Reporting income data: penalty fees

- Date of issue

- 12/16/2020

- Record no.

- VH/8374/00.01.00/2020

- Validity

- 1/1/2021 - 12/31/2021

These instructions replace the earlier instructions titled Reporting income data: penalty fees.

The following additions and clarifications have been made to the instructions:

- Clarified the determination of the late-filing penalty when data on fringe benefits is reported late in Section 2.1.

- Added the guidance of the determination of a punitive tax increase to Section 3.1.

- In addition, technical specifications have been added to the instructions.

1 General

It is important that the data reported to the Incomes Register is reported on time and that the data is correct. This ensures that insurance contributions related to payments can be collected and payments to tax recipients made on time. If the reporting obligation is neglected, penalty fees will be imposed. The purpose of penalty fees is to encourage the reporting of correct information at the right time.

The Tax Administration will impose penalty fees related to reporting to the Incomes Register. The penalty fees will ensure that the payers fulfil their reporting obligation. All data users will benefit from correct information being submitted on time. The penalty fee for reports submitted late to the Incomes Register is a late-filing penalty based on the act on the incomes information system (laki tulotietojärjestelmästä 53/2018). The penalty fees for failure to fulfil the reporting obligation to the Incomes Register with regard to taxation data include a tax increase in accordance with the act on assessment procedure for self-assessed taxes (laki oma-aloitteisten verojen verotusmenettelystä 768/2016) and the third-party-information provider’s negligence penalty in accordance with the act on assessment procedure (laki verotusmenettelystä 1558/1995). Other sanctions may be imposed by the data users of the Incomes Register.

Data reported to the Incomes Register will be used to replace various reports filed for the payment of wages and benefits. For this reason, the regulation of penalty fees imposed as a result of reporting failures has been reformed to correspond to the needs of the Incomes Register’s reporting procedure.

1.1 Application of sanction provisions regarding late-filing penalties

The deployment of the Incomes Register on 1 January 2019 has brought changes to the payer’s reporting obligation and procedure. The changes will initially apply to the data reported by wage payers and, from 1 January 2021, to data reported by benefits payers.

Transition period for earnings payment data

Late-filing penalties for earnings payment data submitted late by payers to the Incomes Register will mainly be imposed only after the transition period. This means that late-filing penalties will not apply to payments made before 1 January 2021, unless failure to fulfil the reporting obligation demonstrates a clear disregard for reporting. In addition to payments, this applies to benefits granted or repayments made.

Transition period for benefits data

Benefits payment reports will be submitted to the Incomes Register as of 1 January 2021. If the late report is a benefits payment report, a late-filing penalty will only be imposed if the failure to fulfil the reporting obligation demonstrates a clear disregard for reporting. The transition period for late-filing penalties applies to reports concerning payments or repayments made before 1 January 2022. If the obligation to report benefits data to the Incomes Register is based on provisions other than those concerning the reporting obligation in tax laws, no penalty fees will be imposed for late reports even after the transition period.

If the data on withholdings and tax at source for pensions and other benefits paid in 2020 is submitted late on a tax return in accordance with the act on assessment procedure for self-assessed taxes (laki oma-aloitteisten verojen verotusmenettelystä 768/2016), the Tax Administration can still impose a late-filing penalty for 2020. The Tax Administration may impose a late-filing penalty under the said act even after 1 January 2021 for the late filing of a tax return on the withholdings and tax at source of pensions and other benefits that do not have to be reported to the Incomes Register.

2 Late-filing penalty

2.1 Imposing a late-filing penalty

The Tax Administration will impose a late-filing penalty concerning reporting to the Incomes Register based on data obtained from the Incomes Register. The late-filing penalty will only be imposed for data that a payer subject to the reporting obligation reports late to the Incomes Register. The payer must be given the opportunity to provide an explanation for the reasons for the delay before the late-filing penalty is imposed, unless hearing the payer before imposing the penalty is clearly unnecessary. If the late-filing penalty is no more than EUR 200, the opportunity to provide an explanation will only be reserved if necessary on special grounds.

The late-filing penalty will be imposed on the basis of the information reported for each calendar month. Data must generally be submitted to the Incomes Register no later than on the fifth calendar day after the payment date. The late-filing penalty, however, is not tied to this deadline. The Tax Administration will impose a late-filing penalty if mandatory data on payments is reported to the Incomes Register after the eighth day of the calendar month following the payment date. If the eighth day of the calendar month following the payment month is a Saturday or public holiday, the report can still be submitted on the next business day, and the late-filing penalty will only be incurred starting from the following day.

Data on fringe benefits provided by the employer must be submitted every month no later than on the fifth day of the calendar month following the fringe benefit’s accrual month. However, if monetary wages are paid for the fringe benefit’s accrual month during the calendar month following the accrual month, the fringe benefit can be reported as income for the calendar month following its accrual month. In this case, data on the fringe benefit must then be submitted no later than on the fifth day of the calendar month following the month as the income for which the fringe benefit was reported. A late-filing penalty will be imposed on reporting fringe benefit data late if the fringe benefit is reported after the eighth day of the month following the month for which the fringe benefit was reported as income.

Separate late-filing penalties are not imposed for earnings payment reports, employer's separate reports and benefits payment reports. In terms of penalties, the reports are considered a single reporting entity (see example 3). However, both the amounts reported late on an earnings payment report and benefits payment report can be taken into account when imposing a percentage-based late-filing penalty.

Late-filing penalties are only imposed for the late reporting of mandatory data as stipulated in sections 6, subsections 2–5 and 8 of the act on the incomes information system (laki tulotietojärjestelmästä 53/2018). Submitting the complementary data referred to in section 7 of the act is voluntary for the payers. As there is no deadline for submitting this data, no late-filing penalty will be imposed. No late-filing penalties will be imposed on the basis of data reported late by benefits payers if the obligation to report benefit data to the Incomes Register is based on provisions other than those concerning the reporting obligation in tax legislation (subsections 6 and 7 of section 6 of the act on the incomes information system).

The late-filing penalty will not be imposed if submitting the report to the Incomes Register was delayed for a reason beyond the payer’s control, or there is a justified reason or other special grounds for the negligence. Reasons beyond the payer’s control may include disruptions in the public data network, a failure in the incomes information system’s e-service or another similar reason.

Late-filing penalties are not imposed on natural persons or death estates. However, a late-filing penalty may be imposed if the natural person or estate engages in business activities, agriculture or forestry, and reports a related payment late.

A late-filing penalty will not be imposed if a third-party-information provider’s negligence penalty is imposed for a late report in accordance with the act on assessment procedure (laki verotusmenettelystä 1558/1995)..

The levying, collection and refunding of a late-filing penalty is subject to the provisions of the act on tax collection (veronkantolaki 609/2005) on the late-filing penalties provided for in the act on assessment procedure for self-assessed taxes (laki oma-aloitteisten verojen verotusmenettelystä 768/2016).. The Tax Administration may refrain from collecting the late-filing penalty if the reporting was delayed for a reason beyond the control of a payer with a reporting obligation, or on other special grounds. Other special grounds may include lack of clarity as to which earnings-related pension act applies to the employment, or whether or not the payment constitutes earnings from work on which the pension is based and which must be reported to the Incomes Register.

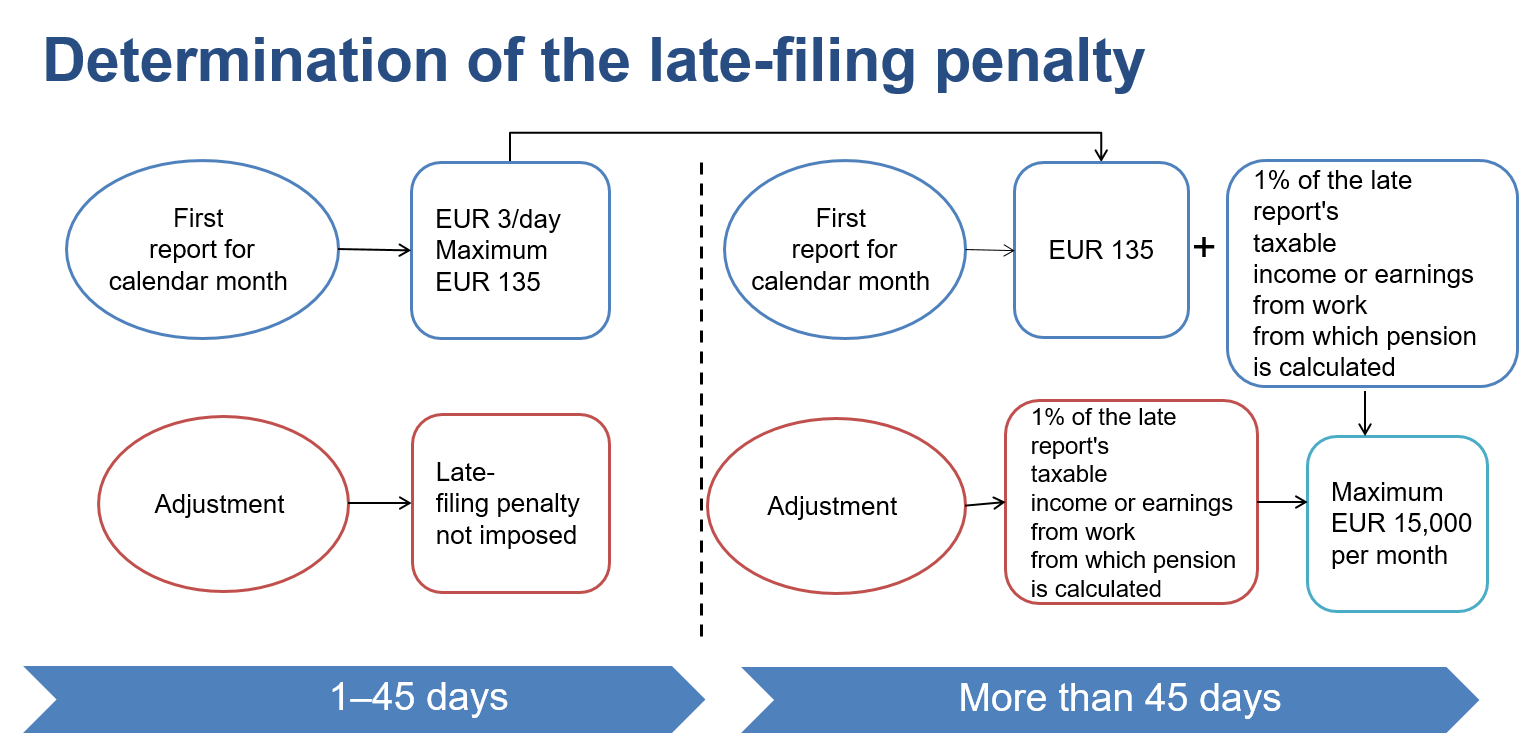

2.2 Amount of the late-filing penalty

Late-filing penalties for reports submitted late to the Incomes Register are made up of two components: the daily amount of the late-filing penalty and the percentage based on the amount of payment reported late.

2.2.1 Daily late-filing penalty component

The amount of a payment or tax reported late does not affect the daily amount of the late-filing penalty. EUR 3 in daily late-filing penalties will be imposed for each day the report is late, until the data has been reported to the Incomes Register. The days for which the late-filing penalty is imposed are calculated from the day following the deadline for the late-filing penalty to the date on which the report is submitted. The daily late-filing penalty for reporting the payment month's wages is imposed for a maximum of 45 days, i.e. the maximum fee is EUR 135.

Example 1: The first report for the calendar month (earnings payment report or employer's separate report) was submitted 30 days late. The late-filing penalty will be 30 x EUR 3 = EUR 90.

Example 2: A regular employer registered with the Tax Administration’s Employer Register submitted 'No wages payable' on the employer’s separate report 15 days late. The late-filing penalty will be 15 x EUR 3 = EUR 45.

Example 3: The payer submitted the earnings payment reports for the calendar month on time, but the employer's separate reports for the same calendar month were 20 days late. No late-filing penalty is imposed because the first report for the calendar month was submitted on time. In determining the late-filing penalty, the earnings payment report and the employer's separate report are considered a single report subject to a single daily late-filing penalty.

Benefits payers report the pensions and other benefits they have paid to the Incomes Register on the benefits payment report. In addition, the benefits payers must report the payments made to employees in the earnings payment report and submit the employer's separate report.

Example 4: The payer submitted the earnings payment report and the employer's separate report for the calendar month to the Incomes Register on time. The payer also paid unemployment benefits on the 15th and 28th day of the same calendar month. The payer reported these payments to the Incomes Register on the 20th day of the following month in two records containing different benefits payment reports.

The benefits payment reports were submitted 12 calendar days after the eighth day of the following calendar month, which means that they were late. As the first reports for the month, i.e. the reports on the earnings payment data, were on time, no late-filing penalty is imposed.

2.2.2 Percentage-based component of the late-filing penalty

If the first report of the payment month is more than 45 days late, the daily late-filing penalty component is EUR 135. A sum equalling 1 percent of the taxable payment or amount of earnings from work on which pension is based that was reported late, whichever is the greater, will be added to the daily component.

Example 5: A payer submitted the first reports for the calendar month 50 days late. The payments in the late reports were calculated as amounting to EUR 10,000. The payment is taxable income and earnings from work on which pension is based. The late-filing penalty will be incurred for 45 days, i.e. EUR 135. In addition, a sum equalling one percent of the payment reported late, i.e. EUR 100, will be added to the late-filing penalty. The late-filing penalty will be EUR 235 in total.

Example 6: A payer submitted the first reports for the calendar month 50 days late. The late reports were only used to report tax-free reimbursements of expenses. The late-filing penalty will be incurred for 45 days, i.e. EUR 135. No percentage-based late-filing penalty will be added to the late-filing penalty, as the submitted reports did not include additional taxable payments or earnings from work on which pension is based. Hence, the total amount of the late-filing penalty is EUR 135.

If the data was reported to the Incomes Register within the deadline, the data submitted for the calendar month can be corrected or supplemented for 45 days after the deadline without incurring a penalty fee. If the data for the payment month is corrected more than 45 days after the deadline, the late-filing penalty is 1 percent of the amount of the taxable payment or earnings from work on which pension is based that was reported late, whichever is greater.

No late-filing penalty will be imposed, however, if the amount of the taxable payment or earnings from work on which pension is based will not increase due to the correction. Correction in this case may mean new or replacement benefits payment reports, earnings payment reports or employer's separate reports submitted for the payment month. The cancellation of previously submitted reports and submitting a new report can also be regarded as a correction in the reporting of income data.

Example 7: The employer submitted the first report for the calendar month on the15th day of the month following the wage payment month. This means that the report was 7 days late. The reports specified a total of EUR 5,000 in taxable payments. The amount of taxable payments in the reports is greater than the earnings from work on which pension is based. The late-filing penalty will be incurred for 7 days, i.e. EUR 21.

The payer corrects the previously submitted reports on the 30th day of the month following the wage payment month. Based on the correction, the taxable payment amount is EUR 5,000 more than previously reported, i.e. the taxable payments of the calendar month amount to a total of EUR 10,000. No late-filing penalty will be imposed on the payer, as the replacement reports arrived in the Incomes Register before 45 days had passed from the eighth day of the calendar month following the payment date.

The employer supplements the previously submitted reports again on the 30th day of the second month following the wage payment month. Based on the correction, the amount of taxable payment in the earnings payment reports is EUR 2,000 more than previously reported, i.e. the taxable payments amount to a total of EUR 12,000. The amount of the taxable payment is compared to the previously reported amount of taxable payment, which was EUR 10,000. A late-filing penalty of EUR 20 will be imposed on the payer. The late-filing penalty is 1 percent of the increased taxable payment, i.e. from EUR 2,000.

The percentage-based component of the late-filing penalty applies to wage and benefits data alike. It may be incurred separately both for earnings payment data submitted late and benefits payment reports submitted late. The daily late-filing penalty component, however, is not imposed twice on data submitted for the same calendar month. The late fulfilment of the reporting obligation is treated as a single entity.

Example 8: The benefits payer paid taxable benefits in January and reported the payments to the Incomes Register on 31 March, i.e. 51 days late. However, the benefits payer had already reported the wages it paid in January on a previous occasion and on time. The late benefits payment reports specified EUR 10,000 in taxable benefits. The late-filing penalty will be 1 percent of the payment that was reported late, i.e. = EUR 100.

Example 9: The payer submitted the first report for the calendar month 20 days late. The reports specified a total of EUR 1,000 in taxable payments. The late-filing penalty will be incurred for 20 days, a total of EUR 60.

The payer submits new reports 120 days after the deadline. Based on the correction, the total amount of taxable payments in the calendar month is EUR 400 less than previously reported. No further late-filing penalties are imposed on the payer, as the total amount of taxable payments decreases.

Example 10: The payer submitted the earnings payment reports and the employer's separate report for the calendar month on time. The taxable payments of the calendar month amount to EUR 15,000. The amount of taxable payments in the reports is greater than the earnings from work on which pension is based.

The payer cancels some of the earnings payment reports it previously submitted. The payer submits a replacement employer's separate report due to the reduced total amount of the employer's health insurance contributions. The report is 50 days late. Due to the cancellations, the amount of taxable payments is reduced to EUR 11,000. No late-filing penalties are imposed on the payer, as the amount of taxable payments decreases as a result of the correction.

Example 11: The payer submitted the earnings payment reports for the calendar month on time. The taxable payment in the calendar month is EUR 30,000. The amount of payments in the reports is greater than the earnings from work on which pension is based.

The payer submits the employer's separate report for the same calendar month over 45 days late. The employer's separate report specified a total of EUR 235 in the employer's health insurance contributions. No late-filing penalty is imposed on the payer, as no taxable payment or earnings from work on which pension is based was reported on the employer's separate report.

Based on the amount of the payment reported late, the late-filing penalty can amount to no more than EUR 15,000 for a calendar month. The maximum amount is reached if an amount of EUR 1,500,000 in taxable payments or earnings from work on which the pension is based is reported for the calendar month more than 45 days late. When the daily late-filing penalty is calculated based on this amount, the late-filing penalty can amount to no more than EUR 15,135.

The percentage-based late-filing penalty based on the payment amount will be adjusted if the payment amount is reduced due to the correction of data or the adjustment of a decision, an appeal or for another similar reason. The daily late-filing penalty imposed for the first report of the calendar month will not be adjusted due to the above-mentioned reasons, even if the payment amount decreases as a result of the change.

Example 12: The first report of the calendar month was submitted by the deadline. The payer submits a replacement report for the same calendar month in which the amount of taxable payment increases. The report is 50 days late. A late-filing penalty of 1 percent is calculated for the amount of payment reported late. If the amount of payments reported for the calendar month later decreases, the late-filing penalty imposed on the basis of the previous amount will be adjusted.

Figure 1: Determination of the late-filing penalty

2.3 Appeal

The procedure, decision and appeal process regarding late-filing penalties are subject to the provisions of the act on the incomes information system (laki tulotietojärjestelmästä 53/2018), as well as the provisions related to late-filing penalties in the act on assessment procedure for self-assessed taxes (laki oma-aloitteisten verojen verotusmenettelystä 768/2016). The applicable provisions include the provisions on the claim for adjustment procedure, appeals submitted to the Administrative Court or to the Supreme Administrative Court, and the notification on the decision.

The payer may appeal against the Tax Administration’s decision concerning the late-filing penalty or the decision on the claim for adjustment. The appeal may also be submitted by the party liable for the late-filing penalty under the act on tax collection (veronkantolaki 609/2005) or other tax law. The Tax Recipients' Legal Services Unit may appeal against the claim for adjustment or the decision issued on the claim to the extent that the Tax Administration’s decision regarding the late-filing penalty has been changed or repealed. When determining the deadlines for imposing the late-filing penalty and the appeal, the tax period for the data reported to the Incomes Register is considered to be a calendar month. The claim for adjustment must be submitted within three years from the beginning of the year following the calendar year including the calendar month for which the tax should have been reported and paid. If the taxpayer’s accounting period is not a calendar year, the three-year deadline is calculated from the beginning of the year following the end of the accounting period including the calendar month for which the tax should have been reported and paid.

Example 13: The payer’s accounting period is 1 May 2021–30 April 2022. The tax period for the late-filing penalty for Incomes Register data is a calendar month. The payer reported a taxable payment for June 2021 late to the Incomes Register. A late-filing penalty is imposed on the taxable payment reported late. The payer appeals against the late-filing penalty by submitting a claim for adjustment to the Adjustment Board. As the three-year deadline is calculated from the beginning of the year following the end of the accounting period, the claim for adjustment must be submitted no later than on 31 December 2025.

3 Penalty fees imposed on the basis of tax legislation

3.1 Tax increase

The tax increase provided for in section 37 of the act on assessment procedure for self-assessed taxes (laki oma-aloitteisten verojen verotusmenettelystä 768/2016) is imposed if the tax-related information reported to the Incomes Register is incomplete or incorrect, or is not reported at all. A tax increase is also imposed if taxes have not been withheld or tax at source has not been collected by the deadline.

Imposing a tax means that the Tax Administration imposes the missing tax to be paid by the taxpayer. The tax is also imposed if the taxpayer has not reported enough taxes, or not enough taxes have been paid for some other reason. Imposing a tax also refers to situations in which the tax is imposed to be paid by the payer due to the full or partial non-withholding of tax, or tax has been withheld but not reported or paid. In these situations, a tax increase is imposed in addition to the tax.

If the payer fails to report data on payments made during a calendar month despite a request, the taxes withheld and other employer contributions are imposed for payment by the payer based on an assessment. If tax is imposed on the basis of an assessment, the tax increase is 25 percent of the assessed amount of taxes. The Tax Administration can cancel the assessment and tax increase if the taxpayer later submits a report on this information, and the data in it is reliable. In such a case, the report is considered a report submitted late, and a late-filing penalty is usually imposed on the taxpayer under the act on the incomes information system (laki tulotietojärjestelmästä 5372018). If the taxes to be paid are not specified in the report, only a daily late-filing penalty will be imposed.

Example 14: The taxpayer fails to submit a report. The Tax Administration assesses the amount of payments and imposes EUR 1,000 to be paid in taxes. In addition, the Tax Administration imposes a EUR 250 tax increase.

If the taxpayer later submits a report to the Incomes Register, the Tax Administration will cancel the assessment and tax increase imposed in connection with it. The missing report was submitted 50 days late. If the amount of taxable payments in the report submitted after the tax assessment is EUR 5,000, a daily late-filing penalty is imposed for 45 days for the late report, i.e. EUR 135. In addition to the daily late-filing penalty, a sum equalling 1 percent of the payment reported late, i.e. EUR 50, will be imposed.

If the payer submits a report late, but the punitive tax increase is imposed based on a reason other than late reporting, the punitive tax increase plus a late-filing penalty due to late reporting will be imposed on the payer under the act on the incomes information system.

If a taxpayer submits a tax return or adjusts the amount of tax with the apparent intent of avoiding a late-filing penalty or punitive tax increase, a punitive tax increase will be imposed on the tax-payer instead of a late-filing penalty under section 37, subsection 2 of the act on assessment procedure for self-assessed taxes.

Further instructions on the imposing, calculation and appeal of a tax increase are provided in the Tax Administration guidelines (in Finnish) Penalty fees in self-assessed taxation.

3.2 Negligence penalty for a third-party-information provider

Penalty fees are also imposed for failure to fulfil the obligation to report data to the Incomes Register when the negligence does not concern the payer’s obligation to pay a tax or payment.

The Tax Administration can impose a negligence penalty for a third-party-information provider for failure to fulfil the reporting obligation in accordance with section 22 of the act on assessment procedure (laki verotusmenettelystä 1558/1995) in the following cases:

- there is an omission or error in the data reported to the Incomes Register

- the data is reported to the Incomes Register late

- the data is not reported to the Incomes Register in a manner other than that laid down by law or determined by the Tax Administration

- the data is not reported at all

- the data is only submitted after a request.

Negligence penalties are not imposed on natural persons or death estates. However, a negligence penalty may be imposed if the natural person or estate engages in business activities, agriculture or forestry.

Data to be reported to the Incomes Register that is within the scope of the third-party-information provider’s reporting obligation is subject to the provision on late-filing penalties in the act on the incomes information system. If a late-filing penalty in accordance with the act on the incomes information system is imposed for reporting data late, no further negligence penalty will be imposed for the late reporting and correction of data subject to the third-party-information provider’s reporting obligation. This is because no overlapping penalty fees are imposed with regard to the same matter.

The negligence penalty may be fully waived or its amount reduced if the taxpayer has a justified reason for the negligence. Such a justified reason could be that the failure to fulfil the reporting obligation is minor given the circumstances.

Information on grounds for the negligence penalty imposed due to errors and defects in data reported to the Incomes Register is provided in the instructions (in Finnish) Negligence penalty for Incomes Register reporting.