Malicious companies have been revealed that set up schemes for tax evasion “as a service” – Finland’s loss of source tax may be 80 million euros per year.

Tax Administration Bulletin, 6/8/2022The Finnish Tax Administration’s recent control action revealed many players that operate a malicious activity to enable investors evade Finnish taxes. We estimate that systematic evasion by these companies has resulted in an 80-million-euro tax gap for Finland in 2018 to 2021 every year because taxes have not been withheld at source.

– The schemes have had structures that suggest standardised, organised planning: new conduit companies are established only for the purpose of tax evasion. Both Finnish and foreign citizens have been among the founders of the conduit companies. We have a number of pending audit cases that will probably result in added taxes to be collected from the perpetrators, says Katja Pussila, Risk Manager at the Tax Administration.

Deals have been uncovered where some 700 million units of corporate shares are suspected to have changed hands repeatedly between investors in back-and-forth trades. The deals obviously have no purpose other than evasion of source taxes.

Our increased capability to analyse large data volumes has contributed to the recent successes in tax control work. We have received information from many different sources, also from authorities in other countries, and have compared the records.

Schemes for avoiding source taxes, and cum/ex transactions and cum/cum transactions have caused major tax losses in European countries as well. However, our close cooperation with other countries and exchange of fiscal information have played an important role in the success of tax control, explains Katja Pussila.

For example, in Germany and Denmark, scammers submitted refund applications relating to securities trading and shares, to benefit investors and companies around the world. In reality, the dividend-bearing shares had only one real owner. The shares had been sold to several parties on a temporary basis to make the number of dividend recipients grow.

– During the control effort, we also have identified conduit companies registered in Finland that have been established only for the purpose of avoiding a foreign tax in another country. Our part in the cooperation is to pass the relevant facts on to the tax authorities of the country concerned, notes Katja Pussila.

There are several pending audits ongoing at the Finnish Tax Administration, so new cases may surface in the near future.

The Tax Administration’s next control effort is on refunds of tax at source

According to tax rules in force, if the payer of dividends has withheld too much tax at source, the beneficiary is entitled to ask the Finnish Tax Administration for refund. Because it is necessary to prevent tax evasion from spreading, the Finnish Tax Administration now watches over all operations connected to refunds of tax at source.

– The risk of increased fraudulent refund activity with refunds is particularly relevant now that we have made it increasingly difficult to gain unfounded tax benefits through relief at source procedure of dividend payments, Katja Pussila continues.

A new tool ensuring better control is the OECD initiative known as the TRACE — Treaty Relief and Compliance Enhancement — for taxation at source, implemented since 2021. With the TRACE model, the Tax Administration has better access to information regarding corporate stockholding under nominee registration, the custodial chains and the identities of dividend beneficiaries. The revised reporting rules also require that the authorised intermediary must pay the tax in situations where no tax at all has been withheld at source or where not enough tax has been withheld due to the authorised intermediary’s neglect. Because it is now easier for the Tax Administration to obtain information, it is also easier to focus the control efforts.

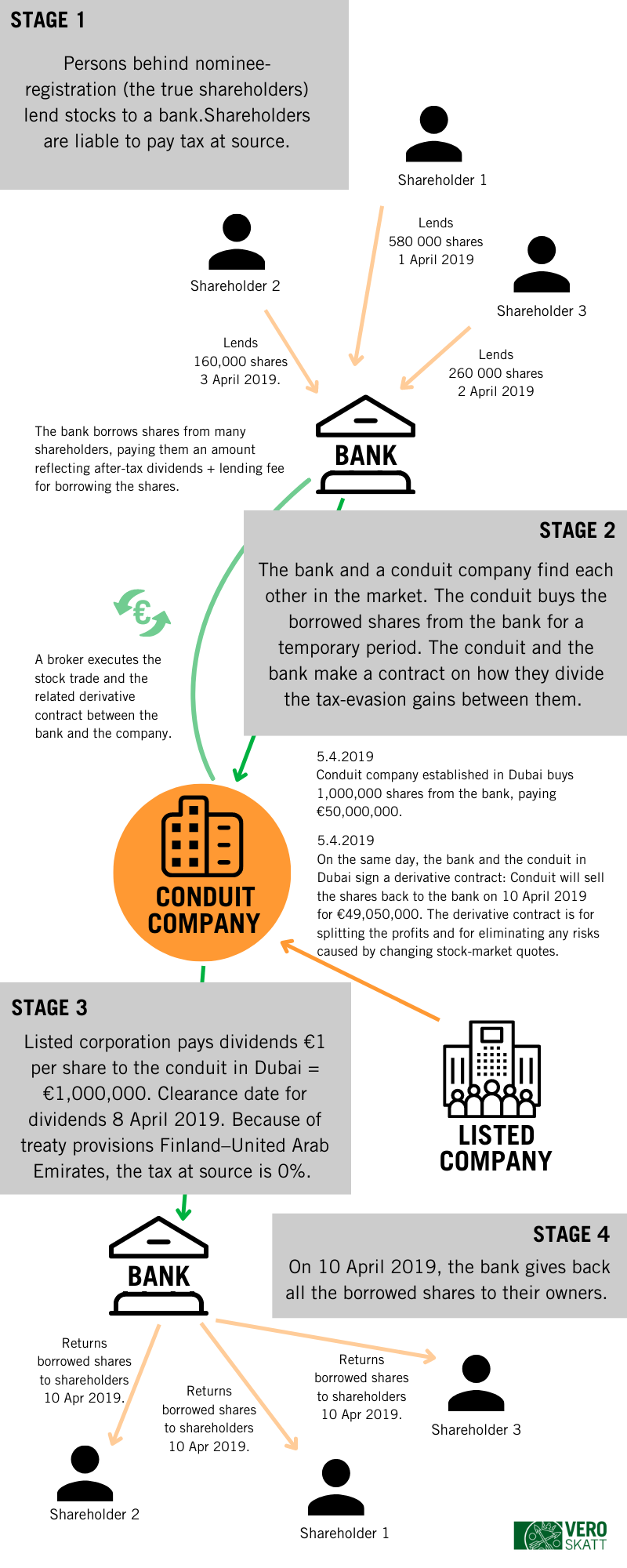

Facts: Conduct of tax-evasion companies in Finland

- In general, the payer of dividends must withhold tax at source before sending the payment of dividends to a beneficiary residing in a foreign country. However, fraudsters set up a company that can receive dividends exempt from such withholding. This is possible because of a treaty between Finland and the company’s country. The newly established company has no other business than the evasion scheme based on holding corporate stock temporarily when dividends are being distributed. Tax treaties giving exemption to receival of dividends exist between Finland and countries like the United Kingdom, Ireland, France and the United Arab Emirates.

- The temporary recipient cannot use the dividend money itself. Instead, it must send the better part of the amount on to the other party of the transaction. Typically, after distribution of dividends, the corporate stocks that had entitled the temporary recipient to receive the dividends are returned back to their original owner. Tax-evasion gains are then shared between participants in the scheme.

- This is typically based on an agreement that the tax evaders have made beforehand. Accordingly, every one of the evaders has been informed of the amount of evasion gain they would receive. The amount is not affected by any developments in the stock market. The scheme is created without any intention to keep the corporate stocks for a longer time. Many schemes contain various derivative contracts. This eliminates the risks that may result from changed stock quotes in the market. Derivatives are also used to distribute the unjust profits to the participants. We have observed many variations of the evasion scheme.

- Nominee-registered shareholdings are involved in the schemes. After registration for a nominee, the holder’s identity becomes secret. As a result, the official register of stockholders only shows the account operator’s or custodian’s name, not the name of the person or company that really owns the shares.

Example — schemes aiming for evading taxes at source

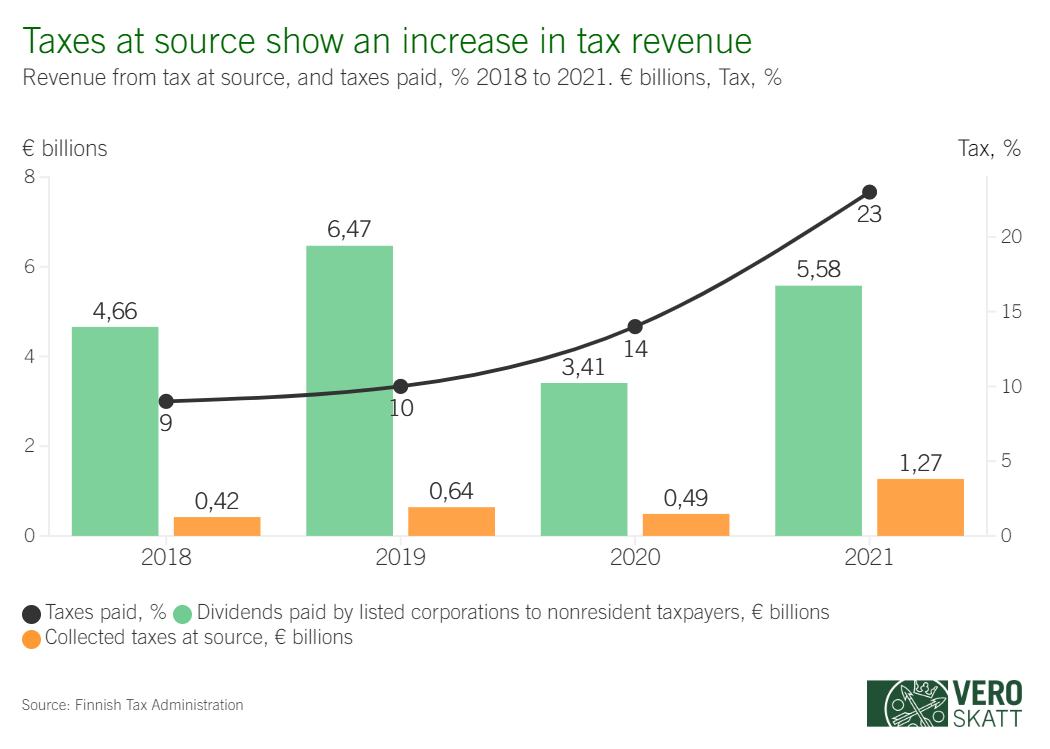

Results from improved control are visible: growth in tax revenues from taxes-at-source

Although the cases are still under investigation, the control efforts make an impact on tax revenue already.

– We can see a downward trend in this type of evasion schemes. Our conclusion is that the perpetrators have noticed that Finnish authorities do take action, says Katja Pussila.