On the taxation of investment funds and the provisions of section 20a of the Income Tax Act

- Date of issue

- 6/22/2022

- Validity

- 6/22/2022 - 12/19/2022

This is an unofficial translation. The official instruction is drafted in Finnish (Sijoitusrahastojen verotuksesta ja TVL 20 a §:n sääntely, record number VH/3253/00.01.00/2022 ) and Swedish (Om beskattningen av placeringsfonder och bestämmelserna i 20 a § i ISkL, record number VH/3253/00.01.00/2022 ) languages.

This detailed guidance concerns the income taxation of domestic and foreign investment funds and special investment funds, the criteria for tax exemption and the taxpayer’s obligation to provide information, in view of the amended provisions on investment funds in the Income Tax Act (1535/1992) and the Act on the Taxation of Nonresidents’ Income (627/1978) entered into force on 1 January 2020. This detailed guidance also briefly discusses the taxation of foreign investment funds that do not qualify for tax exemption under the Income Tax Act.

On 7 April 2022, at the request of the Helsinki Administrative Court, the European Court of Justice (ECJ) has given a preliminary ruling in case C-342/20, A SCPI, concerning the condition of contractual form in section 20a of the Income Tax Act in the light of Articles 63 and 65 of the Treaty on the Functioning of the European Union (TFEU). In its judgment the ECJ held that the condition relating to contractual form constituted a restriction on the free movement of capital, which could not be justified by overriding reasons in the public interest, when it excluded from entitlement to that exemption a foreign alternative investment fund constituted in the form of a company, even though that fund, which benefits from a system of tax transparency in the Member State in which it is established, was not subject to income tax in that latter Member State. Based on the judgment, the Helsinki Administrative Court issued a similar decision No. H3151 / 2022 on 7 June 2022.

On the grounds of the judgement, a foreign investment fund constituted in the form of a company is tax exempt despite the condition of contractual form in section 20a of the Income Tax Act and section 3(10) of the Act on the Taxation of Nonresidents’ Income when such a foreign investment fund is in an objectively comparable situation with a domestic contractual investment fund or special investment fund and the fund fulfils the other requirements for tax exemption laid down in section 20a of the Income Tax Act. In such circumstances the sections of this detailed guidance on foreign contractual investment funds and special investment funds also apply to foreign funds constituted in the form of a company. As the free movement of capital also extends to third countries, a similar principal is applied to foreign funds constituted in the form of a company that reside outside the European Economic Area (EEA).

The objective comparability of the situations is examined having regard to the aim pursued by the tax ex-emption of investment funds and special investment funds under section 20a of the Income Tax Act, the purpose of which is, as stated in the ECJ's judgement, to avoid the double taxation of income from investments and to endeavour to treat investments made through funds in the same way as direct investments for tax purposes. In light of these aims, a foreign fund constituted in the form of a company can be considered to be in a comparable situation to a resident contractual investment fund or special investment fund when the foreign fund in the form of a company benefits from an exemption in respect of its income or belongs to a system of tax transparency in its State of residence (paragraph 77 of the ECJ's judgement). In order to obtain a tax exemption, a foreign investment fund constituted in the form of a company must demonstrate that it is in an objectively comparable situation to a domestic contractual investment fund or special investment fund and that it meets the other conditions for tax exemption under section 20a of the Income Tax Act.

There are a number of pending cases before the Supreme Administrative Court on the interpretation of section 20a of the Income Tax Act, including appeals concerning the condition of contractual form in respect of foreign funds constituted in the form of a trust (e.g. KVL 36/2020, pending final decision). The detailed guidance will be updated more broadly with regard to the condition of contractual form following the decisions issued by the Supreme Administrative Court.

This guidance is applied in taxation in tax years beginning on or after 1 January 2020.

1 General

The provisions regarding the taxation of the investment funds were revised by clarifying the legislation which entered into force on 1 January 2020, further clarifying the terms of ‘investment fund’ and ‘special investment fund’ and further specifying the criteria for tax exemption for investment funds and special investment funds as given in the Income Tax Act and in the Act on the Taxation of Nonresidents’ Income. The provisions regarding tax exemption for investment funds and special investment funds shall also apply to equivalent foreign contractual funds. Provisions on the tax treatment of sub-funds were also enacted in the connection of the legislative change. The purpose of the legislative change was not to change the tax treatment of investment funds (Government proposal HE 304/2018, p. 53) except for introducing the concept of ‘sub-fund’ and its tax treatment into tax law.

In the legislative change, special investment funds were added alongside investment funds to the list of corporate entities pursuant to section 3(1)4 of the Income Tax Act. Investment funds were removed from the list of tax-exempt corporate entities in section 20 of the Income Tax Act, and provisions on tax exemption for investment funds and special investment funds were transferred, with further specifications, to the new section 20a in the Income Tax Act, which concerns both domestic and foreign investment funds. A separate provision on the tax treatment of sub-funds was added to the Income Tax Act (section 20a(7)). Also, provisions on exemption from tax-at-source for an investment fund satisfying the criteria given in section 20a of the Income Tax Act, and on the taxpayer’s obligation to provide evidence of compliance, were added to section 3(10) of the Act on the Taxation of Nonresidents’ Income.

The legislative change regarding the provisions of tax treatment of investment funds was partly related to an amendment made to the Act on Investment Funds (213/2019). The regulations of private law concerning investment funds is contained in the Act on Investment Funds, which in turn regulates such areas as fund investments pursuant to contractual law. The Act on Investment Funds implements the Undertakings for Collective Investment in Transferable Securities Directive (hereinafter the UCITS Directive), including later amendments thereto. Regulation of special investment funds was transferred in the process of legislative change from the Act on Investment Funds to the Act on Alternative Investment Fund Managers (162/2014, AIFM Act), which implements the Alternative Investment Fund Managers Directive (2011/61/EU, AIFM Directive). The legislative changes made to private law also involved making the sub-fund structure provided for in the UCITS Directive allowable in investment funds and special investment funds.

2 Taxation of domestic investment funds

2.1 Domestic fund investments and general considerations on the taxation of investment funds

Domestic investment funds include contractual investment funds as per the Act on Investment Funds and contractual special investment funds as per the AIFM Act. Domestic investment funds are contractual arrangements that do not have legal personality. They may be described as a separate set of assets which are jointly owned by the unitholders that have invested in the fund. An investment fund is managed by an asset management company, a limited liability company with which the unitholders in the investment fund enjoy a contractual relationship. It is not permitted under Finnish law to establish other kinds of UCITSs referred to in the UCITS Directive, such as an investment company with variable capital or a unit trust. However, a domestic investment fund may consist of one or more sub-funds.

Fund investments may also be made in Finland for instance in the form of a limited partnership or public limited liability company (REIT company) investing in real estate as per section 1 of the Real Estate Funds Act (1173/1997). Fund investments are also undertaken in the form of private equity funds set up as limited partnerships. In a private equity fund set up as a limited partnership, the asset management company (a limited liability company) is the general partner and the investors are silent partners.

Investment funds as per the Act on Investment Funds and special investment funds as per the AIFM Act are corporate entities as referred to in section 3(1)4 of the Income Tax Act, for which criteria for tax exemption are provided in section 20a of the Income Tax Act.

Limited partnerships are business partnerships as referred to in section 4 of the Income Tax Act. Funds set up as limited partnerships and their unitholders shall be taxed like other partnerships, as per section 16 of the Income Tax Act. Also, silent partners in a limited partnership engaging exclusively in private equity investments who are taxpayers with limited tax liability are subject to the exception in section 9(5) of the Income Tax Act, whereby under certain conditions the portion of the income of the limited partnership corresponding to a partner’s share in the partnership shall be deemed taxable income only to the extent that the income would have been taxable had it been received directly by the taxpayer with limited tax liability.

Taxation of REIT companies is provided for in the Act on tax relief to specified limited companies in the rental housing business.

2.2 Taxation of contractual investment funds

2.2.1 Taxation of an investment fund under the Act on Investment Funds

Under section 20a(1) of the Income Tax Act, an investment fund as referred to in Chapter 1 section 2(1)2 of the Act on Investment Funds shall be tax-exempt in income taxation when it has 30 or more unitholders.

Under Chapter 1 section 2(1) of the Act on Investment Funds, an investment fund is defined as a set of assets obtained in the course of investment fund operations and invested as per by-laws confirmed in Finland and pursuant to Chapter 13 of the Act on Investment Funds, including any obligations thereby incurred. In order for a fund to qualify for tax exemption as above, the fund must have been established and must operate as specified in the Act on Investment Funds. Also, in order to qualify for tax exemption, an investment fund must have at least 30 unitholders; an exception may be made thereto when the fund is newly established or if the number of unitholders decreases temporarily (Income Tax Act, section 20a(6), see section 4 of this document for more details). The criteria for the number of unitholders and exceptions thereto are consistent with the provisions in the Act on Investment Funds. Therefore, a domestic investment fund as per the Act on Investment Funds is, by default, a corporate entity exempt from income tax.

Under Chapter 1 section 2 of the Act on Investment Funds, an investment fund may consist of one or more sub-funds, to which the provisions on investment funds also apply (Income Tax Act, section 20a(7), see section 5 of this document for more details).

2.2.2 Taxation of a special investment fund under the AIFM Act

Under section 20a(2) of the Income Tax Act, a special investment fund as referred to in Chapter 2 section 1(2) of the AIFM Act shall be tax-exempt in income taxation if the fund is open-ended and has at least 30 unitholders.

Under Chapter 2 section 1(2) of the AIFM Act, a special investment fund is defined as an AIF as referred to in Chapter 16a section 1 of the AIFM Act which must be managed in accordance with the obligations set in that Chapter. Because of this, the primary criterion for a special investment fund being tax-exempt is that the special investment fund must be an AIF established and operating pursuant to the AIFM Act.

In order to be tax-exempt, a special investment fund must also be open-ended. The concept of ‘open-ended’ as referred to in section 20a(2) of the Income Tax Act is consistent with the concept of ‘open-ended’ as referred to in Chapter 16a section 4 of the AIFM Act, meaning that the special investment fund is open to the public and obliged to issue and redeem shares. A special investment fund may derogate from the requirements for being open-ended; for example, under its own rules a fund may be open for subscriptions and redemptions once every three months. In such cases, the frequency of the opening times is usually coordinated with the realisation times of investments in the special investment fund. According to the Government proposal (HE 304/2018, p. 56), a restriction on opening times does not in itself render a special investment fund to be closed-ended. Although a special investment fund is not offered to the public, it may still meet the requirement set to AIF to be open-ended. In this respect, the Government proposal refers to Commission Delegated Regulation (EU) No 694/2014 supplementing Directive 2011/61/EU of the European Parliament and of the Council with regard to regulatory technical standards determining types of alternative investment fund managers, in which an AIF is defined as follows:

“…an AIF the shares or units of which are, at the request of any of its shareholders or unitholders, repurchased or redeemed prior to the commencement of its liquidation phase or wind-down, directly or indirectly, out of the assets of the AIF and in accordance with the procedures and frequency set out in its rules or instruments of incorporation, prospectus or offering documents.

A decrease in the capital of the AIF in connection with distributions according to the rules or instruments of incorporation of the AIF, its prospectus or offering documents, including one that has been authorised by a resolution of the shareholders or unitholders passed in accordance with those rules or instruments of incorporation, prospectus or offering documents, shall not be taken into account for the purpose of determining whether or not the AIF is of the open-ended type.

Whether an AIF's shares or units can be negotiated on the secondary market and are not repurchased or redeemed by the AIF shall not be taken into account for the purpose of determining whether or not the AIF is of the open-ended type.”

In applying section 20a(2) of the Income Tax Act, a special investment fund shall be considered to fulfil the requirement of being open-ended with respect to issuing and redemption of shares when it satisfies the criteria of being open-ended referred to in the aforementioned Delegated Regulation.

Also, in order to qualify for tax exemption, a special investment fund must have at least 30 unitholders; an exception may be made thereto when the fund is newly established or if the number of unitholders decreases temporarily (Income Tax Act, section 20a(6), see section 4 of this document for more details).

Under the AIFM Act, it is permissible for a special investment fund not to be open-ended or to have fewer than 30 unitholders. A special investment fund that fails to satisfy either or both of those criteria may nevertheless be considered tax-exempt if it satisfies all the criteria given in section 20(3) of the Income Tax Act:

- the special investment fund distributes to its unitholders at least three quarters of its profits for the financial year, excluding unrealised appreciations;

- the special investment fund has a capital of at least EUR 2 million; and

- the unitholders of the special investment fund are professional investors or high net worth individuals treated as such within the meaning of Chapter 16a, Section 4 of the AIFM-law.

The requirement for profit distribution in each financial year is mandatory. A special investment fund must therefore distribute at least three quarters of its profits for the financial year to its unitholders each year, excluding unrealised appreciations. This requirement is consistent with the requirement for profit distribution in each financial year in Chapter 16a section 5 of the AIFM Act.

The ‘professional investors or comparable high net worth individuals’ referred to in Chapter 16a section 4 of the AIFM Act refer to the concept of ‘professional client’ defined in the AIFM Act, which is equivalent to the group defined in Chapter 1 section 23 of the Act on Investment Services (747/2012), to which the concept of ‘professional investor’ in Chapter 1 section 2(1)31 of the Act on Investment Funds is also equivalent. A high net worth individual comparable to a professional investor is defined in Regulation (EU) No 345/2013 of the European Parliament and of the Council on European venture capital funds and in Regulation (EU) No 346/2013 of the European Parliament and of the Council on European social entrepreneurship funds (high net worth individuals).

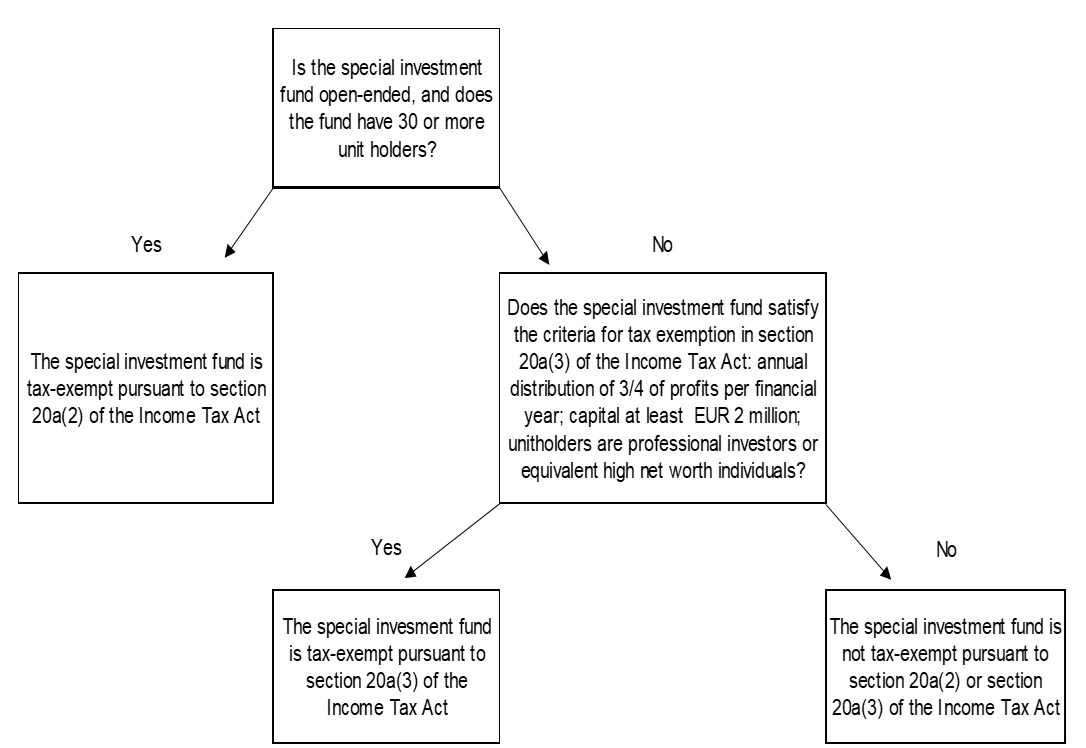

The tax-exempt status of special investment funds pursuant to the AIFM Act in cases where section 20a(2–3) of the Income Tax Act is applied is determined as shown below:

2.2.3 Taxation of real estate investment funds

Under section 20a(4) of the Income Tax Act, a special investment fund as referred to in Chapter 2 section 1(2) of the AIFM Act which invests its assets primarily in real estate and real estate securities as referred to in Chapter 16a section 4 of said Act, shall be tax-exempt if the fund distributes annually at least three quarters of its profits to its unitholders, excluding unrealised appreciations.

Section 20a(4) of the Income Tax Act is applied as an independent provision. Therefore, the provisions on tax-exempt status for special investment funds in section 20a(2–3) of the Income Tax Act shall not apply to real estate investment funds as referred to in section 20a(4) of the Income Tax Act.

For a real estate investment fund to qualify for tax exemption, it must perform annual profit distribution. The profit distribution requirement for tax exemption means that a real estate investment fund must actually distribute three quarters of its profits in any given financial year, excluding unrealised appreciations. This requirement is consistent with the requirement for profit distribution in each financial year in Chapter 16a section 5 of the AIFM Act.

Section 20a(4) of the Income Tax Act makes reference to a special investment fund which invests in real estate and real estate securities as referred to in Chapter 16a section 4 of the AIFM Act. Chapter 16a section 4 of the AIFM Act contains the provisions regarding minimum capital and specifies the situations when a special investment fund is considered to be open-ended. It follows that for a real estate investment fund to be tax-exempt it must by default be open to the public. This criterion is considered to be satisfied if a real estate investment fund has 30 or more unitholders. By derogation from the above, a real estate investment fund shall be considered to qualify for tax exemption when it has 10 or more unitholders if its fund rules specify that each unitholder must subscribe to fund units to a value of at least EUR 1 million. If a special investment fund has fewer than 30 unitholders, in order to qualify for tax exemption it must also satisfy the criterion of the unitholders being professional clients or comparable high net worth individuals (see subsection 2.2.2 in this document for more details). If even one of the unitholders in a real estate investment fund has subscribed to fund units to a value of less than EUR 1 million, then in order to qualify for tax exemption the fund must have 30 or more unitholders.

3 Taxation of foreign investment funds

3.1 Foreign investment funds

There are various legal structures in various countries available for pursuing investment fund activities. In Member States of the European Union and within the European Economic Area (EEA), investment fund operations are governed by the UCITS Directive, which provides for three legal structures (contractual common funds, an investment company with variable capital and unit trusts). The overall term for all of these in the Directive is ‘undertaking for collective investment in transferable securities’ (UCITS). Investment funds established in Finland can only be contractual common funds (contractual investment funds), but the other legal structures defined in the UCITS Directive are in use in other Member States.

There are also funds in various Member States that are not investment funds as defined in the UCITS Directive but instead, for instance, alternative investment funds (AIF) as defined in the AIFM Directive. The AIFM Directive allows for a variety of legal structures for operations. Furthermore, there may be AIFs not covered by the AIFM Directive in EU Member States and in third countries. The legal structure of such funds depends on the national legislation of each country in question.

3.2 Taxation of taxpayers with limited tax liability

Foreign investment funds are taxpayers with limited tax liability in Finland, also referred to as nonresident for tax purposes (Income Tax Act, section 9(1)). Nonresidents are only liable to pay tax in Finland on income received from Finland under the Income Tax Act, and the taxation of which is not restricted by a tax treaty between Finland and the fund’s country of residence.

Under sections 9 and 10 of the Income Tax Act, income received from Finland includes income from real estate or from the sale of real estate (Income Tax Act, section 10(1)1,10), and dividends paid in Finland (Income Tax Act, section 10(1)6). The right of Finland to levy taxes may be restricted by virtue of certain taxpayers and certain types of income having been defined as tax-exempt in national tax legislation. For investment funds, such provisions exist in section 20a of the Income Tax Act, which specify the criteria for tax exemption.

In cases where Finland does not have a tax treaty with the country in which a foreign corporate entity is resident, the right of the Finnish government to levy taxes is determined solely on the basis of Finland’s national tax legislation. In most cases, however, tax treaties restrict the right to tax based on Finland’s national legislation.

For more information on the taxation of taxpayers with limited tax liability, see the Tax Administration guidelines Income taxation of foreign corporate entities, Payments of dividends, interest and royalties to non-residents and Impact of EU Law on the taxes withheld at source when dividends are paid.

3.3 Tax treaty law and significance of EU law

The international tax law applicable in Finland consists of tax treaty law, EU law and national legislation. Whether income is taxable or expenses are deductible is by default resolved on the basis of national legislation. Tax treaties are applied to resolve how the right to levy taxes is divided between the country of residence and the source country. A tax treaty may restrict the right to tax based on Finland’s national legislation and reduce the amount of tax-at-source to be withheld from income.

When a foreign investment fund invests in a Finnish investment(s), it may be necessary to resolve whether the foreign investment fund is entitled to any tax treaty benefits. Entitlement to tax treaty benefits requires that the investment fund must be regarded as a person resident in a country party to the treaty. For the purposes of a tax treaty, a resident of a country is often seen to be any person that is liable to tax under the domestic laws in the state of residency. Also, tax treaties generally require that the dividend beneficiary is the beneficial owner of the dividends

The taxation of investment funds involves several issues of international tax law, and it may be necessary within a single case to resolve whether an investment fund is considered an investment fund for the purposes of the Income Tax Act and a beneficial owner for the purposes of the relevant tax treaty. It may also be necessary within a single case to resolve whether an investment fund is considered a tax treaty subject or a flow-through fund that is not an independent taxpayer or tax treaty subject.

In certain situations, the interpretation of the legal status of a taxpayer may differ under national legislation on the one hand and under a tax treaty on the other. In the Supreme Administrative Court decision KHO 2004:116, a Luxemburg-based FCP investment fund was regarded as a flow-through fund. The interest or dividend income received through the fund from the USA by A Oy, a company with general tax liability in Finland which was a unitholder in the fund, was subject to the application of the tax treaty between Finland and the USA, not the tax treaty between Finland and Luxemburg. This was the case despite the fact that the Supreme Administrative Court ruled in its decision that the Luxemburg-based FCP fund in question must be regarded as a corporate entity as defined in section 3 of the Income Tax Act for the purposes of Finnish national legislation.

EU tax law and equivalence demands pursuant thereto have become a major issue of interpretation in the taxation of foreign investment funds. The primacy of EU law over national legislation prevents Member States inter alia from enacting legislation that conflicts with EU law. National legislation and tax treaties must therefore be applied and interpreted within the requirements of EU law. The case law of the European Court of Justice is of great importance in interpreting EU law.

The Treaty on the Functioning of the European Union (TFEU) has an impact on direct taxation, for instance via the fundamental freedoms. The most important fundamental freedoms vis-à-vis the tax treatment of foreign investment funds are provided for in Articles 49 and 63 of the TFEU (right of establishment and free movement of capital, respectively). The provisions of Article 63 of the TFEU are also applicable to residents of countries other than EU or EEA Member States, i.e. third countries. Fundamental freedoms may overlap one another in their application, and with respect to tax-at-source on dividends, for instance, the right of establishment as defined in Article 49 of the TFEU may become applicable, but only between Member States.

3.4 Tax regulation concerning foreign investment funds

In Finland, tax provisions concerning investment funds are given in section 20a of the Income Tax Act; a foreign investment fund that satisfies those criteria shall be exempt from income tax. Section 20a of the Income Tax Act only applies to contractual investment funds, and even then only to those that satisfy the criteria specified in the Act.

The provisions of 20a of the Income Tax Act do not apply to investment funds other than contractual ones. These funds are taxed according to the tax provisions applying to their respective legal forms.

An important factor in determining the tax treatment of investment funds is the legal form in which the fund operates and with which Finnish entity a given foreign investment fund may be considered equivalent. For tax purposes, a foreign investment fund is usually considered equivalent to a contractual investment fund, a limited liability company or a limited partnership. Another important factor in determining the tax treatment of investment funds is whether an investment fund that is considered to be contractual in nature satisfies the criteria for tax exemption in section 20a of the Income Tax Act

3.4.1 Criteria for tax exemption for a foreign investment fund

Under section 20a(1) of the Income Tax Act, a contractual, open-ended foreign investment fund equivalent to an investment fund as referred to in Chapter 1 section 2(1)2 of the Act on Investment Funds shall be exempt from income tax if it has 30 or more unitholders.

Under Chapter 1 section 2(1) of the Act on Investment Funds, an investment fund is defined as a set of assets that have been obtained in the course of investment fund operations and invested as per the fund’s rules which have been confirmed in Finland and are pursuant to Chapter 13 of the Act on Investment Funds, including any obligations thereby incurred. The equivalence specified as a criterion for tax exemption under section 20a(1) of the Income Tax Act means that the foreign investment fund in question must have been established an essentially similar manner to that specified in the Act on Investment Funds, and is operating in a manner essentially consistent with an investment fund as defined by the Act on Investment Funds.

The contractual nature specified as a criterion for tax exemption means that the foreign investment fund in question must have been established as a contractual arrangement and must comprise an aggregate of separate assets that do not have a legal personality. In order to be contractual, the fund must exist as a contractual arrangement between the asset management company and the unitholders. A UCITS in any other legal form cannot be tax-exempt under section 20a of the Income Tax Act.

The contractual nature requirement is satisfied for instance by any contractual UCITS established in another EEA Member State in compliance with the UCITS Directive. On the other hand, UCITS investment companies with variable capital do not satisfy the contractual nature requirement, nor do unit trusts. An exception may be made to the above in a case where a unit trust may be considered to be contractual in nature.

The Supreme Administrative Court ruled in its decision KHO 2015:9 that in the case of a US Delaware Statutory Trust, a closed-ended fund and a legal person, its closest Finnish equivalent was a public limited liability company engaging in investment operations. In the relevant case law, Luxemburg-based contractual FCP (Fonds Commun de Placement) investment funds, have also been considered contractual investment fund (KHO 2004:116). Also, the Central Tax Board stated in its advance ruling KVL 2013/8 that an FCP fund in Luxemburg is considered equivalent to a domestic investment fund.

An investment fund must be open-ended in order to be tax-exempt, meaning that the fund must be open to the public and must have an obligation to issue and redeem shares in the fund. The definition of ‘open-ended’ in section 20a(1) of the Income Tax Act is consistent with the definition of same in Chapter 8 section 8 of the Act on Investment Funds. According to the provision, an investment fund satisfies the open-ended criterion if it is open to all investors without restrictions. The requirement for an investment fund to be open-ended, provided in Chapter 8 section 8 of the Act on Investment Funds, stems from Article 1(2) of the UCITS Directive, according to which:

“UCITS means an undertaking a) with the sole object of collective investment in transferable securities or in other liquid financial assets referred to in Article 50(1) of capital raised from the public and which operate on the principle of risk-spreading; and (b) with units which are, at the request of holders, repurchased or redeemed, directly or indirectly, out of those undertakings’ assets. Action taken by a UCITS to ensure that the stock exchange value of its units does not significantly vary from their net asset value shall be regarded as equivalent to such repurchase or redemption.”

Thus, an investment fund which complies with the UCITS Directive or an equivalent requirement for being open-ended, is to be considered as open-ended as referred to in section 20a(1) of the Income Tax Act.

For exchange traded funds (ETF funds), the requirement for being open-ended and liquidity obligation may be satisfied by an alternative action as specified in the second sentence of Article 1(2)b of the UCITS Directive, meaning that the ETF fund must repurchase a unitholder’s fund units at a market price determined on a business day at the exchange. This alternative action is regarded as equivalent to repurchase or redemption.

Also, in order to qualify for tax exemption, an investment fund must have at least 30 unitholders; an exception may be made thereto when the fund is newly established or if the number of unitholders decreases temporarily (Income Tax Act, section 20a(6), see section 4 of this document for more details). In the Act on Investment Funds, the minimum number of unitholders is given as 30 to ensure that the fund really is a joint investment undertaking. The unitholder requirement in the Income Tax Act is consistent with the definition in the Act on Investment Funds. In counting the number of unitholders, a unitholder and any corporation or comparable foreign company under its control as defined in Chapter 1 section 5 of the Accounting Act (1336/1997) shall be considered as a single unitholder. A fund unit manager shall not be considered a unitholder if the fund unit manager satisfies the requirements on providing information to the authorities in Chapter 11 section 7 of the Act on Investment Funds.

For an investment fund registered outside the EEA to be tax-exempt, not only the criteria specified in section 20a(1) of the Income Tax Act apply, but also the special criteria referred to in section 20a(5) of the same Act must be satisfied (see subsection 3.4.4 in this document for more details).

3.4.2 Criteria for tax exemption for a foreign special investment fund

Under section 20a(2) of the Income Tax Act, a foreign contractual special investment fund equivalent to a special investment fund as referred to in Chapter 2 section 1(2) of the AIFM Act shall be tax-exempt in income taxation if the fund is open-ended and has at least 30 unitholders.

Under Chapter 2 section 1(2) of the AIFM Act, a special investment fund is defined as an AIF as referred to in Chapter 16a section 1 of the AIFM Act which must be managed in accordance with the obligations set in that Chapter. For this reason, the equivalence specified as a criterion for tax exemption under section 20a(2) of the Income Tax Act means that the foreign special investment fund in question must have been established essentially in the manner specified in the AIFM Act and is operating in a manner essentially consistent with the AIFM Act.

The contractual nature specified as a criterion for tax exemption means that the foreign special investment fund in question must have been established as a contractual arrangement between an asset management company and unitholders, i.e. it must comprise an aggregate of separate assets that do not have a legal personality. AIFs as per the AIFM Directive may be set up with a variety of legal forms: an investment company with variable capital (or fixed capital), a unit trust, a contractual special common fund or a fund with another legal form. Also, there may be AIFs that deviate from the provisions of both the AIFM Directive and the AIFM Act, particularly in third countries. The provisions in section 20a of the Income Tax Act require as a criterion for tax exemption that any special investment fund must comprise a contractual arrangement, and not all foreign special investment funds satisfy this requirement.

A special investment fund must be open-ended in order to be tax-exempt, meaning that the fund must be open to the public, and must have an obligation to issue and redeem shares in the fund. The definition of ‘open-ended’ in section 20a(2) of the Income Tax Act is consistent with the definition of same in Chapter 16a section 4 of the AIFM Act. Under Chapter 16a section 4(1) of the AIFM Act, special investment funds must be open to the public.

Under Chapter 16a section 4(1) of the AIFM Act, by derogation from Chapter 8 section 8 of the Act on Investment Funds, the special investment fund may specify restrictions in its rules for the fund being open-ended. A special investment fund may derogate from the requirements for being open-ended; for example, under its own rules a fund may be open for subscriptions and redemptions once every three months. In such cases, the frequency of the opening times is usually coordinated with the realisation times of investments in the special investment fund. A restriction on opening times does not in itself render a special investment fund to be closed-ended (Government proposal HE 304/2018, p. 56). A special investment fund not being open to the public can nevertheless satisfy the requirements for being open-ended set for an AIF, with respect to which the Government proposal refers to Commission Delegated Regulation (EU) No 694/2014, where an open-ended AIF is defined as follows:

“…an AIF the shares or units of which are, at the request of any of its shareholders or unitholders, repurchased or redeemed prior to the commencement of its liquidation phase or wind-down, directly or indirectly, out of the assets of the AIF and in accordance with the procedures and frequency set out in its rules or instruments of incorporation, prospectus or offering documents.

A decrease in the capital of the AIF in connection with distributions according to the rules or instruments of incorporation of the AIF, its prospectus or offering documents, including one that has been authorised by a resolution of the shareholders or unitholders passed in accordance with those rules or instruments of incorporation, prospectus or offering documents, shall not be taken into account for the purpose of determining whether or not the AIF is of the open-ended type.

Whether an AIF's shares or units can be negotiated on the secondary market and are not repurchased or redeemed by the AIF shall not be taken into account for the purpose of determining whether or not the AIF is of the open-ended type.”

A foreign special investment fund that does not satisfy the requirement of having 30 or more unitholders or the requirement of being open-ended, or both, may nevertheless be tax-exempt if it satisfies all of the requirements given in section 20a(3) paragraphs 1–3 of the Income Tax Act:

- the special investment fund distributes annually to its unitholders at least three quarters of its profits excluding unrealised appreciations;

- the special investment fund has a capital of at least EUR 2 million; and

- the unitholders of the special investment fund are professional investors or high net worth individuals treated as such within the meaning of Chapter 16a, Section 4 of the AIFM-law.

The requirement for profit distribution in each financial year is an actual requirement to qualify for tax exemption. A special investment fund must therefore distribute annually at least three quarters of its profits for the financial year to its unitholders, excluding unrealised appreciation. However, there may be exceptions to the requirement of profit distribution in certain circumstances. Given that the profit-sharing provision is intended to prevent a tax deferral, a flow-through fund is deemed to meet the requirement of the actual profit distribution if at least three-quarters of the fund's profits are considered distributed, or those profits are taken into account in the taxation of the unit-holders as actually distributed income (C-156/17, Köln-Aktienfonds Deka).

Also, the unitholders of the special investment fund must be professional investors or comparable high net worth individuals as referred to in Chapter 16a section 4 of the AIFM Act.

The ‘professional investors or comparable high net worth individuals’ referred to in Chapter 16a section 4 of the AIFM Act refer to the concept of ‘professional client’ defined in the AIFM Act, which is equivalent to the group defined in Chapter 1 section 23 of the Act on Investment Services (747/2012), to which the concept of ‘professional investor’ in Chapter 1 section 2(1)31 is also equivalent. A high net worth individual comparable to a professional investor is defined in Regulation (EU) No 345/2013 of the European Parliament and of the Council on European venture capital funds and in Regulation (EU) No 346/2013 of the European Parliament and of the Council on European social entrepreneurship funds (high net worth individuals).

For a special investment fund registered outside the EEA to be tax-exempt, not only the criteria specified in section 20a(1) of the Income Tax Act must be fulfilled, but also the special criteria referred to in section 20a(5) of the same Act must be satisfied (see subsection 3.4.4 in this document for more details).

3.4.3 Criteria for tax exemption for a foreign real estate investment fund

The criteria for tax exemption for special investment funds investing mainly in real estate or real estate securities differ from the criteria for other special investment funds. The provisions on tax-exempt status for special investment funds in section 20a(2–3) of the Income Tax Act shall not apply to real estate investment funds; instead, tax exemption for the latter is provided for in section 20a(4) of the Income Tax Act.

Under section 20a(4) of the Income Tax Act, a foreign contractual special investment fund equivalent to a special investment fund as referred to in Chapter 2 section 1(2) of the AIFM Act which invests its assets primarily in real estate and real estate securities as referred to in Chapter 16a section 4 of said Act, shall be exempt from income tax if the fund distributes annually at least three quarters of its profits to its unitholders, excluding unrealised appreciation.

It is a requirement for tax-exempt status that such a foreign contractual special investment fund is equivalent to a special investment fund as defined in the AIFM Act. The equivalence specified as a criterion for tax exemption under section 20a(4) of the Income Tax Act means that the foreign special investment fund in question must have been established essentially in the manner specified in the AIFM Act and is operating in a manner essentially consistent with the AIFM Act.

A real estate investment fund as referred to in Chapter 16a section 4 of the AIFM Act means a special investment fund which invests its assets primarily in real estate and real estate securities. Chapter 16a section 6 of the AIFM Act provides for how the assets of a special investment fund should be invested. Under that provision, a special investment fund which invests its assets primarily in real estate and real estate securities shall comply with the provisions in Chapters 3 and 4 of the Real Estate Funds Act on the investment of assets in a real estate fund, on borrowing, on asset appreciation and valuation, and on chartered surveyors and real estate valuation. In section 1 of the Real Estate Funds Act, a real estate fund is defined as an operation where a company invests assets received from members of the public primarily in real estate and real estate securities for purposes other than construction or property development.

Section 20a(4) of the Income Tax Act makes reference to a special investment fund investing in real estate and real estate securities as referred to in Chapter 16a section 4 of the AIFM Act. Chapter 16a section 4 of the AIFM Act contains the provisions regarding minimum capital and specifies the situations when a special investment fund is considered to be open-ended. It follows that for a real estate investment fund to be tax-exempt it must by default be open to the public. This criterion is considered to be satisfied if a real estate investment fund has 30 or more unitholders. By derogation from the above, a real estate investment fund shall be considered to satisfy the criteria for tax-exempt status when it has 10 or more unitholders if its fund rules specify that each unitholder must subscribe to fund units to a value of at least EUR 1 million. If a special investment fund has fewer than 30 unitholders, in order to be tax-exempt it must also satisfy the criterion of the unitholders being professional clients or comparable high net worth individuals (see subsection 3.4.2 in this document for more details). If even one of the unitholders in a real estate investment fund has subscribed to fund units to a value of less than EUR 1 million, then in order to be tax-exempt the fund must have 30 or more unitholders.

The contractual nature specified as a criterion for tax exemption means that the real estate investment fund in question must have been established as a contractual arrangement and must comprise an aggregate of separate assets that do not have legal personality (for more on the contractual requirement for tax exemption, see subsection 3.4.2 in this document). In practice, AIFs pursuant to the AIFM Directive that invest in real estate may be set up as an investment company with variable capital, as a contractual arrangement or in some other legal form. Also, there may be AIFs that deviate from the provisions of both the AIFM Directive and the AIFM Act, particularly in third countries.

The provision in section 20a of the Income Tax Act requires special investment funds to be contractual arrangements, and investment companies, for instance, do not qualify. As an example, in past taxation practice German Sondervermögen contractual real estate investment funds, have been considered to satisfy the legal form criterion for funds (see e.g. Central Tax Board advance ruling KVL 2019/48 (not final)).

The requirement for profit distribution in each financial year is an actual requirement to qualify for tax exemption. A special investment fund must therefore distribute annually at least three quarters of its profits for the financial year to its unitholders, excluding unrealised appreciation. However, there may be exceptions to the requirement of profit distribution in certain circumstances. Given that the profit-sharing provision is intended to prevent a tax deferral, a flow-through fund is deemed to meet the requirement of the actual profit distribution if at least three-quarters of the fund's profits are considered distributed, or those profits are taken into account in the taxation of unit-holders as actually distributed income (C-156/17, Köln-Aktienfonds Deka).

For a real estate investment fund registered outside the EEA to be tax-exempt, not only the criteria specified in section 20a(1) of the Income Tax Act but also the special criteria referred to in section 20a(5) of the same Act must be satisfied (see subsection 3.4.4 in this document for more details).

Income from real estate or real estate securities shall be taxed in accordance with the Act on Assessment Procedure (1558/1995). If taxation is carried out as per the Act on Assessment Procedure, it shall be based on a tax return filed by the taxpayer, i.e. the recipient of said income.

If a foreign real estate investment fund is regarded to be a tax-exempt real estate investment fund as referred to in section 20a(4) of the Income Tax Act, the fund shall not be obliged to file a tax return on income that it has gained from real estate or real estate securities in Finland. However, pursuant to section 3(10) of the Act on the Taxation of Nonresidents’ Income, such a real estate investment fund does have an obligation to provide evidence of compliance for the requirements for tax exemption in section 20a of the Income Tax Act.

3.4.4 Special requirements for funds not registered in the EEA

Under section 20a(5) of the Income Tax Act, for a foreign investment fund or foreign special investment fund registered outside the European Economic Area to qualify for tax exemption, it must satisfy the following requirements in addition to what is provided in section 20a of the Income Tax Act:

- Finland must have an agreement on the exchange of information on tax matters with the country of registration, and the country of registration must be able to provide sufficient information for tax assessment and for verifying the correctness of taxation; and

- The fund must have been established pursuant to UCITS-directive equivalent legislation in the country of registration in the case of a foreign investment fund, or the fund must have been established pursuant to the legislation in the country of registration equivalent to the AIFM Act and/or the AIFM Directive in the case of a foreign special investment fund.

The ability to obtain information as referred to in section 20a(5) of the Income Tax Act means, despite the difference in wording, the same as ‘sufficient information exchange’ in section 3(2)2 of the Act on the Taxation of Shareholders in Controlled Foreign Companies (1217/1994) (see Government proposal HE 304/2018 p. 54–55).

Sufficient information exchange for the purposes of the aforementioned obtaining of information may be satisfied by the Tax Administration being able to request the information required from the country of registration of a foreign investment fund.

Exchange of data volumes by automatic information exchange is not sufficient to satisfy the information exchange requirement. The information exchange requirement is only satisfied if an agreement has been made with the country of registration of a foreign investment fund concerning, at a minimum, the exchange of information on request, on the basis of which it is actually possible to receive information on individual cases, and if such an agreement is enforced. It is also required that there must be no restrictions imposed on information exchange by the national legislation of the country of registration of such a fund. Information exchange may be agreed upon in a tax treaty equivalent in scope to the OECD Model Tax Convention on Income and on Capital. Sufficient information exchange may also have been agreed on by implementing the OECD Convention on Mutual Administrative Assistance in Tax Matters. Additionally, with certain countries Finland has more limited agreements in place concerning inter alia the exchange of tax information, and sufficient information exchange may have been agreed upon in these. To satisfy the requirement of sufficient information exchange, it is not enough to have an agreement in place; information exchange must also actually happen. In other words, sufficient information exchange must be possible and the Tax Administration must be actually able to request the information required from the country of registration of a foreign investment fund.

Information exchange is not considered to have happened before the enforcement of an agreement on information exchange has begun. If the information exchange requirement is satisfied at the beginning of a taxpayer’s tax year or at any time later in the tax year, the requirement is considered to have been satisfied for the entire tax year. If any circumstances emerge in the course of a tax year leading to the requirement for sufficient information exchange no longer being satisfied, this shall have no impact on the taxpayer’s taxation in the current tax year, only in the following tax year.

For the purpose of the information exchange mandated in the Act on the Taxation of Shareholders in Controlled Foreign Companies, the Tax Administration maintains a list of the jurisdictions for which the information exchange requirement is satisfied. For the jurisdictions on the list, either there is an agreement in place that satisfies the information exchange requirement in section 20a(5) of the Income Tax Act, or information exchange is considered to be otherwise sufficiently provided for. Also, the jurisdictions on the list satisfy the requirement of actual information exchange. The list is available at Laki ulkomaisten väliyhteisöjen osakkaiden verotuksesta, valkoinen lista (only available in Finnish and Swedish).

In addition to the information exchange requirement, for a foreign investment fund registered outside the EEA to qualify for tax exemption it must have been established pursuant to UCITS-directive equivalent legislation of its country of registration.

For a foreign special investment fund registered outside the EEA to qualify for tax exemption, it must have been established pursuant to the legislation in its country of registration equivalent to the AIFM Act. ‘Equivalent’ here means that the legislation on special investment funds in the country of registration must be essentially similar to the provisions of the Finnish AIFM Act and/or the AIFM Directive.

3.4.5 Foreign investment funds, special investment funds and real estate investment funds that do not qualify for tax exemption

If a foreign investment fund or a foreign special investment fund does not satisfy the criteria for tax exemption given in section 20a of the Income Tax Act, the fund shall have a limited tax liability for income earned in Finland. Here, too, it is essential to determine to which kind of Finnish operator the foreign investment fund or foreign special investment fund is equivalent. An investment fund may resemble a Finnish limited liability company or corporation in its legal form, or it may be contractual yet fail to satisfy the criteria in section 20a of the Income Tax Act. In these cases, any income earned in Finland, such as dividends, shall be taxed according to the tax provisions on the income and legal form in question, taking into account the provisions of any applicable tax treaties and EU law (Supreme Administrative Court decisions KHO 2010:15, KHO 2015:9).

Taxation of the income earned in Finland by a person with limited tax liability is provided for in the Act on Taxation of Nonresidents’ Income. State tax and municipal income tax of a person with a limited tax liability are collected as a final tax withheld at the income source (source tax) or levied as per the Act on Assessment Procedure. According to section 3(1) of the Act on Taxation of Nonresidents´ Income, tax-at-source shall be paid inter alia on dividends.

If a foreign investment fund is equated with a Finnish limited liability company or contractual fund yet fails to satisfy the criteria given in section 20a of the Income Tax Act, the corporate tax-at-source rate (20%) will by default be applied to dividend income earned by the fund in Finland. This rate may, however, be decreased by provisions in a tax treaty, or the collection of the tax may be prevented by the provisions of section 3(5–6) of the Act on Taxation of Nonresidents’ Income, if the relevant criteria are satisfied.

An investment fund that does not qualify for tax exemption as per section 20a of the Income Tax Act but may be considered to be equivalent to a corporate entity as referred to in section 3(1)4 of the Income Tax Act may thus be tax-exempt for dividend income similarly to a Finnish corporate entity pursuant to section 6a of the Act on the Taxation of Profits and Income from Business Activity (360/1968), provided that the criteria given in section 3(5) of the Act on the Taxation of Nonresidents’ Income are satisfied. The factors determining whether the dividend income is tax-exempt include whether the corporation paying out the dividend is a publicly traded corporation or not and whether the units or shares in the investment fund receiving the dividend is operating in a regulated market.

An investment fund that fails to qualify for tax exemption as per section 20a of the Income Tax Act but may be considered to be equivalent to a corporate entity as referred to in section 3(1)4 of the Income Tax Act may also be earning income from real estate or real estate securities as referred to in section 10(1)1 or 10(1)10 of the Income Tax Act. The tax treatment of such income shall be determined according to the general provisions of the Act on the Taxation of Profits and Income from Business Activity, taking into account any relevant tax treaty provisions. The income referred to in section 10(1)1 and section 10(1)11 of the Income Tax Act shall be taxed as per the Act on Assessment Procedure. If taxation is carried out as per the Act on Assessment Procedure, the taxpayer shall file a tax return in Finland on the basis of which said taxation shall be carried out.

For example, a foreign investment fund whose closest Finnish equivalent is a limited partnership is generally considered a flow-through fund. For a foreign investment fund considered to be a flow-through fund, any income earned in Finland under section 10 of the Income Tax Act shall be taxed as unitholders’ income. Unitholder taxation is affected inter alia by the legal form of the unitholder, i.e. whether a unitholder may be considered equivalent to a Finnish investment fund or limited liability company or is a natural person.

The legislation of the country of registration of the fund, the applicable tax treaty and any interpretative governance deriving from EU legislation also affect the taxation of income earned in Finland by a foreign investment fund considered equivalent to a limited partnership. Therefore, the taxation of investment funds equivalent to a limited partnership also depends on whether the fund is considered a separate taxpayer in its country of registration and pursuant to a tax treaty and, among other things, whether the beneficial owner(s) of the dividend income in question is the investment fund itself or its unitholders.

Example 1. A foreign investment fund is a unit trust with independent legal personality. The investment fund was established pursuant to corporate law. The investment fund is closed-ended and has more than 30 unitholders. The investment fund does not satisfy the criteria for legal form or the requirement of being open-ended given in section 20a(1) of the Income Tax Act and thus does not qualify for tax exemption. The investment fund is considered equivalent to a limited liability company as referred to in section 3(1)4 of the Income Tax Act. The investment fund is not tax exempt pursuant to section 20a of the Income Tax Act. The fund is a taxpayer with limited tax liability for dividend income earned in Finland. The tax treatment of said dividend income shall be determined according to section 3(5–6) of the Act on the Taxation of Nonresidents’ Income. A tax treaty in place between Finland and the country of residence of the investment fund may decrease the amount of tax-at-source to be deducted.

Example 2. A foreign special investment fund is a contractual arrangement without legal personality. The special investment fund is closed-ended and has 33 unitholders. Because the special investment fund is closed-ended, it must satisfy the criteria given in section 20a(3) of the Income Tax Act to quality for tax exemption. The special investment fund is a flow-through fund, whose annual profit distribution for the financial year are taken into account in the taxation of unit-holders as actually distributed profits. The special investment fund provides the clarification to Finnish Tax Administration required in the section 3 (10) of the Act on the Taxation of Nonresidents´ income which includes the documentation of the provisions of the national tax legislation of the country which the fund is domiciled. The fund demonstrates in its clarification that at least three-quarters of the profit distribution for the financial year is considered distributed, and the profit are take into account in the taxation of unit-holders as actually distributed income. In its clarification, the special investment fund has demonstrated that it is in a comparable situation compared to a domestic investment fund. The special investment fund is a tax-exempt special investment fund pursuant to section 20a(3) of the Income Tax Act and is equivalent to a special investment fund pursuant to section 3(4) of the Income Tax Act.

4 Derogation to the requirement on the number of unitholders

The number of unitholders in an investment fund or special investment fund may be fewer than 30, which is given as the minimum for qualifying for tax exemption in section 20a(1–2) of the Income Tax Act, immediately after the fund is newly established or at other times on a temporary basis. Derogations to the requirement on the number of unitholders have been enacted to address such situations (Income Tax Act, section 20a(6)). Under this provision, tax exemption as provided for in section 20a(1–2) of the Income Tax Act shall also apply to:

- a newly established investment fund or special investment fund where the requirement of 30 or more unitholders has not yet been satisfied during the first year of operations and which was not created through a merger or demerger;

- an investment fund or special investment fund where the number of unitholders has temporarily fallen below 30, provided that the fund unit manager has undertaken the measures referred to in Chapter 19 section 7 of the Act on Investment Funds to rectify the situation, or if the fund is dissolved.

These derogations shall only apply to the requirement for a minimum number of unitholders. In other words, an investment fund or special investment fund that has fewer than 30 unitholders when newly established or on a temporary basis must satisfy all other criteria given in section 20a(1–2) of the Income Tax Act to quality for tax exemption.

The first paragraph, concerning newly established investment funds and special investment funds, shall only apply in cases where the fund genuinely is a newly established fund and not to funds created through a merger or demerger. Also, the derogation shall only apply to the first year of operations of such a fund.

The second paragraph applies to a situation where the number of unitholders in an investment fund or special investment fund has temporarily fallen below 30. This provision refers to Chapter 19 section 7 of the Act on Investment Funds, which also applies to special investment funds pursuant to the reference provision in Chapter 16a section 1 of the AIFM Act. Under Chapter 19 section 7 of the Act on Investment Funds, a fund shall have 90 days in which to rectify the situation if the number of unitholders in the fund falls below 30. Under Chapter 10 section 6(2) of the Act on Investment Funds, this period shall be calculated from the time when the minimum requirement ceased to be satisfied.

If the fund can rectify the situation within the prescribed time, the fund shall be considered to have satisfied the requirement for the minimum number of unitholders also for the period when there were actually fewer than 30 unitholders. By contrast, if the fund fails to rectify the situation within the prescribed time, the Act on Investment Funds prescribes that action must be taken to merge or dissolve the fund. In such a situation, the fund shall be considered to satisfy the requirement for the minimum number of unitholders up until the time of its merger, if the merger leads to a situation where the combined number of unitholders in the receiving and merging funds is 30 or more. If the fund is dissolved instead, the fund shall be considered to satisfy the requirement for the minimum number of unitholders up until the time of its dissolution.

The same principles shall also apply to foreign investment funds if the fund unit manager has undertaken measures equivalent to those referred to in Chapter 19 section 7 of the Act on Investment Funds when the number of unitholders falls below 30.

5 Sub-fund structures

A sub-fund is a subdivision of an investment fund whose investments may differ from those of other sub-funds in the same investment fund and from the general investment policy of the investment fund, as described in the rules of the investment fund. A structure known as an ‘umbrella fund’, where an investment fund consists of dozens or even hundreds of sub-funds, is permissible in several EU Member States within either an investment company with variable capital or a contractual common fund. Umbrella funds of the unit trust form can be established for instance in the USA. In an umbrella fund, an investor subscribes directly to units in the sub-fund(s) of their choice, and in many cases to a specific series of units within a sub-fund.

The taxation of sub-fund structures is provided for in section 20a(7) of the Income Tax Act. Under this provision, where an investment fund or special investment fund consists of one or more sub-funds, the sub-funds shall be subject to the provisions on investment funds and special investment funds given in section 20a(1–6) of the Income Tax Act. Therefore all of the above in this document concerning investment funds, special investment funds and real estate investment funds shall apply to sub-funds according to which type of fund any given sub-fund may be equated to. Tax exemption as per section 20a of the Income Tax Act shall not apply to a sub-fund that is not contractual.

The structure formed by the ‘principal’ umbrella fund and its sub-funds shall by default be considered as a single legal entity. The legal form of the principal fund shall by default determine the legal form of its sub-funds. If the principal fund is considered a contractual arrangement pursuant to section 20a of the Income Tax Act, its sub-funds shall be similarly considered a contractual arrangement if the sub-fund is of the same legal form as the principal fund.

In case law, a SICAV fund has been equated with a Finnish limited liability company, which has legal personality (Supreme Administrative Court decision KHO 2010:15). If the principal fund is a SICAV fund and therefore a legal person under corporate law, its sub-funds cannot be considered contractual arrangements. An investment fund that is a sub-fund of a principal fund must satisfy the criteria given in section 20a(1) of the Income Tax Act to qualify for tax exemption. Specifically, each sub-fund must separately satisfy the criteria for tax exemption in section 20a of the Income Tax Act.

6 Obligation of a foreign investment fund to provide evidence of compliance and documentation

6.1 Disclosure obligation as per section 3(10) of the Act on the Taxation of Nonresidents’ Income

Section 3(10) of the Act on the Taxation of Nonresidents’ Income and Capital includes a provision on the obligation of the taxpayer to provide evidence of compliance. Under this provision, tax-at-source shall not be levied on dividends paid to a foreign contractual investment fund that is equivalent to a Finnish investment fund or special investment fund and qualifies for tax exemption under section 20a of the Income Tax Act. Under this provision, the exemption from income tax on dividends earned is contingent on the dividend recipient submitting evidence of compliance to the Tax Administration explaining how the criteria for tax exemption are satisfied. The burden of proof thus rests with the taxpayer. The obligation to provide information applies to applications for tax-at-source refunds and for tax-at-source tax cards, and to applications for an advance ruling pursuant to section 85 of the Act on Assessment Procedure (875/2012), in connection with which it will be resolved whether the applicant qualifies for tax exemption.

Information may be provided in Finnish, Swedish or English. In addition to the above, funds must also comply with other obligations to provide documentation regarding applications for tax-at-source refunds, tax cards or advance rulings. The other documentation and appendices required are described in detail in the instructions for filling out the application forms.

Forms related to this guideline

Cover page for advance ruling, special permit or guidance application (7300e)

6.2 Content of the documentation

Section 3(10) of the Act on the Taxation of Nonresidents’ Income and Capital provides for the taxpayer’s obligation to provide information, meaning that the taxpayer must submit a report on the legal and operational characteristics of an investment fund that are relevant for qualifying for tax exemption under section 20a of the Income Tax Act. The actual content of the obligation to provide evidence of compliance shall be determined according to the criteria given in section 20a(1–7) of the Income Tax Act. The criteria given in each of these subsections are minimum requirements; the Tax Administration may request a further clarification for the purpose of resolving the matter. In addition to information pertaining to the criteria given in the aforementioned provisions, an investment fund, a special investment fund, a real estate investment fund and each of their sub-funds shall submit to the Tax Administration the financial statements for the tax year in which dividends or other income earned in Finland was received, or the financial statements for the year before that if the financial statements for the tax year in question are not yet completed. If the fund does not have available the financial statements for the tax year that the decision will concern, the fund must nevertheless be able reliably to verify any and all information that is relevant for resolving the matter.

A foreign investment fund shall demonstrate that it qualifies for tax exemption as per section 20a(1) of the Income Tax Act by submitting to the Tax Administration an evidence of compliance on:

- the legal form of the fund, including a description of the national legislation pertaining to investment funds in the country of registration of the fund, its instrument of incorporation and a description of the relationship between the asset management company and the unitholders; and

- the open-ended nature of the fund and its number of unitholders, including the rules of the fund and a fund prospectus concerning the year in which the dividends were paid or the year before that.

A foreign special investment fund shall demonstrate that it qualifies for tax exemption as per section 20a(2–3) of the Income Tax Act by submitting to the Tax Administration an evidence of compliance on:

- the legal form of the fund, including a description of the national legislation pertaining to special investment funds in the country of registration of the fund, its instrument of incorporation and a description of the relationship between the asset management company and the unitholders;

- the open-ended nature of the fund and its number of unitholders, including the rules of the fund and a fund prospectus concerning the year in which the dividends were paid or the year before that; and

- in cases where subsection 3 applies, annual profit distribution for the financial year, minimum capital and whether the unitholders are professional investors, including the rules of the fund and a fund prospectus, and annual financial statements from the tax year in question and/or the previous tax year.

A foreign special investment fund shall demonstrate that it satisfies the annual profit distribution requirement given in section 20a(3)1 (and section 20a(4)) of the Income Tax Act by submitting to the Tax Administration an evidence of compliance on:

- profit distribution by financial year, including the rules of the fund and a fund prospectus, and annual financial statements from the tax year in question and/or the previous tax year, showing actual profit distribution by financial year; and

- a calculation showing the actual profit distribution of the fund by financial year, showing the realised profits of the fund for the financial year and the profits distributed by the fund to its unitholders. The calculation must also demonstrate that the fund has distributed annually at least three quarters of its profits for the financial year to its unitholders, excluding unrealised appreciation.

A flow-through fund, whose actual profit distribution is less than three-quarters of the profit distribution for the financial year, must demonstrate that the requirement for profit distribution is met by explaining the national tax legislation of the country in which the fund is domiciled. This explanation must reference how at least three-quarters of the profit distribution for the financial year is considered distributed, or how those profits are taken into account in the taxation of unit-holders as actually distributed income. In the documentation, the fund must essentially be able to demonstrate that it is in a comparable situation to a domestic investment fund as a result of its national legislation.

If the fund has not yet actually distributed any profits for the financial year at the time when it applies for a tax-at-source tax card or an advance ruling, the fund must nevertheless present a reliable description, based on documents prepared by the fund, the rules of fund and the national legislation of the country of registration, that in the financial year the fund will in fact distribute annually at least three quarters of its profits for the financial year, excluding unrealised appreciation. The fund must also be able to demonstrate after the fact that it has actually distributed annual profits to its unitholders as required in the legislation.

A foreign real estate investment fund shall demonstrate that it qualifies for tax exemption as per section 20a(4) of the Income Tax Act by submitting to the Tax Administration an evidence of compliance on:

- the legal form of the fund, including a description of the national legislation pertaining to special investment funds in the country of registration of the fund, its instrument of incorporation and a description of the relationship between the fund company and the unitholders;

- annual profit distribution by financial year (see above concerning the requirements for providing information concerning annual profit distribution as referred to in section 20a(3) of the Income Tax Act); and

- minimum capital, the number of unitholders, the amount of capital subscribed by each unitholder and whether the unitholders are professional investors, including the rules of the fund and a fund prospectus, and annual financial statements from the tax year in question and/or the previous tax year.

An investment fund or special investment fund registered outside the EEA and applying for tax exemption pursuant to section 20a of the Income Tax Act shall demonstrate that it qualifies for tax exemption as per section 20a(5) of the Income Tax Act by submitting to the Tax Administration an evidence of compliance on:

- Finland having an agreement on the exchange of information on tax matters with the country of registration, and the country of registration is able to provide sufficient information for tax assessment and for verifying the correctness of taxation, for example by demonstrating that the country of registration is on the so called ‘whitelist’ (for details, see subsection 3.3.4 in this document);

- (for an investment fund) that the investment fund was established pursuant to UCITS directive equivalent legislation in the country of registration: the report must include the instrument of incorporation of the fund, the rules of the fund and a description of the legislation on UCITS equivalent investment funds in the country of registration and how this legislation applies to the investment fund, and the equivalence of the legislation on UCITSs in the country of registration to the provisions of the UCITS Directive; and

- (for a special investment fund) that the special investment fund was established pursuant to legislation in the country of registration equivalent to the AIFM Act: the report must include the instrument of incorporation of the fund, the rules of the fund and a description of the legislation in the country of registration equivalent to the AIFM Act and/or AIFM Directive and how this legislation applies to the fund.

The documentation on the equivalence of relevant legislation in the country of registration shall include a list of items of legislation and regulation concerning investment funds or special investment funds, a brief summary of the content of said legislation and a link to the online statute book of the country of registration (in English), if available. The documentation may be appended to the application for a tax-at-source refund, a tax-at-source tax card or an advance ruling.

A newly established investment fund or special investment fund that has not satisfied the requirement for the minimum number of unitholders during its first year of operations must submit a report on how it satisfies the criteria for tax exemption in section 20a(6) of the Income Tax Act. For this reason, a newly established investment fund or special investment fund must submit to the Tax Administration, among other documentation, an evidence of compliance on:

- the number of unitholders, including the rules of the fund and a fund prospectus for the year when the dividend or other income earned in Finland was paid, and the number of unitholders at the end of the first year of operations; and

- the establishment of the fund, including the instrument of incorporation of the fund and the rules of the fund, demonstrating that the fund was not created through a merger or a demerger.

Newly established investment funds and special investment funds must satisfy the requirement for a minimum of 30 unitholders provided for in section 20a(1–2) of the Income Tax Act in the year after their establishment (second year of operations). However, such funds must also submit a documentation on the number of unitholders for the first year of operations and a report on satisfying the requirement for the minimum number of unitholders in the second year of operations.

The derogation provided for in section 20a(6)2 of the Income Tax Act applies to situations where the number of unitholders is lower than 30 immediately after establishment or has fallen below 30 on a temporary basis. In such a situation, foreign investment funds and special investment funds must submit a report to the Tax Administration on:

- the number of fund unitholders in the tax year in which their number temporarily fell below 30 and the fact that the fund unit manager has rectified the situation within 90 days by employing measures equivalent to those required in the Act on Investment Funds (see section 4 in this document); or

- the fund unit manager of the fund having taken the measures referred to in Chapter 19 section 7 of the Act on Investment Funds, as specified in section 6(2), if the fund unit manager did not manage to rectify the situation within 90 days. The latter report must describe the measures to be taken to merge or dissolve the fund (see section 4 in this document).

In addition to information on qualifying for tax exemption as per section 20a(1–6) of the Income Tax Act, the sub-fund(s) must submit an evidence of compliance to the Tax Administration on: