Obligation to report information about services and sales transmitted via digital platforms

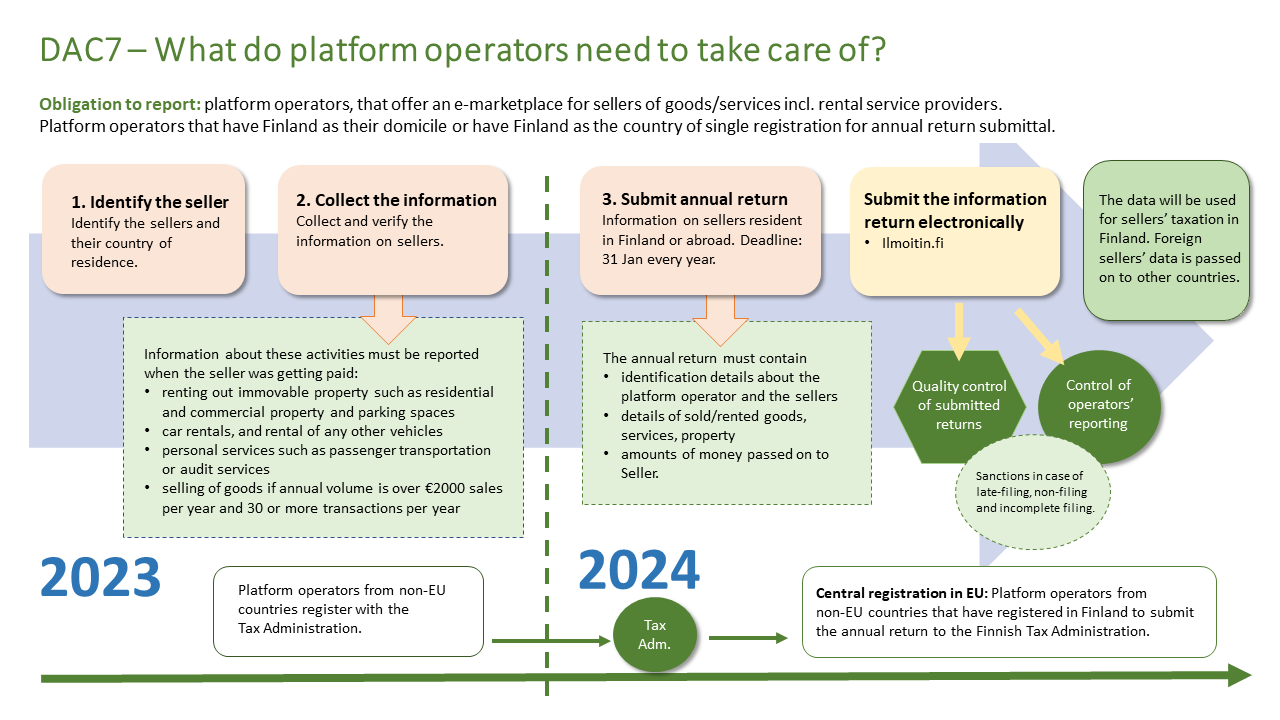

From 2023, platform operators must collect information about all sales and leases they have transmitted via digital platforms. The information must be reported to the Finnish Tax Administration for the first time regarding the 2023 calendar year. The information must be submitted through an annual information return by the end of January 2024.

The new harmonised information reporting obligation applies to all EU Member States. It is based on the amended EU directive known as DAC7. Tax administrations of all EU Member States collect information about sellers, service providers and renters that reside in their country and other EU Member States.

A platform means a digital, or electronic, trading platform. It can be software, a website or a mobile app, using which sellers can enter into an agreement with buyers and sell goods or services. Through platforms, sellers and buyers can also take care of payments related to sales or leases, but buyers can also pay considerations directly to sellers.

A platform operator, or platform service provider, means a company which enters into an agreement with a seller, as a result of which the seller can provide services or goods for sale through the digital platform maintained by the platform operator. A platform operator can, for example, be a company which provides a platform for an individual or company to rent residential or commercial facilities, or a taxi company which provides a platform for a car owner to offer transport services. A platform can also be used to sell goods or rent a boat, for example.

Example: A Oy, a Finnish company, runs a website called platform.fi. Sellers – either private individuals or companies – can register on the website and use it to provide their cottages for rent. The website’s booking system shows the price for each rental period, and users can use it to book a cottage. A Oy is a platform operator, and the website (platform.fi) is a digital platform.

Who needs to submit an annual information return?

If a platform operator is domiciled in Finland, it must submit an annual information return to the Finnish Tax Administration regarding

- sellers and service providers residing in Finland and other EU Member States;

- individuals and companies renting out fixed assets situated in the EU through a platform

This obligation to report information also applies to non-EU platform operators that have selected Finland as a country of registration in the EU, i.e. platform operators that report the platform services they have transmitted annually to the Finnish Tax Administration. Read more: Digital platform operator outside the EU: How to register in the EU

Reporting obligation expanded

The new obligation to report information replaces the annual reporting of transmitted services. At the same time, the obligation has become more extensive. Previously, annual information returns only covered activities used to provide transport services or rentals of apartments or real estate units.

The broader obligation to report information means that, also when a private individual or company leases out a boat, provides beauty services, or sells paintings or other home valuables through a Finnish platform, the platform operator must submit information about the seller or lessor, as well as sales or leases.

Reporting platform operators also submit the same information about foreign individuals and companies that receive income. The Finnish Tax Administration transmits information about foreign income earners to their countries of residence in the EU. When renting fixed assets, such as an apartment, information is also transmitted to the EU Member State in which the assets are located, meaning the country in which the real estate unit is.

Reporting platform operators must observe diligence obligations

Platform operators have certain due diligence obligations that they need to meet. The obligations ensure that platform operators collect and submit information about all sellers to the Finnish Tax Administration and that the information is accurate. In practice, platform operators must investigate and identify all sellers that use their platform. Information must also be collected and verified regarding leased fixed assets.

What information do platform operators need to submit on an annual information return?

Platform operators must submit information about their company and the companies and private individuals that have received income from sales and leases carried out through their platform during the calendar year.

Sales and leases carried out through a platform include

- the sale of goods;

- personal services, including taxi services and auditing;

- the leasing of residential and commercial facilities, parking spaces and real estate units;

- the leasing of vehicles, including recreational vehicles and boats.

With regard to companies and individuals receiving income, platform operators must submit identification information, the country of residence and the amount of income received through their platform. Income must be reported if the platform operator can identify it by reasonable means. If considerations have been paid through a party other than the reporting platform operator, the price indicated by the seller on the platform is sufficient. The address of the leased asset must also be reported.

Platform operators must also submit an annual information return when they have nothing to report for a calendar year.

When must the information be submitted and how?

Reporting platform operators must submit an annual information return for the first time regarding 2023. The information must be submitted by the end of January 2024. The information return can be submitted in XML format using the Ilmoitin.fi service (Annual information return of Reporting Platform Operators, technical guidance).

What situations are excluded from the platform operators’ reporting obligation?

Information does not need to be submitted regarding

- situations where a platform operator sells their own goods or services on their platform, e.g. leases out vehicles they own, such as electric scooters, directly to users through their mobile app;

- services provided by an employee of the platform operator company;

- small-scale sales of goods – if a seller has at most 30 sales transactions per platform operator during a calendar year and if total considerations amount to no more than €2,000.

Example: Company A Oy provides its customers with a mobile app, which companies and private individuals can use to sell dog care and walking services, as well as dog accessories.

A Oy must collect the necessary information about sellers, verify its accuracy, and report it and other information required to the Finnish Tax Administration by submitting an annual information return.

A Oy does not need to submit an annual information return regarding sellers that have at most 30 sales transactions and that receive at most €2,000 during a calendar year.

Negligence penalty

If a platform operator submits information late or fails to submit an annual information return, a negligence penalty may be imposed.

The change increases the international exchange of information

Later, the Finnish Tax Administration will also receive information that platform operators submit to tax administrations of other EU Member States. The Finnish Tax Administration will obtain information about the income that individuals and companies residing in Finland receive through foreign platforms.

Correspondingly, the Finnish Tax Administration will send to other EU Member States information which it has received from platform operators that submit an annual information return in Finland. Information about foreign income earners will be sent to each income earner’s country of residence. If real estate units or other fixed assets have been leased out through a platform, information will also be sent to the country in which the assets are located.

The exchange of information will also later expand to non-EU countries.

Why is the information collected?

The harmonised obligation to report information ensures a fair playing field for platform operators and sellers in the EU. Information submitted in Finland and obtained through the international exchange of information will be used in taxation. However, income earners will still be obligated to report all income earned abroad and all expenses allocated to that income.

Do you have any questions?

Contact us by emailing Alustapalveluraportointi.DAC7(at)vero.fi