VAT special scheme

- Date of issue

- 1/13/2021

- Validity

- 1/1/2021 - Until further notice

This is an unofficial translation. The official instruction (record number VH/8600/00.01.00/2020) is drafted in Finnish and Swedish languages.

You can read more about Brexit´s impact on how to report VAT and how to correct the VAT return here.

Section 3.2 has been updated due to the legislative changes that came into force on 1 January 2021. Because of the changes, the VAT registration threshold was increased from €10.000 to €15.000.

The guidance has been updated due to the legislative changes that came into force on 1 November 2019. These changes are provided by the act on the amendment of the Value Added Tax Act (Laki arvonlisäverolain muuttamisesta 342/2019), the act on the amendment of § 38 and § 71 of the act on tax collection (Laki veronkantolain 38 ja 71 §:n muuttamisesta 343/2019) and the act on the amendment of the act on surtax and late-payment interest (Laki veronlisäyksestä ja viivekorosta annetun lain muuttamisesta 344/2019).

The guidance has also been updated because MyTax has replaced the special scheme e-service.

Sections 3, 4, 5.1, 5.2, 5.5, 6, 6.1–6.4 and 8.5–8.12 have been changed.

The guidance has been updated due to the changes that came into force on 1 January 2019. These changes are provided by Council Directive (EU) 2017/2455, the act on the amendment of the Value Added Tax Act (Laki arvonlisäverolain muuttamisesta 545/2018) and the act on the amendment of the act on exceptions to the excise duty legislation regarding the Åland Islands (Laki Ahvenanmaan maakuntaa koskevista poikkeuksista arvonlisävero- ja valmisteverolainsäädäntöön annetun lain muuttamisesta 546/2018). In addition, technical changes have been made to the guidance document.

Sections 1, 3.1.2, 3.1.3, 3.2, 3.3, 4.2, 8.2 and 8.4 have been changed.

1 Introduction

As a rule, telecommunications services, radio and television broadcasting services (hereafter: broadcasting services) and electronic services sold to other than businesses (hereafter: consumers) are taxable in the country where the buyer is established. The seller can file and pay VAT on the supply of such services in the VAT special scheme: A seller established in the EU VAT area can use the Union scheme, and a seller established outside the EU VAT area can use the non-Union scheme. These schemes are in use in all the EU countries.

More information about the services included in the special scheme and about the rules of place of supply is available in the Tax Administration guidance on VAT treatment of telecommunications, broadcasting and electronic services (available in Finnish and Swedish).

A business established in an EU country can use the special scheme when selling telecommunications, broadcasting or electronic services to consumers in EU countries where the business does not have its place of establishment or a fixed establishment. A business established in a non-EU country can use the special scheme when selling telecommunications, broadcasting or electronic services to consumers within the EU.

A business using the special scheme attends to its filing and payment obligations related to VAT payable for the supply of telecommunications, broadcasting and electronic services in a concentrated manner through a single EU country. A business not using the special scheme is obliged to register for VAT in the EU countries where it sells telecommunications, broadcasting or electronic services to consumers.

After registering as a special scheme user, the business must report all sale transactions covered by the special scheme through the scheme.

The VAT special scheme is provided by Council Implementing Regulation (EU) 2011/282, Council Regulation (EU) 2010/904 and Commission Implementing Regulation (EU) 2012/815, as well as national VAT legislation. The EU regulations are directly applicable. The Commission has also published a guide on the special scheme. The guide is not binding.

2 Concepts related to the special scheme

This sections defines concepts related to the special scheme.

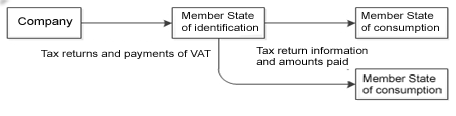

Member State of identification

The Member State of identification is the EU Member State where the business registers for the special scheme, files the VAT returns and pays the tax. The Member State of identification forwards the tax return information and the payments to Member States of consumption. The tax procedure applied to sales in the Member State of identification is discussed in sections 3.1.1–3.1.3. and 5.

Member State of consumption

The Member State of consumption is an EU Member State where telecommunications, broadcasting or electronic services are considered to have been sold according to the rules of place of supply. The Member State of consumption receives the tax return information and the payments it is entitled to from the Member State of identification.

Member State of establishment

The Member State of establishment is an EU Member State where the business using the VAT special scheme has a fixed establishment. The tax procedure applied to sales in the Member State of establishment is discussed in sections 3.1.1., 3.1.3 and 5.

3 Scope of the special scheme

The special scheme is applied only to telecommunications, broadcasting and electronic services sold to consumers established in the EU area.

Consumer here refers to a natural person or a legal person that has not been registered for VAT. However, in the supply of telecommunications, broadcasting and electronic services, any buyer that does not state a valid VAT number to the seller may be considered to be a consumer.

More information about the service definitions and about the rules of place of supply is available in the Tax Administration guidance on VAT treatment of telecommunications, broadcasting and electronic services (available in Finnish and Swedish).

Sales of telecommunications, broadcasting and electronic services are covered by the national legislation of the Member State of consumption even though the tax paid on the sale in the special scheme goes to the Member State of identification. National rules apply, for example, to the VAT rate, invoice requirements, temporal allocation of sales, adjustment items, penalty fees and late-payment charges. Some of Finland’s national rules area discussed in section 8.

3.1 The place of establishment

A business using the special scheme uses either the Union scheme or the non-Union scheme, depending on whether the business is established in an EU country or a non-EU country.

When registering as a special scheme user in Finland, the business specifies its place of establishment. The place of establishment determines whether the Union scheme or the non-Union scheme will be applied.

3.1.1 Business established in a EU country

A business established in a EU country is a company or organisation that has its place of establishment of a business or a fixed establishment within the EU. These businesses can use the Union scheme.

The concepts “place of establishment of a business” and “fixed establishment” are defined in articles 10 and 11 of Council Implementing Regulation (EU) 2011/282, and they are discussed in the Tax Administration guidance on how Regulation (EU) 2011/282 harmonises the interpretation of the VAT directive. If the business does not have a separate place of establishment, its domicile or permanent address is considered to be its place of establishment.

VAT registration does not in itself give rise to a fixed establishment. VAT liability in another EU Member State (for example, VAT liability for distance sales) does not prevent the use of the Union scheme for sales in that EU Member State.

A business using the Union scheme cannot use the special scheme for sales in the Member State of identification and the Member State of establishment.

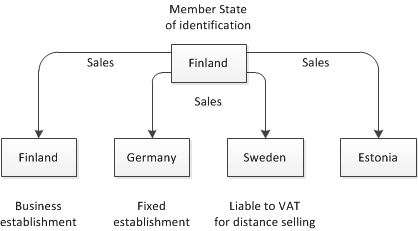

Example 1 (the Union scheme):

The company’s place of establishment of a business is in Finland, so its Member State of identification is Finland. The company has a fixed establishment in Germany. The company has registered for VAT on distance sales in Sweden. The company sells services covered by the special scheme in all the three countries and in Estonia. The special scheme is used only in the case of sale transactions taking place in Sweden and Estonia. Sales in Finland and Germany are reported on these countries’ national tax returns.

3.1.2 Business established outside the EU

A business established outside the EU is a company or organisation that does not have its place of establishment or a fixed establishment within the EU. The business can use the non-Union scheme.

Starting 1 January 2019, the registration of a business established in a non-EU country or its obligation to register for VAT in the EU no longer prevents the use of the non-Union scheme.

A business using the non-Union scheme will also use the special scheme for sales in the Member State of identification.

Example 2 (the non-Union scheme):

The company has its place of establishment in Russia. The company selects Finland as its Member State of identification. The company sells services covered by the special scheme in Finland and Estonia. The special scheme is used for sales both in Finland and in Estonia.

3.1.3 Business established on the Åland Islands

There are special features in the use of the special scheme on the Åland Islands. They are based on the act on exceptions to the value added tax and excise duty legislation related to the Åland Islands (Laki Ahvenanmaan maakuntaa koskevista poikkeuksista arvonlisä- ja valmisteverolainsääntöön 1266/1996) (hereafter: separate statute).

Sale transactions of a business established on the Åland Islands in various situations are presented as a table in the Appendix.

A business established only on the Åland Islands can use the non-Union scheme (see section 3.2.1) even if it is registered for VAT in Finland (§ 25 c of the separate statute).

When the business’s Member State of identification is Finland, the non-Union scheme will also be used for sales to consumers established in mainland Finland and on the Åland Islands. When the business’s Member State of identification is another EU Member State, the non-Union scheme will be used for sales to consumers in mainland Finland, but not to consumers on the Åland Islands (§ 25 d of the separate statute).

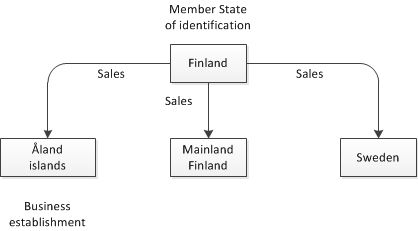

Example 3 (the non-Union scheme):

The company has its place of establishment on the Åland Islands and has no fixed establishments in the EU area. The company registers with the special scheme as a business established in a non-EU country and selects Finland as its Member State of identification. The company sells services covered by the special scheme on the Åland Islands, in mainland Finland and in Sweden. The special scheme is used for all these sale transactions.

A business established on the Åland Islands can use the Union scheme (see section 3.1.1) only if its place of establishment is:

- in mainland Finland or in another EU Member State. In this case, the Member State of identification is the EU country where the business has its place of establishment.

- on the Åland Islands, but the business has a fixed establishment in mainland Finland or in another EU Member State. In this case, the Member State of identification is the EU country where the fixed establishment is located.

- on the Åland Islands, but the business has fixed establishments in several EU Member States. In this case, the business can select its Member State of identification from the EU Member States where it has a fixed establishment.

When the business’s Member State of identification is Finland, the Union scheme cannot be used for sales to consumers established in mainland Finland and on the Åland Islands. When the business’s Member State of identification is other than Finland, the Union scheme will be used for sales to consumers established in mainland Finland (except if the business is established there) but not to consumers established on the Åland Islands.

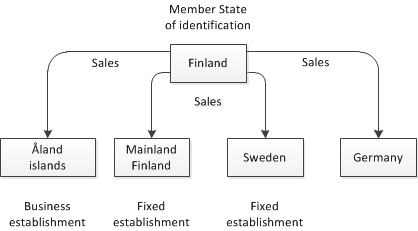

Example 4 (the Union scheme):

The company has its place of establishment on the Åland Islands and a fixed establishment in mainland Finland and in Sweden. The company registers with the special scheme as a business established in an EU Member State and selects Finland as its Member State of identification. The company sells services covered by the special scheme on the Åland Islands, in mainland Finland, in Sweden and in Germany. The special scheme is used for sales in Germany. Sales in mainland Finland, on the Åland Islands and in Sweden are reported on national tax returns.

Situations related to the special status of the Åland Islands where the Member State of consumption is Finland are discussed in greater detail in section 8.8.

3.2 Small entrepreneurs (§ 3, Value Added Tax Act)

A small entrepreneur established in Finland and with a turnover of no more than €15.000 per accounting period does not need to register for VAT.

Tax exemption for small entrepreneurs is not applied when goods or services are sold in an EU Member State where the seller is not established and when the seller must pay VAT to the EU Member State in question (Art. (1) (c) of Council Directive (EU) 2006/112, hereafter: VAT directive). Similarly, the tax exemption for small entrepreneurs is not applied in Finland to foreign entrepreneurs who do not have a fixed establishment in Finland (§ 3, subsection 4 of the Value Added Tax Act).

Because of this, small entrepreneurs are obliged to register for VAT in other EU Member States where they sell telecommunications, broadcasting or electronic services to consumers and where they do not have their place of establishment or a fixed establishment.

A business like this can register as a special scheme user only if it has been registered for VAT in the EU area. If a small entrepreneur registers for VAT in Finland, they will be liable to pay VAT on all sales, not only those covered by the special scheme.

As of 1 January 2019, the sales of telecommunications, broadcasting and electronic services to consumers in other EU Member States are taxable in the country of a seller established in the EU VAT area up to the tax-exempt VAT limit of €10 000 (read more in section 3.1.2 of the Tax Administration guidance on the value added taxation of telecommunications, broadcasting and electronic services). It is therefore no longer necessary for a small entrepreneur established in Finland to register for VAT in another EU Member State for the sales of telecommunications, broadcasting or electronic services to consumers in that other EU Member State up to the tax-exempt VAT limit of €10.000. If the VAT limit of €10 000 is exceeded a small entrepreneur established in Finland has to register for VAT in another EU Member State for the sales of telecommunications, broadcasting or electronic services to consumers in that other EU Member State even though the VAT registration threshold of €15 000 is not exceeded.

3.3 VAT taxpayer group (§ 13 a of the Value Added Tax Act)

VAT taxpayer groups can use the special scheme.

4 Registration for the special scheme

A business wanting to start using the VAT special scheme must submit a registration notice to the Member State of identification.

The Member State of identification is determined as follows:

- If the business has its place of establishment in an EU Member State, the Member State in question is its Member State of identification.

- If the business does not have its place of establishment in an EU Member State but has a fixed establishment in a Member State, the Member State in question is its Member State of identification.

- If the business does not have a place of establishment but has fixed establishments in several EU Member States, it can select a Member State of identification from the Member States in question. The selection is binding to the business for two calendar years, starting from the end of the calendar year during which the selection was made.

- If the business does not have its place of establishment or a fixed establishment within the EU, it can select any EU Member State as its Member State of identification.

The business can have only one Member State of identification at any one time.

When the Member State of identification is Finland, the registration notice is submitted in the Tax Administration’s MyTax e-service. Read more about how to log in to the service and authorise an agent on tax.fi/e-file.

You can use the special scheme only after your registration notice has been accepted. You can find the acceptance or rejection in MyTax. At the business’s request, an appealable decision on the registration can be issued.

4.1 Registration

As a rule, a business is registered from the beginning of the calendar quarter following the filing of the registration notice.

If the business has sale transactions covered by the special scheme before the beginning of the calendar quarter following the registration notice, the registration can become effective on the date of the first sale transaction. The business must notify the Member State of identification of the matter by the 10th day of the month following the sale transaction. In Finland, the notice is submitted in MyTax.

If the notice is not submitted on time, the business will have to register for VAT in those EU Member States where it has had sales covered by the special scheme.

Example 5:

The company submits a registration notice to Finland on 1 February. The company will be registered as a special scheme user on 1 April. However, the company sells goods or services to Germany on 7 February. The company submits the sales details on 9 March and the registration will therefore become effective on 7 February. In this case, the company does not have to register for VAT in Germany.

In the non-Union scheme, the business will be assigned a unique VAT number (of format Euxxxyyyyyz) after the registration notice has been accepted.

In the Union scheme, the business will use its national VAT number assigned previously by the Member State of identification. It is not possible to register as a Union-scheme user without a VAT number, so the Union scheme can be used only by a business with valid VAT registration.

The VAT number of a business established in Finland, used in the Union scheme, consists of the country code FI and a string of digits that is the same as the Business ID without the hyphen between the last two digits.

4.2 Changes to registration details

Special scheme users must report changes in their registration details to the Member State of identification by the 10th day of the month following the date of change.

A business registered in Finland can change its registration details in MyTax.

4.3 Deregistration

A business can notify the Member State of identification that it will stop using the special scheme. In Finland, the notice is submitted in MyTax. As a rule, registration is terminated at the end of the calendar quarter during which the decision was submitted.

Registration with the special scheme can be terminated on the following grounds:

- The business stops selling telecommunications, broadcasting or electronic services to consumers.

- The business deregisters from the special scheme but continues selling services covered by the special scheme.

- The business no longer meets the requirements for using the special scheme (see section 3).

- The business changes its Member State of identification.

Situation 1:

A business terminating the use of the special scheme because it no longer supplies telecommunications, broadcasting or electronic services must notify the Member State of identification no later than on the 10th day of the month following the termination.

Situation 2:

A business wanting to terminate the use of the special scheme regardless of continuing the supply of the services must notify the Member State of identification no later than 15 days before the end of the calendar quarter during which it wants to stop using the special scheme.

If the notice is not filed on time, deregistration will not take effect until the end of the following calendar quarter.

The termination will be followed by a quarantine period during which the business cannot re-register for the special scheme (see section 4.5).

Situation 3:

A business that no longer meets the requirements for using the special scheme (see section 3) must notify the Member State of identification by the 10th day of the month following the month when it stopped meeting the requirements.

Such a situation will arise, for example, when a business using the Union scheme no longer has a place of establishment or a fixed establishment in the Member State of identification.

If the business no longer meets the requirements for using the special scheme due to a change of the place of establishment or fixed establishment, the registration will be terminated on the date of the change.

Situation 4:

A business using the special scheme may change its Member State of identification for the following reasons:

- A business using the non-Union scheme wants to identify itself in another EU Member State.

- The place of establishment of a business using the Union scheme is not in the EU area and the company wants to identify itself in another EU Member State where it has a fixed establishment.

- The place of establishment of a business using the Union scheme is not in the EU area, a fixed establishment in one EU Member State has been wound up, and the company wants to identify itself in another Member State where it has a fixed establishment.

- The place of establishment of a business using the Union scheme is transferred from one EU Member State to another.

A business using the non-Union scheme and wanting to change its Member State of identification must deregister in its current Member State of identification and submit a registration notice to the new Member State of identification.

A business using the Union scheme that changes its Member State of identification without that its fixed establishment is wound up or place of establishment is transferred must deregister in its current Member State of identification and submit a registration notice to the new Member State of identification. The selection of the Member State of identification is binding to the business for the ongoing year and the next two calendar years.

A business using the Union scheme that changes its Member State of identification because its fixed establishment is wound up or place of establishment is transferred must notify both Member States no later than on the 10th day of the month following the change. Deregistration in the current Member State of identification will take effect on the date when the registration in the new Member State of identification enters into force. If the reason for the change of the Member State of identification is that the place of establishment or a fixed establishment changes, deregistration will take effect on the date of the change. If the notice is not filed on time, the business must register for VAT in the EU Member States where it has had sales covered by the special scheme.

Example 6:

A company established in the EU has registered for the special scheme in Finland. The company’s place of establishment of a business is transferred from Finland to Sweden on 21 March. On 10 April, the company announces that its new Member State of identification will be Sweden. The company will be registered in Sweden as of 21 March and deregistered in Finland as of 21 March. Sales covered by the special scheme that have taken place on 21 March will be reported in Sweden.

4.4 Exclusion from the special scheme

A business can be excluded from the special scheme by the tax authorities for the following reasons:

- It can be assumed that the business no longer has sales covered by the special scheme (for example, if the business has filed a zero return during eight consecutive quarters).

- The business no longer meets the requirements for using the special scheme (see section 3).

- The business repeatedly fails to comply with the obligations related to the special scheme.

The registration will be terminated at the end of the calendar quarter during which the decision on the exclusion has been sent to the business. If the exclusion is due to a change of the place of establishment or fixed establishment, the deregistration will take effect on the date of the change.

Failure to comply with the obligations related to the special scheme will be deemed repeated in at least the following cases:

- The business has been sent a reminder to file VAT returns for the preceding three calendar quarters but the business has not submitted the returns for those calendar quarters within ten days of the date of reminder.

- The business has been sent a payment reminder for the preceding three calendar quarters but the business has not paid the tax in full for those calendar quarters within ten days of the date of reminder. This is not applicable if the outstanding amount is less than €100 per calendar quarter.

- The business has not provided its accounting records in electronic form on the request of the Member State of identification or Member State of consumption within a month after a reminder from the Member State of identification has been sent.

The Tax Administration serves the decision of exclusion electronically. The decision is considered to have been served by the seventh day after the decision has been made available for retrieval in MyTax.

4.5 Waiting period

After the registration has ended, there may be a quarantine period during which it is not possible to re-register as a user of the special scheme.

When the business announces that it will stop using the special scheme but will continue selling services covered by the special scheme, the quarantine period is two calendar quarters starting from the date of termination. In such a case, the quarantine period applies only to the use of that special scheme in which the business was registered before the deregistration, i.e. either the Union scheme or the non-Union scheme.

The quarantine period is eight calendar quarters as of the date of exclusion if a business is excluded by the tax authorities because of repeated non-compliance. In such a case, the quarantine period applies to the use of both the Union and the non-Union scheme.

During the quarantine period, the business must register for VAT and take care of the reporting and payment obligations in all EU Member States where it sells telecommunications, broadcasting and electronic services to consumers.

5 How to report VAT

The VAT return of the special scheme is used for reporting the sales covered by the special scheme (see section 3) and the VAT payable on the sales, specified by Member State of consumption and by VAT rate. A business using the Union scheme will also specify the sales according to the Member States of establishment from which the services have been supplied.

Sales covered by the special scheme are subject to the VAT rate of the Member State of consumption. If a sale transaction is exempt from tax in the Member State of consumption, it will not be reported on the special scheme VAT return. VAT rates applicable in the EU Member States can be found on the website of the European Commission.

The amounts must be reported in euros. If the sale transaction was made in another currency, the exchange rates of the last day of the reporting period must be used on the return. The average exchange rates published by the European Central Bank for that day have to be used in the conversion or, if no rates have been published for that day, the rates of the following day. (§ 134 c of the Value Added Tax Act)

The amounts on the return are not rounded to the nearest full monetary unit. The precise amount of tax must be reported and paid.

A business using the Union scheme does not report such sales on the special scheme VAT return that take place in a Member State where it has its place of establishment or a fixed establishment. These sales are reported on a national VAT return.

Businesses using the non-Union scheme will also report sales in the Member State of identification on the special scheme VAT return.

5.1 Due date of the tax return

In the special scheme, the tax period is a quarter year. The VAT return must be filed by the 20th day of the month following the calendar quarter. The return cannot be filed before the end of the tax period. The due dates for the special scheme VAT return are as follows:

| Tax period | Due date |

|---|---|

| Q1 (January–March) | 20 April |

| Q2 (April–June) | 20 July |

| Q3 (July–September) | 20 October |

| Q4 (October-December) | 20 January |

The due date of the VAT return will not be postponed because of a weekend or public holiday. Consequently, the due date of the payment will not be postponed, either. Even if the due date falls on a weekend or public holiday, the return must be filed by the due date. However, because of reasons related to payment transfers, the payment must be made before the due date for it to be deemed arrived on time (see section 6.1).

The return must also be filed for tax periods during which the taxpayer did not make any sales covered by the special scheme. Such a report is called a zero return.

When Finland is the Member State of identification, a return is deemed filed when it has arrived at the Tax Administration. An electronic return is considered to have arrived at the Tax Administration when it is available to the authority for processing in a reception device or in a data system.

5.2 Filing the VAT return

The VAT return is filed in the Member State of identification. When the Member State of identification is Finland, the report is filed electronically in MyTax. If the Member State of identification changes during a reporting period, a separate return must be filed in each Member State of identification for the same calendar quarter.

Example 7:

A company was registered as a special scheme user in Finland from 1 January to 15 February, but on 16 February the company changed its Member State of identification to be Sweden. The company must file two returns for the first calendar quarter: one in Finland for 1 January–15 February and the other in Sweden for 16 February–31 March.

You can submit a return in MyTax within three years from the due date. You can correct a previously submitted return in MyTax within the same three-year period. If you file a return after the due date, you may have to pay a penalty feelate-payment charges.

5.3 Correcting the VAT return

A VAT return filed in Finland can be corrected in MyTax.

If there is an error on the return, the correction must be allocated to the tax period that the error concerns. Correspondingly, when an adjustment item is allocated to a reported sale transaction, the adjustment is allocated to the tax period for which the original sale was reported. The error amount or adjustment item cannot be taken into account in a later tax period. Once the correction has been made, a replacement return is formed for the tax period.

The correction can be made in MyTax within three years from the due date of the tax period. This also applies to businesses whose registration in the special scheme has ended.

If a business has changed its Member State of identification, the correction must be submitted to the EU Member State where the original sale transaction took place.

Example 8:

A company has been registered as a special scheme user in Finland from 1 January to 31 March but on 1 April it changed its Member State of identification to be Sweden. The company has noticed an error in its reports for both the first and the second quarter. The company will correct the report of the first quarter in Finland and the report of the second quarter in Sweden.

5.4 Special scheme user’s right of deduction

The special scheme VAT return cannot be used for reporting deductible taxes. It can only be used for reporting VAT payable for sales.

The special scheme user has the right to a VAT refund to foreign businesses.

Detailed information on the VAT refund to foreign businesses can be found in the following Tax Administration guidance documents:

- Refund of VAT to Finnish businesses from other EU countries

- VAT refunds to self-employed individuals residing in another EU Member State

- Refund of VAT to foreign businesses established outside the EU

If a business using the Union scheme registers for VAT in a Member State where it does not have its place of establishment or a fixed establishment (e.g. for distance selling), deductions related to the sales covered by the special scheme in that country must be reported on the national VAT return of the country in question.

5.5 Consequences of failure to file a VAT return

If a taxable person does not file a return within ten days of the due date, the Member State of identification will send them a reminder that the return is late. When the Member State of identification is Finland, the reminder can be found in MyTax.

The Member State of consumption may later take measures to obtain the return. However, the return must always be filed with the Member State of identification.

Penalty fees and late-payment charges will be imposed according to the national regulations of the Member State of consumption. The taxable person must make these payments directly to the Member State of consumption.

Repeated failure to file a return is grounds for excluding the business from the special scheme (see section 4.4).

6 Payment of VAT

Payments must be made to the Member State of identification. The Member State of identification will remit the VAT to the Member States of consumption in proportion to the VAT amounts reported on the tax return.

The amount of VAT paid for the tax period must be as reported on the tax return. The payable amount can be changed only by correcting the return that the amount is based on. If the taxable person corrects the VAT return such that the payable amount increases, the difference must be paid to the Member State of identification.

If the taxable person pays only part of the reported tax, the Member State of identification will divide the payment between the Member States of consumption in proportion to the VAT amounts belonging to them based on the return.

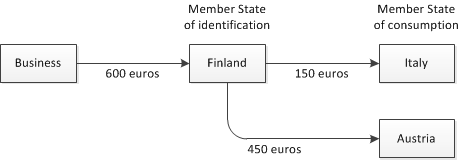

Example 9:

A company has reported €1,200 of VAT on sales, €300 of which belongs to Italy and €900 to Austria. By the due date, the company pays €600 to the Member State of identification, which is Finland. Finland will allocate one fourth of the payment, €150 (300/1,200*600), to Italy and three quarters, €450 (900/1,200*600), to Austria.

6.1 Due date of the payment

The due date for the payment is the 20th of the month following the tax period, i.e. the same as the due date for the tax return. The VAT must be paid when the return is filed, but no later than by the due date.

In the special scheme, the payment is deemed paid at the time when the payment arrives on the bank account of the Member State of identification. Time must therefore be allowed for payment transfer. As the due date of the return will not be postponed because of a weekend or public holiday, neither will the payment due date be postponed. In such cases, the payment must be made before the filing deadline for it to be deemed to have arrived on time.

6.2 Making a payment

The VAT is paid to the Member State of identification as reported on the VAT return. When the Member State of identification is Finland, the currency used in the payment is euro.

You can make the payment in MyTax as soon as you have filed the return. The online payment template is pre-populated with the reference number, account number, payable amount and due date.

If you pay the tax in some other way, for example in your online bank or via accounting software, you should first check the payment details in MyTax.

Use the tax-period-specific reference number when you pay. The Tax Administration will use the reference number to allocate the payment to the correct tax period.

6.3 Refunding a payment

A payment can be refunded if the taxable person has paid too much compared with the information on the return.

A refund can be made in the following situations:

- The taxable person has paid too much compared with the information on the return.

- The taxable person files a replacement return. After the corrections, it turns out that the taxable person has paid too much as compared with the information on the return. The payment has not yet been remitted to the Member States of consumption.

- The taxable person files a replacement return. After the corrections, it turns out that the taxable person has paid too much as compared with the information on the return. The payment has already been remitted to the Member States of consumption.

Situation 1:

If the taxable person pays too much compared with the information on the return, the Member State of identification refunds the excess amount, unless the refund is used for the taxpayer’s other overdue taxes and authorities’ receivables.

Situation 2:

If the Member State of identification has received the same amount of tax as was filed on the VAT return and the taxable person then corrects the return such that the payable amount decreases before the payment is remitted to the Member State of consumption, the Member State of identification will refund the excess amount to the taxable person, unless the refund is used for the taxpayer’s other overdue taxes and authorities’ receivables.

Situation 3:

If the Member State of identification has received the same amount of tax as was filed on the VAT return and divided it between the Member States of consumption and the taxable person then makes corrections to the return such that the payable VAT decreases, the Member States of consumption will refund the excess amount directly to the taxable person.

Corrections may be made in a situation where too little VAT on sales has been reported for one Member State of consumption and too much for another. The original payment has already been remitted to the Member States of consumption. In this case, the Member State of consumption that has received too much will refund the excess amount directly to the taxable person. The taxable person must pay the amount owed to the Member State of consumption that has received an insufficient amount to the Member State of identification.

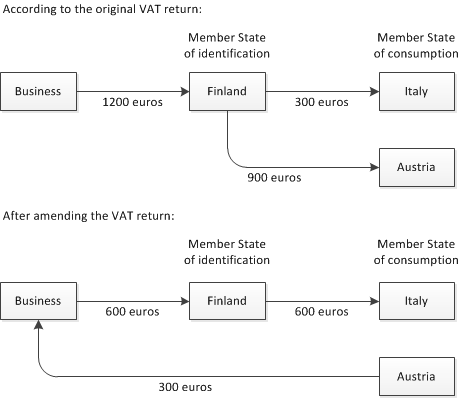

Example 10:

A company has reported €1,200 of VAT on sales, €300 of which belongs to Italy and €900 to Austria. The company has paid €1,200 to the Member State of identification, Finland, by the due date and the payment has been remitted to the Member States of consumption. The company later notices that its return information is not correct and makes corrections to the return.

After the corrections, the payable amount is €1,500, €900 of which belongs to Italy and €600 to Austria. The company will receive a €300 refund directly from Austria. The company has to pay €600 to Finland. Finland will forward the payment to Italy.

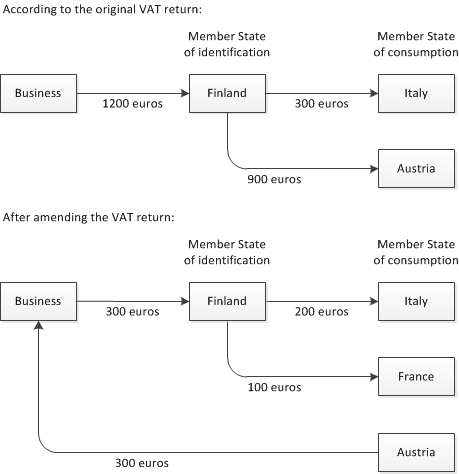

Example 11:

A company has reported €1,200 of VAT on sales, €300 of which belongs to Italy and €900 to Austria. The company has paid €1,200 to the Member State of identification, Finland, by the due date and the payment has been remitted to the Member States of consumption. The company later notices that its return information is not correct and makes corrections to the return.

After the corrections, the payable amount is still €1,200, but now €500 belongs to Italy, €600 to Austria and €100 to France. The company will receive a €300 refund directly from Austria, and it has to pay €300 to Finland. Finland will forward €200 to Italy and €100 to France.

The Member State of identification may retain a certain part of the tax payments allocated to the calendar quarters from 1 January 2015 to 31 December 2018. This will not affect the amount of tax payable by or refundable to the taxable person. The transition period applies only to VAT paid by Union scheme users.

During the transition period, the taxable person will receive a refund of the excess payment partly from the Member State of identification and partly from the Member State of consumption, if the payment has been remitted to the Member State of consumption. The amount that Finland as the Member State of identification would refund to the taxpayer can be used in Finland for the taxpayer’s other overdue taxes and the Tax Administration’s or other authorities’ receivables.

6.4 Consequences of failure to pay

If a taxable person does not pay the reported tax within ten days of the due date or makes a partial payment, the Member State of identification will send the taxable person one reminder of a late payment. When the Member State of identification is Finland, the reminder is sent to MyTax.

The Member State of consumption may later take measures to obtain the payment. The payment can be made to the Member State of identification until the Member State of consumption contacts the taxable person because of the missing payment. After this, the payment must be made directly to the Member State of consumption. The Member State of identification will refund the payment to the taxable person if the taxable person has made the payment to the Member State of identification rather than the Member State of consumption by mistake. The refund can be used for the taxpayer’s other overdue taxes and authorities’ receivables.

The penalties from failure to pay the tax will be imposed according to the national regulations of the Member State of consumption. The taxable person must make these payments directly to the Member State of consumption.

Repeated failure to pay the tax is grounds for excluding the business from the special scheme (see section 4.4).

7 Accounting information

The taxable person must keep accounting records of business transactions covered by the special scheme. The records must be sufficiently detailed so that the authorities of the Member State of consumption can verify that the information on the VAT return is correct. This section does not describe the content requirements set for invoices and receipts.

Records containing the following information can be deemed sufficiently detailed:

- the Member State of consumption to which the service is supplied

- the type of service supplied

- the date of service supply

- the taxable amount and the currency used

- any subsequent increases or reductions of the taxable amount

- the VAT rate applied

- the payable amount of VAT and the currency used

- the date and amount of payments received

- any advance payments received before the supply of the service

- if an invoice is issued, the details contained on the invoice

- the customer’s name, if known to the taxable person

- the information used to determine where the customer is established (see section 6 of the Tax Administration guidance on VAT on telecommunications, broadcasting and electronic services (available in Finnish and Swedish).

The taxable person has to keep records in such a way that they can be made available to the Member State of identification and the Member State of consumption without delay and for each individual service supplied.

If the taxable person does not provide the Member State of identification or the Member State of consumption with the requested information, they can be excluded from the special scheme (see section 4.4).

The information must be kept for ten years from the end of the year when the business transaction was carried out. The information must be kept available even if the taxable person has stopped using the special scheme.

8 Finland as the Member State of consumption

This section discusses various regulations applicable when Finland is the Member State of consumption.

8.1 VAT rate

Telecommunications, broadcasting and electronic services sold in Finland are subject to the general 24% tax rate (§ 84, Value Added Tax Act).

8.2 Invoicing requirements

As of 1 January 2019, Finland’s invoicing requirements are applied whenever a special scheme user that has selected Finland as its Member State of identification sells services covered by the special scheme (Art. 219 a (2) (b) of the VAT Directive).

According to Finland’s invoicing requirements, no invoice has to be issued if the buyer is a private individual. The seller must issue an invoice if the buyer is a business or a legal person that does not operate a business (§ 209 b, Value Added Tax Act).: The invoice can be provided electronically.

The invoice requirements are discussed in greater detail in the Tax Administration’s guidance on invoicing requirements in value added taxation.

8.3 Allocation with regard to time

The obligation to pay VAT on a sale transaction taking place in Finland arises when the item sold or service provided has been supplied. An item sold or a service provided on a continuous basis is regarded as having been supplied at the end of each remittance period. In the case of advance payments, however, the obligation arises as soon as the consideration or part of the consideration has accrued. (§ 15, Value Added Tax Act)

8.4 Sales adjustment items

A taxable person using the special scheme may deduct annual discounts and replacement discounts granted to the buyer, rebates, surplus refunds or other such adjustment item from the taxable amount of sales. Also, credit losses related to taxable sales can be deducted. (§ 78, Value Added Tax Act.)

The Accounting Board of the Ministry of Economic Affairs and Employment of Finland issued general instructions on how to record VAT on 31 October 2017 (available in Finnish and Swedish). Section 4.3 of the instructions discusses how to record sales adjustment items.

If the taxable person cannot make the deductions in full when the tax payable to Finland for the tax period is calculated, the amount that was not deducted will be returned to the taxable person (§ 134 h, subsection 2, Value Added Tax Act).

8.5 Due dates for filing the tax return and paying the tax

When Finland is the Member State of consumption, the filing deadline is determined by the provisions of the Member State of identification. Also, the due date for paying the tax is determined by the rules applied in the Member State of identification.

The late-filing penalty, punitive tax increase and late-payment interest are imposed based on Finnish legislation, and they are paid directly to the Tax Administration.

If VAT reported in the Member State of identification has not been paid in full, measures will be taken to collect the missing amount.

8.6 Refunding a payment

The Tax Administration will refund any excess amounts paid. Refunds may be generated, for example, if you correct your VAT return such that the payable amount decreases or if you have paid too much VAT for another reason. Credit interest will be added to the refundable amount.

The Tax Administration can pay the refund to the taxpayer without delay, unless the refund is used for the taxpayer’s other overdue taxes and authorities’ receivables.

8.7 Late-filing penalty and tax increase

A late-filing penalty and tax increase can be imposed on tax payable to Finland in accordance with § 35 and § 37 of the act on assessment procedure for self-assessed taxes (Laki oma-aloitteisten veron verotusmenettelystä 768/2016).

A late-filing penalty can be imposed if the tax return is filed late (§ 35, act on assessment procedure for self-assessed taxes). The Tax Administration can refrain from imposing a late-filing penalty if the late filing is due to technical problems in the public information network or in the Tax Administration’s e-service. No late-filing penalty is imposed if a punitive tax increase is imposed on the tax filed late (§ 35, subsection 5, act on assessment procedure for self-assessed taxes).

A punitive tax increase can be imposed if the tax return filed is incomplete or incorrect or if no tax return has been filed at all (§ 37, act on assessment procedure for self-assessed taxes).

A punitive tax increase rather than a late-filing penalty is imposed if the taxpayer files a tax return or adjusts the amount of tax with a view to avoiding the late-filing penalty or punitive tax increase (§ 37, subsection 3, act on assessment procedure for self-assessed taxes).

You can read more about late-filing penalties and punitive tax increase in the Tax Administration guidance on penalty fees in self-assessed taxation (available in Finnish and Swedish).

8.8 Late-payment interest

If the VAT payable through the special scheme to Finland is paid late, late payment interest is added to the payable amount.

The late-payment interest is calculated in accordance with § 5 b of the act on surtax and late-payment interest (Laki veronlisäyksestä ja viivekorosta 1556/1995).

8.9 Summary of tax payment status

If the taxpayer is issued a reminder of overdue taxes or a decision on a late-filing penalty, the Tax Administration will also generate a tax summary for them. The summary contains instructions on how to pay the taxes to the Tax Administration.

8.10 Advance ruling and written guidance

It is possible to apply for an advance ruling on the VAT treatment of the applicant’s certain business transaction subject to VAT in Finland. Written guidance can be requested on a general question related to the applicant’s value added taxation or on a procedural question.

An advance ruling or written guidance cannot be requested from the Tax Administration on tax payable to another Member State (§ 134 n, Value Added Tax Act).

You can read more about applying for an advance ruling in the Tax Administration guidance (available in Finnish and Swedish).

8.11 Appeal procedure

You can read more about the appeal procedure in the Tax Administration guidance (available in Finnish and Swedish).

A claim for adjustment must be filed within three years from the beginning of the calendar year that follows the year including the tax period for which the tax should have been filed and paid.

However, a claim for adjustment can always be filed within 60 days from the day when the taxable person received the tax decision. The period of appeal against decisions on registration is 60 days.

8.12 Sales on the Åland Islands

Cases of selling telecommunications, broadcasting or electronic services on the Åland Islands are divided between the following sellers:

- A business established in mainland Finland

- A business established on the Åland Islands

- A business not established in mainland Finland that uses the non-Union scheme with Finland as its Member State of identification

- Other businesses not established in Finland

Situation 1:

When a business established in mainland Finland sells a telecommunications, broadcasting or electronic service on the Åland Islands, the transaction is regarded as a domestic sale and reported on the VAT return.

Situation 2:

Different cases where a business established on the Åland Islands sells telecommunications, broadcasting or electronic services are presented as a table in the Appendix.

Situation 3:

When a business uses the non-Union scheme with Finland as its Member State of identification, the supply of telecommunications, broadcasting or electronic services to consumers on the Åland Islands is reported on the special scheme VAT return as sales in Finland.

Situation 4:

Other EU Member States than Finland are not obligated to apply the special scheme to supply of telecommunications, broadcasting or electronic services to consumers on the Åland Islands.

A business that does not have its place of establishment or a fixed establishment in mainland Finland or on the Åland Islands and that does not use the non-Union scheme with Finland as its Member State of identification, can still use the special scheme when it sells telecommunications, broadcasting or electronic services to consumers established on the Åland Islands. The seller then has to report and pay the VAT on the sales to consumers established on the Åland Islands directly to the Finnish Tax Administration using the procedure for reporting sales on the Åland Islands.

If the seller does not use the special scheme, the sales have to be reported on the VAT return in Finland, which requires registration for VAT in Finland.

The return for sales on the Åland Islands is filed electronically in MyTax. Filing the return requires that the seller has registered as a special scheme user and specified a Member State other then Finland as its Member State of identification. The above sales are not reported on the VAT return submitted through the Member State of identification, nor is the VAT paid through the Member State of identification.

The return procedure for Åland does not apply to businesses whose place of establishment or fixed establishment is in mainland Finland or on the Åland Islands, nor to businesses that use the non-Union scheme and have Finland as their Member State of identification.

The return for sales on the Åland Islands has the same reporting periods and due dates as the special scheme VAT return (see section 5.1). Paying the VAT is discussed in section 6.2. Unlike in the case of VAT returns filed in the Union scheme and the non-Union scheme, the due dates of filing and paying VAT for sales on the Åland Islands will be postponed until the next working day if they fall on a weekend or public holiday. Further, the payment is deemed paid at the time when the payment is debited from the payer’s account.

The return for sales on the Åland Islands can be filed and corrected in MyTax within three years from the end of the accounting period for which the tax should have been reported.

Appendix – sales of a business established on the Åland Islands

This appendix discusses the sales of a business established on the Åland Islands and the tax procedure applied in various situations. In Finland, the general tax procedure means that the sales are reported on the national VAT return.

A business established on the Åland Islands uses the non-Union scheme

Member State of identification is Finland:

| Place of supply | Tax procedure |

|---|---|

| Åland Islands | Special scheme |

| Mainland Finland | Special scheme |

| Other Member State | Special scheme |

Member State of identification is other than Finland:

| Place of supply | Tax procedure |

|---|---|

| Åland Islands | General tax procedure |

| Mainland Finland | Special scheme |

| Other Member State | Special scheme |

A business established on the Åland Islands uses the Union scheme

Member State of identification is Finland:

| Place of supply | Tax procedure |

|---|---|

| Åland Islands | General tax procedure |

| Mainland Finland | General tax procedure |

| Other Member State with a fixed establishment | General tax procedure |

| Other Member State, no fixed establishment | Special scheme |

Member State of identification is other than Finland:

| Place of supply | Tax procedure |

|---|---|

| Åland Islands | General tax procedure |

| Mainland Finland with a fixed establishment | General tax procedure |

| Mainland Finland, no fixed establishment | Special scheme |

| Other Member State with a fixed establishment | General tax procedure |

| Other Member State, no fixed establishment | Special scheme |

Senior Tax Specialist Mika Jokinen

Tax Specialist Hanna Lindholm