If you are an operator of trade or business (T:mi), an agricultural/forestry operator, select Manage your tax matters in MyTax. When you start with Manage your tax matters, you can access all your tax affairs. Read more: New in MyTax

This is an English translation. The official instruction is available in Finnish (Arvonlisäveroton vähäinen toiminta VH/1581/00.01.00/2024) and Swedish (Momsfri verksamhet i liten skala VH/1581/00.01.00/2024). In case of divergence of interpretation, the versions in the two national languages will prevail.

These instructions discuss the EUR 20,000 turnover threshold for small-scale business activity in Finland and the EUR 100,000 threshold applied to Union-wide annual turnover. In addition, these instructions cover the new EU VAT scheme for small-scale businesses that entered into force on 1 January 2025.

These instructions replace the previous guideline ‘The limit for a VAT-exempt small-scale business is EUR 15,000’. The most significant changes concern the turnover threshold in euros, threshold appraisals looking at the entire calendar year instead of the accounting year, consideration given also to the preceding calendar year’s turnover, the elimination of the present VAT relief for small businesses, and the start date of tax liability.

Foreword

1.1 Background

The VAT exemption scheme for small businesses was harmonised and updated in the EU from the beginning of 2025. The amendment is based on the SME Directive adopted in 2020 (Council Directive (EU) 2020/285) and the amendment to Regulation (EU) No 904/2010.

At the same time, the threshold for VAT liability was increased to EUR 20,000.

The key changes applied from the beginning of 2025 were as follows:

- The method of threshold appraisals changed. In the future, threshold appraisals will always target the turnover of the entire calendar year instead of the accounting year. In addition, turnover shall be indicated for both the current and previous calendar year.

- The starting point of VAT liability changed. The start date for VAT liability is the date on which the threshold for VAT liability is exceeded.

- The VAT relief for small business was abolished. This meant eliminating the tax relief for companies whose turnover for the accounting year was below EUR 30,000.

- The EU VAT scheme for small-scale businesses was adopted. The most significant change for companies engaging in international business was that the new scheme allows the VAT exemption for small businesses offered by one EU country to be extended to business conducted even in other EU countries. Companies wishing to benefit from the VAT exemption in other EU countries must register for the new EU VAT scheme for small-scale businesses.

- The possibility of companies established outside the EU to apply the VAT exemption for small businesses in Finland was eliminated. The VAT exemption cannot be applied even if the company would have a permanent establishment in Finland.

The new VAT guidelines concern all small businesses regardless of their type or legal form. Therefore, the VAT exemption for small businesses may be applied to, for example, companies, associations, foundations, and cooperatives. However, the VAT exemption does not apply to wellbeing services counties or municipalities. These instructions discuss the limits of small-scale business activities and the EU VAT scheme for small-scale businesses mainly from the perspective of small Finnish companies.

The countries and areas belonging to the EU VAT territory are listed on the Vero.fi website: EU VAT and excise duty area (available in Finnish and Swedish).

2 The Finnish threshold for small-scale business is EUR 20,000

2.1 Small-scale business activities

The scale of business activities is determined on the basis of turnover. A seller is not liable to pay VAT if the turnover of the current calendar year and the previous calendar year, as referred to in the Value Added Tax Act, does not exceed EUR 20,000, and the seller has not registered for VAT voluntarily.

Example 1:

A company’s turnover for the previous calendar year was EUR 17,000. The company does not need to register for VAT, as long as the limit of EUR 20,000 is not exceeded during the current calendar year. However, if the company were to exceed the threshold at some point during the calendar year, the company would be required to register for VAT starting from the date on which the threshold was exceeded.

The seller must monitor the turnover of two consecutive years, meaning the turnover of the current and previous calendar years. This means that it is not possible to leave the VAT register as soon as the turnover falls below the threshold for small-scale business activities.

Example 2:

A company’s turnover in 2024 was EUR 22,000. The company has registered for VAT. Although the company’s turnover would decrease to EUR 18,000 in 2025, the company may leave the VAT register on the grounds of small-scale business activities at the earliest on 1 January 2026.

Threshold appraisals will be carried out on the basis of two consecutive calendar years. If the seller's 12-month accounting year is not the calendar year, the turnover for the calendar year is calculated by combining the turnover of the different accounting years accordingly. If the accounting year is longer than 12 months, only the turnover falling within the calendar year period is taken into account in the appraisal.

Example 3:

The company’s accounting year runs from 1 January 2025 to 30 June 2026. Only the turnover belonging to the calendar year 2025 is included in the turnover for 2025. In other words, only the turnover for the period from 1 January 2025 to 31 December 2025 is included in the turnover for 2025.

Example 4:

The company has a non-calendar accounting year from 1 July to 30 June. The turnover for 2025 is calculated based on the accounting periods 1 July 2024–30 June 2025 and 1 July 2025–30 June 2026 by including only the turnover accrued in the year 2025. In other words, only the turnover for the period from 1 January 2025 to 31 December 2025 is included in the turnover for 2025.

2.2 Sales included in turnover

When assessing the turnover for a calendar year, consideration shall be given to the taxable sales of goods and services referred to in the Value Added Tax Act, sales subject to the reverse charge procedure (sections 8a–8d of the Value Added Tax Act), and the following sales determined as tax-exempt under the Value Added Tax Act:

- sales of goods to other EU countries (intra-Community sales of goods, sections 72a–72c of the Value Added Tax Act), including also transfers of own goods handled as intra-Community sales;

- export sales (section 70 of the Value Added Tax Act);

- tax-free sales to travellers (section 70 b of the Value Added Tax Act);

- sales of tax-exempt services (sections 71 and 72 of the Value Added Tax Act);

- sales of tax-exempt vessels and work on similar vessels (section 58 of the Value Added Tax Act);

- sale of an edition of a newspaper or periodical, published at least four times a year, to a corporation for promoting the public good (section 56 of the Value Added Tax Act);

- tax-exempt sales to embassies, international organisations, defence forces of states belonging to the North Atlantic Treaty Organization, and defence forces of EU Member States (section 72 d of the Value Added Tax Act);

- tax-exempt sales of motor vehicles (section 72 e of the Value Added Tax Act);

- sales of financial services and insurance services (sections 41 and 44 of the Value Added Tax Act);

- transfer of immovable property or rights thereto;

- certain sales to the European Commission or to an agency or body established by the European Union in response to the COVID-19 pandemic (section 38d of the Value Added Tax Act).

In value-added taxation, the concept of immovable property, or real estate, covers not only land but also buildings, permanent structures and their components. Thus, VAT-exempt transfers of immovable property or rights thereto also include the sales and rentals of apartments. Moreover, the concept of immovable property also covers machinery, equipment and components thereof that serve a specific purpose at the property site and are permanently installed in a building or structure and cannot be moved without amending or damaging the building or structure (see Concept of real estate for VAT purposes as of 1 January 2017, available in Finnish and Swedish).

Although no VAT is payable on the tax-exempt sales listed above, they are included in the appraisals concerning the EUR 20,000 turnover threshold.

Example 5:

The turnover of a Finnish company from domestic sales of goods is EUR 10,000 per calendar year.

In addition, the company’s VAT-exempt export sales of goods (section 70 of the Value Added Tax Act) from Finland to Norway total EUR 15,000 per calendar year. According to the provisions on the country of supply, export sales in which the transport of goods to Norway starts in Finland are conducted in Finland. The export sales are included in the company’s turnover, which means that the total turnover to be taken into account is EUR 25,000.

The company cannot apply the VAT exemption for small businesses in Finland because its Finnish turnover exceeds the threshold for small-scale business activities. The company must be registered for VAT.

Turnover for the calendar year is calculated on the basis of the tax-exempt value of sales. The tax-exempt value refers to the contractual price agreed between the seller and the buyer which does not include VAT payable on the sales in question.

When calculating the amount of turnover, the following shall not be taken into account:

- the selling prices of financial and insurance services of an ancillary nature, and

- the sales of fixed assets.

In Finland, turnover does not include sales which, according to the provisions on the place of supply included in the Value Added Tax Act, are not conducted in Finland.

Example 6:

A Finnish company sells consulting services to taxable persons established both in Finland and abroad. Under the so-called general provision (section 65) of the Value Added Tax Act, the country of supply of the consulting service is determined on the basis of the Member State of establishment of the taxable person acting as the buyer.

The company’s sales in Finland during the calendar year total EUR 18,000. The company had a similar turnover in the previous accounting year. The company’s sales to businesses established in other EU Member States amount to EUR 7,000 per calendar year, and the sales to businesses established outside the EU area total EUR 5,000 per calendar year. The company only sells goods and services abroad to taxable persons.

The company’s turnover in Finland is EUR 18,000. The company may apply the VAT exemption for small-scale businesses in Finland.

Links to instructions covering the provisions on the country of supply are listed in section 3.4.

Only sales are included in turnover. For example, intra-community acquisitions are not included in turnover. For more information on intra-community acquisitions, see the instructions Value added taxation in the EU sales of goods (available in Finnish and Swedish).

2.3 Exceeding the threshold in Finland

When a seller notices that the turnover threshold of EUR 20,000 is exceeded, they must apply for VAT registration in Finland. The start date for registration is the day when the threshold was exceeded.

The obligation to pay VAT begins on the date when the turnover threshold is exceeded. All sales exceeding the threshold are subject to VAT.

Example 7:

A company only sells services in Finland. The company has not registered for VAT due to its low turnover. However, in November 2025 the entrepreneur notices that the total turnover for 2025 is EUR 19,800.

The next service charge in November is EUR 210, which means that the threshold of EUR 20,000 will be exceeded. The company must be registered for VAT starting from the date on which the limit is exceeded. All sales exceeding the turnover threshold (EUR 210) must be treated as subject to VAT.

Companies are required to actively monitor their turnover, and if the threshold is exceeded, they must submit an application for VAT registration to the Tax Administration well in advance.

2.4 Voluntary VAT registration in Finland

In Finland, companies have the option to register for VAT voluntarily even if their turnover does not reach the annual threshold of EUR 20,000. To qualify for VAT, the company activities must take place in the conduct of business. Activities taking place in the conduct of business are defined as continuous, outward-focused and independent activities which involve a normal entrepreneurial risk and are intended to earn a profit. A company that has voluntarily applied for VAT is referred to as a VAT applicant. VAT applicants pay VAT on all sales made in the conduct of business.

You can apply for VAT registration either by submitting an electronic start-up or change notification in the Business Information System (BIS) or by using the paper version of the same form (Y form) found in the BIS service. Companies that already have a business ID can also apply for VAT registration in MyTax. Private individuals who do not yet have a business ID can already apply for VAT registration in MyTax when starting a business (as self-employed or operators of agriculture and forestry).

An applicant is registered as liable to pay VAT at the earliest from the date of the application. This means the date on which the Tax Administration or the Finnish Patent and Registration Office receives notice of the application for VAT registration or the date on which the electronic application has been submitted in the BIS or MyTax. In other words, the applicant cannot be entered retroactively in the VAT register. An exception to this rule is made for those applying for VAT registration due to transfer of rights to use immovable property, as they can, under certain circumstances, be registered retroactively under the so-called six-month rule. More information on the six-month rule can be found in chapter 4.4 of the instructions Applying for VAT registration for the transfer of rights to use immovable property (available in Finnish and Swedish).

Example 8:

A barber company engages in small-scale business and has no obligation to register for VAT. However, the company decides to voluntarily apply for VAT registration. The company fills out and returns the relevant form in MyTax on 5 October. The company can be entered in the VAT register as of 5 October at the earliest.

If a company with a turnover of under EUR 20,000 per calendar year has voluntarily applied for VAT registration, the company must pay VAT on all its sales subject to VAT even if the turnover would remain below the threshold.

Example 9:

A small business has applied for VAT registration for hairdressing activities. The company also starts the small-scale sales of handmade jewellery. The combined turnover from both the hairdressing activities and sales of handmade jewellery is less than EUR 20,000 per year. The company must pay VAT on both the hairdressing operations and jewellery sales.

Example 10:

A private person has applied for VAT registration due to forest sales, but they will not have any sales activities in the next few years. The person starts a small-scale car repair business as a self-employed operator, and the annual turnover of the business is less than EUR 20,000. The person must pay VAT on the car repair operations because they have voluntarily applied for VAT registration due to the forest sales.

Similarly, if a performing artist, public performer, athlete or artist agency voluntarily applies for VAT registration, they must pay VAT on all other business activities as well, no matter how small-scale they are.

For more information on the VAT registration of non-profit organisations, see the Tax Administration’s instructions Value added taxation of non-profit organisations (available in Finnish and Swedish).

Those who have applied for VAT registration voluntarily are not removed from the VAT register retroactively. They can be removed from the register at the earliest from the date when the person liable to tax presents a request to that effect.(section 174, subsection 2 of the Value Added Tax Act). This means the date on which the Tax Administration or the Finnish Patent and Registration Office receives the notification of changes/termination or the date on which the electronic notification is submitted in the BIS or MyTax. However, a person who has applied for VAT registration due to the transfer of rights to use immovable property will not be removed from the register until the preconditions for VAT liability have ceased to apply for all the properties associated with the VAT registration (section 174, subsection 3 of the Value Added Tax Act).

Example 11:

A company starts selling children's clothes in January. The company estimates the total sales to be approximately EUR 5,000, but it still applies for VAT registration voluntarily. In December, the company’s sales are EUR 4,500 in total. The company submits an application to the Tax Administration to be removed from the VAT register. The application arrives at the Tax Administration on 18 December. As the total sales for the calendar year are less than EUR 20,000 and there have been no sales in the previous calendar year, the company can be removed from the VAT register. The company’s notification is received by the Tax Administration on 18 December. The Tax Administration removes the company from the VAT register as of 18 December.

The Tax Administration has issued instructions on Discontinuing activities subject to VAT and bankruptcy (available in Finnish and Swedish).

A company applying for VAT registration can also apply for extended tax periods when registering. As a rule, the tax period for VAT is the calendar month, but for small businesses it may also be the calendar year or calendar quarter. The turnover threshold for optional tax periods is determined on the basis of the turnover of the calendar year referred to in the Accounting Act or other corresponding revenue. The tax periods and turnover thresholds are described on the vero.fi website Making changes to the tax period for VAT.

3 The European Union turnover threshold is EUR 100,000

3.1 Turnover threshold in the EU

The EU turnover threshold refers to the total value of the sales of goods and services in the EU area during a calendar year excluding VAT. The annual turnover threshold in the EU is EUR 100,000.

A company established in Finland may apply national tax exemptions granted for small businesses even in other EU Member States, provided that the Union annual turnover does not exceed EUR 100,000. To avoid exceeding the threshold, the EU-wide turnover for both the current and the previous calendar year must remain under EUR 100,000. In addition, it is required that the national turnover threshold of the country or countries in which the tax exemption is applied may not be exceeded.

The list of EU Member States belonging to the EU VAT area can be found here (available in Finnish and Swedish).

Example 12:

The turnover of a Finnish company this calendar year is EUR 10,000 in Finland, EUR 20,000 in Estonia, EUR 20,000 in Latvia, and EUR 5,000 in Sweden. The total turnover is EUR 55,000.

In the previous year, the company had a turnover of EUR 10,000 in Finland, EUR 15,000 in Estonia, EUR 15,000 in Latvia, and EUR 5,000 in Sweden. The company’s total turnover in the previous calendar year was EUR 45,000.

The EU-wide annual turnover is less than EUR 100,000 for both the previous and the current calendar year.

Companies must monitor their EU-wide turnover in real time. For more information on currency conversion, see section 6.3.3 ‘Converting turnover into euros’ of these instructions.

3.2 Sales included in the annual EU-wide turnover

The Union annual turnover includes sales made in other Member States that would be included in the annual turnover in Finland.

The sales included in the turnover in Finland are covered comprehensively in section 2.2 ‘Sales included in the turnover’ of these instructions. In essence, the annual EU-wide turnover refers to a company’s total turnover from all EU Member States where the company operates.

Therefore, in addition to sales subject to VAT made in Finland and other Member States, the Union annual turnover shall include, for example, tax-exempt intra-Community sales, tax-free exports of goods, tax-exempt financial and insurance services, and rentals of immovable property. In each Member State, all sales made under the provisions on the country of supply are counted toward the turnover only once. Transfers of own goods within the Community territory are included in the turnover of the Member State from which the goods are dispatched.

In addition to the sales included in the turnover as described in section 2.2, some Member States may have in place their own provisions on specific VAT-exempt sales (Article 98, paragraph 2 and Article 105a of the VAT Directive) that are included in the EU-wide annual turnover. In Finland, for example, the sale of an edition of a newspaper or periodical to a corporation for promoting the public good under section 56 of the Value Added Tax Act constitutes such a special exemption. For more information on tax-exempt sales in other Member States, visit the European Commission’s website (SME web portal).

Example 13:

A Finnish company has a turnover of EUR 10,000 for goods sold in Finland and EUR 20,000 for goods sold in Estonia per calendar year. In addition, the company’s VAT-exempt export sales of goods (section 70 of the Value Added Tax Act) from Finland to the US total EUR 80,000 per calendar year. The company has had similar turnover even in the previous years.

Since VAT-exempt export sales are included in the Union annual turnover, the company’s annual turnover in the EU is EUR 110,000. Thus, the EU threshold for annual turnover is exceeded. The company cannot apply the VAT exemption for small businesses in Estonia, even if the Estonian national threshold for small-scale business is not exceeded.

In Finland, the threshold for small-scale business activities is exceeded, as export sales from Finland are included in the Finnish turnover. Therefore, the company’s sales in both Finland and Estonia are subject to VAT.

Companies can also use an online simulator (SME web portal) to calculate their Union annual turnover.

3.3 Exceeding the EU turnover threshold

When the threshold for EU annual turnover is exceeded, the tax exemption for small businesses can no longer be applied in EU Member States other than the country in which the company is established. If the Union annual turnover of a Finnish company exceeds EUR 100,000, but the Finnish turnover threshold is not exceeded, the company may only apply the tax exemption for small businesses in Finland. Companies must actively monitor their turnover and possible exceedances.

In other words, the possibility for a Finnish company to benefit from the tax exemption in other EU Member States ends when the EU turnover threshold of EUR 100,000 is exceeded. When the EU-wide turnover threshold of EUR 100,000 is exceeded, the general VAT provisions in force in the Member States concerned must be applied immediately from the moment the threshold is exceeded.

More information on submitting a notification of threshold exceedance can be found in section 6.4.3 of these instructions.

3.4 Provisions on the country of supply

When calculating turnover, it is necessary to know the country of supply of the goods or services for VAT purposes. The provisions on the country of supply of goods or services are discussed in different Tax Administration guidelines.

For EU trade in goods, the country of supply is discussed in the instructions Value added taxation in EU trade in goods – vero.fi (available in Finnish and Swedish). Export sales are discussed in the instructions Value added tax on export trade (available in Finnish and Swedish).

The country of supply of goods and the country of supply in distance sales are discussed in the instructions Value added taxation in the distance sales of goods (available in Finnish and Swedish). When small businesses are selling goods to consumers online, it is important to take note of the specific provisions on the country of supply applied to disrance sales, along with the related requirements and value thresholds (section 69 m of the Value Added Tax Act).

With regard to the sales of services, the country of supply is discussed on the vero.fi website under VAT on international supply of services. The website offers step-by-step instructions for determining the country of supply. The Tax Administration has also issued in-depth instructions on Value-added taxation of cross-border supply and acquisition of services – vero.fi.

4 Threshold for small-scale businesses in other EU countries

The regulation of thresholds for small-scale business activities is not uniform in the EU Member States. Instead, the thresholds are based on the national regulations of each EU Member State.

In some Member States, such as Sweden, the threshold appraisal period may be three years. Moreover, not all Member States have adopted any threshold for small-scale businesses.

Some EU Member States apply different thresholds for different business sectors. In this context, a specific business sector refers to an area of business for which an EU Member State has set a national threshold. A company may only apply one threshold for small-scale businesses at a time in one Member State. For example, France has set separate small-scale business thresholds for goods and services.

In addition, some EU Member States have adopted a procedure in which a taxable person can continue to benefit from the VAT exemption for a limited period of time after the national threshold for small-scale businesses has been exceeded, provided that the company’s turnover does not exceed the national threshold for small businesses by more than 10% or 25%. Finland has not adopted this type of a ceiling value for deferred VAT-taxable status.

The appraisals of the national thresholds of other EU Member States are governed by the VAT legislation of the State in question. Instructions on the national thresholds of other EU countries can be found on the Commission’s website (SME web-portal) or received directly from the tax authorities of the Member State in question.

5 Who can apply the VAT exemption for small businesses

5.1 Finnish companies operating only in Finland

A company established in Finland whose turnover in Finland is no more than EUR 20,000 per calendar year is not obligated to apply for VAT registration. Moreover, when a company established in Finland only sells goods or services in Finland, the company need not register with the EU VAT scheme for small-scale businesses in order to apply the VAT exemption for small businesses.

A company established in Finland refers to a company that has its permanent domicile here. The company is deemed to have its domicile in Finland when its central administrative tasks are carried out here. If the company has no such domicile, the place where the entrepreneur has their address or usually resides is considered to constitute the business premises of the company.

Example 14:

A Finnish company only sells services in Finland. The turnover for 2024 was EUR 18,000, and the turnover for 2025 will also be approximately EUR 18,000. The company is registered for VAT, as its turnover has exceeded the previous threshold of EUR 15,000 applied to small-scale business activities.

In 2025, the company has no obligation for VAT registration because the turnover threshold has been changed, and the company’s turnover remains under EUR 20,000 for both the current and previous calendar year.

The company may, if it so wishes, leave the VAT register at the beginning of 2025. In that case, the company shall also not register for the EU VAT scheme for small-scale businesses, as the company only sells services in Finland.

The Tax Administration has issued separate instructions on Discontinuing activities subject to VAT and bankruptcy (available in Finnish and Swedish)..

5.2 Åland-based companies operating only in Finland

The province of the Åland Islands (hereinafter Åland) is not part of the EU’s VAT or excise duty territory. Due to the special status of the Åland Islands, there is a tax border between the Åland Islands and the EU VAT territory. In practice, the tax border means that, in trading with third country jurisdictions as laid down in the Value Added Tax Act, the provisions on exports and imports apply to the selling and shipping of goods between Åland and the EU VAT area.

When applying the VAT exemption for small-scale businesses, Åland is considered a part of Finland. Therefore, under the Finnish Value Added Tax Act, small-scale businesses based in Åland are treated equally to small-scale businesses established elsewhere in Finland.

When carrying out threshold appraisals for small-scale businesses established in the province of the Åland Islands, the sales made both in Åland and elsewhere in Finland are taken into account. It is irrelevant whether the company has a permanent establishment elsewhere in Finland.

Example 15:

A company based in Åland sells goods in mainland Finland and Åland. The company’s turnover was EUR 4,000 in Åland and EUR 10,000 elsewhere in Finland in 2024. Thus, the company’s turnover totalled EUR 14,000 in Finland. The turnover will not increase from the current level in 2025.

The company is not obliged to apply for VAT registration because the turnover does not exceed the EUR 20,000 threshold.

A company established in the Åland Islands cannot register with the EU VAT scheme for small-scale businesses, as the scheme applies only to sellers established within the EU area.

5.3 Finnish companies operating also in other EU Member States

Other than Åland-based Finnish companies, can apply the VAT exemption both in Finland and in other EU Member States by registering for the EU VAT scheme for small-scale businesses. A precondition for this is that the threshold for Union annual turnover is not exceeded. In addition, it is required that the national turnover threshold of the country or countries in which the VAT exemption is applied may not be exceeded. Threshold appraisals will look at minimum into the current and previous calendar year’s turnover. In some Member States, such as Sweden, appraisals will target the two previous calendar years in addition to the current year.

Member states mean all of the European Union’s Member States.

Example 16:

A Finnish company sells goods and services in Finland, Sweden and Austria. The table below indicates the turnover by country of supply. The company has no other business activities, such as export outside the EU.

Table of sales

| Member State | Member State’s national turnover threshold (EUR) | Company's turnover in the previous year (EUR) | Company's turnover for the current year (EUR) | May the company apply the exemption for small businesses? |

|---|---|---|---|---|

| Finland | 20,000 | 10,000 | 10,000 | YES |

| Sweden | approx. 10,000 (SEK 120,000) * | 3,000 3,000** |

5,000 | YES |

| Austria | 42,000 | 25,000 | 25,000 | YES |

| Other EU Member States | - | 0 | 0 | - |

| Union turnover | 100,000 | 38,000 | 40,000 | YES Union turnover threshold not exceeded |

* The Swedish national threshold is in SEK. For more information on conversion into EUR, see section 6.4.2 of these instructions.

** Swedish threshold appraisals look into the previous two years.

The threshold for Union annual turnover (EUR 100,000) is not exceeded, and the turnover in each EU Member State is below the threshold for small-scale businesses. The company may apply the exemption for small-scale business activities in Sweden and Austria by registering for the EU VAT scheme for small-scale businesses.

Even if the national threshold of a single Member State would be exceeded, the Finnish company may apply the tax exemption for small businesses in other Member States where the national threshold is not exceeded. However, it is required that the threshold for Union annual turnover (EUR 100,000) may not be exceeded, either. Moreover, to apply the VAT exemption, the company must register for the EU VAT scheme for small-scale businesses.

Example 17:

A Finnish company sells goods and services in Finland, Sweden and Austria. The table below indicates the turnover by country of supply. The company has no other business activities, such as export outside the EU.

Table of sales

| Member State | Member State’s national turnover threshold (EUR) | Company's turnover in the previous year (EUR) | Company's turnover for the current year (EUR) | May the company apply the exemption for small businesses? |

|---|---|---|---|---|

| Finland | 20,000 | 25,000 | 30,000 | NO |

| Sweden | approx. 10,000 (SEK 120,000) * | 3,000 3,000 ** |

5,000 | YES |

| Austria | 42,000 | 25,000 | 25,000 | YES |

| Other EU Member States | - | 0 | 0 | - |

| Union turnover in total | 100,000 | 53,000 | 60,000 | YES Union turnover threshold not exceeded |

* The Swedish national threshold is in SEK. For more information on conversion into EUR, see section 6.4.2 of these instructions.

** Swedish threshold appraisals look into the previous two years.

The threshold for Union annual turnover of EUR 100,000 is not exceeded. In Sweden and Austria, the activities remain below the threshold for small businesses. The company must register for the EU VAT scheme for small-scale businesses if it wishes to apply the VAT exemption in Sweden and Austria. However, the company may not apply the VAT exemption in Finland.

It is not necessary to register for the EU VAT scheme for small-scale businesses if the seller does not wish to apply the VAT exemption for small businesses in other EU Member States. In this case, the general VAT provisions of the Member States are applied to the activities.

Example 18:

A Finnish company sells services to private individuals in Finland and Estonia. The annual turnover in Finland is around EUR 10,000 and in Estonia roughly EUR 10,000. Estonia has a national threshold of EUR 40,000.

In both Member States, the turnover is below the threshold for small-scale businesses. As the company wishes to apply the threshold for small-scale business activities only in its own Member State, i.e. in Finland, the company shall not apply for registration in the EU VAT scheme for small-scale businesses. In this case, Estonian VAT regulations are applied to the sale of services in Estonia.

If the company does not wish to register for the EU VAT scheme for small-scale businesses, it must check its registration obligations in other Member States. The company may report and pay VAT in other Member States by using the Union’s VAT special scheme as long as the sales are covered by the special scheme. Such sales include, for example, services sold by a Finnish company to consumers in the EU area and distance sales of goods within the EU. For more information on reporting VAT in a special scheme, see the detailed instructions on VAT special schemes. (available in Finnish and Swedish).

5.4 Foreign businesses in Finland

A foreign business refers to a company that is established abroad. The domicile of a foreign company is located outside Finland. Companies established in an EU Member State and outside the EU are treated differently in the scheme.

5.4.1 Businesses established in another EU Member State

A business established in another EU Member State, i.e. within the EU VAT area, may apply the tax exemption for small businesses when selling goods and services in Finland as long as the threshold for Union annual turnover of EUR 100,000 is not exceeded and the company has not applied for VAT registration in Finland. In this case, the company established within the EU area shall first register for the EU VAT scheme for small-scale businesses in its Member State of establishment.

A company that has its domicile in some other EU Member State and only has a permanent establishment in Finland shall register for the EU VAT scheme for small-scale businesses in its own Member State of establishment. For VAT purposes, the Member State of establishment shall be the Member State in which the company’s administrative tasks are carried out. If the company has no such domicile, the place where the entrepreneur has their address or usually resides is considered to constitute the business premises of the company.

Example 19:

A company has premises in Stockholm and Turku. The company’s administrative tasks are carried out in Stockholm, where the entrepreneur lives. Therefore, the Member State of registration for the EU VAT scheme for small-scale businesses is Sweden.

Example 20:

A company established in Sweden sells goods in Finland. The turnover in Finland is approximately EUR 5,000 per calendar year. The company’s EU-wide turnover is less than EUR 100,000 per calendar year, both for the current and the previous year. The company established in Sweden wishes to apply the threshold for small-scale business activity in Finland. The company registers for the EU VAT scheme for small-scale businesses in Sweden. The company submits a prior notification and states Finland as a Member State in which the exemption is to be applied.

The list of EU Member States belonging to the EU VAT area can be found here (available in Finnish and Swedish).

5.4.2 Companies established outside the EU

Non-EU companies cannot apply the VAT exemption for small businesses at all and, therefore, they cannot register for the EU VAT scheme for small-scale businesses. The VAT exemption for small businesses is not applied to sellers established outside the EU, and such sellers are, therefore, not entitled to the VAT exemption even if they would have a fixed establishment in Finland.

Example 21:

A company established in Norway sells real estate-related services to Finnish private persons in Finland. Norwegian companies cannot apply the VAT exemption for small businesses in Finland at all. Moreover, Norwegian companies cannot register for the EU VAT scheme for small-scale businesses.

When a Norwegian company sells a service related to real estate to private persons in Finland, the business activity is subject to VAT regardless of the total turnover.

6 The EU VAT scheme for small-scale businesses

6.1 Registering for the EU VAT scheme for small-scale businesses

Small businesses that are established in Finland and wish to apply the VAT exemption for small businesses in one or more EU Member States besides Finland shall register for the EU VAT scheme for small-scale businesses in Finland. In other words, companies shall only register for the EU VAT scheme for small-scale businesses if they decide to apply the VAT exemption for small businesses in a Member State other than Finland. The registration takes place in MyTax.

A company can register simultaneously for a VAT special scheme (Union scheme) and the EU VAT scheme for small-scale businesses, provided that the conditions are met. Such a situation may arise, for example, when a company has sales in several EU Member States, and the turnover remains below the national threshold in only some of the States.

Companies cannot register for the import scheme and the EU VAT scheme for small-scale businesses simultaneously. Therefore, a company registered for the import scheme cannot register for the EU VAT scheme for small-scale businesses even if the company would have a low turnover and be established within the EU area. Such companies engaging in distance sales of imported goods to consumers shall declare and pay VAT under the import scheme, irrespective of the total turnover.

For more information on the VAT special schemes, see the Finnish Tax Administration’s guidance on VAT special schemes (available in Finnish and Swedish).

6.1.1 Prior notification of registration

For the VAT exemption to be applied in other EU Member States, companies established in Finland must provide the Finnish Tax Administration with a prior notification of registration for the EU VAT scheme for small-scale businesses.

The prior notification shall include the following details:

- the company name, sector of business, legal form, address, telephone number, e-mail address, and the company's online address;

- the EU Member States in which the company plans to apply the VAT exemption;

- a list of the EU Member States in which the company has already completed sales;

- a description of the sales of goods and services made in Finland and in other EU Member States during the previous calendar year, which are included in the appraisal of small-scale business activity (see sections 2.2, 3.2 and 4 of these instructions). The sales shall be specified in the notification for each Member State;

- a description of the sales of goods and services made in Finland and in other EU Member States during the current year, which are included in the appraisals of small-scale business activity (see sections 2.2, 3.2 and 4 of these instructions). The sales shall be specified in the notification for each Member State;

- Member States with a three-year monitoring period, i.e. where turnover appraisals look into the current year and two preceding years, require data of the turnover for all the years in question;

- Member States that apply different thresholds for different specific business sectors require a separate notification for each threshold.

For more information, see the instructions on How to register for the EU VAT scheme for small businesses.

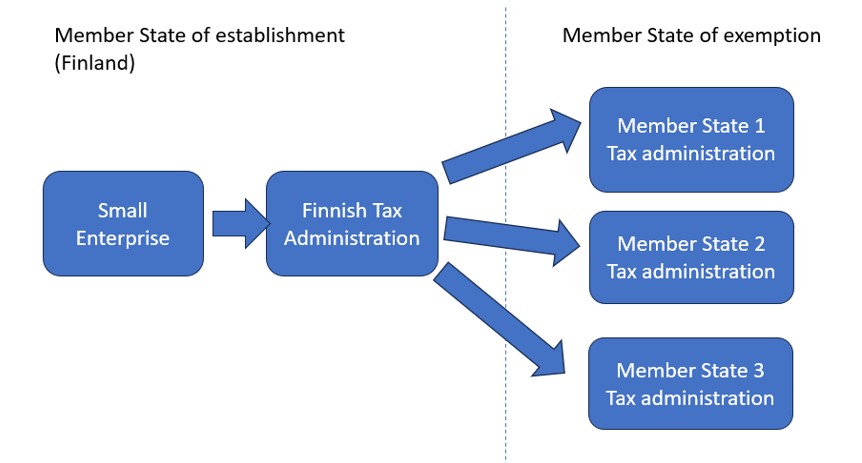

Figure 1. Conveying the details included in a registration notification to other Member States.

6.1.2 Identification register and Exempt ID

Companies established in Finland will be recorded in an identification register for the purposes of applying the VAT exemption in other Member States. Each company will be issued a unique Exempt ID. The Exempt ID is otherwise similar to the VAT identification number, except for the letters "EX" added at the end.

Example: FI07654321EX

The Exempt ID is used by the tax authorities of other EU Member States to identify a company. The Exempt ID is used in the prior notification, turnover reports, and invoicing.

Finnish companies that engage in small-scale business activities only in Finland and do not apply the VAT exemption for small businesses in any other Member State are not entered in the identification register. Therefore, Finnish small businesses operating only in Finland do not receive an Exempt ID.

A Finnish company will receive an Exempt ID if even one Member State other than Finland has approved the company’s prior notification.

A company that is established in Finland and entered in the separate identification register may also be entered in the Finnish VAT register. Thus, the company can have both a VAT identification number and an Exempt ID valid at the same time. However, the Exempt ID differs from the VAT number in that the letters "EX" are added at the end when applying the tax exemption. The Exempt ID is only used when applying the VAT exemption for small businesses.

Example 22:

A company sells services in Finland. The company also starts selling goods locally to private persons in France and Germany. The company has voluntarily applied for VAT registration in Finland, even though its turnover from service activities remains below the Finnish threshold for small businesses.

The company wishes to apply the VAT exemption for small-scale businesses in France and Germany. The company registers for the EU VAT scheme for small-scale businesses and submits a prior notification stating that it intends to apply the exemption in France and Germany. France and Germany grant the exemption.

The company is registered for VAT in Finland based on a voluntary application. Therefore, the company also has a valid VAT number. The company must use the Exempt ID when selling goods in France and Germany, and it may not use the VAT number.

The Tax Administration always issues a decision to enter a company in the identification register. If the company is not entered in the register, it shall be informed of the decision.

The validity of the Exempt ID and the Member States indicated for the ID can be checked in the SME web portal (SME on the web tab).

6.2 Starting tax-exempt activities in other EU countries

6.2.1 Start of VAT exemption

A Finnish company may start applying the VAT exemption based on a prior notification given in another Member State as of the date on which the Finnish Tax Administration issues an Exempt ID to the company. The company will be informed of the decision of each Member State granting the exemption in MyTax. The notification shall indicate whether the Member State in question has granted an exemption for its territory.

When a company indicates several Member States on the prior notification of registration, it may, after receiving an Exempt ID, start applying the VAT exemption in all Member States which have granted the exemption for their territory.

Example 23:

A Finnish company uses a prior notification to declare that it intends to apply the VAT exemption for small businesses in Estonia and Sweden. Estonia is the first to grant a tax exemption, and it informs the Finnish authorities of the decision. The company may now start applying the VAT exemption in Estonia as soon as it receives an Exempt ID from the Finnish authorities.

Sweden grants the VAT exemption and submits information of the decision to Finland two weeks later. The company may start VAT-exempt activities in Sweden as of the date on which the Finnish Tax Administration informs the company of the exemption granted by Sweden. The company is notified of the Swedish decision in MyTax.

In essence, the VAT exemption can be applied at the earliest from the date on which the exemption is granted by the Member State in question. Some Member States may take a longer time to issue a decision.

If a company submits an update notification of changes in the registration data, it may start applying the VAT exemption in other Member States from the date on which the Finnish Tax Administration confirms that the Member State in question has granted the exemption.

Example 24:

A Finnish company has submitted a prior notification of registration stating that it intends to apply the VAT exemption for small businesses in Finland, Sweden and Estonia. Now the company is also launching business activities in Denmark.

By way of an update notification, the company indicates Denmark as a Member State where the exemption will be applied. The VAT exemption will be applicable in Denmark from the date on which the Tax Administration confirms that Denmark has granted the VAT exemption.

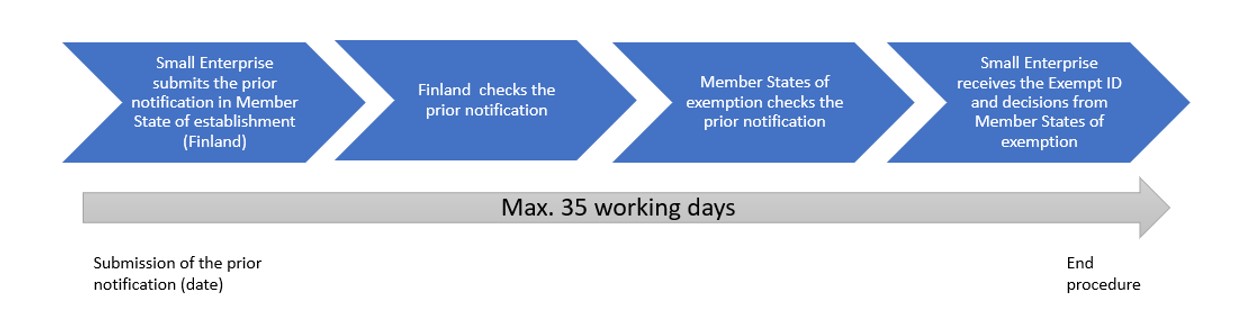

However, the VAT exemption shall be applicable at the latest within 35 working days after the authorities have received the prior notification or update notification.

Figure 2.

In exceptional circumstances, the tax authorities of a Member State may need more time to carry out tax control measures or efforts to prevent tax avoidance or fraud. In such situations, the company is informed that the processing of the prior notification will take more than 35 days.

6.3 Reporting turnover data

6.4 Reporting sales in the EU VAT scheme for small-scale businesses

Companies registered for the EU VAT scheme for small-scale businesses must submit a quarterly Report on EU sales in the VAT scheme for small businesses.

The report must contain the following information:

- the Exempt ID;

- the total quarterly sales of goods and services by Member State. If no sales have been made, the turnover is reported as 0";

- if a Member State applies different thresholds for different specific business sectors, the sales data must be indicated separately for each threshold.

The due date for the quarterly report is the end date of the second month following the calendar quarter concerned.

For example, the first report in 2025 (1 January–31 March 2025) must be submitted by 30 April 2025.

6.4.1 Correcting EU sales reports

An error in the EU sales report must be corrected by submitting a correction for the tax period in question. The report shall be submitted in MyTax. Any error in a report shall be corrected by submitting a replacement report. The replacement report will replace the previously submitted quarterly report fully, which means that it must include all the correct, previously submitted data as well as the corrected data.

6.4.2 Converting turnover into euros

The reported information shall be indicated in EUR. If the sales are made in a currency other than EUR, the company shall use the conversion rate applicable on the first day of the calendar year. The conversion rate shall be the rate published by the European Central Bank for that day or, in the absence of such a rate, the rate published on the next applicable day.

6.5 Changes in activities

6.5.1 Update to registration information

When business activities change, an update notification on any changes in registration information must be submitted in advance to the Member State of establishment. Finnish companies shall submit the update notification to the Finnish Tax Administration. An update notification is required when the VAT exemption is applied in new Member States, or when a company stops applying the exemption in a Member State. The prior notification of an update to registration information must be submitted well before the change is implemented.

The same data that was provided in the initial prior notification shall be provided for any new Member States where the VAT exemption will be applied in the future.

Example 25:

In its prior notification for 2025, a Finnish company has indicated Germany and Denmark as the Member States where the VAT exemption is applied. The company plans to launch activities also in Sweden in June 2026. The company must provide the update details for Sweden in advance by way of a prior notification.

The VAT exemption may be applied as of the date on which the Tax Administration confirms that Sweden has approved the update notification. The update notification shall be approved within 35 days. For this reason, the company submits the notification well in advance in March.

If a company wishes to stop applying the VAT exemption in an individual Member State, an update to the prior notification is required. In such a situation, the right to apply the EU VAT scheme for small-scale businesses remains in force. The company may submit an update to the prior notification to declare that it wishes to stop using the VAT scheme in one country while still continuing to apply the VAT exemption in the other indicated Member States. The application of the VAT exemption is deemed to end in the Member State in question from the beginning of the calendar quarter following the receipt of the notification. However, if the notification is not received before the last month of the calendar quarter, the exemption shall be deemed to expire during the second month of the calendar quarter following the receipt of the notification. After this, the general VAT provisions valid in the Member State in question shall be applied.

Example 26:

In the prior notification for 2025, a Finnish company has indicated Germany and Denmark as the Member States where a VAT exemption is applied. In the future, the company only wishes to apply the VAT exemption for small businesses on goods sold in Germany.

The company submits an update to the prior notification stating that it wishes to stop using the VAT scheme in Denmark. The update is submitted in advance in May 2026. As of July 2026, the company will no longer be able to apply the VAT exemption for small-scale businesses to the sales of goods in Denmark.

6.5.2 Exceeding the national threshold in another Member State

If a company exceeds the threshold for national annual turnover applied to small-scale businesses in some other Member State, it may no longer apply the VAT exemption in that State. In this case, the company must submit an update to the prior notification in MyTax. The company must find out its liability to register for VAT and pay VAT in the target countries. In the case of sales to consumers, the company may apply a VAT special scheme (Union scheme), provided that the conditions are met. For more information on reporting VAT through a special scheme, see the detailed instructions on VAT special schemes. (available in Finnish and Swedish).

Example 27:

A Finnish company is registered for the VAT scheme for small-scale businesses. The company applies the scheme in Finland, Sweden and Germany. The turnover threshold for small-scale business activity has been exceeded in Sweden. This means the company can no longer apply the VAT exemption for small businesses in Sweden.

Other Member States will issue a decision to a Finnish company when their respective national turnover thresholds are exceeded. The Member States notify the Finnish authorities of the decision, and the company in question can view the decisions made by the other Member States in MyTax.

6.5.3 Exceeding the threshold for EU annual turnover

A company established in Finland must submit a notification if it exceeds the threshold set for Union annual turnover (EUR 100,000). The notification shall be submitted in MyTax. The company shall report its total sales in Finland as well as in other Member States from the beginning of the calendar quarter to the date on which the threshold was exceeded. More information on threshold appraisals can be found in sections 2.2, 3 and 4 of these instructions.

The company shall submit the notification within 15 working days after the threshold has been exceeded. The exact date of the exceedance shall be indicated on the notification.

Once the EU turnover threshold (EUR 100,000) has been exceeded, the VAT exemption for small businesses can no longer be applied in any other Member States besides Finland. The VAT exemption for small businesses can still be applied in Finland despite exceeding the Union-wide turnover threshold if the Finnish threshold of EUR 20,000 set for small-scale businesses is not exceeded.

The Tax Administration will terminate the Exempt ID and it can no longer be used. The company must independently determine its possible registration and VAT liabilities in the other Member States. In the case of sales to consumers, the company may apply a VAT special scheme, provided that the conditions are met. For more information on reporting VAT through a special scheme, see the detailed instructions on VAT special schemes. (available in Finnish and Swedish).

6.5.4 Termination notification

A company must notify the Member State of establishment of the termination of activities if it wishes to stop applying the VAT exemption or if the business activities are discontinued entirely. It is advisable to submit the termination notification well in advance. In this case, the Exempt ID of the company established in Finland will be terminated by the Tax Administration, and the ID can no longer be used.

If the activities are discontinued due to bankruptcy, the business is terminated in the EU VAT scheme for small-scale businesses.

6.6 Appeal procedure

Finnish companies registered for the EU VAT scheme for small-scale businesses are notified of decisions made by both the Finnish Tax Administration and other EU Member States in MyTax.

Decisions issued by the Finnish Tax Administration can be appealed against by submitting a claim for adjustment with the Assessment Adjustment Board. The deadline for submitting a claim for adjustment is usually 60 days from the receipt of the decision. Instructions for submitting a claim for adjustment to the Assessment Adjustment Board are attached to the decision. Appeal procedure applied to the Finnish Tax Administration’s decisions (available in Finnish and Swedish).

To appeal against a decision issued by another Member State, a claim for adjustment shall be lodged with the Member State in question. These include decisions made by other EU Member States not to grant a VAT exemption to a company within said State. Although Finnish companies are notified of such decisions in MyTax, no appeal can be lodged in Finland. The appeal instructions are usually attached to the decision.

7 Right to deduct VAT

A key rule in value added taxation is that sales subject to VAT include a right to deduct VAT payable on acquisitions related to these sales (sections 102 and 117 of the Value Added Tax Act). Thus, only VAT payable on acquisitions that are related to an activity subject to VAT is deductible. Activities subject to VAT mean activities entitling to a VAT deduction or to a refund of the tax (sections 130, 131 and 131a of the Value Added Tax Act).

The right to make deductions does not cover VAT payable on acquisitions that involve such sales made in Finland or other Member States that are exempted from VAT due to the threshold for small-scale businesses.

Therefore, companies whose business activities are exempt from VAT on the basis of the threshold for small-scale business are not entitled to deductions.

Example 28:

A Finnish company sells services in Finland and Sweden. In Finland, the turnover falls below the national threshold for small-scale businesses, and the company has not voluntarily applied for VAT registration.

The company has registered for the EU VAT scheme for small-scale businesses. The company’s sales are also exempted from VAT in Sweden because the turnover remains below the Swedish threshold for small-scale businesses.

The company is not entitled to any deductions on VAT payable on its acquisitions.

Since only VAT payable on acquisitions related to business activities that are subject to VAT is deductible, a company may in some cases be partially entitled to deductions.

Example 29:

A Finnish company sells services in Finland and Germany. The company's turnover in Finland exceeds the threshold for small-scale businesses, so the company is registered for VAT in Finland. The company makes acquisitions related to both Finnish and German sales.

The company has registered for the EU VAT scheme for small-scale businesses. The company’s sales are exempted from VAT in Germany because the turnover remains below the German threshold for small-scale businesses.

The company is entitled to deduct the VAT payable on acquisitions related to sales that are subject to Finnish VAT. The company may not deduct VAT payable on acquisitions that are related to German sales exempted from VAT. General expenses must also be divided into deductible and non-deductible sections.

The Tax Administration has issued instructions on the Right to deduct VAT (available in Finnish and Swedish).

8 Invoicing requirements

The obligation to issue invoices, laid down in the Value Added Tax Act, is limited to sales subject to VAT to non-consumers and to certain VAT-exempt sales. As a result, the invoicing requirements provided in the Value Added Tax Act usually do not apply to companies whose turnover falls below the threshold for small businesses. However, sellers must write up a voucher of the sale for purposes of accounting or recordkeeping. The Finnish Tax Administration has issued instructions on VAT invoice requirements.

There are no separate invoicing requirements in force in Finland for sellers registered for the EU VAT scheme for small-scale businesses. However, a seller may be obliged to issue an invoice under the legislation of another Member State. Member States that have set invoicing requirements must endorse simplified information requirements for the invoices of small businesses included in the VAT scheme. Further information on the invoicing requirements of other Member States can be found in the SME web portal or received directly from the Member State in question.