Correcting data in the Incomes Register

- Date of issue

- 5/13/2019

- Record no.

- VH/1230/00.01.00/2019

- Validity

- 5/13/2019 - 12/26/2019

These instructions are intended for payers who are correcting earnings payment data they have reported to the Incomes Register. The instructions describe

- how to correct an earnings payment report and an employer's separate report in the Incomes Register;

- how to report overpayment and other unjust enrichment; and

- how to report a recovered payment.

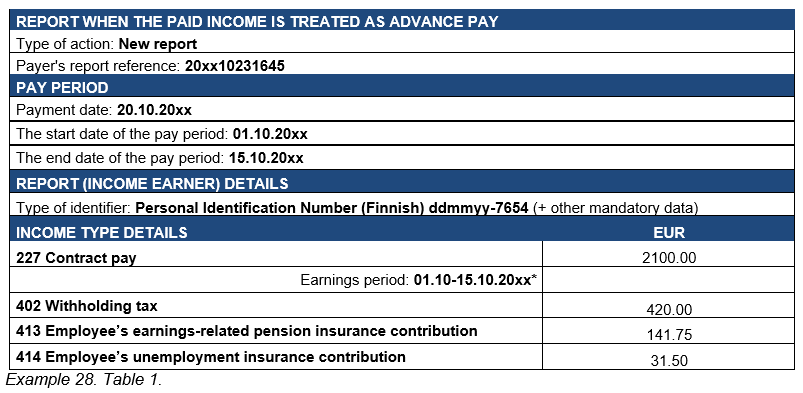

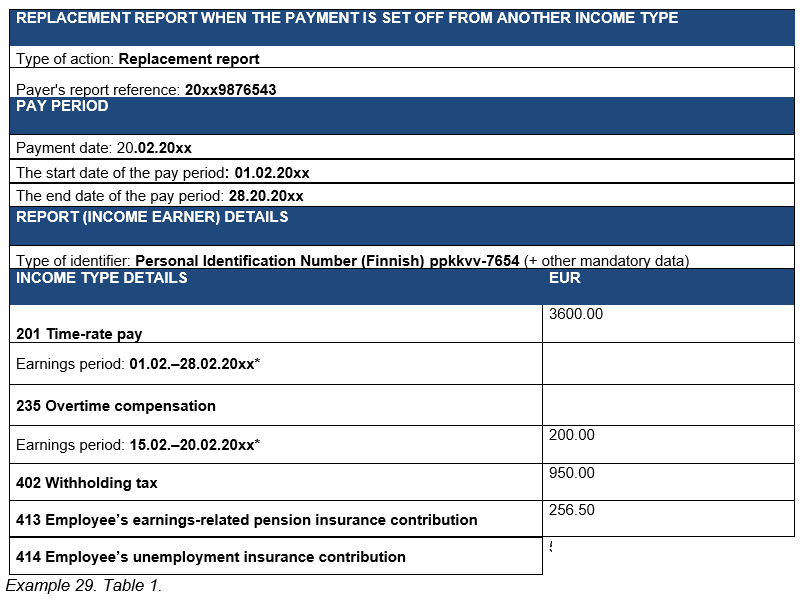

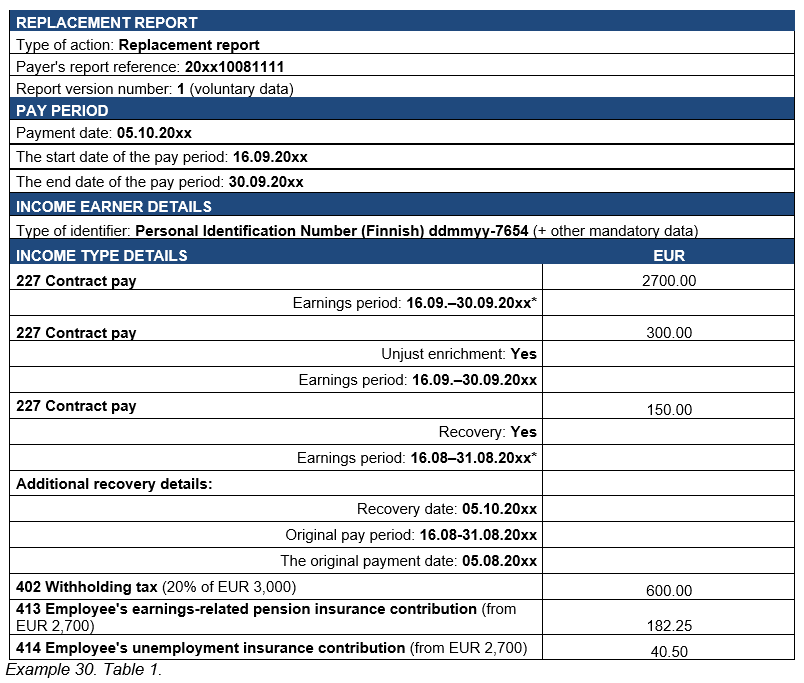

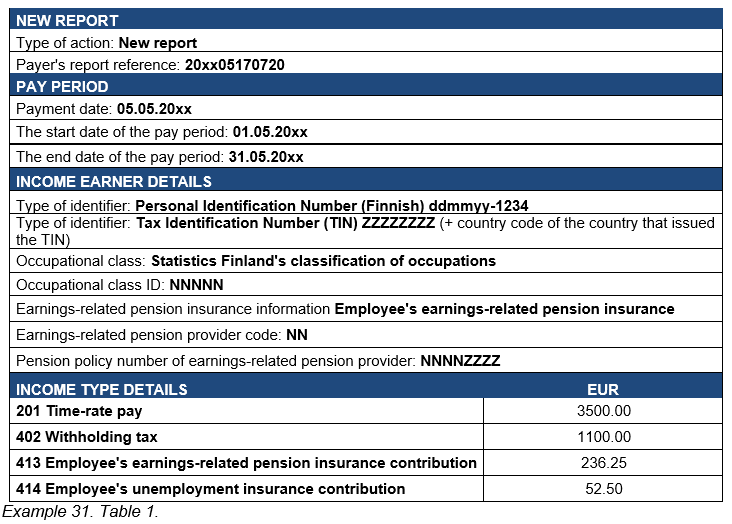

The instructions include examples of correcting information in various cases. The examples do not include all mandatory data that must be entered in the report, but only information that is essential to making corrections.

These instructions replace the previous instructions named Correcting data in the Incomes Register. We have made the following additions and clarifications:

- specified the instructions on reporting reimbursements collected for fringe benefits

- specified the instructions on treating an overpayment as advance pay in Section 4.8.

- added instructions on how to correct data when the lower limit for earnings-related pension insurance is exceeded during the same month.

- changed the amounts of earnings-related pension and unemployment insurance contributions in the examples to reflect the situation in 2019.

1 Correcting data in the Incomes register

1.1 How to correct data?

The payer is responsible for the accuracy and correction of any data it has submitted to the Incomes Register. If incorrect data in the Incomes Register is based on the payer's report, the payer is obliged to correct the incorrect data it has reported. If an income earner notices incorrect information concerning him or her in an earnings payment report in the Incomes Register, the income earner must make a correction request to the appropriate payer.

Data in the Incomes Register is corrected using the replacement method. This means that the original report is amended so that all of the report data is resubmitted, including the data that was correct in the original report, in addition to new and changed data. The replacement report is made for the same payment date as the original.

A record submitted by a payer can include earnings payment reports for several income earners. A report refers to data on one payment transaction paid to a single income earner. If a record contains incorrect reports, the entire record does not need to be resubmitted. Only the incorrect reports must be corrected. Correct reports do not need to be resubmitted.

The data reported to the Incomes Register can be maintained and corrected as long as it is retained in the Incomes Register. Data is stored in the Incomes Register system for 10 years from the beginning of the year following the year in which the data was registered. As a rule, this equals the time employers are obligated to retain their payroll and other accounting data. Reporting to the Incomes Register does not replace the employer's storage obligation regarding its accounting data or other materials. It should be noted, however, that some data users may be entitled to obtain data from the Incomes Register for a period of less than ten years, for example due to appeal deadlines or time periods taken into consideration in the granting of benefits.

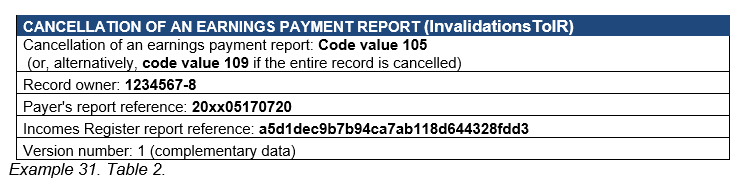

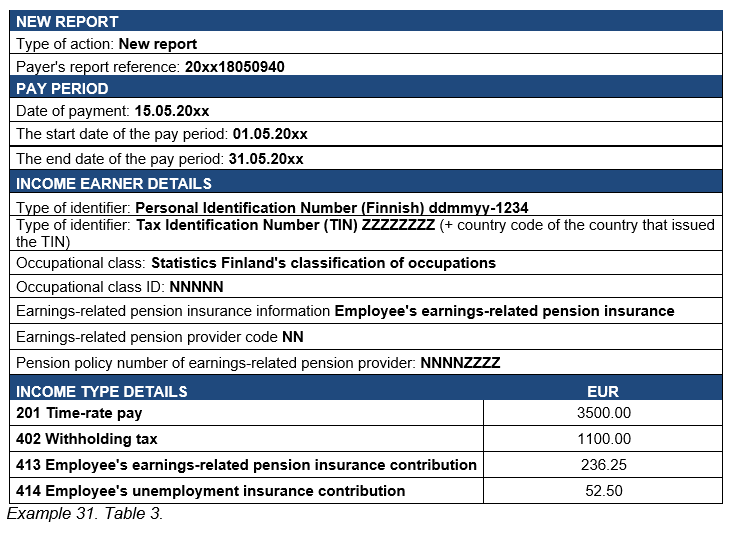

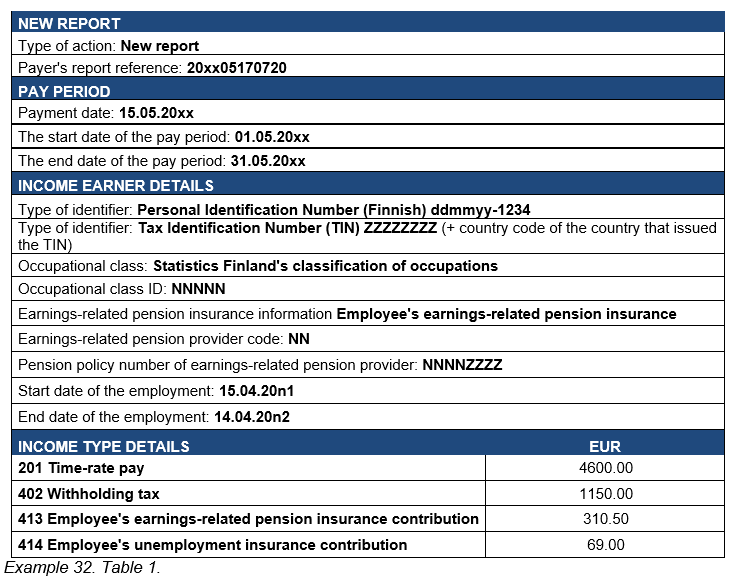

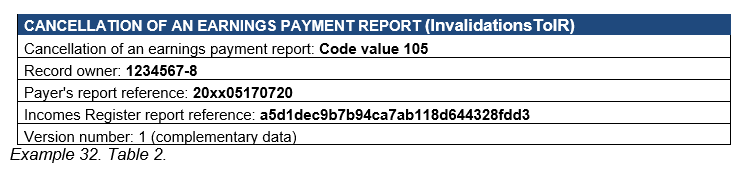

The payer can also cancel, or delete, a report or a record containing several reports it has previously submitted. In certain cases, the payer must correct the information by cancelling the previous report and then resubmitting the report with the correct information. The cancellation of information is described in Section 5. Section 6 describes cases where a replacement report cannot be used, requiring the previous information to be cancelled first.

Payments made on 1 January 2019 and later, and any corrections to be made to such information, are reported to the Incomes Register (see Section 1.7, 'How to correct information submitted prior to 2019?').

1.2 When must a correction be made?

The payer must correct any erroneous reports it has submitted without undue delay. This means that erroneous reports must be corrected as soon as the error is noticed. Postponing the correction to the next payroll run, for example, is not allowed. The deadlines for reporting data to the Incomes Register do not apply to correcting data. All payers, from households to those submitting their reports on paper, must correct any incorrect information without undue delay. Without undue delay means that the data must be corrected as soon as can be reasonably expected from the data submitter's perspective.

Unjust enrichment must be reported without undue delay and no later than within one month of becoming aware of the unjust enrichment. Unjust enrichment means a mistakenly paid payment or benefit to which the income earner is not entitled. An unjust enrichment occurs when, for example, a payment is made on incorrect grounds, to the wrong person, or in an incorrect amount. If the next payroll run is done within one month of the detection of the unjust enrichment, the payer can submit information on the unjust enrichment during this payroll run.

Information on amounts paid back must be reported no later than on the fifth calendar day after the day of becoming aware of the payment of the recovered amount, its payer, and the unjust enrichment to which the payment is connected. The five-day time limit begins from when the received payment has been connected in the ledger and the payroll to the income collected from the income earner.

If information submitted for the payment month is not corrected until after the eighth day of the month following the payment month, a penalty may result in certain situations. The determination of penalty fees is described in more detail in the instructions Reporting income data: penalty fees.

1.3 What data must be corrected?

All errors in the report data must be corrected. This applies both to income data and other mandatory data (section 6 of the act on the incomes information system (laki tulotietojärjestelmästä 53/2018)), mandatory identifying and contact information (section 8) and complementary additional data (section 7) stored in the Incomes Register. Thus, for example, absence data and employment data submitted as complementary additional data must be corrected if they contain errors.

With respect to correcting a report, it does not matter, for example, whether wages paid have been reported using the Incomes Register's reporting method 1 or reporting method 2.

1.4 How is a correction allocated to the correct report?

An income earner may have several valid earnings payment reports from the same payer with the same pay period and payment date. If the payer selects 'New report' as the action type, the report will not replace a previously submitted report, even if the pay period and payment data were the same. When you wish to correct a previously submitted report, select 'Replacement report' as the action type. Correction of data uses report references that allow the correction or cancellation to be allocated to the correct report.

1.4.1 Incomes Register's report reference

When submitting a new report, the payer always receives a report reference generated by the Incomes Register, which can be used to allocate a later correction to the correct report. If the new report is submitted via the technical interface or the upload service, the Incomes Register will return the report reference to the payer in the processing feedback. If, however, the new report is submitted via the online form of the e-service, the Incomes Register will add a report reference to the report.

1.4.2 Payer's report reference

If the payer is unable or unwilling to use the report reference generated by the Incomes Register, a payer's report reference can be used in the correction process. The payer can generate this reference, which must be unique for each report. Numbers and letters, for example, can be used when generating a reference. The characters allowed in a reference are described in Section 1.2, Character set, of the document 'Data delivery - Schemas - Earnings payment report'. The length of a reference is described in Section 2.12, Service data. The payer's payroll system can generate the reference automatically or, depending on the system implementation, the payroll system can ask the user to enter a reference manually.

The payer must generate a payer's report reference when using the technical interface or the upload service, and a new report is being submitted to the Incomes Register for the first time. If a new report is submitted using the e-service online form or on a paper form, and the payer does not submit a payer's report reference, the Incomes Register will generate the required reference for the submitted report. If, exceptionally, the information has been submitted to the Incomes Register on a paper form, the report reference will be sent to the payer in a letter.

1.4.3 Report version number

The Incomes Register assigns version number 1 to a new earnings payment report, while the version number assigned to a replacement report is one higher than the version number of the report that was replaced. If the data is submitted via the technical interface or the upload service, the Incomes Register will return the version number to the submitter in the processing feedback. The payer cannot assign a version number to the first, so-called 'new report'.

Using the version number when correcting data is not mandatory, but it is recommended. Submit the version number to which you wish to allocate the correction on the replacement report. This will ensure that the corrections or cancellation are performed for the correct report. If a version number is not used, the Incomes Register will always perform the action on the latest version of the report. When a version number is used for allocating a replacement, you can ensure that any changes made in another process are not inadvertently overwritten.

1.5 Will the reporting method or channel affect corrections?

The payer chooses whether to report the wages paid as a total amount (the lower level of detail for reporting monetary wages, or the so-called reporting method 1) or by using the complementary income types (the greater level of detail for reporting monetary wages, or the so-called reporting method 2). Monetary wages must be reported using at least reporting method 1. The reporting is described in more detail in the instructions Reporting data to the Incomes Register: monetary wages and items deducted from wages.

With respect to correcting data, it does not matter which reporting method was used. Neither does it matter whether complementary additional data has been submitted. Incorrect information must always be corrected. The examples in these instructions will discuss the correction of data submitted using both reporting methods.

The reporting channel does not affect the correcting of a report, either. Reports submitted via the technical interface, for example, can be corrected using the e-service online form, or reports uploaded as a file can be corrected via the technical interface.

1.6 What reports does the Incomes Register's correction procedure apply to?

The instructions apply to the correction of information on earnings payment reports and employer's separate reports. Most of the examples in these instructions concern the correction of an earnings payment report. Correcting an employer's separate report is discussed separately in Section 7.

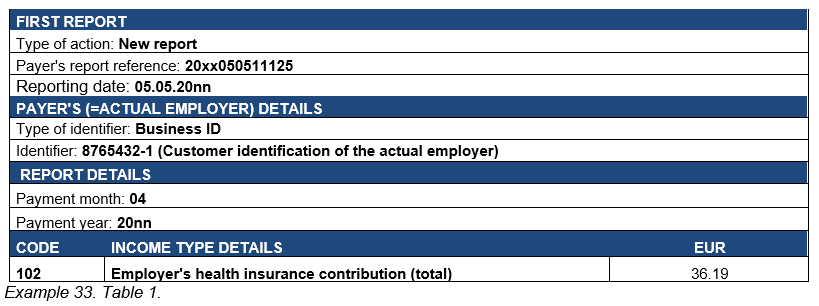

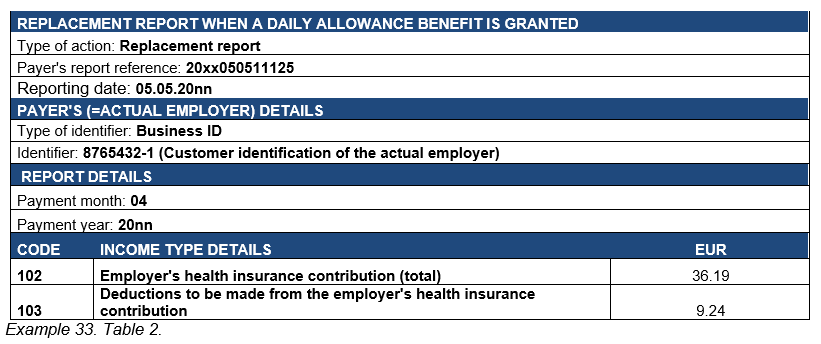

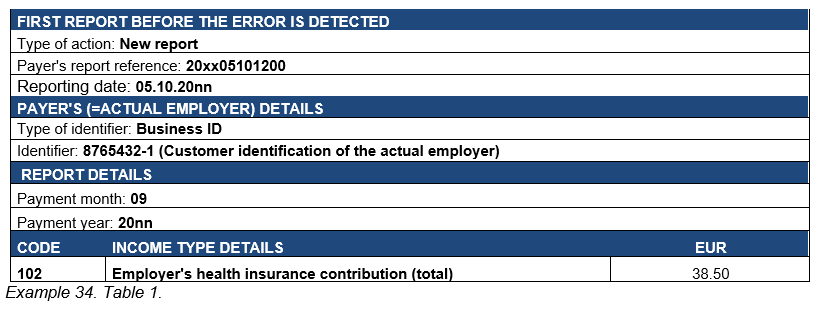

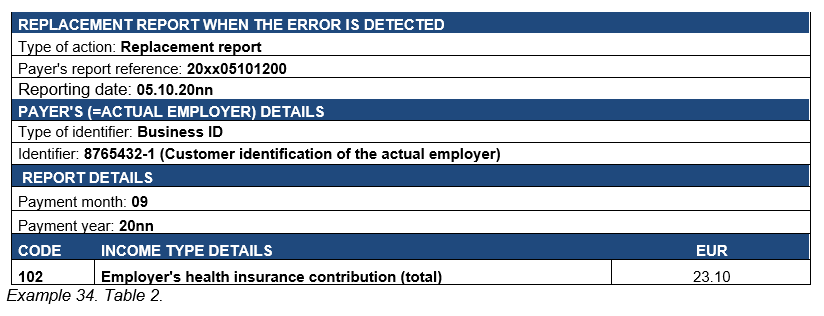

If the income data on an earnings payment report changes in such a manner that the amount of the employer's health insurance contribution also changes, the payer must also correct the submitted employer's separate report on which the total amount of health insurance contribution is reported.

1.7 How to correct data submitted prior to 2019?

Payments made on 1 January 2019 and later are reported to the Incomes Register, and any corrections to be made to these incomes. If payments made prior to 2019 are corrected in 2019 or later, the corrections should not be reported to the Incomes Register. Corrections to payments made prior to 1 January 2019 are made directly to each data user.

However, payments recovered on 1 January 2019 or later are reported to the Incomes Register, even if the original income had been paid prior to 2019. Even though the data on recovery is reported to the Incomes Register, the payer should note that some of the data users may also require that the annual information return filed for 2018 be separately corrected according to the instructions of the data user in question. If necessary, the payer should contact the customer service for submitters of an annual information return.

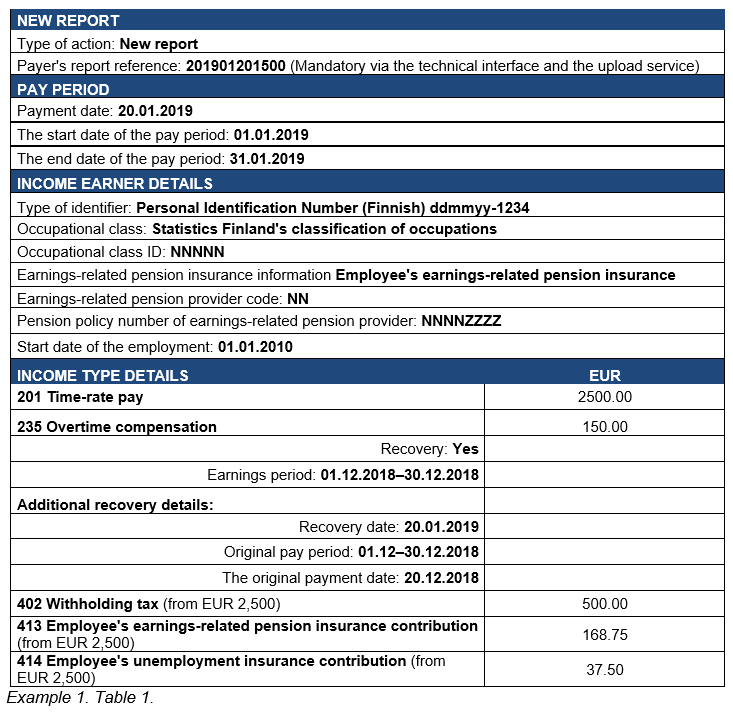

Example 1 (a payment paid in 2018 is recovered from an income earner in 2019):

In December 2018, the income earner was paid EUR 450 as overtime compensation. After making the payment, the payer notices having incorrectly paid EUR 150 too much. The income cannot be recovered from the income earner in 2018. The payer has reported EUR 450 on the annual information returns. The submitted annual information returns must be corrected and the lower amount of income must be reported.

The overpayment is recovered from the income earner in connection with the January 2019 payment of wages. In January, the income earner is paid EUR 2,500 as monthly wages. The payer reports:

2 Correcting incorrect data

The need to correct a report may arise from a payment error or a reporting error. Payment errors are situations where the report as such is correct, but the amount of income paid was too small or too large. Reporting errors are in question when, for example, the income was paid correctly but reported incorrectly to the Incomes Register due to a typing error, for example. Reporting errors also include cases where mandatory information has been incorrectly reported or left out entirely.

Section 2.3 describes how withholding tax is corrected and Section 2.4 how to report negative numbers.

2.1 Correcting reporting errors

In reporting errors, the original data must be corrected or the missing data added on a replacement report by resubmitting all report data, including the data that was correct in the original report.

2.1.1 Income was reported incorrectly due to a typing error, for example

If the submitted report was incorrect due to a typing error, for example, the original data must be corrected using a replacement report by resubmitting all report data, including the data that was correct in the original report.

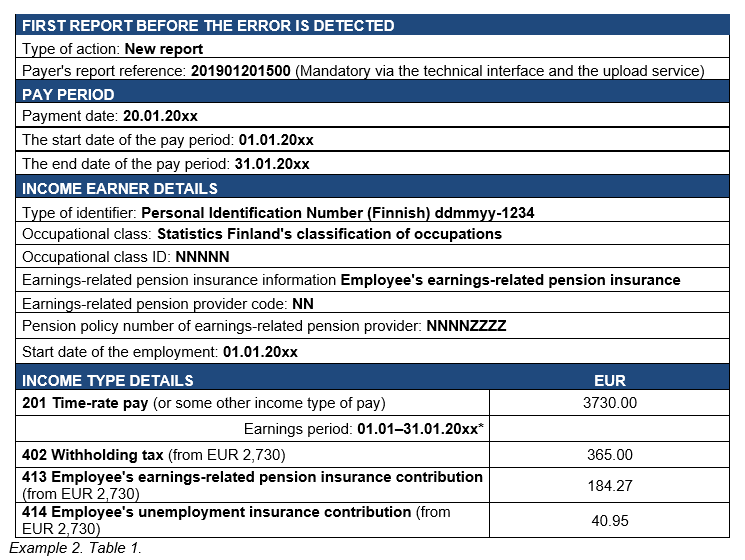

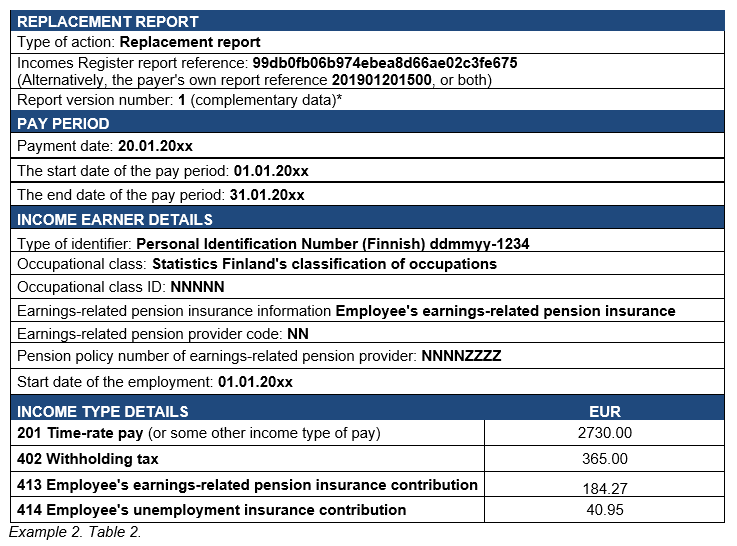

Example 2 (typing error): An income earner in an employment relationship valid until further notice is paid EUR 2,730 as time-rate pay. The payer withholds tax (EUR 365) and collects the employee's social insurance contributions from the wages.

The payer makes a typing error when reporting the information, due to which the amount was incorrectly reported to the Incomes Register as EUR 3,730.

* The earnings period constitutes voluntarily reported complementary additional data, which is, however, needed by several data users. It is therefore recommended that the earnings periods be reported if they are known. The earnings period is reported separately for each income type.

• The payer receives the report reference 99db0fb06b97499db0fb06b974ebea8d66ae02c3fe675 generated by the Incomes Register in the processing feedback.

• The Incomes Register assigns version number 1 to the new earnings payment report.

• The payer can use the payer's report reference when correcting, instead of the report reference generated by the Incomes Register

• The correction can be allocated to the correct report either using the Incomes Register's report reference or the payer's own report reference. Both references can also be submitted in the report.

The typing error is detected at the end of May. The payer must correct the report it submitted for January. All data, including data that was correct, must be submitted in the replacement report.

* Enter the version number of the report you wish to correct. The recommendation is that the payer specifies a version number on the replacement report, allowing the correction to be allocated to the correct report.

2.1.2 Income was reported using the wrong income type

Reporting the correct amount of payment but with the wrong income type to the Incomes Register is also a reporting error.

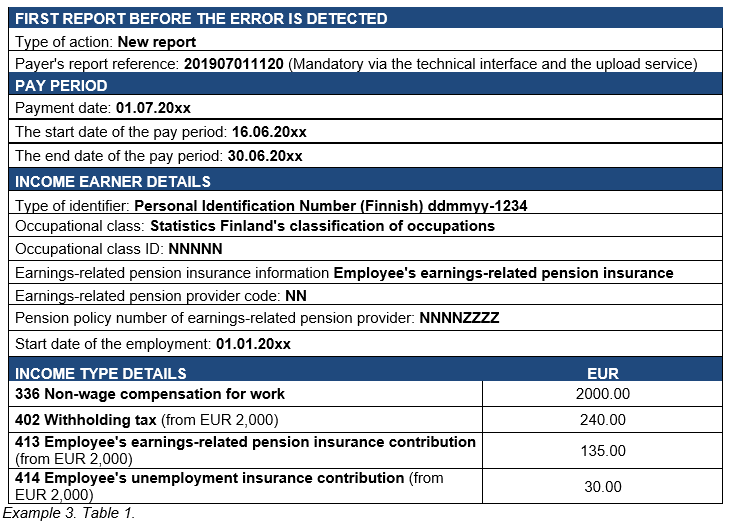

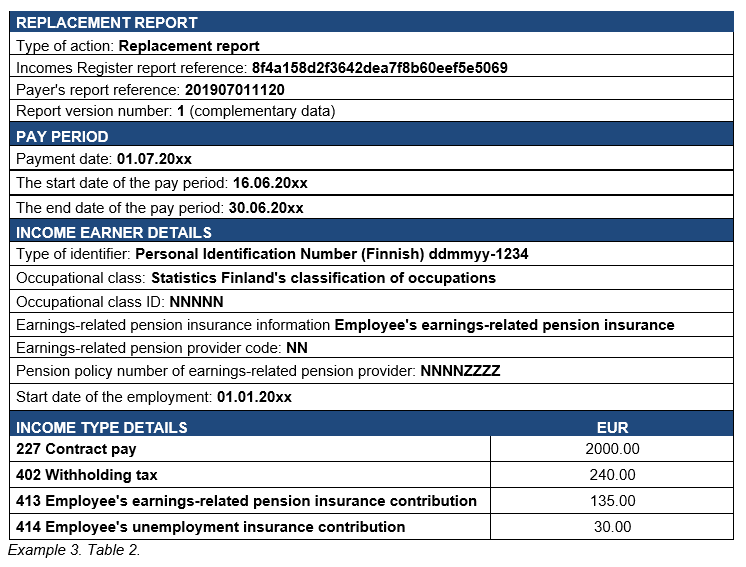

Example 3 (Income was reported using the wrong income type): The income earner was paid EUR 2,000 in contract pay, of which the payer has withheld tax (EUR 240) and collected the employee's social insurance contributions.

The payer has selected the wrong income type code and reported the wages paid as non-wage compensation for work, although the payment was contract pay.

The first report before the error is detected:

• The payer receives the report reference generated by the Incomes Register in the processing feedback: 8f4a158d2f3642dea7f8b60eef5e5069

The error is detected in September. The payer must correct the report it submitted in July:

2.1.3 Mandatory information was not reported

A report must also be corrected when mandatory information was not reported or was reported incorrectly. Such mandatory information includes information on non-resident taxpayers or partial owners, if the income earner is a partial owner in accordance with the unemployment security act (työttömyysturvalaki 1290/2002). Correspondingly, if the insurance information for the income type has been incorrectly reported or left out altogether, the information must be corrected.

In this case, too, the report must be corrected using a replacement report with all information resubmitted. Any missing information is added to the report.

2.1.4 Correcting data already corrected

The payer may need to correct a report it has submitted several times. The number of corrections that can be made is unlimited. All data that was correct in the previous report must be resubmitted in the replacement report in this case, too.

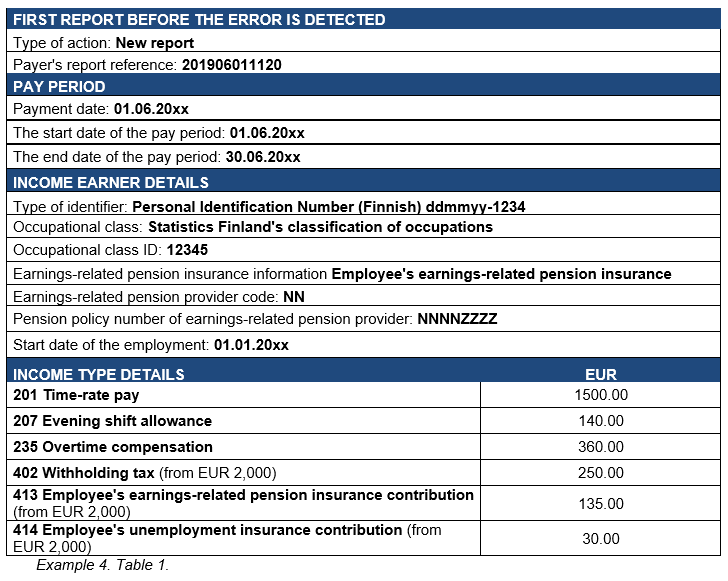

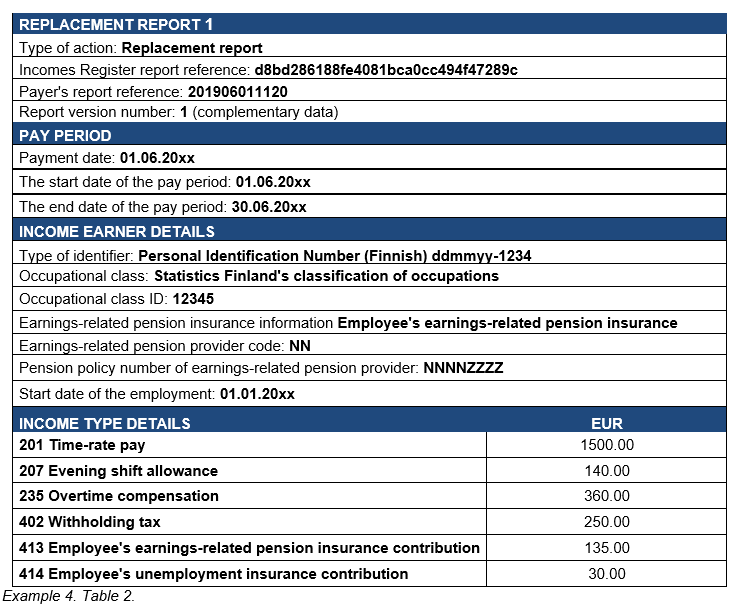

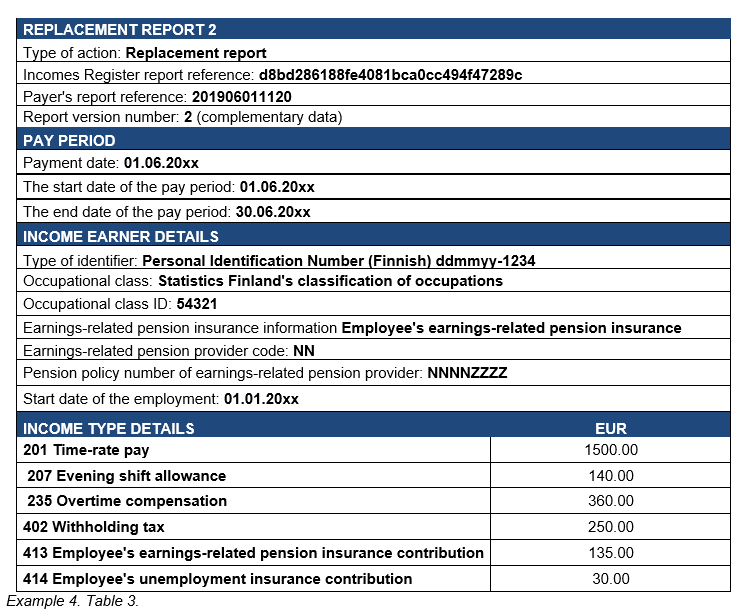

Example 4 (the same report is corrected several times): An income earner has been paid EUR 2,000 in wages that includes EUR 1,500 in time-rate pay, EUR 360 in overtime compensation, and EUR 140 in evening work compensation.

The payer inadvertently reports the evening work compensation as an evening shift allowance.

• The payer receives the report reference d8bd286188fe4081bca0cc494f47289c generated by the Incomes Register in the processing feedback.

During the following week, the payer notices the mistake and submits a replacement report, correcting the incorrect data:

Later, the payer notices having reported the income earner's occupational class incorrectly. The payer must correct the report it submitted:

2.1.5 Other needs to correct a report

There may also be a need to correct a report for some reason other than an error. The work circumstances or tax liability status may change, in which case the original report needs to be retroactively corrected using the replacement method. If, for example, the work period of a foreign income earner is extended so that a non-resident taxpayer becomes a resident taxpayer, the information must be corrected.

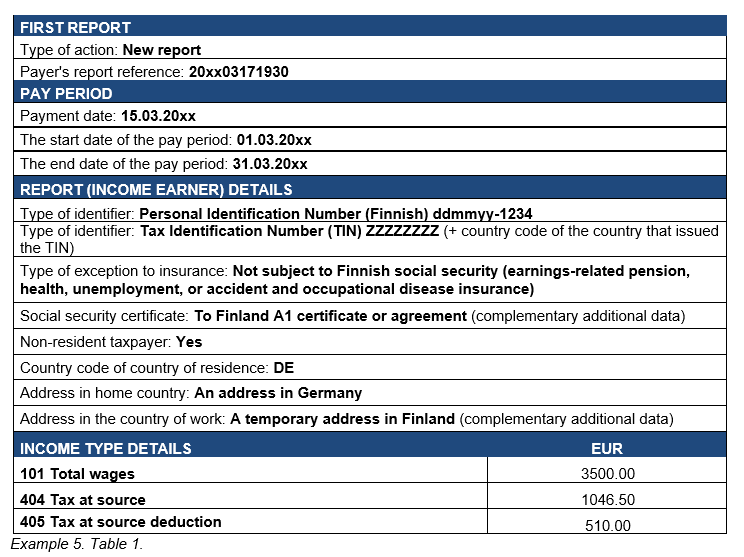

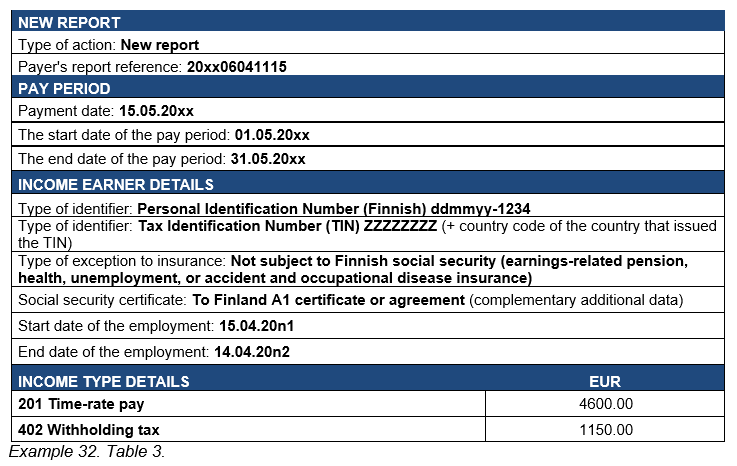

Example 5 (income earner's taxpayer status changes): A person who is a non-resident taxpayer and lives in Germany works in Finland between 1 January and 31 March, employed by a Finnish employer. The employee has an A1 certificate, i.e. he is insured in his home country. The income earner's tax-at-source card includes an entry on a tax at source deduction of EUR 510. The employer pays EUR 3,500 in monthly wages to the person and collects 35% tax at source, i.e. EUR 1,046.50, from the income.

The payer reports the data to the Incomes Register:

• The payer receives the report reference generated by the Incomes Register

eca6e4076ed1403cae19f6c192eff5b8

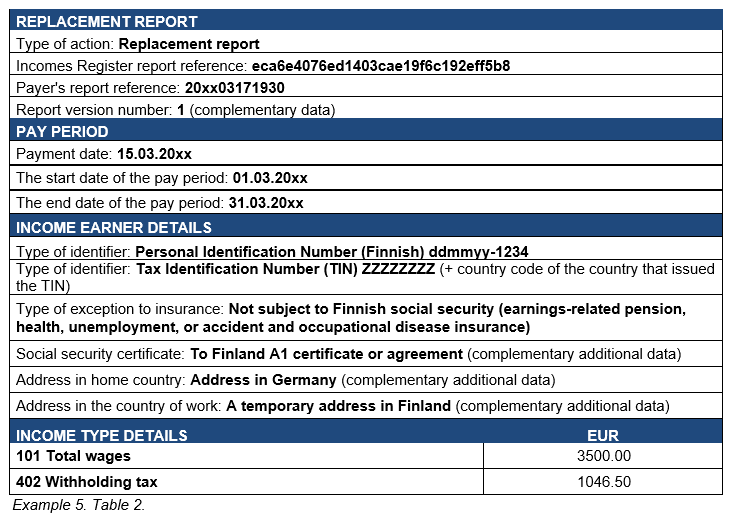

At the end of March, when the work should end, the employer and employee agree that the person's employment will be continued until the end of the year. This means that the person will become a resident taxpayer retrospectively from the beginning of his work. The collected taxes at source must be changed to withholding. The withheld taxes are reported as the amounts in which the tax was collected from the income earner. The income earner still has a valid A1 certificate, i.e., he is not insured in Finland.

The employer submits a replacement report, leaving out the 'Non-resident taxpayer: Yes' entry from the report. As the 'Non-resident taxpayer' entry is not submitted in the replacement report, the income earner is considered to be a resident taxpayer. The data contents have no specific entry that could be used to separately confirm this. The checks related to the original report's 'Non-resident taxpayer' entry are removed after the entry is deleted. Thus, providing data such as the country code of the home country or the address in the home country is not necessary. It is recommended, however, that the foreign identifiers and addresses be provided.

The payer must correct all reports, which it has submitted from January to March, using replacement reports (the March report is used as an example):

Correcting international information is described in more detail in the instructions Reporting data to the Incomes Register: international situations.

2.2 Correcting payment errors

Payment errors are situations where the report as such is correct, but the amount of income paid was too small or too large. Payment errors can be corrected in several different ways, and it is not always necessary to submit a replacement report.

2.2.1 Amount of income paid was too small, corrected with an additional payment

If the income earner has been paid too little in wages – for example, payment of overtime compensation was forgotten – the original report is not corrected. In such a case, a new report is submitted for the date on which the forgotten payment is made.

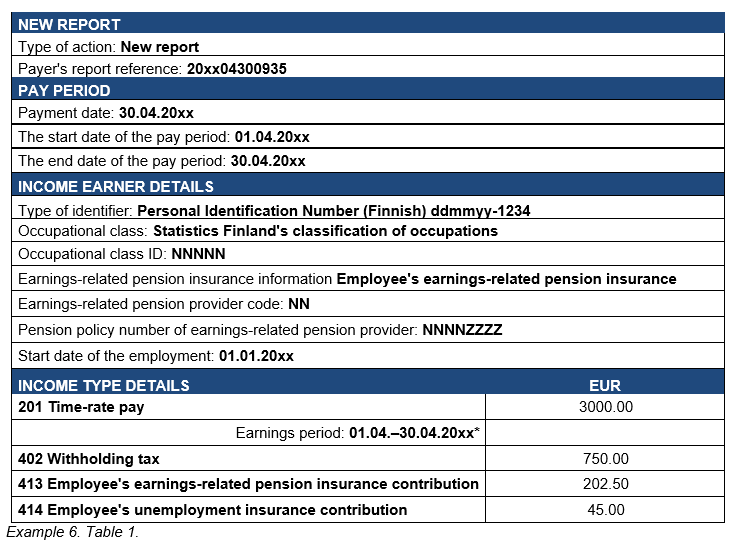

Example 6 (amount of income paid to the income earner was too small, corrected with an additional payment): When paying wages for April, an employer has paid EUR 3,000 in wages to an employee in an employment relationship valid until further notice and reported this to the Incomes Register:

* The earnings period is voluntarily submitted, complementary additional data.

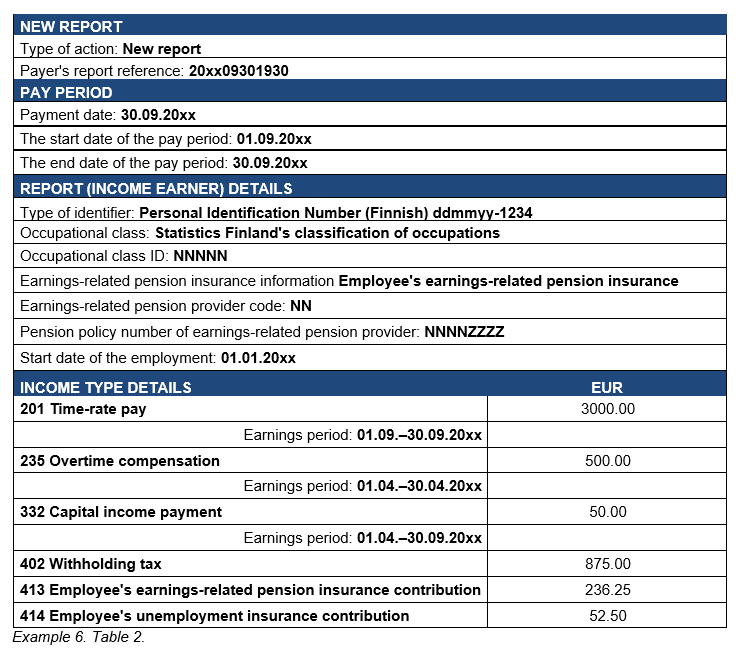

In the beginning of September, the employee notices that the employer forgot to pay him EUR 500 in overtime pay for overtime he worked in April. In connection with the payment of wages for September, the employer pays the missing amount in addition to the employee's normal wages, plus interest for the missing payment. The original report is not corrected.

* The earnings period is voluntarily submitted, complementary additional data.

2.2.2 Amount of income paid was too large

Recovery and reporting of overpayments are described in Section 3 and Section 4.

2.3 Correcting withheld tax

The amount of tax withheld may be incorrect, for example due to a calculation error or the use of an incorrect withholding percentage. Under certain conditions, the payer can correct the tax it withheld regardless of the reason for the error. The amount of tax withheld may be too large or too small.

2.3.1 Correcting tax withheld when the amount was too large

If the payer withheld too much tax, the error can be corrected by reducing the amount of tax withheld from a payment made later during the same calendar year (section 19(1) of the prepayment act (ennakkoperintälaki 1118/1996)). Correcting the withheld tax is voluntary to the payer, and the correction can be made regardless of the reason for the error.

The payer can correct tax withheld in too large an amount, even when it no longer makes any payments to the income earner during the same calendar year. In such a case, the payer returns the extraneous amount withheld to the income earner and deducts the same amount from the total amount of withheld tax to be paid to the Tax Administration. The extraneous amount withheld must be returned during the same calendar year.

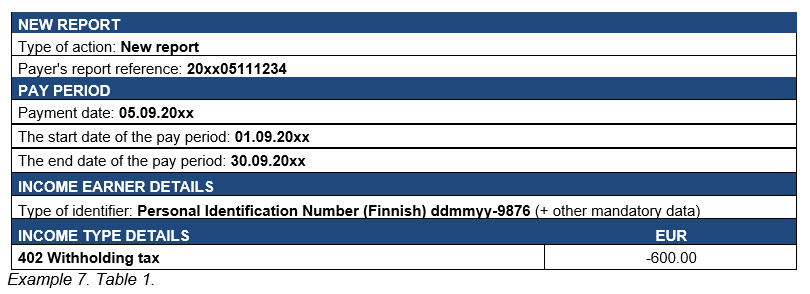

Example 7 (Correcting too large an amount of tax withheld, error is corrected during the same calendar year): On 30 August, the payer inadvertently withheld too much tax from a final payment made to the income earner (EUR 6,000). The withholding percentage was supposed to be 25% (EUR 1,500), but the payer inadvertently withheld tax using 35% (EUR 2,100). The information was reported to the Incomes Register according to the withheld amount.

The income earner notices the error at the beginning of the next month. The payer corrects its error and pays the extraneous amount withheld (EUR 600) to the income earner on 5 September. The extraneous amount withheld, paid to the income earner, can be reported to the Incomes Register as a negative number.

Example 8 (Too large an amount of tax withheld, error is detected after the end of the calendar year): On 15 December, the payer inadvertently withheld too much tax from a final payment made to the income earner (EUR 4,000). The withholding percentage was supposed to be 25% (EUR 1,000), but the payer inadvertently withheld tax using 37.5 % (EUR 1,500). The information was reported to the Incomes Register according to the withheld amount.

The error is detected in the February of next year. The payer can no longer correct the error, because the calendar year has changed. The extraneous amount withheld is accredited to the income earner in taxation.

2.3.2 Correcting tax withheld when the amount was too small

If tax was not partially or entirely withheld, the payer can correct the error on its own initiative by increasing the tax withheld from a payment made later during the same calendar year. However, the withholding may not be increased by more than 10 per cent of the amount that would be otherwise paid that time, unless the recipient of the payment consents to a larger increase (section 19 of the prepayment act (ennakkoperintälaki 1118/1996)).

The payer reports the withholding to the Incomes Register in the amount in which it was withheld.

2.4 Reporting negative numbers

Typically, income types may not be corrected in the Incomes Register using negative numbers, i.e., numbers with a minus sign. An incorrectly reported or paid income is corrected by submitting a replacement report indicating the correct amount or changed nature of the income, for example the change of paid income to unjust enrichment. Furthermore, income recovery is reported as its own data group.

However, there are exceptional situations in the Incomes Register, where tax withheld, tax at source and social insurance contributions collected from an employee can be negative numbers. Tax withheld is not usually reported as a negative number. The amount of employee contributions, withheld tax and tax at source can often be corrected by collecting a lower amount of contributions and taxes from income paid to the income earner at a later date. This will eliminate the need to use negative numbers (see Section 4.2, Net recovery, and the examples described in the section).

Negative numbers may exceptionally appear when, for example, the employment has already ended and the amount of tax withheld or employee's social contributions collected is too large. The payer can correct tax withheld in too large an amount even when it no longer makes any payments to the income earner during the same calendar year. The payer will then return, for example, the excess amount of tax withheld, to the recipient, and report the returned amount as a negative number on the earnings payment report. The extraneous amount withheld must be returned before the end of the calendar year. The employee's social insurance contributions can be corrected in a corresponding way (for more details, see Correcting tax withheld in Section 2.3. and Correcting employee's social insurance contributions in Section 3.2.).

Items deducted from pay include the income types listed below, that can exceptionally be negative:

- 402 Withholding tax

- 404 Tax at source

- 412 Employee's health insurance contribution

- 413 Employee's pension insurance contribution

- 414 Employee's unemployment insurance contribution

It should be noted that a recovered amount cannot be corrected by reporting a negative number for the original pay period, or by reducing the amount of income of the original pay period. Recovery is reported by submitting the Recovery data connected to the income type and the additional data related to the recovery during the pay period in which the income earner pays back the overpayment.

2.5 Correcting data in two different reporting methods of monetary wages

At a minimum, the payer must report the wages paid as a total amount (the lower level of detail for reporting monetary wages, or the so-called reporting method 1). If the payer wishes, it can report wages it has paid more specifically than required by the mandatory reporting method, using the complementary income types intended for this purpose (the greater level of detail for reporting monetary wages, or the so-called reporting method 2). These two different reporting methods are described in the instructions Reporting data to the Incomes Register: monetary wages and items deducted from wages.

Reporting method 1 and reporting method 2 cannot be combined in the same report. However, the payer can use different reporting methods in different reports. When correcting a report, the payer may change the reporting method. Nothing prevents the payer from changing wages previously reported using reporting method 1, to wages reported using reporting method 2 in the replacement report, and vice versa. The payer must then ensure that the social insurance contributions are correctly reported in the replacement report, and that the default values of the income type insurance information are taken into account.

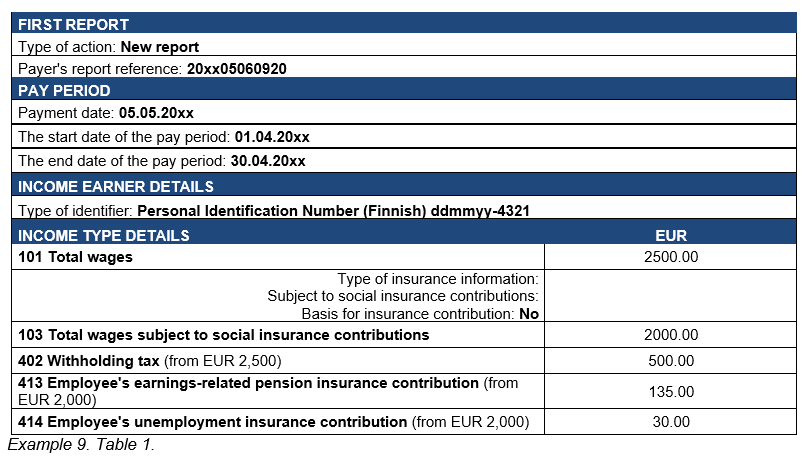

Example 9 (Changing wages reported using reporting method 1 to reporting method 2): The payer has paid EUR 2,500 of income to the income earner. The amount includes EUR 2,000 of time-rate pay and EUR 500 of notice period compensation. The notice period compensation is not subject to social insurance contributions.

The payer reports the following data:

3 Reporting and retroactively correcting a payment made on incorrect grounds

All taxable monetary payments can become unjust enrichment if the income earners are not entitled to income paid to them. Income where the income earner has been paid too much is corrected by submitting the correct amount of income on a replacement report and marking the overpayment as unjust enrichment. Unjust enrichment is discussed in Section 3.1

The Unjust enrichment entry cannot be used for some of the income types used in the Incomes Register due to the nature of the income. These include non-monetary benefits, such as fringe benefits. Fringe benefits have a specific value based on a decision of the Finnish Tax Administration, and if the payer has reported an incorrect value, it must correct the amount of payment on a replacement report without the Unjust enrichment entry. Information corrected for the original pay period without the Unjust enrichment entry is discussed in Section 3.1.3.

There are also some income types that are corrected on the next report. These income types are discussed in Section 3.1.4.

Some of the Incomes Register's data users process the overpayment using the report concerning the unjust enrichment and some process it when the income is recovered. For this reason, the payer must always correct the original payment into an unjust enrichment and report the recovery information when the income has been recovered. It is not possible to only submit a report on the recovery. Instead, the information in the original report must always be corrected into an unjust enrichment.

3.1 Unjust enrichment

In some situations, the income earner is not entitled to a payment made to them and reported in the Incomes Register. An unjust enrichment occurs when, for example, a payment has been made on incorrect grounds, to the wrong person, or in an incorrect amount.

Unjust enrichment must be reported without undue delay and no later than within one month of becoming aware of the unjust enrichment.

Unjust enrichment is reported when the payer separately collects an overpayment from the income earner. If an overpayment is corrected in the following wage payments as advance pay deducted from the gross pay or as some other such payment, the information can, in principle, be corrected by later reporting to the Incomes Register only the gross amount actually paid to the income earner, from which the advance payment has been deducted (see 4.8. Treating an overpayment as advance pay). It should be noted, however, that handling overpayment as advance pay is not recommended, because this can distort the amount of benefits paid to the income earner or, at worst, affect eligibility for the benefit in the first place. If the overpayment is set off from the gross wages, some data users may have to separately request information on the incorrectly paid amounts. Furthermore, the wrong income will be used as the grounds for benefits.

Unjust enrichment must always be reported when the payment of the unjust enrichment leads to its being separately recovered from the income earner. It is also recommended that unjust enrichment be reported on every occasion when the overpayment cannot be fully corrected in the next payment of wages.

Unjust enrichment paid to an income earner is taxable income, but it is not income on which pension is based. For this reason, it must be possible to identify such payments in pension provision, regardless of whether or not the payer has recovered them from the income earner. Correspondingly, unjust enrichment is not subject to any other social insurance contributions, such as unemployment or accident and occupational disease insurance contributions.

The payment can be recovered from the gross amount, or a payment request can be sent to the income earner. The payment can also be recovered as a net amount. Sometimes, the overpayment can be subject to a dispute, or the regulations of the Employment Contracts Act or the collective labour agreement may prevent the recovery of the overpayment. In this case, too, the overpayment must be reported to the Incomes Register. Recovery is discussed in Section 4.

Unjust enrichment is reported in two different ways, depending on whether the income was already reported to the Incomes Register as some other type of income, or whether the unjust enrichment paid is noticed before the report is submitted.

3.1.1 The overpayment is noticed before the report is submitted

If the overpayment is noticed before the report is submitted, use the separate Unjust enrichment income type. This income type is used only when the mistakenly made payment is detected before the first report is submitted, and the income has not previously been reported to the Incomes Register as other income.

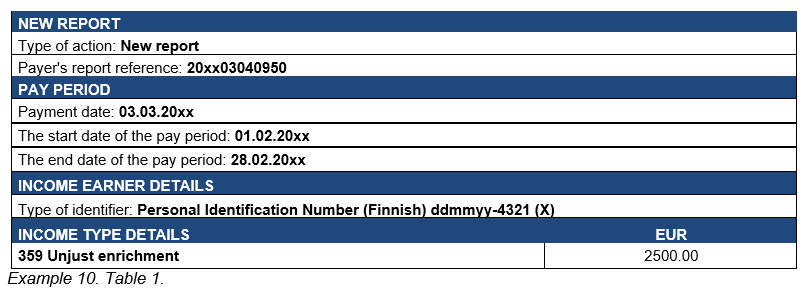

Example 10 (Overpayment is noticed before the report is submitted): A payment of EUR 2,500 intended for income earner Y has been mistakenly paid to X. The mistake is noticed on the very next day, before the report has been submitted to the Incomes Register. The income has not been recovered from X. The payer reports:

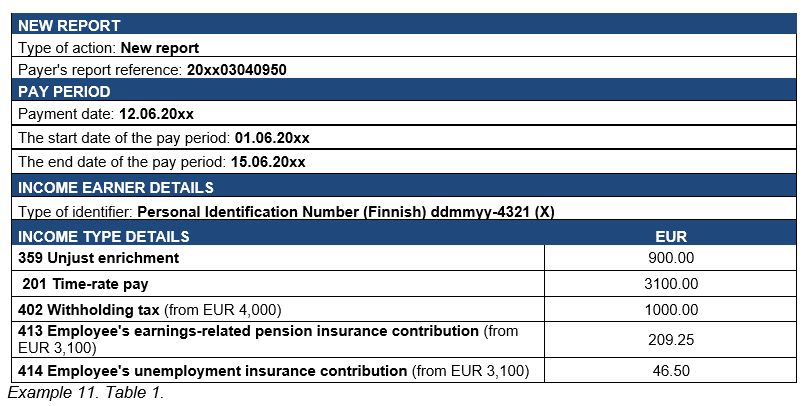

Example 11: (Overpayment is noticed before the report is submitted, other income is also paid to the income earner at the same time): The amount of the income earner’s normal monthly pay is EUR 3,100. During the payment of wages, the payer has mistakenly paid EUR 900 too much to the income earner (EUR 4,000 gross). 25% tax has been withheld and the employee's social insurance contributions have been collected from the income.

The payer notices the mistake on the next day, before submitting the report to the Incomes Register. The tax withheld is reported in the amount withheld in the earnings payment report. However, the payer may correct the employee's social insurance contributions to match the correct amount of pay (see information on correcting an employee's social insurance contributions in Section 3.2).

3.1.2 Overpayment has already been reported to the Incomes Register

Overpayments are usually noticed later, once the income has already been reported to the Incomes Register as some other type of income. In such a case, the original report is corrected using the replacement method. If the unjust enrichment has previously been incorrectly reported to the Incomes Register as some other income, the information must be corrected by submitting

- the previously reported income type (for example, 'Time-rate pay'), and

- submitting the separate 'Unjust enrichment' information in connection with it.

The separate 'Unjust enrichment' income type is not used in this case; instead, the separate 'Unjust enrichment' information connected to the income type is added to the previously reported payment.

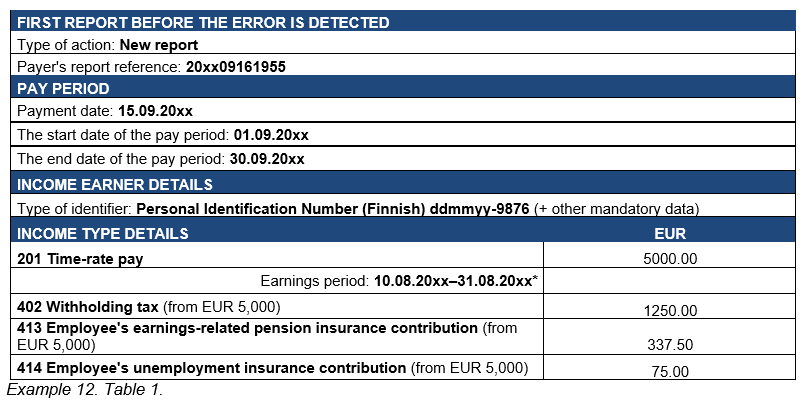

Example 12 (Overpayment is noticed after the report has been submitted): Income earner Z was paid EUR 5,000 on 15 September. The payment was reported to the Incomes Register as time-rate pay.

However, the employer accidentally paid EUR 2,000 too much in addition to Z's normal wages, EUR 3,000. Tax has been withheld (25%) from the payment made (EUR 5,000) in the normal manner, and the employee's earnings-related pension and unemployment insurance contributions have been collected from the income earner.

The employer submits the report in accordance to what was paid and does not notice the mistake before submitting the report.

* The earnings period is voluntarily submitted complementary additional data.

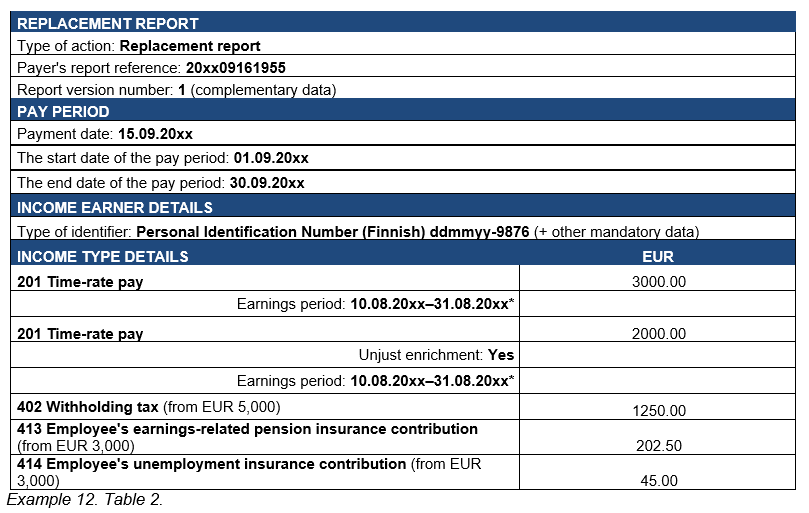

The overpayment is detected in October. The previously submitted incorrect report must be corrected by submitting a replacement report and marking the overpayment (previously paid and reported to the Incomes Register with the 'Time-rate pay' income type) as an 'Unjust enrichment'. Because the income was already reported to the Incomes Register as another income type, the 'Unjust enrichment' income type is not used; instead, a separate 'Unjust enrichment' entry connected to the income type is made for the previously reported income. The amount of pay is corrected in the report.

* The earnings period is voluntarily submitted complementary additional data.

Based on the submitted data, the income earner's income subject to social insurance contributions for September is considered to be EUR 3,000 and the erroneous overpayment (EUR 2,000) changes into an unjust enrichment. The payment obligation of the employer's social insurance contributions is correspondingly reduced. Based on the submitted data, the data users are notified that the income was previously reported to the Incomes Register as time-rate pay.

The tax withheld from the income earner is reported in a replacement report, in the amount in which it was withheld from the income earner. The employee's social insurance contributions should have been collected based on EUR 3,000. The payer can correct the social insurance contributions collected from the employee to the right amount (calculated based on EUR 3,000 of time-rate pay) using a replacement report submitted for an unjust enrichment. If this is not done, the employee's social insurance contributions can be corrected using a recovery report (see information on how to correct employee corrections in Section 3.2).

The payer must remember to correct the information on the employer's separate report for the month in question, if the amount of health insurance contribution paid changes due to the unjust enrichment (see Section 7 and the examples in it).

With respect to correcting the report, it does not matter whether the entire payment made, or only part of it, is changed into an unjust enrichment. If the entire payment is changed into an unjust enrichment, the payer corrects the previous report using a replacement report.

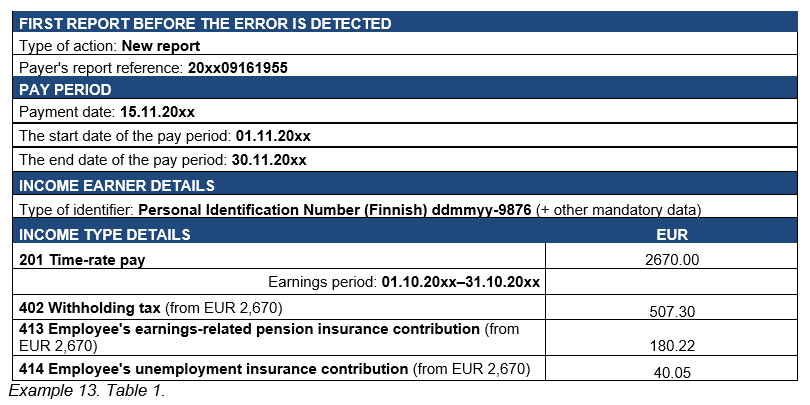

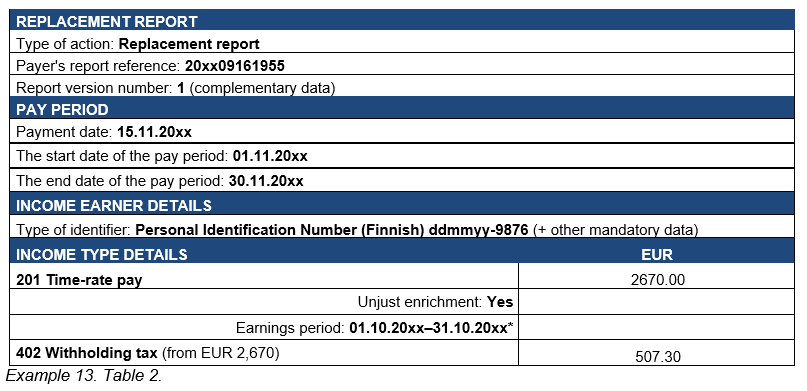

Example 13 (The entire income paid to the income earner is changed into an unjust enrichment). The payer has paid EUR 2,670 of wages to the income earner. It is later noticed that the income earner was on an unpaid vacation for the entire pay period. The entire payment made must be corrected and changed into an unjust enrichment.

The payer corrects the incorrect information submitted using a replacement report:

Because the entire payment was groundless, the income from work on which pension and unemployment insurance contributions are based is correspondingly reduced for the income earner. The payer can thus correct the collected employee contributions by submitting a replacement report. Correcting employee contributions is discussed in more detail in Section 3.2.

* The earnings period is voluntarily submitted complementary additional data.

With respect to correcting the report, it does not matter whether the information was reported to the Incomes Register using reporting method 1 for monetary wages (the so-called lower level of detail for reporting monetary wages) or reporting method 2 (the greater level of detail for reporting monetary wages). The correction procedure is the same, no matter which method was used to report the information.

When using reporting method 1, you must also remember to report the income subtypes connected to the income according to the actual situation, if the income subject to social insurance contributions differs from the income reported using the 'Total wages' income type.

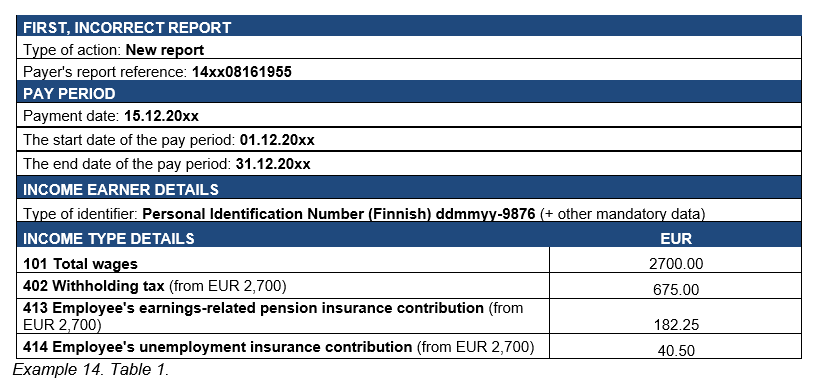

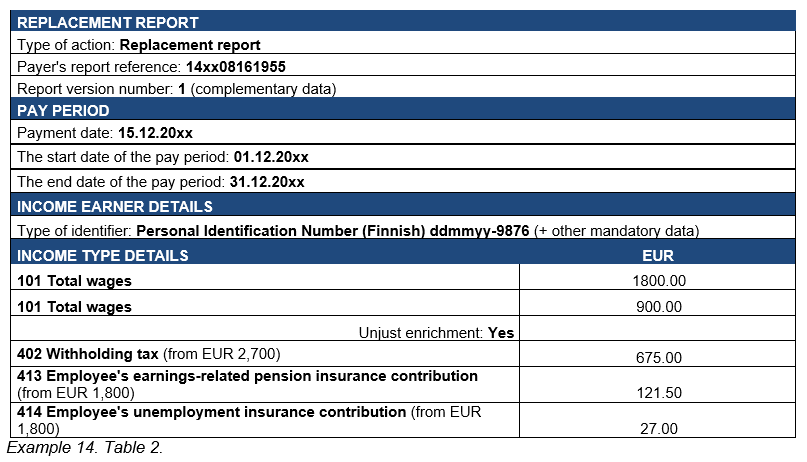

Example 14 (Reporting an unjust enrichment using reporting method 1): An income earner was paid EUR 2,700 in wages for December on 15 December. The payment was reported to the Incomes Register using the 'Total wages' income type. Tax has been withheld (25%) from the payment made (EUR 2,700) in the normal manner, and the employee's earnings-related pension and unemployment insurance contributions have been collected from the income earner.

However, the employee was on unpaid vacation for part of December, due to which the employer paid EUR 900 too much in wages.

The employer is unaware of the unpaid absence before submitting the report, and submits the report according to what was paid.

The overpayment (EUR 900) is noticed at the end of the month. The previously submitted report must be corrected using a replacement report, by marking the overpayment reported to the Incomes Register with the 'Total wages' income type as an unjust enrichment in the overpayment amount. The amount of wages is corrected using a replacement report.

Correcting employee contributions is discussed in more detail in Section 3.2.

If the amount of wages paid includes income items that are not subject to social insurance contributions, any correction of a report submitted using reporting method 1 must also include the income subtypes in the report (such as the amount of wages subject to the employee's social insurance contributions) according to the actual situation. Correspondingly, you must remember to report the Type of insurance information data connected to the income type according to the actual situation.

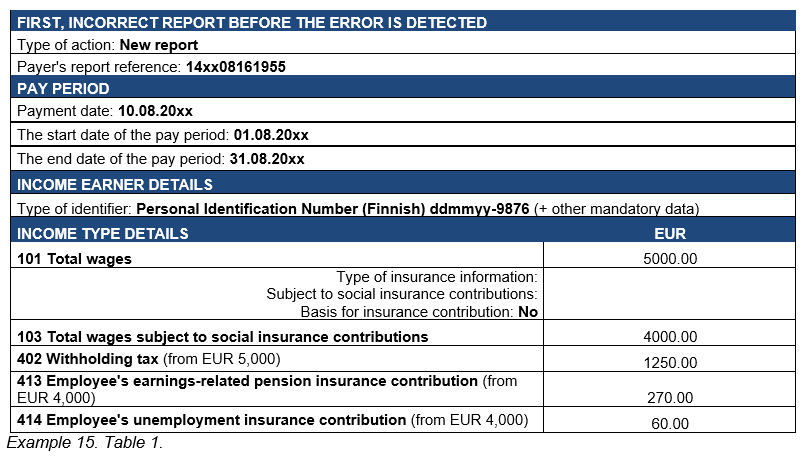

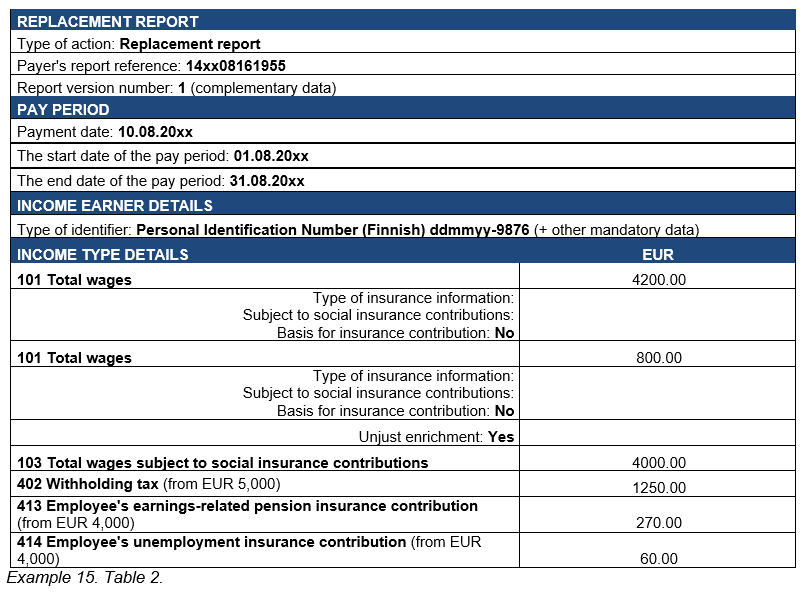

Example 15 (Reporting an unjust enrichment using reporting method 1, when some of the income is not subject to social insurance contributions): The income earner was paid EUR 5,000 on 10 August. The payment was reported to the Incomes Register using the 'Total wages' income type. The payment includes EUR 1,000 of waiting time compensation, which is not subject to social insurance contributions.

However, the employer inadvertently paid EUR 800 too much in waiting time compensation. Tax has been withheld (25%) from the payment made (EUR 5,000) in the normal manner, and the employee's earnings-related pension and unemployment insurance contributions (from EUR 4,000) have been collected from the income earner.

The employer does not notice the error before submitting the report, and submits the report according to what was paid.

The overpayment (EUR 800) is noticed in September. The previously submitted report must be corrected using the replacement method by marking the overpayment (previously paid and reported to the Incomes Register with the 'Time-rate pay' income type) as an unjust enrichment. The income subtype connected to the total amount must be reported on the replacement report according to the actual situation.

The waiting time compensation (EUR 800) that was an overpayment must be reported to the Incomes Register as an unjust enrichment. Correspondingly, the reduced income amount (EUR 4,200) is reported to the Incomes Register in the correct amount. The correct amount of waiting time compensation is EUR 200, and the amount of pay subject to social insurance contributions remains at EUR 4,000. You must also remember to report this to the Incomes Register using the correct income type.

In the replacement report used to report the unjust enrichment, you must remember to also provide the Type of insurance information data according to the actual situation for the income reported as an unjust enrichment.

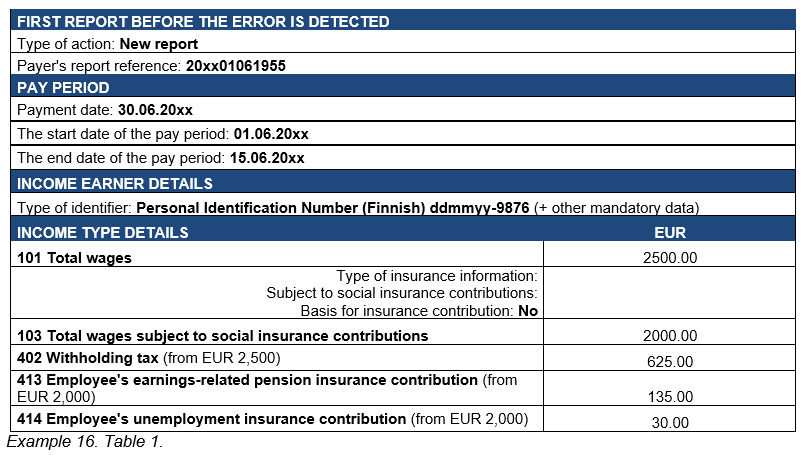

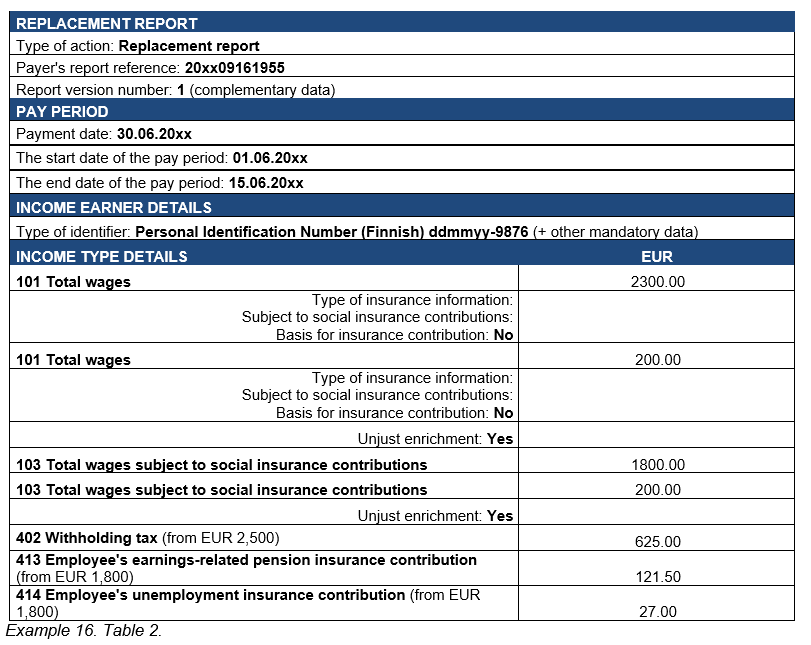

Example 16 (Reporting an unjust enrichment using reporting method 1, when some of the income is not subject to social insurance contributions): The income earner has been paid EUR 2,500. The payment was reported to the Incomes Register using the Total wages income type. The payment includes EUR 500 of notice period compensation, which is not subject to social insurance contributions.

Later, the payer notices having paid EUR 200 too much in wages. The amount of the notice period compensation was correct. Tax has been withheld (25%) from the payment made (EUR 2,500) in the normal manner, and the employee's earnings-related pension and unemployment insurance contributions have been collected (from EUR 2,000) from the income earner.

The employer does not notice the error before submitting the report, and submits the report according to what was paid.

The payer must correct the submitted report after noticing the error. The payer must report the overpayment of EUR 200 as an unjust enrichment and correct the amount of pay to EUR 2,300. Correspondingly, the pay subject to social insurance contributions is reduced to EUR 1,800 (2,300–500).

In the replacement report used to report the unjust enrichment, you must remember to also provide the Type of insurance information data according to the actual situation for the income reported as an unjust enrichment.

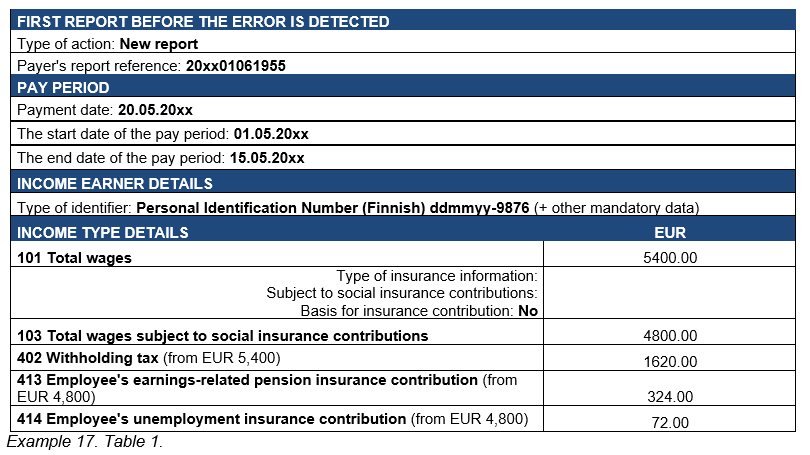

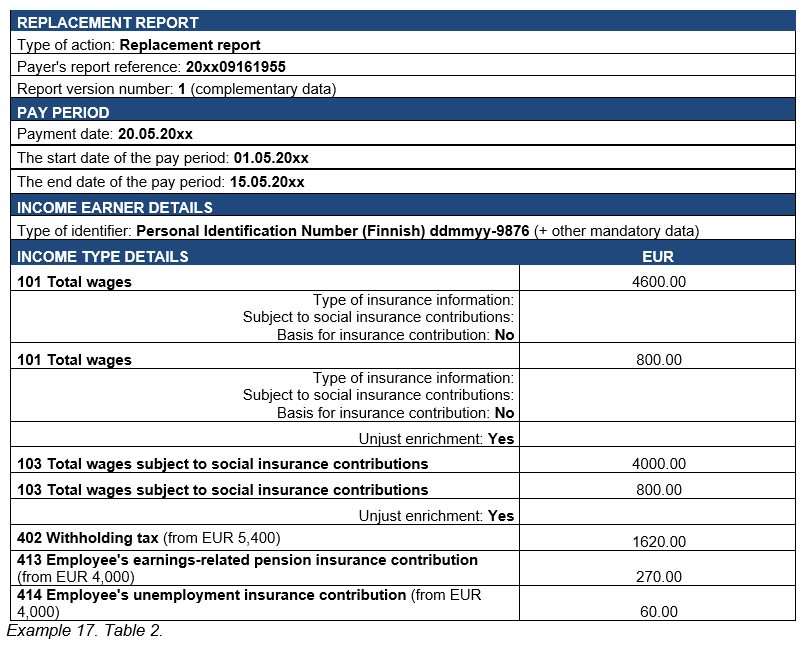

Example 17 (Reporting an unjust enrichment using reporting method 1, when some of the income is not subject to social insurance contributions): The income earner has been paid EUR 5,400. The payment was reported to the Incomes Register using the 'Total wages' income type. The payment includes EUR 600 of voluntary compensation in a situation where employment is terminated, which is not subject to social insurance contributions. Tax has been withheld (30%) from the payment made (EUR 5,400) in the normal manner, and the employee's earnings-related pension and unemployment insurance contributions have been collected (from EUR 4,800) from the income earner.

Later, the payer notices having paid EUR 800 too much in wages. The amount of compensation paid in a situation where employment is terminated was correct.

The employer does not notice the error before submitting the report, and submits the report according to what was paid.

The payer must correct the submitted report after noticing the error, and correct the EUR 800 overpayment, changing it to an unjust enrichment. Correspondingly, the payer must remember to also correct the income subtype included in the report.

3.1.3 When is information corrected for the original period without the Unjust enrichment entry?

Series 300 income types that are not income actually paid to the income earner are corrected for the original pay period by reporting the correct amount of the income without the Unjust enrichment entry. These income types include:

- Income types of payments made by a substitute payer but reported by the actual employer (code values 321–325): If the substitute payer has made an overpayment to an income earner, the substitute payer corrects the report it submitted and marks the overpayment as unjust enrichment. The actual employer must then correct the report it has submitted and report the correct amount of income without including the Unjust enrichment entry.

- Fringe benefits and non-monetary benefits and payments: (code values 301, 302, 304, 315, 317, 330, 334, 341, 342): Fringe benefits cannot be unjust enrichment, because the person has enjoyed the benefit and it is not a case of payment error (overpayment). The payment may have been reported incorrectly to the Incomes Register, but in any case, the income earner has enjoyed the benefit in the correct amount. The incorrect report is then corrected by reporting the correct value on a replacement report without including the Unjust enrichment entry.

- Treatment fee for municipal veterinarian (code value 312) and

- Wages for insurance purposes (code value 352): The treatment fee for a municipal veterinarian and wages for insurance purposes are not money actually paid to the income earner, and cannot thus be overpayments for which the Unjust enrichment entry could be made. If the data has been incorrectly reported to the Incomes Register, it must be corrected by reporting the correct amount of income on a replacement report without including the Unjust enrichment entry.

- Other payments of a nature that cannot involve unjust enrichment are Employee stock option (code value 343) and Employee stock option with a subscription price lower than market price at the time of issue (code value 361).

- In addition to the non-monetary benefits mentioned above, Tax-exempt reimbursement of expenses (code values 303, 311, 331, 357, 358) cannot in principle be unjust enrichment. A reimbursement of expenses in itself cannot be unjust enrichment, but in cases of payment exceeding the values specified in the decision of the Finnish Tax Administration on tax-exempt travel allowances, it can change into a different income type (such as wages) that can be unjust enrichment. If reimbursement of expenses are paid to an income earner in excess of the values confirmed in the decision of the Finnish Tax Administration, the report must be corrected using the replacement method by marking the overpayment as taxable income (e.g. as wages, which can be unjust enrichment).

Example 30: An income earner has been paid a tax-exempt daily allowance of EUR 42 per day for 5 days, or EUR 210 in total. She should only have been paid for 3 days, i.e., she was paid EUR 84 to much. The correct amount, EUR 126, must be reported as tax-exempt daily allowances on a replacement report. The rest is an overpayment (unjust enrichment). Because Daily allowance is a tax-exempt income type and the groundlessly made overpayment is taxable income, the overpayment must be reported using one of the taxable income types, such as Time-rate pay - Unjust enrichment. Although the wages subject to withholding increase on the replacement report, the withholding is reported as the amount actually withheld, as are the employee's earnings-related pension and unemployment insurance contributions. In this case, the amount of the employer's health insurance contribution does not change, which means that the employer's separate report does not need to be corrected. A reimbursement of expenses in itself cannot therefore be unjust enrichment, but in cases of payment exceeding the values specified in the decision of the Finnish Tax Administration, it changes into a different income type (wages) that can be unjust enrichment.

The income types and their descriptions can be found in the document 'Descriptions of income types and items deducted from income'.

3.1.4 When is data corrected on the next report submitted?

The Unjust enrichment entry cannot easily be used for the items deducted from income and other payments of the 400 series income types, such as withholding, distraint, or reimbursements collected for fringe benefits. The collected reimbursements are reported once the reimbursement has been collected. Reimbursements collected for fringe benefits are, as a rule, reported as the actual amounts collected. However, the reimbursements collected for fringe benefits must be reported in the same earnings payment report as the fringe benefits, even if the reimbursements were collected beforehand or afterwards. Taxes withheld and taxes at source collected are reported as the actual amounts withheld or collected, and if the payer needs to correct the amounts, the corrected amounts are reported once the corrections have been made.

The income types and their descriptions can be found in the document 'Descriptions of income types and items deducted from income'.

3.2 Correcting employee's social insurance contributions

3.2.1 Correcting employee's earnings-related pension and unemployment insurance contributions

Employee's earnings-related pension and unemployment insurance contributions are corrected in a different way than withholding, tax at source and the employee's health insurance contribution. The recommendation is to correct employee's earnings-related pension and unemployment insurance contributions on the same report on which unjust enrichment is reported, even if the employee contributions have not yet actually been credited to the income earner.

If the employee's earnings-related pension and unemployment insurance contributions have already been corrected on the unjust enrichment report, the crediting or reduction is not reported again to the Incomes Register when the payer credits the amount to the income earner.

An alternative method for correcting an employee's earnings-related pension and unemployment insurance contributions is to correct them on the report on which the recovery of the unjust enrichment is reported.

The correction of an employee's health insurance contribution is described in Section 3.2.2. The correction of withholding is described in Section 2.3.

Correcting a collected contribution when the amount was too large

If an employee's earnings-related pension or unemployment insurance contribution that is too large has been collected from an employee, the employer can pay back the extraneous amount collected, or correspondingly reduce the income earner's employee contributions for a later pay period. This can occur, for example, in recovery situations or because the income changes to a type that does not constitute grounds for social insurance contributions.

If an employee contribution considered too large that has been collected cannot be subtracted from the income earner's employee contributions for a later pay period, and the payer has not already reduced the amount on the report submitted for unjust enrichment or the recovery report, the excessive amount collected can be paid back to the income earner and the amount reported as a negative number in an earnings payment report.

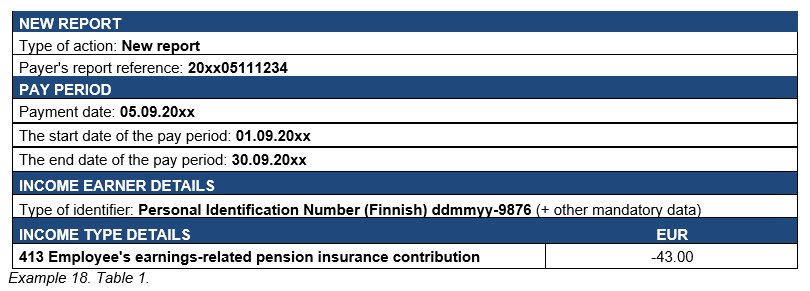

Example 18 (Returning an employee contribution, when the collected amount was too large): The payer has erroneously collected an earnings-related pension insurance contribution that was EUR 43 too high from the income earner's pay. No more payments will be made to the income earner, so the employer returns the excess amount of collected earnings-related pension insurance contribution to the income earner, and reports the amount returned to the income earner to the Incomes Register:

Generally speaking, corrections to an employee's earnings-related pension insurance and unemployment insurance contributions are reported in the report for the pay period during which the income is corrected, for example in the report used to correct the overpayment and change it into an unjust enrichment. The same calculation bases are used in the replacement report as in the original report, for example, the original contribution percentage.

An employee's earnings-related pension insurance and unemployment insurance contributions can also be corrected in the report used to report the recovery of the overpayment, i.e., in the report submitted once the income earner has paid back the overpayment. This is only possible if the contributions are corrected during the same calendar year. If the correction is made after the calendar year in question, the employee contributions must be corrected by reporting an unjust enrichment.

It is recommended that an employee's earnings-related pension insurance and unemployment insurance contributions be corrected in the report in which the unjust enrichment is reported. The reporting of unjust enrichment is described in more detail, including examples, in Section 3.1 Unjust enrichment.

Correcting a collected contribution when the amount was too small

In some situations, the law prevents the employer from collecting overly small contributions from the income earner in later wage payments. For example, if an employee's earnings-related pension insurance or unemployment insurance contribution has not been collected due to an obvious error during the payment of wages, the employer can collect the uncollected contribution during the next two wage payments, but not after that.

In situations involving corrections, the payer reports the amount collected from the income earner to the Incomes Register.

Correcting a submitted report when the lower limit for earnings-related pension insurance is exceeded during the same month is described in Section 6.3 Correcting Exception to insurance information.

3.2.2 Correcting employee's health insurance contributions

When the income earner is a resident taxpayer, the employee's health insurance contribution is always included in the tax withholding. For this reason, in general the health insurance contribution of an income earner who is a resident taxpayer is not separately reported to the Incomes Register.

If an employee who is a non-resident taxpayer is covered by the Finnish social security, the health insurance contribution of a non-resident taxpayer must be collected separately in addition to tax at source, unless the non-resident taxpayer wishes to be taxed in accordance with the tax procedure act (laki verotusmenettelystä 1558/1995), in which case the health insurance contribution is included in the withholding tax or prepayment of tax. If the health insurance contribution has been collected separately and the paid income or part of it changes to an unjust enrichment, the health insurance contribution is corrected in the same report in which the recovery of the income is reported. Unlike in the correction of an employee's earnings-related pension insurance and unemployment insurance contributions, the health insurance contribution cannot be corrected until the income has been recovered.

The instructions Reporting data to the Incomes Register: international situations describe the information correction procedure when tax at source and health insurance contributions have been collected from an income earner who is a non-resident taxpayer, but the income earner becomes a resident taxpayer, in which case the information previously reported as tax at source and the employee's health insurance contribution is reported as tax withheld using a replacement report.

4 Recovery of a payment

4.1 General information on the recovery of wages and other payments

When the income earner pays back a mistakenly paid unjust enrichment or other payment to the payer, the payback must be reported to the Incomes Register. The recovered amount is not corrected on the original report; the recovered amount is reported during the pay period in which the income is recovered. 'Action type' is 'New report'.

The following information is provided for the recovered income:

- Income type

- Recovery – Yes

- Recovered amount

- Recovery date

- Withholding from the recovered amount (if net recovery)

- Original pay period

Additionally, the following information on the recovered income can be provided as complementary additional data:

- Earnings period of the recovered income

- Original payment date

The payment can be recovered as a gross amount (so-called gross recovery) or as a net amount (so-called net recovery).

The most common ways of gross recovery are:

- An invoice is sent to the income earner, who pays it.

- The overpayment is recovered from the income earner's net wages (the full amount of the overpayment is recovered from the income earner's net wages after taxes and employee contributions).

- The overpayment is set off from a later payment made to the income earner, for example by reducing the amount of gross wages (handling the overpayment as advance pay, which is not recommended).

In the case of net recovery, the amount is recovered from the income earner as a net amount, i.e., tax is withheld from the amount before recovery. If the recovery is done as a net amount, the tax withheld from the amount recovered from the employee is reported under 'Withholding from the recovered amount'. When this entry is used, the withholding is not reported as a negative value. The amount of withholding reported here is taken into account in the payer's withholding obligation for the original wage payment month.

When the income data is corrected to an unjust enrichment, the payer must correct the reported employer's health insurance contribution using an employer's separate report. Although the employee's earnings-related pension insurance and unemployment insurance contributions can be corrected in the report submitted for an unjust enrichment, the tax withheld cannot be corrected until the overpayment has been recovered from the income earner.

This section uses examples to describe how the information is reported to the Incomes Register, if the payment is recovered as a gross or net amount. The section also includes a description of how to report when the overpayment is handled as advance pay paid to the income earner.

4.2 Net recovery

Net recovery means that the payer recovers the overpayment from which it has first deducted the share of tax withholding from the income earner. The Tax Administration credits the share of tax withholding to the payer.

The income can be recovered from the income earner as a net amount, if the income is paid back during the same year or in the beginning of the next year. The previous year's taxation has not yet been completed, and the income has therefore not been accredited to the income earner. The Tax Administration will allocate the correction to the tax withholding to the tax withholding obligations for the original payment month. If the recovery takes place so late in the year, following the payment year, that the correction cannot be taken into consideration in open taxation for the payment year, the amount must be recovered as a gross amount (see Section 4.3, Gross recovery). The payer must check with the Tax Administration to find out whether the taxation has already been completed. If this is the case, net recovery is no longer possible.

When the income is recovered as a net amount, and the tax withheld from the recovered amount is reported separately, the tax withholding amount that is the payer's employer obligation for the period in question is reduced. Additionally, based on the information in question, the Tax Administration will also correspondingly reduce the amount of tax withholding previously accredited to the income earner. Tax withheld from the recovered income is reported as the amount originally withheld from the overpayment. Even a change in the tax withholding percentage after the overpayment does not affect this.

Even if the income is recovered as a net amount, the recovered overpayment is reported to the Incomes Register as the amount of the overpayment. Tax withheld from the recovered amount is reported as separate information, and tax withholding is not deducted from the amount of the recovered income.

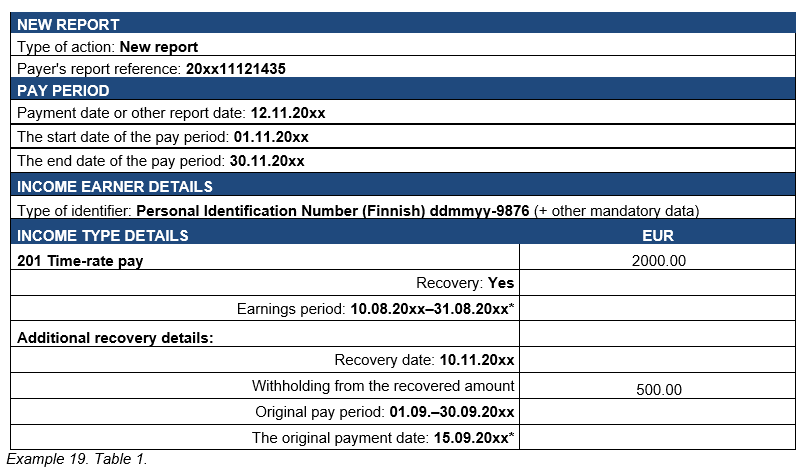

Example19 (Overpayment is recovered as a net amount): In November (10 November), the income earner pays back a EUR 2,000 overpayment paid to her in September (see Example 12, Table 2). The employer recovers the payment as a net amount from the income earner.

*The earnings period and the original payment date are complementary additional data; however, providing them is recommended. The additional recovery data, 'Original pay period', is mandatory. The payer is also recommended to report the Original date of payment in recovery cases, as the Finnish Tax Administration needs this information for allocating the withholding from the recovered amount to the correct tax period.

When the payment is recovered from the income earner as a net amount, the payer reports the tax withheld using the 'Withholding from the recovered amount' entry. In the net recovery in Example 19, the actual amount recovered from the income earner is EUR 1,500. The tax withholding amount for September that is the payer's employer obligation is correspondingly reduced. Even then, the amount of the recovered income type is reported as an amount of EUR 2,000.

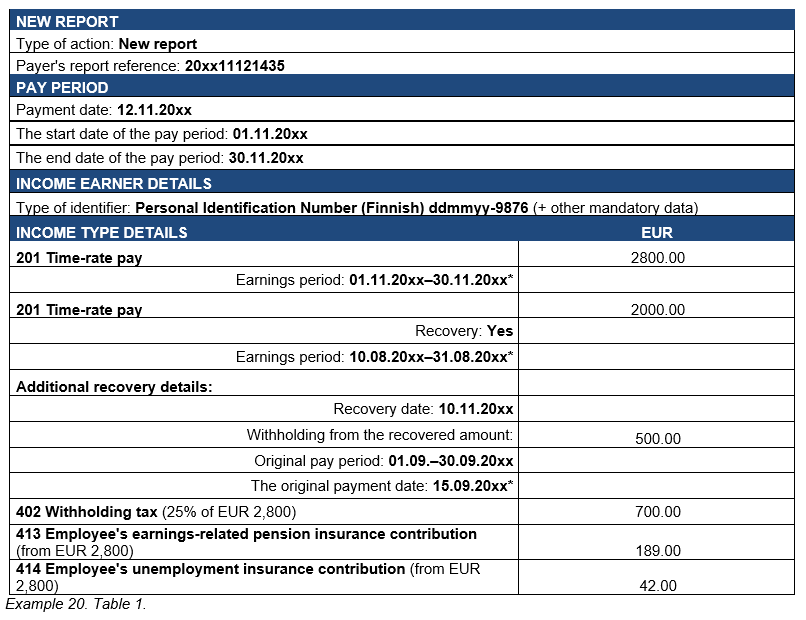

Example 20 (Overpayment is recovered as a net amount, other income is also paid to the income earner at the same time): If, in the previous example, the income earner were paid the normal monthly wages of EUR 2,800 at the same time, it could have been reported in the same report as the recovery.

*The earnings period and the original payment date are complementary additional data; however, providing them is recommended. The additional recovery data, 'Original pay period', is mandatory. The payer is also recommended to report the Original date of payment in recovery cases, as the Finnish Tax Administration needs this information for allocating the withholding from the recovered amount to the correct tax period.

In Example 20, the payer's employer contribution obligation on self-assessed taxes for September is reduced by EUR 500, so, in practice, the payer pays EUR 200 to the Tax Administration in November, as tax withheld from the income earner's income.

If the employee's social insurance contributions were not already corrected in an earlier replacement report, the payer could report them as lower amounts in the report.

If the payment previously made in Example 20 had been reported using the reporting method 1 for monetary wages using the 'Total wages' income type, the amounts paid using the 'Time-rate pay' income type and the amount recovered using the 'Total wages' income type should be reported on separate reports, because reporting method 1 information cannot be submitted in the same report as reporting method 2 information.

4.3 Gross recovery

Gross recovery means that the overpayment is recovered from the income earner as a gross amount, or in the same amount that was paid to the income earner. The recovered amount includes the withheld tax. In gross recovery, the payer can, for example, send an invoice to the income earner, or recover the overpayment at a later date from the net wages paid to the income earner.

Gross recovery with an invoice or other such claim may come into question when no more wages or other payments will be paid to the income earner. The payer cannot then set off or recover income from a payment made later; instead, the income must be recovered from the income earner as a gross amount. The income earner must pay the overpayment back to the payer in the same amount.

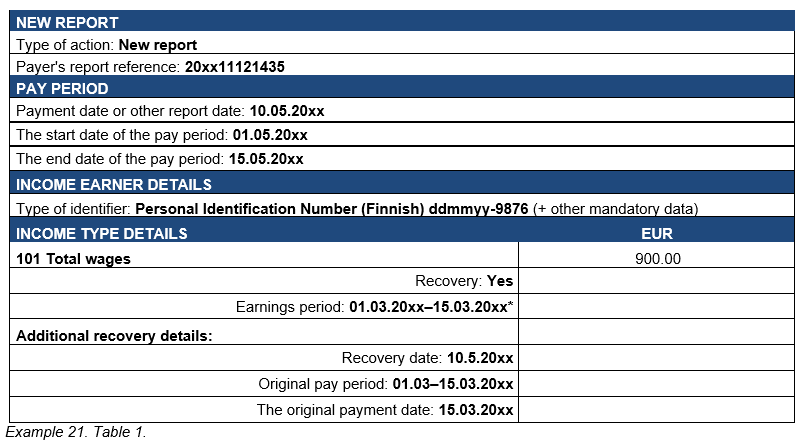

Example 21 (Gross recovery of an overpayment): The income earner was mistakenly overpaid EUR 900 in wages in connection with the last wage payment (EUR 4,500) in March. The payer has withheld tax, collected the employee's earnings-related pension insurance and unemployment insurance contributions, and paid the employer's social insurance contributions based on the gross amount of EUR 4,500. The payer has reported the paid income to the Incomes Register using the 'Total wages' income type.

When the overpayment was noticed, the payer corrected the previously submitted report and reported the overpayment as an unjust enrichment, at which time the payer corrected the amount of the social insurance contributions and corrected the employer's separate report (see Section 3.1, Unjust enrichment, 3.2, Correcting the employee's social insurance contributions, and Section 7, Correcting an employer's separate report).

The payer has sent an invoice to the income earner for the EUR 900 overpayment. The income earner pays back the payment on 10 May. When the income earner pays back the overpayment, the payer (employer) reports the amount paid back to the Incomes Register:

*The earnings period and the original payment date are complementary additional data; however, providing them is recommended. The additional recovery data, 'Original pay period', is mandatory. The payer is also recommended to report the Original date of payment in recovery cases, as the Finnish Tax Administration needs this information for allocating the withholding from the recovered amount to the correct tax period.

Gross recovery also comes into question when the overpayment, such as wages, is recovered after taxation for the year of payment has ended and the income earner has already been taxed for the wages, tax has been withheld from the wages, and the social insurance contributions collected from the employee have been accredited in taxation. The payer can then no longer recover the payment as a net amount.

Correspondingly, gross recovery comes into question when the payer recovers the overpayment from net wages paid to the income earner at a later date. It should be noted that the Employment Contracts Act (55/2001) restricts the employer's right to set off overpayments in certain situations.

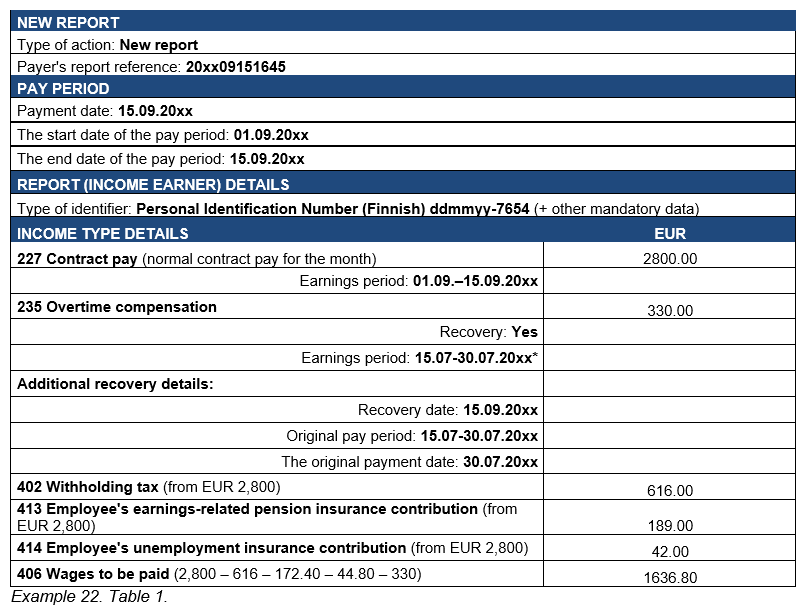

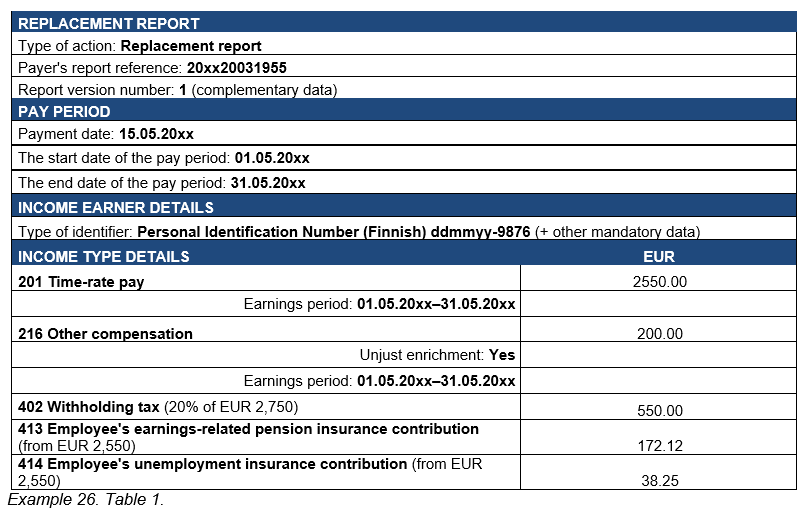

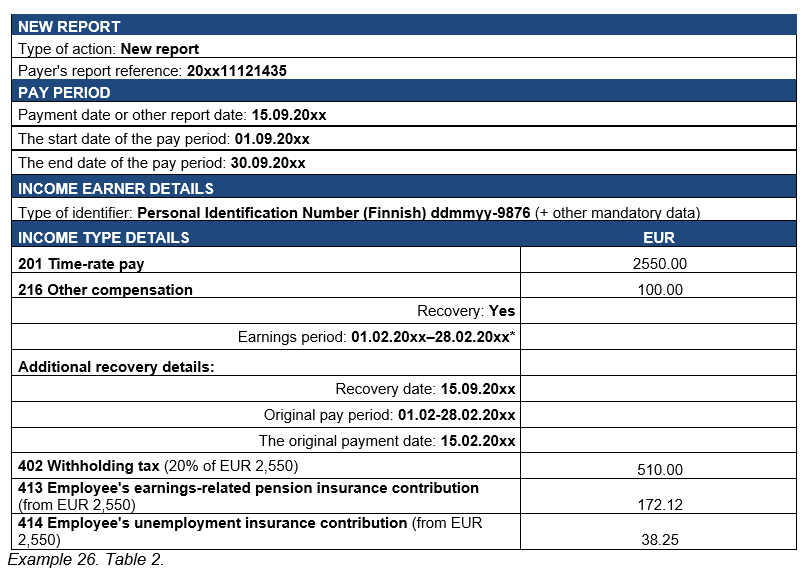

Example 22 (Overpayment is recovered from the net wages paid to the income earner): In July, the income earner was overpaid EUR 330 in overtime compensation. The payer has corrected the report submitted for July and reported the payment of EUR 330 as an unjust enrichment. In the replacement report submitted for July, the payer has reduced the amounts of the employee's earnings-related pension insurance and unemployment insurance contributions to match the correct amount.

In September, the income earner is paid normal monthly pay of EUR 2,800. The payer and the income earner agree that the payer will recover the overpayment (EUR 330) from the income earner's September net wages after the withholding of tax and the collection of the employee contributions. The income earner's withholding percentage is 22.

* The earnings period is voluntarily submitted complementary additional data.

In the example, the payer had already reduced the amounts of the employee's earnings-related pension insurance and unemployment insurance contributions to match the correct amount in the replacement report submitted for July. If the payer had not corrected the amount in the July report, the payer could correct the employee contribution in the September report, or the report in which the recovery is reported. The employee's earnings-related pension insurance and unemployment insurance contribution would then be paid based on EUR 2,470 (2,800 – 330 = 2,470).

If the payment previously made in Example 22 had been reported using the reporting method 1 for monetary wages using the 'Total wages' income type (instead of the 'Overtime compensation' income type), the amounts paid using the 'Contract pay' income type and the amount recovered using the 'Total wages' income type should be reported in separate reports, because reporting method 1 information cannot be submitted in the same report as reporting method 2 information.

If the income is recovered from the income earner as a gross amount, the payer does not deduct the tax withheld from the recovered amount. The recovery of the wages decreases the amount of tax in the income earner's taxation. Once the income earner has paid back the overpayment and the payer has reported it to the Incomes Register, the Tax Administration will take the recovery into consideration in the income earner's taxation, by correspondingly reducing the income earner's income amount. The Tax Administration will take the amount of recovered income into account in taxation, if the person's taxation for the year in question has not yet been completed. If the recovery takes place later, the income earner must submit a claim for adjustment to the Assessment Adjustment Board.

With respect to reporting the recovery, it does not matter whether the information was reported to the Incomes Register using reporting method 1 for monetary wages (the so-called lower level of detail for reporting monetary wages) or reporting method 2 (the greater level of detail for reporting monetary wages). The reporting procedure is the same, no matter which method was used to report the information.

In reporting method 1, you must remember to report the allocation of the recovery to the earnings from work reported using income subtypes. Additionally, you must remember to report the Type of insurance information data connected to the recovered income according to the actual situation.

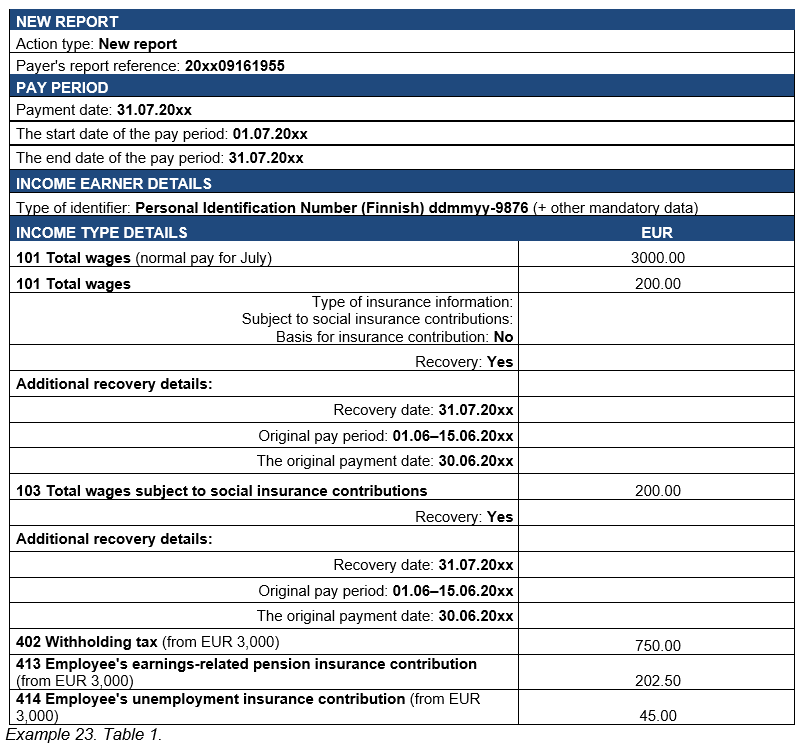

Example 23 (Reporting recovery using reporting method 1, when the report has included income subtypes): The income earner has been paid EUR 2,500. The amount includes EUR 500 of notice period compensation, which is not subject to social insurance contributions. Later, the payer notices having paid EUR 200 too much in wages. The amount of the notice period compensation was correct. The payer has reported the income to the Incomes Register as an unjust enrichment (see Example 16).

The overpayment (EUR 200) is recovered from the income earner during the July wage payment. The income earner's normal pay for July is EUR 3,000.

4.4 Recovered amount includes several income types

In some cases, the recovered amount can include several income types, such as time-rate pay, overtime compensation, and holiday bonus, for which one shared tax withholding has been carried out. In such cases, the recovered income types must be reported separately, but the tax withheld from the recovered amount can be reported as a total amount. Correspondingly, employee contributions collected from the overpayment can be deducted from other employee contributions.

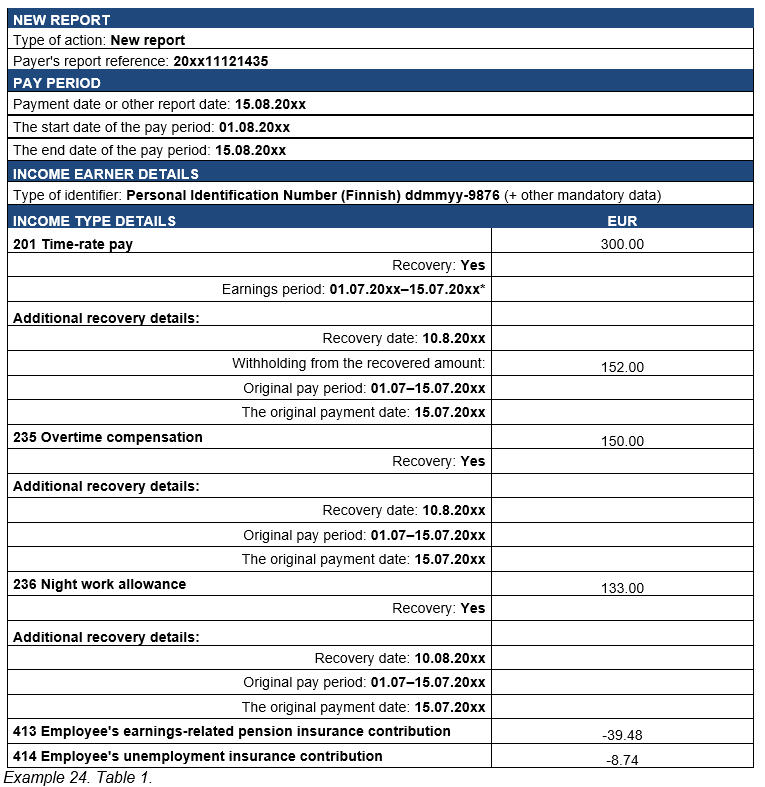

Example 24 (Several different income types are recovered from the income earner): The income earner has been paid EUR 583 too much in July. The amount consists of EUR 300 in time-rate pay, EUR 150 in overtime compensation, and EUR 133 in night work allowance. The payer has withheld EUR 152 in tax and collected the employee's earnings-related pension insurance contribution EUR 39.48 and unemployment insurance contribution EUR 8.74 from the overpayment. The payer has submitted a replacement report for July and specified the above-mentioned payments as unjust enrichment.

The income earner pays back the amount in August. The payer (employer) deducts the tax withheld (EUR 152) from other withheld tax to be paid to the Tax Administration. Correspondingly, the payer can deduct the employee contributions (totalling EUR 48.22) collected from the overpayment from other payments made to the pension provider and the Employment Fund, unless the payer has already reduced the amount in the report reporting the unjust enrichment. In practice, the amount recovered from the income earner is EUR 382.89. The payer reports:

If, in Example 24, other income subject to social insurance contributions is paid to the income earner at the same time, the employee's social insurance contributions could be deducted from other contributions collected from the income earner. This would eliminate the need to report a negative number.

*The earnings period and the original payment date are complementary additional data; however, providing them is recommended. The additional recovery data, 'Original pay period', is mandatory. The payer is also recommended to report the Original date of payment in recovery cases, as the Finnish Tax Administration needs this information for allocating the withholding from the recovered amount to the correct tax period.

4.5 Amount is recovered in several instalments

The overpayment can be recovered from the income earner in several instalments. The payer will report the part of income recovered at the time in question as recovery information. The total amount is not reported. When the error is detected, the original report is corrected with a replacement report and the entire overpayment is marked as an unjust enrichment. However, the recovery is reported in the report for the pay period during which the income is recovered.

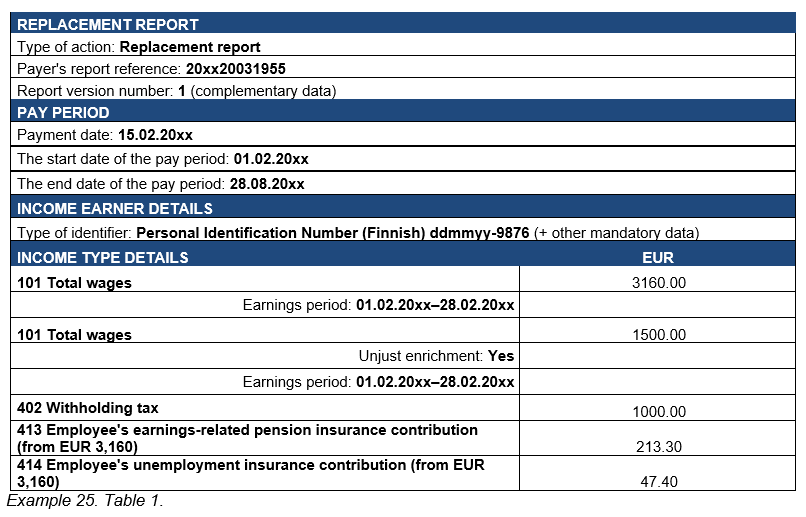

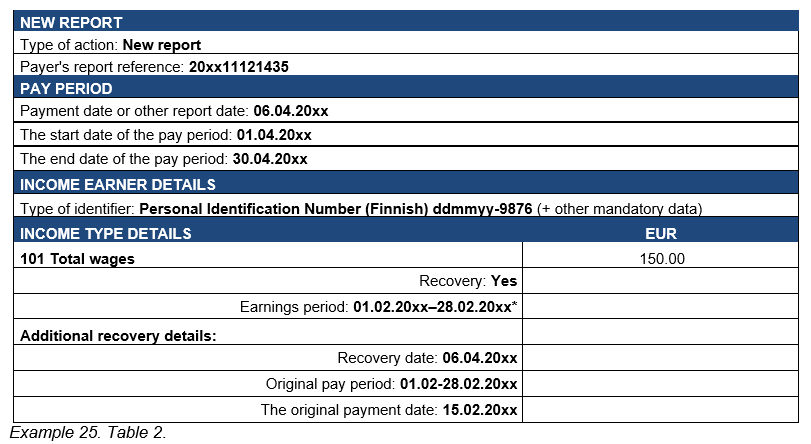

Example 25 (Amount is recovered in several instalments): The income earner was paid an overpayment of EUR 1,500 in February in addition to the normal wages of EUR 3,160. The income was originally reported using the 'Total wages' income type. The payer corrects the report submitted for February and marks the overpayment as an unjust enrichment.

In a replacement report, the payer reports the overpayment as an unjust enrichment:

The payer and the income earner have agreed that the income earner will pay back the overpayments in EUR 150 monthly instalments. The payment is recovered from the income earner as a gross amount. The income earner pays the first instalment in April (6 April).

The payer reports the repayment of the overpayment in instalments:

If income were paid to the income earner at the same time, it could be reported in the same report.

*The earnings period and the original payment date are complementary additional data; however, providing them is recommended. The additional recovery data, 'Original pay period', is mandatory. The payer is also recommended to report the Original date of payment in recovery cases, as the Finnish Tax Administration needs this information for allocating the withholding from the recovered amount to the correct tax period.

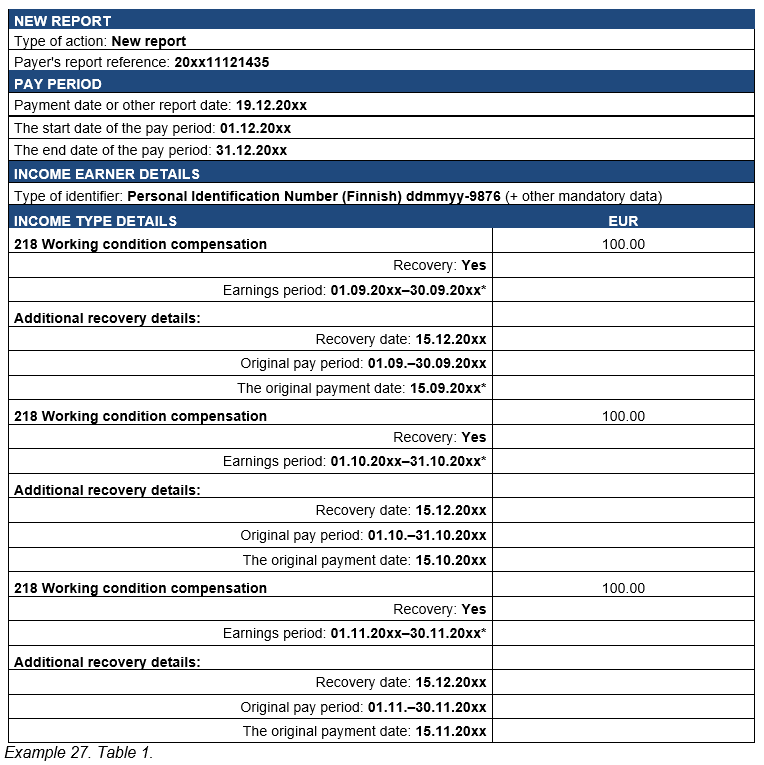

4.6 The overpayment has been paid for a longer period and is recovered in instalments

The overpayment can have been paid to the income earner over several pay periods before the error is detected. The previous pay period and payment date on which the income was originally paid to the income earner is reported in the additional recovery information.