Reporting data to the Incomes Register: international situations

- Date of issue

- 12/20/2018

- Record no.

- VH/3097/00.01.00/2018

- Validity

- 12/20/2018 - 1/19/2020

These instructions replace the earlier instructions titled Reporting data to the Incomes Register: international situations. The instructions have been updated and the following sections have been supplemented:

Section 1.1: limited obligation to inform in situations where a Finnish company engages in business activities in a permanent establishment in another country.

Section 4: clarified a foreign employer’s obligation to report in a situation where it has a permanent establishment in Finland or it has registered voluntarily with the Employer Register.

Section 2.4: updated reporting of additional data related to working abroad.

1 Obligation to inform in international situations

1.1 General information on reporting international information

The income paid to an income earner for work performed abroad and other information must be reported to the Incomes Register on an earnings payment report when the information is required for taxation purposes or when the income earner is insured in Finland. Correspondingly, the income paid for working in Finland to an employee who came to Finland from abroad is reported using an earnings payment report.

Income data must be reported to the Incomes Register in international working situations whenever the payer has an obligation to inform some data user using the Incomes Register. For example, if the income earner is insured in Finland, the payer has an obligation to inform the Incomes Register for the use of earnings-related pension providers and other social insurance providers. In such a situation, it does not matter whether the income is paid by a foreign or a domestic employer or where the work is performed.

A Finnish employer must report information to the Incomes Register on an earnings payment report in the following international situations:

- Income paid for working abroad (to persons living abroad and in Finland).

- Income paid for working in Finland to an income earner coming to Finland from abroad to work .

- Wages paid by a foreign group company for working abroad, when a Finnish employer has posted an employee abroad and the employee is insured in Finland.

- Wages for insurance purposes agreed for the work abroad.

- Additional information on the work abroad for the Tax Administration (the so-called six-month rule).

- Additional information on work in a Nordic country for the Tax Administration.

No report is submitted to the Incomes Register if a Finnish company that engages in business activities in a permanent establishment in another country pays wages that burden the result of the permanent establishment for work performed abroad to an employee who is a non-resident taxpayer. If the employee is insured in Finland, however, the report must be submitted.

1.2 Foreign employer

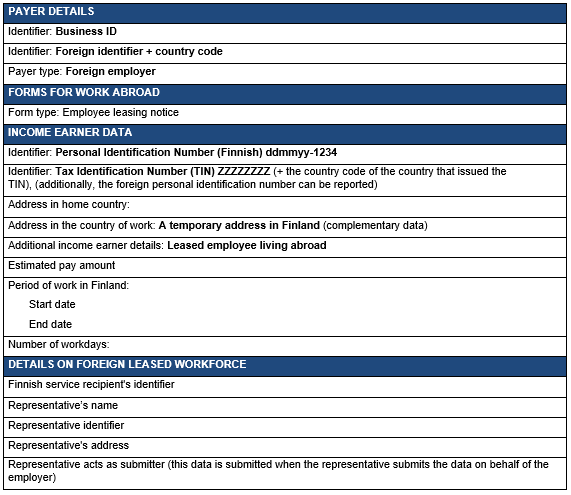

In certain situations, a foreign employer is also obligated to report information to the Incomes Register on wages it has paid. Furthermore, a foreign employer who leases employees to a service recipient in Finland must submit information to the Incomes Register for taxation purposes, for example concerning the employee's work in Finland

In taxation, a company that has not been established in accordance with Finnish law or that has a registered domicile elsewhere than in Finland will be considered a foreign employer. A person who acts as an employer and does not live in Finland is also deemed to be a foreign employer (non-resident taxpayer).

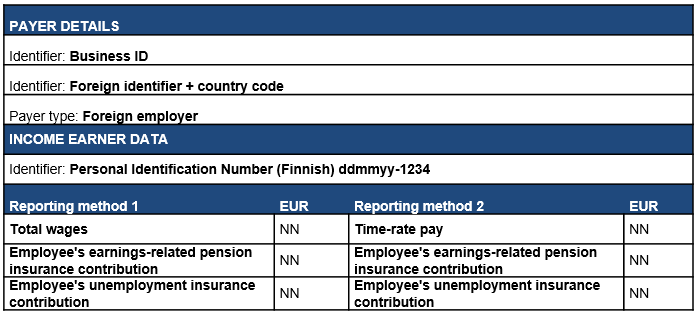

A foreign employer must submit an earnings payment report to the Incomes Register in the following situations:

- Income is paid to an income earner working in Finland, and

- the income earner is insured in Finland;

- the income earner stays in Finland for more than six months, even if they are not insured in Finland;

- the employee is a leased employee who is a non-resident taxpayer, and Finland has the taxing right to the wages according to a tax treaty between the employee's country of residence and Finland.

- An income earner working abroad is paid income, and the income earner is insured in Finland.

Furthermore, a foreign employer who leases an employee coming from abroad to a service recipient in Finland must submit an employee leasing notice to the Incomes Register for the Tax Administration's use.

For more detailed instructions on reporting for foreign employers, see Section 4, Reporting obligation of a foreign employer.

1.3 Representative of a foreign employer

A foreign employer is obligated to submit an earnings payment report and an employer's separate report to the Incomes Register if the employer is registered in the prepayment register. If the employer is not registered in the prepayment register, a representative of the foreign employer has a secondary obligation to report the information required for taxation to the Incomes Register. If, however, the representative does not report the information, it must be reported by the foreign employer. Provisions on the representative have been laid down in section 8 of the Act on Posting Workers.

The representative is obligated to report the following data to the Incomes Register on behalf of the employer (section 15a, subsection 3, act on assessment procedure (laki verotusmenettelystä 1558/1995):

- The wages paid by a foreign employer for work performed in Finland when a foreign employee leasing company has leased an employee to a service recipient in Finland and when the tax treaty between the employee's country of residence and Finland does not prevent Finland from taxing the wages.

- Wage income paid by a foreign employer when the wage earner stays in Finland for a period exceeding six months.

Furthermore, the representative must submit an employee leasing notice when the employee begins work in Finland. The employee leasing notice must include information on the estimated duration of the leased employee's work and the amount of wage, and the service recipient, when the tax treaty between the employee's country of residence and Finland does not prevent Finland from taxing the employee's wages.

Provisions on the representative's obligation to report the above-mentioned information are laid down in section 15a of the act on assessment procedure.

However, a foreign employer always has a reporting obligation to insurers when the income earner must be insured in Finland regardless of whether the employer has a representative or not.

1.4 Income earners with resident and non-resident tax liability

The payments made are reported to the Incomes Register on an earnings payment report. The report and the income types are the same for all income earners, both resident and non-resident taxpayers. Resident and non-resident tax liability are information affecting taxation. They have no effect on the obligation to provide insurance.

Persons whose residence and home are in Finland or who reside in Finland for more than six months consecutively, are deemed resident taxpayers. As a rule, a Finnish citizen who has moved abroad is considered to be a resident taxpayer for three calendar years following the year of the move abroad.

Persons whose residence and home are abroad, and who do not reside in Finland for more than six months consecutively, are deemed non-resident taxpayers. A report must be submitted of payments made to a person who is a non-resident taxpayer, regardless of whether tax at source must have been collected or tax withheld from the payment, or whether the person is insured in Finland. Such a report must also be submitted for compensation paid to a non-resident taxpayer for work performed abroad.

A company is deemed to be a non-resident taxpayer if it has not been established in accordance with Finnish legislation, or if its registered domicile is not Finland. Non-wage compensation for work paid to a company that is a non-resident taxpayer (other than a natural person) is reported to the Incomes Register only if tax at source has been collected from the income. If the payment made to the company is compensation for use (royalty), it must always be reported to the Incomes Register.

The Income Tax Act also includes provisions on resident tax liability that apply to certain special groups, such as persons working for Finland's foreign representative offices or international organisations.

For more information on the tax liability status, see the Tax Administration Guidelines Resident and non-resident tax liability.

1.5 Additional income earner and payer details in international situations

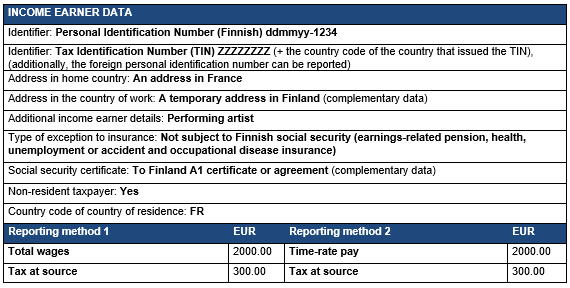

In international situations, income is reported using the same income types of the earnings payment report regardless of whether the income earner is a resident or non-resident taxpayer. If the income earner is a non-resident taxpayer, the following data must also be included in the income earner's details: Non-resident taxpayer: Yes.

With regard to the following special groups, additional income earner details or payer details must be provided:

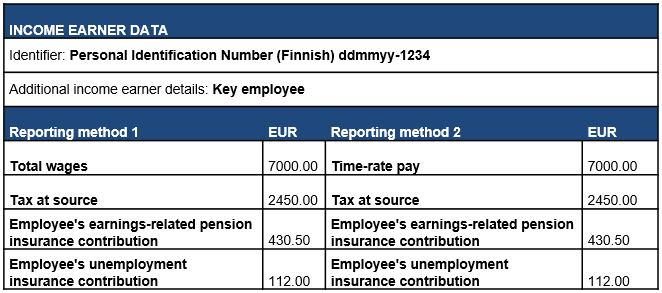

- wages paid under the act governing the taxation of key employees;

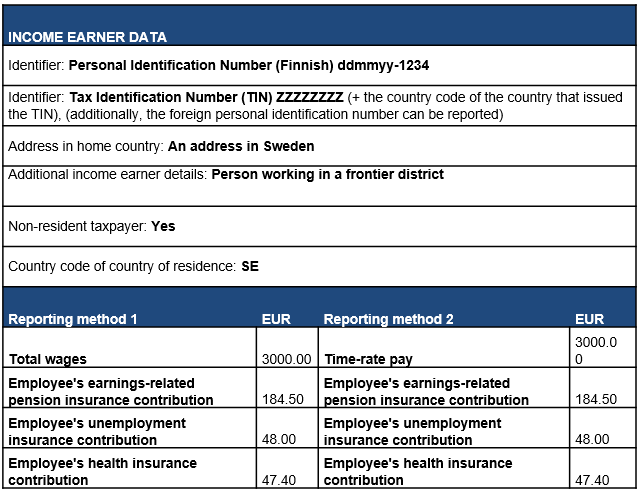

- wages paid for frontier work (Nordic situations);

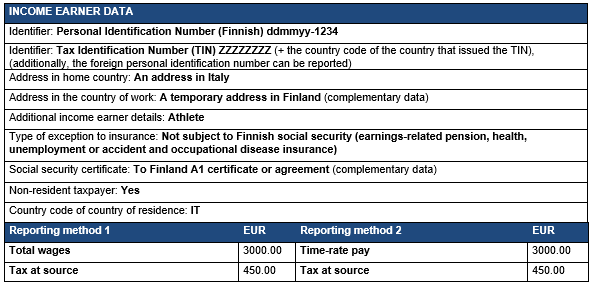

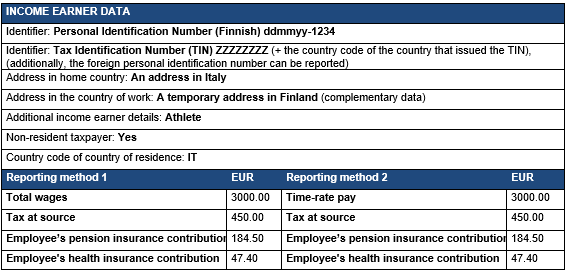

- wages or fees paid to an athlete;

- wages or non-wage compensation for work paid to an artist; and

- wages paid by a specialised agency.

The reporting method related to these special groups is described in more detail in Section 5, Special situations.

As the additional payer details, select Foreign group company as the payer type when a foreign group company is paying the wages of an employee who has been posted abroad but is insured in Finland. The information is provided by the Finnish company who posted the employee. Furthermore, the Person working abroad data must be provided as an additional income earner detail. For more details on the reporting, see Section 2.3.2, Wages for insurance purposes are determined, wages are paid by a foreign group company (resident taxpayer) and 2.6.4, Foreign group company pays the wages (non-resident taxpayer).

When a public sector organisation pays income to a non-resident taxpayer, the additional payer details must indicate that the payer is a public sector organisation. This data is required for international exchange of information.

1.6 Currency conversion

The data is reported to the Incomes Register in euros. If the payment was made in some other currency, the payment must be converted into euros using the ECB's reference exchange rate valid on the payment date (Bank of Finland > Exchange rates). If the payment is reported in the Incomes Register before the payment date, for example in connection with a payroll run, the income amount reported is converted using the reference exchange rate valid on the reporting date in question.

1.7 Customer identifiers

Payer's customer ID

The payer must report the data to the Incomes Register primarily using a Finnish Business ID or personal identity code.

If the payer does not have a Finnish customer identifier, the data should be reported using a foreign identifier. This also requires the entry of further identifying and contact details, such as name and address. If the payer has both a Finnish and a foreign identifier, report both identifiers.

Income earner's customer ID

The income earner's data must be reported to the Incomes Register primarily with a Finnish personal identity code. For a person living abroad, the foreign Tax Identification Number or personal identity code must also be disclosed, if the payer has this information. If the income earner has both a Finnish and a foreign identifier, report both identifiers.

If the income earner does not have a Finnish personal identity code, report their date of birth, gender and address. It is possible to report the address in both Finland and the country of residence to the Incomes Register. For an income earner who is a non-resident taxpayer, the country of residence, the Tax Identification Number (TIN) of the country of residence, if the identifier is in use in the non-resident taxpayer's country of residence, and the contact information in the country of residence must also always be reported.

2 Reporting income paid for work abroad

2.1 Social insurance contributions and provision of insurance

Under certain conditions, an income earner working abroad can be covered by Finnish social security. In such a case, social insurance contributions must be paid to Finland based on the income earner's income. The payer must therefore also report the necessary information to the Incomes Register.

An employee leaving from Finland and working abroad is insured in Finland if

- Finnish legislation is applied to the employee based on the EU social security regulations and the employee has an A1 certificate from Finland; or

- Finnish legislation is applied to the employee based on a social security agreement and the employee has a certificate of the applicable legislation.

For further information on the social insurance contributions in different situations, see the insurers' own websites:

- earnings-related pension insurance: the payer's earnings-related pension provider or the Finnish Centre for Pensions (www.etk.fi)

- unemployment insurance: Unemployment Insurance Fund (www.tvr.fi)

- accident and occupational disease insurance and employee's group life insurance: the payer's accident insurance company or the Workers' Compensation Center (www.tvk.fi)

- employer's health insurance contribution and employee's health insurance contribution: Tax Administration (www.vero.fi) and Kela (www.kela.fi).

If there is no social security agreement between Finland and the country of work, whether or not the income earner is covered by Finnish social security is determined by national legislation. It may be possible in such cases that the employee is insured both in Finland and the country of work. Finnish insurance coverage is separately determined for earnings-related pension, unemployment and occupational accident insurance, and the social security handled by Kela.

When a person is posted abroad, wages for insurance purposes must be determined for him/her. The employer's and the employee's social security contributions are determined based on this. Wages for insurance purposes are calculated wages that would have to be paid, if work corresponding to work performed abroad were to be performed in Finland. Different actors have different rules on when wages for insurance purposes are used to determine the social insurance contributions, and when actual wages paid are used instead.

Wages for insurance purposes do not need to be determined in all situations, for example if the posting abroad is shorter than six months in duration. In such situations, the social insurance contributions are paid based on the actual wages. For more information, see the pensions act service (www.tyoelakelakipalvelu.fi).

The six-month rule for taxation is different than the six-month inspection period used in determining the wages for insurance purposes. The actual work period abroad is considered in determining the wages for insurance purposes. If the work period exceeds six months, wages for insurance purposes must be determined.

2.2 The income on which insurance contributions and the income on which taxation is based are different

In some situations related to working abroad, the income on which some social insurance contributions are based is different than the income on which taxation is based. In these situations, wages for insurance purposes must be reported to some Incomes Register data users and the actual wages paid to some.

In situations where wages for insurance purposes have been determined but the actual wages paid are used as the basis for taxation, the Tax Administration and Kela will use the actual wages paid as the basis for taxes and contributions.

In these situations, the employer's and the employee's health insurance contributions are determined by the actual wages paid when the income is taxed progressively (income received by both resident and non-resident taxpayers). In such a case, include the following data in connection with the wages for insurance purposes: Insurance information type: Subject to health insurance contribution, Grounds for insurance contribution: No. Based on this information, the Tax Administration and some payers of benefits are informed of the wages for insurance purposes not being the grounds for the health insurance contributions and some benefits.

However, the pension and unemployment insurance contributions are paid based on the wages for insurance purposes. The accident and occupational disease insurance contributions are determined based on the wages for insurance purposes, but compensations for loss of earnings paid based on the insurances are determined based on the actual wages paid.

Situations where the income on which social insurance contributions are based may be different than the income on which taxation is based include:

- a resident taxpayer works abroad;

- wages for insurance purposes are determined, but the six-month rule does not apply to the wage income (Section 2.3.1.2);

- wages for insurance purposes are determined and the wages are paid by a foreign group company, but the six-month rule does not apply to the wage income (Section 2.3.2.2);

- a non-resident taxpayer works abroad;

- the income earner is insured in Finland, but

- the income is not taxed in Finland (Section 2.6.1.1);

- the income is taxed in Finland, the income is taxed according to the Tax at Source Act (Section 2.6.1.2);

- income is taxed in Finland, income is taxed according to the act on assessment procedure (so-called progressive taxation of a non-resident taxpayer) (Section 2.6.1.3).

- the income earner is insured in Finland, but

In these situations, the data can be reported to the Incomes Register in one report when the payer uses reporting method 1 for reporting monetary wages. If the payer uses reporting method 2, the data must be reported to the Incomes Register in two reports. There are examples of data submitted using the different reporting methods in the above-mentioned sections.

Reporting method 1

When the payer reports the data to the Incomes Register using reporting method 1, the following income types must be reported:

- Wages for insurance purposes

- Total wages.

In addition to these income types, the payer must report the following data related to the Wages for insurance purposes income type: Six-month rule is applicable: No and Insurance information type: Subject to health insurance contribution, Grounds for insurance contribution: No. Furthermore, the Insurance information type data group connected to the Total wages income type must be used to report the social insurance contributions not paid based on the Total wages income type, but paid on basis of the wages for insurance purposes instead, for example:

- Insurance information type: Subject to earnings-related pension insurance contribution, Grounds for insurance contribution: No

- Insurance information type: Subject to accident and occupational disease insurance contribution, Grounds for insurance contribution: No

- Insurance information type: Subject to unemployment insurance contribution, Grounds for insurance contribution: No

If the Insurance information type data group is not used to report that the contributions in question are not paid for the Total wages income type, the social insurance contributions are determined twice, based on both the wages for insurance purposes and the total wages.

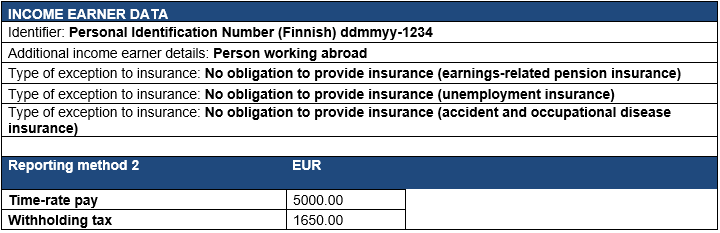

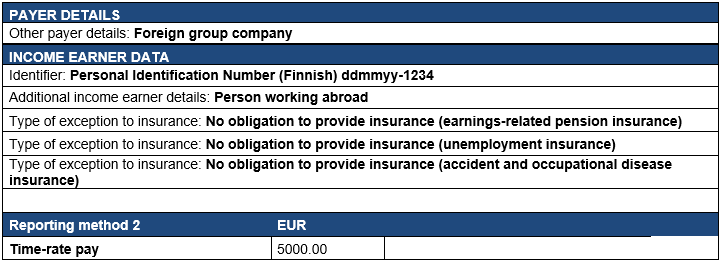

Reporting method 2

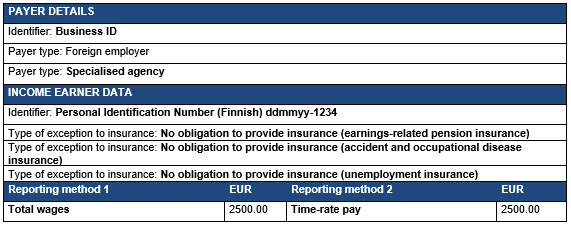

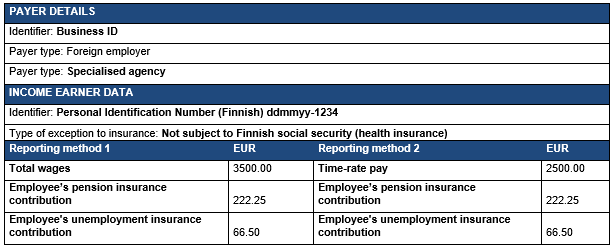

As a rule, income types reported using reporting method 2 include the data on to which social insurance contributions they are subject by default. By default, the Time-rate pay income type is subject to all social insurance contributions. Insurance information type is income-type-specific, but it cannot be connected to the Time-rate pay income type.

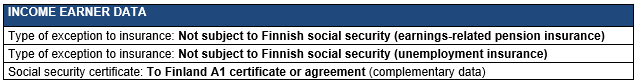

In order for the social insurance contributions to not be levied twice, based on both the wages for insurance purposes and the time-rate pay, the payer must submit two reports to the Incomes Register:

- The wages for insurance purposes are reported in its own report. For the Wages for insurance purposes income type, the following data must be submitted: Six-month rule is applicable: No and Insurance information type: Subject to health insurance contribution, Grounds for insurance contribution: No.

- The Time-rate pay income type is reported in its own report. In addition to the Time-rate pay income type, the following data must be reported:

- Type of exception to insurance: No obligation to provide insurance (earnings-related pension insurance)

- Type of exception to insurance: No obligation to provide insurance (unemployment insurance)

- Type of exception to insurance: No obligation to provide insurance (accident and occupational disease insurance).

Type of exception to insurance data applies to the entire earnings payment report, and the data cannot be connected to an individual income type. Were the data on the wages for insurance purposes and time-rate pay as well as the type of exception to insurance data submitted in the same report, the social insurers would not receive information on the grounds for the insurance contributions.

2.3 A Resident taxpayer works abroad

The so-called six-month tax exemption rule may apply to the wages of an employee working abroad (section 77 of the income tax act (tuloverolaki 1535/1992)). In such a case, the wages paid are tax-exempt in Finland, and only social insurance contributions are paid from the income if the income earner is covered by Finnish social security. For more information on the taxation of work abroad, see the Tax Administration Guidelines Taxation of work abroad.

If the six-month rule applies to the wage income and the income earner is insured in Finland, the employer will perform a so-called minimal withholding (employee's health insurance contributions) based on the wages for insurance purposes automatically, and there is no need to change the tax card. The amount of the minimal withholding is confirmed annually by a decision of the Tax Administration. Additionally, the employer collects the employee's share of the earnings-related pension and unemployment insurance contributions from the wages. The payer reports Person working abroad as an additional income earner detail to the Incomes Register. This data is used always when an employee insured in Finland works abroad as an employee posted by a Finnish employer.

If a Finnish company posts an employee abroad and, for example, a foreign group company pays the employee's wages and the employee is insured in Finland, the Finnish company pays the employer's social insurance contributions (including the employer's health insurance contribution) and reports them to the Incomes Register. The employee's health insurance contribution is levied from the employee as back tax. In these situations, the Finnish company that posted the employee reports its own details in the payer details and submits Foreign group company as other payer details, and Person working abroad as additional income earner details.

When the employer applies the six-month rule of the Income Tax Act to the wage income, the following data must be reported to the Incomes Register in addition to the income type: Six-month rule is applicable: Yes and the country code of the country of work. In situations where wages for insurance purposes have been determined for an employee, but the six-month rule is not applicable, the following data must be submitted: Six-month rule is applicable: No. For more details on these situations, see Section 2.3.1.2.1 (Finnish employer pays the wages) and Section 2.3.2.2 (a foreign group company pays the wages) of these instructions. If no wages for insurance purposes have been determined for the duration of the work period abroad and the six-month rule is not applicable to the wage income, the Six-month rule is applicable data does not need to be submitted.

When an employer does not withhold taxes because the six-month rules applies to the income, the employer must submit complementary information required by the Tax Administration to the Incomes Register; see Section 2.4, Additional information on work abroad.

When an employer posts an employee to another Nordic country, the employer must submit complementary information required by the Tax Administration to the Incomes Register; see Section 2.4, Additional information on work in a Nordic country.

See below for descriptions of different situations based on whether the income is taxable in Finland or not and whether insurance contributions are paid from the income to Finland or not. A Finnish payer's obligations in situations where the payment of wages is transferred to a foreign group company are described in Sections 2.3.2 (income earner is a resident taxpayer) and 2.6.4 (income earner is a non-resident taxpayer).

2.3.1 Wages for insurance purposes are determined

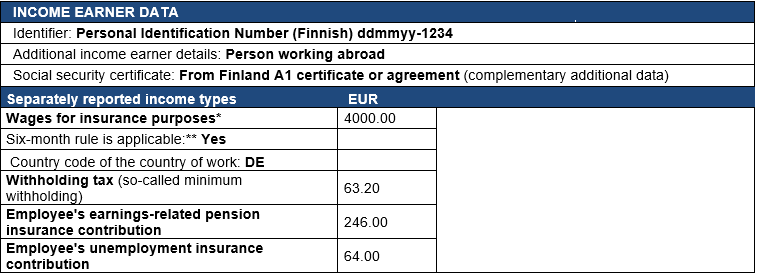

2.3.1.1 The six-month rule applies to the entire pay period

Example 1: A Finnish employer has posted an employee to Germany to work for two years. The employee has an A1 certificate issued by the Finnish Centre for Pensions, and the amount of wages determined for her for insurance purposes is EUR 4,000 per month. The six-month rule applies to the income throughout the pay period. The employer's and the employee's social insurance contributions are paid based on the wages for insurance purposes. The employee's health insurance contribution (so-called minimum withholding) is reported as withholding, although tax does not otherwise need to be withheld from the wages.

*The wages for insurance purposes must be reported monthly, no later than on the fifth day of the calendar month following the work.

**The six-month rule is applicable data can be connected to an individual income type.

In addition to the above-mentioned identifying and income data, the payer must submit complementary additional data on the work abroad required by the Tax Administration as information connected to the work abroad; see Section Additional information on work abroad (six-month rule).

2.3.1.2 Six-month rule is not applicable

When the six-month rule is not applicable to the income earner's foreign wages but wages for insurance purposes have been determined for him/her, the employer may report the data in one earnings payment report when it uses reporting method 1 for reporting monetary wages. If the employer uses the reporting method 2, the employer must submit two reports to the Incomes Register.

For more information on the procedure, see Section 2.2, The income on which insurance contributions and the income on which taxation is based are different.

When wages for insurance purposes have been determined for the employee but the six-month rule is not applicable to the income, the payer must report the following data in addition to the income type: Six-month rule is applicable: No.

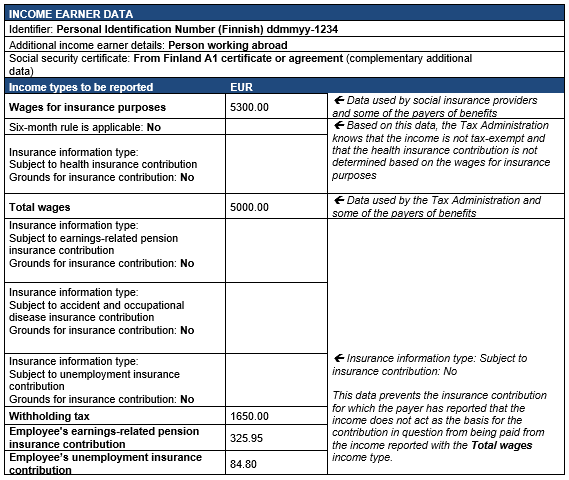

2.3.1.2.1 Income is entirely taxed in Finland

Example 2: A Finnish employer has posted an employee to Sweden to work for one year. The Finnish Centre for Pensions has issued him an A1 certificate from Finland. The employee's wages for insurance purposes have been determined to be EUR 5,300 per month. The employee is paid EUR 5,000 per month in wages. The income earner stays in Finland during his work to the extent that the six-month rule is not applicable to his wages. The employee's withholding rate on the tax card is 33%.

The employer's and the employee's earnings-related pension and unemployment insurance contributions, and the employer's accident and occupational disease insurance contributions are paid based on the confirmed wages for insurance purposes (EUR 5,300). However, taxes are levied from the employee's actual wages (EUR 5,000); correspondingly, the employer's health insurance contribution is paid based on the actual wages paid. Tax is withheld (EUR 5,000 x 33% = EUR 1,650) based on the actual wages paid. The employee's health insurance contribution is included in the withheld tax.

Reporting method 1

If the data is submitted using reporting method 1, it can be reported in one earnings payment report as follows:

Based on the submitted data, the earnings-related pension, unemployment, and accident and occupational disease insurance contributions are paid, based on the wages for insurance purposes (EUR 5,300), but the employer's health insurance contribution is paid based on the actual wages paid (EUR 5,000). Furthermore, the income earner is taxed based on the actual income paid.

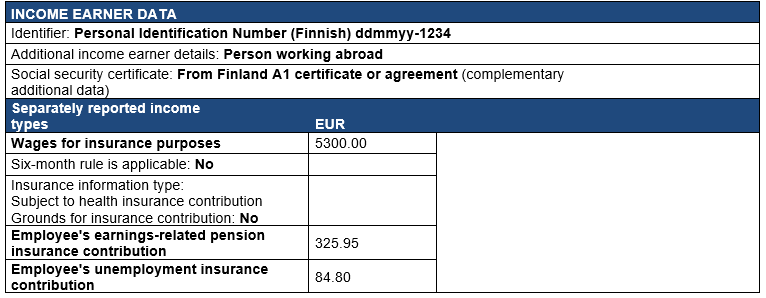

Reporting method 2

When reporting method 2 is used, the data must be submitted in two earnings payment reports. The wages for insurance purposes, used as the basis for some social insurance contributions, are reported in one report, and the actual paid wages for the Tax Administration and the determination of the health insurance contribution in another report.

Reporting the wages for insurance purposes:

Reporting the actual wages paid:

2.3.1.2.2 The country of work taxes the income

If a permanent establishment in the country of work is established for the payer in the country of work as regards income taxation, the payer must usually collect taxes from the income earner's wages for the country of work, too. If the six-month rule is not applicable, the payer must withhold tax in Finland. However, the income earner may apply for a change to his/her tax card, in which case the taxes paid abroad can be taken into consideration in the withholding rate.

The payer can report the taxes collected from the income earner's wages and paid to the country of work using the separately reported income type, Tax paid abroad. This data is voluntarily submitted complementary additional data. In other regards, the data is reported in the same way as in the previous example.

Although the payer reports the tax paid abroad to the Incomes Register, the income earner must request the elimination of any double taxation in his/her taxation; he/she must also report the tax paid abroad in the tax return.

2.3.1.3 The six-month rule is applicable in the middle of a pay period

If the wages for insurance purposes begin to be applied in the middle of a month, the wages for insurance purposes are divided by 30.33 when the pay period is one month. The resulting number is divided by the number of days during which the wages for insurance purposes apply.

Example 3: The amount of wages for insurance purposes is EUR 5,000 per month. The work abroad begins in the middle of the month in such a manner that the wages for insurance purposes apply for 13 days. Regular wages are used for the other days of the month. (EUR 5,000 / 30.33) x 13 = EUR 2,143.09, which is the amount of the wages for insurance purposes for the partial month (13 days).

The following examples describe the reporting procedure in a situation where the employee's work abroad begins in the middle of a pay period and wages for insurance purposes are determined for him.

Example 4: Payer uses a one-month pay period. On 15 April, the employee begins work that will last one year in Great Britain. The six-month rule is applicable to his wages immediately from the beginning of work. The Finnish Centre for Pensions has issued him an A1 certificate from Finland. The income earner's monthly wages are EUR 3,400, and the amount of wages determined for him for insurance purposes is EUR 3,800 per month. The employee's wages are paid from Finland during the posting abroad. On his tax card, the withholding rate is 20%.

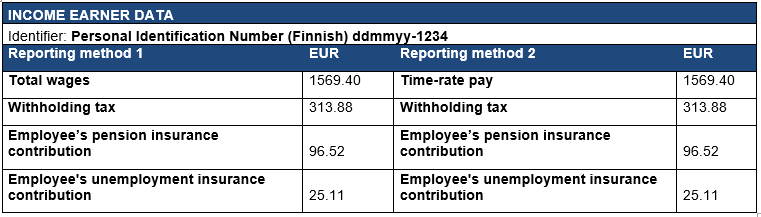

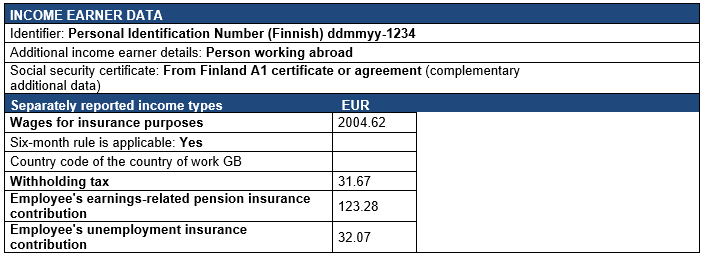

In the beginning of the month, the employer pays the social insurance contributions based on the actual wages paid and at the end of the month based on the wages for insurance purposes. There are 30.33 tax days in one month. The amount of wages paid is (EUR 3,400 / 30.33) x 14 days = EUR 1,569.40. The amount of wages for insurance purposes is (EUR 3,800 / 30.33) x 16 days = EUR 2,004.62. The employer withholds tax (EUR 313.88) from the part of the wages (EUR 1,569.40) that is taxed in Finland, and withholds the minimum withholding (EUR 31.67) from the amount of wages for insurance purposes.

In this kind of a situation, the payer must submit two reports to the Incomes Register: the wages for the first part of the month must be reported in one earnings payment report and the wages for the second part of the month in another.

Reporting the wages for the start of the month (employer works in Finland):

Reporting the wages for the end of the month (employee works abroad, six-month rule is applicable, wages for insurance purpose have been determined):

2.3.1.4 Insurance information changes in the middle of a pay period, the six-month rule is applicable to a part of the wages for the pay period

The insurance information applies to the entire report. If the information changes in the middle of a pay period, the payer must submit two different earnings payment reports to the Incomes Register.

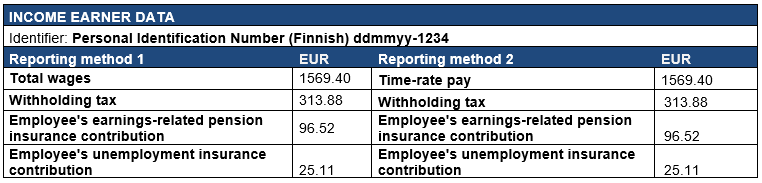

Example 5: Payer uses a one-month pay period. An employee moves abroad to work on 15 April. The six-month rule is applicable to the work abroad. The employee is not insured in Finland for the duration of the work abroad. The employee's monthly wages are EUR 3,400 and his wages are paid from Finland during the posting abroad. The withholding rate on the tax card is 20%.

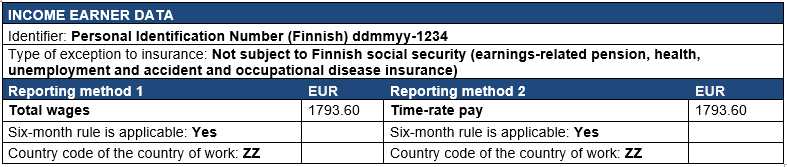

The employer pays the social insurance contributions based on the actual wages paid for the start of the month. There are 30.33 tax days in one month. The amount of wages paid is (EUR 3,400 / 30.33) x 14 days = EUR 1,569.40. The amount of withholding is EUR 313.88. The social insurance contributions are no longer paid to Finland for the end of the month. Neither is minimal withholding done, because the employee is not insured in Finland. The payer must submit two different earnings payment reports to the Incomes Register.

Reporting the wages for the start of the month (employee works in Finland and is insured in Finland):

Reporting the wages for the end of the month (employee works abroad, six-month rule is applicable, employee is not insured in Finland): The amount of wages paid is (EUR 3,400 / 30.33) x 16 days = EUR 1,793.60.

2.3.2 Wages for insurance purposes are determined, wages are paid by a foreign group company

If an employee posted abroad is insured in Finland, the employee's and the employer's social insurance contributions and other social insurance payments must be accrued in Finland even if the wages are paid by a foreign group company or another company where the Finnish company that posted the employee has authority. In these situations, the Finnish company that posted the employee pays the employer's health insurance contribution and other social insurance contributions (including the employee's shares of the pension and unemployment insurance contributions). The Finnish company is also obligated to report to the Incomes Register the information on the wages for insurance purposes, or the actual wages paid if the six-month rule is not applicable to the wage income.

In the reports submitted to the Incomes Register, the Finnish company reports its own details in the payer details, although the payer is in fact a foreign company. When a foreign group company pays the wages to an employee posted abroad who is insured in Finland, the Finnish company that posted the employee must submit the Foreign group company data as other payer details and the Person working abroad as an additional income earner detail.

The wages for insurance purposes must be reported to the Incomes Register monthly, no later than on the fifth day of the calendar month following the work.

2.3.2.1 Six-month rule is applicable

When the six-month rule is applicable to the wage income and the wages for insurance purposes have been determined, the employer's health insurance contribution and other social insurance contributions are paid based on the wages for insurance purposes. The withholding (so-called minimal withholding) of the employee's health insurance contribution does not accrue, because the wages are paid by a foreign company. Based on the data submitted to the Incomes Register, the Tax Administration determines the amount of the employee's health insurance contribution in final taxation, and it is paid as back tax.

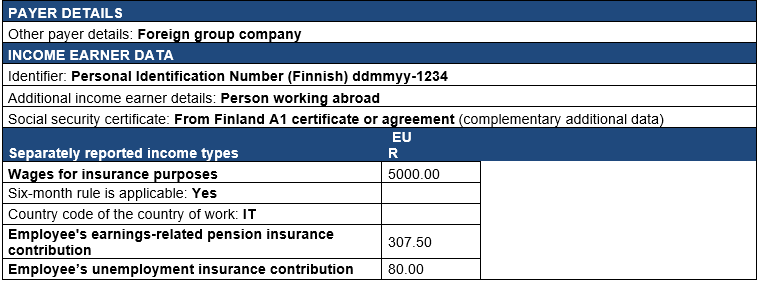

Example 6: A Finnish company posts an employee to work in Italy for two years for its subsidiary. The Finnish Centre for Pensions has issued her an A1 certificate, and EUR 5,000 have been determined as her wages for insurance purposes. The wage payment is transferred to the Italian subsidiary.

Because the employee is insured in Finland, the Finnish company is obligated to pay the employee's health insurance contribution and other social insurance contributions to Finland, and to report the wages for insurance purposes to the Incomes Register. The Italian subsidiary collects the employee's share of the earnings-related pension and unemployment insurance contributions from the wages it pays and pays the contributions to the Finnish company.

The Finnish company reports to the Incomes Register the wages for insurance purposes and the employee's shares of the earnings-related pension and unemployment insurance contributions. Based on the wages for insurance purposes submitted to the Incomes Register, the Tax Administration determines the amount of the employee's health insurance contribution in the employee's final taxation, and it is paid as back tax.

2.3.2.2 Six-month rule is not applicable

If the employee posted abroad is insured in Finland, but the six-month rule is not applicable to the income, the employer's and the employee's health insurance contributions are paid based on the actual wages paid. The employer's and the employee's earnings-related pension and unemployment insurance contributions, and the employer's accident and occupational disease insurance contributions are paid based on the wages for insurance purposes.

The actual wages paid are the basis of the employer's and the employee's health insurance contributions up to the amount in which the wages would be subject to withholding if the work had been performed in Finland. In other words, the payment obligation is not linked to the wages for insurance purposes. The Finnish company that posted the employee must request the necessary information on the wages paid from the foreign payer. The fringe benefit decision of the Tax Administration also confirms the value of foreign fringe benefits.

Because the six-month rule is not applicable to the income, the income is taxed in Finland. If a right to tax the wages is established for the country of work, the employee must request the elimination of double taxation in a tax return submitted to Finland.

If the Finnish and foreign company belong to the same group, the Finnish employer is obligated to report to the Incomes Register the wages paid by the foreign employer. At the same time, the employer may also report any taxes collected for the foreign country by the foreign employer. The information must be reported monthly, no later than on the fifth day of the calendar month following the payment of wages.

The data can be submitted to the Incomes Register in one earnings payment report when reporting method 1 is used. When reporting method 2 is used, two reports must be submitted. For more information on the procedure, see Section 2.2, The income on which insurance contributions and the income on which taxation is based are different.

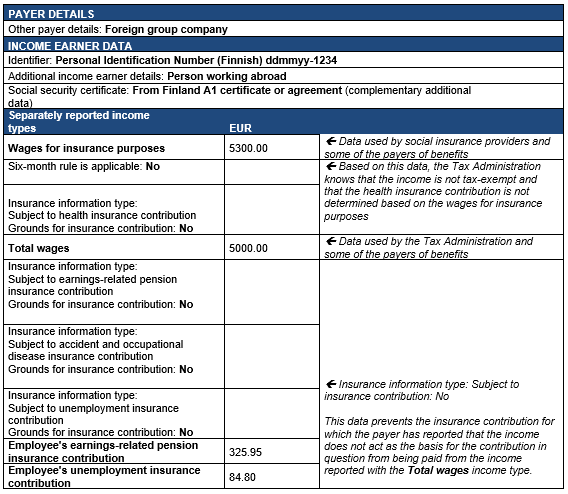

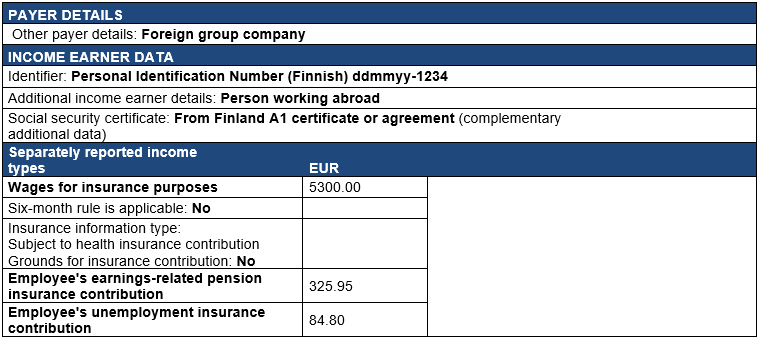

Example 7: A Finnish company posts an employee to work in Denmark for two years for its subsidiary. The Finnish Centre for Pensions has issued her an A1 certificate, and EUR 5,300 has been determined as her wages for insurance purposes. The wage payment is transferred to the Danish subsidiary. The amount of wages paid is EUR 5,000.

The employee spends her free time in Finland with her family. She stays in Finland so much that the six-month rule is not applicable to the income.

Because the employee is insured in Finland, the Finnish company is obligated to pay the employee's health insurance contribution and other social insurance contributions to Finland, and to report the data to the Incomes Register. The Danish subsidiary withholds the employee's share of the earnings-related pension and unemployment insurance contributions from the wages it pays.

Because the six-month rule is not applicable to the income, the income is also taxable in Finland. The double taxation is eliminated in Finland in accordance with the provisions of the tax treaty. Furthermore, the Tax Administration determines the amount of the employee's health insurance contribution in the final taxation based on the actual wages paid; the contribution is paid as back tax.

Reporting method 1

If the data is submitted using reporting method 1, it can be reported in one earnings payment report as follows:

Reporting method 2

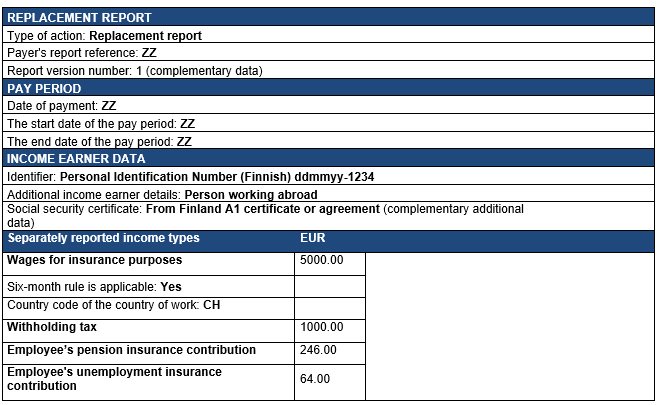

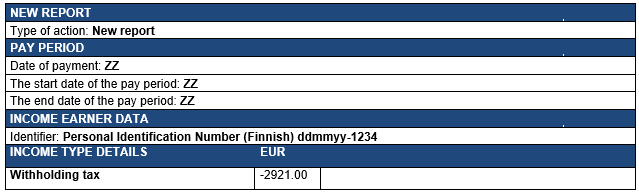

When reporting method 2 is used, the data must be submitted in two earnings payment reports. The wages for insurance purposes, used as the basis for the social insurance contributions, are reported in one report, and the actual paid wages for the Tax Administration and the determination of the health insurance contribution in another report.

Reporting the wages for insurance purposes:

Reporting the actual wages paid:

2.3.3 Income earner is not insured in Finland

2.3.3.1 Six-month rule is applicable

If a resident taxpayer working abroad is not insured in Finland and the six-month rule is applicable to the wages paid to him/her, the Finnish employer must report the income to the Incomes Register.

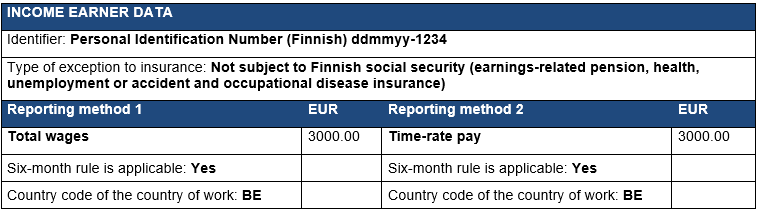

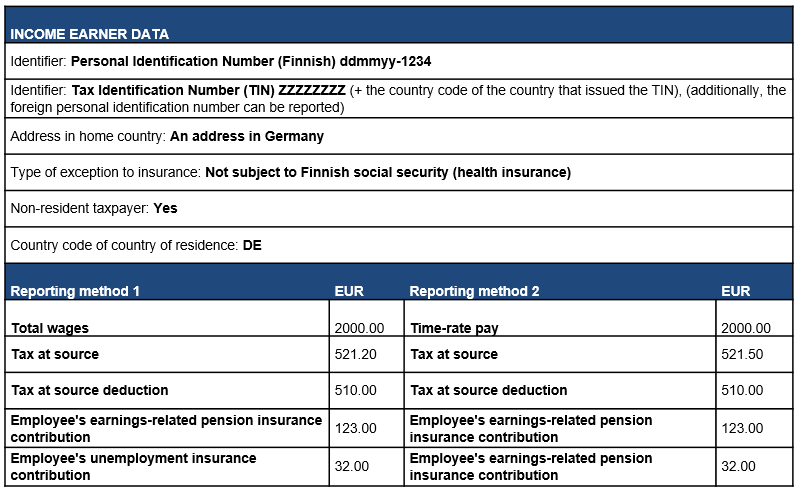

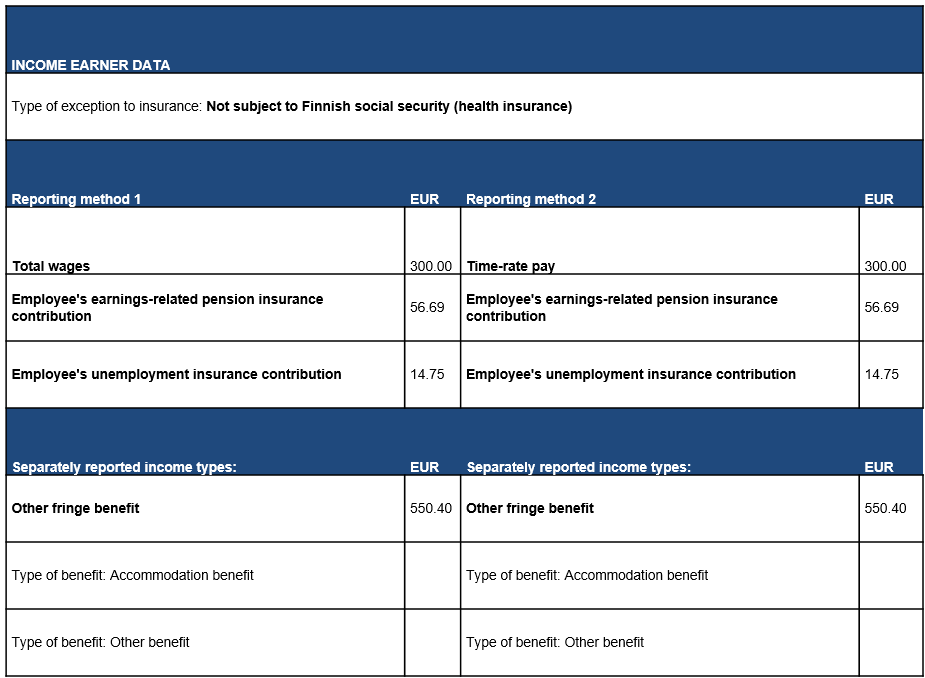

Example 8: A Finnish citizen has worked in Belgium for two years in the service of a local employer. The employee is a resident taxpayer in Finland. He moves to work for a Finnish company at a place of business located in Belgium. The amount of the wages is EUR 3,000. The six-month rule is applicable to the wage income. The employee is not covered by Finnish social security.

2.3.3.2 Six-month rule is not applicable

If the six-month rule is not applicable to the wages of a resident taxpayer working abroad, the income is taxable in Finland. The Finnish employer must withhold tax from the income to Finland in accordance with the stipulations of the tax card and report the data on the wages paid to the Incomes Register.

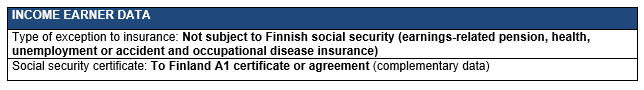

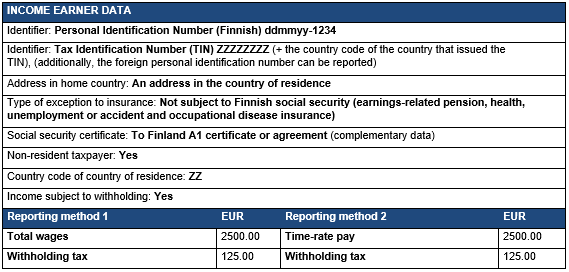

The payer must also use the Type of exception to insurance data to report that the social insurance contributions are not paid to Finland, for example: Not subject to Finnish social security (earnings-related pension, health, unemployment or accident and occupational disease insurance) As complementary data, the following can be reported: Social security agreement: To Finland A1 certificate or agreement.

2.3.4 Wage income subject to seafarers' pensions act and work abroad

The seafarers' pensions act (merimieseläkelaki 1290/2006) does not include the concept of wages for insurance purposes. If a wage earner is subject to the seafarers' pensions act the payer reports the income according to the actual wages paid. The social insurance contributions are determined based on the wages paid.

The six-month rule of the income tax act (tuloverolaki 1535/1992) is not applicable to income from work on board a Finnish ship. A foreign ship leased by a Finnish company is also considered equivalent to a Finnish ship if the ship has only a minor foreign crew or no crew.

Work performed on board a foreign ship, however, may be tax-exempt under the six-month rule.

Read more about reporting seafarer’s income in Section 2, Seafarer's income, in Reporting data to the Incomes Register: rewarding employees, payments made to an entrepreneur and other special circumstances.

2.3.5 Wages paid to an entrepreneur and the six-month rule

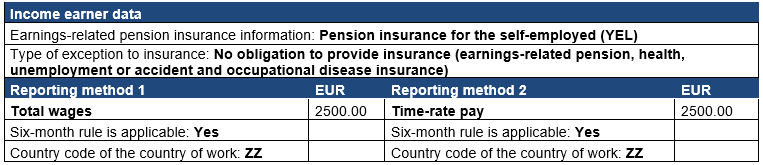

If an income earner who goes abroad to work is YEL-insured (pension insurance for the self-employed) and the six-month rule applies to the wages paid, the social insurance contributions are paid based on the YEL income from work. The income is reported to the Incomes Register as follows:

2.3.6 Incentives and the six-month rule

Income from an employee stock option may under certain conditions be tax-exempt under the six-month rule. If the conditions are met, the employer may apply the six-month rule when reporting the payment to the Incomes Register. For example, the employer must arrange reliable tracking of working days and, when reporting the employee stock option to the Incomes Register, check that the conditions of the income being tax-exempt have been fulfilled.

For more information on the conditions, see the Tax Administration Guidelines Taxation of employee stock options.

Example 9: On 1 May 2017, an employee working in Finland is given employee stock options the earnings period of which ends on 12 December 2018. In the service of his employer, he moves abroad starting on 17 November 2017. The six-month rule is applicable to both the wages and the stock options.

The employee exercises the options on 1 April 2019. He receives a benefit to the amount of EUR 90,000 from the options, divided into shares that are taxable and tax-exempt in Finland in the ratio of the working days. The share that is taxable in Finland is (200 / 600 x 90,000) EUR 30,000.

The employer cannot withhold tax from the value of the option benefit if the employer is not also concurrently paying taxable monetary wages to the employee. If the six-month rule applies to the monetary wages, tax does not need to be withheld from the share of the taxable employee stock option.

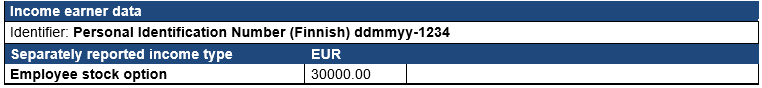

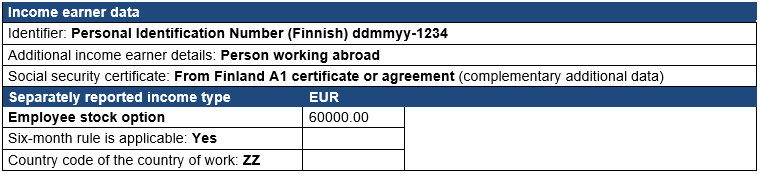

The benefit gained from the employee stock option is reported to the Incomes Register. The taxable share, EUR 30,000, is reported in the earnings payment report for April 2019 using the Employee stock option income type. The amount of option benefit to which the six-month rule is applicable, EUR 60,000, is reported using the Employee stock option income type, and in connection with it, the following data is submitted: Six-month rule is applicable: Yes and Country code of the country of work.

Reporting an employee stock option taxable in Finland:

Reporting an employee stock option to which the six-month rule is applicable:

2.4 Additional information on work abroad (six-month rule)

2.4.1 Information to be reported

The additional information on work abroad is reported to the Incomes Register for the purposes of the Tax Administration. In this section, additional information on work abroad refers to NT2 data and the employer's report on periods of stay in Finland. The data can be submitted either in connection with earnings payment data or separately. The recommendation is, however, that the additional information on work abroad is submitted in a separate earnings payment report.

The data must be reported when the employer has applied the six-month rule as defined in section 77 of the income tax act (tuloverolaki 1535/1992) to the wage income.

The wages earned from the work abroad are tax-exempt in Finland if the six-month rule as defined in section 77 of the income tax act is applicable to them. For more information on the taxation of work abroad, see the Tax Administration Guidelines Taxation of work abroad.

2.4.1.1 Withholding is not done to Finland (NT2 data)

The employer may choose not to withhold tax from the wages it has paid for work abroad if the conditions of the six-month rule are fulfilled. When the employer does not withhold tax from the income earner's wages and starts applying the six-month rule, the employer must submit the information on the work abroad as NT2 data.

The following data is then reported as NT2 data:

- Country of work or countries of work, if several (mandatory data)

- District of work (voluntary data)

- Address in country of work (voluntary data)

- Stay periods in country of work (mandatory data)

- start date

- end date (estimated)

- Work periods abroad (mandatory data)

- start date

- end date (estimated)

- Pay burdens the result of a permanent establishment in the country of work (Y/N) (mandatory data)

- Country of work has right to tax the wages (Y/N) (mandatory data)

- Pay per month (voluntary data)

- Other remunerations and benefits (voluntary data)

2.4.1.2 Employer's report of periods of stay in Finland

The following data is submitted in the report:

- Stay periods in Finland (mandatory data)

- start date

- end date

- If the employee has not stayed in Finland at all during the time period for reporting, the payer must choose the following entry for Stay periods in Finland:

- Report contains no stay periods in Finland (Y/N)

2.4.2 The time of reporting data and correcting data

Before the first payment of wages for work abroad, the employer must evaluate whether tax needs to be withheld from the payment to Finland. The employer must report the NT2 data no later than on the fifth calendar day after the first wage payment date after tax was not withheld for the first time.

The NT2 data must be submitted for each calendar year. If working abroad continues into the next year, the previously submitted NT2 data does not need to be corrected; instead, the changed data is reported on a new earnings payment report. In this case, the NT2 data must be submitted by the end of January of the following year.

The NT2 data provided for the last year of work must be corrected by the end of January of the following year if there have been changes in it. For example, if the actual end date of the stay or employment abroad differs from the estimated end date, the last end date data on the NT2 form must be corrected.

If the country of work changes, however, new NT2 data must be submitted if tax is still not withheld. The data must be reported no later than on the fifth calendar day following the first payment date on which tax was not withheld for wages paid for work performed in this country.

Example:

The Finnish employer of employee A, who lives in Finland, sends A to work in Germany on 1 June 2019. The work is expected to end on 31 March 2020. Under the six-month rule, the employer does not withhold tax from the beginning of June. In the autumn of 2019, it is discovered that the work period will continue until 30 April 2020.

The employer must submit additional information on working abroad to the Incomes Register as follows:

- After the work begins, the employer must submit the NT2 data no later than on the fifth day after the June wage payment. The employer reports 1 June 2019–31 March 2020 as the work period.

- The estimated employment end date is not corrected in the autumn of 2019.

- In the following year, 2020, the employer submits the NT2 data in a new report. The data must be reported to the Incomes Register by 31 January 2020. The employer specifies the work period as 1 June 2019–30 April 2020, in accordance with the currently known work period.

In February 2020, it is discovered that the work period will continue until 30 June 2020. The employer corrects the NT2 data submitted earlier during the same year. The correction must be made by 31 December 2021.

Even if tax is initially withheld to Finland, it may be later confirmed that the six-month rule applies to the wage income. Once the applicability of the six-month rule has been confirmed, the employer may choose not to withhold tax to Finland by its own decision. Additionally, the employer must then submit the NT2 data to the Incomes Register.

In the employer's report of stay periods in Finland, the stay periods in Finland during the work abroad are reported. This data must be reported to the Incomes Register no later than by the end of January of the following the year. The stay periods in Finland are not usually known during the payment of wages; instead, the employee may report them to the employer afterwards. However, the data can also be submitted immediately after the work abroad has ended, or by pay period during the assignment. In the latter case, however, the employer must ensure that the data is submitted for the entire tax year.

2.4.3 Transition period at the turn of 2018–2019

If tax was not withheld on wages paid in 2018, the procedure valid in 2018 will be followed. The NT2 data must be submitted to the Tax Administration within one month of the first occasion on which tax is not withheld. Notification of wages earned abroad where the six-month rule is applied to withholding tax (5053a) must be submitted to the Tax Administration by the end of January 2019.

The NT2 data must be submitted for each calendar year. If tax was first not withheld from wages paid in 2018, the employer would have had to file the NT2 form with the Tax Administration. If employment continues in 2019, the employer must submit the new NT2 data to the Incomes Register by 31 January 2019. The periods of work and stay are reported according to the actual periods.

If tax was first not withheld from the December 2018 wage payment, the NT2 form and notification of wages earned abroad (5053) must be submitted to the Tax Administration no later than January 2019. In such cases, when employment continues into 2019, the NT2 data for December 2018 does not need to be reported separately to the Tax Administration; instead, the data can be reported directly to the Incomes Register as new NT2 data by 31 January 2019.

2.5 Additional information on work in a Nordic country

The Nordic Agreement Concerning the Collection and Transfer of Tax (97/1997), or the so-called TREKK Treaty, regulates information exchange and the transfer of taxes between the Nordic countries. For this purpose, the employer must submit the following information on work in another Nordic country to the Tax Administration:

- NT1 data when tax is still withheld to Finland;

- NT2 data when tax is not withheld to Finland.

Once the Tax Administration has received the NT form data, it sends the data to the tax authority of the country of work. The Tax Administration also provides the payer with a notification of the withholding of tax to Finland when the income is still taxed in Finland.

For more information on reporting work in Nordic countries, see the Tax Administration Guidelines Taxation of work abroad.

2.5.1 Information to be reported

The additional information on work in a Nordic country is reported to the Incomes Register for the purposes of the Tax Administration. In this section, additional information on work abroad refers to NT1 and NT2 data and the employer's report on periods of stay in Finland. The data can be submitted either in connection with earnings payment data or separately. The recommendation is, however, that the additional information on work abroad is submitted in a separate earnings payment report.

When an employee works in another Nordic country, either the NT1 or NT2 form data must always be reported to the Incomes Register. Furthermore, when tax has not been withheld due to the applicability of the six-month rule, the stay periods in Finland must be reported in addition to the NT2 form data in the same way as described above in Section 2.4.

2.5.1.1 Tax is withheld to Finland (NT1 data)

When an employee works in another Nordic country, tax must be withheld to Finland if:

- the employee's stay in the country of work does not exceed 183 days within a period of 12 months;

- the wages are paid by the Finnish employer;

- the wages do not burden the financial result of a permanent establishment in the country of work; and

- this does not constitute employee leasing.

When tax is withheld to Finland, the employer must submit the NT1 data for the employee working in another Nordic country to the Incomes Register. The following data is reported as NT1 data:

- Country of work (mandatory data)

- District of work (voluntary data)

- Address in country of work (voluntary data)

- Stay periods in country of work (mandatory data)

- start date

- end date (estimated)

- Principal in the country of work (mandatory data)

- identifier, name

- address

- Pay burdens the result of a permanent establishment in the country of work (Y/N) (mandatory data)

- Country of work has right to tax the wages (Y/N) (mandatory data)

2.5.1.2 Withholding is not done in Finland (NT2 data)

When an employee is working in another Nordic country and tax is not withheld in Finland, information on not withholding must always be submitted as NT2 data. Tax does not need to be withheld for two reasons:

- under section 77 of the income tax act (tuloverolaki 1535/1992) concerning income for work abroad

- due to a tax treaty, when the six-month rule is not applicable, but the relief method is applied to the elimination of double taxation of the income.

The wages earned from the work in another Nordic country are tax-exempt in Finland if the six-month rule as defined in section 77 of the income tax act is applicable to them. Even if the six-month rule is not applicable, the country of work may establish a taxation right under the Nordic Tax Treaty. The taxation right may be established, for example, by the employer having a permanent establishment in the country of work. The possible double taxation will then be eliminated in the country of residence, i.e. Finland. If, however, the six-month rule is not applicable to the wage income, the employer may choose not to withhold tax only if the employee has applied for a change to his/her tax card.

In Nordic situations, the following data is reported as NT2 data:

- Country of work or countries of work, if several (mandatory data)

- District of work (voluntary data)

- Address in country of work (voluntary data)

- Stay periods in country of work (mandatory data)

- start date

- end date (estimated)

- Work periods abroad (mandatory data)

- start date

- end date (estimated)

- Pay burdens the result of a permanent establishment in the country of work (Y/N) (mandatory data)

- Country of work has right to tax the wages (Y/N) (mandatory data)

- Pay per month (voluntary data)

- Other remunerations and benefits (voluntary data)

2.5.1.3 Employer's report of periods of stay in Finland

When an employee works in another Nordic country and the six-month rule applies to the income, the employer must submit the "Employer's report of periods of stay in Finland". The following data is submitted in the report:

- Stay periods in Finland (mandatory data)

- start date

- end date

- If the employee has not stayed in Finland at all during the time period for reporting, the payer must choose the following entry for Stay periods in Finland:

- Report contains no stay periods in Finland (Y/N)

2.5.2 The time of reporting data

Before the first payment of wages for work abroad, the employer must evaluate whether tax needs to be withheld from the payment to Finland. The NT data must be submitted no later than on the fifth date after the first payment date of wages for work in another Nordic country after the employee has started working in another Nordic country.

The NT2 data must be submitted for each calendar year. If working abroad continues into the next year, the previously submitted NT2 data does not need to be corrected; instead, the changed data is reported on a new earnings payment report. In this case, the NT2 data must be submitted by the end of January of the following year.

The NT2 data provided for the last year of work must be corrected by the end of January of the following year if there have been changes in it. For example, if the actual end date of the stay or employment abroad differs from the estimated end date, the last end date data on the NT2 form must be corrected.

If the country of work changes, however, new NT2 data must be submitted if tax is still not withheld. The data must be reported no later than on the fifth calendar day following the first payment date on which tax was not withheld for wages paid for work performed in this country.

Unlike NT2 data, NT1 data is not submitted by calendar year. NT1 data is only submitted at the start of employment in another Nordic country.

Even if tax is initially withheld to Finland, it may be later confirmed that the six-month rule applies to the wage income. The employer has then initially submitted the NT1 data for the working in another Nordic country. Once the applicability of the six-month rule has been confirmed, the employer may choose not to withhold tax to Finland by its own decision. Additionally, the employer must then submit the NT2 data to the Incomes Register. In accordance with the TREKK Treaty, the employer cannot then return the already withheld taxes to the employee; instead, the authorities of the two countries will handle the transfer of the withheld tax to the other Nordic country.

The procedure is the same in Nordic situations where the six-month rule is not applicable and it is only discovered during the work period that a taxation right to the wages will be established for the country of work under a tax treaty. Even then, information on tax withholding has initially been submitted as NT1 data. Once it has been discovered that the country of work has the right to tax the wages, tax is no longer withheld to Finland. This is based on a tax card issued to the employee, taking into consideration the elimination of double taxation in Finland. The employer must then also submit information on the tax not being withheld as NT2 data.

The stay periods in Finland are reported in an "Employer's report of stay periods in Finland". This data can be reported to the Incomes Register no later than by the end of January of the year following the year of payment. The stay periods in Finland are not usually known during the payment of wages; instead, the employee may report them to the employer afterwards. However, the data can also be submitted immediately after the work abroad has ended, or by pay period during the assignment. In the latter case, however, the employer must ensure that the data is submitted for the entire tax year.

Read more about the transition period at the turn of 2018–2019 in Section 2.4.3.

2.5.3 Correction of information

If the additional information on Nordic work has been reported incorrectly, the information must be corrected when the error is discovered.

If changes take place in the mandatory data (see Sections 2.5.1.1 and 2.5.1.2) during the assignment, the corrections can be made no later than by the end of the January of the year following the tax year. If the country of work changes, new NT1 or NT2 data must always be submitted, depending on whether tax is withheld to Finland or not.

2.6 A non-resident taxpayer is working abroad

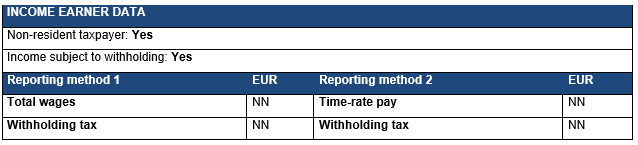

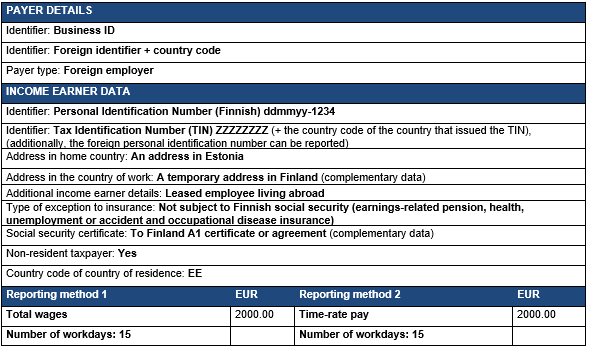

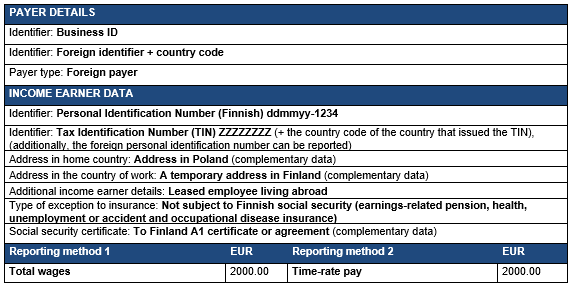

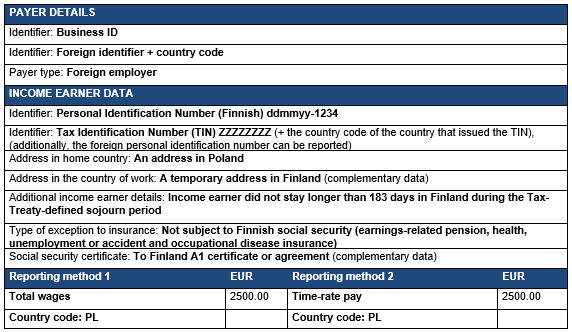

A Finnish citizen who has moved abroad will generally become a non-resident taxpayer from the beginning of the fourth calendar year following the year of the move. The private-sector wages paid to a non-resident taxpayer for work abroad are not taxable in Finland. If the wages are paid by a public sector payer, the wages can usually be taxed in Finland.

The income paid to a non-resident taxpayer and other information are reported to the Incomes Register in the same way as payments made to a resident taxpayer. Furthermore, the following data must be included in the income earner details: Non-resident taxpayer: Yes. The data is reported using a Finnish Personal Identification Number when the income earner has a Finnish ID. Furthermore, the foreign Tax Identification Number, the country of residence and the contact information in the country of residence are always reported of an income earner who is a non-resident taxpayer. If an employee who is a non-resident taxpayer does not have a Finnish Personal Identification Number, the payer must report, in addition to the foreign identifier, the employee's name, date of birth, address and gender.

When the wages paid to a non-resident taxpayer are taxable in Finland, tax at source or withholding tax can be collected from the wages. If tax is withheld from the wage income paid to a non-resident taxpayer instead of tax at source, the so-called progressive taxation of a non-resident taxpayer is followed. In that case, the following data must be included in the earnings payment report: Income subject to withholding: Yes. Tax can be withheld only if the employee has a tax card of a non-resident taxpayer.

If a non-resident taxpayer is insured in Finland, the employer's and the employee's health insurance contributions and other social insurance contributions must be paid from the wages regardless of whether the wages are taxed in Finland or not. If the wage income is subject to tax at source, the employee's health insurance contribution is collected and reported to the Incomes Register in addition to the tax at source. If the wage income is subject to withholding, the employee's health insurance contribution is included in the withheld amount.

When an employee insured in Finland works abroad posted by a Finnish employer, the additional income earner detail Person working abroad must be included. When a public sector payer is paying income to an income earner who is a non-resident taxpayer, the additional payer details must include information of the payer being a public sector payer.

2.6.1 Income earner is insured in Finland

The posting of a person working abroad may continue so long that he/she becomes a non-resident taxpayer in Finland. If he/she is still insured in Finland and wages for insurance purposes have been determined for him/her, the social insurance contributions are paid based on the wages for insurance purposes. Private-sector wages are not taxed in Finland, but the payer must collect the employee's health insurance contribution. If the payer is a public sector payer, the income can be taxed in Finland. The taxation is based on the actual wages paid. The wages paid for work on board a Finnish ship or aircraft can also be taxed in Finland.

If wages for insurance purposes have been determined for the income earner, data on both the wages for insurance purposes and the wages paid must be reported to the Incomes Register. Because the insurance contributions are based on the wages for insurance purposes and the actual wages paid must be reported for the purposes of the Tax Administration, the payer can submit the data in one earnings payment report when reporting method 1 is used. When reporting method 2 is used, two reports must be submitted to the Incomes Register. For more information on the procedure, see Section 2.2, The income on which insurance contributions and the income on which taxation is based are different.

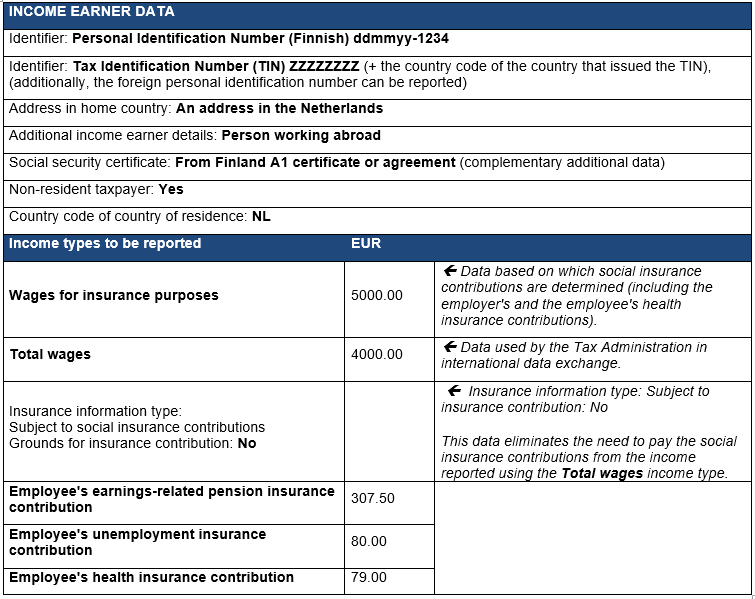

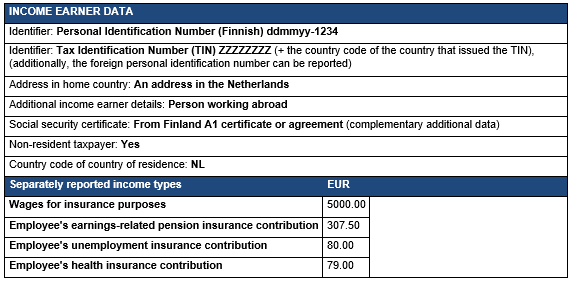

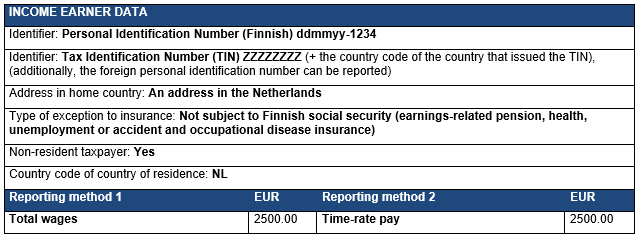

2.6.1.1 Income is not taxed in Finland

Example 10: A Finnish private-sector employer has posted an employee to the Netherlands. The employee has an A1 certificate from Finland, based on which he is covered by Finnish social security. In the beginning of his posting, EUR 5,000 have been determined as his wages for insurance purposes. The amount of the actual wages paid is EUR 4,000. Once three full calendar years have passed from the move abroad, the person becomes a non-resident taxpayer in Finland. According to section 10 of the income tax act (tuloverolaki 1535/1992), the wages are not taxed in Finland. Because the employee is still covered by Finnish social security, the social insurance contributions are paid to Finland. The social insurance contributions (including the employer's and the employee's health insurance contributions) are paid based on the wages for insurance purposes.

The six-month rule is applied to the wages paid to resident taxpayers. For this reason, information on the applicability of the six-month rule is no longer reported to the Incomes Register, as the income earner is a non-resident taxpayer in Finland.

Reporting method 1

If the data is reported using reporting method 1, it can be submitted in a single earnings payment report as follows:

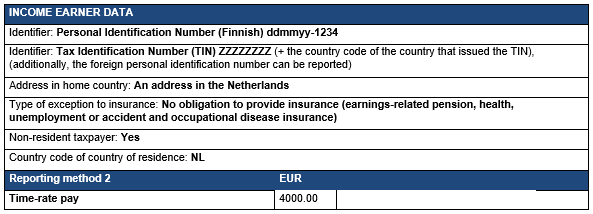

Reporting method 2

When reporting method 2 is used, the data must be submitted in two earnings payment reports. The wages for insurance purposes, used as the basis for the social insurance contributions, are reported in one report, and the actual paid wages for the purposes of the Tax Administration in another report.

Reporting the wages for insurance purposes:

Reporting the actual wages paid:

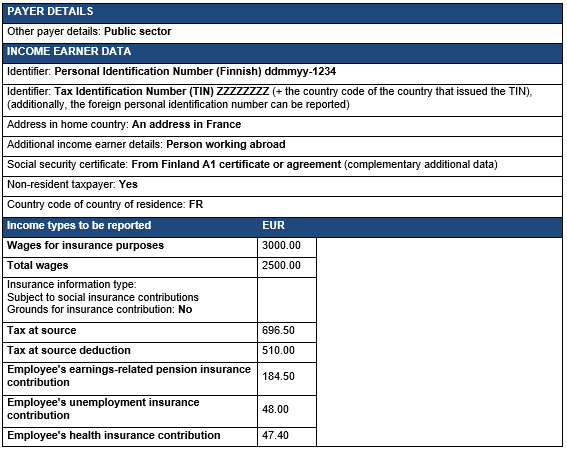

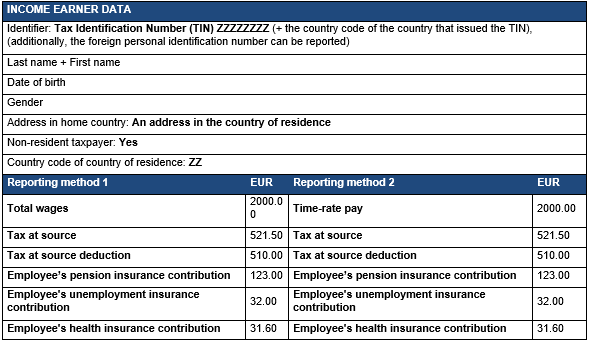

2.6.1.2 Income is taxed in Finland, tax at source

The wages paid to a non-resident taxpayer for work abroad may be taxable income in Finland. The wages are taxable when, for example, the payer is a public sector payer. The wages paid for work on board a Finnish ship or aircraft can also be taxed in Finland. Tax at source or withholding must be collected from the wages.

If the income is subject to tax at source, the payer may make a tax-at-source deduction of the income only if the tax at source card includes the relevant entry. The employee's health insurance contribution must be reported separately.

The social insurance contributions are paid based on the wages for insurance purposes. The employee's health insurance contribution is also paid based on the wages for insurance purposes. However, tax at source must be collected based on the actual wages paid.

When a public sector organisation pays income to a non-resident taxpayer, the additional payer details must indicate that the payer is a public sector organisation.

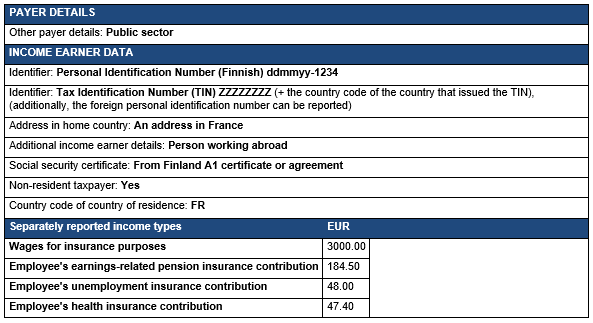

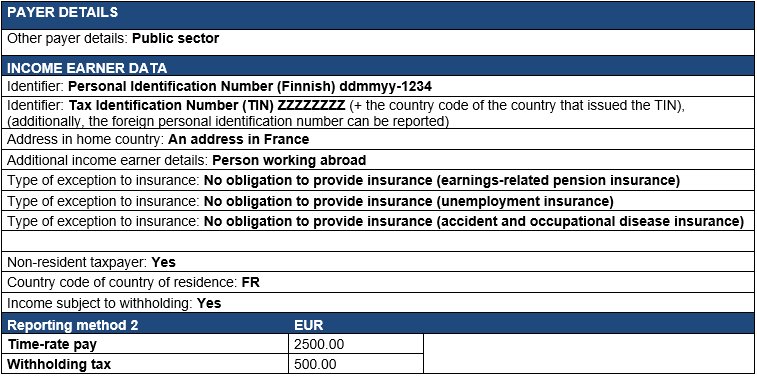

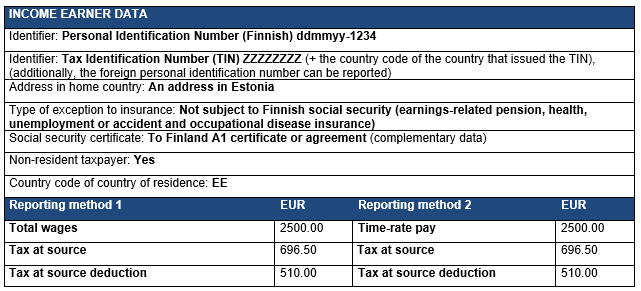

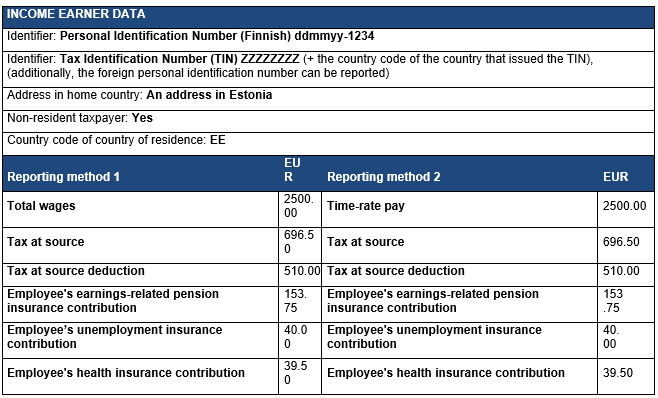

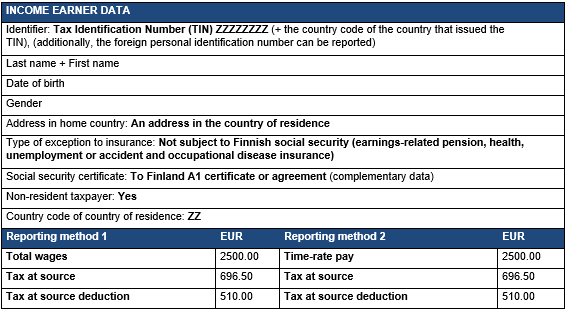

Example 11: A non-resident taxpayer works in the service of a public sector entity in France. He has an A1 certificate from Finland. EUR 3,000 has been agreed as the amount of the employee's wages for insurance purposes. The social insurance contributions (including the employer's and the employee's health insurance contributions) are paid based on the wages for insurance purposes.

The income earner is paid EUR 2,500 in wages. The employee presents a tax at source card to the employer; the card includes an entry of a tax at source deduction, EUR 510 per month. The 35% tax at source is paid according to the actual wages paid, 35% x (EUR 2,500 – 510) = EUR 696.50.

Reporting method 1

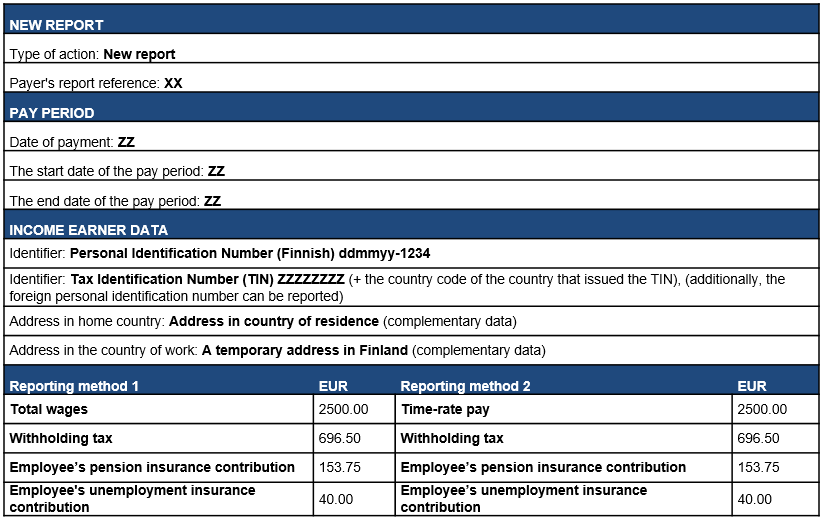

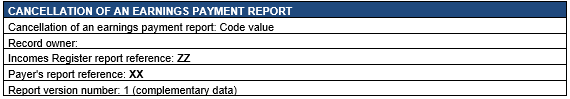

If the data is reported using reporting method 1, it can be submitted in a single earnings payment report as follows:

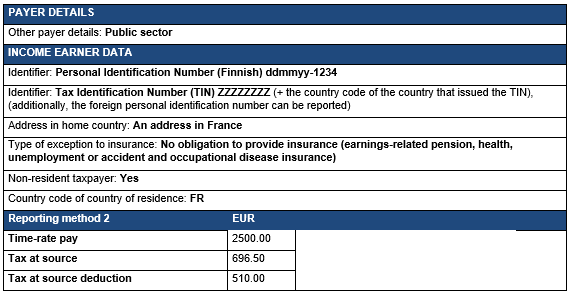

Reporting method 2

When reporting method 2 is used, the data must be submitted in two earnings payment reports. The wages for insurance purposes, used as the basis for the social insurance contributions, are reported in one report, and the actual paid wages for the purposes of the Tax Administration in another report.

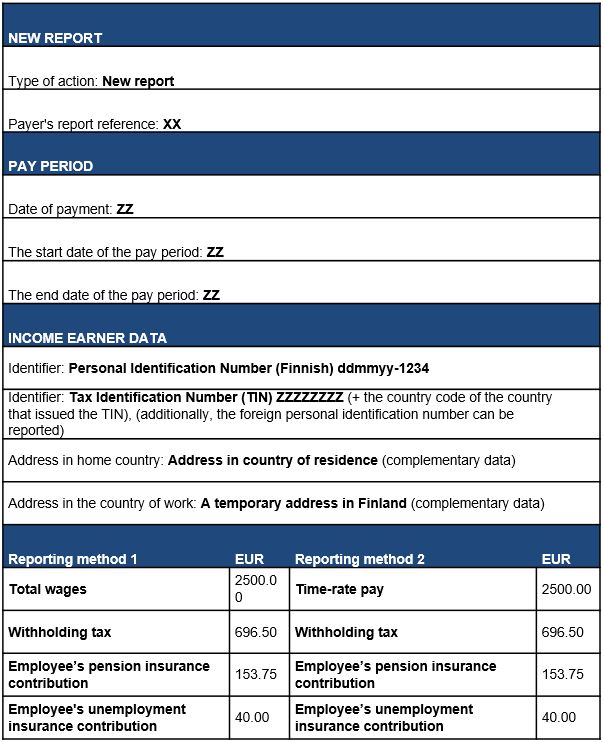

Reporting the wages for insurance purposes:

Reporting the actual wages paid:

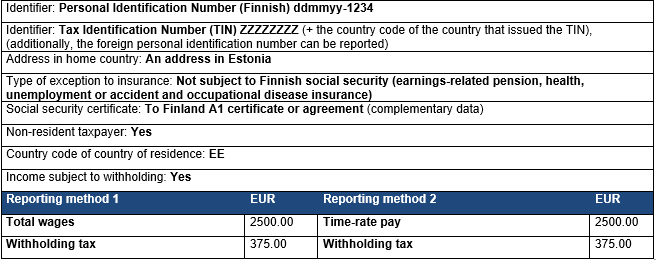

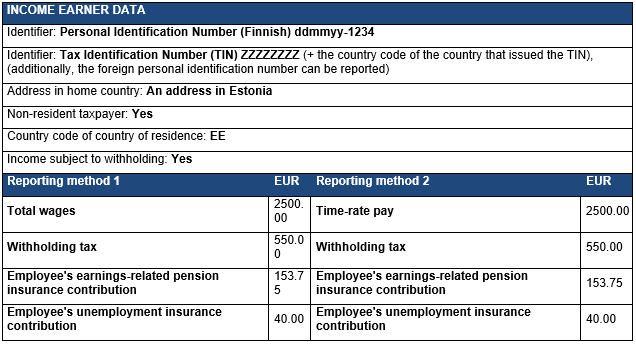

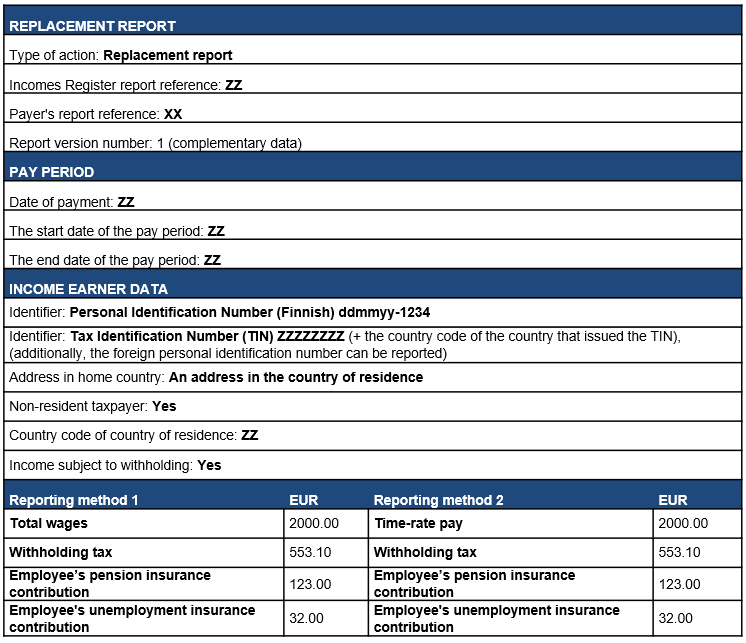

2.6.1.3 Income is taxed in Finland, taxation according to the act on assessment procedure (so-called progressive taxation)

The payer may withhold tax from the wages paid to a non-resident taxpayer if the income earner presents a tax card of a non-resident taxpayer. The income earner details must then include an entry indicating that the income is subject to withholding. The employee's health insurance contribution is not reported separately; it is included in the withholding rate.

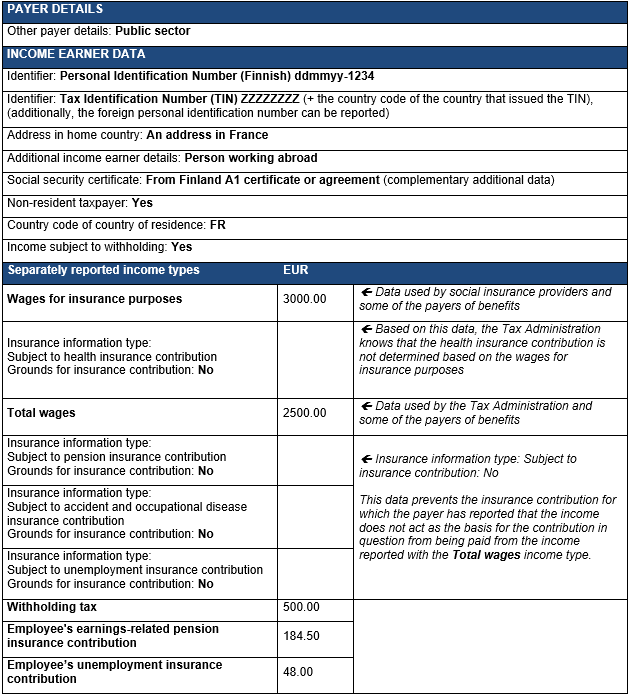

Example 12: A non-resident taxpayer works in the service of a public sector entity in France in Finland's representative office. He is a Finnish citizen and, according to the tax treaty, Finland has the right to tax his wages.

The employee has an A1 certificate from Finland. The amount of wages for insurance purposes has been agreed to be EUR 3,000. The social insurance contributions (with the exception of the employer's and the employee's health insurance contributions) are paid based on the wages for insurance purposes.

The amount of the wages paid is EUR 2,500. The employee has a tax card of a non-resident taxpayer with a tax rate of 20%. The tax is paid based on the actual wages paid, 20% x EUR 2,500 = EUR 500. The employee's health insurance contribution is included in the tax rate and is not reported separately. The employer's health insurance contribution is paid based on the actual wages paid.

If the data is reported using reporting method 1, it can be submitted in a single earnings payment report as follows:

Reporting method 1

Reporting method 2

When reporting method 2 is used, the data must be submitted in two earnings payment reports. The wages for insurance purposes, used as the basis for the social insurance contributions, are reported in one report, and the actual paid wages for the Tax Administration and the determination of the health insurance contribution in another report.

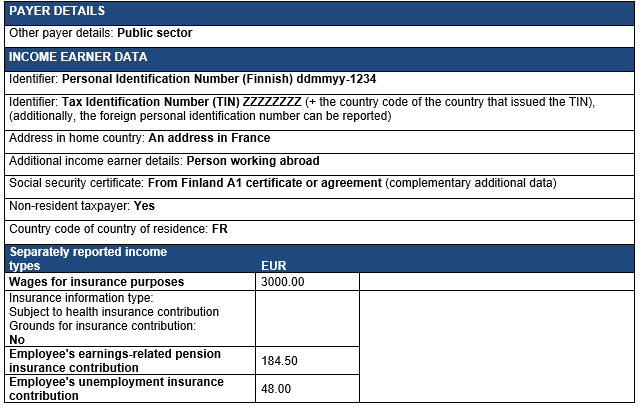

Reporting the wages for insurance purposes:

Reporting the actual wages paid:

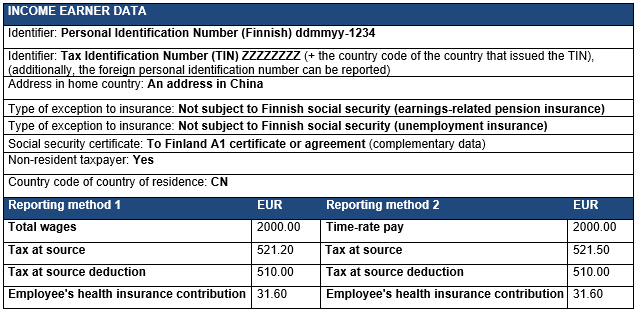

2.6.2 Income earner is not insured in Finland

If a non-resident taxpayer working abroad is not insured in Finland, the Finnish employer must report the actual wages paid to the Incomes Register.

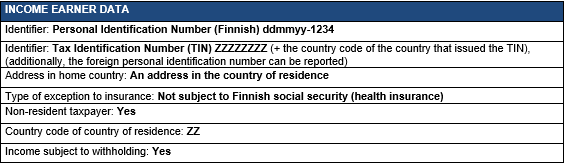

Example 13: A Finnish private-sector employer hires a person living in the Netherlands to work in the Netherlands.

The amount of the wages is EUR 2,500. The employee is not covered by Finnish social security. According to section 10 of the income tax act (tuloverolaki 1535/1992), the wages are not taxed in Finland. Because the employee is not covered by Finnish social security, the social insurance contributions are not paid to Finland. The income must be reported to the Incomes Register, even if no taxes or social insurance contributions are collected from it.

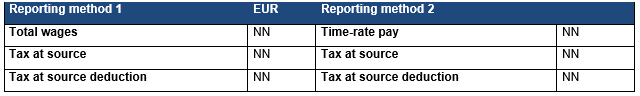

The data to be reported to the Incomes Register:

If the employee's wage income is taxed in Finland, the tax at source or withholding collected from the income is reported as follows:

Reporting income subject to tax at source:

Reporting income subject to withholding:

2.6.3 Income earner is voluntarily insured in Finland

A voluntary TyEL insurance (employee's earnings-related pension insurance) can be taken out for an employee who works abroad and is not subject to the mandatory TyEL insurance. In this situation, it is a requirement that the other statutory prerequisites concerning the employee and the employer are met. The wages for insurance purposes are also used as the basis for the pension in the voluntary TyEL insurance.

A voluntary TyEL insurance is reported to the Incomes Register by submitting the following data: Type of exception to insurance: Voluntary insurance in Finland (earnings-related pension insurance).

For more information on the voluntary TyEL insurance, see the pensions act service (www.tyoelakelakipalvelu.fi).

In corresponding situations, a Finnish employer can take out a voluntary insurance for accidents and occupational diseases for its employee working abroad. This is not reported to the Incomes Register; the employer handles the insurance coverage directly with an insurance company.

2.6.4 Foreign group company pays the wages

If a non-resident taxpayer working abroad is insured in Finland and works for a group company, the Finnish company that posted the employee must pay the employer's health insurance contribution and other social insurance contributions (including the employee's share of the earnings-related pension and unemployment insurance contributions) to Finland. The contributions are paid based on the wages for insurance purposes, and the data must be reported to the Incomes Register. The income is not taxable in Finland, and withholding or tax at source will not be collected to Finland.

When a foreign group company pays the wages to an employee posted abroad who is insured in Finland, the Finnish company that posted the employee must submit the Foreign group company data as other payer details and the Person working abroad as an additional income earner detail.

The Finnish company reports to the Incomes Register the wages for insurance purposes and the employee's shares of the earnings-related pension and unemployment insurance contributions. Based on the data submitted to the Incomes Register, the Tax Administration determines the amount of the employee's health insurance contribution in final taxation, and it is paid as back tax.

2.7 Correcting information in situations involving work abroad

2.7.1 Applicability of the six-month rule is not confirmed until later

If a work assignment abroad was initially planned to last only a couple of months, but the assignment continues for over six months, the payer may have to correct the information it has reported to the Incomes Register.

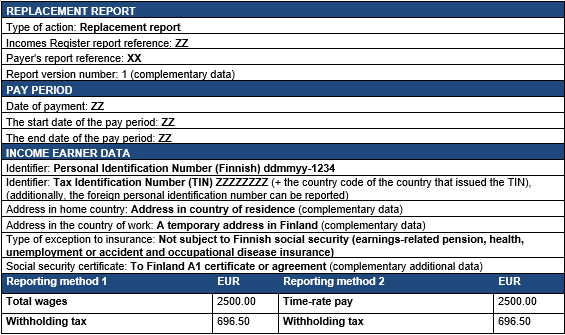

Example 14: A Finnish employer posts an employee to Switzerland for four months from the beginning of February. At the end of April, the employer and the employee agree that the posting will be extended by four months, i.e. the posting will last for a total of eight months.

If the requirements of the six-month rule are met and the wage income is tax-exempt in Finland, the employer may correct the information it has submitted to the Incomes Register and return the taxes withheld to the employee with the exception of the minimal withholding. Generally, wages for insurance purposes have to be retroactively determined for the employee. See Section 2.7.2 for a description of the retroactive determination of wages for insurance purposes.

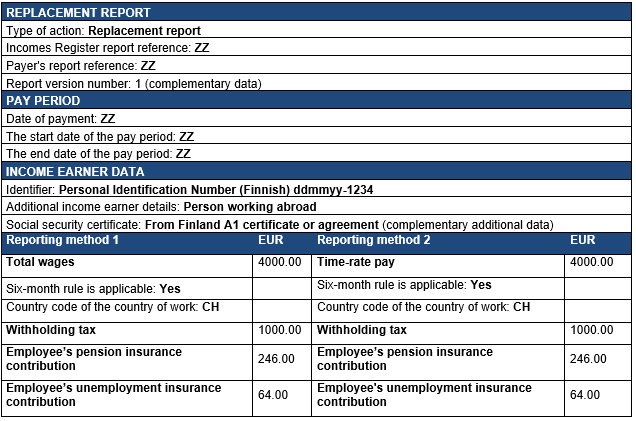

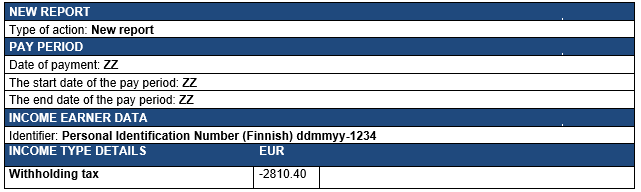

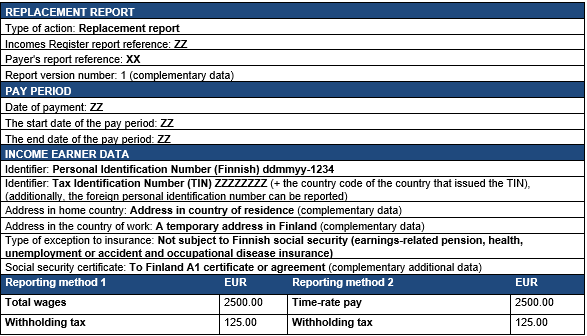

The payer has reported the wages for February-April in the same way as if the income earner had worked in Finland. In May, the payer corrects the information reported to the Incomes Register. The payer uses a replacement report to indicate that the six-month rule is applicable. The amount of wages is EUR 4,000 and the tax rate according to the tax card is 25%, i.e. the amount of tax withheld is EUR 1,000.

In May, the employer also returns the difference between the tax withheld and the minimal withholding to the employee. A separate report must be submitted to the Incomes Register of the return, in which the returned amount is reported as a negative number.

In this example, the wages for insurance purposes are not retroactively determined.

The payer corrects the earnings payment reports for February-April as follows: