snapshot. This makes it possible to find common features or even mechanisms of action between different phenomena or within a single phenomenon.

Alcohol administration is combatting the shadow economy

Source: The Finnish Supervisory Agency, Alcohol administration

Until the end of 2025, alcohol administration referred to the overall system of licensing administration, supervision and steering comprising the National Supervisory Authority for Welfare and Health (Valvira) and the Regional State Administrative Agencies (AVI), which acted as the alcohol authorities. The Regional State Administrative Agencies supervised the serving and retail sales of alcoholic beverages in their areas. Valvira attended to nationwide supervision and the provision of guidance for the Regional State Administrative Agencies on supervising the serving and retail sales of alcohol. In the beginning of 2026, the newly launched Finnish Supervisory Agency took over all the official duties under the Alcohol Act that were previously the responsibility of the Regional State Administrative Agencies and Valvira.

The basic task of the alcohol administration is to prevent harm that the consumption of alcohol causes to the people consuming alcohol, other people and society as a whole. This is done by restricting the consumption of alcoholic beverages and supervising the related business activities. This core task provides a solid basis for the network of authorities combatting the shadow economy.

The Alcohol Act emphasises the role of self-monitoring, and it requires licence holders to prepare a self-monitoring plan to support their operations. A well-drafted self-monitoring plan can prevent many practical problems, and it is important that licence holders take their self-monitoring obligation seriously.

During 2025, the alcohol administration prepared for the reform of regional state administration. The reform being completed and the changes it introduces will inevitably also have an impact on other official functions, including combating the grey economy.

Number of cases processed by the alcohol administration increased moderately

The number of cases handled by the Regional State Administrative Agencies decreased to less than 8,000 cases during the coronavirus restrictions in 2021. In 2022, that number increased slightly to a little over 8,500. In 2023, the Regional State Administrative Agencies processed around 8,000 cases related to serving and retail sales of alcoholic beverages. The decrease in the number is likely to be due to uncertainties related to the business and the reform of the alcohol trade register. The number of cases handled in 2024 almost reached the level preceding the overall reform of the Alcohol Act, and in 2025, the number clearly exceeded this level (Figure 1).

The number of serving licences increased while the number of retail sales licences decreased

The number of licences to serve alcohol has been steadily increasing since 2020. At the end of 2025, there were a total of 9,939 valid serving licences in Mainland Finland (Figure 2). The increase in the number of alcohol serving licences can be partly attributed to the easing of requirements for obtaining a serving licence; for example, the responsible manager only needs to possess an alcohol proficiency certificate. Licences have also been applied for as a secondary service for other activities.

The number of retail sales licences has been steadily decreasing since 2021. The licences apply to the sale of fermented alcoholic beverages up to 5.5%, and as of 10 June 2024, they also apply to the sale of fermented alcoholic beverages up to 8% between 9 am and 9 pm. The development can be attributed, among other things, to the granting of retail sales licences to holders of serving licences and to producers of craft beer and farm wine. At the end of 2025, alcoholic beverages could be purchased for takeaway from a total of 4,474 outlets in Mainland Finland. This was 144 fewer than at the end of 2024 (Figure 2). The decrease in the number of retail sales outlets can partially be attributed to the concentration of the business in shopping centres and the statistical methods introduced as part of the alcohol trade register reform. Takeaway licences granted to serving premises are not included in the retail sales statistics.

Alcohol administration has contributed to combatting the shadow economy – statistical methods were updated again

To monitor the effectiveness of the measures taken to combat the shadow economy, the focus in supervision is also on measures to ensure that licence holders have the prerequisites to carry out their business operations. Between 2012 and 2021, Valvira compiled comparable statistics on serving supervision carried out to combat the shadow economy. From the beginning of 2022, the statistics were updated to reflect the content of the current Alcohol Act. As of 1 January 2023, statistical data batches on serving alcohol were split into licensing administration matters and supervisory matters. From the beginning of 2024, the statistics were extended to include licensing administration and supervision of retail sales.

Licensing administration statistics cover the measures carried out in connection with the applications for new alcohol serving and retail sales licences whereas the statistics on supervisory matters cover the measures arising from existing licences. The statistical data forms an overview of the measures taken by the alcohol administration to combat the shadow economy and the effectiveness of the measures.

Combatting the shadow economy is one part of the extensive responsibilities of the alcohol administration. The measures taken by the alcohol administration to combat the shadow economy in 2025 can be regarded as successful, considering the impacts of the payment and operating relief granted to the entrepreneurs, the decrease in the personnel resources of the alcohol administration and the preparations required by the regional state administration reform.

Statistics on combatting the shadow economy – licensing

Tables 1a and 1b show the supervisory measures to combat the shadow economy taken by the Regional State Administrative Agencies in 2025 in the context of the processing of new licences for the serving and retail sales of alcohol. The summaries show the number of investigations on economic preconditions carried out by region. They also show the number of measures taken to investigate licensing matters and their results, including requests for clarification sent to licence holders, cancellation of licences, negative decisions, licences granted on a temporary basis, licences granted in accordance with the application, payment arrangements and programmes introduced as a result of completed licensing cases, as well as the tax debts paid.

In 2025, 266 licensing matters resulted in 199 requests for clarification. The tax debt payments resulting from the measures totalled about EUR 1.33 million (Table 1a).

In 2025, 13 retail sales licensing matters resulted in 6 requests for clarification. The tax debt payments resulting from the measures totalled about EUR 143,000 (Table 1b).

Statistics on combatting the shadow economy – supervision

Tables 2a and 2b show the supervisory measures to combat the shadow economy taken by the Regional State Administrative Agencies in 2025 in the context of the processing of existing licences for the serving and retail sales of alcohol. The summaries show the number of supervision cases opened to examine financial prerequisites in each region. They also show the number of measures and their results, including requests for clarification sent to licence holders, deadlines set and guidance issued, the cancellation of serving and/or retail sales licences, and payment arrangements and plans agreed as a result of supervisory measures, as well as outstanding taxes paid.

In 2025, a total of 254 supervisory cases for serving alcohol were opened and they led to 202 requests for clarification. The tax debt payments resulting from the measures totalled about EUR 2.5 million (Table 2a).

In 2025, a total of 15 cases of supervising the retail trade were opened and they led to 12 requests for clarification. The tax debt payments resulting from the measures totalled about EUR 177,000 (Table 2b).

Accuracy of Trade Register records is monitored

Source: Ministry of Economic Affairs and Employment

The Finnish Patent and Registration Office (PRH) is responsible for maintaining and monitoring the accuracy of information submitted to the Trade Register. The number of registration offences, cases of suspected misconduct and Trade Register submissions investigated on a risk basis brought to the attention of the Trade Register are indicative of the possible extent of shadow economy activity.

Since 2016, the Finnish Patent and Registration Office has introduced various needs-based intensified control measures in the processing of notifications. Depending on the case, the Finnish Patent and Registration Office has requested further clarification of the accuracy of the reported issue or has conducted its own investigations to rule out the possibility of misconduct. Based on the provisions adopted as a result of the reform of the Trade Register Act, the Finnish Patent and Registration Office may also require that the identity of the person providing the information on the notification form be verified at the Finnish Patent and Registration Office’s or the Tax Administration’s service point.

Since 2022, the Finnish Patent and Registration Office has been targeting its intensified control measures to notifications using risk-based criteria. The number of notifications subject to risk-based control has remained stable over the years. There have been a handful of obvious cases of misconduct each year, although there were no actual cases of misconduct in 2023. The targeted control measures have helped prevent any incorrect data from being registered. In cases where data that has proved to be erroneous has already been registered, the data has been quickly corrected.

At the beginning of 2024, the Finnish Patent and Registration Office introduced a notification for updating the responsible persons in the automated decision-making section. The criteria for notifications subject to automated decision-making have been defined in a manner that enables minimising misconduct. Indeed, the related observations made after the introduction of this practice are positive. The introduction of automated decision-making has also enabled allocating resources to notifications that involve a higher risk of misconduct.

Labour market issues identified in the entrepreneur's residence permit application still affect the interface between entrepreneurial work and employment

Source: Uusimaa Centre for Economic Development, Transport and the Environment

An entrepreneur’s residence permit is granted in two stages: the Uusimaa Centre for Economic Development, Transport and the Environment (ELY) makes an interim decision before the final decision is made by the Finnish Immigration Service. The interim decision is made assessing the profitability of companies and the preconditions for the livelihoods of permit applicants.

In 2024, the Uusimaa ELY Centre issued a total of 1,191 interim decisions, of which 45% were negative. The ratio of negative interim decisions decreased by 3% from the previous year. Interim decisions on first residence permits accounted for 19% and subsequent permits 81% of all interim decisions.

Many reasons for negative decisions

A negative decision is not a direct indication of shadow economy activities, while some of these situations may involve the shadow economy and economic crime as underlying factors. The most common reasons for negative interim decisions include deficiencies in complying with statutory obligations, irregularities in the payment of wages, deficient or erroneous accounting, or a non-viable business idea and lack of profitability, which mean that the applicant cannot ensure their livelihood by means of their business operations.

The Uusimaa ELY Centre works with other authorities to combat the shadow economy and economic crime. Any deficiencies and neglects discovered during the processing of entrepreneurs’ residence permit applications were reported to the Finnish Immigration Service, the Regional State Administrative Agencies, the Finnish Tax Administration and the Police of Finland.

Disguised employment, underpayment, labour exploitation, forwarding co-operation agreements through substitution arrangements and the increase in the number of middlemen used without any business justification are phenomena that were highlighted in negative interim decisions. The volume of disguised employment and observations of labour exploitation continued to increase in the past year. Applications were still found to feature paid services by professional enablers as well.

The ELY Centre cannot adopt a positive view in its assessment on underpayment or avoidance of statutory employer obligations. One manifestation of entrepreneurs’ weakened position are poor contractual terms that do not generate an equal contractual relationship between the client company and the subcontractor. If the services of a self-employed individual are used, the calculated hourly wages must be higher than those of employees, because the costs and livelihood of the self-employed person must be covered. The fee has to include slow times, annual holidays, sick leaves, mandatory indirect costs, administrative, marketing and equipment costs and other similar expenses that are the responsibility of the employer in an employment relationship. Otherwise, work done as an entrepreneur is not profitable and does not follow the rules of fair working life. With regard to substitution arrangements, one noteworthy aspect is a contract holder’s opportunity to benefit financially from a situation where their contract should be abandoned, allowing new actors to conclude a new agreement instead of “renting out” the existing contract. Dependence on a partner exposes workers to different types of exploitation.

Negative interim decisions by nationality

Applications for entrepreneurs’ residence permits were received from citizens of 65 countries. The largest number of applications was received from citizens of Russia, India and Pakistan. As in previous years, Russia and Pakistan were the most prevalent nationalities in self-employed persons’ residence permit applications, but India has risen to second place as a new addition. The number of Indian applicants had increased by 146% compared to the previous year. Correspondingly, the number of Russian applicants had decreased by 36%. Relatively the most negative decisions were made regarding the citizens of Nigeria, who also made up the eighth largest group of applicants out of all nationalities.

Negative interim decisions by principal activity

Applications for entrepreneurs’ residence permits include companies in a large range of sectors. In 2024, applications included 164 different principal activities. In terms of quantity, the largest principal activities were postal, distribution and courier services, the restaurant sector and IT (software design, etc.). It is noteworthy that the number of persons engaging in postal, distribution and courier services increased by 78% compared to the previous year, making it the largest principal activity in the statistics. In the restaurant sector, growth was 4% compared to the previous year. The ratio of negative interim decisions was highest in the cleaning sector (55%) and management consulting (56%).