Loan information

Loan information includes information on such loans granted to you that lenders have reported to the register. Lenders report only such loan information to the register that must be reported under the Act on the Positive Credit Register.

Lender is an operator that grants loans. Lenders here refer to all parties that are required to submit reports to the register. The parties with the reporting obligation also include Kela, debt collection agencies that buy debts, other businesses to which the lender’s rights arising from a loan contract are transferred (reassignees), and peer-to-peer loan brokers. All the above operators are referred to as lenders in the register.

The Positive credit register’s e-service is for private individuals wishing to view their personal data. You cannot use the service to make payments to lenders, postpone due dates or contact your lender, for example.

Loan information

The Loan information page shows a summary of the loans that have been granted to you and reported to the Positive credit register. If a loan has ended because you have repaid the loan in full, for example, the loan is not shown in the e-service, nor on the credit register extract.

The loans are divided into lump-sum loans, running-account loans and leasing contracts. The total amount of loans and the total amount of delayed amounts, if any, are shown.

Loan information is not updated in real time because lenders report up-to-date information within the time limits prescribed by law. Usually the delay is a few days. The most up-to-date information on your loan is available from the lender or from your online bank, for example.

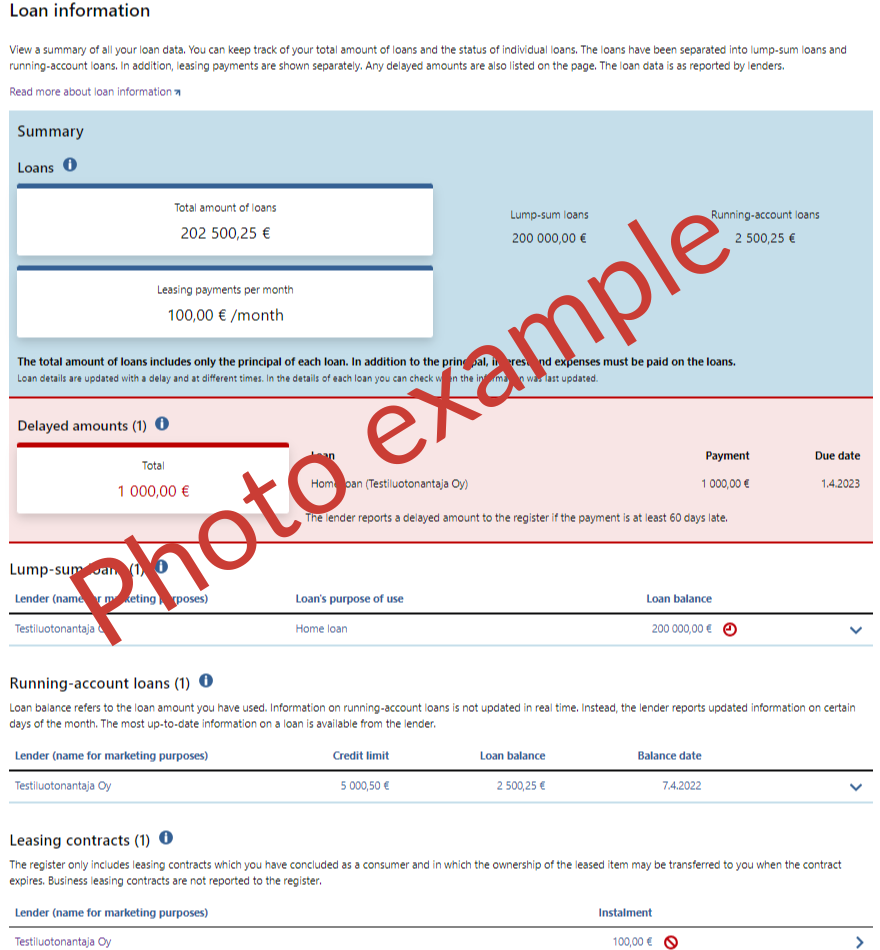

Figure 1: Example of the Loan information page

Summary

In the Summary section, you can see the total amount of lump-sum loans and running-account loans granted to you, and the total amount of monthly instalments of leasing contracts. The total amount usually contains only the loan principal, i.e. it does not necessarily include all interest or all loan-related expenses. If you have been granted loans in different currencies, note that the total amount of loans is shown per currency.

Lump-sum loans

Lump-sum loans include one-off loans offered by banks, such as home loans, student loans and consumption loans. Lump-sum loans also include instant loans. In lump-sum loans, the lender and the borrower agree on the loan principal and the period of repayment. Further, Kela reports guarantee receivables for student loans to the register, and they too are regarded as the lump-sum loans.

If lump-sum loans granted to you have been reported to the register, they are shown as a list. If no lump-sum loan has been reported to the register, you see the text 'No lump-sum loans have been reported to the register.

The header line shows the number of loans on the list in brackets, and the info button, through which you will find more information. If you want to view the details of any particular loan, click on the line of the loan in question. If you want to see all up-to-date information reported on the loan, select Open all details. The loan balance of a lump-sum loan refers to the loan principal, excluding interest or expenses.

View all details of a lump-sum loan

Running-account loans

Running-account loans include credit cards and accounts with credit facilities, for example. In a running-account loan, the lender and the borrower agree on the credit limit, i.e. the maximum amount of credit available. The borrower can use the credit on a continuous basis until the credit limit is reached. After paying the debt or part of it, credit is available again. The register shows the information of a valid contract on a running-account loan even if you do not actively use the loan or if you always repay the amount you have drawn by the due date at the latest.

If running-account loans granted to you have been reported to the register, they are shown as a list. If no running-account loan has been reported to the register, you see the text 'No running-account loans have been reported to the register.

The header line shows the number of loans on the list in brackets, and the info button, through which you will find more information. If you want to view the details of any particular loan, click on the line of the loan in question. If you want to see all up-to-date information reported on the loan, select Open all details. Loan balance refers to the amount of credit you have used. The register does not include information about amortizations of running-account loans or individual credit card payments.

View all details of a running-account loan

Leasing contracts

Leasing generally refers to long-term rental of an item. A leased item may be a car, for example, for which you pay a certain monthly payment agreed on in advance. The register includes only leasing contracts which you have concluded as a consumer and in which the ownership of the leased item can transfer to you when the contract expires. In other words, leasing contracts that involve only renting and whose terms and conditions stipulate that the ownership of the item cannot transfer to you are not stored in the register. Business leasing contracts are not reported to the register at all.

If leasing loans granted to you have been reported to the register, they are shown as a list. If no leasing contract has been reported to the register, you see the text 'No leasing contracts have been reported to the register.'

The header line shows the number of loans on the list in brackets, and the info button, through which you will find more information. By clicking a loan, you will see all up-to-date information on the loan reported to the register.

View all details of a leasing contract

Delayed amounts

Lenders report payments that are at least 60 days late to the register. If your loans have delayed amounts, the amounts are displayed both individually and all together. If a loan has delayed amounts, they are also shown for the loan in question.

For each delayed amount, the register shows the amount that fell due on the original due date, and the original due date. A delayed amount may differ from the amount specified in the letter you received from the lender or debt collection agency, for example, because the payments reported to the register do not always include interest or expenses. If your loan has been accelerated to be paid in full, no delayed amounts are shown for the loan. Information on delayed amounts is removed from the register when you pay a delayed amount in full and the lender reports it to the register.

If the lender agrees with you on a new payment plan regarding the payment of the delayed amount, the lender will remove the delayed amount from the register. If instalments of the new payment plan are delayed, the lender will report them to the register in the same way as they reported the delayed amounts of the original payment plan.

Accelerated loans

Acceleration means that the lender requests that the future instalments or the entire loan should be paid off before they are due.

Lenders report the acceleration to the register only if the reason for it is delayed amounts. If a lender reports that a loan has been accelerated, the delayed amounts relating to the loan are removed from the register.

If one or more of your loans have been accelerated, the loan amounts are shown both individually and all together. However, the total amount does not contain accelerated leasing loans. Information on the acceleration is also shown in the details of each accelerated loan.

Symbols indicating loan status

|

A clock face symbol means that the loan has a delayed amount. |

|

An x inside a circle means that the loan has been accelerated. |

|

A prohibition symbol means that you have denied the accuracy of loan data. Denying loan data means that you think there is an error in the data and have requested that the processing should be restricted in accordance with the EU General Data Protection Regulation. In spite of this, your loan data may be disclosed to lenders on a credit register extract. However, when lenders see that accuracy has been denied, they understand that there may be an error in the loan data. |

|

An exclamation mark means one of the following:

In these situations, the loan data you see is more limited than usual. |

|

An arrow pointing right means that the loan has been transferred to another lender. The transfer of a loan refers to a situation where the lender has sold the loan to another lender or the loan has been transferred to another organisation within the same group. The loan will be removed from the register within a few days, and the new lender will then report the loan to the register. Sometimes a transferred loan may be shown as a duplicate entry in the register for a few days. |

What information is not shown in the register, and why not?

Information not reported to the register

Lenders report only such loan information to the register that they are required to report under the Act on the Positive Credit Register. According to the Act, payment defaults and information that a loan is in debt recovery or being recovered by enforcement, for example, are not reported to the register.

In general, lenders are only obligated to report loans that need to be reported to the register, and changes to such loans, and only insofar as the information is reasonably accessible to them.

Delayed amounts and acceleration

Lenders report to the register if a loan has been accelerated to be paid in full due to a delayed amount. Only loans that have been accelerated due to a delayed amount are shown in the register as accelerated loans. Loans accelerated for other reasons are shown in the register normally, without information on acceleration.

Amortizations

On lump-sum loans, you will see only the latest amortization. The amortization data on the Loan details page is updated whenever the lender reports a new amortization. In other words, you cannot view your loan amortization history, for example, in the e-service.

Lenders report less information on running-account loans than on lump-sum loans. On running-account loans, the register does not contain any information on amortizations, for example, but only the amount of loan balance.

Leasing

The data content that lenders report on leasing contracts is different from that of lump-sum loans. For example, the register does not contain information on the monthly instalment you paid last but only on the amount of monthly instalment agreed on with the lender.

Debt arrangement and business restructuring

If your loan is included in a debt arrangement payment plan or a business restructuring program confirmed by a court of law, the lender reports only certain information on the loan. Because of this, you will see only limited information on the loan. If the loan has several co-debtors and one of them is in a debt arrangement, all debtors will see limited loan data. After the debt arrangement payment plan or the business restructuring program lapses, the lender will report data normally again.

Missing information

The register may contain less information on old loans than on new ones. Old loans refer to loans granted before the introduction of the register in spring 2024. The missing information may include, for example, the date of conclusion, one-time charges paid when a loan contract is concluded, information whether a loan falls within the scope of the Consumer Protection Act, and information whether a loan relates to goods or services.

If you are added as a new debtor to a specific loan only after the lender has reported the loan to the register, you will see only loan information updated to the register after you became a co-debtor.