Reportable cross-border arrangements (DAC6)

News

The Tax Administration e-service will be integrated into MyTax

You can now submit your DAC6 report in MyTax.

The current login page to the e-service with the heading “Electronic filing of returns and requests” will be taken out of use. In future, you will be able to access these services by logging in to MyTax and selecting “Report or request information in a limited scope”.

As before, you can also submit a DAC6 report as an identifier pair file or xml-file through the Ilmoitin.fi service. A natural person or an estate can also submit a report using paper form 6910e.

The EU list of non-cooperative jurisdictions was updated on 20 February 2024

Bahamas, Belize, Seychelles and Turks and Caicos Islands have been removed from the list. Please take this into consideration when reporting an arrangement with the hallmark DAC6Cbii.

Transactions made between associated persons to Russia must be reported to Tax Administration

The European Union has added Russia to the list of non-cooperative jurisdictions for tax purposes on 14.2.2023. All transactions made between associated persons to Russia must be reported to Tax Administration starting from the mentioned date (18 § subsection 1 paragraph 2 b Act on Reportable Arrangements in the Field of Taxation).

The Act on the Reporting Obligation for Cross-Border Tax Planning Structures entered into force at the beginning of 2020. The Act is based on the European Union's DAC6 Directive concerning cross-border arrangements, which entered into force on 25 June 2018. The aim of the Directive is to increase transparency in taxation and deter aggressive tax planning.

The information-reporting requirement primarily concerns the service providers operating in the EU countries who participate in the planning, marketing or implementation of the arrangement. Service providers may be, for example, tax consultants and attorneys, financial sector operators and parent companies of groups.

Taxpayers are obliged to report arrangements only when an arrangement does not involve a service provider with a reporting obligation, or the service provider has the right to a waiver due to legal professional privilege.

Contact us by e-mail: raportoitavatjarjestelyt(a)vero.fi.

Please note that the e-mail connection is not encrypted. If you want to use an encrypted connection, send us an e-mail requesting encryption before sending any other information.

What is a reportable arrangement?

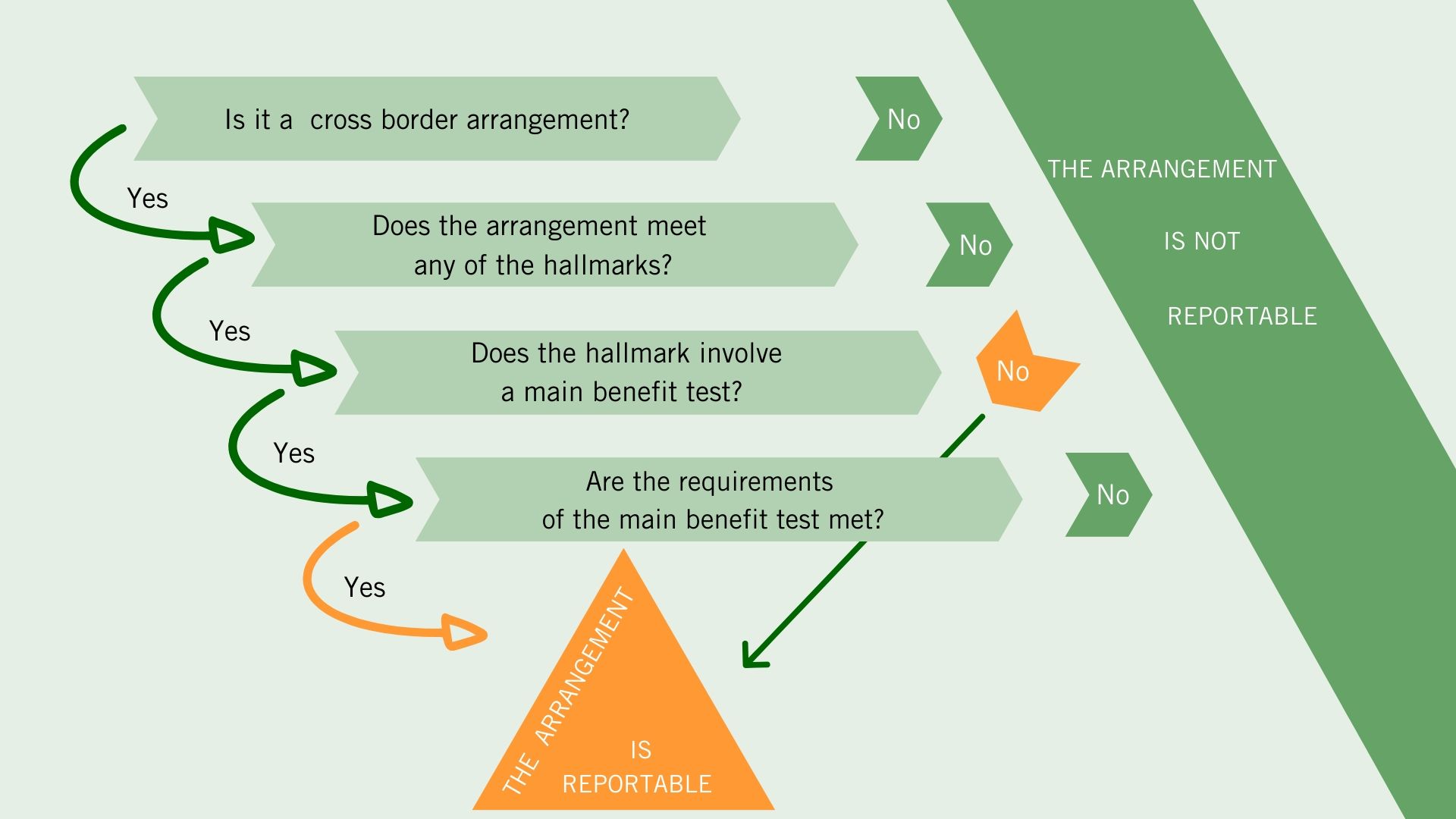

The reporting obligation applies to tax planning structures in which the parties to an arrangement are from more than one Member State and the arrangement includes at least one of the distinguishing hallmarks defined in the Act. What is meant by “hallmark” is a reportable arrangement's characteristic or typical feature. The hallmark often explains how taxation is being evaded. The legal act lists all the hallmarks.

In addition some of the hallmarks are also subject to the main benefit test. The test determines if obtaining a tax advantage is the main purpose or one of the main purposes of the arrangement.

What information must be reported?

Reportable information consists of the identification details of the persons and companies involved in the arrangement and information on the reportable arrangement, such as a description of the arrangement and the national provisions of which it takes advantage.

Finland exchanges reportable information with the other EU Member States on the basis of the Directive. The exchange of information enhances tax control and makes tax evasion more difficult.

When should the report be submitted?

Reports must be submitted within 30 days of an arrangement exceeding the reporting threshold.

You can either use the .xml file format or create a name:value file to submit your report electronically. If the report is submitted by a natural person or by an estate of a deceased person, it can be submitted on paper (on Form 6910).

Submit the notification on Ilmoitin.fi or in MyTax.