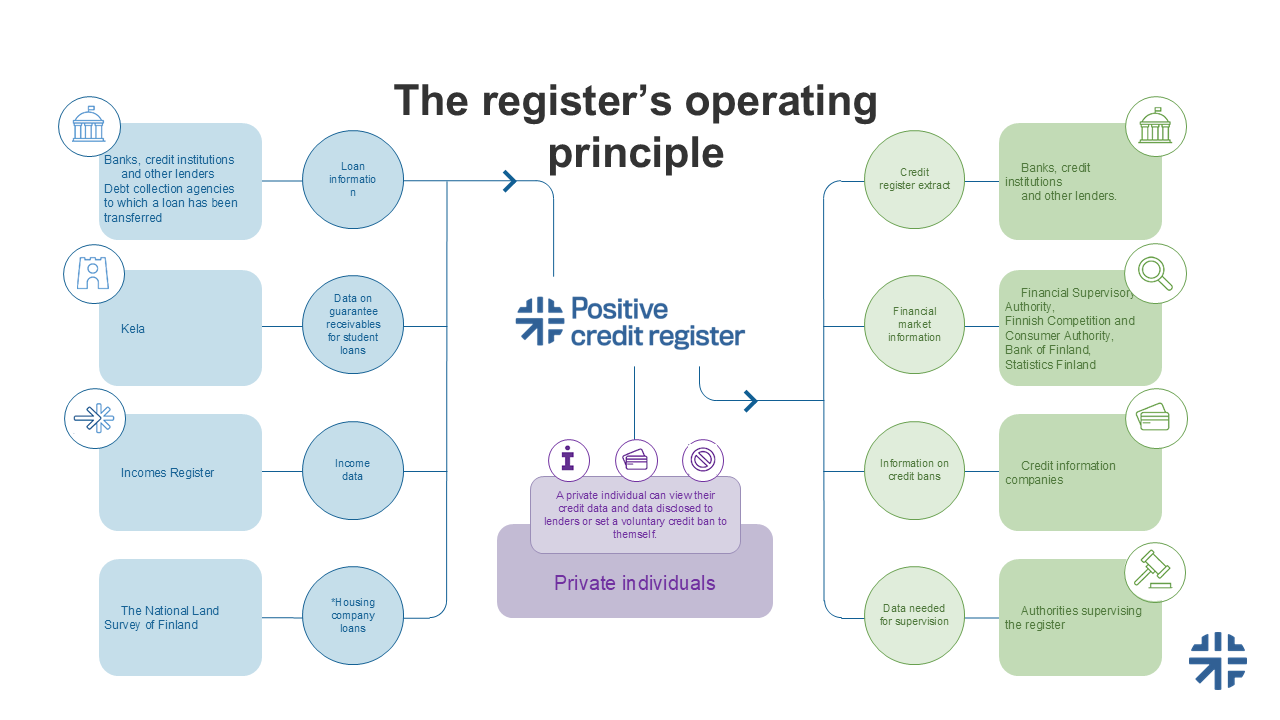

How does the register work?

The Positive credit register gathers information on the credits issued to Finnish individuals, and gathers information on their current income. The aim is to:

- prevent households from taking on too much debt

- improve lenders’ ability to test the creditworthiness of loan applicants

- assist individuals who want to manage their finances better

- provide a source of reliable information on the credit market

provide an easier method of follow-up and control for the public bodies that supervise the market

The Positive credit register offers

- Better opportunities for credit institutions and other lenders to ascertain customers' ability to pay back debts.

- New ways to monitor the financial market for public authorities.

- A real-time view for private individuals of their credit information with an added voluntary option to establish a personal ban on credits.

Credit institutions send information to the register on the loans they issue and on any changes in the loan contracts. Examples of reportable changes include received amortizations, and revised contract terms.

- When a private individual applies for a loan, the lender is required to check their creditworthiness

- For this, the lender requests a credit register extract from the Positive credit register

- The extract contains up-to-date information on applicant’s loan contracts and current income.

Private individuals can view their personal credit information. They can set up a voluntary credit ban free of charge.

The public authorities which the legal act enumerates can utilize data from the Positive credit register for carrying out their legal duties. For example, the Financial Supervision Authority, the Bank of Finland, the Financial Stability Authority, the Finnish Competition and Consumer Authority and Statistics Finland are the authorities that will utilize the data.

The register’s data content will increase gradually

The Positive credit register was introduced on 1 April 2024. However, new data content will be added gradually to the register.

- In the first phase of the register, consumer credits and comparable loan data were reported to the register.

- In the second phase, starting on 1 December 2025, lenders began to register loans granted to, for example, self-employed persons, farmers and foresters.

- This information is displayed on credit register extracts and in the e-service as soon as the lender has submitted it. Since 1 December 2025, it has also been possible to use the data in consumer credit lending.

- These data may be used for non-consumer credit lending starting on 1 April 2026. For example, this applies to cases where a sole trader applies for a loan for their business activities.

- In the third phase, i.e. in early 2027, data on the apartment-specific credit exposures of housing company loans will be transferred to the register. The data will be received from the National Land Survey’s Residential and Commercial Property Information System.

- This information will be visible on credit register extracts and in the e-service starting on 1 April 2027.