Increase in offences related to subsidies

Offences related to subsidies are provided for in Chapter 29 of the Criminal Code of Finland (39/1889). Offences related to subsidies include subsidy fraud, aggravated subsidy fraud, aggravated subsidy misuse and subsidy violation. Subsidy fraud is committed by a person who obtains or attempts to obtain economic benefit for himself or herself or for another person by providing false information or failing to provide information on such a change in circumstances that affects the granting, amount or conditions of a subsidy. This means that a person commits fraud by providing false information in a subsidy application, even if the subsidy has not yet been granted or paid. Meanwhile, a person who uses the subsidy in a manner that is essentially contrary to its intended purpose commits subsidy misuse. Offences related to subsidies lead to the recovery of the subsidy and may result in criminal prosecution.

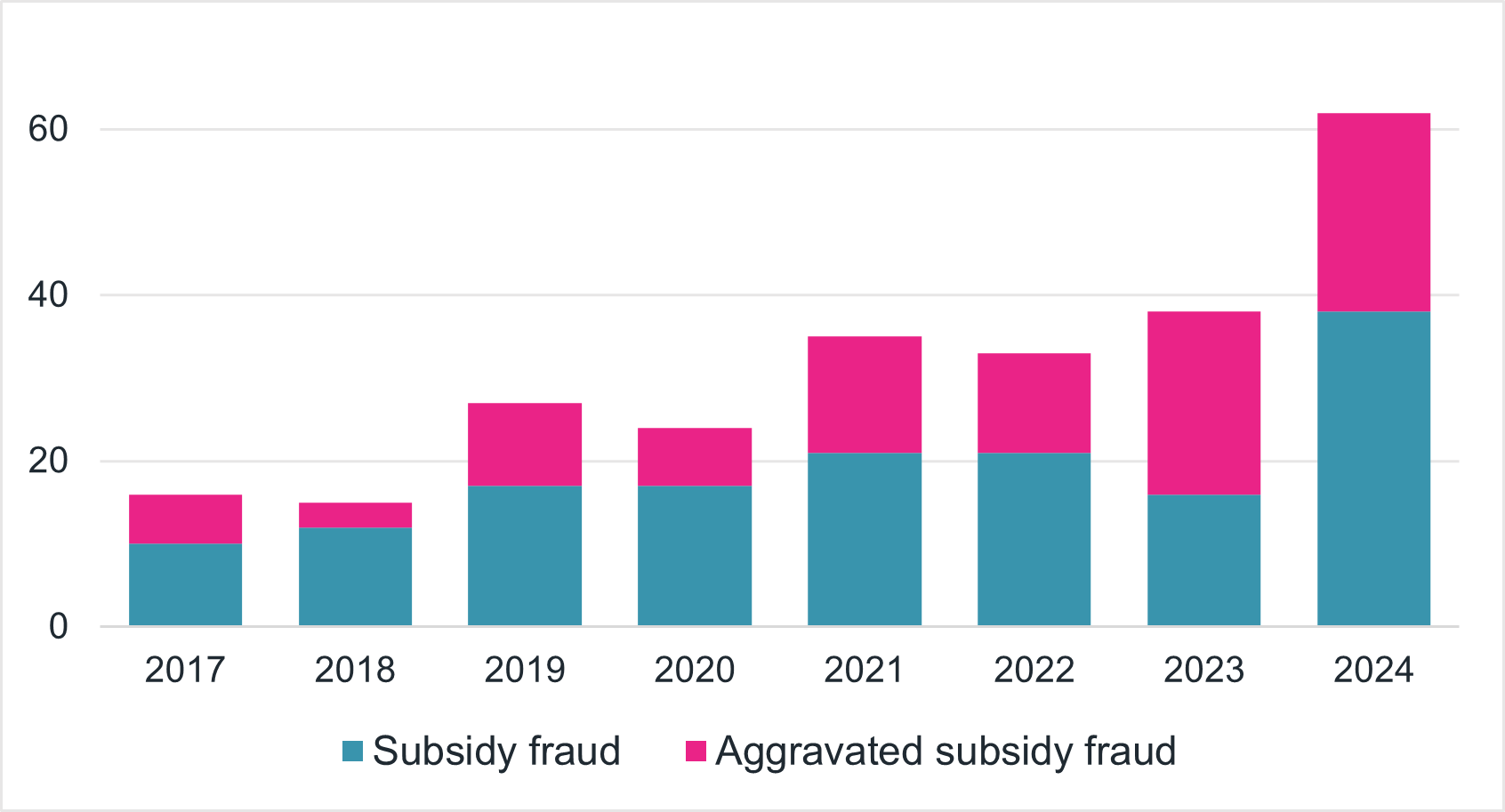

Increase in offences related to subsidies reported to the police in recent years

While the number of offences related to subsidies reported to the police is low, this number has increased over the past seven years. In offences related to subsidies, the proportion of unreported crime is likely to be high, and offences reported to the police only provide a partial picture of the extent of the phenomenon. In particular, there has been a steady increase in basic subsidy fraud, with the exception of a slight decline in 2023. Between 2023 and 2024, there was a clear increase in the number of aggravated subsidy fraud cases reported to the police. Cases involving subsidy misuse and subsidy violation are rarely reported to the police.

The increase in the number of offences related to subsidies reported to the police can be partly explained by more effective control by the state grant authorities and a lower threshold for reporting the offences. Changes in legislation have also affected the number of offences related to subsidies. The so-called COVID-19 grants also increased the risk of subsidy misuse.

Offences reported to the police (2017–2024)

Violations of other statutory obligations also observed in relation to subsidy offences

It is typical for offences related to subsidies that the offence has continued for a long time, and it is reported to the police with a delay. Persons suspected of offences related to subsidies have typically also been found to violate other business-related obligations, such as neglecting their accounting duties (accounting offence) or by reporting false information to registers (registration offence). The subsidy offences reported to the police involve companies representing sectors typically involving a high risk of the grey economy, such as construction, agriculture, forestry and fisheries (also known as seasonal work sectors). Some subsidy offences are also related to the agricultural subsidies granted by the European Union and subsidies awarded to companies at the national level. Subsidy misuse has also been detected in the activities of associations and foundations. Cases involving the signs of professional crime, in which the same individuals commit several subsidy offences through different companies, are also brought to the attention of the authorities. International research has also detected that companies committing fraud tend to apply for small loans and subsidies from various parties through several different companies.

Control reveals subsidy offences

Active control measures reveal offences related to subsidies. Typically, a subsidy recipient has failed to fulfil the reporting obligations related to the subsidy conditions. This prompts the state subsidy authority to examine the use of the subsidy in more detail. Private traders may already be subject to control measures that give rise suspicion of an offence during the subsidy period. A subsidy offence may also be detected in the tax control of the Finnish Tax Administration when a tax audit reveals subsidy misuse.

Typical methods of committing subsidy offences

Many ways to combat subsidy offences

Discretionary government grants are a form of discretionary public funding granted from central government funds to support activities or projects considered necessary in society. Government grants are used to support various issues of general interest, regional and labour policy objectives, and business activities, and to promote international competition. Subsidies granted from public funds are a significant part of general government finances, as the subsidies awarded by the government grant authorities amount to approximately EUR 4 billion each year. This amounts to around 5% of central government expenditure. Subsidy misuse may undermine trust in the grant system and public authorities among the general public and distort competition and the allocation of subsidies.

The Act on Discretionary Government Grants guides the awarding, monitoring and recovery of subsidies, and the access to and storage of related data. In addition to the Act on Discretionary Government Grants, special regulation steers the use of subsidies, and various subsidy-specific acts and decrees apply to them.

From the perspective of preventive action, measures taken before a subsidy is granted, such as sufficiently extensive background checks, the verification of the accuracy of information given in the subsidy application and effective control, play a key role.

From the perspective of the prevention of subsidy offences, it is important that, during the subsidy discretion and application process:

- The terms and conditions of the subsidy are clear, easy to understand, and the application process requires the applicant to read and understand them.

- At the application phase, the applicant is informed of the right of the party granting the subsidy to take control measures and carry out inspections.

- The applicant understands that a breach of the subsidy conditions will result in the recovery of the subsidy and may lead to criminal prosecution.

- The subsidy applicant acknowledges that receiving the subsidy is public information published on the tutkiavustuksia.fi website.

From the perspective of control, preventive action is supported by factors such as:

- The party granting the subsidy has an accessible whistleblowing channel and provides information about this.

- The party granting the subsidy has effective preventive controls, including the ability to identify forgery, audit the accounts and perform risk assessments.

- Cooperation between public authorities works well, and the authorities have sufficient rights to access data.

- The control is comprehensive and also targeted at parties applying for smaller subsidies.

What is meant by a subsidy?

A subsidy refers to financial support provided on a statutory or discretionary basis, which may also be a loan, interest subsidy or loan collateral. The subsidy may be granted by the European Union, the state, a wellbeing services county, a joint county authority for wellbeing services, a municipality, a joint municipal authority, another body governed by public law, or a body or foundation separately laid down in the law. Typically, subsidies are awarded by a government grant authority, of which there are more than 90 (see a list of government grant authorities [.fi]›).

The subsidy types include project grants, general grants, investment grants, special grants and other financial grants. Subsidies may be awarded to various parties, but they are typically granted to companies and associations. See the Government grants - Tutkihallintoa.fi (in Finnish) [.fi]› website for more detailed information about the applied-for and awarded government grants to the extent that the government grant authority has been subject to an obligation to submit data as of 1 October 2023.

Also see: