Reporting data to the Incomes Register: payments made by substitute payer

- Validity

- - 8/26/2018

These instructions are for parties acting as substitute payers and for actual employers.

They describe:

- the obligation of substitute payers and actual employers to report data to the Incomes Register

- reports submitted by a substitute payer to the Incomes Register

- reports submitted by an actual employer to the Incomes Register in situations involving a substitute payer.

In addition, examples are provided to describe the reporting of the most common situations involving a substitute payer: reporting of payments made by Kela, a bankruptcy estate, municipalities and pay security.

More information on households' obligation to report income is provided in the instruction Reporting data to the Incomes Register: Households as employers (to be published in the spring of 2018).

1 General information on situations involving a substitute payer

Substitute payer means a payer who pays wages or other remuneration from their own funds on behalf of a party with the actual liability to pay (actual employer). Further, the substitute payer reports data to authorities on behalf of the actual employer based on either law or agreement (e.g. reports to the Incomes Register). As a rule, the substitute payer pays the wages and withholds tax while the actual employer pays the employer’s social insurance contributions.

Usual substitute payers include enforcement agencies, municipalities, Kela, Centres for Economic Development, Transport and the Environment (ELY Centres) and bankruptcy estates. Other potential substitute payers include creditors, guarantors or other payers acting on behalf of an employer who is in financial difficulties. Group companies and foreign employers can also use substitute payers.

A substitute payer is not the same as an agent. Agents act in, and under, the name of the actual payer (e.g. the employer). Their actions are usually based on an authorisation. They can also use the funds of the principal to make payments. The agent and the actual employer can also agree that the agent should handle all the employer obligations on behalf of the actual employer. Detailed information about being an agent is not provided in these instructions.

The municipality's role as a substitute payer is significant when the municipality is in charge of paying wages to a personal assistant and reporting data on behalf of a person requiring assistance.

The substitute payer can report the data on all the employees of one actual employer in one record. Payments made as a substitute payer and payments made by the same party to its own employees cannot be reported in one and the same record. More information on reporting is provided in the instructions Reporting data to the Incomes Register.

1.1 Substitute payer’s obligations

The substitute payer pays an employee or other income earner on behalf of the actual employer from their own funds. Under the prepayment act (ennakkoperintälaki 1118/1996), the substitute payer is obligated to withhold tax even if the work paid for was carried out in the name of the actual employer. If, instead of the payer, the payer's guarantor, creditor or other payer (substitute payer) pays wages to the income earner, the party who makes the payment has the obligation to withhold tax on the paid amount if no tax has been withheld previously. Correspondingly, the enforcement authority is liable to withhold tax on the funds accrued through enforcement, and a bankruptcy estate on payments made from the estate's assets.

The substitute payer must submit a report to the Incomes Register on all the wages paid and taxes withheld. The substitute payer must also report to the Incomes Register the earnings-related pension insurance contributions and unemployment insurance contributions collected from an employee, if the substitute payer has collected and deducted the employee's social insurance contributions from the wages paid to the employee. Income tax is levied in the income earner's tax assessment on the basis of the substitute payer's report. Correspondingly, the guarantor, creditor or other payer is obligated to report to the Incomes Register any payments they have made as a substitute payer. Social insurance contributions can be imposed on the actual employer on the basis of the substitute payer’s reports.

The substitute payer’s obligations may vary according to what has been agreed between the substitute payer and the actual employer. As a rule, the substitute payer is not obligated to pay the employer’s social insurance contributions – paying them is the responsibility of the actual employer.

1.2 Employer obligations

Although the substitute payer pays wages on behalf of the employer, the actual employer is obligated to report the wages paid by the substitute payer on an earnings payment report using a separate form for each income earner. Specific income types for situations involving a substitute payer are used to report this data.

The actual employer is obligated to pay the employer’s social insurance contributions on the basis of the wages paid by the substitute payer. This means that the actual employer must see to it that they arrange statutory earnings-related pension insurance with an authorised pension provider (i.e. take out insurance with an authorised pension company or provide insurance through an industry-wide pension fund or a company pension fund) and, as a result, have a pension policy number required for pension insurance purposes.

The employer has the obligation to take out occupational accident and occupational disease insurance by signing an insurance contract with an accident insurance provider. Insurance must be taken out before the commencement of work. As a policy holder, the employer is obligated to pay the insurance contributions. On the Incomes Register's earnings payment report the employer must report the occupational accident insurance company identifier and the policy number, if the employer has concurrent occupational accident insurances.

The employer is also obligated to pay the unemployment insurance contributions and submit earnings payment reports to the Incomes Register. Similarly, the employer is obligated to pay and report the employer's health insurance contributions to the Incomes Register using the employer's separate report.

1.3 Deadline for reporting

As a rule, substitute payers must submit reports on monetary payments no later than on the fifth calendar day after the date of payment. The date of payment refers to the date on which the payment is available to the income earner, for example withdrawable on the income earner's account.

Actual employers must submit an earnings payment report and the employer's separate report to the Incomes Register for each wage payment month no later than on the fifth day of the calendar month following the payment month (section 12(9) of the act on the Income Information System; laki tulotietojärjestelmästä 53/2018). If the actual employer itself has also made payments to the income earner, they must be reported in addition to the payments made by the substitute payer. However, it must then be taken into account that, as a rule, the deadline for reporting payments made by the actual employer is the fifth calendar day after the date of payment.

Reporting deadlines and penalties for failing to meet deadlines are described in more detail in the instructions Late fees and other penalties in reporting data to the Incomes Register (to be published in the spring of 2018) and Reporting data to the Incomes Register.

1.4 Terminology

| Term | Description |

|---|---|

| Substitute payer | A payer who pays wages or other remuneration from their own funds on behalf of a party with the actual liability to pay (actual employer). |

| Actual employer | A party who has a legal obligation to pay wages and take out insurance for employees. The actual employer is the party who has hired the employee and in whose name the employee works. |

| Agent | A party who acts in, and under, the name of the actual payer. Agents usually act based on an authorisation. They can also use the funds of the principal to make payments. |

| Contractual employer | A term used in the earnings-related pension sector to refer to the employer in the following situation: The employer has at least one employee on a continuous basis or the amount of wages paid by the employer over a period of six months is at least EUR 8,346 (in 2018). A contractual employer has a contract with an authorised pension insurance company and provides statutory pension coverage under the Employees Pension Act (TyEL insurance; pension policy number xx-xxxxxx). |

| Temporary employer | A term used in the earnings-related pension sector to refer to the employer in the following situation: The employer has arranged pension coverage for employees without taking out an insurance policy. Operating as a temporary employer is possible only if the employer does not continuously have at least one employee on the payroll and if the total wages paid by the employer to fixed-term employees over a period of six months are below EUR 8,346 (in 2018). |

| Personal assistant | Personal assistant means an employee who has been hired as an assistant for a person with severe disability, for example. |

| Person requiring assistance (PRA) | PRA refers to a person who requires assistance, i.e. the actual employer. |

| Substitute payer’s report | The substitute payer's report means an earnings payment report that the substitute payer is obligated to submit to the Incomes Register on each income earner on the basis of the payments made. |

| Actual employer's report | The actual employer's report means the earnings payment report submitted by the actual employer to the Incomes Register on the wages paid by a substitute payer. Additionally, the actual employer must report any other payments it has made to the income earner. The actual employer’s report also means the employer's separate report on the total amount of health insurance contributions submitted by the actual employer. |

2 Reporting of substitute payers payments to the incomes register in different situations

2.1 Basic situation

As a rule, a substitute payer reports monetary payments and other benefits to the Incomes Register no later than on the fifth calendar day after the date of payment using an earnings payment report. All the income types used in the Incomes Register are at the substitute payer's disposal. Monetary wages, for example, are reported by the substitute payer using either a method with lower level of detail (reporting method 1) or a method with greater level of detail (reporting method 2). The reporting of wages is described in more detail in the instructions Reporting data to the Incomes Register: monetary wages and items deducted from pay. The substitute payer reports their substitute payer status and the actual employer's customer identifier in the “Substitute payer” data group.

The income and the tax withheld are taken into account in the income earner’s tax assessment on the basis of the report submitted by the substitute payer. In contrast, the employer’s social insurance contributions are determined on the basis of the actual employer's earnings payment report and the employer's separate report.

The actual employer must submit to the Incomes Register an earnings payment report and the employer's separate report on the wages paid by the substitute payer. Also, if the actual employer itself makes payments to the income earner, they must be reported as well. The actual employer's report can also be submitted by another party, such as a substitute payer, if this has been agreed separately between the substitute payer and the actual employer. Even in this case the responsibility for reporting falls on the actual employer.

The actual employer must submit an earnings payment report to the Incomes Register using income types specified for situations involving a substitute payer (see the list below). If the wages paid to the income earner are subject to all social insurance contributions, the actual employer reports the wages under the income type: ”Wages paid by substitute payer: employer pays for the employer's social insurance contribution (earnings-related pension, health, unemployment, and occupational accident and disease insurance contributions)”. If the wages are subject only to a certain employer's contribution, the income is reported under the income type for that particular contribution. For example, if the income were subject only to the employer's health insurance contribution, it would be reported under the income type “Wages paid by substitute payer, employer pays for employer's health insurance contribution”. More than one income type intended for situations involving a substitute payer can be used for the same payment (see chapter 2.4, example 9, table 2).

The actual employer can use the following income types in its reports:

| Code* | Income type name |

|---|---|

| 321 | Wages paid by substitute payer: the employer pays for the employer's social insurance contributions (earnings-related pension, health, unemployment, and accident and occupational disease insurance) |

| 322 | Wages paid by substitute payer: employer pays for employer's earnings-related pension insurance contribution |

| 323 | Wages paid by substitute payer: employer pays for employer's unemployment insurance contribution |

| 324 | Wages paid by substitute payer, employer pays for accident and occupational disease insurance contribution |

| 325 | Wages paid by substitute payer, employer pays for employer's health insurance contribution |

* The code in front of the name of the income type is the code value used for the income type in the earnings payment report.

Any payments made are reported according to the employer's obligations regarding the income in question.

The actual employer must report all the data about the employer and the income earner that are needed by data users. This means that, for example, if the actual employer is a temporary employer, they must report the detailed contact information needed by the authorised pension provider. Correspondingly, the data needed by data users about the income earner must be reported; for example, if the income earner is a non-resident taxpayer. Furthermore, it is recommended that the actual employer should report the necessary employment relationship data about the income earner and any absence data available.

In addition to the payments made by a substitute payer, the actual employer must report any payments it has made to the income earner. However, it must then be taken into account that, as a rule, the deadline for reporting payments made by the actual employer is the fifth calendar day after the date of payment. If a payment is made by a natural person or an estate that is not registered in the Tax Administration’s Employer Register, the data on the payments made by the employer itself can be submitted by the same deadline as the data on the substitute payer's payments, i.e. by the fifth day of the calendar month following the month of payment.

The payment periods of the actual employer and of the substitute payer may be different.

The actual employer must also submit to the Incomes Register the employer's separate report, reporting the total amount of the employer’s health insurance contribution and a deductible amount calculated on the basis of any items deductible from the employer’s health insurance contribution. Households must submit the employer's separate report if the amount of wages paid to one employee is more than EUR 1,500 a year. More information on households' obligation to report income is provided in the instructions Reporting data to the Incomes Register: Households as employers (to be published in the spring of 2018).

The reporting of payments made as pay security and payments made by a bankruptcy estate is described separately in section 2.4.

2.1.1 Examples of reporting

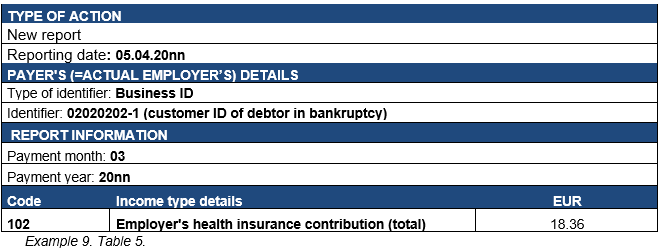

Example 1 (Basic case, the actual employer is a contractual employer):

On 15 August, a substitute payer has paid an income earner on behalf of the actual employer EUR 1,500 in time-rate pay and EUR 500 in evening shift allowance, withheld EUR 400 in taxes and collected the employee’s social insurance contributions.

The substitute payer reports to the Incomes Register the following details:

Earnings payment report submitted by substitute payer

The substitute payer does not collect and deduct the employee’s social insurance contributions from wages in all situations. To determine and verify the employer's social insurance contributions, the actual employer must report on its own report the wages paid by the substitute payer on which the employer pays the social insurance contributions.

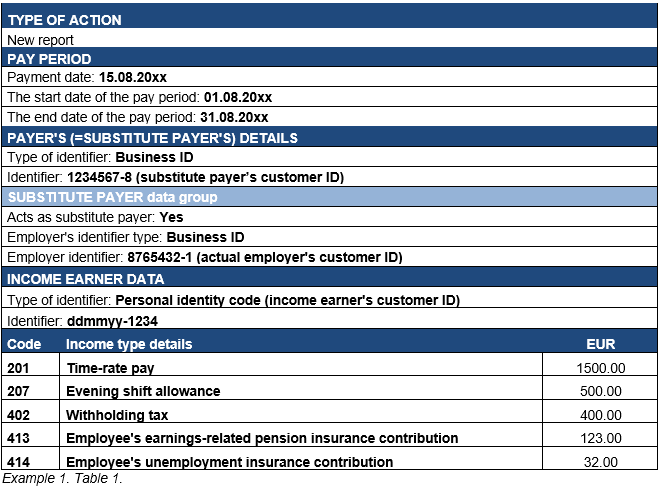

The actual employer reports to the Incomes Register the wages paid to the income earner by the substitute payer:

Additionally, the employer must report on the employer's separate report the total amount of health insurance contributions it has paid on the basis of the wages paid by the substitute payer.

The employer reports:

Actual employer’s report (employer’s separate report)

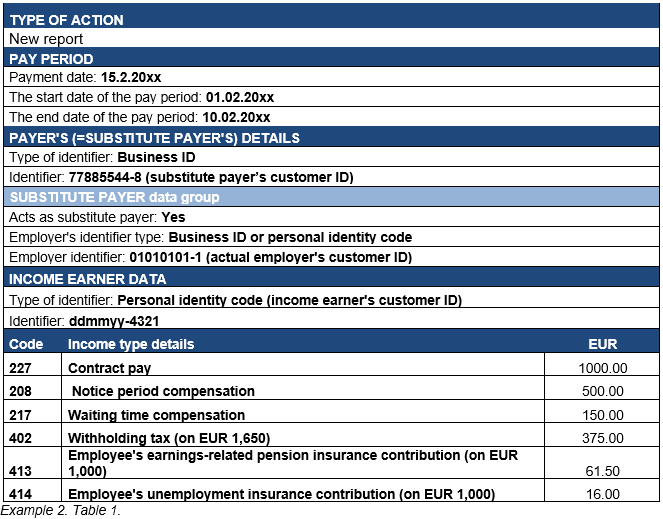

Example 2 (Basic case, the actual employer is a temporary employer):

The substitute payer pays EUR 1,650 to the income earner. The amount contains EUR 1,000 in contract pay, EUR 500 in compensation for termination and EUR 150 in compensation for waiting time.

The substitute payer withholds taxes (EUR 375) from the income earner's pay. In addition, the substitute payer collects the employee’s social insurance contributions from the pay subject to earnings-related pension and unemployment insurance contributions (EUR 1,000). The compensations for waiting time and termination are not subject to social insurance contributions.

The substitute payer reports the data to the Incomes Register on an earnings payment report.

Earnings payment report submitted by substitute payer (reporting method 2 for monetary wages)

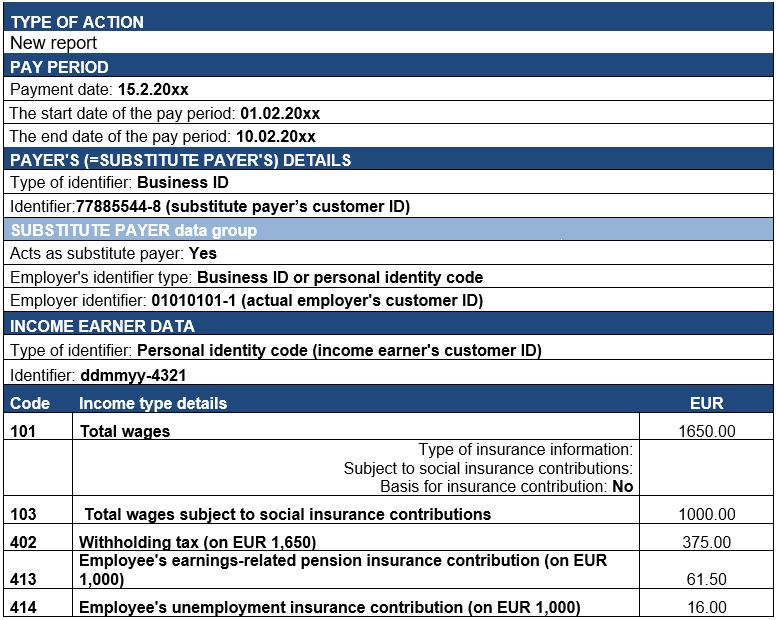

Alternatively, the substitute payer can report the monetary wages it has paid in accordance with reporting method 1. The different ways of reporting monetary wages are described in greater detail in the instructions Reporting data to the Incomes Register: monetary wages and items deducted from pay. In such a case, the substitute payer reports the data as follows:

Earnings payment report submitted by substitute payer (reporting method 1 for monetary wages, alternative method)

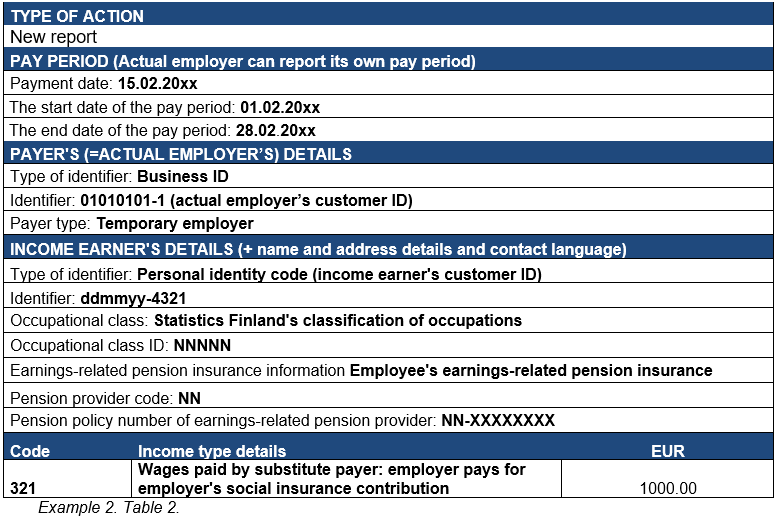

The actual employer is obligated to report the income earner's wages on which the employer has paid social insurance contributions. Since only the contract pay (EUR 1,000) included in the wages paid by the substitute payer is subject to the employer's social insurance contributions, this is the amount that the actual employer must report on the actual employer's report:

Actual employer’s report (earnings payment report)

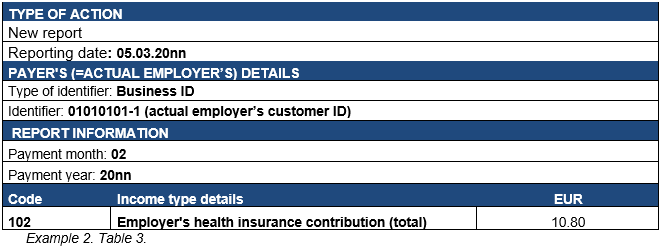

Additionally, the employer must report on the employer's separate report the total amount of health insurance contributions it has paid on the basis of the wages.

The employer reports:

Actual employer’s report (employer’s separate report)

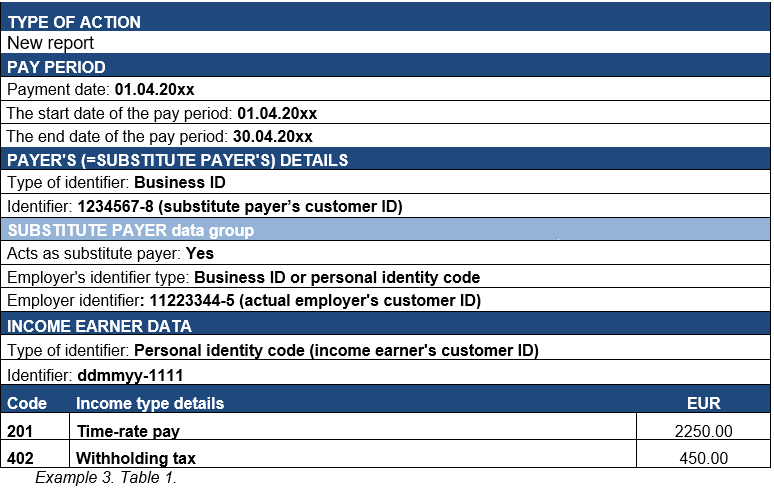

Example 3 (Basic case, income is paid to a 16-year-old person):

The substitute payer pays a 16-year-old summer worker EUR 2,250 in time-rate pay on behalf of the actual employer. Since the income earner is 16, the income is not subject to earnings-related pension insurance or unemployment insurance contributions. However, the income is subject to the health insurance and occupational accident and occupational disease insurance contributions.

When submitting the substitute payer’s report, the substitute payer need not take a stand on social insurance, because the substitute payer is not responsible for paying the contributions.

The substitute payer reports:

Substitute payer's earnings payment report

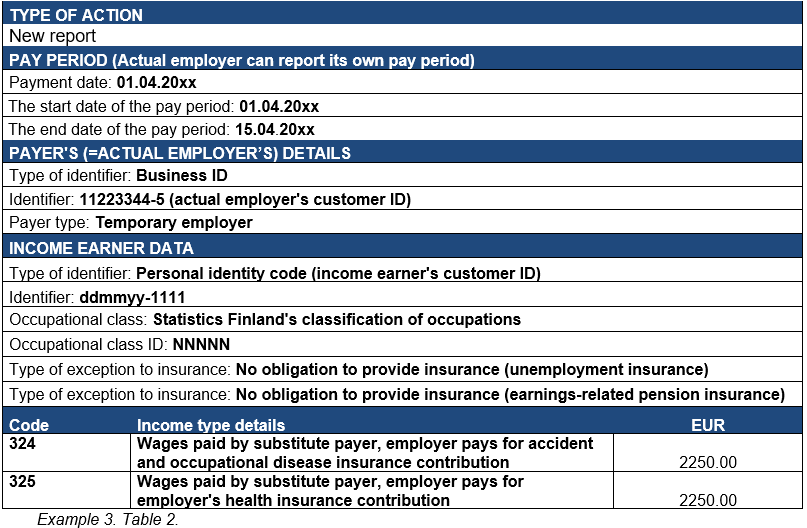

Although the substitute payer need not take a stand on the social insurance contributions, the actual employer must provide all the relevant information needed for social insurance purposes on its report. Since the income is paid to a 16-year-old person, it is not subject to earnings-related pension insurance or unemployment insurance contributions. However, the income is subject to the health insurance and occupational accident and occupational disease insurance contributions. For this reason, the actual employer reports the data as follows:

Actual employer’s report (earnings payment report)

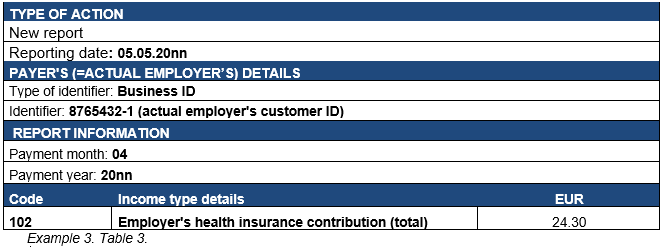

Additionally, the employer must report on the employer's separate report the total amount of health insurance contributions paid on the basis of the wages.

The employer reports:

Actual employer’s report (employer’s separate report)

If the actual employer itself makes payments to the income earner in addition to the payments made by the substitute payer, the actual employer must also report those payments, the taxes withheld, and the employee's social insurance contributions collected.

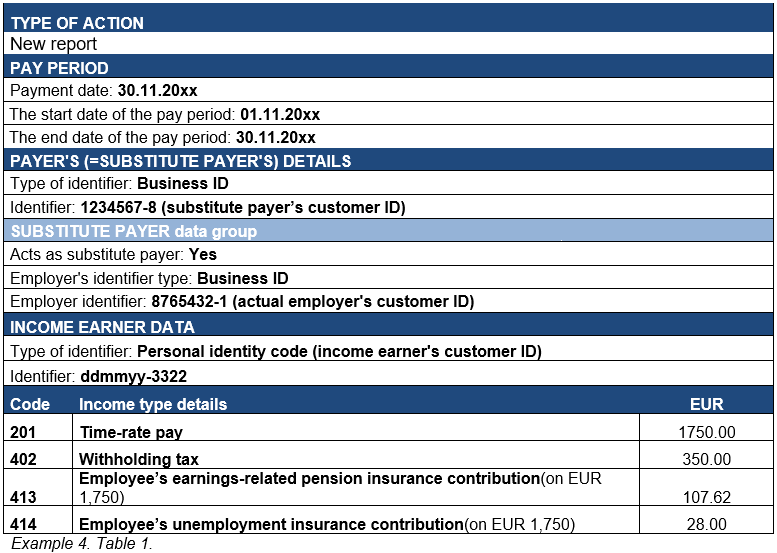

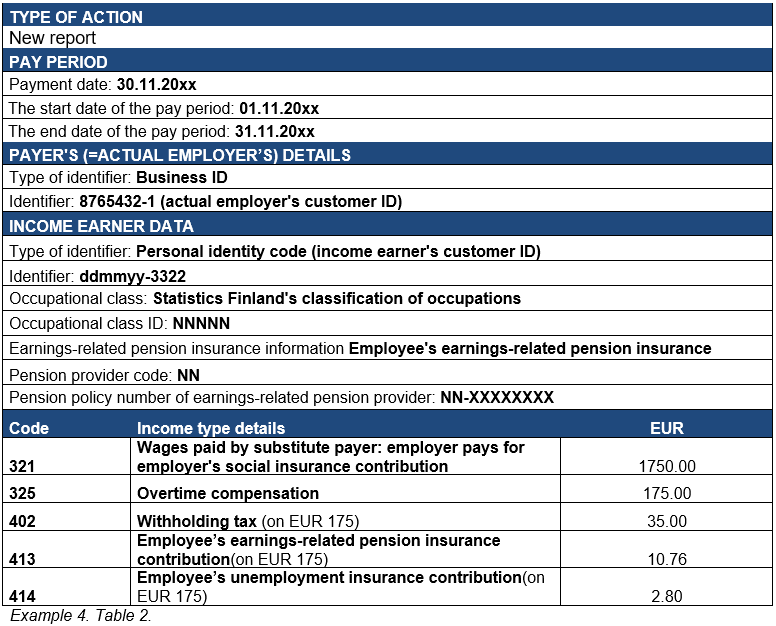

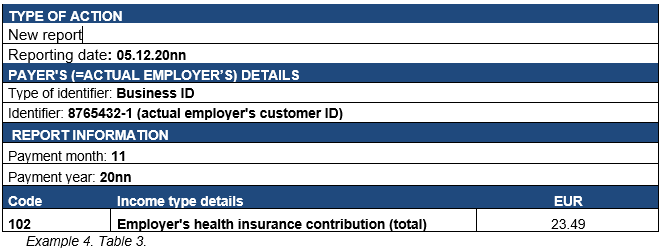

Example 4 (Actual employer itself also pays wages to the income earner):

A substitute payer has paid the income earner EUR 1,750 in time-rate pay on behalf of the actual employer. In addition to this, the actual employer has paid EUR 175 in overtime compensation.

The substitute payer reports to the Incomes Register the payments it has made:

Earnings payment report submitted by substitute payer

The actual employer must report the wages paid to the income earner by the substitute payer. If the substitute payer and the actual employer have paid income to the income earner on the same payment date, the actual employer can also report the payments it has made itself on the same report on which the wages paid by the substitute payer are reported. The taxes withheld from the payments made by the actual employer and the employee's social insurance contributions collected must also be reported:

Actual employer’s report (earnings payment report)

Additionally, the employer must report on the employer's separate report the total amount of the health insurance contributions paid on the basis of the wages paid by the substitute payer and the actual employer itself.

The employer reports:

Actual employer’s report (employer’s separate report)

2.2. Municipality as a substitute payer (personal assistant and person requiring assistance)

Hiring a personal assistant involves employer obligations. Many municipalities have concluded agreements with persons requiring assistance (PRA) on the handling of employer obligations related to the payment of wages to a personal assistant.

A municipality acts as a substitute payer when it pays the personal assistant's wages from municipal funds. The municipality acting as a substitute payer reports in accordance with section 2.1. Often the municipality also handles other employer obligations on behalf of the PRA: for example, submits earnings payment reports and employer's separate reports to the Incomes Register and pays social insurance contributions to social insurance providers. The municipality here acts as an agent on behalf of the actual employer on the basis of an agreement, taking out insurances, paying insurance contributions and reporting data. If the PRA is an underage person, their guardian or other legal representative can act as the actual employer.

Previously, when reporting data to the Tax Administration, the municipality was able to apply for a separate Business ID for use in reporting data as a substitute payer. It should be noted that is no longer possible when reports are submitted to the Incomes Register. The municipality acting as a substitute payer reports data to the Incomes Register using the municipality’s own Business ID no later than on the fifth calendar day after the date of payment.

2.2.1 Example of reporting

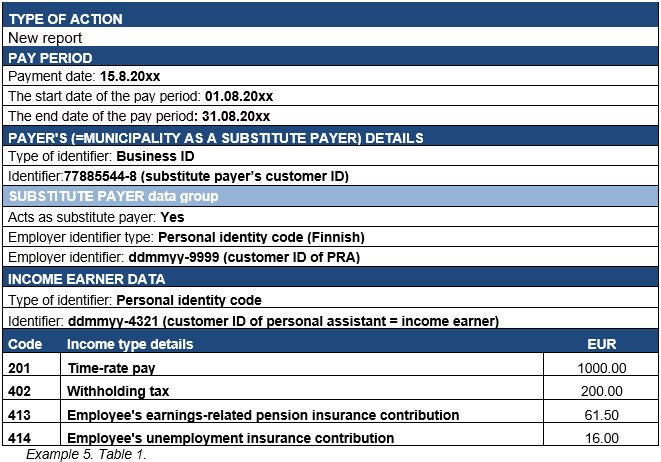

Example 5 (Municipality pays a personal assistant's wages):

In August, a municipality pays EUR 1,000 in wages to a personal assistant and withholds EUR 200 in tax. The municipality reports the payment to the Incomes Register as a substitute payer:

Earnings payment report submitted by a municipality as a substitute payer

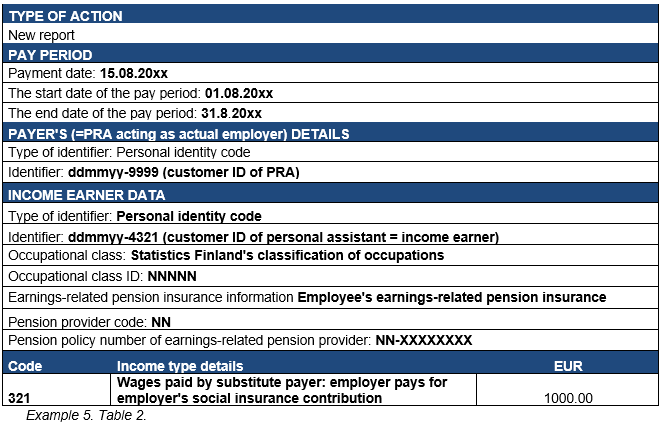

For the purposes of determining and verifying the employer's social insurance contributions, the actual employer must report, on its own report, the wages paid by a substitute payer on which the employer pays the social insurance contributions. A municipality can act on behalf of the actual employer and report data to the Incomes Register if this has been agreed with the actual employer.

Actual employer’s report (earnings payment report) submitted by a person requiring assistance (PRA) or by the municipality

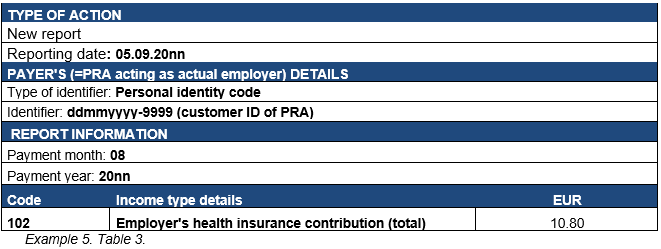

Additionally, the employer (or the municipality acting as an agent) must report on an employer's separate report the total amount of the employer’s health insurance contributions it has paid on the wages. Households must submit the employer's separate report if they pay more than EUR 1,500 to the same income earner in a calendar year.

The employer (or municipality acting as an agent) reports:

Actual employer’s report (employer's separate report), submitted by a PRA or the municipality

2.3 Private day care allowance (wages)

As a substitute payer, Kela reports data on the wages it has paid to a caregiver who has an employment relationship with a family. In the case of private day care allowance, Kela acts as a substitute payer and does not pay social insurance contributions on the allowance. Further, Kela does not withhold the employee’s social insurance contributions from the payment.

The family member is also obligated to take out earnings-related pension insurance for the caregiver with an employment relationship and to pay the unemployment insurance contributions. The family member must also take out occupational accident and occupational disease insurance from an accident insurance company before the caregiver’s work commences.

The earnings-related pension insurance contribution is divided into the employer’s and employee’s shares, which are both given as a percentage of the wages. The employee’s share is calculated on the basis of the total amount formed by the gross wages paid by the family member and the private day care allowance paid by Kela. However, the entire employee’s share is withheld by the family member from the wages paid to the caregiver. The earnings-related pension provider charges the employer for the entire earnings-related pension insurance contribution, including both the employer’s and employee’s shares. The corresponding procedure is applied to the unemployment insurance contribution.

The family member must report a private day care allowance regarded as wages received by a caregiver with an employment relationship, using the income type “Wages paid by substitute payer, employer pays social insurance contributions”. Whether or not the family pays any other income to the caregiver is insignificant. The report must be submitted even if the family does not pay any other income. If the family pays other income to the caregiver during the same month, both the wages paid by the substitute payer and the payments made by the family can be reported on the same report.

Kela does not withhold the employee’s social insurance contributions from the payment it makes. The family withholds the employee’s contributions on the portion of the wages paid by the family and also on the portion paid by Kela. On the report it submits, the family must report the employee’s social insurance contributions both on the income it has paid and on the income paid by Kela.

2.3.1 Examples of reporting

Example 6 (Kela pays private day care allowance to a caregiver hired by a family. The family does not make payments to the income earner):

Kela pays EUR 300 to the caregiver. The family does not pay any other income to the caregiver.

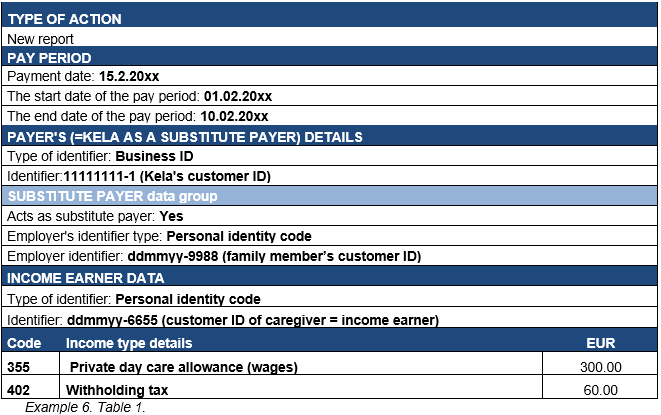

Kela submits a substitute payer's report on the private day care allowance it has paid:

Substitute payer's earnings payment report submitted by Kela

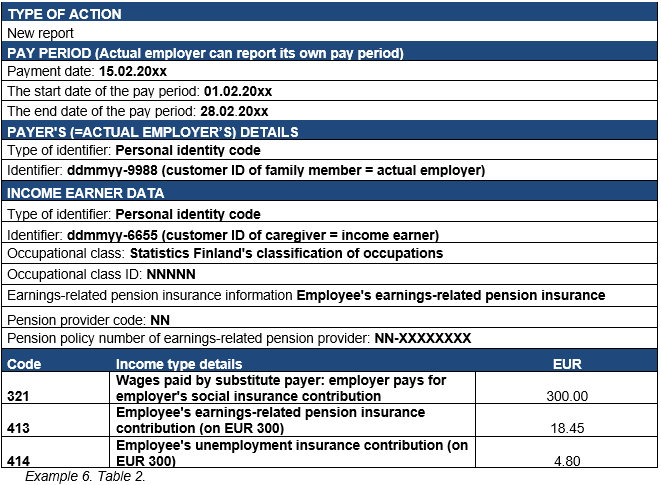

For the purposes of determining and verifying the employer's social insurance contributions, the family member acting as the actual employer must report, on its own report, the wages paid by Kela on which the employer pays the social insurance contributions.

Actual employer’s report (earnings payment report) submitted by a family member

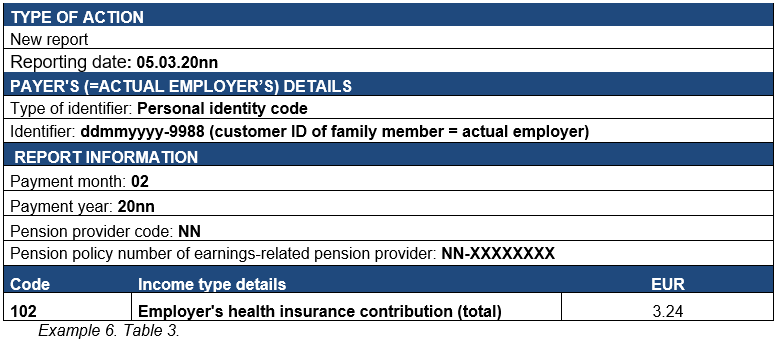

A family member who acts as the employer must also use the employer’s separate report to report the total amount of the employer’s health insurance contribution they have paid on the basis of the wages paid by Kela if the household in question pays more than EUR 1,500 in wages to the same income earner in a calendar year.

In such a case, the family member reports the amount of the employer’s health insurance contribution calculated from the wages (EUR 300) on which the health insurance contribution is based:

Report by a family member acting as an actual employer (employer's separate report)

If the family also pays other income to the caregiver, that income must be reported to the Incomes Register as well. The family's other payments to the income earner can be reported on the same report that is used to report the wages paid by the substitute payer, if the payments are made during the same calendar year.

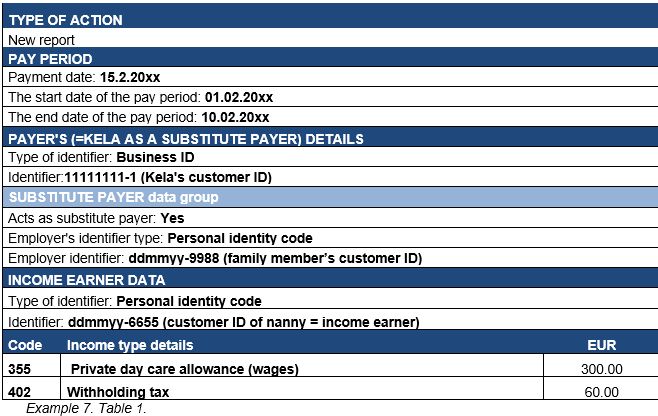

Example 7 (The family pays wages to the caregiver in addition to the private day care allowance that is paid by Kela):

Kela pays EUR 300 to the caregiver. In addition, the family pays EUR 1,000 in wages to the caregiver. Kela submits a substitute payer's report on the private day care allowance it has paid:

Substitute payer's earnings payment report submitted by Kela

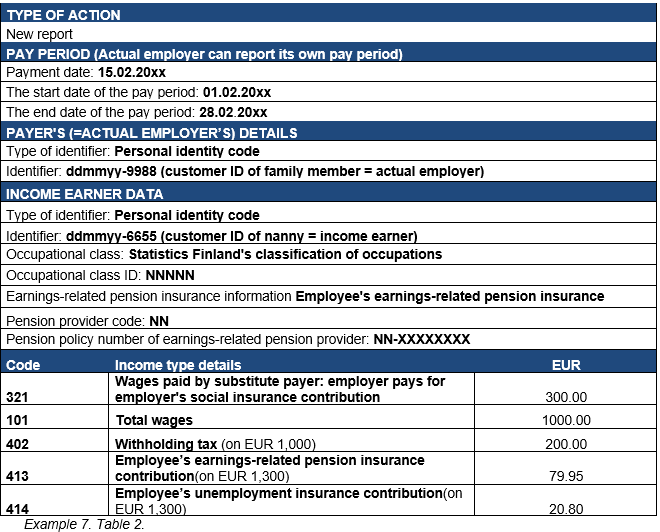

For the purposes of determining and verifying the employer's social insurance contributions, the family member acting as the actual employer must report, on its own report, the wages paid by Kela on which the employer pays the social insurance contributions. The family must also report the wages it itself has paid to the income earner.

Actual employer’s report (earnings payment report) submitted by a family member

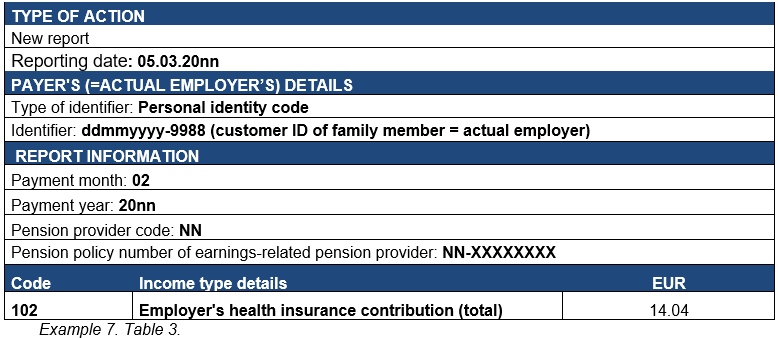

A family member who acts as the employer must also use the employer’s separate report to report the total amount of the employer’s health insurance contribution they have paid on the basis of the wages paid by Kela and the family, if the household in question pays more than EUR 1,500 in wages to the same recipient in a calendar year.

The family member reports the total amount of the employer’s health insurance contribution calculated from the wages (EUR 1,300) on which the health insurance contribution is based:

Report by a family member acting as an actual employer (employer's separate report)

2.4 Pay security and cases of bankruptcy

Applications for pay security should be submitted to a Centre for Economic Development, Transport and the Environment (ELY Centre). The pay security system ensures the payment of an employee's claims arising from an employment relationship in the event of the employer's insolvency. Pay security is paid on the basis of the employee’s claims arising from an employment relationship, when their grounds and amount have been settled. An application for pay security can be submitted by a bankruptcy estate, an employee or an employee organisation to which the employee has transferred its claims.

The ELY Centre withholds tax and deducts the employee’s earnings-related pension insurance contribution and unemployment insurance contribution from the claims paid as pay security. It is especially important to report the earning periods of the income paid. If no earnings period is reported on the earnings payment report, the social insurance provider will not know, in the case of bankruptcy, whether the case involves lodged claims or liabilities of the bankruptcy estate (see section 2.4.2).

2.4.1 Example of reporting

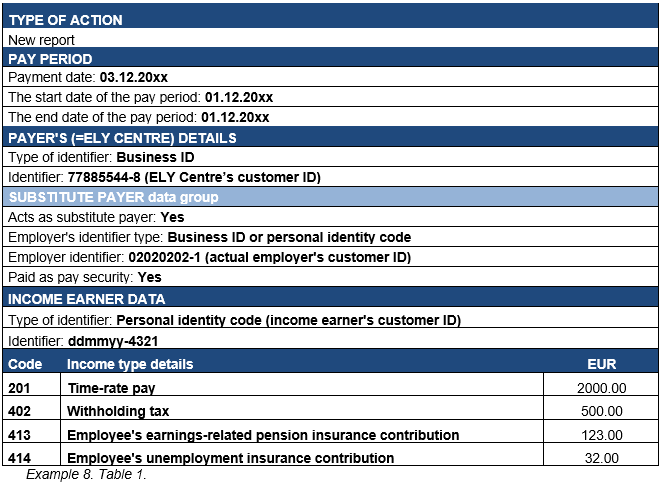

Example 8 (Pay security pays the wages claims):

The ELY centre pays the employee a wage claim of EUR 2,000. EUR 500 in income tax is withheld from the income. Pay security reports the payment it has made to the Incomes Register.

Substitute payer’s report submitted by pay security

The ELY centre delivers the pay security decision to the Finnish Centre for Pensions. The Finnish Centre for Pensions delivers the pay security decision to the correct insurance provider on the basis of the actual employer’s customer ID (e.g. Business ID) and pension policy number.

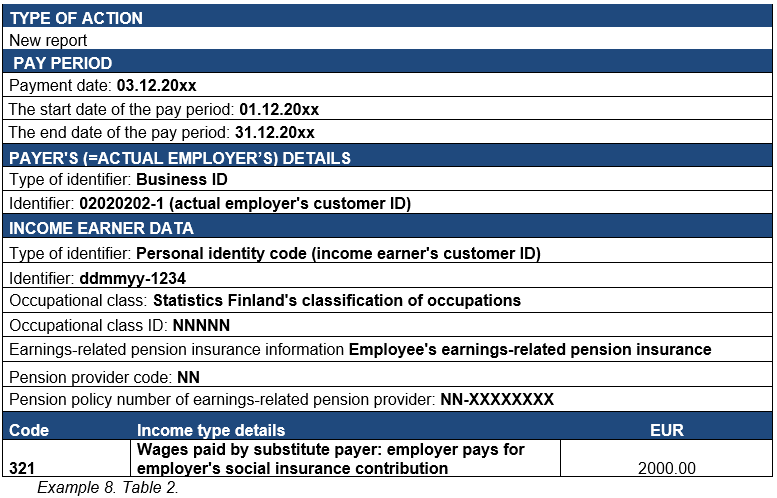

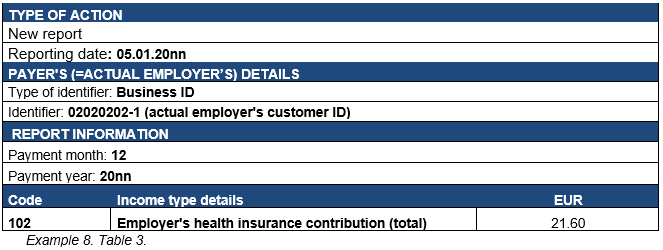

The actual employer submits the earnings payment report and employer's separate report as follows:

Actual employer’s report (earnings payment report)

Actual employer’s report (employer’s separate report)

2.4.2 Bankruptcy estate as payer of wages

A bankruptcy estate can apply for pay security on behalf of employees by submitting a joint application to the ELY Centre. An accelerated procedure can be used to apply for pay security for both lodged wage claims and wage claims included in the bankruptcy estate’s liabilities. Wage claims included in the bankruptcy estate’s liabilities are, for example, wages including holiday compensation and other supplements for the period of bankruptcy as well as wages paid for the notice period. These are the bankruptcy estate’s own debts and must be paid from the estate’s funds without the lodgement of claims. Pay security is paid to the bankruptcy estate’s account.

Lodged wage claims mean claims that have arisen before the bankruptcy, up to and including the bankruptcy filing date. Liabilities of the bankruptcy estate mean claims that have arisen after the bankruptcy filing date.

If the bankruptcy estate continues the business operations of the debtor in bankruptcy and pays wages for work performed after the bankruptcy filing date, the bankruptcy estate acts as an actual employer.

It is especially important to report the earnings periods of the income paid. If no earnings period is reported on the earnings payment report, the social insurance provider will not know, in the case of bankruptcy, whether the case involves lodged claims or liabilities of the bankruptcy estate.

2.4.2.1 Lodged wage claims

If the bankruptcy estate uses an accelerated procedure to apply for pay security for wage claims lodged by income earners, pay security pays the total amount of the wage claims to the bankruptcy estate. The bankruptcy estate pays the wages to the income earners, withholds tax and reports to the Incomes Register. This means that pay security does not submit any reports. Instead, the bankruptcy estate acts as a substitute payer for the actual employer (debtor in bankruptcy).

The bankruptcy estate submits reports to the Incomes Register using its own Business ID in the same manner as described in example 8 (table 1). The bankruptcy estate also submits reports to the Incomes Register on behalf of the actual employer (debtor in bankruptcy) using the actual employer’s identifier in accordance with example 8 (tables 2 and 3).

The employer's obligation to pay health insurance contributions on the lodged wage claims falls on the actual employer. The bankruptcy estate submits the employer's separate reports using the actual employer’s (debtor in bankruptcy) Business ID.

2.4.2.2 Wage claims included in the liabilities of bankruptcy estate

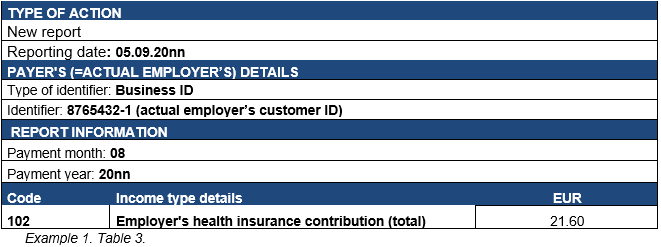

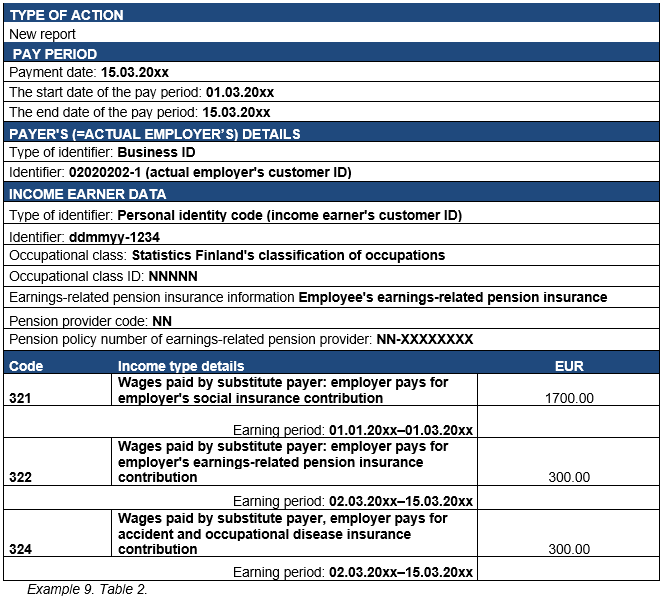

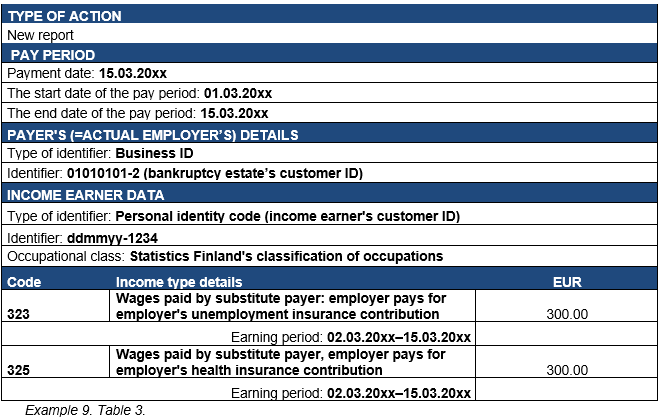

The bankruptcy estate must submit a substitute payer’s report on the wage claims included in the bankruptcy estate’s liabilities using the bankruptcy estate’s Business ID. The bankruptcy estate must submit the actual employer's report using both the Business ID of the debtor in bankruptcy and the bankruptcy estate’s own Business ID. When the actual employer's report is submitted using the Business ID of the debtor in bankruptcy, the pension policy number of the earnings-related pension provider is reported and the income types “Wages paid by substitute payer: employer pays for employer's earnings-related pension insurance contribution” and “Wages paid by substitute payer, employer pays for accident and occupational disease insurance contribution” are used. When the actual employer's report is submitted using the Business ID of the bankruptcy estate, data are reported under income types “Wages paid by substitute payer: employer pays for employer's health insurance contribution” and “Wages paid by substitute payer, employer pays for unemployment insurance contribution”.

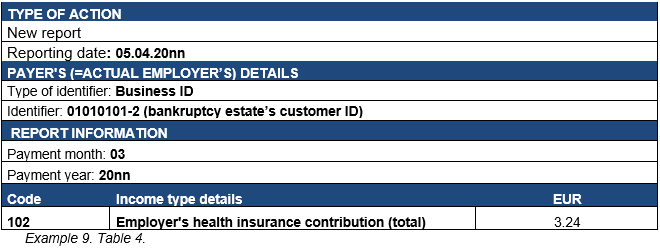

The bankruptcy estate pays the employer’s health insurance contributions on the wage claims included in the liabilities of the bankruptcy estate from the bankruptcy estate’s funds and submits the employer's separate report using the bankruptcy estate’s Business ID. More information is provided in the Tax Administration’s instruction Payment and reporting of employer’s contributions in bankruptcy.

The bankruptcy estate submits reports to the Incomes Register as described in examples 8 and 9.

2.4.2.3 Example of reporting

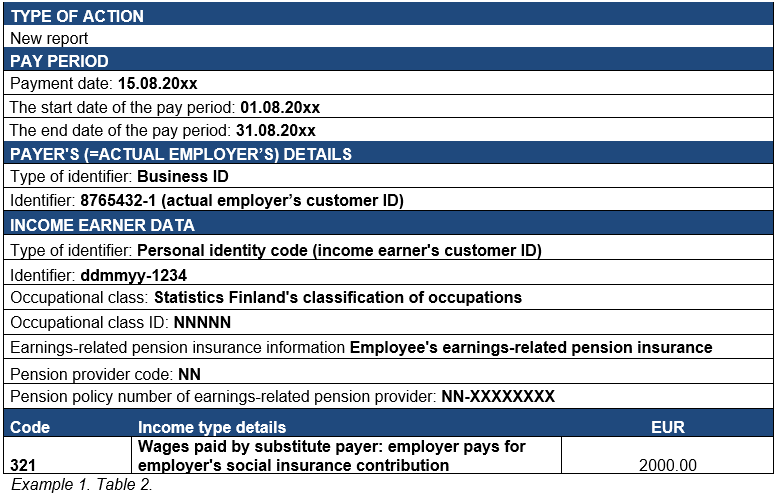

Example 9

A company has been declared bankrupt on 1 March 2019 and that year’s wages have not been paid to the employees. The lodged claims include wages for the period 1 January to 1 March 2019, while the liabilities of the bankruptcy estate include wages for the period 2 March to 15 March.

For the payment of the wage claims included in the bankruptcy estate’s liabilities (wages paid for the notice period), the bankruptcy estate has applied for pay security on behalf of the employees by submitting a joint application to the ELY Centre. Pay security is paid to the bankruptcy estate’s account. The estate administrator pays the net wages to the employees on 15 March and transfers the withholding taxes to the Tax Administration.

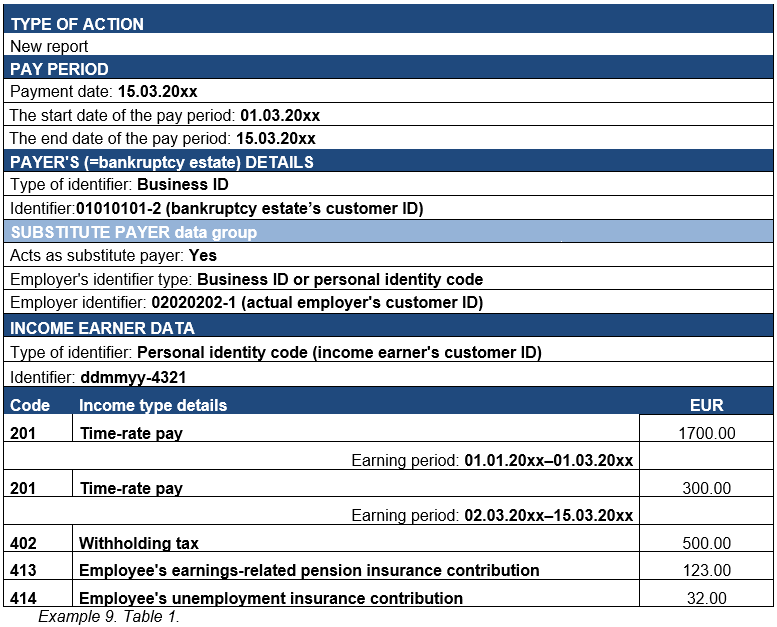

It is recommended that the wages covered by the lodged claims and the wage claims included in the bankruptcy estate’s liabilities should be reported separately and recorded under separate earnings periods as described below. In the example, the income earner is paid EUR 2,000, of which EUR 1,700 is allocated to the period 1 January to 1 March 2019 and EUR 300 to the period 2 March to 15 March 2019.

Substitute payer’s report submitted by a bankruptcy estate

The bankruptcy estate submits data using the actual employer’s (debtor in bankruptcy) identifier to meet the requirements of the earnings-related pension provider and the insurance companies.

Actual employer's report submitted using the identifier of the debtor in bankruptcy (earnings payment report)

The bankruptcy estate submits the earnings payment report to the Incomes Register using its own Business ID for purposes of the Tax Administration and the Unemployment Insurance Fund.

Another actual employer's report submitted using a bankruptcy estate's identifier (earnings payment report)

Actual employer's report: bankruptcy estate’s identifier, wage claims included in the bankruptcy estate's liabilities (employer’s separate report)

Another actual employer's report: debtor in bankruptcy’s identifier, lodged wage claims (employer's separate report)