Reporting data to the Incomes Register: absence data

- Validity

- - 11/1/2018

These instructions are intended for payers. The instructions describe:

- reporting of paid and unpaid absences to the Incomes Register

- the reporting of Kela reimbursement application data to the Incomes Register

- the correction of absence data.

1 Absences

Reporting absence data to the Incomes Register is voluntary. When absence data are reported comprehensively and correctly to the Incomes Register on an earnings payment report, data users and income earners do not need to ask for separate certificates from the payer about the absences. Data users are able to utilise absence data if they are reported on a regular basis.

Payments must be reported to the Incomes Register either as a lump sum (reporting method 1) or in more detail than required by the mandatory reporting method, using separate complementary income types intended for this purpose (reporting method 2). The reporting of absence data is not connected with the method of reporting monetary wages. In other words, the payer can report voluntary complementary absence data, even if they report monetary wages using reporting method 1. Correspondingly, the payer can leave the absence data unreported, even if they report monetary wages in more detail using reporting method 2.

Absence data are reported only on income earners who have an employment relationship. Absences are not reported to the Incomes Register if the income earner has an employment or assignment relationship.

If the reported data are unclear, the Incomes Register's data users request further information primarily by contacting the contact person responsible for the content of the record by phone or by secure email. For this reason, the email address of the contact person responsible for content should be provided in the record. The address can be, for example, the address of a group email account which is read daily and from which any questions are forwarded to staff responsible for the report in question.

The absence data of an income earner must be reported on the next pay period's report at the latest. For example, absence data for pay period 01/20xx must be reported no later than on the report for pay period 02/20xx. In this way, data users such as benefit processors gain access to the absence data in a timely manner.

Only full days of absence are reported. It is not possible to distinguish between full-time and part-time absences in the Incomes Register's data content. Part-time absences are reported only if a sick leave that lasts at least one full day has begun in the middle of a workday. Where necessary, data users obtain information on part-time absences from sources other than the Incomes Register.

Full-day absences related to the performance of part-time work are not reported. For example, working full-time every other week can be agreed upon if part-time employment is based on 50% weekly working time. In such a case, no absences are reported for the weeks during which the income earner does not work. If the income earner is on part-time pension, for example, absences are not reported for the weeks considered pension weeks, i.e., the weeks during which the income earner does not work. However, if a period of absence due to a reason other than pension extends to a week during which the income earner does not work because of a part-time pension, the absence is reported in the normal manner. For example, a sick leave can begin in the middle of the week during which the income earner works and extend to a pension week.

If the income earner is absent from work due to rehabilitation, for example, only full days of absence are reported in the absence data.

1.1 Time period for reporting absences

The time period for reporting absences is the period for which the income earner’s potential absences are known by the person submitting the report at the time of reporting. The payer reports the date up to which absence periods have previously been reported as the start date (enters the date following the time period reported previously). The date up to which absences are known by the report submitter or have been entered in the employer’s system is reported as the end date.

An absence agreed for a future time period, such as a paternity leave or absence due to rehabilitation, is reported when all the absences preceding that time period are known.

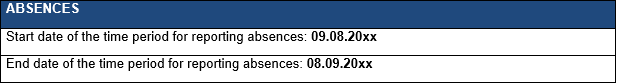

Example 1. Time period for reporting absences, no days of absence

As a rule, the supervisors at the reporting organisation enter the absences of income earners in the employer’s system no later than on the day following the period of absence. For example, when monthly paid employees' earnings payment data for September are reported to the Incomes Register on 10.9.20xx, the absences have been recorded in the employer’s system at least up to 8.9.20xx. Absences for August have been reported to the Incomes Register up to 8.8.20xx in the earnings payment report for August. As a result, in the earnings payment report for September, the start date of the time period for reporting absences is 9.8.20xx and the end date 8.9.20xx.

No other data of the “Absences” data group are reported because the income earner has no days of absence.

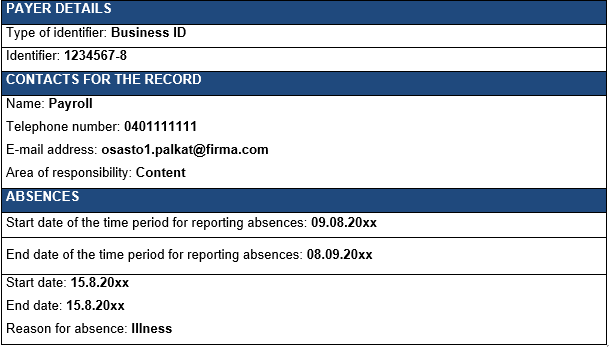

Example 2. Time period for reporting absences, one sick day (cf. example 1)

The income earner was sick on 15 August and was paid sick pay for that day.

The start date of the time period for reporting absences must be the same or earlier than the start date of the earliest period of absence reported on the report. The end date of the time period for reporting absences must be the same or later than the end of the last period of absence. For example, when a maternity leave that lasts several months is reported, the end date of the time period for reporting absences must be the same or later than the last day of the maternity leave.

The time period for reporting absences must be reported on every earnings payment report. If there are no changes in the data, the same data are reported again.

Data users may ask the person responsible for content for clarification if any conflicts are found in the data, or if the time period for reporting absences does not continue uninterrupted from one report to the next.

The time period for reporting absences can vary in length. The time periods given on different reports may overlap, for example if the income earner is known to be absent for a certain period in the future and new reports are submitted for the same time period (see examples 16 and 17 on how to report maternity and parental leave). The time period for reporting absences may also overlap with a previously reported period, if the previously reported period of absence continues without interruption. The time period may start prior to 1 January 2019, if the continuous period of absence started before that date.

The payer may also start reporting absences to the Incomes Register in the middle of the calendar year. If time periods for reporting absences have been reported and errors are detected later, the payer must correct the incorrect information. All information that has changed must be corrected whether absences were reported for the original time period or not. If data users require absences from a period for which the payer has not reported a time period for reporting absences, the users must obtain such information through another channel. If the payer has reported a time period for reporting absences, the data users will trust the information available in the Incomes Register.

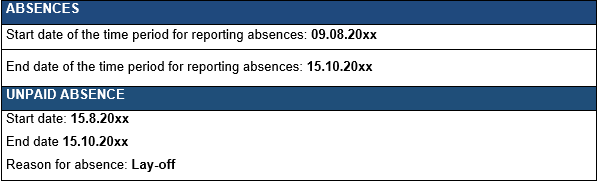

Example 3. The income earner was laid off full-time starting from 15 August and, at the time of reporting, the lay-off was known to continue until 15 October.

The time period for reporting absences is needed in the processing of benefits. The time period tells data users for what period absence data has been reported and whether there were any absences during that period.

If it later turns out that the time period for reporting absences was incorrect, the payer must submit a replacement report to the Incomes Register. A more detailed description of how to correct information is provided in the instruction Correcting information in the Incomes Register. Correcting the time period for reporting absences is also described in chapter 6.1. of these instructions

2 Period of absence

The income earner may be absent from work for several different reasons during the same pay period. Only one reason is reported for each period of absence. If the absence continues and the reason remains the same, the same start date can be given on a later report but the end date of the absence must be changed.

The Incomes Register does not check whether the period of absence has already been reported partially or fully, or whether the same period is also included in another period of paid or unpaid absence. The data users’ systems, however, may compare a reported period of absence with a previously reported period and ask the payer to provide further information, if there are conflicts in the data. In addition, the benefit processor or the income earner may contact the payer if the reported periods of absence are inaccurate.

Any data reported incorrectly must be corrected by submitting a replacement report.

Each continuous period of absence must be reported separately. A continuous period of absence may include a weekly time off, but periods of paid and unpaid absence must be reported as different periods.

The periods of absence are utilised in decisions on nearly all benefits. A description of what benefits are affected by a reported period of absence and any special instructions for reporting absences are provided under “Reason for absence”.

Effect of weekly time off on reporting of period of absence

A period of absence is reported to the Incomes Register in the way agreed between the income earner and their supervisor, either as a continuous period that also includes the weekly time off, or as two separate periods before and after the weekly time off. The reporting method may affect the processing of the benefit if the income earner's benefit application also covers the weekly time off, such as a Saturday, and the benefit processor is not aware of the weekly time off.

Example 4. Reporting of absence for a period of weekly time off

The income earner works from Monday to Friday (5 days a week) and is absent from work on Friday and Monday due to their child falling ill. The absence is reported as a continuous absence, with the reason for absence being “Child's illness or a compelling family reason”. If the income earner applies for a special care allowance; the allowance can also be granted for a Saturday that falls between two days of absence.

2.1 Start date

The start date of each continuous period of absence is reported as the start date. If the reason for absence changes during a continuous period of absence, the absence must be reported as a separate time period.

The period of absence may be reported to start earlier or end later than the pay period. If a period of absence reported previously continues uninterrupted, the date reported as the start date is the start date of the continuous period of absence or the calendar day following the end date of the period of absence reported previously.

2.2 End date

The end date of each continuous period of absence is reported as the end date. If the period of absence continues until further notice, the date reported as the end date is the end date of employment or, for example, the last day of the calendar year or another day starting from which a new, specified report on the absence is submitted.

2.3 Number of days of absence

The number of workdays included in the period of absence is reported as the number of days of absence. The number of days of absence is voluntary, complementary data. Reporting the time periods of absence (start and end dates) will suffice for most data users utilising absence data.

3 Unpaid absences

The payer selects the reason for unpaid absence from the value list.

| Code | Description |

|---|---|

| 1 | Illness |

| 2 | Part-time sick leave |

| 3 | Maternity, paternity and parental leave |

| 4 | Special maternity leave |

| 5 | Rehabilitation |

| 6 | Child's illness or a compelling family reason |

| 8 | Training, education |

| 9 | Job alternation leave |

| 10 | Study leave |

| 11 | Industrial action or lock out |

| 13 | Interruption in work provision |

| 14 | Leave of absence |

| 15 | Military refresher training |

| 16 | Military or non-military service |

| 17 | Child care leave |

| 99 | Other |

If an absence is of a sensitive nature, the reason is not reported to the Incomes Register.

3.1 Unpaid sick leave

This reason is selected if the income earner is absent from work due to illness or an accident and no pay is paid for the period of absence. Absence due to an occupational accident can be reported only as paid absence. If no pay is paid for a period of absence caused by an occupational accident (for example, the employer is not obliged to pay sick pay due to an occupational accident because the obligation to pay wages under the collective agreement has ended), the absence is reported as a sick leave.

The employee either presents a medical certificate to the employer for the period of absence or is absent from work by their own account. This has no effect on reporting the absence.

The absence must last for at least one full workday, otherwise it is not reported to the Incomes Register.

The payer reports the workday on which the income earner's continuous period of sick leave started as the start date of absence. The date on which the income earner left the workplace due to illness may be reported as the start date; in other words, the income earner was at work for part of the day before falling ill. If pay for regular working hours is paid for the unfinished workday, the unfinished workday is reported as paid absence. A condition is that the reported absence should continue at least for the following calendar day, paid or unpaid. Individual sick leaves that last less than a full workday are not reported to the Incomes Register. If the income earner does not fall ill until the workday has ended, the payer does not report that workday as a day of absence.

In industries in which employees are paid an hourly rate, the first day of absence may be an unpaid waiting day; this depends on the duration of the sick leave. In such cases, the absence is reported only after it has been determined whether the waiting day is paid or unpaid.

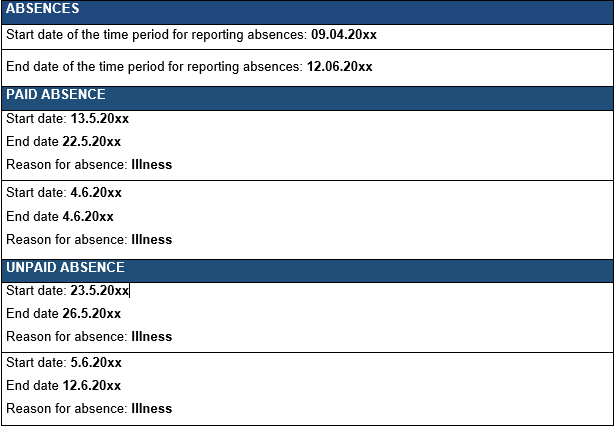

Example 5. Reporting a period of unpaid sick leave

- The income earner tells the supervisor that they have fallen ill and leaves the workplace in the middle of the workday on Monday 13 May. The income earner says that they will be absent from work due to illness until Thursday 16 May. The income earner visits a doctor on Friday, 17 May, and delivers a medical certificate on inability to work for the period of 17 May to 26 May.

- The payer reports a sick absence to the Incomes Register for the period of 13 May to 26 May, dividing it into periods of paid and unpaid absence based on the number of days for which the employer pays sick pay to the employee.

- The employee returns to work on Monday, 27 May, and continues working until falling ill again on Tuesday, 4 June. The employee delivers a medical certificate covering the period from Wednesday, 5 June, to Wednesday, 12 June, and returns to work on Thursday, 13 June.

- The employer no longer pays wages for the period of absence; however, wages are paid for the day on which the employee fell ill. The payer reports a paid sick leave to the Incomes Register for the day on which the employee fell ill, i.e. 4 June, and an unpaid sick leave for the period of 5 June to 12 June.

3.2 Unpaid maternity, paternity or parental leave

This reason is selected if the income earner is fully absent from work due to a maternity, paternity or parental leave for at least one full workday and no pay is paid to the income earner for the period of absence.

If a complementary wage/salary is paid for the duration of the maternity, paternity or paternal leave under the collective agreement applicable in the industry (income type 204, “Complementary wage/salary paid during benefit period”), the absence is first reported as an unpaid leave to avoid delays in the reporting of absences.

The payer reports the complementary wage/salary on an earnings payment report using reporting method 1 or 2, after receiving the benefit decision from the income earner. If necessary, the payer also corrects the time period for unpaid absence insofar as any complementary daily allowance is paid for the period of absence.

The payer reports the full workday on which the income earner’s continuous period of unpaid leave started as the start date of absence.

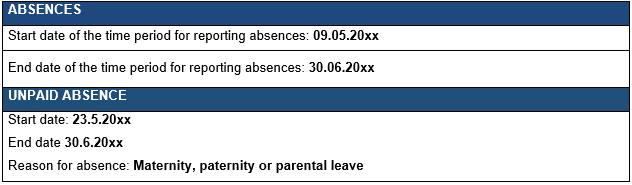

Example 6. Reporting of unpaid paternity leave

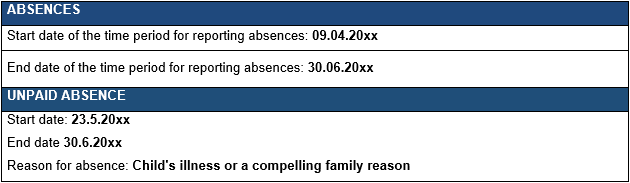

The income earner announces that he will be on paternity leave for the period 23.5.20xx–30.6.20xx. The payer reports the paternity leave when submitting an earnings payment report on absences up to the start date of the paternity leave.

Kela uses the data on unpaid maternity, paternity or parental leaves when processing applications for a parental allowance. The daily allowance for the absence is paid to the income earner.

3.3 Unpaid special maternity leave

This reason is selected if the pregnant income earner is fully absent from work due to a risk relating to work tasks or working conditions for at least one full workday and no pay is paid to the income earner for the period of absence. In such cases, the employer must always submit a separate report to Kela, providing information on the income earner's work tasks and working conditions. This report is made in Kela’s e-services or on form SV96.

The special maternity allowance for the period of unpaid special maternity leave is paid to the income earner.

The payer reports the full workday on which the income earner’s continuous period of unpaid leave started as the start date of the period of absence.

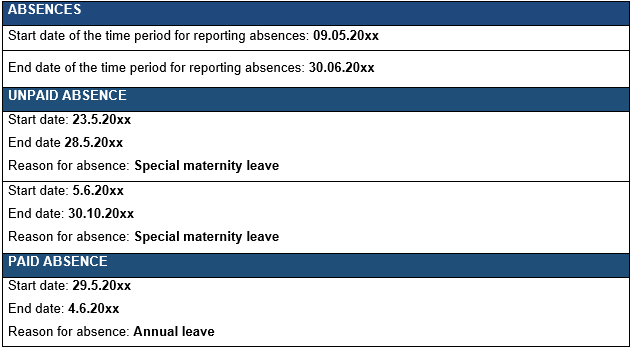

Example 7. Reporting of unpaid special maternity leave

A chemical substance, radiation, an infectious disease or other comparable factor associated with the income earner's work tasks or working conditions poses a risk to the health of the income earner or her unborn child, and the employer is not able to offer the income earner any other work for the days on which she normally works (certificate SV96). The income earner goes on special maternity leave on 23 May, but is on annual leave for the period of 29 May to 4 June. The unpaid absence is reported as three separate absences.

3.4 Unpaid absence due to rehabilitation

This reason is selected if the income earner is fully prevented from working due to participation in professional or medical rehabilitation and no pay is paid to the income earner for the period of absence. Part-time unpaid absences due to rehabilitation are not reported to the Incomes Register.

The payer reports the full workday on which the income earner’s continuous period of unpaid leave started as the start date of the period of absence.

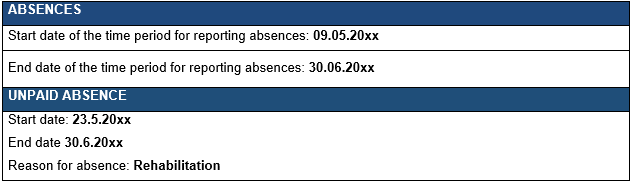

Example 8. Reporting of unpaid absence due to rehabilitation

The income earner participates in a rehabilitation course consisting of three separate periods. The first period of absence due to rehabilitation reported by the payer is 23.5.20xx–30.6.20xx. The other periods (12.10.–17.10.20xx and 1.2.–5.2.20xx) are not reported until all the other potential absences up to the start of these periods are known.

Rehabilitation can take place in several periods known in advance. However, no rehabilitation period is reported until after all the other absences up to the start of that particular rehabilitation period are known.

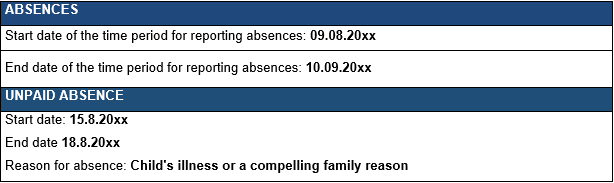

3.5 Unpaid absence due to a child’s illness or a compelling family reason

This reason is selected if the income earner is fully prevented from working and no pay is paid for the period of absence. The income earner is prevented from working due to one of the following reasons:

- The income earner’s child who is under 10 years of age, or another child under 10 who lives permanently in the same household as the income earner, has suddenly fallen ill.

- A family member or some other person close to the income earner requires special care, and the income earner has to be absent from work.

- The income earner's immediate presence is necessary due to an unanticipated and compelling reason relating to an illness or accident within the family.

The payer reports the workday on which the income earner’s continuous period of unpaid absence started as the start date of the period of absence. A full day of absence means that the income earner is absent from work for at least 6 hours.

Example 9. Unpaid absence, income earner is absent from work due to caring for a sick child

3.6 Unpaid absence due to training/education

This reason is selected if the reason for the income earner's unpaid full-day absence is participation in training by the employer's order, training required under co-operation agreements of labour market organisations, trade union training, or information-focused training that is part of apprenticeship training, and if no pay is paid to the income earner for the period of absence.

3.7 Unpaid absence due to job alternation leave

This reason is selected if the income earner and the employer conclude a fixed-term agreement on the income earner’s job alternation leave.

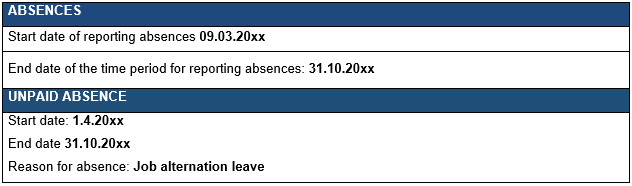

Example 10. Reporting of job alternation leave to the Incomes Register

3.8 Unpaid absence due to study leave

This reason is selected if the employer has released the income earner from their work duties to allow them to focus on studies meeting the requirements of the Study Leave Act and no pay is paid to the income earner for the period of absence.

This reason is also selected if the income earner has been granted discretionary study leave.

3.9 Unpaid absence due to industrial action or lock-out

This reason is selected in the following situations:

- The income earner interrupts their employment-related duties full-time due to industrial action and no pay is paid to the income earner for the period of absence.

- The employer prevents the income earner from handling their employment-related duties full-time due to industrial action and no pay is paid to the income earner for the period of absence.

3.10 Unpaid absence due to interruption in work provision

This reason is selected if the income earner cannot work full-time for reasons unrelated to them and no pay is paid to the income earner for the period of absence.

3.11 Unpaid leave of absence

This reason is selected if the income earner is on unpaid leave of absence and the reason for the leave of absence is not known or not included in the selection list; for example, the income earner may be employed by another employer during the leave of absence.

3.12 Unpaid absence due to military refresher training

This reason is selected if the income earner is absent from work due to participation in military refresher training and the employer does not pay any wages or salary for the period of training.

3.13 Unpaid absence due to military or non-military service

This reason is selected if the income earner is absent from work due to military or non-military service.

3.14 Unpaid lay-off

This reason is selected if the income earner is laid off full-time.

3.15 Unpaid child care leave

This reason is selected if the income earner is on child care leave full-time. A part-time child care leave is not reported to the Incomes Register if the income earner is absent from work only part of the day. Unpaid full-day absences during the part-time child care leave are reported using the reason code for child care leave. If necessary, data users will separately request further information on the duration of the part-time child care leave, on the way it is arranged, and on wage/salary allocation.

3.16 Unpaid absence due to other reason

This reason is selected if the reason for the income earner’s absence is not included in the selection list.

4 Paid absences

The payer selects the reason for paid absence from the value list.

| Selite | |

|---|---|

| 1 | Illness |

| 2 | Part-time sick leave |

| 3 | Maternity. paternity and parental leave |

| 4 | Special maternity leave |

| 5 | Rehabilitation |

| 6 | Child's illness or a compelling family reason |

| 8 | Training, education |

| 10 | Study leave |

| 13 | Leave of absence |

| 14 | Military refresher training |

| 18 | Mid-week holiday |

| 19 | Accrued holiday |

| 20 | Occupational accident |

| 21 | Annual leave |

| 22 | Part-time absence due to rehabilitation |

| 99 | Other |

The payer must also report the amount of pay for the period of absence if the “Payment data type” selected on the report is “Kela, daily allowance application”, which means that the report is used to apply for a daily allowance from Kela. Applying for a daily allowance is possible only if the reason code for absence is 1, 3, 4, or 5.

If an absence is of a sensitive nature, the reason is not reported to the Incomes Register.

4.1 Reporting of date for “Absence continues, until when”

The payer reports the date up to a which pay will be paid for this absence. Reporting the date means that the payer knows that the absence will continue, but the pay for the period of absence cannot be reported yet when the report is submitted. The date for “Absence continues, until when” may not be included in the reported period of absence.

Kela uses the date when the employer is entitled to a sickness allowance paid by Kela based on an employment contract, collective agreement or other agreement and the payer cannot report the sick pay for the whole period of absence on one and the same report. If the date has been reported, Kela will not pay the income earner’s sickness allowance (reason code 1), maternity, paternity or parental allowance (reason code 3), special maternity allowance (reason code 4) or rehabilitation allowance (reason code 5) to anyone, until the payer who has reported the date has reported the amount of sick pay paid up to the date reported.

The daily allowance is always paid afterwards.

Example 11. Reporting of date for “Absence continues, until when”

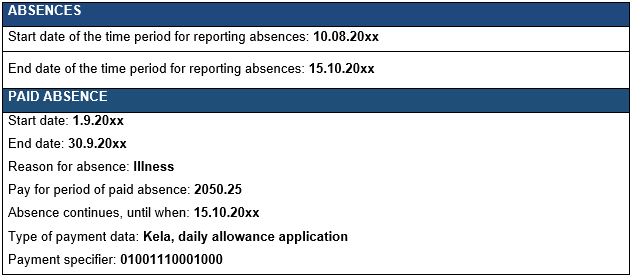

The income earner has delivered a medical certificate on inability to work for the period 10.8.20xx–15.10.20xx and the amount of sick pay can be reported only for the month of August. As it is not necessarily known whether the paid time will continue after the pay period, the date until which the paid time is known to continue at the minimum is reported.

- Sick pay for the period of 10 August to 31 August has been reported to the Incomes Register earlier, and the date reported for ”Absence continues, until when” is 30 September.

- Kela has obtained the information from the Incomes Register and has on 12 August issued a decision on sickness allowance for the period of 22 August to 15 October based on the employer’s application details reported to the Incomes Register and on the medical certificates presented. In connection with the decision, daily allowance was paid to the employer up to 31 August. The decision states that a new decision will be issued for the period of 1 September to 30 September on how the payment will be allocated between the employer and the income earner, and that, starting from 1 October, the benefit will be paid to the income earner.

- As earnings payment data for September are reported to the Incomes Register, sick pay for the period of 1 September to 30 September is reported and 15 October is reported as the date for “Absence continues, until when”, because it has turned out that partial pay will be paid to the income earner for the duration of the absence.

- Kela obtains the data from the earnings payment report for September and reviews the earlier sickness allowance decision on 2 October. In connection with the decision, the daily allowance is paid to the employer for the period of 1 September to 30 September. The decision states that a new decision will be issued for the period of 1 October to 15 October on how the daily allowance payment will be allocated between the employer and the income earner.

A description of how to correct the date for “Absence continues, until when” is provided in section 6.4.

4.2 Paid sick leave (Kela: employer’s daily sickness allowance application)

This reason is selected if the income earner is fully absent from work for at least one full workday due to inability to work caused by an illness or a non-occupational accident, and receives wages for the period of absence. This reason is also selected if the income earner was party to a traffic accident or victim of an assault or offence or had a non-occupational accident, and receives pay for the period of absence. Occupational accident is selected as the reason if the absence is caused by an occupational accident.

The income earner either presents a doctor's or nurse's certificate for the period of absence to the employer or is absent from work by their own account. This has no effect on how the absence is reported.

The absence must last for at least one full workday, otherwise it is not reported to the Incomes Register.

The payer reports the workday on which the income earner's continuous period of sick leave started as the start date of absence. The date on which the income earner left the workplace due to illness may be reported as the start date; in other words, the income earner was at work for part of the day before falling ill. If pay for regular working hours is paid for the unfinished workday, the unfinished workday is reported as paid absence. A condition is that the reported absence continues at least for the following calendar day, paid or unpaid. Individual sick leaves that last less than a full workday are not reported to the Incomes Register. If the income earner does not fall ill until the workday has ended, the payer does not report that workday as a day of absence.

Kela does not use the part-time sick leave data, and the earnings payment report cannot be used to apply for a partial sickness allowance.

Example 12: Reporting of paid sick leave without a Kela application

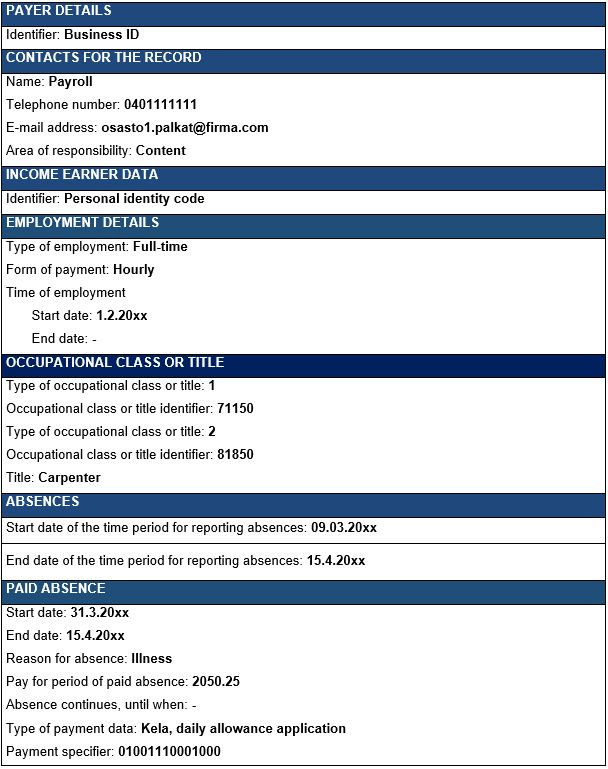

Example 13: A sickness allowance application – the pay for the period of absence is reported at one go

Example 14 a: A sickness allowance application – pay for the period of absence is reported using two reports (first report)

A medical certificate up to 30.4.20xx has been delivered to Kela. The income earner has no other employment relationships.

Kela issues a decision on sickness allowance to the employer and the income earner for the period 31.3.–30.4.20xx.

The decision states that the daily allowance will be paid up to 15.4.20xx, and describes how the payment will be allocated between the employer and the income earner.

A new daily allowance decision will be issued for the period starting 16.4.20xx when the Incomes Register has received a report including the amount of sick pay and the application for daily allowance from Kela as of 16.4.20xx.

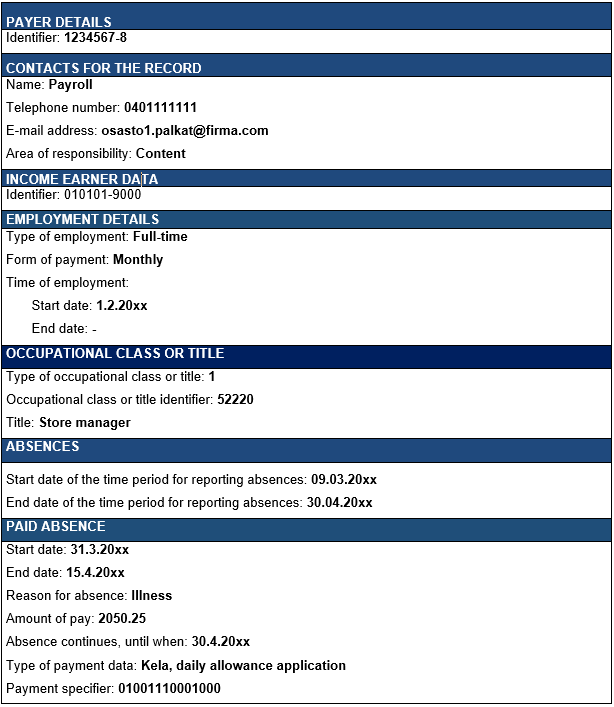

Example 14 b: A sickness allowance application – the pay for the period of absence is reported on two reports and is partly a partial pay (second report)

If reduced sick pay is paid for the sick leave in accordance with a collective agreement or collective agreement for public servants, the pay must be reported to the Incomes Register. The payer reports the pay under the income type “Partial pay during sick leave” (reporting method 2) or “Total wages” (reporting method 1).

If the payer uses the earnings payment report to report Kela application details (type of payment data: Kela, daily allowance application), the partial sick pay for the period of absence must be reported as a separate period (the period used in the example is 26 April to 30 April) to enable allocating the daily allowance amount correctly between the employer and income earner. If the payer reports a partial sick pay using reporting method 2, Kela will not use the data as part of the application data when processing the employer's application.

4.3 Paid maternity, paternity or parental leave (Kela: maternity, paternity or parental leave application for employer/income earner)

This reason is selected if the income earner is fully absent from work for at least one full workday due to a maternity, paternity or parental leave and receives pay for the period of absence.

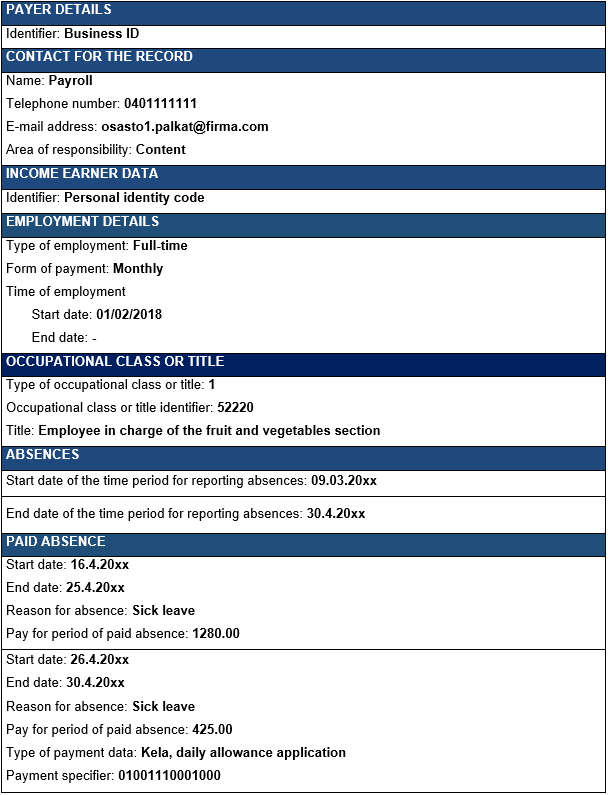

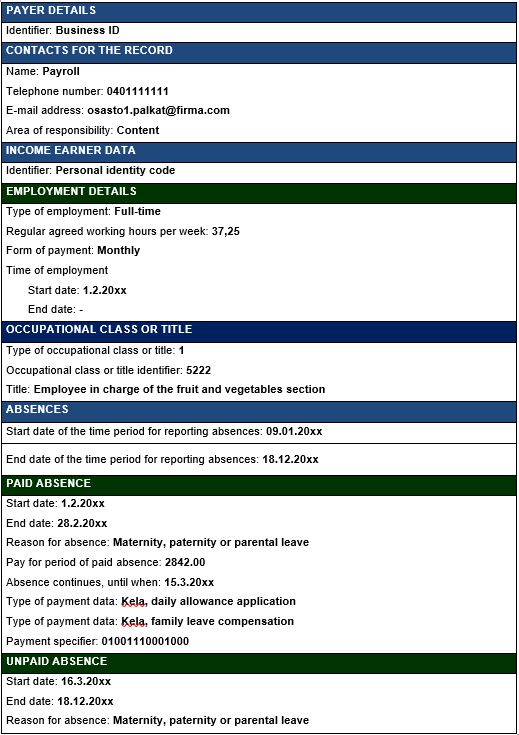

Example 15. Applying for maternity allowance for maternity leave (first report)

In this example, wages and salaries are reported by pay period (by calendar month), and the first report comprises only three days. At the time of submitting the first report, the submitter already knows up to what date pay will be paid for the maternity leave.

Example 16. Applying for a maternity allowance and family leave compensation for maternity leave (second report) – wages and salaries are reported by pay period (by calendar month)

If a complementary wage/salary is paid for the duration of the maternity, paternity or paternal leave under the collective agreement applicable in the industry (income type 204, “Complementary wage/salary paid during benefit period”), the absence is first reported as an unpaid leave to avoid delays in the reporting of absences.

The payer reports the amount of the complementary wage/salary on an earnings payment report using reporting method 1 or 2 after the income earner has delivered the benefit decision to the payer. If necessary, the payer also corrects the time period for unpaid absence insofar as any complementary daily allowance is paid.

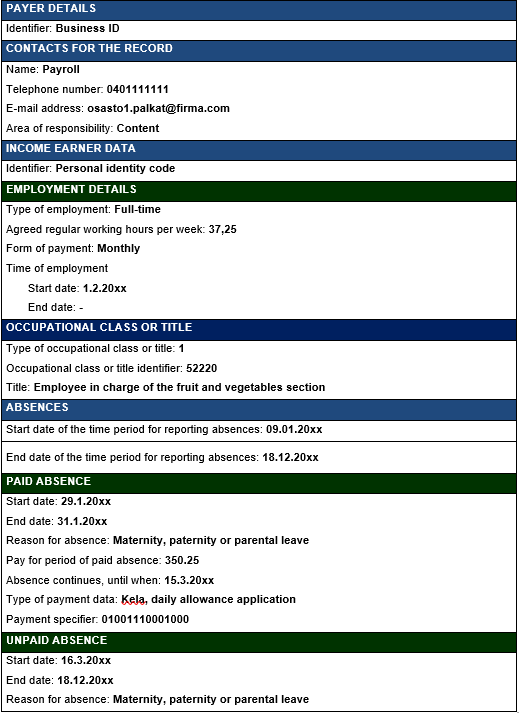

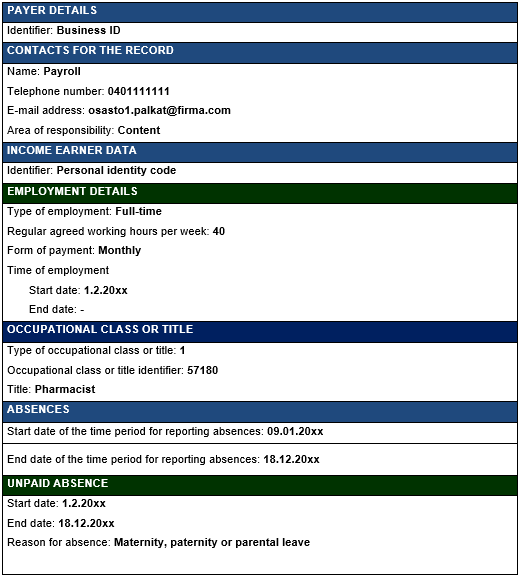

Example 17 a. Reporting of maternity leave – complementary wage/salary is paid to the income earner (first report)

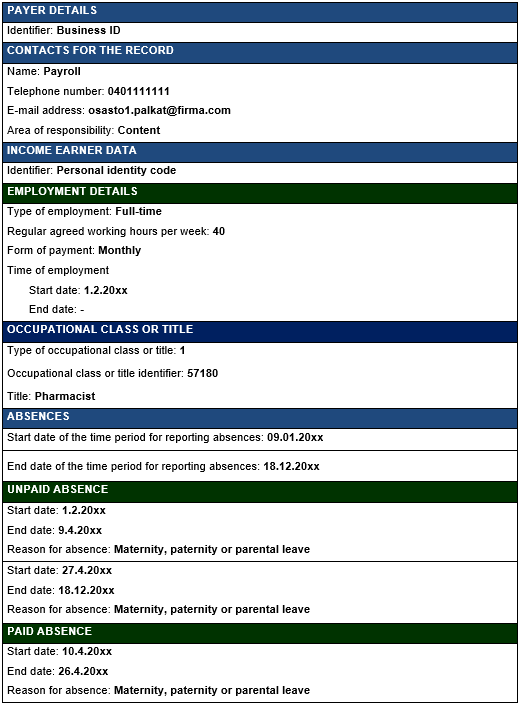

Example 17 b. Correcting absence details when complementary wage/salary is paid (replacement report)

A replacement report is submitted when the income earner has provided the employer with a decision on a maternity and parental allowance and a complementary wage/salary is paid to the income earner. In the example, no complementary wage/salary remains to be paid for the first 56 weekdays of the period of maternity allowance, which means that the amount of daily allowance is 90% of the 1/300th of annual earnings. Please note that the number of weekdays must be calculated separately for each calendar year. The number of weekdays for the same time period varies from year to year.

Kela processes the report details as part of the payer's and income earner’s maternity, paternity or parental allowance application.

4.4 Paid special maternity leave (Kela: employer's special maternity leave application)

This reason is selected if, due to a risk relating to work tasks or working conditions, the income earner is prevented from working for at least one full workday and receives pay for the period of absence. In such cases, the employer must always submit a separate report to Kela to provide information on the income earner's work tasks and working conditions. This report is made in Kela’s e-services or on form SV96. If a future maternity leave is known when the report is submitted, it is reported as a separate absence.

Pay for period of absence is mandatory information if the report is used to apply for a special maternity allowance for the employer.

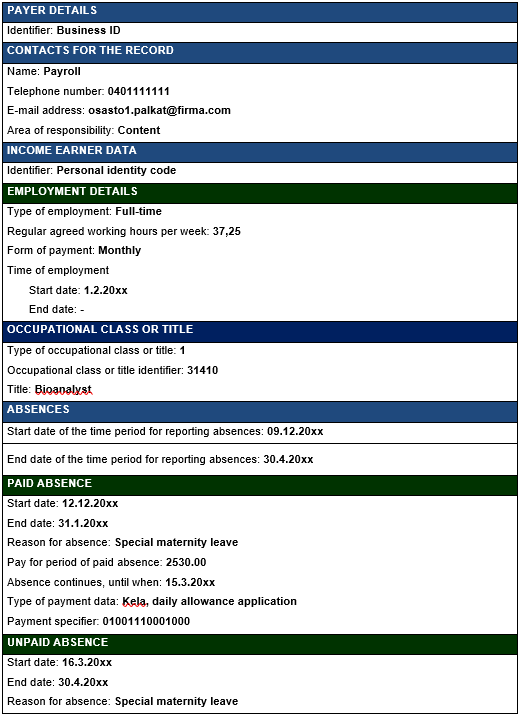

Example 18. Employer applies for special maternity allowance

Kela processes the report data as part of the employer’s special maternity allowance application. An employer's report on the working conditions and absence from work is also required in order that the application could be processed. The employer can make the report in Kela's e-services or on form SV96.

4.5 Paid absence due to rehabilitation (Kela: employer’s rehabilitation allowance application)

This reason is selected if the income earner is fully prevented from working due to participation in professional or medical rehabilitation and receives pay for the period of absence. Only full-day absences are reported in this field.

Pay for a period of absence is mandatory information if the report is used to apply for a rehabilitation allowance for the employer.

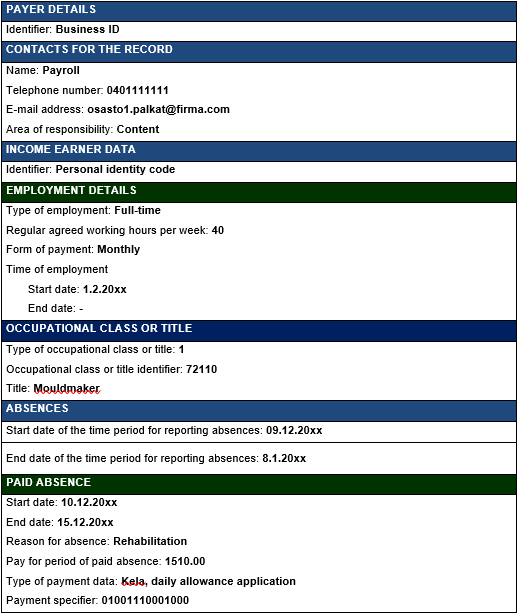

Example 19. Employer applies for a rehabilitation allowance

Kela processes the report data as part of the employer’s rehabilitation allowance application. A certificate of attendance must be enclosed, so the income earner must deliver it to Kela.

4.6 Paid absence due to a child’s illness or a compelling family reason

This reason is selected if the income earner is fully prevented from working and receives pay for the period of absence. The income earner is prevented from working due to one of the following reasons:

- The income earner’s child who is under 10 years of age, or another child under 10 who lives permanently in the same household as the income earner, has suddenly fallen ill.

- A family member or some other person close to the income earner requires special care, and the income earner must be absent from work.

- The income earner's immediate presence is necessary due to an unanticipated and compelling reason caused by an illness or accident within the family.

4.7 Paid absence due to training/education

This reason is selected if the reason for the income earner's full-time absence is participation in training by the employer's order, training required under co-operation agreements of labour market organisations, trade union training or information-focused training that is part of apprenticeship training, and the income earner receives pay for the period of absence.

4.8 Paid absence due to study leave

This reason is selected if the income earner has been granted a paid study leave.

4.9 Paid leave of absence

This reason is selected if the income earner is on paid leave of absence and the reason for the leave of absence is unknown.

4.10 Paid absence due to military refresher training

This reason is selected if the income earner is absent from work due to participation in military refresher training and receives pay for the period of absence, for example, an amount equal to the difference between the reservist's pay and the income earner's normal pay.

4.11 Paid absence due to a mid-week holiday

This reason is selected if the time period for reporting absences includes a mid-week holiday for which pay for a period of absence is paid. For example, Good Friday and Easter Monday are reported as mid-week holidays if they are paid days off.

4.12 Paid accrued days-off

This reason is selected if paid accrued days off (“pekkasvapaa”) are included in the time period for reporting absences. Accrued days off are paid absences if compensation for accrued days off is paid to the income earner.

4.13 Paid absence due to occupational accident

This reason is selected if it is known, at the time of the report, that the income earner's absence is due to an occupational accident and wages are paid for the period of absence. The same time period is not reported as a sick leave.

4.14 Paid annual leave

This reason is selected if the time period for reporting absences includes days of annual leave or a period of annual leave for which holiday pay is paid. If the income earner falls ill during their annual leave, the days of annual leave spent are reported as the period of annual leave. In such a case, as provided in the Annual Holidays Act or agreed in a collective agreement, part of the annual leave can be considered 'waiting days', which will not be postponed to a later date.

4.15 Paid absence due to another reason

This reason is selected if the reason for paid absence is not included in the selection list. The absence may be, for example, days off accrued from working overtime, holiday pay converted to days off, or a flexitime leave.

5 Kela reimbursement applications

5.1 Type of payment data

The employer can apply for a daily allowance from Kela using the Incomes Register's earnings payment report. Kela processes the employer’s daily allowance application primarily on the basis of the “Type of payment data” selection.

The payer selects the type of payment data from the selection list:

| Code | Description |

|---|---|

| 1 | Kela, daily allowance application |

| 2 | Kela, family leave compensation |

If the application is not formally correct, Kela sends an email notification of the error to the email address of the contact person responsible for content provided on the Incomes Register's report. The email address can also be a group email address.

An erroneous report must be corrected by submitting a replacement report. If no replacement report is submitted, Kela cannot process the matter.

A formally correct application received by Kela and any related formally correct replacement reports are available in PDF format in Kela’s e-services for both the income earner and the employer.

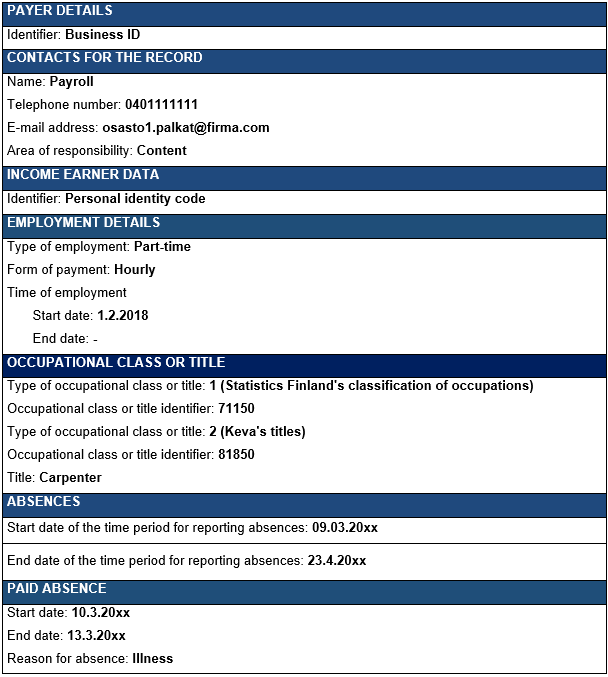

Kela, daily allowance application can be selected as the type of payment data if the following conditions are met:

- The income earner has a Finnish personal identity code.

- The email address of a person responsible for content has been submitted.

- The period of absence is included in the time of employment.

- The form of payment has been reported.

- The occupational class or title “Statistics Finland's classification of occupations” has been reported.

- The occupational class or title identifier has been reported.

- The employer is entitled to a sickness allowance, rehabilitation allowance, maternity, paternity or parental allowance, or special maternity allowance on the basis of a collective agreement, collective agreement for public servants, or other similar agreement.

- The period of paid absence has been reported and at least one of the following reason codes for paid absences has been reported for the period in question:

- illness = sickness allowance application

- rehabilitation = rehabilitation allowance application

- maternity, paternity or parental allowance = maternity, paternity or paternal allowance application

- special maternity allowance = special maternity allowance application

- In addition, the employer has reported to Kela:

- their consent to receiving decisions electronically

- the bank account number of the employer for the payment of the benefit.

Applying for a daily allowance is not possible if a complementary wage/salary is paid for the period of absence.

Kela, family leave compensation can be selected as the type of payment data if the following conditions are met:

- The income earner is female.

- The income earner has a Finnish personal identity code.

- The email address of the person responsible for content has been submitted.

- A paid maternity leave or parental leave for an adoptive parent lasting at least 30 days has been reported for the income earner previously or on the same report.

- In addition, the employer has reported to Kela:

- their consent to receiving decisions electronically

- the bank account number of the employer for the payment of a family leave compensation.

The employer is entitled to a family leave compensation only if they have paid a complementary wages/salary. See example 17.

5.2 Kela’s decision to an employer with a Business ID

Kela issues a decision on daily allowance or family leave compensation electronically. An employer with a Business ID can give their consent to receiving decisions electronically in Kela's e-services. The consent is valid until cancelled by the employer. The consent also covers a partial sickness allowance, partial rehabilitation allowance, partial parental allowance or annual leave compensation, even though these cannot be applied for on the Incomes Register's earnings payment report.

Kela sends an email notification of having issued a decision electronically. An exception is formed by recovery decisions, which cannot yet be delivered electronically. Kela also sends customer letters, such as requests for clarification and hearing letters (for example consent to adjustment of decision) by post. Kela mails the decisions to the employer's address obtained from the Business Information System (BIS).

5.3 Kela's decision to a person acting as an employer

Until changes related to persons acting as an employer are implemented in Kela’s e-services, Kela delivers decisions concerning daily allowance or family leave compensation to such persons’ addresses obtained from the BIS.

5.4 Processing of “Payment reference” and “Payment specifier” data

Payment references used in Kela’s reimbursement applications may not have more than 20 characters, and the characters must be digits.

Payment specifiers used in Kela’s reimbursement applications may not have more than 20 characters, and the characters must be digits. The payment specifier is an alternative to the payment reference.

If applications generated from several earnings payment reports submitted to the Incomes Register are used in one benefit decision and different “Payment specifier” and “Payment reference” data have been reported in them, Kela will use only the data (“Payment specifier” or “Payment reference”) reported for the latest time period.

5.5 Paying daily allowance to the employer

Kela processes applications that are formally correct (see section 5.1).

Kela pays the daily allowance to the employer’s bank account. The employer can give the bank account number in Kela's e-services.

Until changes related to persons acting as an employer are implemented in Kela’s e-services, such persons must use Kela’s paper form to report their bank account number for the payment of daily allowances.

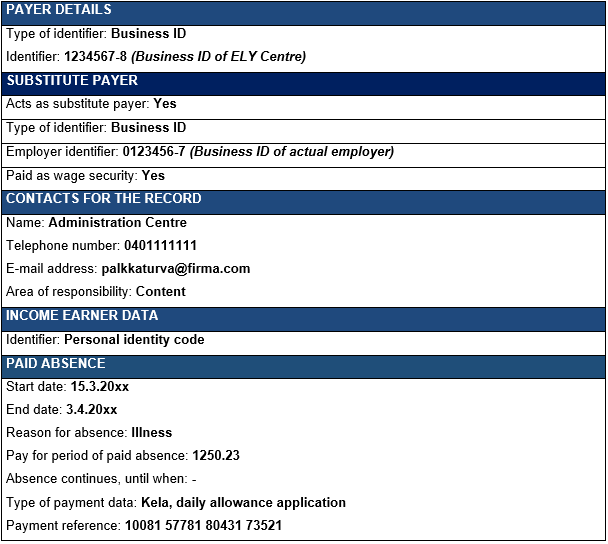

5.6 Wage security, daily allowance applied from Kela

If sick pay is paid as wage security, the Incomes Register's earnings payment report can also be used to apply for a sickness allowance from Kela.

Example 20. The Centre for Economic Development, Transport and the Environment (ELY Centre) pays sick pay to the income earner as wage security for the period 15.3.20xx–3.4.20xx and applies for a daily allowance from Kela for this period.

6 Correcting absence data

6.1 Correcting the time period for reporting absences

If the payer has reported an incorrect time period for reporting absences, the information can be corrected in one of the following ways:

- The payer submits a replacement report, in which the time period for reporting absences is corrected and the periods of absence and other information that were correct in the earlier report are reported again.

- Instead of submitting a replacement report, the payer reports the time period for reporting absences on the next new report such that the days for which absence details were reported incorrectly in the earlier report are included. The time period for reporting absences given on the new report does not have to be of the same length as on the previous report (see example 21). If the same time period has been submitted as the time period for reporting absences on several earnings payment reports, data users will only use the most recent report.

Example 21. Time periods for reporting absences have been provided earlier on two separate reports for the periods of 15 January to 14 February and 15 February to 14 March, and no absences have been reported. In April, it turns out that the income earner has been absent from work due to illness from 13 February to 14 March and received full pay for this period. If the amount of sick pay is the same as the monetary wages reported earlier, a new report can be submitted to report the time period for reporting absences for the period 13 February to 14 March or the period 15 January to 14 March while also reporting a paid absence that was not reported earlier for the period of 13 February to 14 March.

A more detailed description of how to correct information is provided in the instructions Correcting information in the Incomes Register.

6.2 Correcting a period of absence

6.2.1 Unnecessary period of absence

If a whole period of absence has been reported incorrectly, the payer corrects the information by submitting a replacement report. The information submitted on the replacement report is otherwise the same but the period of absence, reason for absence and potential Kela reimbursement application data are not submitted at all.

6.2.2 Incorrect start date of period of absence

If the start date of a period of absence has been reported incorrectly, the payer corrects the information by submitting a replacement report on which all the other information is reported as previously but the start date is corrected.

6.2.3 End date of period of absence too late

If the end date of a period of absence has been reported incorrectly such that the actual end date is earlier than the end date provided on the report, the payer corrects the information by submitting a replacement report. In the replacement report, all the other information is reported as previously but the end date is corrected.

6.2.4 End date of period of absence too early

If the end date of a period of absence has been reported incorrectly such that the actual end date is later than the end date provided on the report, the payer corrects the information by submitting a replacement report. In the replacement report, all the other information is reported as previously but the end date is corrected. If an absence reported earlier has continued after the time period for reporting absences, the absence can be reported on the next report (new report).

6.3 Correcting the reason for absence

The reason for absence must be corrected if the grounds for absence have been reported incorrectly. Only one reason per absence is allowed, and the same period of absence can be reported with only one reason for absence. If the income earner is absent from work for several reasons or if new reasons for absence arise during the period of absence, the reason on the basis of which pay is primarily paid will be reported to the Incomes Register.

The information must be corrected, for example, if an absence reported as a sick leave was in fact caused by an occupational accident, or when the time of the income earner's annual leave is changed due to illness, accident or child birth and this is not known until after the report has been submitted.

Example 22. An income earner's unpaid absence has been reported for the time period for reporting absences of 1 April to 30 April, the reason being a child’s illness or a compelling family reason. The reported period of absence is 14 April to 17 April. After the report was submitted, it turned out that the income earner had a non-occupational accident on 15 April, which entitles the income earner to sick pay for the period of 15 April to 25 April. The previously reported period of absence and reason for absence must be corrected in the Incomes Register.

There are two ways of correcting the absence details. The payer can re-report the time period for reporting absences from 14 April up to the date until which absences are known. In such a case, an unpaid absence is reported for the period 14 April to 14 April (reason: child’s illness and a compelling family reason) and a paid sick leave is reported for the period of 15 April to 25 April. Alternatively, the payer can submit a replacement report, providing correct absence details for the time period for reporting absences of 1 April to 30 April.

6.4 Correcting the date for “Absence continues, until when”

If the date has been reported incorrectly, the payer must correct it in the Incomes Register as soon as possible so that Kela does not pay the daily allowance to the income earner for the period during which the employer pays them wages and that the income earner does not have to wait for the payment of the daily allowance unnecessarily.

If the date for “Absence continues, until when” is too early (Kela has paid the daily allowance to the income earner or another employer), the payer can correct the date in one of the following ways:

- The date is corrected immediately by submitting a replacement report.

- The pay for the period of absence is reported for the missing time on a new report, in which case the date for “Absence continues, until when” is not reported at all.

- The correct date is reported immediately on a new report and, at the same time, part of the pay for the period of absence is also reported.

If the report arrives at Kela before any daily allowance payments based on incorrect data have been made to the income earner or another employer, Kela will review the decision and issue a new decision. If the report arrives after the daily allowance has been paid, the decision concerning the payment of daily allowance can be reviewed only with the permission of the income earner or the employer (if any), or adjustment must be requested at appellate level.

If the reported date for “Absence continues, until when” reported is too late (Kela has not paid the daily allowance to anyone), the payer can correct the date in one of the following ways:

- The date is corrected immediately by submitting a replacement report.

- The pay for the period of absence is reported for the missing time on a new report, in which case the date for “Absence continues, until when” is not reported at all.

- The correct date is reported immediately on a new report and at the same time part of the pay for the period of absence is also reported.

6.5 Correcting a Kela application

If the employer uses the Incomes Register’s earnings payment report to apply for a sickness allowance, maternity, paternity or parental allowance, special maternity allowance, rehabilitation allowance or family leave compensation from Kela and, after the report has been submitted, it turns out that information is missing from the application or that a data item used in the application is incorrect, the employer must correct the information by submitting a replacement report.

If Kela detects an error or conflict in the information provided in the application, Kela will send a description of the error to the contact person's email address provided in the report. If no email address is provided in the report, Kela will contact the employer's representative using the contact information provided in the Business Information System (BIS).

Here are some examples of when a daily allowance application is formally incorrect:

- The reason for paid absence is something other than illness, rehabilitation, a maternity, paternity or parental leave, or a special maternity leave.

- Several reasons for absence have been reported for the same time period.

- The same time period is reported for both paid and unpaid absence, with the same or different reasons for absence.

A PDF document is generated of the application details at Kela, including the Incomes Register's report reference, the payer’s report reference and the version number. If the report containing application details and the related replacement report are submitted on the same day, a PDF document is generated at Kela only for the replacement report.

If the employer deletes application details either by cancelling the original report or by submitting a replacement report from which the application details have been removed, a new PDF document will be generated at Kela, showing which application has been deleted. If the original report containing application details and its cancellation or a related replacement report from which the application details have been removed arrive on the same day, no PDF document will be generated at Kela at all.

The PDF document generated will be processed as an application. The application will be available in Kela’s e-services to both the income earner and the employer.